Guest “divestment my @$$!” by David Middleton

Jude Clemente rocks!

Sep 29, 2019

The U.S. Department Of Energy Says More Oil, More Natural GasJude Clemente Contributor

Energy

I cover oil, gas, power, LNG markets, linking to human development.Numerous energy headlines from this past week alone caught my attention. They perfectly illustrate the massive scale of investment plans for oil and gas projects around the world. Here are just a few:

*”Japan to invest $10 billion in global LNG infrastructure projects.”

*”Tellurian Signs $7.5 Billion LNG Pact With India’s Petronet.”

*”LNG investments hit record of $50 billion in 2019.”

*”Brazil’s Huge $25 Billion Oil Auction Clear Very Important Hurdle.”As fate would have it, on Tuesday, a day after my birthday (I turned 25 again), the U.S. Department of Energy’s EIA released its International Energy Outlook 2019. It’s a glorious read, and one that I deem mandatory for all Americans, and even those globally interested in energy. We should all take advantage of the fact that we have such government information freely available to us open-source online.

You should know that the vast majority of countries have no such access to their own governments. Again, this is the official modeling from the U.S. Department of Energy and its National Energy Modeling System. This is not from ExxonMobil, the Sierra Club, or the American Wind Energy Association trying to sell you something or make you think a certain way. This is the outlook of the U.S. Department of Energy.What’s past is prologue: more oil, more natural gas. No kidding. These two essential fuels supply nearly 65% of the energy used in the U.S. and global economies. Global annual oil demand has been surging ~1.4 million b/d since 2000 alone, with gas usage up 8 Bcf/d per year.

[…]

The simple reason why we see such huge investments in oil and gas as seen in the above headlines is because we know that the world will need even more of them. In particular, the still developing world is looking at the oil and gas consuming West to see how affordable and reliable energy can grow economies and improve human development.

[…]

The main reason for the following graphic is that oil is the world’s most vital fuel and has no significant substitute whatsoever. Oil is the basis of globalization, utilized in practically everything that we do, and the most internationally traded commodity in the world. Oil’s value is so immense that too high of a price can cause a global economic recession.

[…]

Next comes the world’s go-to fuel: natural gas.

Just last year alone, global gas demand jumped over 5% to a staggering 137 trillion cubic feet.

That’s a Marcellus’ shale worth of production devoured every three weeks.

[…]

Forbes

Mr. Clemente’s graphs…

INTERNATIONAL ENERGY OUTLOOK 2019

Looks like Peak Oil won’t be getting here before 2050…

•In the Reference case, world production of crude oil and lease condensate increases from about 80 million barrels per day (b/d) in 2018 to 107 million b/d in 2050. Total liquids production increases from 100 million b/d in 2018 to 127 million b/d in 2050.

•Liquid fuels consumption increases 45% in non-OECD countries and falls 4% in OECD countries.

•In the High Oil Price case, world liquid fuels consumption in 2050 is 4 million b/d higher than in the Reference case. Primarily, emerging, non-OECD nations drive faster economic growth, which contributes to higher energy demand. In the High Oil Price case, proportionally higher amounts of crude oil are supplied by countries that are not part of the Organization of the Petroleum Exporting Countries (OPEC).

•In the Low Oil Price case, world liquids consumption in 2050 is 1 million b/d higher than in the Reference case. Slower non-OECD economic growth assumptions lead to lower energy demand, but the lower prices mean that consumers use more liquid fuels. Low-cost producers located in OPEC countries supply more crude oil and condensate to the global marketplace.

US Energy Information Administration

Too fracking funny for words…

•End-use fuels include those fuels consumed in the industrial, transportation, and buildings sectors and exclude fuels used for electric power generation.

•Liquid fuels, because of energy density, cost, and chemical properties, continue to be the predominant transportation fuel and an important industrial feedstock.

•Electricity use in the residential and commercial building sectors increases rapidly because of growing income, a growing population, and increased access to electricity in non-OECD regions.

•Electricity use in the industrial sector and transportation sector also grows, respectively, as a result of increasing product demand and increasing use of electric vehicles.

•Coal continues to be an important end-use fuel in industrial processes, including the production of cement and steel.

US Energy Information Administration

Here’s the really funny bit…

•Use of all primary energy sources grows throughout the Reference case. Although renewable energy is the world’s fastest growing form of energy, fossil fuels to continue to meet much of the world’s energy demand.

•Driven by electricity demand growth and economic and policy drivers, worldwide renewable energy consumption increases by 3% per year between 2018 and 2050. Nuclear consumption increases by 1% per year.

•As a share of primary energy consumption, petroleum and other liquids declines from 32% in 2018 to 27% in 2050. On an absolute basis, liquids consumption increases in the industrial, commercial, and transportation sectors and declines in the residential and electric power sectors.

•Natural gas is the world’s fastest growing fossil fuel, increasing by 1.1% per year, compared with liquids’ 0.6% per year growth and coal’s 0.4% per year growth.

•Coal use is projected to decline until the 2030s as regions replace coal with natural gas and renewables in electricity generation as a result of both cost and policy drivers. In the 2040s, coal use increases as a result of increased industrial usage and rising use in electric power generation in non-OECD Asia excluding China.

US Energy Information Administration

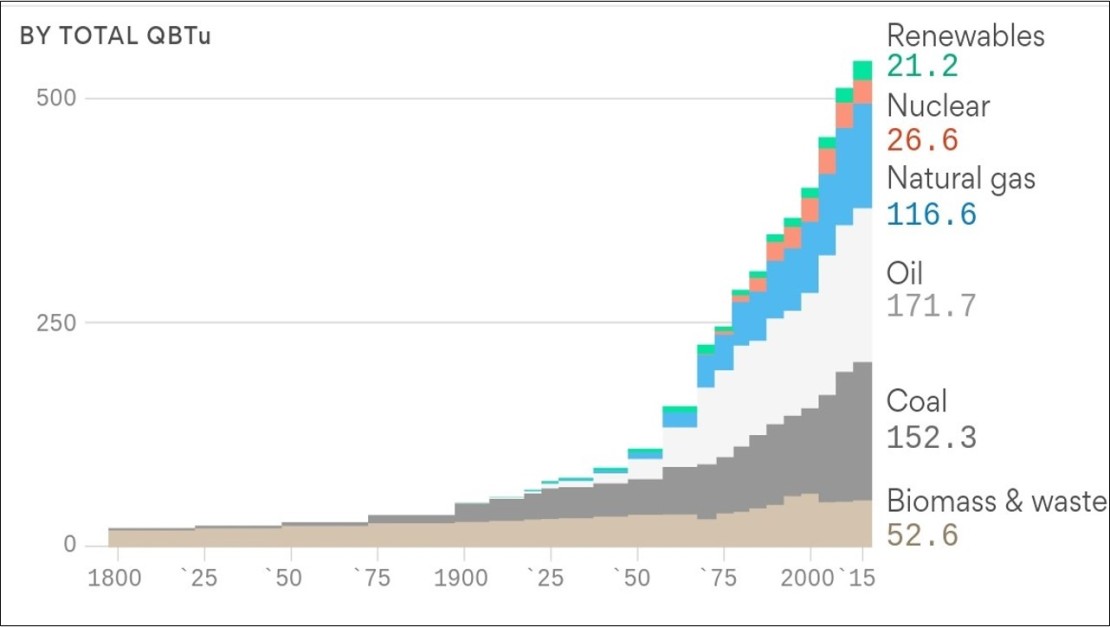

While EIA forecasts an explosive growth in renewable energy, it doesn’t replace fossil fuels. It just get piled on top of the energy mix… Just like fossil fuels and nuclear were piled on top of biomass.

