Guest opining by David Middleton

EDITORIAL

Trump’s Deceptive Energy Policy

“We have ended the war on American energy,” President Trump boasted in his State of the Union address, “and we have ended the war on beautiful, clean coal. We are now, very proudly, an exporter of energy to the world.”

Those two sentences were about all Mr. Trump devoted to his energy policy in his message. Brief as they were, they encapsulated nearly everything that is shallow, dishonest and just plain wrong with that policy, as well as his approach to environmental issues generally.

Here’s what’s deceptive: There has been no war on energy. American oil, gas and renewables like wind and solar flourished under President Obama. Coal was the exception, but Mr. Obama was not its enemy; the market was. “Beautiful, clean coal,” meanwhile, remains a mirage, at least for now; the affordable technology isn’t there. And the United States has always exported energy. In recent years — the Obama years — the amount of energy the country has sent abroad has begun to catch up with the energy it brings in.

[…]

All this production, however, has a dark side, rarely mentioned in the huzzahs about the 10-million-barrel milestone: the continued carbon-loading of the atmosphere…

[…]

Such concerns are nowhere to be found in the playbook of a man who says that climate change is a hoax. Hence, full speed ahead, at the Environmental Protection Agency and the Interior Department, with Mr. Trump’s “energy dominance” agenda, and with the overturning of rules that seek to balance conservation and commercial exploitation, and the opening up of nearly all of America’s offshore waters to drilling — whatever the risk, and however small the need.

If you’re going to lie, you may as well make it a whopper…

There has been no war on energy. American oil, gas and renewables like wind and solar flourished under President Obama.

Renewables, including hydroelectric, “flourished” from about 4 quadrillion btu (quad) in 2009 to about 7 quad in 2016. Total U.S. annual primary energy consumption is around 96 quad [1]. And there very much was a war on energy. At least there was a war on energy that works. The war on coal was obvious. Fortunately, the war on oil and natural gas was mostly limited to Federal leases.

President Obama did everything he could to impede oil & gas production. Unfortunately for him, the shale revolution took place on State and private mineral leases.

All of the increase in oil & gas production came from areas not under Federal control:

The Obama administration’s unlawful drilling moratorium and subsequent “permitorium,” led to the loss of over 200,000 bbl/day of oil production from 2010-2015:

Oil and natural gas flourished despite President Obama. President Trump has begun the process of undoing 8 years of regulatory assault on the oil & gas industry.

Trump Administration to Open Oil & Gas Leasing on the Atlantic Outer Continental Shelf (OCS)

“Offshore drilling is not a fit for Florida”… It doesn’t have to fit in Florida.

A Senate Tax Bill Energy Trifecta: Opening ANWR, Killing EV’s and Energy Dominance!

Irony can be so… Ironic – Trump’s solution to AGW: “Drill, Baby, Drill!”

While not all of these areas will be fully opened due to challenges from States like Florida, much of it will be open and available for leasing, exploration, drilling and production.

And the United States has always exported energy. In recent years — the Obama years — the amount of energy the country has sent abroad has begun to catch up with the energy it brings in.

The energy the country sends abroad mostly consists of refined petroleum products… And Obama had nothing to do with it.

The U.S. “energy trade balance” turned the corner in 2005. If not for Obama’s war on energy, the U.S. may have actually become a net energy exporter while he was in office. As it now stands, the U.S. is poised to become a net energy exported for the first time since the 1950’s, during President Trump’s first term in office.

Hence, full speed ahead, … opening up of nearly all of America’s offshore waters to drilling — whatever the risk, and however small the need.

Because if you wait until the nation needs the oil to open the areas up, you won’t be able to get the oil when the nation needs it. ANWR Area 1002 is practically a step-out from Prudhoe Bay… But it will probably take at least five years to establish meaningful production after the first leases are issued. In the meantime, “Little Oil” is “getting busy” around ANWR…

Small bidders snatch up land near ANWR in state oil lease sale

Alex DeMarban December 30, 2017

Major oil companies did not bid Wednesday on state leases near the Arctic National Wildlife Refuge as Congress moves to open the refuge’s coastal plain to drilling, but small bidding groups did.

And new North Slope prospects generated interest in the annual state lease sale that officials said was one of the biggest of the last two decades.

The state received $19.9 million in bids for the North Slope lease sale on Wednesday, making it the third-largest sale in the last two decades, said Chantal Walsh, director of the Alaska Oil and Gas Division. That was a surprise because so much of the land in the region had already been leased, she said.

The amount of leased state land on the North Slope is at historically high levels, said Mark Wiggin, deputy commissioner of the state’s Natural Resources department.

[…]

Somehow, I doubt that The New York Times Editorial Board reads the Anchorage Daily News.

References

[1] Annual Energy Outlook 2017. US EIA.

[2] January 2018 Monthly Energy Review. US EIA.

Funny isn’t it how all of a sudden the MSM and the eco-loons want to give Obama credit for the shale revolution.

Only for about a half a second any more. The duplicity of the left leaning press is a serious issue, imo. They do this with almost everything they publish, the twisting facts I mean.

Everything the NYT publishes is lies or propoganda

Yes, the Leftwing MSM wants to give Obama credit for everything. For shale oil, and for the economy as a whole, as examples.

