Essay by Eric Worrall

The Australian Energy Market Operator, the industry body tasked with overseeing electricity supplies in East Coast Australia, has shied away from endorsing an Aussie government claim that renewables will reduce prices.

The full video is well worth watching, the commentators go into an in depth explanation of why renewables are the most expensive form of power, and will remain so for the foreseeable future.

The guy in the screenshot above is Minister for Climate Change and Energy Chris Bowen, who persists in claiming if you spend enough money on renewables prices will come down – a view apparently not shared by the head of the Australian Energy Market Operator Daniel Westerman.

The senator who pushed AEMO head Daniel Westerman into giving a straight answer on whether he endorsed the view renewables will bring down prices was LNP Federal Senator Matt Canavan, whom I spoke to in person at the recent Aussie CPAC conference. Matt Canavan together with my local MP Keith Pitt appear to be leading an effort to bring a sensible discussion about coal back into mainstream Aussie politics.

But Nick sez they are free, something doesn’t jibe here.

What part of “all politicians lie” don’t you understand?

All fine and dandy but Nick isn’t a politician.

A Pollytitian perhaps, he loves to Parrott the narrative

Proof? Their lips are moving.

Wind and solar are not cheaper than fossil fuel and nuclear. They can not provide continuous energy, they can’t provide the energy we need when we need it, the are short lived, the can not be recycled, they have a huge footprint, the, kill thousands animals, they get paid for energy that they haven’t sold, they get subsidies, tax preferences, their product is mandated, they get regulatory forgiveness, they disrupt the grid and on and on. The whole business is a lie, they should be shut down immediately.

“AEMO Head Avoids Endorsing a Government Guarantee that Renewables will Reduce Energy Prices”

Of course not. Because anyone with half a brain knows that renewables I mean unreliables will cause energy prices to skyrocket.

You are assuming (or it is implied) that politicians do not have half a brain. I agree.

It is not the job of the AEMO to forecast prices overall. What he did say was that renewables are the lowest cost pathway – ie anything else would cost more.

The “commentators” are basically Chris Uhlmann, of Murdoch’s Australian. They seemed to have latched onto a claimed “explicit guarantee” of Minister Bowen. But, as so often, they don’t tell us what Bowen actually said.

Oh, Nick. Stooping ever lower!

What does ‘cost pathway’ mean to you, if not ‘prices overall’?

I do suspect that you might be claiming that fossil fuel backup that intermittent renewable energy absolutely requires, will be more expensive, ignoring the blatantly obvious increases in costs for forcing reliable power generation into an intermittent schedule. Or it might be the massively expensive extra infrastructure that renewable energy requires. Or even the insanely expensive ‘pie-in-the-sky’ storage mechanisms, due to be invented any day now.

Please enlighten us by weaving your ever-more tangled web.

“What does ‘cost pathway’ mean to you, if not ‘prices overall’?”

Simple. It means that any other plan would have higher prices. You can see how that works in the actual history of State prices here. Prices went way up in 2022, and are still not back to a minimum. But the renewables states (Vic, Tas, SA) had lower prices in FY 2023/4 than the coal states (NSW, Qld). And that is basically because of the high export price of coal, which neither the AEMO nor Mr Bowen can control.

So why the spike in 2022? 😉

World wide spike in coal and gas prices. So NSW was importing all the electricity they could get, which put up prices in Vic and SA.

And nothing to do with the renewables in place? Good to know they achieved little. 😉

So how much storage is required to keep them “cheap”?

And of course the “cheap” renewables benefited from the price increase. 😉

What are your actual domestic retail prices over the last few years, Nick?

You were a total coward and refused to present them last time I asked. !!

“So NSW was importing all the electricity they could get”

NSW nearly always imports electricity.

