Guest Post by Willis Eschenbach

I’ve crossposted this from my blog, “Skating Under The Ice“.

The unscientific enterprise called the Social Cost of Carbon (SCC) is a thinly disguised political attempt to justify some kind of a “carbon tax”. Of course calling it a “carbon tax” or the “social cost of carbon” is doublespeak, or perhaps triplespeak. It is doublespeak because the issue is carbon dioxide, not carbon. What they are talking about taxing is not carbon but CO2. (In passing, the irony of a carbon-based life form studying the “social cost of carbon” is worth noting …)

It is triplespeak because in the real world what this so-called “carbon tax” means is a tax on energy, since the world runs on carbon-based fossil fuel energy and will for the forseeable future.

This energy tax has been imposed in different jurisdictions in a variety of forms—a direct carbon tax, a “cap-and-trade” system, a “renewable mandate”, they come in many disguises but they are all taxes on energy, propped up by the politically driven “Social Cost of Carbon”.

I’ve written before about how taxes on energy are among the most regressive taxes known. Increasing fuel prices hurt the poor more than anyone, because the poor spend a larger fraction of their income on energy. Gasoline prices to drive to work don’t matter to the wealthy, but they can be make-or-break for the poor.

However, in addition to harming the poor, there is a deeper reason that such a tax on energy is a very bad idea.When you tax energy, you are taxing an input to wealth production. Taxing any of the inputs to wealth production is destructive. Instead of inputs, you want to tax the outputs of wealth production. Let me lay out the several reasons why.

I’ve discussed in the past that there are three and only three ways to create real wealth. By real wealth I mean the actual stuff that we use—houses and food and cars and clothing and nails and fish. Real wealth. Here are the three ways to create wealth:

First, you can manufacture wealth—you can build a shirt factory, manufacture a new medicine, or sew clothing in your living room and sell it on the web.

Next, you can grow wealth—you can cultivate an apple tree, keep a home garden, or plant a thousand acres of corn.

Finally, you can extract wealth—you can drill for oil, dig for gold, or fish for trout in a mountain stream.

Everything else is services. Important services to be sure, life-and-death services in some cases … but services nonetheless.

To understand this distinction between services on the one hand and wealth generating activities on the other hand, let me use an example I’ve given before. Suppose there are two couples on a tropical island. One person fishes, one has a garden, one gathers native medicines and building materials from the forest, one builds huts and makes clothes from local fiber. They could go on for a long time that way, because they are creating real wealth. They have food and clothing and housing, the things that we need to survive and thrive.

Next, suppose on a nearby tropical island there are two other couples. On that island one person is a barber, one is a doctor, one is a journalist, and one is a musician. Noble occupations all, but services all … those folks will have nothing to eat, nothing to wear, nothing to keep the rain off. None of those occupations create any real wealth at all, while all the activities on the first island do create real wealth.

This means that if we want our country to be wealthy we need to do everything we can to encourage manufacturing, agriculture, and extraction. And that brings me back to the subject of this essay, the energy tax masquerading as a “carbon tax” and crudely propped up by the laughable “Social Cost of Carbon”.

Let’s set aside for the moment the question of whether a given tax is used wisely or not. And let’s also set aside the consideration of WHAT we tax. Instead, let’s look at the effects of WHERE in the economic cycle we apply our tax.

Each of the three ways to earn wealth has both inputs and outputs. For example, I’ve worked a lot as a commercial fisherman, an extractive industry. The inputs to this way to generate wealth are a boat and motor, nets, diesel, a captain, and some deckhands. The output is yummy fish.

Similarly, the inputs to manufacture are things like raw materials and labor and energy and machinery. The outputs are manufactured goods.

In the third and final way to create wealth, inputs to agriculture are things like water and seeds and fertilizer and tractors and diesel and farmers and field workers. The outputs are fruits and vegetables and fiber and oils and all the rest of the things we grow.

So let me pose you a theoretical question. Assuming that we need to tax the wealth generating process … is it better to tax the inputs to the process, or to tax the outputs of the process?

The answer is perhaps clearest in the field of agriculture, where the question becomes:

Should we tax the seed corn, or should we tax the resulting corn crop?

The first and most obvious reason that we should tax the corn crop is because taxing the seed corn makes it more expensive, and thus it discourages people from planting. We don’t ever want to do that. Discouraging the generation of wealth weakens the economy. We want to encourage the generation of wealth.

The second reason not to tax the seed corn is that agriculture, like all ways to generate wealth, has a multiplier effect. Every single corn seed will likely turn into a plant yielding hundreds of corn seeds. Taxing the seed corn means a farmer can buy less seed … and a reduction of one seed can reduce the eventual crop by a hundredfold. This damages the economy in a second and distinct way.

Finally, there is a third separate hidden damage from taxing the seed corn instead of the corn crop. Having grown up on a remote cattle ranch I know that farmers are broke in the spring and generally only have cash when the crop comes in. The same is true of most wealth generating activities. Money is scarce at the start of the process and ample at the end. This means that extracting the dollars by taxing the inputs to the wealth generating activities puts a much greater strain on the individual wealth generators, the farmers and the fishermen, than does extracting the same dollars from the outputs of the process.

From these three separate kinds of damage it is clear that taxing the inputs to wealth generating activities is generally a mistake.

And this brings me back again to the question of taxing energy. The problem is that energy in the form of fossil fuels is an input to all forms of large-scale wealth generation. This means that driving the cost of energy up for any reason, or in any manner, imposes a greatly magnified cost on the economy through at least the three separate and distinct mechanisms I listed above.

And this is the reason that I am utterly opposed to any kind of tax on energy, whether it is a so-called “carbon tax”, a “renewable energy mandate”, or any other measure to increase energy costs. We have businesses fleeing California for neighboring states in part because our laws REQUIRE that we pay astronomical costs for electricity from expensive green power sources.

When I was a kid, my schoolbooks were clear that cheap electricity was the savior of the poor housewife and the poor farmer. And growing up on a remote cattle ranch where we generated our own electricity, I could see as a kid that it was absolutely true. Having ample cheap electricity transforms a family, a farm, a town, or a society.

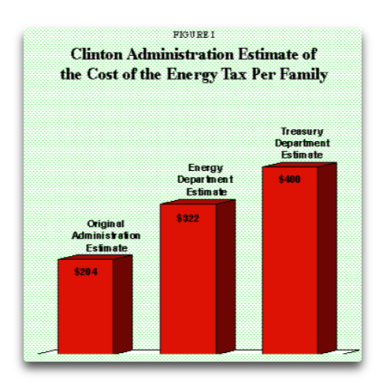

But now, based on the crazy war on CO2, people are doing everything that they can to drive the cost of energy up. Obama’s Energy Secretary famously said he wanted US gasoline (petrol) prices to go up to $8 a gallon like in Europe. Obama himself said that his electricity policy would necessarily cause electricity prices to “skyrocket”. We were into this nonsense all the way back to Clinton.

Let me recap. In addition to energy cost increases hitting the poor harder than anyone, taxing or increasing prices of any of the inputs to wealth generation also damages the economy in three separate ways.

First, taxing or increasing the price of the seed corn discourages planting.

Second, taxing or increasing the price of the seed corn has a very large effect because of the multiplicative power of wealth generation. Since each corn seed can become a plant that produces hundreds of kernels of corn, anything affecting the seeds has a disproportionately large effect on the eventual production.

Third, taxing or increasing the price of the seed corn hits the producers when they have the least money to pay the tax.

Now, consider the role of energy in this process. For all three wealth-generating activities, energy is an input. And this in turn means that any increase in energy prices reduces wealth generation by more, sometimes much more, than the price increase would suggest.

==================

Let me move to a final topic, the size of the claimed Social Cost of Carbon. Estimates range from a “negative cost”, or what ordinary humans would call a “Social Benefit of Carbon”, through net zero cost to a cost of fifteen hundred dollars per tonne. Let me take eighty dollars a tonne as a representative price for the following calculations.

In 2016, humans emitted on the order of ten gigatonnes (10E+9 tonnes) of carbon in the form of CO2. At eighty bucks a tonne, that works out to about $0.8 trillion dollars per year. Since the global GDP (the value of all goods and services) is about eighty trillion dollars per year, supporters of a carbon tax have pointed out that if we taxed all emissions that is only one percent of GDP. They say that this is a small price to pay.