The facts are Obama did everything in his power to stifle U.S. energy production (with the exception of windmills and solar), and the general economy.

A president can do a lot of things to harm an economy, but very few things which will help an economy.

The main things a president can do to promote an economy is to cut taxes and reduce regulations and get the government out of the way as much as possible. This is what Trump did. Obama did just the opposite.

So anyone giving Obama credit for promoting the U.S. energy sector or the U.S. economy in general, please give an example or two of Obama policies that accomplished these goals. Don’t waste your time looking for any though because Obama did nothing to help the energy sector or the economy.

All those jobs Obama claims he created? They would have been created whether Obama was president or not. The U.S. economy has a momentum of its own, and that’s what creates the jobs or cuts the jobs. Obama stunted this momentum and Trump enhances it.

TA, i think that Obama stumbled backward into the truth (whilst falling down!). For all his war on energy did, at the end of the day energy prices are fairly low. Just compare the end of the Bush years when energy prices were very high. Another truth that BarryO stumbled into was a long period of economic growth. This year will mark ten years since the crash in ’08. Slower growth means a longer time between recessions. If this economy lasts until the 2020 election, which Trump will need, then that will be 12 years! (that’s a long time)…

It was the weakest recovery on record (since 1947)…

https://www.minneapolisfed.org/publications/special-studies/recession-in-perspective

Lowering the unemployment rate by driving workers out of the labor force.

https://data.bls.gov/pdq/SurveyOutputServlet

2.0% real growth is barely treading water…

Real growth starts at 2%.

https://www.frbatlanta.org/cqer/research/gdpnow.aspx

Yes, David, all true, but that’s beside the point. If the recovery had been faster, we would already be in our next recession by now. And if Trump is smart, he won’t step on the gas like it appears that he is doing. Don’t we want this boom to last? It ain’t gonna happen with high growth at this point, the unemployment rate is already too low. Besides, the fed isn’t going to allow high growth to happen at this point anyway. Yellen has already stated such. Powell’s the wild card, never know just what he’ll do. (be nice if they were to install him soon)…

Unlike his predecessors, Trump won’t hesitate to fire the Fed chairman if he gets too aggressive with interest rates… And the low unemployment rate is a mirage.

https://data.bls.gov/pdq/SurveyOutputServlet

During the Reagan boom (1981-2007), the Labor Force Participation Rate generally rose with generally declining unemployment. The opposite happened from 2009-2016…

(BTW, nice graphs… ☺)

“Latest forecast: 5.4 percent — February 1, 2018”

I’m glad you included that tidbit of information. The economy is really taking off. Who says tax cuts and regulatory reform don’t work? They work every time they are tried. Tax revenues will increase, not decrease as the Democrats claim. The Democrats don’t have a clue about how an economy works. All they know is how to spend money. Other people’s money.

The corporate tax cuts will have a YUGE, almost immediate impact on the economy, particularly the repatriation tax relief. Up to $2.3 trillion will be injected into the economy if everyone follows Apple’s lead.

There were no jobs created under Obama. The longest job creation streak is a myth. I remember quite a few months where job growth was negative or just a few thousand. Then they fiddled with the birth-death model to make them look better. Then came the adjustments months later to make it look even better. Remember the double-seasonal-adjustments because there were never any cold winter months before Obama was president

David, again, very true. But, the unemployment rate at this point will be an indicator of the pace of economic growth. If it stalls out (or rather if the fed stalls it out) that simply means that economic growth is slow enough for a recession to kick in. Even with a stalled unemployment rate, there is still job growth for population growth (as well as people reentering the job market). As i showed you recently, the unemployment rate is the key metric for determining when the next recession hits.

[continued in another comment, don’t want length to trip spam]

Hard to say exactly what Trump will do if Powell begins to get hawkish. We can’t assume that Trump actually knows what he is doing! Now, he may. (he’s got to be very poker face about what he’s doing, so it might just be hard to tell at this point) Conservatives won’t like it one bit if inflation kicks in and interest rates are not raised. If Trump does decide to can Powell for someone further left, he might get bi-partisan support, but politically it’ll get nasty. Should be interesting to see this play out, especially how low the unemployment rate will go. Could we see 3% or even 2% unemployment? If it doesn’t go that low then our next recession probably isn’t too far off. If it does, well, things could get interesting both economically and politically. (very interesting indeed)…

Fonz… I think you can maintain solid job growth without dropping the unemployment rate much further. There’s room to grow on the participation side,

Whatever happens, with Trump it won’t be boring!

what about all the jobs bo created writing regulations?

Yes, David, let’s hope for the very best and keep our eyes open (we may just learn something new)…

Well. maybe because the Obama “boot on the neck of the oil industry” has been removed by Trump.

Who was it who stopped the Alaska oil pipeline then? God?

http://nation.foxnews.com/strategic-petroleum-reserve/2012/10/15/obama-bans-drilling-half-alaskas-petroleum-reserve

https://www.wsj.com/articles/obamas-trans-alaska-oil-assault-1422319740

https://www.usatoday.com/story/news/politics/2015/02/24/obama-keystone-veto/23879735/

I think this guy is proving to be the very worst and deceitful president in American history

Cheers

Roger

If you like your policy, you can keep your policy.