The population areas on the north coast are closer to the SEQ power Stations than to the Hunter and Eraring (which most supplies Newcastle and Sydney)

The population areas on the and somewhat to the north of the Murray River (Albury, Wagga etc and one the south NSW coast are closer to the Victorian power stations than to the Hunter and Eraring.

Nick obviously doesn’t understand much about how the NEM works.

That statement is misleading at best, in 2023 ‘renewables’ (excl. hydro) accounted for 31% of electricity generation in Victoria and 18% in Tasmania while it was 71% in SA.

Retail prices (as opposed to wholesale) of electricity (cents / kWh):

NSW 33 – 37, VIC 25 – 34, QLD 32, SA 44, ACT 29, TAS 28 (Canstar 17/10/2024).

Tassie is almost entirely renewables. There is no reason to leave out hydro here.

Except when they draw down too much from the dams. 😉

Only renewable that provides anything regularly in Tassie is HYDRO..

That works ONLY because they are a TINY state with a TINY demand and just happen to have the topology and climate on the west coast to support hydro.

Wind often produces less than 10% of their supply.

Why do you continue to provide deceitful MALINFORMATION in every post you make , Nick?

Very DISINGENUOUS and DECEITFUL of you.. as I know you are well aware.

Malinformation is simply being mistaken.

DISINFORMATION includes intent to deceive.

Those two words are too often conflated.

Tasmania has 80% hydro, the link above shows that.

You are being disingenuous any discussion of the viability of ‘renewables’ in all states except Tasmania means wind and solar, you know that.

Guess what the water renewables include the cost of storage , ie the dam, in the pricing of the power.

Wind seems to be the only unreliable renewable that doesn’t include the cost storing it’s output to match the variable demand .

Many years ago I remember a series of rapids – now used kayakers – but long before that had a hydro generator that used a slight river diversion to produce power. No storage of water required.

Even coal and gas supplies have some storage ability, coal for the winter or summer longer generation hours , natural gas is stored in it’s distribution network and vast underground salt domes

You cannot tell anything from retail prices, which are influenced by many other factors than total costs.

You can get an idea of the cost position of wind, particularly off-shore, by looking at the UK wholesale prices for the wind auctions. That is what suppliers are actually prepared to bid, so it reflects their cost position, its what they need if they are to make a reasonable return.

Paul Homewood had a piece on AR6 in September.

https://notalotofpeopleknowthat.wordpress.com/2024/09/05/9-billion-subsidy-bill-for-latest-round-of-cfds/

The Market Price used by the LCCC for calculating subsidy payments, has averaged £58.34/MWh between April and August 2024.

This is how the LCCC’s calculate it: The Intermittent Market Reference Price (IMRP) is the GB Day Ahead Hourly Price published by the Intermittent Day Ahead Indices.

The Strike Prices in the DESNZ table above are at 2012 prices; the inflator to July 24 is 1.3926. So, for instance, the current strike price for offshore wind is now £81.98/MWh – this of course will be increased each year in future in line with CPI.

Based on these current prices, the annual subsidy payment to the successful AR6 bidders is projected to be £629 million by the time all projects are up and running in 2030. In reality, given likely inflation in the meantime, that actual figure could be 10 or 15% higher still. CfDs are guaranteed for 15 years, so the total subsidy payout at current prices over that period would be over £9 billion.

Even this underestimates costs, because it doesn’t include the costs of the transmission required to get the intermittent power to somewhere there is demand for it. It also does not include, of course, the costs of making the supply dispatchable. But its a better clue than retail prices, and even without including all the costs its obvious that offshore wind is far more expensive than conventional.

You will reach the same conclusion if you look at the previous failed auction, which, lets remember, attracted no bids. The government had made the mistake of treating the industry predictions of lower costs as true and sincere, they priced the tender accordingly, and lo and behold, it turned out when the renewable industry realized that they would actually be held to the prices they bid, this time, they walked.

What Nick needs to produce, to show that (for instance) offshore wind is a low cost option is simple. Produce a case where the wholesale bid for supplying it, plus some allowance for transmission and remedying of intermittency, was lower than the current wholesale price.