But this is a simple view that ignores several important things.

First, the critical metric is not GDP. It is GDP growth. GDP growth averages something around 3% per year. This continued growth is critical both to provide for the needs for an increasing population as well as to providing for lifting the global population further out of poverty. A drag of one percent on the economy reduces growth by a third.

Next, the carbon tax itself would be somewhere around 1% of GDP or less … but that doesn’t allow for the multiplier effect of taxing energy. Because energy is an input to all forms of wealth generation, for all the reasons discussed above the cost to the economy of taxing an input to all wealth generation is much larger than just the size of the tax itself.

Finally, the magic of compound interest and the “rule of seventy”. At three percent growth per year, the “rule of seventy” says that the economy will double in size in 70 / 3 = 23 years. But if we foolishly impose a carbon tax and it drags economic growth down by only a single percent, at 2% growth it will take 70 / 2 – 35 years for the economy to double in size. And since all of these CO2 fears are a long ways out, fifty or a hundred years, over time the small drag of a carbon tax on the economy will loom large.

All of this leads us to a simple conclusion. Even if you wish to fight the eeeeevil scourge of CO2, increasing the cost of fossil fuels is the wrong way to go about it. The associated present and future damage from increasing energy costs, both to the poor and to the economy, far outweigh any possible future benefits fifty years from now.

Now me, I see no reason to fight CO2. I don’t think CO2 is the secret temperature control knob of the climate. No persisting complex natural system is that simply controlled.

But if you do want to fight CO2, DON’T RAISE THE COST OF ENERGY. If you raise energy costs in any manner you are fighting CO2 on the backs of the poor housewife and the poor farmer, the very people you are claiming you are helping. And it’s not just the poor you are hurting. If you raise energy costs you are doing untold damage to the economy itself.

There are other options. Go for greater energy efficiency if you wish, that will reduce emissions without increasing energy cost. Get more production out of each gallon. Or support a shift from coal to natural gas. That shift does both—it reduces both energy costs AND emissions of CO2. Or for the third world solution, fog nets in Peru provide water for hillside dwellers without requiring energy to pump water up the hills. And as always, the mantra of reduce, reuse, and recycle combined with general energy conservation all can cut emissions without cutting CO2.

Because in all of this useless and futile fight against CO2, I can only implore everyone to follow the Hippocratic Oath, which says “First, Do No Harm“. And that means no carbon tax in any form, no “renewable mandate”, no “cap-and-trade”, because they all raise the cost of energy. A carbon tax, backed up by the anti-scientific political cover story for that tax called the “Social Cost of Carbon”, will do and in some parts of the world already is doing immense harm to both the economy and the poor. Carbon tax and the “Social Cost of Carbon” do uncalculated damage, they should be avoided completely.

My best to everyone,

w.

As Usual: if you comment, please QUOTE THE EXACT WORDS YOU ARE REFERRING TO, so that we can all understand your exact subject.

Previous Posts on the SCC:

The Bogus Cost Of Carbon

[See update at the end] From the New York Times a while back: In 2010, 12 government agencies working in conjunction with economists, lawyers and scientists, agreed to work out what they considered a coherent standard for establishing the social cost of carbon. The idea was that, in calculating the costs and benefits of pending…

Monetizing Apples And Oranges

Let me start by thanking Richard Tol, Marcel Crok, and everyone involved in the ongoing discussion at the post called “The Bogus Cost of Carbon”. In particular, Richard Tol has explained and defended his point of view, giving us an excellent example of science at work. In that post I discussed the “SCC”, the so-called “Social Cost of Carbon”. There…

Willis,

The clarity of your analogies in this article are superb, direct, and to-the-point!

Excellent!

+10

I agree Willis – an excellent article.’

Cheap abundant reliable energy is the lifeblood of society – it IS that simple.

Best, Allan

_____________

http://wattsupwiththat.com/2014/10/11/video-why-renewables-equal-death/#comment-1760174

Some of my posts on cheap abundant energy [excerpts]:

http://wattsupwiththat.com/2014/09/06/analysis-solar-wind-power-costs-are-huge-compared-to-natural-gas-fired-generation/#comment-1730316

Seriously, good people: Cheap abundant energy is the lifeblood of modern society.

http://wattsupwiththat.com/2014/08/23/cold-summer-us-daily-record-minimum-outnumbering-record-maximums-3-to-1-in-the-last-30-days/#comment-1717275

rgbatduke says: August 25, 2014 at 3:23 am

“NOW you can conclude “For this we should destroy our economy?”.

This I agree with. And not just our economy — we are killing the poorest people in the world, disproportionately children, with the deliberate distortion of energy prices brought about by the stridently anti-carbon policy.

_________

Allan says:

On Cheap Energy:

I strongly agree with your last sentence. All societies rich and poor benefit from cheap abundant energy.

http://wattsupwiththat.com/2012/08/10/oxburghs-climate-madness/#comment-1056398

The developed world is entirely dependent on inexpensive, efficient energy for its economic and physical survival.

Allan M.R. MacRae,

Thanks.

“This I agree with. And not just our economy — we are killing the poorest people in the world, disproportionately children, with the deliberate distortion of energy prices brought about by the stridently anti-carbon policy.” [By Allan, rgbatduke, or even Willis. But it doesn’t matter who wrote it.]

Sorry, I thought that was the whole point of the watermelons’ policies – a world of – not seven billion or so – just seven hundred million at most.

Naturally including all the elite, and their pals, and, possibly, useful idiots.

Not sure why an image of Michael E. Mann leapt to mind as I typed that!

Most of us are simply pollution, in their world view.

Auto.

Don’t overlook ease of use either. The alternative energies all seem to add complications rather than remove them.

He, rgbatduke, hasn’t been here for some time. I miss him.

If he still reads here then I really do wish that he would comment. Agree or disagree, always an individual that had one question ones core beliefs.

That can’t be a bad thing ever.

Agree!

agreed j mac. there are more than a few salient points here i have been struggling to articulate to a few people in the uk that cannot grasp why it is a bad thing our economy is too heavily loaded toward the services sector. i now have just the article for them to read. whether they actually understand will be another thing.

thanks for yet another great post willis.

I’ve always found that Willis, agree with him or not, is never anything other than direct.

(And usually quite right in my view)

The intent is to cripple Capitalist economy and who it impacts is of no concern to the perpetrators. AGW has nothing to do with temperature.

Indeed. I think Willis is missing the point when he says:

“taxing the inputs to wealth generating activities is generally a mistake.”

It is not a mistake if your intent is to shut down the production system. It seems that many hardcore enviros want exactly this.

While stopping pointless consumerism where we spend our lives on a treadmill, working in futility to buy another manufactured good which we already bought last year but no longer works because of designed in obsolescence may be highly desirable, we need to work out what to replace it with before shut it down.

The current paradigm of ever increasing debt to buy ever more useless objects over and over again is just a form of economic slavery. Debt bondage.

A friend just showed me his internet connected food blender which cost him about 1000 euro-bucks.

We urgently need to find a better way of using our resources and working lives.

Greg, you are correct, and additionally think about this: the voting block most likely too put the “I know how to spend your money better than you do” crowd into office are mostly from the service sector. So these huddled masses in the service sector think (feel?) that the three pillars of wealth generation are evil processes that should be made to pay for their conduct. I live in Argentina where the extractive sector is not permitted to advance and the ENSO effects make the agriculture sector erratic and the combined effect is permanent recession. And just to make sure it’s really a mess there is a 21% sales tax on everything! I’m hoping that President Trump and his Cabinet look at things like Willis states it, and maybe some real health will come back into the economy. Looks like the Climate Change nonsense has gone from the Whitehouse website so we all might have some hope in this reagrd.

A carbon tax as a disruptive force on the input to wealth creation. That is exactly what the Malthusian Left wants.

The elitists want a return to a feudal society. No large, prosperous middle class able to compete with them for “luxury” resources.

Algore, DiCaprio, Obama, LeGarde, Trudeau, Soros, Steyer, Obama, Clintons, and all the uber rich of Hollywood, … by their wealth they all are insulated from their policy prescriptions. Expensive energy, they don’t care. Rampant violence in urban slums, they do ‘t care. Open borders so cheap labor continues, they love that.