If you like your doctor, you can keep your doctor.

The average family will pay more than $2000 less for a helath plan/policy.

Gums sends…

“I think this guy is proving to be the very worst and deceitful president in American history”

Obama may be even worse than we thought, depending on how the current investigation of his former administration and minions goes. Obama may be neck-deep in this corruption. If you ask me, he orchestrated it.

Even if he didn’t, he is still the Worst President Evah!!!

Not God and not Obama.

He was for it before he was against it.

http://www.nytimes.com/2012/03/23/us/politics/in-oklahoma-obama-declares-pipeline-support.html

What about drilling offshore?

https://www.theguardian.com/world/2010/mar/31/barack-obama-drilling-offshore-approves

What about drilling on federal lands?

http://www.politifact.com/truth-o-meter/promises/obameter/promise/451/expedite-oil-and-gas-drilling-from-domestic-shale-/

More nuance (something Obama apparently did not possess)

https://www.factcheck.org/2012/10/obamas-drilling-denials/

The fact is that this president, like all of them, has a narrative that is more or less detached from reality. This narrative was the “I’m an eco-president”, while the reality was, “I’m pro-campaign contribution and eventual personal financial gain from my time in office”. Please don’t blindly believe either left wing MSM or right wing infotainment.

Who was it in the Obama administration that claimed health care premiums would go down 200%?

He had no executive experience and little legislative experience. What he had was Chicago politics experience, and that’s what he brought to and inflicted upon the Federal government and American people.

IRS – in on the fix against conservative foundations, and nobody was going to pay. EPA – in on the fix with blatant political sabotage masquerading as science. DOJ/FBI – in on the fix with blatant corruption ensuring HRC’s emails would get a blind eye. Energy giving away vast sums of taxpayer money on the thinnest of schemes… Department after department made over in the image of a Chicago political machine. And on top of that he made race relations worse than before… Hard to beat that record, especially for a Nobel prize winner. What a yuk.

I believe he will go down as one of the worst presidents ever, once the media figures it out, as I suspect will eventually happen. But I’m not holding my breath.

[ All this production, however, has a dark side, ..: the continued carbon-loading of the atmosphere ]

And, where does the carbon in organic material come from?

That’s “light side” carbon… /sarc

The atmosphere needs to carbon-load, in preparation for the Olympics.

Yeah, I caught that “carbon loading” also. Perhaps soon we will see diamonds floating all through the atmosphere. Perhaps Lucy will be there too.

And where does it go…into greening the biosphere …Go Green Carbon

More proof the NYT is mostly fake news.

No war on energy? => Obama placed most offshore off limits. Ditto ANWR block 1002.

No war on coal? => Obama CPP.

See essay Clean Coal at Judith Curry’s Climate Etc or in ebook Blowing Smoke for further thoughts and more Obama legal outrages concerning fossil fuel energy.

It’s not fake news. It’s not even news. It is an editorial article, just another misguided opinion.

Opinions are like a$$holes, everybody has one. It’s just that some people practice better hygiene.

Plus many. Going to ‘borrow’ that comment for future use.

It’s not opinion. It’s sophistry based on a lack of journalism that includes any depth in the research. Like the article says, they don’t read the Anchorage Daily News. In other words, they have their set “go-to” industry sources who have a very narrow access viewpoint and likely wear green glasses.

– 2012 – Mitt Romney morphed into a traveling salesman here Thursday as he gave his best pitch for an energy plan that’s big on loosening environmental regulations and expanding domestic oil drilling and coal production. To those who might doubt Romney’s projection that his plan would make North America energy independent by 2020, the presumptive Republican presidential nominee had a simple message: “It is achievable.” “This is not some pie-in-the-sky kind of thing,” Romney told a modest crowd outside a truck warehouse in New Mexico. “This is a real, achievable objective, and I have a chart that’s still, despite the wind, still holding up up here.” While Romney stressed the idea of independence, the plan relies heavily on imports from Canada and Mexico, two of the world’s biggest oil producers. Hence the use of the phrase “North American” before energy independence. “The net-net of all this, as you can see, is by 2020, we’re able to produce somewhere between 23 million and 28 million barrels per day of oil, and we won’t need to buy any oil from the Middle East or Venezuela or anywhere else where we don’t want to,” Romney said.

“This isn’t a recipe for energy independence,” Obama campaign spokeswoman Liz Smith said in a statement. “It’s just another irresponsible scheme to help line the pockets of big oil while allowing the U.S. to fall behind and cede the clean energy sector to China.” In a conference call with reporters, the Obama campaign criticized Romney’s energy proposal, casting it as an attempt to cater the oil industry. “One thing is clear that we should take away from today. Mitt Romney’s energy plan is simply doing the bidding of big oil,” said Obama deputy campaign manager Stephanie Cutter. – –

That was from the Washington Post. I mean seriously – Romney predicted this, all of it, and Obama and the dems made silly jokes about how stupid his ideas were. Now…what? he was right, waaaaay back in 2012. And to their very last day in office, Obama and the items insisted they were wrong.