More good news…

While they forecast that renewable energy sources will account for nearly half of global electricity generation by 2050, total demand more than doubles. The growth in renewable energy barely keeps up with total demand growth.

Oops!

Did I mention that Peak Oil has been postponed… Again?

Even better news…

•Non-OPEC crude oil and lease condensate production grows 23% between 2018 and 2050, reaching 59 million b/d in 2050. These increases are driven by growth in Russia (22%), the United States (11%), Canada (126%), and Brazil (59%).

•United States crude oil and lease condensate production increases from 11 million b/d in 2018 to approximately 14 million b/d from 2025 to 2040, driven by hydraulic fracturing of tight resources in the U.S. Southwest. Subsequent production falls to 12.2 million b/d by 2050, as development moves into less productive areas and well productivity declines. Nevertheless, 2050 production increases 11% from 2018 levels.

•Russia’s 2.3 million b/d increase in production by 2050 comes mainly from non-tight resources, but the country also sees accelerated growth in tight oil production after 2030.

•Canada’s 5.4 million b/d increase in production by 2050 is a result of oil sands development, particularly toward the end of the projection period, as easily accessible global resources are increasingly depleted and global oil prices gradually increase.

•Brazil’s 1.5 million b/d increase in production by 2050 results from continued development of offshore pre-salt oil resources.

US Energy Information Administration

More offshore drilling and oil sands development! Too fracking cool.

The US will continue to kick @$$ when it comes to natural gas…

And now for the pièce de résistance…

Could the EIA Projections Be Wrong?

Sure they could. EIA totally missed the shale revolution.

The real shortage is in risk takers and honest governments, not petroleum resources.

https://www.reuters.com/article/us-mexico-oil-zama-exclusive/exclusive-mexicos-pemex-seeks-control-of-u-s-oil-firms-billion-barrel-find-idUSKBN1WF11Z

You can magnify this story times 50x in the case of undiscovered resources offshore Mexico (akin to satellite photos of North Korea at night) and 100x for Venezuela. That’s not even getting to Russian shale and Russian Arctic with Chinese money.

That really sucks. Pemex will probably spend twice as much money, take twice as long and produce half as much oil as the US operator would have.

David Middleton October 1, 2019 at 2:28 pm

Hi David. Seems the problems with doing business with mexico is a bit worst. They have a Pirate problem.

Maybe we could send a group of esteemed CAGW scientist to lecture them on their evil ways and adopt an “leave it in the ground” philosophy

https://oilprice.com/Energy/Energy-General/The-Gulf-Of-Mexico-Has-A-Billion-Dollar-Pirate-Problem.html

michael

This bit is unadulterated Horst schist…

“Opening up the local oil and gas industry to private players has increased the number of targets for pirates offshore and this includes not just the oil itself but also equipment and raw materials.”

I used to work for a company that designed and marketed controls for high-speed turbomachinery, turbo compressors and gas turbines. They were looking at a couple of jobs in Mexico that would have meant dealing with Pemex. In the words of our lead turbo engineer, “It’s going to take some serious graft to get in there.”

What a blessing.

“I cover oil, gas, power, LNG markets, linking to human development.” !!!!

The writer is a young guy. It’s not that he hasn’t learned to speak English yet, but rather because he’s learned post normal newspeak English. Eirher that or the non-human development linking to oil and gas markets is too specialized a field.

If you call 50 young.

I do… 😉

Where is the graph where the whole world decides to leave it in the ground after 97% of everyone under the age of 86 years old is convinced we have only 96 months to save the planet?

The reality, of trying to do without oil and NG, bites big time. I predict that, once people start feeling real pain, they will quit giving lip service to CAGW and will become really skeptical. 🙂

The case you talk about will be a short lived blip on the graph.

That’s my belief too. Peopole give mindless assent to what they hear about climate change in the media, to the extent they think about it at all, because it costs them nothing. The real change in opinions will occur when they are faced withthe true personal costs of eliminating fossil fuels.

I saw someone give a AGW believer the real talk yesterday. He seemed to be a half believer, but told her the truth – that if this is real, the only solution is to give up a modern lifestyle entirely and support a totalitarian government that will force us all back into the Stone Age. This includes giving up the internet on which they were conversing (few things nowadays use more electricity than the huge internet data centers), because just becoming a vegan and selling your car isn’t going to make a meaningful difference. And he will continue doing what he wants until the world ends, or doesn’t.

She didn’t reply 😛

The graphs in Dave’s article tells the whole story.

Our civilization only exists because of the abundance of cheap energy.

It will become blindingly obvious when renewables cause regular blackouts due to their intermittency. High costs are blamed on the greedy utilities, but when they can’t even supply the power needed, it will become as apparent as a fish in the face.

Nicholas

You don’t need a graph for that, just a wooden cross in the ground will do nicely.

5 or 6 billion of them, most probably.

Just posted here on WUWT, an article detailing that to reach zero emissions by 2050 will require a new nuclear power plant every single day between now and then.

Someone needs to do a study detailing what would happen if the energy powering our civilization was slashed without new sources of energy sufficient to meet demand are not in place FIRST.

It would not be pretty.

But the fact is, to even begin to acquire the just the materials to completely rebuild our energy infrastructure would require burning more fossil fuels than ever.

It looks like both Peak Oil and the Global Warming Climate Meltdown are both being progressively moved into the distant future.

Reminds me of the old saying: “The cure for high oil prices, is high oil prices”

Well, one of them might be, but if David’s CO2 emissions graph above is anything to go by – still rising exponentially in 2050 – then RCP8.5 here we come.

Get your microscope out and take another look at that graph.

As usual… Nothing but moronic blather.

Trend line is way below 8.5. It almost perfectly matches the linear model.

As usual Loydo, you see what you want to see.

The trend line is in the upper range of RCP2.6 and lower range of RCP4.5.

The graph is funny but not that funny.

Exponential seems to mean something else in your world.

Regardless, so what. More CO2 means a better world.

Dear Loydo

Ever heard of the inverted logarithmic effect of CO2?

That means that to achieve a linear increase in temperature requires exponential growth of CO2. Anything less will result in a decreasing rate of increase.

Welcome to elementary mathematics.

“requires exponential growth of CO2”

Uh huh….and that is what the CO2 graph above projects….welcome to elementary global warming.

The honest studies of how much warming comes from CO2 is somethin between .6 C to 1.6 C per doubling. If they are correct and they seem to be that means we are look at best about 2 to maybe 3 C of warming and that and to get to 6 C(which were we about at 8000 years ago) of warming would require doubling the amount of CO2 three time. There is not enough coal, gas or oil to do that. So the entire global warming scare is only about power not the environment. CO2 warming is a moot point.

By “honest” you mean the ones you like?

I predict you wont like the latest modelling.

“Analysis shows the climate sensitivity of the models is high. For both models the Transient Climate Sensitivity (TCR) is about 2.7 °C, while the Equilibrium Climate Sensitivity (ECS) is about 5.4°C for UKESM1 and about 5.8°C for GC3.1.”

https://www.metoffice.gov.uk/research/approach/modelling-systems/new-flagship-climate-models

Loydo. We live in the actual, material world, not in model lalaland.

Someone should tell Greta Humbug good news!

It’s not only EIA that has gotten shale the wrong way. The entire world did not believe that some roughneck in the brush could make a difference, let alone break every bit of certainty that Russian oligarchs and Arabian sheiks in their palaces were sure about. That the world will pay high prices for what they oull out of the soil forever. It’s one powerful message to the rest of the world. Shape up or ship out. The resource economy model is always doomed to fail in the long term. They are all living on borrowed time.

