Guest “Now that’s funny, right there” by David Middleton

Feb 24, 2021 – Energy & Environment

Oil stocks are destroying clean energy in 2021 after years of lagging behindDion Rabouin, author of Markets

Over the past two years, electric vehicle and emerging renewable technology stocks have soared as investors priced in the transition away from fossil fuels, but so far in 2021 that narrative has reversed.

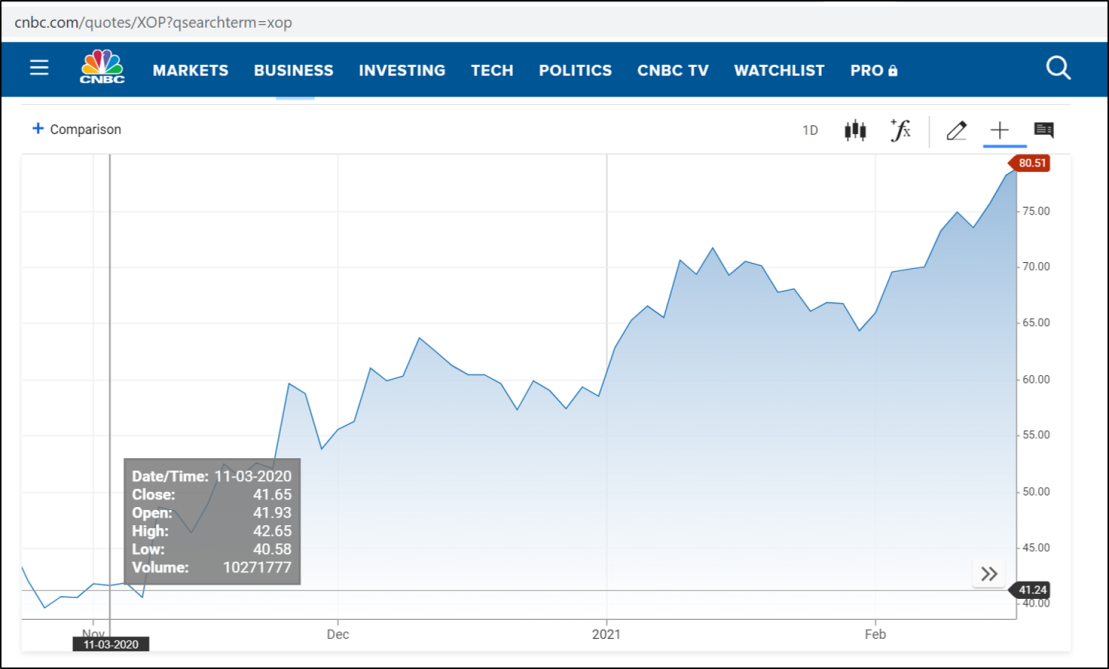

By the numbers: XOP, an ETF that tracks the largest U.S. oil and gas companies, has gained nearly 40% so far this year as oil producers like Diamondback Energy and Occidental Petroleum have seen their shares jump by more than 50%.

[…]

On the other side: Clean energy has suffered, led by the swoon of 2020’s world-beating stock, Tesla, which has dropped into “bear market” territory having fallen by 20.6% from its last record high on Jan. 8.

[…]

The big picture: Tech companies have broadly seen a turndown so far in February, but renewable energy companies have fared much worse. ICLN has declined 7.1% this year, while the Nasdaq Composite is up 4.5 % and the Nasdaq 100 is up 2.4%

The last word: The 2021 malaise is happening despite good news for the industry coming into the year: President Biden is expected to increase renewable energy investment in the U.S., oil prices are rising, and early estimates of global 2020 EV sales jumped to more than 3 million, reaching a market share of 4.4% — almost double 2019’s 2.5% share.

Axios

I have my own pet theory as to why, oil stocks have suddenly surged, while the green schist has tanked.

“Buy the Rumor, Sell the News”

Buy the rumor, sell the news is a market adage based on the belief that stock prices move in anticipation of rumors and rebound when profit taking occurs after the actual news is released.

CNBC

The Rumor

The “rumor” was that if President Donald Trump was defeated by a Democrat in 2020, the new administration would finish off the oil & gas industry and save the planet with a Warp Speed Moon Shot clean energy pogrom.

The News

The “news” was that the November coup d’état delivered dementia-ridden Joe Biden, who often doesn’t know where he is, and the even less competent Vice President Harris to finish off the oil & gas industry and save the planet with a Warp Speed Moon Shot clean energy pogrom.