Romny did have a good plan for North American Energy Independence.

https://wattsupwiththat.com/2012/08/30/north-american-energy-independence-by-2020/

But, he didn’t have a plan for American Energy Dominance.

During a presidential election debate, Romney said Russia was our most serious foreign policy problem, Obama scoffed and said, “The 1980’s want their foreign policy back!”, as if Romney was a fool for thinking good ole Russia was any threat to us.

Worst president evah!

It appears that the Deep State used the same tactics to discredit Romney as they used on Trump, with even most of the same people involved.

This is a good read.

https://idahoconservatives.com/national/fisa-memo-obama-fusion-gps/

Hey New York Times, it is not carbon – tell the truth, it’s Carbon Dioxide which is not pollution. Do you have a problem stating that NYT? Get your facts straight.

When taking into account all the CO2 put into the atmosphere (natural causes & mankind’s activities) our activities, don’t they only comprise about 2 – 3 % of the CO2 released into the atmosphere?

If so, sure seems a tempest in a teapot….

According to CO2 recording station at Mauna Ioa, Hawaii. Total CO2 in the atmosphere is 0.041%

It’s YUGE! /Sarc

And water vapor is measured in percentage that the atmosphere can hold.

410,000 ppb – we’re all gonna die!

The NYT is a top-down organization. They don’t read the Anchorage Daily News. The Anchorage Daily News is obligated to read the NYT and then know what to print. That’s how it’s supposed to work in MSM-Land.

quem deus vult perdere prius dementat: Whom a god would destroy, he first drives insane.

This Year alone, the New York Times could win the BookBrowse Awards, Pulitzer Prize for Letters, Drama and Music, Man Booker Prize,The John Newbery Medal, Edgar Awards, National Book Critics Circle Award, National Book Awards, Nobel Prize in Literature, Costa Book Awards, Neustadt International Prize for Literature, Hugo Award, and the Grauniad First Book Award for major contributions to Fiction Production..

Damning with fake praise…..

Ntesdorf, was your comment sarcasm? The only prize you list that the NYT might win is the Pulitzer. All the rest are awards given to authors or publishers.

It is hard imagine how the editors of the NYT keep a straight face when they write that there was no war on energy (Keystone Pipeline, anyone?) from the Obama administration. I bet most of the comments by the NYT’s readers are in total agreement.

Those are all prizes for fiction. The sarcasm is obvious.

Drill. baby, drill.

Frack, baby, frack.

Put the Saudis in crack.

If at first you don’t succeed, lie. Then rely on the main stream media to cover for you.

The NY Times is written, produced and distributed by carbon pollution.

It’s coming, Clean Coal is possible, but it’s not just about taking the CO2 out of combusted coal exhaust, it’s taking a waste product and creating jobs and product, turning this CO2 into money. It’s good for the economy, and if good for the environment, that’s a bonus.

In talking about clean coal, you must also consider extraction. W. Virginia and Kentucky have some of the highest rates of cancer in the country, especially in those counties near mines.

Yawnnnn….. Zzzzzzzz……..

Coal haters are so boring.

No such thing as clean coal…… stop with the propaganda nonsense!

Oh no cancer!

cancer = fear mongering

The people who use cancer to fear mongering never tell you what the actually tell you what the rates are and what kind of cancer is higher.

‘In talking about clean coal, you must also consider’ that living near a coal mine you are living in a beautiful area. If the NYT is your local paper you are living in a concrete cesspool.

I understand why city dwellers worry about the environment. Thanks to the interstate systems, Americans living in big cities can drive from NYC to LA and never see America.

“W. Virginia and Kentucky have some of the highest rates of cancer in the country”

Probably because the smoking rates are higher there.

But don’t let facts get in the way of your preconceived biases.

http://content.gallup.com/origin/gallupinc/GallupSpaces/Production/Cms/POLL/xi3tqz0theklqpedsb-97g.png

In general, there is a correlation between poverty and cancer rates.

@MarkW

Mostly because there is a very good correlation between poverty level and smoking. It’s no coincidence that states on the lower end of the economic spectrum show higher rates of smoking.

You missed one ☝️

“Beautiful, clean coal,” meanwhile, remains a mirage, at least for now; the affordable technology isn’t there.”

This is the left’s constant sleight of hand- always assuming that when you say “clean coal” you mean CO2 free when you simply mean very much reduced/scrubbed sulphur and NOX.

Because of the EPA directive that designated CO2 as a pollutant, they feel they can include CO2 in the definition of clean coal and of course we all know that carbon capture is too costly. That’s why the NYT said “the affordable technology isn’t there” and helpfully confirmed in the process that one of their pet technologies is a dud. But none of this is out in the open and stated definitively as involving the inclusion of CO2. This allows them to say there’s no such thing as clean coal.

So long as they don’t mention it, they can talk at cross purposes with you while smugly thinking they’re calling you out on your clean coal assertion.

Now add in a related sleight of hand: “carbon pollution”. Shouldn’t that mean soot from chimneys? No, it’s their shorthand for CO2 but they don’t tell you that’s what they mean. Then they’ll show power station chimneys spewing soot and you think “well, yes, that does look like carbon pollution I suppose”. And then they add the obligatory cooling towers to enhance the effect.

