In the Politico article “Major offshore wind projects in New York canceled in latest blow to industry”, the author, Marie J. French, admits “New York’s signature offshore wind projects meant to boost confidence in the industry are being scrapped, a major hit to the industry in the state and the nation”. But are the Greens listening, comprehending?

Then, a Wall Street Journal article, “Gone with the New York Wind. Three more offshore windmill projects hit the rocks, despite subsidies”, asks “Is offshore wind a perennial infant industry?” Ouch!

Finally, some are waking up, seeing the reality over the hype. (May this become a trend.) But why have the officials deciding on these projects been turning a blind eye to the negatives. It’s $$$$$. The honey trap of most officialdom.

The offshore wind industry received a strong tailwind from the Inflation Reduction Act, which included tax credits that cover 30% or more of a project’s cost. The law also subsidized the domestic manufacturing of components, which New York’s wind developers and their suppliers planned to exploit by making parts at new plants in the state. WSJ

And:

In an earlier article, French noted “It’s clear now the state is no longer on track — derailed by growing costs, canceled projects and regulators’ refusal to provide more ratepayer-funded subsidies. Part of the problem is there are simply not enough existing, awarded and contracted projects in the pipeline to hit the 2030 target”. Politico

Then there is the problem of bigger is not necessarily better. The wind power projects originally bid upon were for large (18-megawatt turbines), but, according to Bloomberg News,

Bigger and more powerful turbines have recently been toppling over, requiring expensive repairs. This is one reason GE’s renewable business lost $1.44 billion last year, which was an improvement on its $2.24 billion loss in 2022. WSJ Ouch!

And:

In February, POLITICO’s E&E News reported that GE didn’t plan to move forward with an 18 megawatt turbine. NYSERDA (New York State Energy Research & Development Authority) confirmed that was the main reason no final awards were made. A smaller turbine means a project would need more individual turbine locations to deliver the same power — and the costs would have been higher.

And:

More than a dozen projectsin New York’s (as well as other states’) quest to lead the U. S. in renewable energy goals by 2030, the negatives of wind power – cost, reliability, environmental damages — have been ignore. It’s been full speed ahead to phasing out fossil fuels for so-called green energy. WSJ

I guess it’s “better late than never” that energy writers are seeing the truths of wind power that have been up-front all along.

• The decision is another setback to New York’s aspirations to achieve 70 percent renewable energy by 2030 and be a hub for the nascent industry in the United States. It will also be another challenge for President Joe Biden’s already likely out-of-reach 30-gigawatt goal for offshore wind by 2030. Politico

• New York awarded the three projects after the state Public Service Commission last fall rejected a request for higher prices from other developers. The PSC drew a line in the sand that likely constrained NYSERDA’s negotiations: no price increases for competitively awarded projects. Other early projects canceled their deals after the decision, and similar moves have upended efforts in other states. Politico

Hmmmm, there seems to be a trend setting here. As Bob Dylan said, “You don’t need a weatherman to know which way the wind blows”. But you might want to pray that it keeps blowing if you work for NYSERDA.

But money isn’t the only significant factor here. What about the environmental damage to whales and other sea life that is being brought about by the existing wind turbines. These will be exacerbated by the “massive underwater foundations” needed for the smaller turbines. While these are called “green energy” promoted by major environmental organizations and foundations, their outcomes are hardly green, hardly human and animal-friendly, and definitely not economical on any way you look at them. In fact:

The unsuccessful solicitation comes after several blows to the industry in the U.S. in the past year, indicating the high costs and regulatory hurdles each project faces — along with the concern over socking utility customers with higher bills to pay for them. Politico

Other early projects canceled their deals after the decision, and similar moves have upended efforts in other states. Politico

Perhaps states will take deep looks into so-called green energy and determine if they fit the needs of their customers and our habitat. The negatives against wind power have been building up in recent months. Considering the high costs, according to Science Direct, “wind power intermittency has been the major barrier for large scale wind power integration… “including its impacts on power, how it is measured, and mitigation solutions. It has been found that as wind power integration increases, the system reverses and costs consequently increase, while the system reliability and CO2 reductions decrease”.