Reducing consumption by poverty of the working class ensures they and their families enjoy the wealth and privilege they desire.

-How can one enjoy a Carribean vacay when the prolitariate cruise ship comes to dock on your island getaway?

– What if the prolitariate use up all the diesel for their silly farm power stroke Cummings diesel Dodge power wagons while their private jets have to compete with that consumption?

Let’s not kid ourselves anymore about what this carbon tax nonsense is. It is a frontal assault on the very foundation of western capitalism that built free markets, and the most properous middle class the world has ever seen. And the Left hates that.

The problem for the elites is that, if they smash the economy by reducing the rest of us to poverty, the economy won’t be able to produce the goods they need to support their lifestyles.

A good example is medicine. Right now there are medicines that aren’t produced because the diseases they treat are too rare. There’s no money to be made producing those medicines.

If we make it so 99% of the population can’t afford drugs at all, there will be a whole bunch more diseases for which drugs can’t be produced economically. In that regard, the elites will be worse off than they are now.

The above logic applies to most manufactured goods. Our economy is incredibly complex. Every manufactured good has to be supported by a web of dependencies. Consider the business jets that carry the elites. The machine tools that are used to build them won’t be made without the market for commercial aircraft. If we kill the economy by making it too expensive for regular folks to fly, then commercial aircraft won’t be built. That means the machine tools to build them won’t be built. That means no corporate jets to fly the elites around.

The elites will be worse off in absolute terms. Of course, in relative terms, they will live like kings. The problem is that I would rather live like the peasant I am today rather than as a king two hundred years ago. The reason I can live better than a king of olden times is that hundreds of millions of other people are doing the same.

Exactly—Just keep following the money, and it becomes the old shell game, as to whose pocket it is really going into. Do you honestly think that Jerry Brown’s Carbon Tax , in California, is really “..going back to the poor impoverished underclass…(That he is creating)..”, or into the pockets of those like Tom Steyer, and his NexGen group who are flooding the airwaves with Green ads..? From what I understand, DeCaprio’s Fantasy island doesn’t even have a natural source of water, other than rain….Wonder how they are going to power that desal plant??

Wash DC demonstrators against Trump carried signs calling for the end of Capitalism. Birds of a feather …

There’s plenty wrong with the current system , what were they wanting to replace it with ??

Did they print the sign with their Apple computer on their Canon printer while wearing shoes by Prada? Let’s get rid of all those running dog capitalist corporations.

Willis,

Thanks for and excellent posting that clearly explains the impact of raising the cost of fuels which are so critical to a healthy economy which includes jobs.

Since it is so obvious, it is inexplicable to me that so many of our politicians are unable or just don’t want to understand it.

This simple fact stuck home to me in the 70’s/80’s (I think) when the price of oil was around $100/Bbl.. Just using logic it struck me how expensive energy filtered into virtually and product we buy because every thing we use and need requires energy to produce or grow or transport it to market. Because of this and probably other factors, inflation ran rampant. Even a cheap person like me was deciding to buy a new car now even though I did not yet need it since the cost was going up faster than I could save the added cost later.

wut?

” you want to tax the outputs of wealth production.”

no, WE do not. I do not. you do, though.

like i need more insipid apologetics for the monstrosity of collectivism.

this articvle is rhetoric of an office (rent) seeker.

gnomish, as I said, this post is not about whether the tax is valid or not. As I said, my point was that IF you want to tax you do NOT want to tax at the beginning of the wealth generation cycle.

It was not an apology for a tax. It was a clear statement of the reasons that a carbon tax is a huge mistake.

Regards,

w.

just so you know- i’m legit and not trolling you on this – which is why i’m gonna bother to elaborate even tho, to me, it’s like turkeys discussing the best day of the week for thanksgiving…

to me, it’s not right vs left or any kind of simple strawfoot/hayfoot prepositional analogy.

the axis is state vs individual.

the justification for a state at all is to protect us from – guess what from…

a man has a right to provide for his own defense but only at his own expense.

if that man becomes the agent of predation and takes what belongs to another by force then that man is now the threat from whom others have need of defense and the right to defend themselves against.

neither you nor anybody else has any right to the property of another man. there is no right to violate rights,

english is only my first language but it seemed to me that you were not condemning a tax but endorsing an alternative form of taxation.

like as if there’s a preferred orifice for suprise sex with strangers. it represents a threat of harm.

and when it’s done by a person who invokes an imaginary crowd of supporters with first person plurals, using this bandwagoning gaslighting tactics of the demagogue it makes me want to scream.

it doesn’t matter if you understand or agree. i respected you enough to explain it. that’s as good as it gets.

gnomish January 20, 2017 at 11:19 pm

Thanks for the reply, gnomish. I had said the following (emphasis mine)

When I say “no carbon tax in any form” that seems quite explicit to me. And none of the proposed alternatives I listed involved taxes. This is why I ask people to quote exactly what they are referring to. I haven’t endorsed anything.

Overall, you seem to misunderstand what I’m doing. I am ANALYZING THE EFFECT OF THEIR PROPOSED CARBON TAX to show just how very destructive it is to wealth production. I am not endorsing an alternate form of taxation. I’m pointing out that in addition to screwing the poor, they’ve chosen a very destructive form of taxation that is very hard on the economy.

Regards,

w.

WILLIS,

I am in full agreement with your thesis not to tax energy as an input to producing the basis of wealth.

However, I think that the way you separated your three primary examples from all other services is quite artificial.

There really is only one primary wealth source — some natural material. Manufacturing takes one or several such natural materials and changes them in some way to be more useful. So in a real sense manufacturing is a service. Also it often is difficult to say the first step in this process is more valuable than later so-called services steps.

As a simple example, a person in a more primitive society strips long bits of wood from a log and weaves them into baskets — a fundamental creation. But after he sold six such baskets locally, there was no further market. A second person had a truck and then took many baskets to distant cities. There he sold hundreds of baskets. Not only was the total amount of wealth created greatly expanded, but the good that came from owning a sturdy basket was greatly multiplied.

Making things from nature may be “fundamental”, but alone is quite often characteristic of a primitive society.

Out of curiosity, would you classify producing an original software program as fundamental or service? It is fundamental, and the raw material used is human brain power.

The leftists don’t want that. In their fantasies (from which their protests and policies are based) they’d rather have this:

“We have wished, we ecofreaks, for a disaster… to bomb us into the stone age, where we might live like Indians.” -Stewart Brand, Whole Earth Catalogue

Their 2009 Cap & Trade plan, which was really a thinly disguised de-industrialization plan, would have cut CO2 emissions by, ultimately, 83%. And we would have seen a near 20% cut already! Devastating! As the energy cuts got bigger and bigger there is no way that efficiency or prohibitively expensive renewables could make made up even a small fraction of the loss of energy. Indeed, with the 2009 Cap & Trade lunacy Obama’s Science Czar would have gotten his dream:

“A massive campaign must be launched to de-develop the United States.” -John Holdren, 1973

So would have the first UNEP Director:

“Isn’t the only hope for the planet that the industrialized civilizations collapse. Isn’t it our responsibility to bring that about?” -ex UNEP Director Maurice Strong

The Whole Earth Catalog was all about self-sufficiency. The trouble is that, carried to its logical extreme, self-sufficiency requires that more than 9/10 of the world’s population has to die because the last time we had true self-sufficiency was the stone age. The only reason the planet can support the human population it does is technology.

We are highly interdependent and the hippies, libertarians, and survivalists don’t realize the implications of that. Do-it-yourself sounds wonderful until you experience the impossibility of do-everything-yourself.

Exactly, Bob. What the whole earthers never seem to comprehend is that even things as simple as a weed hoe or cooking pot or pocket knife implies an iron mine and miners and smelters somewhere and a foundry with forges and tools and workers which implies even more mines and miners and tools. And fuel.