This wilful talking at cross purposes on CO2 “pollution” and “carbon pollution” while being coy about hiding behind the EPA directive, will totally confuse students and hard working voters. They’re duped into thinking power stations are much dirtier than they really are.

Here’s an example of three sceptics including me, confusing each other when they’re all in agreement but getting tripped up by this crazy leftist trick:

https://twitter.com/rogtallbloke/status/949574036216008704

I definitely should have given a shout out to coal. I’ve written quite a few posts on the reality of “beautiful, clean coal.”

Scute

You pretty much nailed that one. I don’t see a problem collecting the heavy valuable metals from the coal for other applications. SO2 is a fertiliser in appropriate quantities. NO and NO2 are pollutants because they are PM precursors. They need management, unless there can be shown some commercial use of it. CO2 is being put back where it belongs in the air.

If we learn from history, it is that not long ago the planet came perilously close to losing its biomass foundation for the food chain. Can we really affect it? Let’s see.

Two more points: coal mining and human health, then the numbers employed in ‘renewable vs coal’.

First, coal mining is highly suited to the use of industrial robots but that high tech transition is not yet started. The management of the environment around the mines is a challenge for us and future mining engineers. Estimates should be based on what can be learned, not what was done by scallywags.

For employment, I hear frequently the stat that more people are employed in ‘renewables’ than coal. If true, it merely shows how inefficient renewables are at generating power. But with that claim should be clarification about deaths on the job per GWH of output. Wind and solar are dangerous. The renewables hardware industry spreads it’s pollution and impacts over large areas of land often in overseas countries.

Effective management of the environment and the energy supply remains a perpetual challenge whether we live in caves or castles. There is nothing wrong with consulting honestly about it. I am an admirer of all energy. I have never met a Watt I didn’t like.

The NYT Editorial Board, reporters, writers, staff and owner live in the castles of vapor that Al Gore imagines in his alarmist sociopath mind.

Where do they live, how do they travel, and what is their carbon (sic) footprint (c.f.) ?

I dare anyone of them to compare their “c.f.” to mine.

” In recent years — the Obama years — the amount of energy the country has sent abroad has begun to catch up with the energy it brings in.”

Trust me. That statement actually has the merit of being true. Every time Air Force One, or two, instead of a broom stick, spirited Michelle (whoever dressed that woman?) and the lil’ ones to vacations in the Bahamas, Mexico, and other spots it was bringing energy abroad.

And, since these trips certainly separated Michelle from the high-end WH chef we can assume Air Force One, or Two, slurped up less energy bringing her back in since it had less poundage to contend with on the return.

Now, I know what I’ve just written could not possibly pass any standards of professional, factual journalism. Maybe (but probably not) the NYT could recognize that.

Let’s not forget that many of the most unpleasant regimes in the world are also supported by oil revenues. There is something to said for not having to pay lots of money to your sworn enemies.

Putin’s Russia needs oil revenues. The 9-11 attacks on the USA were by religious fundamentalists bankrolled by a Saudi with more money than he knew what to do with. There may well be others. US wars in the Middle-East have been fought primarily because that is where the geo-political oil was. No one gives a toss about most of Africa because……same reason. We all know why China is getting so territorially belligerent about the Spratly Islands, and it is the most likely trigger for World War III.

Not needing to be so polite to oil producers in the Middle-East and elsewhere ought to allow America to start living up to its principles in the foreign-policy arena. And shared frackable gas deposits in the Eastern Mediterranean could, potentially, oil the wheels of a peace-outbreak between Israel and its neighbors. If it happens in the next decade, the NYT and Obama may recognise it in thirty years time. And claim credit for knowing it all along.

It’s incredible, isn’t it, that green mouthpieces say all that oil and gas is going to be left in the ground by wind mills and a smattering of solar panels? Yet the value of petroleum products is still determining the future of world peace and the living standards of 7+ billion people. And it will continue to do so, long after the BBC luvvies have forgotten carbon dioxide and plastics.

+10

Not much oil in Afghanistan and Iraq is one of the smaller oil producers in the region.

Not much oil in Israel or the Palestinian territories.

Wrong. Iraq has lot’s of high quality, light oil. It used to be the second largest oil producer in the Middle East. The cost production is also low in Iraq when it is not gripped in civil war.

The WUWT editorial ignores all factors like global markets, automation and methods in coal mining, the rise of natural gas, environmental costs, etc in the “evidence” that the Obama administration was at war with the FF industry. One thing Obama did was to simply enforce regulations that were on the books from earlier administrations.

The coal mining industry has been suffering since long before Obama; new regulations had an impact but it was small compared to other factors. Mining and burning are sources of costs to human health that aren’t factored in when looking at its role in the economy.

But all that is irrelevant to the main question, which comes down to motive. Wanting to ameliorate negative effects of FF extraction, transport, refinement and use on humans, economy and environment is not the same as declaring war on an industry. Why would any president want to destroy an industry, especially one that is important to the economy? It’s a baseless accusation.