To read these articles, go to:

https://www.politico.com/news/2024/04/19/new-york-offshore-wind-canceled-00153319

and …

https://www.wsj.com/articles/new-york-offshore-wind-projects-ge-vernova-green-energy-8f6fb0c8

Government is the problem. Remove tax preferences, subsidies, environmental forgiveness and mandates and all of this mess goes away. It is only the power of government keeping it afloat. What a disgrace.

The power of the elites, that have the ear of $politicians, use the power of government, and the lapdog Media, and academia to enrich themselves and oppress and screw everyone else

If I had seen a comment like that when I was in college in the late ’60s- I would have thought “oh, there goes a right wing capitalist, blah, blah”. But what you say- I’ve seen with my own eyes for over half a century. It really can’t get any worse than here in self congratulatory Wokeachusetts.

Joe,

Here is a more expanded version from another site:

The elites, and IPCC, and WEF, and $politicians, and entrenched bureaucrats, and compromised academia, and lapdog Media, have combined to perpetuate and/or enrich themselves, using the hoax of global warming (NOT DUE TO CO2), to implement the West’s rules-based renewables scam to defraud all others

However, fast-growing BRISC, including China, India, Russia, etc., are not playing along with the hoax and scam

EXCERPT from:

https://www.windtaskforce.org/profiles/blogs/hunga-tonga-volcanic-eruption

https://www.windtaskforce.org/profiles/blogs/natural-forces-cause-periodic-global-warming

Retained Energy

In 2023, 16 C

World: (16.1 + 6.3 + 0.155) kJ/kg dry air) x 1000J/kJ x 5.148 x 10^18 kg x 1/10^18 = 1.161 x 10^5 EJ

Dry air, WV and CO2 played 71.38%, 27.93% and 0.69% retained energy roles.

Tropics: (27.2 + 43.3 + 0.155) kJ/kg dry air x 1000J/kJ x 2.049 x 10^18 kg, atmosphere/10^18 = 1,448 x 10^5 EJ.

Dry air, WV and CO2 played 38.5%, 61.28% and 0.219% retained energy roles.

The Tropics is a giant energy storage area, almost all of it by evaporating water. At least 35% of the Tropics energy is transferred, 24/7/365, to areas north and south of the 37 parallels with energy deficits

Humans consumed 604/365 = 1.65 EJ/d, in 2022

In 1900, 14.8 C

World: (14.8 +5.8 +0.106) kJ/kg dry air) x 1000 J/kJ x 5.148 x 10^18 kg x 1/10^18 = 1.066 x 10^5 EJ

Dry air, WV and CO2 played 71.48%, 28.01% and 0.51% retained energy roles.

The 2023/1900 retained energy ratio was 1.089

This video shows, CO2 plays no retained energy role in the world’s driest places, with 423 ppm CO2 and minimal WV ppm,

https://youtu.be/QCO7x6W61wc

Yes, Bob. And add to that the government rules just finalized that are intended to shut down fossil fueled power plants because they are based on technologies that are not available, no matter how much money you throw at them.

While Australia can lean on China for all the useless transition hardware, the USA is a bit big to expect China to do all the heavy lifting. So the galloping inflation in an economy not prepared to burn coal like it is in endless supply makes any large-scale projects uneconomic.

Of course how long will China accept US debt for the stuff it makes.

If Trumps makes it this time around, New York and California will be heading to China to partner with Chinese wind and solar producers to build out the subsidy extractors so China will control the power supply in the USA. Of course this could garner Trump’s ire.

It depends on how much of a majority Trump has. The Democrats are likely to lose the Senate, but there are enough incumbent vendido Republicans to snatch defeat from the jaws of victory.

My prediction- Trump will lose and the Republicans will lose both Senate House. Not necessarily what I wish for- I don’t like either major party- just saying what I see in my crystal ball.

and my crystal ball says just the opposite. Think Harris for president…

The last time Trump was in office unemployment reached 14.8 percent, the highest since the Great Depression.

Mr. Trump had no control over the spread of the pathogen.

True.

However, even the BBC concedes the unemployment rate was due to the pandemic, not Trump’s policies.

Why tell half a story?

Because he is a Leftist stooge.

Was that 14.8% connected with an extreme unusual occurrence by any chance?

Are you nuts?