I’m blessed to live in a rural area with acres of woodland that I can cull every year for winter wood heat (low so far this year -30C) but I’m privileged to be able to do that with a chain saw and to haul it in a truck not cut with a homemade stone axe and haul in an ox cart. And, if I don’t cut enough wood and run out I can just flip a switch and stay warm (and alive)

I once cut down a largish tree with a nice sharp steel axe. If you didn’t witness it at the time, you’re out of luck because there won’t be a repeat performance. 🙂

What libertarians are you speaking of? Libertarians in name only, perchance. Libertarians, formerly known as (classical) liberals, want maximum personal liberty and sovereign individuals trade whenever it is mutually beneficial. This includes their sovereign extensions as voluntary associations. Some government is necessary due to Man’s fallen state such that some will not civilize themselves. A soundly organized custom and culture is required for a soundly functioning society, Societies are created by the individuals. Promote barbarism in the people, you get barbaric cultures and thus barbaric societies. As a sovereign individual, I always have these competing choices: 1. Do without, 2. Make my own, and 3. Pay someone else to make it. Take that away from me, then I’m not free. Note that take it from someone else is not an option. [Also note that asking the government for permission to do 1 through 3, nor having the government take it are not options, either.]Taking it from someone else must result in my own punishment, provided an ordered liberty is the goal.

intentions don’t equate to results, dav09

you might bear in mind that everything you say was discovered and said and written thousands of times in the past couple of thousand years. for some of us it’s not news.

if commiebob missed out, it’s not from looking too hard…lol. he has a right to be what he makes of himself. he must make his own mistakes. enjoy his pain.

Here’s an example:

It sounds to me as if gnomish wants to be his/her own police department, fire department, and everything else.

No. He doesn’t want to be forced to pay for some particular provider of police, fire – or any other – service. Saying gnomish – or libertarians in general – believe or advocate that each person has to provide those services on their own, with no collaboration or cooperation with others is, to put it as politely as possible, a gross misrepresentation.

Dav09 correctly interpreted my statement.

Does that include the right to plant a machine-gun nest in the front yard along with the tulips?

commieBob says:

“Does that include the right to plant a machine-gun nest in the front yard along with the tulips?”

fine – just keep your tulips away from me!

nanogressor!

yes, i willingly passed up a much more poignant turn of phrase.

be grateful.

Apologists for the State are really good at making up contrived examples of bad things which might happen without the State, and even better at totally ignoring the immense amount of bad things which actually have happened and actually will continue to happen which couldn’t happen without the State.

A few machine-gun nests amongst the tulips of suburbia would be a small price to pay to eliminate the possibility of World War One, World War Two, US Civil War, Holodomor, Khmer Rouge, Cultural Revolution, to name offhand just six instances of State perpetrated mass slaughter and destruction.

If I thought that would work, I would heartily agree. What I worry about is that, when the government doesn’t have a monopoly on physical force, the vacuum is quickly filled by warlords, paramilitaries, criminal gangs, and terrorists. Certainly, that seems to happen with failed states 100% of the time.

so, if one finds a single example of force being exercised by anybody who is not authorized by law, is the concept of ‘the gov has a monopoly on the use of force” falsified?

would it cause you to modify your proposition to better reflect reality?

a powderpuff snowflake diet will make your fat look really butt…

That doesn’t even make sense. Perhaps Dav09 can help you out.

commieBob @January 23, 2017 10:31 am:

“Perhaps Dav09 can help you out.”

I’ll help both of you out: 🙂

The State Lives in the Minds of its Victims

Thanks Dav09. The article reminds me that my Anthropology prof pointed out that any system can work as long as the people agree.

Brilliant, Willis! Simply Brilliant!!!

I second that.

Your essay is absolutely fabulous Willis. If it were only on the study curriculum in every classroom.

Makes absolute sense Willis , you’ve done it again .

Recognized it the first time I heard the term. It was fabricated to create another revenue stream. Need to teach the kids that in school.

Willis welcome to being a responsible adult. Willis spent much of his life as a California hippie. Working at a nuke plant is why I do not have much time for such idiots.

Working in the power industry is a 24/7/365 job. I paid taxes on income and property. Power plants pay taxes on property, income, sales, and generating tax.

The taxes were used to provide services like schools and fire departments. It works.

Then the activist (aka, California hippies and assorted dogooders) decided energy companies were evil and consumers needed protection. Politicians figured out that they could tax the hell out of energy and the energy companies would get the blame.

This not a universal problems. Many places in the US have reasonable taxes on energy. It is the California hippie mentality that fosters ‘social justice’ with the unintended consequences of hurting the poor.

A carbon tax is an example of a sin tax. Some decide what is best for others. But it is just an excuse for collecting taxes. Taxes on booze and and a pack of smoke also hurts the poor more than the rich.

Since there are other solutions that do not involve taxes, it is about taxes.

Retired Kit P January 20, 2017 at 10:56 pm

Jeez, Kit, welcome to being an unpleasant adult. I’ve been responsible since I started working at age 13, and your unfounded allegations of irresponsibility lack both truth, merit, and friendship.

However, if I ever do get to be an adult, you’ll be the first to know.

w.

if growing up on a working ranch (implies chores and an early introduction to the work ethic) and sweating to cord up firewood to sell for college expense, and working in commercial fishing makes one a “hippie” then I guess I are one too, Willis. Peace, bro..;… (can’t wait until I grow up. Since I’m retired it should be any day now.)

Willis good reply, you are a star!

I had my first job at 10, I worked hard and saved like crazy. The results were a great/hand made road bike at 13 I cycled from Liverpool into North Wales every Sunday winter and Summer often 150 to 200+ miles round trip. My Own Fender Teli guitar and Vox AC 30 amp by16. A Used Morris minor at 17, A Ford Zodiac at 18 and then a self financed 6 months travel all over Africa and Europe as a hippy at 21. Self reliant never afraid to work any job and all the better for it!

PS- great writing as usual.

You can create wealth in another way: by thinking.

As in thinking the explosion engine or the transistor and so on.

Extraction can create wealth and so can thinking of a mean to have a faster, cheaper extraction mean. Growing crops can generate wealth as well as thinking some mean of making better and cheaper crops on the same piece of land. Manufacturing can create wealth as so can thinking of a way to improve it.

Think of the industrial revolution.

Adrian Roman January 20, 2017 at 11:19 pm

Thanks, Adrian, but I must disagree. Good ideas are a dime a dozen. Imagining something that might or might not ever get manufactured doesn’t actually create anything we can use. Until it is an actual manufactured product it is just another good idea.

w.

” Good ideas are a dime a dozen.” Obviously I did not talk about those cheap ideas. The industrial revolution was not made with cheap ideas, but with great ideas. Humanity had all the three mentioned ingredients before the industrial revolution but nevertheless it did not do so great. The main reason was that the ideas were missing.

With all due respect, Willis, thinking is exactly where wealth comes from. It comes from a correct assessment of subjective values and turns a potentiality into a reality. There are two kinds of economic goods, and yes, services are economic goods. These are capital goods and consumption goods. Note well that the two feed back on each other and that consumption goods will have to be produced for capital goods to have their potential value made actual.

Adrian Roman January 21, 2017 at 1:58 pm

I’m not talking about cheap ideas either. I’m talking about great ideas. The road to manufacturing is littered with great ideas.

The lack in this world is not ideas. The lack is champions who can convert those ideas into reality. Like they say … talk is cheap, and so are ideas.

w.

Nah. Those ‘champions’ are one million to one great idea. They are a dime a dozen. A great idea: the wheel. Almost anybody can manufacture a wheel. Including the individuals from societies that did not have the wheel. So maybe you talk about any idea, I don’t.

Good ideas and production based off of those ideas are sometimes not on the same wagon. Example : Edison and Tesla.. Edison was a master promoter, who had many extremely wealthy , high heeled investors, and hired Tesla to maintain his DC power system, yet , ended up with the means of production for electricity along with most of the credit , after Westinghouse (Then Tesla’s employer ) failed in their promotion of the same. Many of Edison’s patents were actually those of employees of Edison, similar to in house patent contracts with workers in many industries. The timing of the need of an idea often determines which idea becomes successful, along with the promotion, and that idea is not often the one which is the best., but one that is first, or promoted heavily. Similar to our Political system, in ways..

Ideas are only valuable if they are manifested through work into something tangible that other people are willing to pay for. It is not mere thought that on its own is of value.

I know: You didn’t do that. Obama

Taking the merit from a genius that invented a useful thing to give it to the working class is soooo communist.

When a beaver builds a dam, he creates wealth for himself and his family, so perhaps we are not so unique.