It would be so much easier for the climate alarmists’ message if fossil fuels were a diminishing resource today. Then the world could all follow the Socialist/Marxist lead into the lowest common denominator of energy, industry, and economies. Now the developing world will have to suffer through the possibility of catching up to the rest of the world instead of the rest of the world lowering to their standard. Unless of course the Socialists/Marxists figure out a way to control the nuclear energy market then they can grasp on to that as our next savior. (is /sarc necessary?)

Technically, fossil fuels are diminishing resources… It’s just a big@$$ resource base

Technically, unless fossil fuels were transported by a meteor to earth in their current state, there’s never peak oil. 🙂 But you’re right. We just seem to be finding so much more as time goes on that it seems limitless.

Cannot understand how such massive supplies were generated and how they could get so deep.

https://wattsupwiththat.com/2019/05/08/how-climate-change-buried-a-desert-20000-feet-beneath-the-gulf-of-mexico-seafloor/

100 million years is a long, long, time.

And it really is a small, small small part of the buried organic material that gets turned into coal/oil/gas.

Think of all the oxygen in the air, all the clays and soil and rocks that have been oxidized by free oxygen over the last 2,000,000,000 years. All that oxygen was created by photosynthesis, and all the hydrocarbon created at the same time had to get buried deep, because otherwise it would have reunited with the oxygen to make CO2.

Whilst coal is said to be in decline until the 2030 tees, it has one big thing going for it. Its natures storage battery. It can just sit there by a coal fired power station, no costly storage needed, no pumping water uphill stuff.

So its a very attractive fuel to power poorer countries seeking to develop.

MJR VK5ELL

We have a problem. Not yet but somewhere in our forseeable future. At the current extraordinary rate of growth of demand for enrgy there won’t eventually be enough of the stuff in the ground to meet our needs. It has been repeatedly fashionable to declare ‘the end of oil’ but not withstanding all the false prophets it is obvious that we must at some stage reach a choke point and we presently have only the dimmest of idea of what primary energy source is going to take over the burden. I wonder what the solution will be that still lies over the horizon.

There’s plenty “of the stuff in the ground to meet our needs” for at least 1,000 years… at the right price.

No, that there is not – not fossil oil anyway

Nuclear yes. But not oil/gas

We are burning it faster than it’s being laid down.

The energy cost of extracting it is increasing. It it gets beyond the energy obtainable by burning it, it is economically and physically useless as a fuel, no matter how much is left.

Renewable energy is pretty much there already – the lifetime output of a solar panel or windmill is scarcely above the energy used to make it.

Abject nonsense.

coal is stored solar energy. So too petroleum and most nat gas.

“There’s plenty “of the stuff in the ground to meet our needs” for at least 1,000 years… at the right price.”

E.g.,, coal gasification, as China is now utilizing to reduce soot. (But the process increases CO2 over just burning the coal.)

We have a coal gasification plant in the US don’t know if it still running but it did work. The funny part is it in North Dakota, the place that has gas under in all but two counties.

Nuclear.

There is still heaps of amazon rainforest to clear for Sustainable Ethanol production.

“Top Sugarcane Producing Countries

Brazil (739,300 TMT) Brazil tops the list of sugarcane producers, with an annual production of 739,300 thousand metric tons.

India (341,200 TMT) …

China (125,500 TMT) …

Thailand (100,100 TMT) …

Pakistan (63,800 TMT) …

Mexico (61,200 TMT) …

Colombia (34,900 TMT) …

Indonesia (33,700 TMT) …

More items…

•

Apr 25, 2017

https://www.worldatlas.com/

https://www.worldatlas.com/https://www.worldatlas.com › articles › top-sugarcane-producing-countries

Top Sugarcane Producing Countries – WorldAtlas.com

I like my ethanol in my beverage, not so much in my truck’s engine.

Yes, well, (clearing my throat)…fortunately, there is ample amazon rainforest to burn down for more Sustainable Ethanol/Sugar Cane production and Vodka grade Ethanol…..the recent fires in the amazon are by no means Peak Ethanol Production……and its Carbon Neutral….win/win.

Green Vodka…..i like it!

Fair enough….. Sustainable farming practices, Ethanol for Carbon Neutral cars and Green Vodka We are no-where-near peak Vodka .

*And trucks!

We have hundreds, if not thousands of years before we need to worry about running out of the stuff.

Declaring that we need to find a solution now is like asking someone from the year 1019 to solve the problem of nuclear fusion.

We can’t imagine the technology that will be available in 100 years, much less 1000. Let the future worry about the future’s problems. We have enough problems of our own to deal with.

^^^^ That

You can’t try and solve future problems with todays technology, they will solve it in the future with future technology.

Flux Capacitor.

That’s as plausible as limitless energy from fusion.

But remember, fission nuclear power was supposed to deliver electricity “too cheap to meter”.

Some one has to make a buck somewhere, else there’s no incentive to build and operate it.

Interocitor

Eric, please remember that the stone age didn’t end because they ran out of stones!!! Technology comes in cycles, and just as the bronze age followed the stone age (because some smarter than average guys invented bronze, which was superior to flint for knives and weapons), and so on thru the iron and steel ages. The same applies to energy – wood, then coal, then oil, etc. Nobody can predict when the next energy source will be invented, but it certainly will. And the closer we get to needing a new energy source, the more smart guys will be working on its invention. Any other approach is just socialism.

Our consumption of stones has massively increased since the stone age.

The biggest ancient stonework I can think of is the Egyptian pyramids.

That’s not shabby, but almost three orders of magnitude less than America’s annual production and it took the Egyptians twenty years to build.

Forty + years ago I moved to Houston, TX. In those forty + years there has always been somewhere with great flourish a scary story with large headlines that we are hitting or about to hit peak oil. Soon thereafter with much smaller headlines is a story that, no, we are not hitting peak oil and the world is no where near peak oil.

I never pay attention to these stories anymore.

Peak Oil is “out there”… Just like the truth in the X-Files… 😉

North Korea hit peak oil years ago.

It’s the perfect “sustainable” living conditions country of the left.

Sarc off

NK is an example of how nations fail. Failure is social, and the visible political features are not important. The social failure is rooted in a spiritual crisis.

In short, a spiritual solution is needed to solve the social collapse, which then changes the political horizon, ultimately creating a new economy and economic relationships.

The Marxists say they will solve the problems quickly by setting the economic relationship in order first. This is a very important claim. They will bypass the necessary development of necessary spiritual capacity development of the population on the assumption that “good people” will result from the removal of economic class differences. It is, of course, a disaster each time for a variety of reasons.

Watch Iran closely in the coming months as a non-material revolution sweeps across the land. You cannot see it at present. You see mullahs and guns, which is not what the people want at all.

We live in the most interesting of times.

Crispin, I thought that Marx wanted to fix the (British) ‘class problem’, via a ‘peoples revolution’ per his and Engel’s 1848 Manifesto. Lenin believed him and wanted to get rid of the Czar, who was repressing the peasants, and hey presto – the Russian Revolution. But both Marx and Lenin vastly underestimated the difficulties that running a command economy creates, and ran Russia into the ground. The Chinese (after a poor start) figured this out and introduced ‘capitalism’ but kept the rest of Marx’s Communism. And I can’t see much room in either for ‘spiritualism’.

“The Chinese (after a poor start) figured this out and introduced ‘capitalism’ but kept the rest of Marx’s Communism. And I can’t see much room in either for ‘spiritualism’.”

Russia and Putin are promoting the Orthodox church. China and Xi suppressed Falun Gong.

The communists were unable to suppress Confucianism, Daoism, and Buddhism. They run as deeply in the Chinese personality as does Christianity in the west.

The Confucian idea is that the people must make the country succeed in spite of bad leadership. That’s one of the reasons China is doing much better than Russia.