The Axios article compares two Exchange Traded Funds (ETF’s):

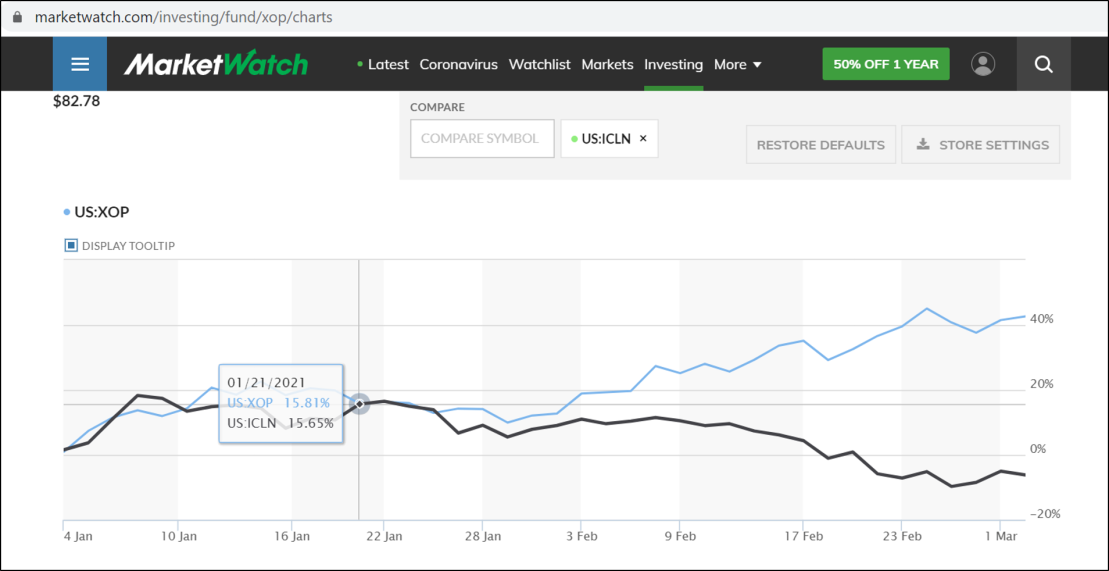

I made my own chart of XOP & ICLN on the MarketWatch website:

In terms of year-to-date performance, the two funds were neck-and-deck right up to the first full day of Harris-Biden Dominion.

XOP actually took off right after Election Day:

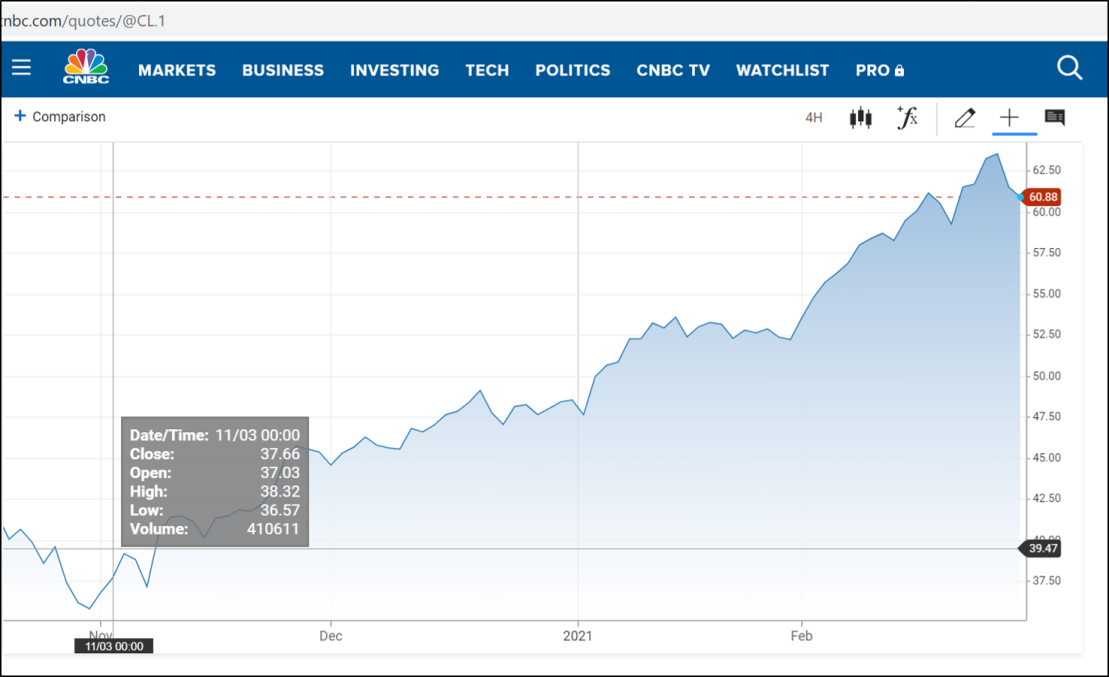

XOP took off because that’s also when oil prices took off…

Oils Well That Ends Well

Additional Notes to SJW Fact Checkers:

- Learn to recognize sarcasm

- The following words/phrases were used sarcastically (sort of):

- coup d’état

- dementia-ridden

- Harris-Biden Dominion

- pogrom

- If you’ve ever fact-checked The Babylon Bee, you might be an idiot.