Ha ha ha,

it clear you suffer from Ocular partisan disease, since David exposed the deception by showing that Obama DID NOT support Oil and NG production since he tried to shut them down on “Federal” lands. It was on STATE lands that the OIL and NG boom occurred on.

The NYT claimed,

“There has been no war on energy. American oil, gas ”

Suuuure if you are a partisan lemming.

Obama did a lot more than just enforce existing regulations, which by the way were already being enforced.

He created entire books of new regulations, and when that wasn’t enough, just created new laws with a stroke of his pen.

Obama declared during the campaign that he was going to bankrupt the coal industry, and as soon as he took office, he started to make good on that promise.

:”Obama declared during the campaign that he was going to bankrupt the coal industry,”

Are you referring to what David posted? In that he says nothing of the kind. I’m aware he made new regulations. He was trying to reduce CO2 emissions. I think that’s a good thing. These days it would seem foolhardy to open a new coal-fired plant unless it’s to replace an old one.

I’ll say it again to all of you:

“The coal mining industry has been suffering since long before Obama; new regulations had an impact but it was small compared to other factors.”…primarily natural gas, automation and dropping prices – the international demand is shrinking.

The number employed by coal mining actually rose a little during Obama’s presidency (then dropped a lot), though it has been dropping since 1986; the latest peak was in 2012.

https://fred.stlouisfed.org/series/CES1021210001

The energy industry is not a jobs program.

https://wattsupwiththat.com/2017/03/30/what-npr-misses-about-energy-jobs-in-america/

https://www.newsbusters.org/blogs/nb/pj-gladnick/2008/11/02/audio-obama-tells-sf-chronicle-he-will-bankrupt-coal-industry

Ms. Silber, do you get paid by the word to lie on WUWT?

If the link works, you can watch ex-POTUS Obama say that,

“So if somebody wants to build a coal power plant, they can. It’s just that it will bankrupt them because they are going to be charged a huge sum for all that greenhouse gas that’s being emitted.”

https://youtu.be/4aTf5gjvNvo

Directly quoting a Democrat President = baseless accusation to the troll.

Thanks for the link Mr. Middleton – you obviously type much faster than I do!

About 6 WPM after adjusting for typos… LOL!

The Obama war on oil & gas was very real…

https://www.politico.com/story/2015/08/oil-gas-obama-environment-agenda-121347

http://www.offshore-mag.com/articles/print/volume-76/issue-12/regulatory-update/industry-responds-to-final-well-control-rule.html

While the final Well Control Rule was not as bad as Obama’s first version, it was totally pointless, increased drilling costs and made no measureable difference in well control.

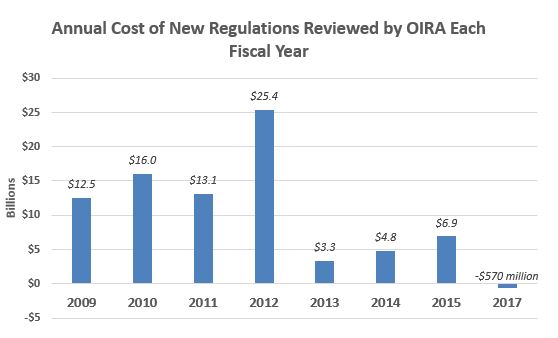

https://www.uschamber.com/series/your-corner/regulatory-relief-the-untold-story-2017

https://www.uschamber.com/series/above-the-fold/the-trump-administration-s-historic-year-deregulation

“One thing Obama did was to simply enforce regulations that were on the books from earlier administrations.”

Complete nonsense.

E.H.,

Adding to your view:

And as a constitutional scholar, he shredded the US Constitution.

And lied, a lot.

Worst president ever.

John, I stumbled upon this last night which really sums things up:

President Barack Obama’s Complete List of Historic Firsts [Updated]

http://directorblue.blogspot.ca/2011/06/president-barack-obamas-complete-list.html

The list is a bit old and has 388 comments. I don’t have the time to read it all.

If I did, I’d likely not sleep well and would be angry for a week, maybe longer.

Still, I appreciate knowing it exists.

John, it was updated to the end of his Presidency. But you’re right. Not good for anybody’s sleep!

The Aussies seem anti-coal and anti-CO2….but…when they advertise for global tourism they never show them arriving by sail boat……………

With friends like Obama, nuclear did not need enemies.

The first thing Obama did was install an anti-nuke to run the NRC and stop review of Yucca Mountain.

Harry Reid was probably an even bigger obstacle to Yucca Mountain… The most suitable geological repository for nuclear waste in these United States.

Not that we need a repository. Just reprocess the stuff like the rest of the world does.

Fortunately, Obama was not well versed in the law of unintended consequences. As a result of what he did other options were found. Now that Trump is in, not only are those other options going strong, but he can now undo the damage that Obama did (thus adding to those other options). AND we’re gonna need it. Did any of y’all notice the stock market today? Inflation jitters. Cheap energy is going to have to be a big part of the Trump Boom going forward. It can go a long way toward keeping inflation in check. (in fact we’re already in very good shape wrt cheap energy thanx to Obama’s unintended consequences, but it must get even better) And this is imperative because once inflation sets in for real it’s adios economy. The federal reserve sits poised to shut this economy down, as it’s always been one to do, once inflation sets in…

The federal reserves job is to protect the value of the currency.