I look forward to a lush, green future when atmospheric CO2 concentration reaches 800 ppm. It’s too bad that it doesn’t cause warming because our long term temperature trends are not favorable.

We’ll just have to see about that, won’t we? Oil projections are just the same type of extrapolations climate scientists like so much. They wouldn’t see a Peak Oil even if it was happening right now. We won’t get a warning about Peak Oil.

One would think that with Iran sanctions, Venezuela’s oil production crash to the ground, and Yemen attacks on Saudi Arabia’s infrastructure this is not precisely the best time to be optimistic about near future oil production.

Tell that to the price of oil.

That’s actually worrisome. We only have data to June, but it already looks like World crude + condensate production for 2019 is likely to be lower than for 2018 and we still have to see KSA production after the attacks. It is clear that global inventories must be reducing, yet the price is not moving higher. I wonder if the futures market is anticipating global economic weakness with the trade wars, Brexit and so on.

The current atmosphere of the futures market reflects $30/bbl oil. When they realize they’re wrong, oil prices will shoot up to $80-100/bbl, until they figure out they were wrong again, and oil prices will drop back to ~$50/bbl.

Javier has a point. Global oil (NB oil not O&G) production has been increasing yoy but by less and less. The signs are there that the world will struggle to keep oil production increasing, and the reality is that it is approaching a plateau – and decline follows plateau. OK so the full plateau may be 20 or so years away, but it could feel like it somewhat earlier.

But that’s not necessarily a message of gloom. It depends on what we (and technology) do in the meantime. Any sensible government, even of a modest-sized nation, will make sure it has coal in its energy mix and will already be checking out nuclear energy.

The biggest future headache – until the technology fixes it – is that coal and nuclear do electricity generation and oil does transport. So coal and nuclear aren’t yet candidates to replace oil. There’s maybe 20 or so years for the technology to come through, and 20 years is a long time (in technological terms), so there’s no need to panic. Just a need to stay compos mentis.

Renewables? Well, I won’t rule out technology making it viable on a large scale within 20 years, but its chances don’t look good to me. Every $ invested in nuclear technology looks likely (to me) to give a massively better return than any $ invested in renewables. Both unsubsidised, of course.

Oil prices have been low for a number of years.

It isn’t surprising that companies aren’t investing lots of money in developing new sources.

When prices go back up, that will reverse, right up till the time that the new production causes prices to fall. Again.

Peak oilers are always confusing normal market cycles as proof that this time, they got it right.

Some peak oilers have no problem recognizing market cycles. However it is important to recognize another trend. Over time the average cost of oil extraction increases inevitably, as more difficult reservoirs have to compensate the decreasing production from the low hanging fruit of easier reservoirs and provide also for the ever increasing production. It is the law of diminishing returns. Marginal economic activities then become unprofitable and a larger share of the economy has to be dedicated to the procurement of oil or other expensive alternatives.

“[Joseph] Tainter argues that … societies collapse when their … “energy subsidies” reach a point of diminishing marginal returns. He recognizes collapse when a society involuntarily sheds a significant portion of its complexity.”

It is clear to me that we are now in a long-term process of decreasing marginal returns from our “energy subsidies” that includes not only oil, but also wind and solar energy. Whether that leads to collapse or not remains to be seen, but it is not encouraging that we focus on the wrong problem (climate), and fail to explore obvious solutions (nuclear).

Greta might be right for the wrong reasons about her bleak future.

Extraction costs don’t inevitably rise. They pretty well track the price of oil.

The cost per barrel in deepwater has actually been cut in half since 2013.

Improvements in seismic imaging enable us to find large prospects that we couldn’t “see” ten years ago. It also enables us to drill wells far more efficiently. Costs have also been reduced by simply learning how to do things more efficiently.

That said, Peak Oil is a real function. It “is out there somewhere”.

Regarding Tainter… He’s a fracking idiot. Joeseph Tainter authored a 2012 book on the Deepwater Horizon (Macondo) disaster and its supposed relevance to EROEI. His coauthor was Tadeusz Patzek, a professor of engineering. This is from Chapter 2, The Significance of Oil in the Gulf of Mexico, page 8…

Why would a company like BP build such a monument to technology and ingenuity as the Macondo well in the first place?

Because that’s where the oil was.

Why was it necessary to drill for oil one mile beneath the surface of the Gulf of Mexico?

Because that’s where the oil was.

Hubris among top management may have minimized the perception of risk, but well-informed employees throughout the organization understood the perils as well as the benefits of deep offshore operations.

Dudes! Five companies bid against BP for an opportunity to drill “Macondo”… BP’s high bid barely beat out smaller independent oil company LLOG Exploration…

Only one of BP’s competitors for the lease, Eni, was a major oil company. The rest were small, mid-sized and large independents. Anadarko wound up partnering with BP on the Macondo well. After the Deepwater Horizon disaster, LLOG Exploration was able to take the lease over and successfully drill the prospect.

LLOG Exploration renamed the prospect “Niedermeyer”… part of an Animal House theme.

Niedermeyer was a nice discovery.

The Niedermeyer, Marmalard and Son of Bluto 2 fields were completed as subsea tiebacks to LLOG’s “Delta House” floating production system (FPS) on MC 254.

Murphy Oil just bought this and other deepwater assets from LLOG for $1.4 billion. So, I think the industry has a much better grip on the “perils as well as the benefits of deep offshore operations” than an anthropology professor does.

You may think that the need and motivation for these operations are obvious, but any rationale for drilling in these inhospitable environments must take into account the amount of oil (or energy in some form) that is needed to build and maintain an offshore drilling rig such as the Deepwater Horizon, extract the oil, and transport, store, and bring the precious liquid to market.

The “need and motivation for these operations are obvious”… To make money. No oil company or any other type of business would “take into account the amount of oil (or energy in some form) that is needed to build and maintain an offshore drilling rig such as the Deepwater Horizon, extract the oil, and transport, store, and bring the precious liquid to market,” and remain in business.

I can guarantee that we don’t factor the cost of building the drilling rigs that we contract to drill wells in the Gulf of Mexico. We factor in the cost to contract the rig and drill the well.

The most fracking hilarious thing from Tainter’s and Patzek’s book was this Gulf of Mexico production “forecast”…

I have no idea what “industry projection” they were referring to. Prior to Macondo deepwater production was forecast to increase sharply because a large number of deepwater discoveries, particularly ultra-deepwater Lower Tertiary discoveries were expected to come online. All of these projects were delayed by the Obama maladministration’s unlawful drilling moratorium and “permit-orium” in the aftermath of Macondo .

Here is a plot of actual Gulf of Mexico production overlaid on “Patzek’s Projection”…

Of course, that’s not how the oil industry would plot the production. This is how we would plot it:

Since I put those graphs together, Gulf of Mexico production has continued to increase, trailing only the Permian Basin (about 63% of Texas production is from the Permian Basin)…

Another 100,000 bbl/d and it’ll be 2 million barrels per day… And I think we’ll get there next year.

Appomattox is just the first deepwater Norphlet field to be brought on production… The Norphlet is one of the hottest plays in the Gulf… Hottest activity-wise. It’s actually quite cool geologically – That’s why it’s oil and not gas like the shallow water Norphlet in Mobile Bay. For a detailed discussion of the Norphlet, see “How Climate Change Buried a Desert 20,000 Feet Beneath the Gulf of Mexico Seafloor”.

Yes they do because the easier oil to extract is the first to be extracted. In the old days you just had to poke the ground and oil would come out pushed by its own pressure. Now we have to fracture the rocks to get a small stream flowing that decays by 70% in a couple of years. Technical improvements might temporarily reduce the cost of extracting certain oils from certain places, but globally the overall cost of oil production keeps increasing. As the cheap-to-produce oil decreases, it is substituted by more expensive oil. It is related to entropy.

