Guest Post by Willis Eschenbach

A “progressive” tax is one where the wealthier you are the higher percentage of tax you pay. On the other hand, I’ve said before that a tax on energy, the so-called “carbon tax”, is one of the most regressive taxes available. It is the reverse of progressive, it hits the poor the hardest. This is because poor people spend a larger percentage of their income on energy than do rich people.

Someone challenged me on this claim about energy taxes the other day, and I realized I believed it without ever checking it … bad Willis, no cookies. So of course, having had that thought I had to take a look.

The Energy Information Agency (EIA) collects data on this, with the exception of gasoline usage. I got the most recent data, for 2009. (Excel workbook). Gasoline usage figures are here from the Bureau of Labor Statistics. Finally, income averages by tiers are available here from the Census Bureau.

Putting all those data sources together, here are the expenditures on energy as a percentage of the average income.

As always, data brings surprises. I didn’t expect the main expense to be heating (water and space heating) and the smallest to be gasoline.

In any case, it is quite clear that my original intuition was correct. The wealthiest of our households spend about 6% of their income on energy, while the poorest spend just over 40% of their income on energy.

And of course, this means if energy costs go up by say 25%, the rich will get a bite out of their income of 1.5%. But the poor will get an additional bill for no less than 10% of their income …

Sadly, in reality it is worse than that. At the poor end of the spectrum, there is very little slack in the budget. There is a concept in economics called “disposable income”, money that you have at the end of the month that isn’t already spoken for to pay some bill or other.

People living on the economic bottom floor not only don’t have disposable income, they never heard of disposable income. Every dollar is spoken for, and often over-promised.

So the poor get it from both ends. Not only does any price increase bite the poor harder than it does the wealthy, but the poor have much less available money to pay for any increase. That means the energy price increase has to come out of their kids food or the doctor bills or somewhere else important … bad news.

The rich pay a percent and a quarter, and the poor pay ten percent? This is the action that will save the planet in fifty years, to shaft the poor with an incredibly regressive tax?

I say again: fight CO2 if you wish, but fighting it by increasing the price of energy harms the poor more than anyone. Look at the graph above. Energy taxes are wildly regressive, and the worse off a family is, the harder any such “carbon tax” or any energy tax will hit them.

Best to all,

w.

PLEASE, if you comment QUOTE THE EXACT WORDS YOU ARE DISCUSSING, so we can all be clear about your subject.

‘A “progressive” tax is one where the wealthier you are the higher percentage of tax you pay.’

No. The U.S. has few wealth taxes. Taxes generally are on income and transactions. Having a high income does not equate to wealthy, though it can lead to it, as YOU say.

‘the fact that the tax comes from the input to wealth generation’

Sales taxes are also regressive.

Looks to me that people who make less than 20k are wasteful, the percentage is more then double the 20-40k tier. What’s considered income? Food stamps? I doubt it. It should be for the purposes of this comparison. Which is probably why the big spike. One would think at that income you couldn’t drive. So something is skewing the data.

Under 20k are home all the time, as opposed to working people who are not home all the time. When you are home all the time you are running your heat or air conditioner all the time, you are watching The View all the time, you are opening get and closing the refrigerator all the time, to reduce boredom you are driving to the store for cigs and beer or whatever all the time.

TY for a fine example of the liberal mindset LIES and HATE.

@ur momisugly Bill Taylor:

I assume you meant TV (The View) rather than TY.

We should never confuse environmentalism with humanism:

(References from Wikipedia)

Humanism:

“Humanism is a philosophical and ethical stance that emphasizes the value and agency of human beings, individually and collectively, and affirms their ability to improve their lives through the use of reason and ingenuity as opposed to submitting blindly to tradition and authority or sinking into cruelty and brutality.”

Environmentalism:

«An environmentalist broadly supports the goals of the environmental movement, “a political and ethical movement that seeks to improve and protect the quality of the natural environment through changes to environmentally harmful human activities”. An environmentalist is engaged in or believes in the philosophy of environmentalism.