Do that, and you’re home free. Maybe I am wrong, maybe there is such a case. Let’s see it.

Incidentally, what about floating offshore wind. Is that supposed to be cheaper too? Look up what the prices for THAT were at the latest auction!

The plots I (and Mike Jonas) showed were wholesale, not retail. I agree that they are the relevant ones.

No Nick, It is the prices that people have to pay, that are the important ones.

Or are you subsidised somehow ??

Yes, OK. But how do you account for the UK tender prices, if wind is supposed to be lower cost than conventional? That’s on fixed offshore, floating of course is ridiculous.

Total cost of ownership.

Amortize the total costs over the total product delivered for comparison of one versus another.

Anything else is just deceit.

Yes. I keep saying this. Just do ordinary net present value analysis, as done all over the world by finance departments for business cases to be presented to senior management investment committees.

I have even implored them to read Brealey and Myers if they haven’t been exposed to the way this is done.

But there is never a case, nor a pointer to one, nor even an acknowledgement that this is the method to use. Instead you get these vague indicative gestures towards things that don’t prove cost effectiveness one way or the other.

I do think the UK auctions are decent evidence. The people bidding will have gone through NPV analysis to do their business case. Its true they are able to leave out the costs of making their product dispatchable and available. But even with that qualification, the prices they choose or refuse to bid at are valuable, if partial, evidence of the real cost picture.

Nic

When will you stop believing that the spot prices are true “wholesale” prices. You do not understand markets and residuals. They also average the negative pricing – which confounds the numbers. Most of today is negative pricing but they are predicting $17k/MWh when demand peaks after sunset. How will a 24h average of just prices not load weighted average reflect that?

You also do not seem to understand the components that make up retail electricity prices. The generation cost is a minor and decreasing component of the price. You need to add the grid charges. That is why the householder in your beloved SA has to pay so much. A good example of the hidden grid charges is like what happened today in Victoria where Snowy Hydro units were dispatched on to stabilise the grid even when there was negative pricing. How do you think that is paid for?

“The generation cost is a minor and decreasing component of the price.”

Good to know. Sounds like renewables are working.

Working to maximise the grid charges as mentioned above, yes.

“Sounds like renewables are working.”

NO, renewables have pushed retail prices up massively in EVERY place where they infect the grid to any degree.

They do that because THEY DON’T WORK for large proportion of the time, especially not when needed..

No Nick – that is being stupid. The wholesale costs are decreasing as a percentage because the cost of supporting them is going up. As it doesn’t show in the generation side of the ledger, useful idiots claim costs are decreasing and pretend the retail price (plus off book subsidies) is irrelevant.

Good point . The true wholesale power prices in Australia are done in off market bulk deals, this often called hedging or contract pricing

You get it Duker, though the prices are also hiding the increasingly common market interventions. Dispatching solar off while constraining GTs on in SA is the most common one.

Yes, but the bulk deals are guided by spot markets, which either side could revert to.

No, you have it the wrong way around Nick. The spot prices are effectively the residuals between generation and the contracts. That is why they have the volatility. Most companies buy a very large proportion of their power on long term contracts and have a float on the spot. Either that or they say price is too high and get a subsidy from the government to continue operation. Another hidden charge on the cost of unreliables power.

The challenge for Nick is simple. If it is true that you can produce dispatchable power cheaper from wind and solar than from conventional, then someone should have done it. This is what makes the UK auctions so informative. They should be bidding lower than current conventional wholesale.

But they are not. When an auction was conducted on the assumption that they could bid cheaper, there were no bidders. This is why they raised the target in the latest auction.

Of course, they do not bid dispatchable. So to get a real picture you have to add the costs of making what they deliver dispatchable. But its a bit academic, since even supplying their intermittent power they are obliged to bid well over current wholesale from conventional to make any money.