No he is not. He is a leading expert in the collapse of ancient civilizations. He is just outside his field of expertise when writing about oil extraction in the Gulf of Mexico. His work “The collapse of complex societies” is a masterpiece and in my opinion the most significant contribution to the question of why past civilizations collapsed.

Oil fracking companies make money from extracting oil, but the market value of that oil is vastly inferior to the amount of debt generated in the process. Overall the balance is clearly negative, but the gains and loses will be unequally distributed.

Nothing you wrote is even close to reality.

Finding and development cost: 1977-1994 (1992 USD)

Finding and development costs: 2018

$19.68/bbl in 2018 USD is $11.00/bbl in 1992 USD.

Yeah, right. I guess you heard about global liquids cost curves:

As the cheaper producing fields are substituted by more expensive non-producing fields, the average cost increases. And since 2010 most of the growth in global oil production has come from non-conventional North American LTO and oil sands that are the most expensive of all.

Or why do you think there is $60 billion in unsecured US E&P debt?

https://www.artberman.com/wp-content/uploads/Peak-Prosperity-4-SEP-2019.pdf

I guess you are not counting that debt as part of the cost of oil as there are no plans to ever repay it.

F&D “all inclusive” is all inclusive… Not cherry picked segments. Exploration is always more expensive than exploitation. Your Rystad article is from April 2016. This reflects a period when oil prices (and F&D costs) were falling from >$100/bbl to ~$50/bbl, and were supposedly at rock bottom

This is the comparable graph from 2019…

The 2019 breakeven price is lower than 2016 in most categories, based on volumes.

Furthermore, “breakeven” is not the same as F&D. F&D are the direct costs of finding and development. Breakeven price is what a company need to cover F&D and other costs.

Javier, as you said below about Tainter, “He is just outside his field of expertise when writing about oil extraction in the Gulf of Mexico.”

Perhaps you too are outside your field when discussing nuances of oil production and peak oil with David Middleton.

That said, I keep all your excellent Climate Change work handy and reference it often. Thanks for all you contribute!

+42×1042

Javier’s climate change work is so good, that I initially thought he was a geologist.

High Praise there David.

The markets will solve that.

If oil is over $150/bbl you can make it out of trees, they will not have to, but the market will solve this.

Ultimately MSR nuclear is there, plus others, and even if we all say we will not have it, the rest of the world will choose to use it, we can live in poverty if it should be the option we run with.

“Ultimately MSR nuclear is there, plus others, and even if we all say we will not have it, the rest of the world will choose to use it ….”

Sold to them by Russia and/or China, perhaps.

Thousands of Dutch farmers block 1100 km of roads protesting the government’s blaming them for climate change. Mayor of Hague sets up roadblocks to keep them from reaching city. They detour through a beach.

https://twitter.com/ohboywhatashot/status/1178973044297142272

Seems like peak oil will happen when it becomes seriously uncompetitive at any price. That appears unlikely in the near to medium term future unless radical ideologues are able to create that environment through the law.

Hmmmm…. we have people working at the highest levels night and day to achieve just that.

Greta is not going to like this.

I do not for a second believe their prediction in the growth of “green energy”, however they define that. Eventually the prime sites are covered with wind-warts, people figure out that solar is not only intermittent daily, but also hourly, and the real costs will be eventually come out into the open as older sites are decommissioned.

One strong tornado through a Texas wind farm (or worse a glass farm) and people are going to start paying attention.

I also keep wondering when they will figure out how to extract oil economically out of the Green River formation. Maybe as much as 3 trillion barrels of oil waiting for someone to figure out how to get at it – and make a profit.

We could already economically exploit the Green River oil shale… However, the economics are barely marginal at $50/bbl, access is largely prohibited and potential environmental liabilities are YUGE.

Regarding their renewables forecast, they may be over-compensating for earlier misses on the low side.

The key point is that the forecasted explosive growth barely covers the demand increase.

Is this story from The Onion? It sure reads a lot like it. In no particular order let me make a few points.

First, resources are very different from reserves and in the US there is a serious misclassification due to a change in the SEC rules that were put into place to allow shale companies to make claims without proving them. The assumption is that formations are approximately homogeneous so the results from one part can be considered to represent other areas. But that is not true. While some of the core areas are prolific and worth developing, most areas are not economic. The US shale sector has NOT produced positive free cash flows in the past decade and a half. Debt is piling up as it is being used to close funding gaps as management keeps trying to increase production. While losses are minimized by using EURs that do not represent the real-world data, the cash flows cannot be minimized or hidden from view. When the next contraction comes, most shale sector projects will have to be written down.

Second, there should be lots of natural gas around in many areas of the world because exploration for it was not done. After all, why spend money drilling in deep formations when the gas is stranded? Now that there are ways to move that gas, a lot will be brought on-line so many markets should be well served. In the case of the US, it will have to hope that Mexico will develop gas formations that must be around. Americans did not have stranded markets so they have already drilled and found most of the gas that there is to find.

Third, there is no doubt that we have seen the peak production for economically viable oil. That does not mean that companies will not produce at a loss as they have in the shale sector, but that is not very effective and clearly not sustainable.

Fourth, the infatuation with renewables is idiotic. Renewables are not economic and not very environmentally friendly. The solution is nuclear and coal, not wind and solar.

There is no doubt that we have already seen peak oil?

What world have you been following?

I have to ask, how old are you? Because it feels like you don’t remember the last peak oil scare.

I had a friend who was obsessed with peak oil, and for a while followed a super popular website that gave a lot of predictions about what would happen when we reached peak oil. He sat around preparing for the end and spent a good deal of time calling me a “sheeple” when I told him it wasn’t going to happen.

This was over a decade again now. Gas prices are actually lower than they were then and no end to oil is in sight. The internet-fueled proponents of peak oil all quietly drifted off and mostly quit mentioning it because they were embarrassed. The website about how we were all going to die is now defunct and the dude who ran it became some marketing person or lawyer, I forget which.

EIA is a bunch of swamp dwelling liberals who are wrong about everything everytime everywhere. Renewables have essentially peaked. Take a look at Germany’s Energiewende program, especially onshore wind. In Germany, 2020 is the first year of expiring subsidies. It’ll be a close race between “retiring” and constructing wind mills for the next 20 years. How much longer are solar panels going to be installed in cloudy northern cities? How does the market look for London, Oslo, Moscow, Edmonton? Battery storage will always be more expensive than “load shedding”. EIA is as wrong about nuclear (small modular) as they were about shale, and even more wrong about future coal consumption in India and China. Lucky to have this “wealth” of information from our government? BS, total waste of taxpayer money.

Can someone bring this to Lord Moncton’s attention (vindication): https://www.theguardian.com/food/2019/sep/30/research-red-meat-poses-no-health-risk

As Pink Floyd sang all those years ago

You can substitute oil for money. It’s as true now as it was then. Oil makes the world go round. Gang-greene can’t change that but can’t yet admit it, either publicly or to themselves.

Yep.

Hard currency cash will be worthless and e-transactions will be monitored by state apparatchniks. Bullets and gasoline will be the new underground currency of that Leftist-driven dystopian future – a barter economy where no government taxes can reach.

Peak oil defying the predictions of just 20 years ago with the shale revolution was the Black Swan the Climate Change scammers didn’t see coming (by definition of a Black Swan event). The Climate scammers were banking peak oil/expensive natural gas to provide a fat ROI on their wind and solar investments without having to do much heavy lifting/convincing. The shale gas revolution and the resulting build out of LNG terminals has turned that long bet on its head. Grid operators and power providers everywhere now have incentive now to build CCGT and not more wind/solar unless substantial ITC/PTC subsidization remain in-place.