My personal favorite depiction of wealth creation, at 1:00

https://youtu.be/U2iiPpcwfCA

where to begin …

Willis’ opening bits reflect an understanding that historically is placed somewhere between Francois de Quesnay and Karl Marx. This was overturned by Jevons, Menger and Walras between 1871 and 1877.

Willis rightly notes that the estimates of the social cost of carbon suggest that the initial burden of climate policy should be a tiny fraction of total income. He overlooks that the feedbacks are negative: If the social cost of carbon is imposed as a carbon tax (a negative economic impact), the tax revenue is spent (a positive economic impact, even if all the money goes to gold statues of the president’s daughter).

Instead, Willis resurrects his “climate policy will be our ruin” argument by comparing tax revenue to economic growth, a meaningless comparison.

Alternatively, you could have a look at the data: Norway has had a carbon tax since 1991. Other jurisdictions followed, including the UK, Ireland, British Colombia. Three areas use tradable permits instead: EU, US NorthEast, California. The notion that climate policy will be a major drag on the economy simply does not stack up.

Alternatively, you could have a look at the data: Norway has had a carbon tax since 1991. Other jurisdictions followed, including the UK, Ireland, British Colombia. Three areas use tradable permits instead: EU, US NorthEast, California. The notion that climate policy will be a major drag on the economy simply does not stack up.

Richard – I have a lot of respect for you, for many reasons. Maintaining your integrity in regard to the IPCC among them and many other things. But I find this statement astonishing.

Are there two Norways? One that implemented a carbon tax and one that didn’t so that we can compare them? Is there a second UK? Or BC? Or California? The fact is that you don’t know how those economies would have performed without those measures. So you cannot say if they are a drag on the economy or not.

“Norway has had a carbon tax since 1991”

ROFLMAO..

Norway uses nearly all Hydro . That means that carbon tax affect basically no-one except some manufactures that need carbon in their product

It is a FEEL-GOOD POLITICAL gesture, at best. !

Richard Tol (@RichardTol) January 20, 2017 at 11:46 pm

Richard, good to hear from you. However, that is argument by assertion plus name-dropping. Sorry, not impressed. You’ll have to make your argument, not resort to magical incantations.

Richard, you repeat the error many economists make of not distinguishing activities that produce wealth from activities that are services. You seem to think that we can take money from a productive activity, give it to barbers, and end up just as wealthy.

Curiously, this is not an uncommon failing among economists. I’m not sure why.

I am absolutely not equating tax revenue with economic growth. I am noting that in this particular instance, the tax is extracted from the INPUT to the wealth producing activity. Perforce, this will reduce the amount of wealth produced. And thus it will indeed affect both economic growth and the GDP. Not only will it affect economic growth, but because it is taken from the input side of the wealth generation process, the effect will be magnified beyond just the size of the tax itself.

Richard, you know very well that that argument won’t wash. According to exit interviews, businesses are currently fleeing California because of high energy costs from a carbon tax (cap and trade plus renewable mandate). People in BC drive to the US to buy their fuel to avoid the carbon tax. The Chicago carbon market collapsed in a heap.

And regarding Norway, as you also well know, the fact that some nation has had a carbon tax for some amount of time proves nothing. Countries have survived all kinds of asinine taxes, doesn’t make them harmless.

Finally, I fear that you are engaging in magical economic thinking. You are claiming that you can extract money from the input side of wealth production without affecting the amount of wealth produced. Doesn’t work that way.

w.

PS—Those interested in the British Columbia carbon tax fiasco, here are my posts on the subject:

British Columbia, British Utopia 2013-07-11

I was pointed by a commenter on another blog to the Canadian Province of British Columbia, where they put a carbon-based energy tax scheme into effect in 2008. Before looking at either the costs or the actual results of the scheme, let me start by looking at the possible benefits…

Fuel On The Highway In British Pre-Columbia 2013-07-12

Supporters of the British Columbia (Canada) carbon-based energy tax that I discussed in my last post have made claims that the data shows this tax was a success … so being a suspicious-type fellow, I thought I’d take a look at the data myself. I didn’t figure the tax was…

The Real Canadian Hockeystick 2013-07-13

Well, the leaders of the carbophobes in British Columbia are already declaring victory for their carbon-based energy tax as a way to reduce CO2 emissions. They highlight as a main indication of success the reduction in per-capita gasoline use, and my research shows that their numbers are right. Here’s a…

Why Revenue Neutral Isn’t, and Other Costs of the BC Tax 2013-07-15

I hope against hope that this is my last post on this lunacy. I started by foolishly saying I would write about the benefits, costs, and outcomes of the BC carbon-based energy tax, so I was stuck with doing it. I discussed the possible benefits of the tax in “British…

Willis, Richard

I have great respect for you both but I’m not really clear what you are arguing about. Tax has effects on wealth creation, but it is primarily concerned with wealth redistribution (whether from rich to poor or poor to rich, is another matter).

What creates wealth is better described as an increasingly efficient division of labour (of which technology is the greater part). And for what it is worth, I will define wealth as an increasing amount of leisure time (that is, time not spent obtaining essentials for staying alive, such as food, water, shelter, warmth – as Willis says). We can spend that increased leisure time by consuming increasing amounts of services such as medical, entertainment, holidays, fashion etc. And service/ leisure industries can themselves become more efficient under the influence of the market and they in turn create more wealth by doing so (more services purchased at less cost). In that, I think I am with Richard.

On the whole, though, I am with Willis. Better to tax the leisure/service side of things than to tax the fundamentals like energy. Taxing energy won’t be much felt by the wealthy, but is the crucial thing for the poor of advanced nations, and for the whole population of undeveloped nations. Wealthy nations such as Norway think they can get away with it because the additional cost is lost to sight at those levels of GDP. Lesser nations cannot. Energy underpins every element of health, wealth and wellbeing. It is, in fact, the KEY to wealth. Don’t tax it!

“Curiously, this is not an uncommon failing among economists. I’m not sure why.”

probably because your understanding of economics is stuck in the 19th century

probably because your understanding of economics is stuck in the 19th century

Richard,

I don’t want to insert myself into the discussion between you and Willis, but this comment provides zero value. If you think Willis is wrong, explain the mechanisms which illustrate this. Saying Norway has a tax is meaningless because you don’t have an identical Norway sans tax to compare to. Denigrating an explanation by saying you don’t understand economics rings of the same haughtiness displayed by climate science who, when confronted by irrefutable evidence that they are wrong, retreat into the snotty defense that “you aren’t a climate scientist so you wouldn’t understand”.

I disagree with Willis on a number of points, but his main point is correct, and anyone who has ever had bottom line P/L responsibility knows it without any study of economics involved. When you tax the inputs to a business, the “cost” of that tax is magnified by the supply chain. Business functions on profit margin. So raise the cost of my inputs by $1.00 and I must raise my sell price by $1.30 to maintain my profit margin. My customers in turn must raise the price on their products that subsume mine by $1.69 to maintain THEIR profit margin. The more layers there are in the supply chain, the more that base $1.00 gets magnified. You can study economics all day long, but this is how business works.

My issue is that you need to distinguish between services which are wealth creating (hair dresser, gardener) from services which are primarily about wealth transfers (much of insurance and lawyers.) The wealth transfers are much more difficult to identify, but these are inherent drags on the economy which is the opposite of most services. You can usually tell the wealth transfer services from the amount of rent-seeking they gain through government contacts.

Wealth redistribution goes both ways — to the poor or to the wealthy. Intuitively, most of us understand the compassionate need for wealth transfer to the poor. This money is usually re-spent anyway. However, it is much more difficult to understand the need for massive transfers to the wealthy (money which is usually not re-spent.) Bankruptcy relief for someone who is broke is much more valuable to the economy than bankruptcy relief for a billionaire, because this allows a person to rejoin the productive workforce.

Richard Tol (@RichardTol) January 21, 2017 at 5:42 am

davidmhoffer January 21, 2017 at 11:30 am

Richard, I agree with David, but I tend to put it in an earthier way.

I say that when a man starts throwing mud as you have done, it is a clear sign that he’s out of scientific ammunition.

That’s twice you’ve tried to bluff me, the first was something about Karl Marx.

Now, you’re a smart guy. And you clearly think I’m wrong. In addition, it’s clear that in my world failure is always an option. I’ve been publicly wrong more than once. It’s how I learn.