If this is wrong, just show a case where someone has bid below current conventional and is making money – after the costs of making it dispatchable and getting it to wherever its needed, of course.

“The challenge for Nick is simple.. If it is true that you can produce dispatchable power cheaper from wind and solar than from conventional, then someone should have done it.”

And over and over, I have done it, even on this thread. Ten years ago South Australia, relying on coal, had the most expensive power in the nation. Then they blew up their coal station, embraced renewables (now about 70%), installed the world’s first utility battery, and are now mid-range in wholesale price. They have left the coal states behind; only Vic and Tas, also much into renewables, are doing better.

Sounds of laughter filling the room.

SA didnt ‘blow up coal’ they just got it from Victoria via the HVAC link– but with hidden catch that the state grid had to have a stable frequency to match Victoria or it would be cut off in milli seconds

Changes in demand from the decline of manufacturing ( previously an SA strongpoint backed by cheaper power) , shown by Whyalla a small heavy industry town in the west part which previously had its own 500 MW coal power station for the smelters and steel mill and ship yard. In Adelaide itself the coal was replaced by a newer fossil fuel , natural gas from SA own gas fields

For a few years SA was a net exporter. Lately they have been importing on average about 100 MW from Vic. That is about 5% of their usage. And of course, VIc is also about 30% VRE.

SA is 70% VRE. The other 30% is mostly gas.

“previously had its own 500 MW coal power station”

It was never much more than a tenth of that.

Nick Do not talk about averages, They are misleading at the best of times. Look at the line loading data. How SA is exporting/ dumping their solar in middle of day, often at negative pricing, then importing expensive coal power later. The net energy transfer might be zero but SA consumers are paying through the nose for that virtue signalling. The interconnectors are often at rating. That is why they are having to build more.

“It was never much more than a tenth of that.”

LIAR.. or ignorant?! … We can never tell with you, Nick.

Playford B had 240MW capacity (closed 2015)

Northern had 520MW capacity (closed 2016)

Poor Nick.

Your graph clear shows the big rise in price in SA in 2016 when they closed Northern Power Station.

Your own data proves you wrong. !!

As for the Hazelwood closure in Victoria..

OK, you’ve given an instance. I have to look at it carefully to come to a conclusion (assuming the data is there). Will try to find time.

But, what about the UK auctions? How do you square the results and the levels there with the claim that wind is cheaper?

Why did SA prices double, it looks like, between 2021 and 2023?

Also, is there anyplace easy to get a chart or listing of how much renewable SA has been using over this period? I mean a chart of a listing of energy used by generation source? The kind of thing you can get from gridwatch for the UK?

Then we could plot against wholesale prices, might give a clearer idea what is going on.

If you are right, the higher the percentage of wind and solar, the lower the wholesale price ought to be. You would have to control for the price of coal of course.

“Why did SA prices double, it looks like, between 2021 and 2023?”

Same reason as elsewhere – very high export prices for gas and coal. SA is interconnected – other states can buy SA elec, to a limited extent. Also SA is still about 30% gas, at utility level.

“a chart or listing of how much renewable SA has been using over this period?”

The AEMP dashboard is here. Unfortunately it only gives the last 12 months at best. It shows 68% W&S for that period, but that does not include rooftop solar, which is very big in SA:

What do you say about the latest UK auction? Why did they have to raise the prices so much? Why did the previous auction at what ought, on the theory, to have been a very reasonable price level fail to attract any bidders?

The charts so far produced for SA don’t tell me a whole lot. I am looking for some definite proof that the introduction of more wind and solar into SA resulted through the period in lower wholesale prices, when you hold all other fuel prices constant.

Its too much for me to do at the moment, but what needs doing is get the total generation annually by source, then list prices annually by source. Then we could see what is really going on, and whether wind and solar really are resulting in lower wholesale prices.

I cannot tell much of anything from the two charts so far.