If you think high inflation is a joke, perhaps you should review the days of the Wiemar republic.

The federal reserve only has two levers to control the money supply. The first is by either buying or selling t-bills which directly impacts interest rates.

Or by adjusting the reserve requirements of all banks. This reduces the supply of money and causes banks to stop lending while they build their reserves to the new levels.

Well, if it isn’t Little MarkoW spewing his usual monetary nonsense…

Folks, the way that the federal reserve protects the value of the currency (as mark so eloquently put it) is by undermining the value of labor. Yes, they do keep prices lower, but at the greater expense of buying power. Which is better? To have higher prices that more people can afford or lower prices that fewer people can afford? If inflation does kick in soon, the fed will bring the economy to a stand still. They’ll do this to keep fewer people employed and to keep wages lower for those who are employed. The net result is less economic activity— less buying and selling of goods and services. (all in the name of curbing inflation)…

Why do you leftists get so upset when faced with reality.

When inflation hits, the only people who do well are those who own real assets. Mostly the rich.

The poor are killed by inflation because the stuff they need to buy is going up in price much faster than their wages are.

It would be nice if you actually learned something about economics instead of spouting third rate marxism over and over again.

Why doesn’t Little MarkoW get on the phone and tell Big Don what a commie he is for suggesting that poor people should have more jobs and better wages?

re the stock market plunge: Interest rates are going up so some people are moving a little money from stocks into bonds.

And then there is program trading. A normal drop of a couple of hundred points becomes a big drop of 1,000 points when you have the robots doing the trading.

And the stock market has climed steadily for 8,000 points so it was due for a pull back.

But the fundamentals of the economy are strong and getting stronger so the stock market is going to go higher.

Now might be a good time to buy in.

Hi TA, always nice to read your comments…

Yes, the fundamentals of the economy are strong, but that’s not the issue here. The by-product of a robustly growing economy is inflation. So what the federal reserve does is make sure that the economy is less than robust by raising interest rates (which is what drove investors’ actions today). The unemployment rate stands now at 4.1%, the lowest the fed has let it go in nearly fifty years save briefly at the end of clinton’s term. If inflation kicks in, the fed will shut down the economy, period! So it’s only a good time to buy in if inflation doesn’t show up. The only wild card here is Jerome Powell, Trumps pick for the fed chair. This guy, being what they call a dove, is probably about as liberal as any fed chair that we’ve seen in a long time. Hard to say exactly what he’ll do in the face of inflation pressures. (all depends on him and cheap energy as to whether our next recession shows up before or after the 2020 election)…

afonzarelli wrote “The by-product of a robustly growing economy is inflation.”

Thanks for this insight. I’ve been trying to understand the high inflation rate of Venezuela.

+1 John F. Hultquist

Inflation through out the whole XIX century, time of the most robust long term growth, was ZERO. Even the civil war only affected “greenback” value, but currency (silver and gold coins) were unaffected.

A dollar could buy just the very same thing from ~1800 to ~1900. Now you need ~25 of those dollar to get it

Guys, that a robustly growing economy causes inflation is the cornerstone of federal reserve monetary policy. That’s why they raise (and are currently raising) interest rates, to slow the economy down. There are differing reasons that inflation can happen. (what i’m referring to here is known specifically as demand inflation)…

People got so used to near-0% interest rates, that 3% 30-yr Treasury yields cause panic-selling.

The best wage growth since 2009 and this triggered the sell-off…

3% 30-yr Treasury yield in perspective…

What causes inflation is the money supply growing faster than the supply of goods.

P@ranoia may be cute, but it’s an awful economic policy.

A number of things can cause inflation. Yes, growing money supply is one. But there is also higher energy prices, higher wages and higher demand, etc. The fed treats them all the same. They raise interest rates to curb economic growth which reduces demand inflation (and wage inflation)…

Also… Remember that the stock market often reacts to indications of things to come.

The best wage growth in a decade, spiked bond yields, which tanked the stock market on fears that the Fed would raise interest rates more quickly than expected… The Fed didn’t actually do anything or even say anything.

“There has been no war on energy.” Right. Hillary never talked about putting coal miners out of business, and the Climate Mafia never invoke the evils of fossil fuels, the evil of fossil fuel companies, and/or the evil of fossil fuel employees. Apparently progressivism means never having to say you’re sorry.

Huh … ? Speaking of Energy Auctions … Obama CLOSES the Caribbean to deepwater drilling … while Mexico opens it … https://www.spe.org/en/jpt/jpt-article-detail/?art=3858

Once again, Obama on the WRONG side of History. The WRONG SIDE of Energy.

Let’s see now, Obama helps bankroll Al Gore’s Chicago Climate Exchange then once in the President chair

pushes policy (cap and trade ) that would directly benefit his pals at the Chicago Climate Exchange . No conflict there .

How much unauthorized money disappeared from USA tax payers as Obama got set to collect his pension ? $ Half a billion plus all that to rent seekers .

President Trump will eventually get around to it’s recovery and hopefully criminal charges .