But equally clearly, you are unwilling to QUOTE WHAT YOU THINK IS WRONG and explain to us just where I went off the rails. Instead you snipe at the edges and make ad hominem accusations to see if they will stick.

Which tends to make a man … you know … suspicious …

================================

To return the the question at hand, the statements which you did NOT quote were the statements that started all of this. Let me review the bidding. To begin with, you said:

Note that you are asserting equivalence, saying that a non-wealth-producing activity has the same “economic impact” as a wealth-producing activity. In response I had said:

You ridiculed me for that rather than answer it.

Despite the ridicule, I stand by that statement. There is a net loss to the economy if you take money from farmers and give it to barbers. You start out with well-fed people with bad haircuts. You end up with immaculately-tonsured individuals who are starving to death. Yes, as you point out the amount of dollars is exactly the same … but it is still an obvious net loss to the economy nonetheless.

That is the part that both you and many other economists continue to overlook, and I’m still not sure why. If you have an explanation, now would be the time to advance it.

w.

Those who live near the U.S. and Canada border do their own trading if they want to and have for a long time.

People are very creative about how to trade cross-border. Economic information about this is lacking.

One example is truckers fuel up in the U.S. and drive right through Ontario. No new Ontario carbon taxes will be collected from creative people.

Willis writes —

I disagree. There is a net loss to the economy if the government mandates that these farmers have to have their hair cut at a government licensed barber at least once a month, but there is a net gain to the economy if the farmer chooses to spend his money on a professional haircuts.

Cutting hair is a bad example here — barbers are an economic resource. It’s the government distortion of the free market which is bad. There still may be a reason for government influence (for instance, the removal of lead from gasoline), however, the benefit must be worth the economic cost.

My problem with the Social Cost of Carbon (SCC) is that many people consider it different ways and many “climate scientists” want to use it to drive behavior. If we add $40 per ton of carbon, there will be a cost to the middle class, but nobody will change their driving habits. “Climate Scientists” will then seek to increase the assessment on the SCC until it begins to drive behavior the way they want. This would probably be at least $800 per ton or more.

By comparison, gasoline costs rose by a factor of three from 1998 to 2007 (from ~$1.50 to $4.50). Consumption did not begin to drop until the recession of 2007 and then dropped by ~ 10%. Environmentalists are targeting at least a 50% reduction which will require an economic depression.

$40 per ton will be a small (immeasurable) drag on the economy and another drop in the steady economic water torture of the middle class. $800 per ton will be a substantial drag on the economy.

Willis:

Apologies if this feels like mockery.

The social cost of carbon is a Pigovian concept. I would expect someone who critiques Pigou to have at least read Pigou. From your remarks, it is not obvious that you have. It is obvious, however, that you have not read Jevons. You cannot understand Pigou without understanding Jevons.

I could, of course, repeat all that material here. Alternatively, you can walk to the local library and read up. Hey, these books are out of copyright protection so you can even read them online.

Richard, good to hear from you. However, that is argument by assertion plus name-dropping. Sorry, not impressed. You’ll have to make your argument, not resort to magical incantations.

Beautiful Willis! Just Beautiful!

A Churchillian response!

Keep up the good work

Mike Macray

Richard Tol writes

His argument is that a carbon tax will be highly regressive and that regressive tax will have a drag on the economy.

As a comparatively socialist nation, Norway is a poor comparative example. Compared to most nations, the income inequality in Norway is very low which makes the concerns of regressive taxes lower. Norway has a World Bank Gini Coefficient of 25.9 compared to the United States of 41.1. UK is a better comparative example (Gini 32.6), but they have rampant reports of “fuel poverty” — I’d like to avoid that.

Classic Keynesian sleight-of-hand. All you have to do is move money around and economic numbers magically go up. The more times you can get money to change hands, the better. And nothing moves lots of money around better than deficit spending by the state. Income stratification? Heavier tax burdens? Burgeoning debt? Losing sources of real wealth creation? Who cares? The data shows the economy is growing, so all is well.

Don’t eat the seeds, eat the corn…

“Taxing any of the inputs to wealth production is destructive. Instead of inputs, you want to tax the outputs of wealth production.”

As the rural vehicle bumper sticker says around here ;

“Everything begins by being grown or mined”.

Why go to all that hard work of creating wealth? There is a different way to acquire wealth, steal it from someone else:- hence the primary motive for crime, for slavery and in the case of nations, for wars & invasions. As Pistol said:-

“We’re off to France—like leeches, my boys: to suck, to suck, their very blood to suck! ”

Shakespeare: Henry V.

Willis, a very clear, concise argument against taxing the inputs rather than the outputs. I especially like your style of writing which avoids all the usual superfluous cr*p that academics use to try and make themselves appear intelligent.

I also fully support your views that you need to be wealth creators and not be just “service types”. When Maggie announced that the UK was no longer a manufacturing base, but a service economy, which although most probably very accurate, I knew the UK was doomed. We cannot exist in the long term by being purely a service economy.

Maybe BREXIT will bring some wealth creation back into the country. Here’s hoping.

Actually it is possible for a service economy to sustainably exist. There is an important qualification, though, it must be able to trade with other economies. Willis puts it perfectly with his model of two island economies. With them far enough apart so that trade cannot occur the purely service economy must die (unless the participants learn agriculture and manufacture – in which case it is no longer a service economy).

With the two islands sufficiently close, so that trade between the two can occur, the ‘service’ economy can prosper as its products benefit the agriculture/manufacture economy, and in return the products of the latter benefit the former. A bit of specialization is good for the people, rather than each having to produce everything and service everything. Microeconomics 101. Remember that the UK was described as a nation of shopkeepers – perhaps an exaggeration but a large truth was there.

The reference to Norway is a bit misleading – Norway’s wealth has been created by North Sea oil and to some extent by the export of hydro power to the EU. They can afford, a bit like Saudi Arabia to have social programs that are simply devastating in other economies that have few natural resources.

the saudi social programs are just as devastating for them these days. they cannot afford them anymore. around 3 years until d-day and i don’t see the new american administration providing the help that may have been expected from previous administrations.

Social BENEFITS of CO2 increase probably outweigh real social costs by at least 100:1.

I was going to say that the ‘1’ in your ratio was generous, then I considered the very real human cost due to the dangers of fuel extraction. I applaud the engineers that continue to make this a decreasing cost.

Carbon Dioxide is freely distributed throughout the world. The unintended consequence of increasing atmospheric Carbon Dioxide by burning fossil fuels adds this CO2 to the world domain. Its value is shared by all people. The olive tree in Greece, the grassy Mongolian plains, the fishing seas off Japan all have equal access. The polar bears benefit, penguins, panthers and plankton. Wherever there is photosynthesis/phytoplankton there is life (wealth) creation, that’s the ‘seed’ that has the multiplier effect.