If you are selling a goos in high demand (say dispatchable power), it is quite obvious that you can charge what you like.

On the other hand if you are trying to sell goods into an oversupplied market (say lunchtime solar and wind) you have to dump it into the market at negative prices that you can just bear because the government have arranged a bagmen (retailers) to rob consumers.

The reason coal generation is expensive is the suppliers have removed themselves from the market to create a squeezer so those remain are still profitable.

The guaranteed output of wind and solar is zero so there will be always room for dispatchable generators to force prices up.

The lowest cost form of power generation in Australia is coal generation based on lignite coalfields because there is no export market for the lignite. The next lowest cost is nuclear.

The “pathway” is a result of the UN stooges at the BoM and CSIRO creating ridiculous climate models based on the false assumption that CO2 can somehow alter Earth’s energy balance.

Ah! So the AEMO actually is forecasting prices overall, even though it’s not their job?

No. An example is the price spike in 2022, following the war in Ukraine and high world prices for gas and coal. AEMO could not be expected to forecast that, and it raises all prices (W&S too). But they can say that you’d be better off minimising exposure to those high prices.

“you’d be better off minimising exposure to those high prices.”

WOW, Nick has just aid that if Australia still had sufficient brown and black coal, the Australian price would have hardly changed.

The exposure to the high prices would not have happened if wind and solar could supply when needed.. which of course.. THEY CAN’T !

Nick is also well aware that if the Victorian and NSW governments had allowed access to the massive supplies on gas under those two states, there would be almost zero price effect from elsewhere.

It is the totally moronic blocking of gas drilling, and the blocking of new coal-fired power stations… both part of the idiotic anti-science anti-CO2 agenda…

… that has caused the vast majority of the electricity price rises.

What are your actual domestic retail prices over the last few years, Nick?

You COWARDLY refused to present them last time I asked. !!

These are the “lowest” prices within the context requiring renewables and shutting down coal. If that was not in force, the costs would not have such a dramatic rise.

An own goal, IMO.

Who cares what Bowen said, Mr. Fake ID? Australia had one of the lowest cost electricity systems in the world and destroyed it for silly reasons.

ie.. Nick cannot counter a single thing said.

Why not just say that Nick..

Or is it that you KNOW that wind and solar a NOT cheap, but end up being the MOST EXPENSIVE form of electricity, pushing prices up where ever they more than slightly penetrate the grid supply.

Then he is an idiot. (but more likely just trying to retain his job)

This is some of what Chris Bowen actually said:

“The fact remains that renewables are the cheapest. The sun doesn’t send a bill. The wind doesn’t send a bill. We’re seeing that at wholesale prices now, wholesale prices are through the floor.

[] it takes a while for wholesale prices to translate to retail prices. Wholesale prices are about a third of what makes up retail prices – the other things being distribution and network costs – but a third is a lot. And then you get the Liberals and National saying, “If renewables are so cheap, why are power prices so high?” Well, it’s because we don’t yet have enough renewables. We’ve also made sure while more renewables come online families and businesses have relief with our energy bill rebates.

[] the electricity market’s more complicated, and many retailers have bought their energy on long-term contracts, so they’re still paying the old price for some time until the new price flows through. But I tell you what, if wholesale prices are coming down, they will flow through to retail. They might not follow through at 100 per cent, they might not flow through the next week, but they will flow through as sure as night follows day. That’s something we expect from retailers.” [my bold]

Chris Bowen said that on September 15, 2024, only a few weeks ago, but ….