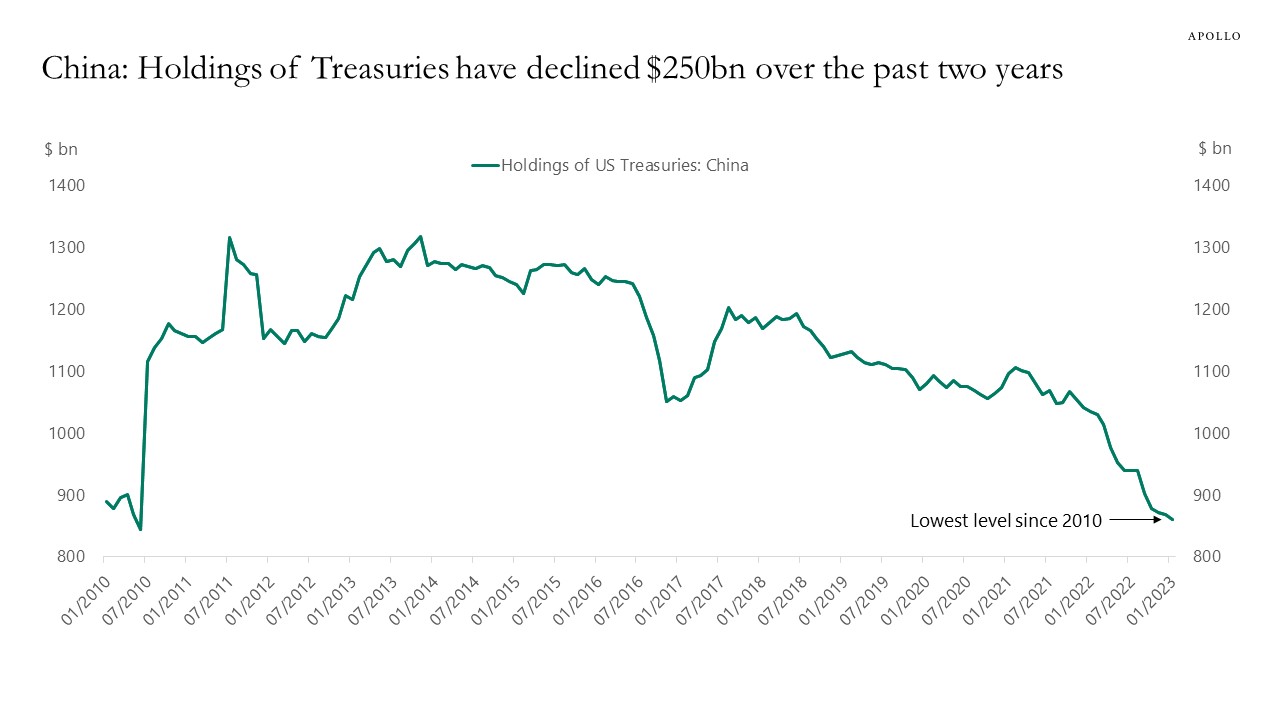

That graph shows, China is dumping a lot of US bonds, which are flooding the market, which means interest rates will need to stay high, to get people to buy the bonds.

These high rates will tank/stagnate many parts of the US economy, such as housing, cars, anything bought on credit, with an election coming up, and millions of scruffy, poor, inexperienced, uneducated folks, from all over, crossing unvetted, our borders, to start sucking from government programs run by Democrats. Geez, we are so screwed!

Gross political and economic/financial mismanagement by the self-serving elites.

The revenue of selling the US bonds, is used by China to buy gold, which has seen an increasing $/troy ounce price

The “transition” to wind and solar isn’t working as this post explains.

Add the stalling of EV adoptions with another great loss of money and there is a stone wall in front of the little green Choo Choo train.

This is better than having DJT move into the White House and make it so via executive order. If elected, maybe he can clean up the mess. It is better that it is happening with Biden and the (so called) inflation reduction act.

China has a windmill with 403 foot blades….and plans for one with 430 foot blades. Wow!

Gotta keep those slave laborers busy, or they might get restive!

/sarc tag off

Maybe they should put one in the middle of The Forbidden City to prove how green they are.

What about the legally binding CO2 reduction targets?

Legally binding is only legally binding for you and I. The government does what it wants.

Legally binding CO2 reduction targets? Leftist governments are again proving that socialist, ideologically driven green laws do not negate the laws of physics and economics. Socialist laws and industrial policies simply pile misery upon misery for regular people for the benefit of the ruling elite and their crony capitalist enablers (and that’s without even considering the socialist body counts).