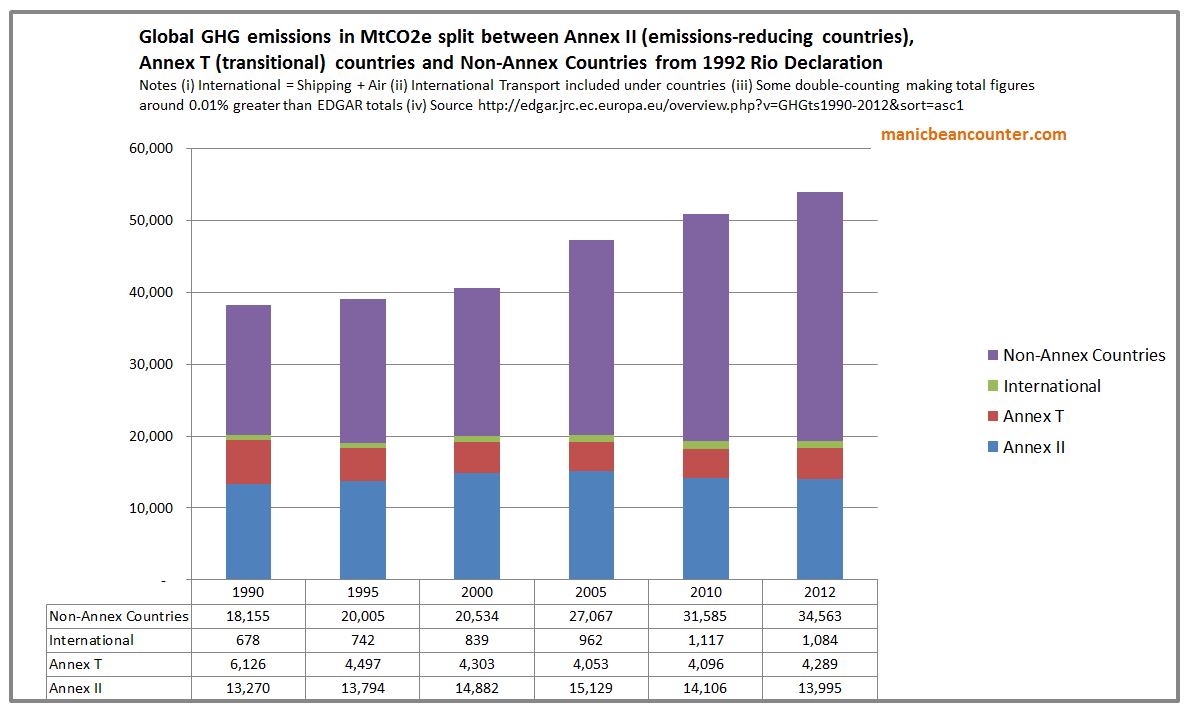

Willis misses out the biggest problem of a Carbon Tax. The theory is that global greenhouse gas emissions are causing the planet’s greenhouse gas levels to rise. Yet most of the people on the planet live in countries that have no primary obligation under the Rio Declaration of 1992 to cut those emissions. These non-policy countries have been developing rapidly in the last couple of decades and their fossil fuel emissions have been rising in step.

These non-policy developing countries now have two-thirds of global emissions and well over 80% of the global population,and all the poorest nations, are likely to collectively increase their emissions by much more. So no matter how much an ineffective carbon tax succeeds in cutting emissions (or other, less efficient means such as renewables subsidies or regulation of industry) in the United States, global emissions will go on rising.

It is even worse for manufacturing in the US. By increasing energy costs relative to non-policy developing countries, a carbon tax destroys American jobs. As developing countries are often less efficient in energy usage per unit of output, this can increase net global emissions. I explain in more detail, backed up with references and more data here.

Here is a wonderful graphic display by Prof Hans Rosling showing the world’s countries health improvements over the last 200 years. If only we could get everyone to spend the 5 minutes to watch his video there would be very few people who would doubt the benefits of fossil fuels

Amazing how all countries started as a tight bunch at the bottom left corner but once the IR started and developed quickly the wealthier western countries moved away. But now a lot of the once poorer countries have almost caught up to Europe, Nth America, OZ, Japan etc. Incredible to think that this has happened over the last 60+ years and certainly within my lifetime. The graphics and data collection for his display were all financed by the US taxpayer and today everyone can quickly look at all the UN and other data and easily understand it.

Of course Lomborg and his mate Ridley have highlighted the incredible health benefits since the beginning of the IR and paid the price demonstrated by verbal abuse etc . Rosling has also had the dopey Ehrlich’s hot on his tail for trying to spread this good news. Here is his short 5 min video and a wiki bio of Prof Hans Rosling. Oh and he’s an award winning stats expert as well, plus many other accomplishments.

https://www.youtube.com/watch?v=ahp7QhbB8G4

https://en.wikipedia.org/wiki/Hans_Rosling

In this video Hans Rosling looks at the Bangladesh miracle that has occurred over the last 30 years or within just one generation. Why is it that a majority of the globe’s population are unaware of this miracle and the wider world health miracle since 1950?

While Goklany, Lomborg, Ridley, Rosling and others have worked hard to counter our ignorance we still find that most so called EDUCATED people haven’t a clue. But why is this the case? I’ve had SFA education yet I can easily answer these questions and believe me I’m not super intelligent. But I do read a lot and I hate BS and BS artists.

Here’s Rosling’s 2014 TED talk to a huge crowd. Even if you just watch the first 5 minutes it is worth it. It must be very difficult for these people trying to cut through the BS and nonsense to deliver the real facts and data. They certainly get very little help from the MSM.

Reply

margaret says:

College: A place where people go to learn more and more about less and less until they learn everything about nothing. Will Rogers. I believe this to be a warning.

Don’t forget Flyover, that per chance you need to go to a hospital for an operation, that both the anesthesiologist and the surgeon working on you went to college to learn their trade.

BZ ngard, this why I read WUWT. While 90% is BS, there is a 10% learning opportunity.

Willis basic assumption is wrong. Today food and energy are a small part of a family budget even for the poor. There has been many times when I did not make a lot of money but I have never been poor.

I was married when I joined the navy. I got my draft notice in bootcamp. Living off base, we car pooled and beer was not in the budget.

If your income is low and you drive a jacked up pickup truck (not required for your job) to pull your boat, I would suggest you not poor. Willis will tell us how terrible raising fuel cost will be.

@Retired Kit P January 21, 2017 at 8:54 am

How do you define “small part”?

Under no circumstances would my family be considered poor and yet food and energy amounts to ~28% of my monthly budget. And we live in an area of the US where fuel, electricity, and natural gas prices are relatively low.

We could, if needed, trim some from the budget. Playing around with the numbers, I estimate I could reduce this to just under 25%.

Even if I managed to it get down to 20%, still don’t see this as a “small part of the family budget”.

Furthermore, these costs remain fairly constant regardless of income.

So someone making substantially less than I do, could have food and energy taking 33% or more of their budget. Hardly a “small part” of any budget.

Gladstone once asked Michael Faraday what use electricity was. Faraday replied that Gladstone would soon be able to tax it.

“Richard, you repeat the error many economists make…” I would be very careful about accusing a whole branch of study as having made a mistake based on my own half-arsed ideas.

There is a principle of economics that says the burden always falls at the same place wherever the tax is imposed. Therefore it makes no difference if the corn or the seed is taxed.

https://en.wikipedia.org/wiki/Tax_incidence

It may make no difference as to where the burden falls. The point in the article is that the amount of burden is greater when you tax the input.

“Should we tax the seed corn, or should we tax the resulting corn crop?”

The point of the principle is that it makes no difference. You can tax shoes and people buy fewer shoes because the price is higher. You can tax shoe leather and people fewer shoes because the price is higher. It makes no difference. Tax corn and people buy less corn. Tax seed corn and people buy less corn. If people buy less corn because it is more expensive then farmers will buy less seed corn. the effect is exactly the same as taxing the seed corn. There is a huge and fundamental misunderstanding of economics throughout this article.

The author would be well advised to listen to Richard Tol who in an expert in this field.

The author would be well advised to listen to Richard Tol who in an expert in this field.

The author has made valid points to which Richard Tol has responded with “well you don’t understand because you are not an economist”. This is the type of response that is the sign of an “expert” with no facts to back up their opinion.

Alas, I fear Richard Tol sees the discussion as far too simplistic to get involved by explaining the basics. Richard has not really explained why Willis is so wrong. However, there are many reasons why people who spend their professional lives dealing with a subject might not want to spend their time teaching others about very basic parts of it that are available elsewhere. It might not indicate he has no facts, it might be frustration with telling things to people who will not educate themselves.

Please state the originator of said principle. Your link does not refer to production only commerce. More much less half of farming is commerce. The ethanol mandate which is a tax drove the cost of feed grain to the point where many small producers were forced out, The supermarket price of beef has jumped by more than 25%

I take it you don’t make you living on the farm.

I’m sure there will be a comment on the missing “r” in your in the last line.

Flyoverbob, “The concept was brought to attention by the French Physiocrats, in particular François Quesnay, ” But the originator is not important. You can read about it in any Econ text book.

Just think it through. Start with a market where prices are determined by supply and demand, which is a pretty good model for agriculture. The Govt. tax corn seed. If the farmer plants the same amount of corn he would have to put up the price of corn to cover the extra cost. The farmer knows this and so plants less corn because he knows demand will be lower, or plants less corn because corn seed is now more expensive than wheat seed or whatever. If farmers as a group did not put up prices then marginal farmers would go out of business and we get less corn.

If the Govt taxes corn products instead we get exactly the same result. Consumers buy less corn products and so farmers plant less corn. It does not make any difference where the revenue is generated, the burden always falls on the same people.