- If I have to tell you when I’m being sarcastic, there was no point in being sarcastic… It works the same way with memes.

- No. I can’t prove that Joe Biden caused oil prices to rise, but at least I’m giving him credit for something.

- Yes, I know that Curly Howard was not in Oils Well That Ends Well. He was dead at the time. Joe Besser was the fat guy and he did not say nyuk, nyuk, nyuk… I am fat, I can say fat!

Who remembers this classic?

So, David, the Biden et al greenies threatened the production of the evil oil and the unintended consequence was that the price went up? Who could have thought of that? I grew up with the three stooges (some detractors say that explains a lot), but I also watched Johnny Carson as sort of the antidote. Great report!

Putin suddenly loves Biden, did he offer any help with the election?

This is the craziest thing about the left wing belief that Putin would help Trump.

Trump’s administration was a disaster for Russia’s economy, and anyone who actually listened during the campaign would have known it would be.

Probably not, because Vlad has been busy fending off that usurping fellow Navalny, who has recently been sent to a penal colony (gulag).

Only a minor irritant. In Russia human rights Hr and price of oil $X are in inverse proportion relationship i.e.

Hr = k/$X

More $s Putin gets for his oil, happier are the Russkiys less they are bothered about that western ‘nonsense’ called human rights.

Color Revolutions don’t work against the people who invented them.

Didn’t Hunter receive $3 million from the mayor of Moscow’s widow, who is a major Putin ally?

I believe the figure was $3.5 million.

Ron,

I thought Mr. Rogers or Captain Kangaroo were the only known antidotes? I suffered rather severe injuries from ODing on the Stooges at numerous stages of my life; mostly sore muscles and bruised ribs from laughing too much! What was the episode where a monkey makes a Gatling gun by dumping bullets into a meat grinder? What a classic!

Couldn’t stand the Stooges, but enjoyed the Bowery Boys. Today, stock in the Stooges is doing better than stock in the Boys — probably the influence of the comic books the Stooges were in, though the best were the seven 1953-54 issues published by St. John and illustrated by Norm Maurer. Later comics were nowhere so good. A proper application of Stoogery to our current government might help.

I loved The Bowery Boys (AKA East Side Comedies)! That Slip Mahoney could butcher the English language better than anyone!

Bowery Boys Trivia: The actors who played Slip Mahoney, Louie Dombrowski and Gabe (can’t remember his last name) were brothers.

My memory isn’t as good as I thought it was…

https://en.wikipedia.org/wiki/The_Bowery_Boys

Bernard Gorcey was Leo and David Gorcey’s father.

I depreciate the information, thanks!

Occidental Petroleum Corporation (NYSE-OXY) is the world’s worst hydrocarbon E&P company. You could not pay me to own shares.

It has been managed by a succession of crooks (Armand Hammer, “When he was talking, he was lying. When he was quiet, he was stealing”) and incompetents (B. Ray Irani and the current incumbent, Vicki Hollub).

Current shareholders had to suffer the consequences of the insanely overpriced acquisition of Anadarko Petroleum, which was a colossal squandering of shareholder capital.

Somebody should take this company out in the pasture or behind the barn and put it out of its misery.

Is Prince Albert Gore still a shareholder?

Hold on a second, I’ll ask him! I think he’s still in the can!

I think you just dated yourself (as will I).

The phone prank.

Call a store.

Ask if they have Prince Albert in a can …

(“Prince Albert” being a brand of pipe tobacco.)

Hidin’ Biden and his watermelon (green on the outside, red on the inside) cronies can limit fracking and drilling on Federal land, but not private land, so if some farmer in PA or OH or ND or TX wants royalties in exchange for allowing fracking under their land, they can have at it.

Demand for petroleum was depressed during the COVID-19 lockdowns, and air travel is still well below that of 2019 and previous years, but as more people get the vaccine, people will start flying again, and demand for petroleum will rise. If it is no longer “allowed” to frack on Federal land, the total supply will decrease relative to 2019.