After the Glasgow climate bunfest, a now disappeared report revealed that ‘peak’ renewables had occurred in Europe in 2017(!!!). This was 2 years before the string of bankruptcies in green manufacturing, the subsequent flight of private investors from this sector and the Governments war on fossil fuels that caused rampant inflation in energy costs.

Amazingly, not one of the West’s governments knew that they needed these fuels to make their renewables work! When the prospect of millions of their their citizens freezing in the dark in the looming winter dawned on them, they flew far and wide buying scarce natural gas at towering spot prices!

A telling photo of a Gernan bulldozer pushing over a windfarm to hasten expansion of a coal mine to feed a coal fired electricity plant that was being refitted for emergency recommissioning, captured the panic.

Armed with this scene, and knowing that in 2019, 47MW of spent windfarms was awaiting being taken down, I forecast that the 2017 peak for renewables in Europe was permanent. With California fallen into shocked silence and NY, and the rest of New England suddenly at a standstill amidst the ruins of their impossible mission. It’s a no-brainer that the ‘peak is a global one.

I don’t hate to say we told you so before you spent and wasted $20Trillion directly and multiples of that that in global costs to economies and the untold millons of casualties especially among the two or three billion people already close to the margin. Let’s hope you haven’t broken the 20th century’s gruesome tally

of “government-policy-caused loss of life yet.

“….. and the rest of New England suddenly at a standstill amidst the ruins of their impossible mission.”

Too bad, here, they immediately would knock down the smokestacks- with cheering crowds whenever destroying a ff plant. They could have mothballed those plants- just in case. They knocked down one in Northampton right after that company spent 50 M to clean up its emissions.

I’m an engineer and bound by statute in Canada to not only stay within my field of expertise and maintain up to date on advances in my field, but to report any practitioner whom I suspect is doing substandard work in any field of engineering. I am bound also to refuse work for a client proposing doing something that is not in keeping with good practice and is potentially or certainly harmful to the public.

Yeah, lots of luck with that! The official engineering associations are all-in with the horror of this Net Zero malpractice love-in.

Politicians and bureaucrats as worthy Luddite successors. Why do Leftists and other socialists destroy that which they do not understand?

Wind generation is a serious problem:

Why don’t we push them down?

More exciting to see them explode.

“The offshore wind industry received a strong tailwind from the Inflation Reduction Act…”

Nice pun.

“Bigger and more powerful turbines have recently been toppling over, requiring expensive repairs.”

Engineers should be able to build them so they won’t fall over. It’s not rocket science.

Joseph, you hit a nerve there. I used to hear that from a colleague. And, I would say, “yeah rocket science is so difficult a 4th grader can do it. Combustion science is a chaotic system and much more complicated than rocket science.” When you reach the limits of structural, material and engineering, you need to back off to what is reliable and safe. Time to put these extreme designs in the history books. The lure of putting these gigantic structures in the ocean, unseen but killing whales is obscene. Mason

I didn’t mean to imply I like the idea of gigantic wind turbines or any turbines. Just saying, if you told an engineer to build one that won’t fall over- and you had enough money- I’m sure it could be done with no chance of falling over- at a terrific price to over engineer it to resist any conceivable disturbance. I imagine the price of taking them down is built into the cost?

Joseph, I did not intend the comment to be towards you. Having spent some time engineering in China and noting that the Chinese mantra of cutting corners and spending time at the beach making repairs to my sons’ houses, these things won’t last the expected lifetime. Decent interest rates will kill most of these projects. Take care, Mason

Yep they’re pushing the bounds of blade size output and consequently mast height in order to get more kW out of each costly offshore turbine install and the tradeoffs are apparent. Basically oops that’s too much!

Lifetime Performance of World’s First Offshore Wind System in the North Sea

https://www.windtaskforce.org/profiles/blogs/lifetime-performance-of-world-s-first-offshore-wind-farm

Decommissioning has started at the 26-year-old Vindeby offshore project.

https://storage.ning.com/topology/rest/1.0/file/get/12164044490?profile=RESIZE_710x

The 4.95 MW Vindeby offshore project was installed in 1991

It was located 1.5 – 3.0 km off the southern Danish coast.

.