“Environmentalism or environmental rights is a broad philosophy, ideology, and social movement regarding concerns for environmental protection and improvement of the health of the environment, particularly as the measure for this health seeks to incorporate the concerns of non-human elements. Environmentalism advocates the lawful preservation, restoration and/or improvement of the natural environment, and may be referred to as a movement to control pollution or protect plant and animal diversity. For this reason, concepts such as a land ethic, environmental ethics, biodiversity, ecology, and the biophilia hypothesis figure predominantly.”

And a curiosity: “The biophilia hypothesis suggests that humans possess an innate tendency to seek connections with nature and other forms of life.[1] Edward O. Wilson introduced and popularized the hypothesis in his book, Biophilia (1984). He defines biophilia as “the urge to affiliate with other forms of life». ”

It seems that United Nations has departed from their charter (See article 1) and become in part a totalitarian organisation for environmentalists.

“The UN has shifted to the idea of sustainable development in part because of climate change. According to the Intergovernmental Panel on Climate Change, if climate change is left unchecked, it will increase the likelihood of severe, irreversible changes to our ecosystems. Sustainable development, because it is less harmful to our ecosystems, can help in the fight against climate change. Sustainable development will also help the development needs of the poor and most vulnerable, who have contributed the least to the climate change problem.” United Nations – Key issues – Economic Growth and Sustainable Development

A car is a luxury, a home is a necessity.

When you live in a rural area where public transport is often non-existent, a car is a must.

That’s not what the figures show. People with limited means are forced to make hard choices, either/or, but not both. They choose home heating and hot food for their families before private mechanised transport. Some desperate people with no homes are forced to live in their cars, but that is not recommended in winter with temperatures below zero.

That’s why stealing a horse was a capital crime.

Of course officially the death penalty for horse theft didn’t exist.

Advice from New York PC Frank Regan to grandsons in TV series Blue Bloods.

If and when carbon tax is in force, it will be without consent. In its truest form, taxation without representation. The church needs the money, and ‘ you don’t want to go to hell, do you ? ‘ . In the name of ” Save the planet ” . Either a different kind of human or an alien. I opt for alien since it’s in the Hindu bible. While it’s a little out there, I can have that thought. Whether they are aliens or not, they personify evil. They can take advantage because we can’t differentiate, and most of us don’t know, care, or too busy to know.

Try separating warming from the cause. On the one hand, it is helpful to know what journals are saying, then on the other, I feel I’m supporting them. I think they are blinded and are either accepting the premise of AGW without condition or are being forced.

I totally disagree with Scientific American’s stance on global warming. They don’t even bother to present a proper alternate view. There is very strong evidence that the cause of warming, which they support as being caused by man, is wrong. Further the only solution they have is punitive and regressive. I would far better accept adaptation. We should be prepared for whatever changes climate brings. The warmist are saying ‘ what if we are right about warming ‘ and I’m saying ‘ what if we are right about cooling ‘. Are you going to take that chance ? Are you not really going to do any planning for cooling ? Cooling to me is a much bigger concern than warming. A shorter growing season means less food. More fuel to keep warm. People have lived in the tropics without air conditioning, it is not possible to live in places where it is cold without heat.

There was an article in The Independent on Jan 3rd about a guy from New York who had given up using/abusing depressant substance – particularly alcohol.

And what did he miss?

In his own word – “Gossip”

He couldn’t abide gossip unless he had a drink inside him. Didn’t have time for it.

Think on – what do we get from the MSM, what are papers, TV (news channels and soaps esp), Facebook, Twitter, ‘Social Media’, Celebrity Culture all about – if not the generation and dissemination of Gossip.

So, if you give up the depressant(s) of your life, you find yourself not only with an especially clear head but with a fair bit of time to use that clarity of thought.

With me so far?

Another thing is that you have to be happy in your own company. I think that that comes out of a lot of Eastern culture & thinking (eg Buddhism) If you wanna be nice to others, you first have be able to be nice within yourself.

So now, you’ve got ‘good’ time within your own head and are able to explore it. What also comes out of these things (bastid feedbacks, what came first) is Self Confidence. Donald trump for example.

Self confidence lets you ask, and answer or seriously explore really awkward questions and if you ‘get lost’ you now, by definition, have the time to explore some more. Especially with an tool like the internet.