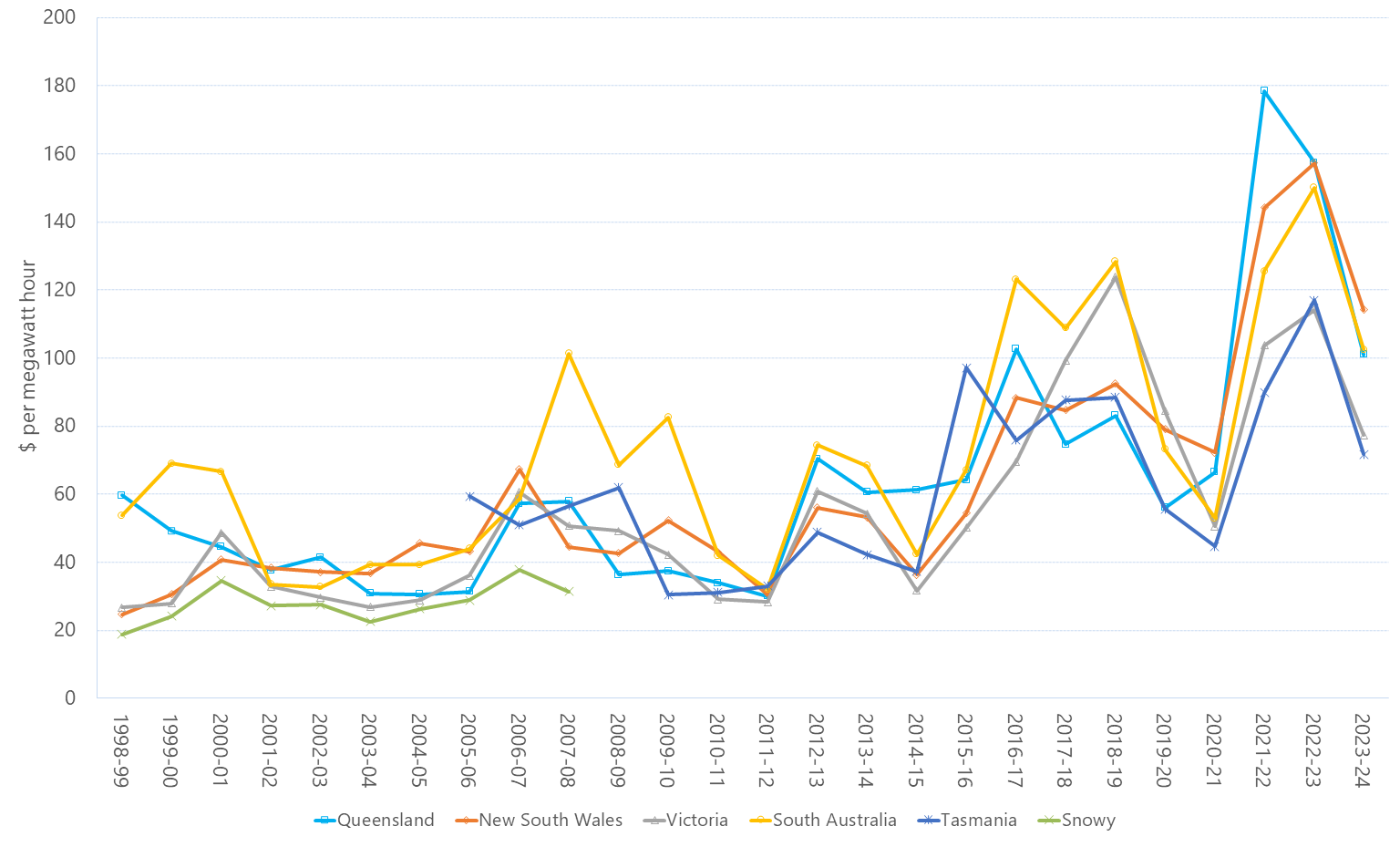

… here’s an AER (Australian Energy Regulator) chart of “annual volume weighted average 30-minute electricity prices in each region of the National Energy Market (NEM). The average is weighted against demand for electricity. Data as at 1 July 2024. Sector Electricity. Segment Wholesale. Categories Electricity spot prices. Source AER; AEMO. AER reference 11048184.”[my bold]:

Chris Bowen actually said “wholesale prices are through the floor”. The figures say he is lying. I could have been more cautious and said that he was mistaken, but he is the minister, he must know what has been happening over the last two decades. He has to be lying.