1991 Vindeby Offshore Wind Turbine System – Denmark

Years of operation: 1991 – 2016 (25y)

Capital cost: 75M Danish Kroner = $13M (1991$) = $23M (2017$)

Number of turbines: 11 @ 450 kW

Lifetime generation: 243,000 MWh in 25 y, or 9720 MWh/y

Nameplate capacity: 4.95 MW

Average power output: 1.1 MW

Cost: $13 million/4.95 MW = $2,627/kW (1991$); $4,700/kW (2017$)

Lifetime capacity factor: 1.1/4.95 = 22.2%

Those wind turbines should have had a CF of about 0.30, but significant downtime, due to breakdowns/increased maintenance caused electricity production to be much less.

1) Levelized capital cost, including financing is $53/MWh (1991$), $95/MWh (2017$)

2) Levelized variable operation and maintenance cost, VOM: $68/MWh (2017$), or 6.8 c/kWh

The calculation is using VOM at $130/installed kW-y, per industry data for 2015. See URL

The installed wind turbine capacity in operation was 4950 kW for one year.

VOM was $130/installed kW-y in 2015, or $134/installed kW-y, in 2017, after adjusting for inflation

Annual maintenance of turbines and cabling to shore is 4950 x 134 = $663,300/y (2017$)

Annual electricity production is 9720 MWh/y, as above stated

Levelized VOM is 663,300/9720 = $68/MWh (2017$)

3) Levelized miscellaneous cost, including Owner return on investment: $39/MWh

Total levelized cost = 53 + 68 + 39 = $160/MWh (2017$) See Note

NOTE:: Not included are the following:

The levelized cost of decommissioning, i.e., disassembly at sea, reprocessing and storing at hazardous waste sites

The levelized cost of any onshore grid expansion/augmentation, about $20/MWh

The levelized cost of a fleet of quick-reacting power plants to counteract/balance the ups and downs of wind output, 24/7/365, about $20/MWh

2015 Industry Performance Data for Offshore

Wind (http://www.windpowermonthly.com/article/1380738/global-costs-analysis-year-offshore-wind-costs-fell).

Cost: $5,000/kW

Capacity factor: 40%

This factor is greater when the system is new, but become less as the years go by, due to increased downtimes for maintenance

Variable operation and maintenance cost, VOM is $130/kW-yr, per industry standard for 2015

Total levelized cost is $150/MWh (2015$), $154/MWh (2017$)

The total levelized cost is reduced with government subsidies by about 40 to 50%.

This enables the Owner to sell his electricity at about 8 c/kWh, or $80/MWh.

This creates the PR appearance of wind being competitive with the levelized cost of fossil fuel and hydro power plants.

Conclusions:

1) Whereas, turbines are getting larger, and able to operate at lower wind speeds, and have greater capacity factors, the total levelized cost, $/MWh, has hardly decreased from 1991 to 2015, 24 years.

Longer cabling from turbines to shore, and higher costs of VOM for larger turbines located farther from shore likely

consumed savings from higher capacity factors.

2) Because wind power is weather dependent, offshore wind generation remains uncompetitive with gas and coal power plants, which have:

– Half the cost (about $70/MWh) and

– Are steady and fully dispatchable, and

– Have much higher value to the electric grid.

Gas and coal power plants also operate for far longer than 25 years.

Thank you.

60% efficient CCGT at least 40 years

Hydro at least 100 years

Nuclear 60 – 80 years

Coal 50 – 80 years

Panic time in Oz-

‘Something is really wrong’: Jonathan Duniam reacts to stark warning about net zero (msn.com)

All mainland Labor States squabbling with their nut-zero mates in Canberra-

State govts ‘frustrated’ with Commonwealth over net zero strategy (msn.com)

Sound familiar?

The reason Australia’s green transition is ‘slower than anticipated’ (msn.com)

Aw shucks we’re all obstructionist NIMBYs now. It’s called being hoisted on your own petard lefties.

The NY projects were not cancelled. Awards could not be made because GE decided not to make the specified turbines. Only two projects have been cancelled, by Orsted because they are having financial problems. There are 27 active projects with more coming this year.

Sadly offshore wind is doing well. State mandates and targets exceed Biden’s 30 GW by 2030. The huge price jump is being eaten by the States.

“huge price jump is being eaten by the States”

WHAT?