Increased demand, decreased supply = higher prices. Economics 101.

FYI, the Delaware River Basin Commission (DRBC) also recently banned fracking on land (public) that they control. It shows the message these liberal/marxist agencies are trying to send.

I’ll have a post on this later… It’s funny!

“Hidin’ Biden and his watermelon (green on the outside, red on the inside) cronies can limit fracking and drilling on Federal land, but not private land, so if some farmer in PA or OH or ND or TX wants royalties in exchange for allowing fracking under their land, they can have at it.”

The federal government can limit fracking indirectly — but very effectively — by imposing strictly-enforced environmental regulations on drilling and production operations which every producer must comply with or be shut down. If Biden’s people decide they want to end fracking everywhere it is now being done, that is how they will go about doing it.

The only way the Federal government could effectively ban frac’ing “by imposing strictly-enforced environmental regulations on drilling and production operations which every producer must comply with or be shut down,” would be by imposing regulations so stringent and all oil & gas production in the US had to shut down.

I don’t think there are any laws on the books that could be regulated that strictly.

The EPA’s power to publish new regulations has the effect of giving that agency the power to write its own new law based on the creative application of older statutes. Given what we have seen since January 20th, 2021, I am guessing that much analysis work is now going on behind the scenes inside the EPA and inside other government agencies to develop a legal means of regulating fracking on private and state lands.

Beta & David:

IIRC didn’t the Obama EPA spend 3 years [and $millions] trying to prove fracking was causing some environmental catastrophe only to come up empty? They were especially keen on proving it damaged the water table.

Yes. They came up very empty.

https://wattsupwiththat.com/2016/12/14/more-fracking-lies-from-the-epa-part-deux/

“If it is no longer “allowed” to frack on Federal land,” royalties paid to the federal government will decline, so Congress will have to increase taxes to make up for the short-fall. Alternatively, they could print more money, which will accelerate inflation, which is a form of tax that neither the government or the public benefits from.

Considering that the debt to GDP ratio is about to hit 130%, there is some benefit to the federal government for inflation.

Gold stocks are the ones to own right now, can’t wait to see those Newmont dividends tomorrow to buy more stock.

Gasoline has already gone up 30 cent/gallon in CA since Joe shut down the pipeline construction, etc. $4 gas before Easter, then who knows when the “special CA only” summer formula kicks in, looks to be an expensive summer for driving.

TSLA actually fell from its all time high of $900.40 in January to an intraday low of $619.00 last month. It soared back to $745.00 on the 24th, then sold off again. Yesterday it followed the market back up sharply, but is back just under $700 again at the moment.

Last year it zoomed (!) from $70.10 low to hit that early January high. Even after the sell off, its trailing P/E ratio is still over 1092.

Buffett’s buying Chevron boosted the sector.

It’s nice that folk who buy not-Teslas end up sending their money to Mr. Musk anyway via the environmental credits that other car makers buy from him.

I mean who wouldn’t want Mr. Musk to be richer than he already is?

That’s the only reason Tesla is in the black. Tax/Environmental credits. They otherwise (still!) lose money on every car.

Looking at today’s numbers, I see that Tesla’s market value is still greater than Ford, GM, Toyota and Exxon combined. Madness.

The world really is in the midst of a mania right now, has been for decades and it is reaching a climax. So many profitable companies out there paying good dividends that are undervalued, meanwhile fake currency, young corps with outrageous P:E ratios (sometimes outrageously negative), and failing brick and mortar game stores are soaring.

It’s a little under the radar that JPMorgan got caught manipulating precious metal stocks last year and paid nearly a $billion fine. There is a reason gold and silver is being artificially depressed, hold on to your butts when April roles around.

TSLA closed down almost 5% today, but not yet a new closing or intraday low for the Feb-Mar selloff.

It’s obviously grossly overvalued, but stocks often remain overvalued longer than shorts can hold their positions. The SEC slapped Musk on the risk for his clearly illegal ploy to spark a short covering squeeze.

TSLA is not an auto stock like F or GM, but a tech stock, where not just stratospheric, interplanetary, or interstellar, but intergalactic valuations are rife. How can TSLA possibly ever grow into such a preposterously rich valuation? It can expand into Asia, but as the subsidies go, so goes TSLA.

Such inflated bubbles usuall burst, AMZN perhaps excepted. It has partially grown into its previously ludicrous P/E ratio, now that it has earnings from monopoly. The problem with other overprice stocks is how to know when the bubble will pop.