As aresult of that and the Trump Administration promoting US energy dominance with fossil fuels, the GreenSlime billionaires are now desperate to install a Democrat US President and Congress. A Democrtic Party regime at the Federal level much like they bought and paid for in Sacramento to put a stop to the assault on their renewables investments and reduce today’s affluent middle class to indentured servitude/peasantry with high energy prices for consumers.

Make no mistake about it, they are planning to unleash several billion dollars on an even louder Climate Scam propaganda campaign between now and November 2020.

Peak oil out to 2040 (and/or beyond) for the US depends on the political system choices made by voters. Already we can see how much a disaster having Democrats dominate a state government like California, Illinois, Connecticut can be for every aspect of life in those states by driving up costs for everything, and making new home ownership for a starting family very unaffordable. And some states like Illinois and Connecticut are barely just getting by today in a healthy economy, so a US recession would send them all over the brink financially to insolvency.

A President Pocahontas or President CommieSanders could do an immense amount of damage to the US economy if either were to follow through with a ban on new Federal land leases and offshore leases. A deep recession would certainly follow either of them getting elected. But it would be the crisis they actually want to force the changes they want. But there would be Grapes of Wrath like suffering and misery across the nation.

The upside would be that if they did that, the economy would tank so bad, they’d likely be a one-term President and Democrats would get banished to the political waste heap. That is unless they packed the Supreme Court with 4 more intellectually dishonest “Living Constitution” justices and then proceeded to abolish many of the constitutional safeguards against an oppressive federal government.

But there would be no telling how such a Radical Left US President and the resulting US economic disaster would play-out on the world geopolitical stage with a surging Chinese military and a likely nuclear weapon-capable missile equipped Iran by then. Some things can be projected were the US military to become neutered under a Pocahontas or Commie President. Australians would probably need to learn Mandarin or

emigrateescape to New Zealand. Germany would certainly fall into Putin’s control sphere, and Poland likely would fall into a New Iron Curtain unable to stop Little Green Men invasions and then piecemeal taking of their territory like Putin is doing in Ukraine.One thing is certain. The Climate Change policies the Democrats have promised if they get power are the very real threat to Western prosperity and survival of an affluent middle class. The Tom Steyer’s of the GreenSlime are gearing up for a multi-billion dollar propaganda blitz starting just after the New Year. How it all will turn out is course unknown by anyone.

This is priceless… The shale Revolution is the first Black Swan to still be a black swan 10 years after it began… 😉

The demise of “Peak Oil” by 2010 was killed by the shale revolution no doubt. The GreenSlime and Climate Scammers they supported never saw the shale revolution coming until it was happening. And there was nothing Barack Obama could do to stop it. But they see it now, and they saw it clearly as BO was starting his 2nd term in 2013.

Obama and his maladministration were positioning the EPA’s WOTUS rules regime as a means to bring a heavy regulatory burden on the frack-waste water disposal to begin to throttle fracking on private and state lands since the Feds couldn’t directly stop that. They were positioning their now-rescinded methane rules in the same manner to further reduce financial incentives for natural gas production. And their Fish and Game Service Prairie Chicken gambit was also a ploy to use wildlife regulatory burdens to limit well pads and infrastructure build-out on private and state land across the western US, just as the spotted-owl regulatory burdens decimated the logging industry 2 decades earlier.

The Left has a play book and “tapes” of last week’s game now that everyone who looks can what is in it and how they operate. Certainly they’ll devise new angles and new minor play revisions to each situation.

But their goals are clear: Stop fracking EVERYWHERE. Stop shale oil and shale natural gas from getting to markets. Stop pipelines. Block more LNG terminals. Do anything possible to make NG and oil expensive and remove financial incentives for their investments via regulatory burdens. And their Holy Grail now is to rescind the ANWR exploration Congressional authorization so that the Alaskan Pipeline ultimately has to be shutdown for lack of flow in few years.

Go Trump.

I commented here, but I used Anthony’s banned “k-word” in the reply.

It’s lost “In moderation” now.

Sigh.

Note to self: Gotta remember to spell it “k|ll” or “k1ll.”

Joel,

Agree that the only hope for renewables is a democrat president. But even in that unlikely event shale gas and the associated export LNG boom will continue. The criminally corrupt democrats will try to undo it, just like they’ve spent the last two, and soon to be three years trying to undo the last election. Their strategy will be a massive carbon tax in an attempt to make solar/wind/storage/hydrogen cost competitive. Impossible yes, but as Joe Biden recently explained facts don’t matter to democrats only the “truth”. Western prosperity truly is at stake and it hinges on the next election.

Everything the middle-class has achieved in the US/Canada/Australia/UK hinges on the next 15 months.

Brexit.

US Presidential Election.

Control of the US Senate.

Canada and Trudeau and its Alberta oil-sand future.

Australia and whether the Greens there can be checkmated.

A Commie Bernie or Pocahontas as President would be an outright disaster. If I were Russian President Putin’s advisor and Bernie or Lizzy was to be the President on January 20, 2021, I’d advise him as follows:

– Swift, rapid invasion of Lithuania on 21 January 2021. Seize Vilnius and open a land corridor to Kaliningrad. Install a Moscow puppet government in Lithuania that disavows NATO support/defense.

– Bernie or Lizzy would refuse to allow NATO to respond militarily. NATO and its Article 5 defense of memeers attacked would be DEAD. NATO would collapse.

– With Latvia and Estonia, surrounded and NATO defunct, blockade both until they capitulate and then install Moscow puppets in both Riga and Tallinn (the capitols).

– With the Baltics now securely in Moscow control and NATO defunct, begin to work on Poland with LGM attacks (little green men) seizing territory from government control.

-Bring Berlin to heel with threats of cutting off NordGas2 pipeline gas deliveries to Germany and threaten to freeze out Germans unless they fell in line with Moscow and distanced themselves from the US by forcing US military Air Force and US Army forces out of Germany in toto.

– With NATO gone, a Moscow-controlled Berlin would tell a President Bernie or Lizzy to withdraw the US military from Germany. It would be a straightforward sell by Bernie/Pocahontas as “cost savings” to Congress and the US so the money could be spent on “social supports” domestically to a battered US population suffering the worst depression since 1935-36. (Brought-on of course by their own election… how convenient).

In the end. Europe and the EU would come under the domination of Moscow, vis-a-vis a Germany dependent on Russian natural gas. Whether the UK falls under this control now depend on the fate of Brexit.

Of course none of this need happen if the US maintains its energy dominance, thus a strong economy, and thus a strong military posture. The choice is up to the US voting public. A public being fed lies on climate change everyday now from the GreenSlime/GreenBlob.

Is it any wonder why Presidents Putin and Xi go along with the climate scam on the West?

There is all kinds of oil, the problem are the eco terrorist outfits who trying to stop exploration and development in order to brink about peek oil.

The fossil fuel haters have their catchy slogan:

Keep it, keep it in the ground.

Whatever. Hey how about this for a pro-fossil fuel slogan:

Dig, dig, dig

An’ you dig it up from the ground!

Right? Just like the song “Another one bites the dust”.

Can ya dig it?

According to the EIA charts, the world will be consuming nearly 130B barrels a day by 2050. That won’t happen at $55 WTI. US production has quit growing this year and with a declining rig count and declining completions that trend looks to continue as long as prices stay this low. The world consumes approximately 36B barrels of oil a year. New discoveries have just been a fraction of that number for years. We are surviving on US shale growth and other countries putting more straws into the same reservoir. Very few countries can add production at these levels outside Iraq, Russia and completing the Brazilian sub-salt fields discovered a decade ago. To get to 130B barrels a day of production it’s going to require significantly higher oil prices. Interestingly, even the climate zealots root for higher oil prices so EVs can narrow some of the economic disadvantages they have versus IC automobiles.