The US is losing out on the renewable energy revolution owing to Trump’s misguided energy policies. Renewables are steaming ahead in Europe and ROW and the Trump-led focus on the dying coal industry means that America is LOSING OUT FINANCIALLY on these fast-growing industries that are creating revenue and jobs around the planet. Countries like the UK and China are capitalising on this market weakness:

https://mankindsdegradationofplanetearth.com/2018/02/06/uk-built-half-of-europes-offshore-wind-power-in-2017/

Sorry, if you quote no source then your dog could have come up with these figures. Did it?

https://wattsupwiththat.com/2015/08/03/obama-may-finally-succeed/

The high electricity prices in Germany, Denmark and other participants in the “renewable energy revolution” isn’t exactly a secret.

https://wattsupwiththat.com/2017/10/19/doe-secretary-rick-perry-resiliency-pricing-rule-for-coal-fired-and-nuclear-power-plants/

No realiable verified source for this data. Cannot be trusted.

“The high electricity prices in Germany, Denmark and other participants in the “renewable energy revolution” isn’t exactly a secret”. And it is not a bug either, it is a feature. Those countries WANT energy to be expensive for average Joe, so that people save it. So they tax it accordingly. And, not being THAT stupid, they manage to exempt their businesses https://www.cleanenergywire.org/factsheets/industrial-power-prices-and-energiewende

Don’t tell that to Ivan, he lives in a fairy tale land, where government are Divine Providence incarnate, caring about people and the Planet. This would shatter his dreams.

Meaning, to be fair, you can expect them to have high retail electricity price even if they didn’t subsidize renewable.

ivan sure works hard to avoid seeing what he’s paid not to see.

@ivankinsman;

The original source of the graph is a post by Willis Eschenbach:

https://wattsupwiththat.com/2015/08/03/obama-may-finally-succeed/

You can see the data sources in that post.

What renewable revolution?

Get off your computer, Mark, step outside your front door and you might actually see it going on around you. Send me some photos.

@ivan,

you quoted no source for your claims, so I guess your dog could have come up with these. Did it?

I think not. No dog is clever enough to state such nonsenses.

You seem very proud of UK of having $9 per Watt offshore wind ( https://www.statoil.com/en/news/hywindscotland.html ; note that they also claim a “60-70 percent cost reduction per MW”, meaning the thing they compare costed like $25~30 per W)

You seem to believe that the more expensive the thing, the more jobs are created. Well, your believing such nonsense is fully coherent with all your other nonsensical beliefs

Offshore wind… Half as reliable as coal *with* CCS *and* more expensive…

https://www.eia.gov/outlooks/aeo/pdf/electricity_generation.pdf

How can companies like Dong bid £57.5/MWh (~$80/MWh) for offshore wind contracts when the LCOE is $157/MWh? By getting a pile of taxpayer-funded cash up front…

https://renewablesnow.com/news/update-dong-to-build-hornsea-2-after-cfd-win-at-gbp-575mwh-582912/

The lower the £/MWh bid, the bigger the pot of corporate welfare…

http://www.telegraph.co.uk/business/2017/10/11/ministers-fire-starting-gun-2019-renewable-energy-boom/

£294 million is about $410 million. Dong will get a big chunk of that $410 million up front.

This is the sort of idiocy that President Trump rejects…

http://www.nortonrosefulbright.com/knowledge/publications/144614/contract-for-difference-in-great-britain-the-offshore-wind-round#autofootnote2

If you’re going to subsidize electricity generation, you should subsidize the generation sources that actually work: “Beautiful, clean coal” and nuclear power.

http://www.azquotes.com/picture-quotes/quote-if-you-want-more-of-something-subsidize-it-if-you-want-less-of-something-tax-it-ronald-reagan-113-67-25.jpg

At the time of the announcement there was coverage here at WUWT re Dong Energy’s bid. I can’t find my post, but I did some digging on the back numbers, and the RET’s and feed in tariff’s were going to cost the consumer some $0.30/kW-hr for all that nice clean energy. That’s how they were reducing the upfront costs.

I wonder if Hornsea Project One and Two had an environmental impact study done? How about those whales?

I think they go through a similar permitting process as offshore oil & gas platforms do. Although, if whales were actually being harmed by marine airguns, offshore wind power would have been banned long ago.

if trump turned water into wine the nyt would complain he was polluting the water.

Obama invested well?

Obamas Pay $8.1 Million for Home Just Miles From White House – The …

https://www.nytimes.com/2017/05/31/us/obama-buys-house-washington-kalorama.html

“Not that we need a repository. Just reprocess the stuff like the rest of the world does.”

MarkW does not have a clue.

Reprocessing does not reduce the the amount of fission products. It only separates potential fuel from spent fuel rods. So you still need to store the fission products someplace for about 300 years until the level of radiation decreases.

“But don’t let facts get in the way of your preconceived biases.”

First of no facts were presented about cancer rates. Second when facts are presented and I check the facts, always, always it is fear mongering.

Here is a verifiable fact. We all die. Age is the most significant factor. Anyone who thinks they can change that is a fool.

People are afraid of dying and fear mongers take advatage of it.

While I am a nonsmoker and I was glad that I did not have sit next to someone smoking at work; fear mongering about smoking and everything else gets old.