I’m glad to know that I am not the only person left on Earth who thinks the Stooges were fun.

The more Biden crushes US Production and runs the debt up crushing the $US, the better off Oil Stocks will perform. Most oil companies are global, not US companies. Renewable energy stocks will only perform as long as subsidies are in place, and that makes them risky investments.

The Texas cold blast was perfectly timed to challenge those high on pixie dust.

David,

Thanks for the post and, especially, the Curly Shuffle!

Hopefully the trend you noted is a sign that the bloom is off the rose for the Unreliables market, and we only have to weather a few years of the insanity and incompetence of the Zhao Bai Den Regime before getting actual Americans back in power in DC to start repairing the damage!

If Calizuela continues to experience wildfires and rolling blackouts there may be a bit of silver lining in the WS Younger Dryas cloud! Dicredit to solar and wind, and promotion of fossil fuels and nuclear will help put us back on the path to economic nationalism and a possibility of producing our way out of the horrendous debt we are placing on the backs of our children!

U.S. House Democratic lawmakers introduce wide-ranging climate bill

https://mobile.reuters.com/article/amp/idUSKCN2AU2JQ?__twitter_impression=true

“It’s time to try something new,” Pallone said, noting that carbon tax plans failed in Congress most recently in 2009/2010. Tonko, who prefers a carbon tax, called a clean energy standard “achievable.”

Another climate bill from Representative David McKinley, a Republican, and Kurt Schrader, a Democrat, includes a less ambitious goal of requiring utilities to cut emissions 80% by 2050. Pallone said his bill could be changed to get Republicans on board.

Given the thinnest possible Democratic majority in the Senate, Pallone suggested that senators could try to pass the bill under budget reconciliation in that chamber. That process requires only 51 votes instead of 60 in the 100-member Senate.

I don’t care what anyone says, I think you have a good sense of humor. Even if the resident trolls don’t appreciate it.

Clyde,

I pride myself in being able to my sarcastic sense of humor to troll the trolls… A sort of Counter-Trolling Operation… 😎

Trolls, especially the leftist ones, don’t have a sense of humor nor do they understand memes..

Private equity is doing fine keeping the lights on under the counter while Big Green does all the up front virtue signalling getting out of coal-

How private equity squeezes cash from the dying U.S. coal industry (msn.com)

Up to the Biden admin if they want to crack down on the payments and leave the majority of US citizens without power backup like Texans found with inclement weather.

Only the impotent are pure leftys but you keep telling yourselves Biden bombs in the ME are different to Trump ones and you’re not flogging the Kashoggi killer with a feather. Welcome to Realpolitik and some ugly tradeoffs occasionally when the playground aint aBiden by Maquis of Queensberry Rules.

Biden may not have “caused” the oil price rise in the sense that he purposely did things to make it happen. However, his actions played a large roll, just as his upcoming gun control actions have the potential to exceed the panic buying that occurred during the Obama administration. Then people will be able to legitimately claim that Biden caused the increase in gun ownership, much to the chagrin of left-hand thread wingnut progressives.

Funny how progressives don’t seem to appreciate or understand that there are always unintended consequences to poking a sleeping bear.

Leftists (on the streets not the cabal in D.C) are in a civil war right now while the right is more united than ever. The riots in Portland were the worst they have been in months.

What’s your thoughts on what OPEC+ will do? Did they learn their lesson over last year’s market share battle?

That is what I want to know, both opec and Russia want higher oil price, Biden is an absolute godsend to them but it can all be upset by one bad actor

As an Albertan I’m very please to see Biden driving up world prices

Aren’t stock prices in general a lot like the weather?

Reality is such a tough task master. It looks much glossier on paper.

Weaning off fossil fuels is an incredibly difficult challenging. After two decades of unrivalled global effort and skewed financial support, a lousy 2% of the global energy needs are coming from weather dependent generators.

The only technology that comes close to having a viable energy return on energy invested is burning wood; that goes back to the Stone Age.

The campaign group believes…..

Petrol cars waste far more raw materials than electric, it’s claimed (msn.com)

They’re really laying it on thick and fast now.

“Energy prices will necessarily skyrocket.”

Renewable energy stocks have been very popular in the year 2020 and their popularity continues to increase in 2021. The newly elected president of the United States Joe Biden is a big supporter of renewable energy resources and has big plans for the clean energy sector. Biden administration has pledged to invest $2 trillion into the development of renewable energy technology over the next four years. Biden plan on making America a net-zero-emissions country by 2050. As a result of Biden’s plans towards a renewable energy sector, major oil and gas projects in Alaska were pulled back.