It will be eaten by the hapless electricity users, by means of exorbitant, electric rate increases, imposed by the STATES

World’s Largest Offshore Wind System Developer Abandons Two Major US Projects as Wind/Solar Bust Continues

https://www.windtaskforce.org/profiles/blogs/world-s-largest-offshore-wind-system-developer-abandons-two-major

New York State had signed contracts with EU big wind companies for four offshore wind projects

Sometime later, the companies were trying to coerce an additional $25.35 billion (per Wind Watch) from New York ratepayers and taxpayers over at least 20 years, because they had bid at lower prices than they should have.

New York State denied the request on October 12, 2023; “a deal is a deal”, said the Commissioner

Owners want a return on investment of at least 10%/y, if bank loans for risky projects are 6.5%/y, and project cost inflation and uncertainties are high

The about 3.5% is a minimum for all the years of hassles of designing, building, erecting, and paperwork of a project

The project prices, with no subsidies, would be about two times the agreed contract price, paid by Utilities to owners. That means, the effect of subsidies reduced the contract price by 50%.

All contractors had bid too low. When they realized there would be huge losses, they asked for higher contract prices.

It looks like the contract prices will need to be at least $150/MWh, for contractors to make money.

Those contract prices would be at least 60% higher than in 2021

Oersted, Denmark, Sunrise wind, contract price $110.37/MWh, contractor needs $139.99/MWh, a 27% increase

Equinor, Norway, Empire 1 wind, contract price $118.38/MWh, contractor needs $159.64/MWh, a 35% increase

Equinor, Norway, Empire 2 wind, contract price $107.50/MWh, contractor needs $177.84/MWh, a 66% increase

Equinor, Norway, Beacon Wind, contract price $118.00/MWh, contractor needs $190.82/MWh, a 62% increase

https://www.windtaskforce.org/profiles/blogs/liars-lies-exposed-as-wind-electricity-price-increases-by-66-wake

Four “On-Hold” Projects

Empire Wind 2, 1260 MW, near Long- Island; 1404 MW, Attentive Energy One; 1314 MW, “Community” Offshore Wind; 1414 MW, Excelsior Wind

https://www.reuters.com/business/energy/equinor-bp-cancel-contract-sell-offshore-wind-power-new-york-2024-01-03/

Offshore Cancellations in Massachusetts, Connecticut and Rhode Island

BP (BP.L) and Oersted (ORSTED.CO) have announced hefty writedowns , and US offshore project cancellations, in recent days, in the face of high inflation, high interest rates, and lack of the timely availability of specialized ships.

In Rhode Island, in March 2023, a procurement for offshore wind drew only one bidder – an 884 MW proposal from Eversource and Ørsted.

In August, Ørsted CEO Mads Nipper warned the company could walk away from unprofitable projects in the US amid the turbulence in pricing and supply chain issues.

Avangrid, a Spanish company, in September 2022, walked away from its 804 MW Park City wind project, planned for off the coast of Martha’s Vineyard. It was no longer feasible at the 2019 contract price agreed with Connecticut.

At the time, the company said, inflation, higher interest rates and supply chain issues made the agreed price of $79.83 per MWh unprofitable.

In July 2023, Avangrid also walked away from its 1200 MW Commonwealth Wind project for Massachusetts.

The two projects became so unprofitable, it made better financial sense for Avangrid to pay $48, Massachusetts + $16, Connecticut = $64 million in walk-away penalties, rather than face much higher costs for building the project, with no prospect of a profit.

SHELL: LONDON, Nov 2 (Reuters) – Shell’s CFO said on Thursday, the firm had abandoned a power purchase agreement (PPA), at contract price of $76.73/MWh, for the planned 2400 MW South Coast offshore wind project, off the coast of Massachusetts, agreeing to pay a $60 million walk-away penalty, rather than face much higher costs for building the project, with no prospect of a profit.

https://ctexaminer.com/2023/10/03/avangrid-cancels-park-city-wind-contract-pays-state-16m-penalty/#:~:text=Avangrid%20agreed%20in%20July%20to,1%2C200%20MW%20Commonwealth%20Wind%20project

Let us hope we soon see the US Wind projects off of the Maryland coast disappear into the wind, also. Although the GE 14.7 MW turbines are presented as a fallback position, it appears the plan was to use the (now cancelled) 18MW turbines.

Offshore ANYTHING is prohibitively expensive. If offshore outhouses were cheaper than onshore outhouses, beachfront property owners would have them already.

Wind power – it blows.