Marc, I think you have a couple of typos in your comment – you used ‘130B’ twice instead of ‘130 M’ barrels/day of consumption. And Iam sure that there are quite a few substantial untapped oil resources in places like Alaska and Victoria, Australia which if allowed to be developed would change the equation. Finally, regarding EVs, what about mentioning the significant economic advantages like subsidies and exemptions from various taxes and tolls, etc. that EVs currently have versus IC vehicles? Personally I think that hybrid (IC/EV) vehicles make a lot more sense than EVs, and seem to be selling quite well globally without significant subsidies. Let’s let the market decide – it seems to achieve better economic outcomes than the government trying to pick winners.

You are correct. My “B’s” should be “M’s”. But what’s an extra billion among friends. There is certainly oil to be found in places like the Arctic and the deep water. Its just more expensive and most won’t be drilled at $55 WTI. For that matter, if you opened the entire world to exploration by the most efficient exploration companies there is likely more oil to be found in places like Mexico and Venezuela. But access has always been a problem in the industry and is likely to remain that way.

David,

A couple of days ago there was article in Wall Street journal on how shale oil production is slowing

https://www.google.com/amp/s/www.wsj.com/amp/articles/shale-boom-is-slowing-just-when-the-world-needs-oil-most-11569795047

Couple of points from article:

– wells producing less than expected

– estimate of peak shale production in 2030 in USA

What are your thought ?

Production will always keep up with prices. At least half of the wells ever drilled produce less than expected. Deepwater GOM conventional is where the growth is.

Deepwater GOM contributed mightily last year causing GOM production to approach 2M barrels a day of production for the first time. But I don’t see a lot coming on line over the next couple of years to offset the significant decline rates most GOM wells experience.

Shell’s Appomattox is just now coming online. It’s the first production from the YUGE Norphlet play. The Lower Tertiary play is still maturing. And many of the largest deepwater fields are still growing.

David,

Your comment is succinct, news-worthy information.

Thanks.

From the article: “Driven by electricity demand growth and economic and policy drivers, worldwide renewable energy consumption increases by 3% per year between 2018 and 2050.”

“Renewables” are a huge waste of time and money and wildlife and human health.

One of the reasons that North Slope oil production has dropped off

is that about half of the hydrocarbons produced from some wells is

natural gas.

In the past, the gas has been flared, but now must be pumped back

into the ground, making production much more expensive. We need

a gas pipeline from the North Slope. Maybe ANWAR and Trump will

provide the impetus for such a line.

When we learn how to harvest the vast stores of natural gas hydrates

in the world’s oceans without blowing ourselves up, there will not be

peak hydrocarbons until we build the number of nuclear plants,

including breeders, required for electricity.

For the origin of natural gas please read the attached link.

https://www.gia.edu/gems-gemology/winter-2017-worlds-biggest-diamonds

These diamonds were formed 360 to 750 km deep in the earth, and carried

natural gas inclusions from their formation when the rose to the surface.

Natural gas does form abiotically.

“Renewables” will die when they must compete unaided in the energy

market place.

“The fluid is not thought to have existed as a free fluid phase while the diamond grew. Rather, it is interpreted to have formed as a result of hydrogen atoms exsolving out of the metallic liquid, and perhaps to some extent the silicates as well, forming CH4 and H2 by reacting with the surrounding diamond”

So this natural gas was formed by dissolving diamond. Probably not a very promising production method.

Hydrocarbon inclusions are found in lessor diamonds which form

at less depth. Some appear to be carbon black. The point is that

hydrocarbons form at great depth, abiotically, deeper than possible

for the “fossil” thing to work.

However the isotope ratios of diamond indicates that the carbon is at least partly organic:

“The source of the carbon that crystallized into diamond is also important. Carbon has two stable isotopes, 13C and 12C, whose ratio varies according to the source, such as ambient mantle carbon or subducted, organic carbon. Variably light carbon isotopes in CLIPPIR diamonds, having 13C/12C ratios lower than the convecting mantle (Smith et al., 2016), suggest derivation from organic carbon (e.g., Kirkley et al., 1991; McCandless and Gurney, 1997), which implies the carbon was originally sourced at Earth’s surface and then subducted.”

It is a good idea to read and if possible understand a reference before linking it.

If anyone did that, abiotic oil would never be mentioned again… 😉

Periodically I drive by an existing oil field….sometimes the pumps are humming…..sometimes idle. By happenstance I talked to a guy who was responsible for whether they were humming or idle. He said it was simple….selling price beats marginal cost….or vice versa….whether the pumps had a positive contribution to overhead. He said the same applies to fracking….once done it is very quick to put a marginal hole back into production upon a selling price signal.

True across the industry??? Or did I possibly misunderstand something?

If true is this measured somehow?

THANKS for everyone’s contribution.

It depends on a lot of factors.

Late-in-life wells that are producing at submarginal rates or with too high of a water cut will often be intermittently produced. Often this is done to extend the lease and/or delay plugging and abandoning (P&A) the wells.

When oil companies lease mineral rights, it is usually for a specific length of time (primary term). If they establish production on a lease, it becomes “held by production” (HBP). The oil company gets to hold the lease so long as they have production and are paying royalties to the mineral rights owner. If all of the wells on the lease go off production, the oil company has a limited amount of time to either reestablish production or relinquish the lease. For Federal leases in the Gulf of Mexico, the length of time was recently extended from 180 days to 1 year.

In the Federal waters of the Gulf of Mexico, once that 1-year clock expires, the platform and all infrastructure above the seafloor has to be removed. This can be very expensive. A lot of effort goes into keeping marginal and submarginal wells “limping along” for as long as possible to delay P&A costs. It’s actually economic keep a cash flow negative platform on production simply to delay P&A expenses – It’s a time-value of money thing.

Thanks David

Aha! Interesting

David, you have said that natural gas is produced in a depth range.

What is that range?

As for isotopes, the Russians say that when natural gas is stored in caves, microbes eat the

lighter, C12 preferentially, changing the ratio.

After his death, some of Dr.Gold’s friends did an experiment that he had proposed.

They put the requisite ingredients in a diamond anvil and created CH4. The isotope was

C12. The isotope proves nothing. The kind of microbes it travels through and the isotope

available when it is created establishes the ratio.

The sheen on oil proves that it traveled through biological life.

What biological life do you propose lives 360-750km below the earth’s

surface.

If you want to understand evidence for the deep, hot biosphere and why it doesn’t provide evidence for Abiotic oil, read, and try to understand, the paper I linked to.

David, how do you propose that the hydrocarbons on Titan, Saturn, Jupiter,

all the outer planets, and all the exoplanets which have had their atmospheres

analyzed were formed?

Can you not grasp the fact that methane is not oil?

Do we agree that natural gas is abiotic?

I have always thought of the earth as a large petroleum distillery. As the hydrocarbon rise the

amount of temperature, metals, and pressure can increase molecule size, and Lawrence Livermore

Labs program agrees with me.

https://www.llnl.gov/news/hydrocarbons-deep-earth

Natural gas is not abiotic.

Methane can be abiotic, biogenic or thermogenic.

While natural gas is composed of anywhere from 60-90% methane, it’s not methane.