The burden of the tax is distributed in some manner over the producer and consumer depending on elasticities of supply and demand. In some markets this will be all on the producer, if the consumer can switch to an almost identical replacement.

If we taxed only one variety of apple the consumer would suffer a reduction of consumer surplus as he switches to a slightly less preferred variety or pays the higher price. The farmer is stuck with his apple trees which take years to replace, so nearly all the burden falls on the farmer of this variety.

If consumers drive the same number of miles regardless of gas prices, then a tax on gasoline will be paid for by consumers and not oil companies.

In practice the burden is spread among producer and consumer – but it does not matter where teh revenue is raised. Taxing corn seed is the same as taxing corn products.

SeaIce — you are right. However, none of it is ever that simple. The argument is that the government should tax the profit, not the costs of production. Taxing the profits will actually shift the supply and demand curve to more production and consumption. Taxing the costs of production will shift the supply and demand curve in the way you suggest.

It’s the difference between “supply side economics” and “demand side economics”.

Unless and until people accept that PROFIT is the source of wealth and the lack of profit is the reason companies move from the US to China, Trump will have trouble turning things around.

There are other options. Go for greater energy efficiency if you wish, that will reduce emissions without increasing energy cost. Get more production out of each gallon. Or support a shift from coal to natural gas.

The first two options run into Jevons’s parodox. Greater efficiency will lead to increased use, which leads to higher emissions. Greater production, cheaper prices, higher demand, higher emissions.

And how would you support a shift to natural gas? Without taxing the use of coal, you would have to offer subsidies to gas. Who’s going to pay for it? An income tax will hit the middle class. A consumption tax will hit the poor.

A carbon tax would make coal more expensive than natural gas, supporting a move to natural gas. It would also offset financial gains from increases in efficiency.. ie you would get the same end result, for the same cost, but use less energy. This would help aviod Jevons’s parodox.

Yes the tax would be a hit, but a one off hit. So to lessen the blow, you would start it lower, and increase it over time.

And as we replace things so that they are more efficient, or build more gas power plants, wouldn’t that boost the economy? And as we start lowering our emissions, we would be paying less tax. So the negative multiplying effects you mentioned, would then revet to positive effects, further boosting the economy?

And as it’s the poor you are concerned about, some/all of the money raised could be used as tax subsidies for those on minimum wage/below average wage. This would cover any additional cost the carbon tax imposes on them, and put more money in thier pockets, making them less poor.

Daveo,

In a perverse way, encouragement to use gas over coal need not be from positive incentives. It can also be done by removal of negative imposts, which sadly are all too abundant these days.

In the US the shift will happen anyway: cleaner burning and lower capital cost per MW to build. The thing which held back natural gas for power all these years was the high price volatility for gas. If you’re building a plant with an expected service lifetime of 40 years and the main operational cost is fuel, you need to have confidence the fuel will continue to be available at a reasonable price. Fracking provided that confidence.

Rather than impose a carbon tax, just approve expanded fracking leases on public lands and grant the pipeline permits. Current federal policy actually gets in the way of accelerating the shift to natural gas.

Daveo, did your mother have any children who were not stupid?

If you want to replace coal plants to reduce the use of fossil fuels, you build nuke plants.

Communities with nuke plants love them. Why? Nuke plants pay lots of property taxes and provide high paying jobs.

Nukes are not too popular with California hippies who worry about radiation but not getting high.

Since I am skeptical about CAGW, I only advocate building nukes to meet power demand.

As someone who does believe CO2 is a problem I also advocate building nukes to meet power demand.

Kit, yes shd did, unlike your poor mother who obviously rasied a fool. Please point to where in Willis article he mentioned nukes? Can’t find it? Well take your rant some place else. Are you really retired, or just cant keep a job causd you talk up irrelevant crap?

A 100% tax credit to US employers on their US payroll taxes would reduce taxes on labor as an input to the wealth generating process and remove a large incentive to offshore production.

Ultimately tax credits are paid for by different tax payers. Would you volunteer to pay higher so another doesn’t pay? Someone always pays full price . . .plus tax.

We should end payroll taxes and use only income and wealth taxes. A tax credit on payroll taxes is only economic friction (i.e the company pays half of your payroll taxes today, but doesn’t get the credit until next year.)

The gas and oil industries are heavily taxed already, The promoters of carbon taxes never seem to mention that they’re arguing for even higher taxes on an already heavily taxed industry and commodity. There were riots recently in Mexico as the A-narco/socialist Mexican gov’t raised the price of unleaded gasoline up to over $4/gallon. Are Mexicans paying the “true cost” for their petro-based economy? After all, the “true cost” is far higher than the price you pay at the pump because of all those darn externalities “they” tell us. Not to pick on the Catholic Church, but the old line about paying money for “indulgences” for the sin you are going to do anyway makes me wonder if there is anyway to wire the money directly to God? Or is the Mexican gov’t as close as some of us in this life will ever get?

Look at that Vatican, the money was not directly wired to God, just those at the Vatican, with every level from the receiver in a church to the Pope taking their cut. And those that think it is, and there are millions, who believe this, are seriously deluded…

Tax on sins. Tax on windows. Tax on CO2.

Sorry, had to stop when the wealth discussion went into the land of the lunatics.

Let’s take banking. An intermediary ensures that those with excess capital (savers) can provide that capital to those with potential investments but no capital. A banker aggregates the savers money and lo an behold a new factory is built. That function, that service, isn’t creating wealth? Of course it is.

Let’s take hairdressers. You pay to have your haircut because you value the way you look. You put a higher value on that look post-hair cut (if you did not, you would not pay). So if we had no hairdressers, that value could not exist. Thus it is utterly obvious that hairdressers create wealth.

Let’s take a book. You pay, you read it, you are amused. That amusement is wealth, that’s why you pay for it.

The idea that “wealth” is only material things is simply dumb. What wealth is is the very basic key to understanding the very basics of economics.

Yes, that troubled me, thanks for setting it out so clearly. UK’s manufacturing output is as high as it’s ever been in real terms (even when we were the workshop of the world) but services are now much higher and we are much wealthier (even if Royal Navy can’t beat everybody else any more!).

Cape St Vincent 14 February 1797, Admiral Sir John Jarvis on HMS Victory with 15 ships of the line as the Spanish fleet is spotted through the early morning fog.

“There are eight sail of the line, Sir John”

“Very well, sir”

“There are twenty sail of the line, Sir John”

“Very well, sir”

“There are twenty five sail of the line, Sir John”

“Very well, sir”

“There are twenty seven sail of the line, Sir John”

“Enough, sir, no more of that; the die is cast, and if there are fifty sail I will go through them”

On 11 February, Commodore Horatio Nelson on the frigate HMS Minerve had passed through the Spanish fleet unseen in heavy fog. Nelson reported the location of the Spanish fleet on 13 February but did not know its size (because of the fog). Jervis’s immediately sailed to intercept.

Tim, I disagree, using your hairdresser example, this service only transfers wealth, it does not create wealth. Once the hair grows back, that wealth disappears. Wealth can be transferred, haircuts cannot. Another example are cars, bolt together one unit of steel (iron ore & energy combined), one unit of engineering and one unit of labor services, then sell it for 5 units as people place value (two units of profit) on the prior three units being combined, two units of wealth seem to have been created, they have not. Once that cars service life it up, it is only worth one unit of steel (scrap). The only way to re-inject those missing units of wealth, excluding “printing money”, is to dig, collect, grow and create new units of energy (heat or electricity). When you manufacture steel, you combine one unit of Iron ore and one unit of energy. When you machine or stamp steel it takes energy input. It is the energy input that start the cycle again. Iron ore would be almost worthless otherwise to a modern economy without the energy input (mechanical, heat and/or electricity).

My understanding what is being argued by Willis is not text book economics but the initial source/input of wealth creation into the economic/human system. This is only raw materials and energy. “Amusement” is not wealth, it is created and destroyed within seconds. Books are wealth but can only be had when there is an excess of energy and raw material above and beyond what is required to sustain our basic needs. A humans, we will waste raw materials/energy to receive amusement or look good (or haircuts) as we like it but “social” wealth is not being argued here.

“My understanding what is being argued by Willis is not text book economics ”

Well, not textbooks from this or the last century, as Richard Tol pointed out. If discussing economics (or anything else) then textbooks are a pretty good starting point.