PS. ourworldindata shows Australia’s “Share of primary energy consumption from renewable sources” rising from just over 4% in 2010 to 15% in 2023. In that period, Australia’s wholesale electricity price has doubled in some states and more than trebled in others.

“ more than trebled in others”

Yes, in coal states. And it is because of the world price of coal.

Excellent. So now that the coal price has come down again in 2023, our electricity prices will halve!

Except that they didn’t…

https://tradingeconomics.com/commodity/coal

Halve? Not quite, because renewables softened the spike. But down a long way.

WRONG…. If allowed, coal prices in Australia, particularly brown coal, would still be very low.

The morons in Vic managed to shut down the cheapest , most reliable supply in Australia, Victorian brown coal.

Other green-slime morons in NSW didn’t upgrade and replace aging black coal infrastructure, which would have been the second cheapest supply.

I know you are well aware of that fact.

So we all know you are deliberately LYING.

You are LYING again, Nick.. why keep doing that. ?

“And it is because of the world price of coal.”

Which is of course a TOTAL LIE.

All coal fired power-stations in Australia use contracted coal, mined at the local level.

It is not “trade” coal.

My understanding is brown coal does NOT participate in the world market.

“The figures say he is lying”

Well, a bit of hyperbole, as is common in politics. But they have come down a long way since Mr Bowen’s government came in, which is at the absolute peak of the top curve. And the reason is mainly world coal and gas prices.

But again, the graph shows the different paths taken. NSW and Qld stuck maily to coal; SA, Vic and Tas went with renewables, and enjoyed lower prices.

And elsewhere, apparently…

Tasmania has always been mostly hydro, because they have the small demand that can be matched by the hydro on the west coast.

SA absolutely relies on DIESEL and brown coal power from Victoria to avoid state-wide blackouts when there is a very regular wind deficiency at night.

What makes you think you can continue to get away with DELIBERATE MISINFORMATION ??

The reason for the high electricity costs is the green agenda idiocy of not updating the CHEAPEST supplies of brown coal them black coal.

The expensive, unsustainable and erratic infection of wind and solar is the primary reason for the increase in electricity prices.

Everyone knows you are well aware of that fact, and are deliberately LYING to push your pathetic agenda.

A fair point.

What he did say was that renewables are the lowest cost pathway – ie anything else would cost more. — That does not mean they are correct.

They seemed to have latched onto a claimed “explicit guarantee” of Minister Bowen. But, as so often, they don’t tell us what Bowen actually said.

From The Australian:

Chris Bowen’s view that an ever-increasing share of renewables will lead to a reduction in power prices largely rests on one document: the CSIRO’s GenCost report, writes Claire Lehmann.

Digging deeper, nothing was found that confirmed an “explicit guarantee” but there is enough signal in the noise to rationally reach the conclusion that that was meant.

Chris Ulhmann was with the ABC (full leftards) for 18 years, he the joined the left minded Channel 9 replacing very left Laurie Oaks. He joined Sky News Australia in 2024.

To try and label Ulhmann as a right wing Murdoch devotee is illustrating only your normal level of superficiality.

https://www.statista.com/chart/18338/australian-energy-prices-increase/

Australian electricity prices have increased five-fold since the industry was directed into ‘renewables. More ‘renewables’ will mean more pain and suffering.

The best way of boosting the NEM reliability and bring down costs is to build a new large and modern COAL fired power station in each major eastern state

More people might start believing them if they start endorsing the truth. But then, if they endorsed the truth, people would realize the sham of Renewable generation

London to a brick Mr Daniel Westerman will be secretly made to retract, back-track, reconsider….

AMEO is complicit in bringing about the situation we are now in.