Lawrence Livermore Labs don’t agree with you. They made a computer model…

The Fischer-Tropsch process can generate more complex hydrocarbons from carbon monoxide. The only clear natural example of this is the Lost City hydrothermal field, where minute, almost undetectable, traces of heavier hydrocarons have been detected, possibly even octane… And octane isn’t oil either. Octane is one of the end products refined from oil.

The chemical equations can be balanced. There’s just no evidence that this process has generated any significant volumes of complex hydrocarbons.

And it is natural gas, not just methane.

It is not natural gas. Even if it was, natural gas is not oil either.

The exact composition of the hydrocarbons on Titan, etc. are unknown. The most likely candidates are methane and ethane.

Natural gas, including methane, ethane, propane, etc. perks up from deep

in the earth and the deep, cold ocean freezes it in what is known as the

zone of stability. The weight of the clathrate accumulates until the back

pressure is great enough to stop additional flow until some of the gas is

relieved in some manor. Think of a stopper in a soda bottle, except that

there is no end to the gas. I

https://scholar.google.com/scholar?hl=en&as_sdt=0%2C14&q=natural+gas+hydrates+including+ethane&btnG=

Which has nothing to do with oil or natural gas being abiotic.

Oil & thermogenic gas form deep in the Earth.

The citation I thought was attached to above

https://scholar.google.com/scholar?hl=en&as_sdt=0%2C14&q=natural+gas+hydrates+including+ethane&btnG=

That’s not a citation. It’s a Google search.

If you will click on it you will see that methane hydrates are

actually natural gas hydrates.

Man cracks methane to diesel, gasoline, etc.

The rock layer which your theory calls source rock is

actually the sedimentary layer which captures the upwelling

hydrocarbons.

I previously described the test that I used to confirm that

natural gas perks up all around the earth, all the time.

Have you tried it?

In your area of Texas, if the shield is deep, you will get

a positive for hydrocarbons.

Yes… Methane hydrates can form from natural gas that has seeped to the surface. Your point?

No. “Man” does not crack “methane to diesel, gasoline etc.” “Cracking” breaks complex hydrocarbon molecules down to less complex hydrocarbons.

The fact that oil & gas can seep to the surface is totally irrelevant to how they formed.

There is no “shield” in Texas.

http://geologylearn.blogspot.com/2016/03/basins-and-domes-in-cratons.html

https://www.technologyreview.com/s/410611/natural-gas-to-gasoline/

Man converts natural gas to gasoline, as referred on the internet,

called cracking.

Man “cracks natural to Diesel” powers the North Slope/

https://www.bing.com/images/search?q=natural+gas+cracked+to+diesel+on+the+north+slope&qpvt=natural+gas+cracked+to+diesel+on+the+north+slope&FORM=IGRE

That’s a Bing search… Not an example of something that is impossible.

Natural gas can be used to make gasoline (GTL). That’s not a “cracking” process.

https://en.wikipedia.org/wiki/Cracking_(chemistry)

GTL is the opposite of cracking…

https://en.wikipedia.org/wiki/Gas_to_liquids

So the “Popular Press ” uses the term differently than the industry.

They call rearranging molecules of natural gas to diesel cracking.

I did not understand how you thought hydrocarbons appear elsewhere

in the universe.

No one calls “rearranging molecules of natural gas to diesel cracking.”

I have no idea how simple hydrocarbons form elsewhere in the Universe. No one really knows. Abiotic methane is a very common organic molecule on Earth and elsewhere. It’s just not oil.

acetylene

The “crack” the natural gas to form “acetylene, a simpler hydrocarbon” and then use it to make ethylene, a more complex hydrocarbon. Only the first step is a form of cracking.

The article you cited says that the methane comes from the

inside of Titan. I believe that all the outer space hydrocarbons

come from inside the sphere where all the ingredients are available.

Do you believe that physics and chemistry are different on earth

then elsewhere in the universe? I don’t.

The test I described to you has been positive for hydrocarbons

every where I have tried it, with the most in Kansas with the very

deep, rich topsoil. Rich upland topsoil is an indicator of upwelling

natural gas. Microbes consume it, using the hydrogen for energy,

and excreting the carbon.

Try the test, David.

Jerry… Your nonsense is indistinguishable from a series of random words.

Try the test David. It will change your paradigm.

What test? You keep babbling incoherent nonsense.

Find a nice piece of upland topsoil in which you can dig a hole.

The hole needs to be at least 14″ in diameter and dug completely

through the topsoil into the subsoil, through any roots and

worm castings.

Take a 12″ stainless steel, invert it, and drill a hole in the now top.

Solder in a 1/4 in copper tube fitting, attach the tubing, lower

it in to the bottom of the hole. Refill the hole, reconsolidating

the soil as you refill. When you reach the original surface,

cut the copper tubing off about six inches high. Add a closed

gas valve,

Two days later, attach a hydrocarbon gas detector with a vacuum

pump and take a reading.

I have used a hydrocarbon detector from Amazon which cost about

$250. The first tester I used was a FID type. I have since acquired a

Sensit Gold with the chip to detect hydrocarbons. It cost about

$2000. at the time I purchased it. You probably have access to a much

more sophisticated meter.

I have done this test many times in east Tennessee, where I live, Middle,

Tennessee which has very good soil, and in the deep, black soil in

Eastern Kansas. The black soil there was more than 1 meter deep.

I have gotten a positive reading for hydrocarbons every time.

I have described this test many times and thought that I had

done so on your threads. I apologize if I haven’t.

Doing this test will help you understand why I am so positive

about my statements.

Hydrocarbons perk up all around the world, but they

are not evenly distributed. In the presence of adequate

moisture, microbes consume it, enriching the soil.

An example of the way this upwelling causes confusion

is the way flooding rice paddies causes the methane to

rise faster than the microbes can consume it. When

the paddy is dry, the microbes bloom to the extent of

food available, so no methane is detected. The rising

methane upon flooding is mistakenly called human

contribution to the atmosphere,

The natural gas found in topsoil has been explained

as being absorbed from the atmosphere. When natural

gas hits the atmosphere, it rises.

This erroneous explanation is the reason my test must

be below any potential contribution from the atmosphere.

Incoherent nonsense.

Read it slowly David. It will come to you.

It’s abject incoherent nonsense.

To:

Jerry H Henson

…“It must be remembered that there is nothing more difficult to

plan, more doubtful of success, nor more dangerous to manage

than a new system. For the initiator has the enmity of all who

would profit by the preservation of the old institution and

merely lukewarm defenders in those who gain by the new ones.”

~ Niccolò Machiavelli

More nonsense.

Simpler tests:

Take a similar stainless steel bowl, put a good adhesive around the rim,

invert it on some 20 mil poly sheet. Allow the glue to dry. Trim out

the poly on the inside of the bowl and leave a 6″ skirt around the outside

of the bowl, and invert it on flat piece of topsoil. Take your CO2 meter,

put it on continuous read and put it under the bow. Place a 10 lb rock

on the inverted bowl and place sand on the skirt around the bowl.

Remove the CO2 meter and read.

When I last did that test, ambient CO2 was 403 PPM. After 12 hours, the

reading was 960 PPM.

If your area is really dry, you can test for natural gas at the surface,

as your area “has no shield”. take the same bowl, solder in a 1/4″

brass fitting, attach a 1/4″ copper tube, and attach the closed gas

valve to the tube. Weight the bowl and skirt as above. Wait 48 hrs,

and attach your hydrocarbon tester to the tube and open

the valve, and red the meter.

If your spot is very dry, the microbial culture will be very inactive,

so the gas will pass through mostly unoxidized.

The first test will be a clue. If the ambient CO2 reading and the

lapsed time reading are close, the microbial culture is nearly

to mostly inactive.

Some papers say the culture in deserts areas has a more diverse culture

than areas with more moisture.

Simple tests.