I’m obviously talking about myself here and my question is:

How did it all get so crazy?

By example, Government is now clearly working against The People, when it was originally set up to *help* The People, and certainly in the UK, Govm’t workers take some sort of oath to that very effect.

Also, how on earth did saturated fat come to be so demonised – it is very fuel our heart muscles burn (C16) but medical, social and every other opinion say it is bad and must not be eaten.

Then we wonder why folks have so many heart attacks. We know our cars stop with no fuel in them so why not other things?

Ozone. Cause and effect utterly mangled. Ozone in the sky comes about because something else intercepts UV radiation. Ozone is the result of something absorbing UV, not the primary absorber.

CFCs and ozone – since when do chemical reactions start in the freezing cold and accelerate as the temp drops? Utterly crazy yet swallowed by almost everyone.

The whole Greenhouse lark – the atmosphere cools the surface, not warms it. Come on lets hear, what’s the surface lunchtime temperature on the moon? Why is it always over 45 degC hotter than anywhere *ever* gets on Earth yet Earth has The Greenhouse.

Millennium Bug. Certainly a lot of very clever people (we know because they still – 2 decades later – gossip about themselves) sorted it and prevented a disaster but how the fook did it ever come to be a possibility in the first place. Not so clever now are we?

Need I continue?

So again.

What Went Wrong?

Living at the bottom end of the income scale, our family joke was always we had to avoid having month left at the end of our money … and this wasn’t always a jest, or trivial!

Willis, I would have added food to the picture. When you work in the cost of FF fertilizer, energy for plowing/harvest/processing, fuel for transportation, heat/cool for warehousing/retailing – the incremental impact of energy cost on the poor is even higher than what you are showing.

The issue with food becomes much more apparent for the truly poor people in the 3rd world as Oxfam pointed out on a number of occasions in relation to adding in the impact of bio-fuel on crop prices. For 3rd world poor the price of food was costing them 80% of their income. As European bio-fuel mandates went into effect, African farmers quickly found out they could get ~double the money growing bio-fuel crops. That reduced acreage for human food causing its price to increase enough that the price of food went from 80% of a family income to over 100% or – one or more in the family started on the path to starvation.

Basically rich pompous self-centered European liberals started buying the food away from starving African children in order to feed it to machines patting themselves on the back declaring that they were more “carbon neutral”. After all, who can fault them or anyone for starving some African children in the course of “saving the planet”?

In the USA, the “poor” really don’t care that much about the cost of food because our government provides food and heating fuel assistance, (along with housing assistance, free education and health care, etc.) It’s quite a contrast to compare the real poor in the 3rd world, people who work hard all day and now some cannot feed their family because of CAGW – to the many US layabouts on welfare who doing nothing but eat all day getting fat while complaining that their “disposable income” is shrinking.

Although your chart is laudable, it doesn’t reflect the differences in who is actually paying a lot of the energy/food cost for those income levels under ~$40,000 – all the higher income people above them who are actually producing something, the ones really taking the hit for this nonsense, especially the middle class.

That a price increase hurts those most who can afford it least is more a tautology than a reason not to increase a price. Having trouble buying things is pretty much what it means to be poor. Yet some prices must sometimes be raised.

If carbon-dioxide emissions did indeed cause more harm than good, and if the net harm could indeed be accurately quantified, the mere fact that a tax used to internalize the cost of that harm would be a greater burden on the poor than on the rich would justify avoiding its imposition; failing to impose the cost-internalizing tax would perpetuate a distortion in the price mechanism and thereby cause society as a whole to continue allocating its resources sub-optimally.

If you think government is a better agent for helping the poor than churches, fraternal organizations, etc., then you can increase welfare payments to keep up with the cost-of-living increase that results from visiting a harm’s cost more accurately on those who occasion it.

That carbon-dioxide emissions do not impose an accurately quantifiable harm is reason enough not to impose a “carbon” tax. There’s no reason to demagogue the issue.

“would NOT justify avoiding..” I think you mean, judging from the rest of the piece.

Very true, and well-put. There is an argument to put more of the cost on those who can afford it, but that is a totally separate argument. Externalities have to be paid by somebody, and it usually makes most sense for the consumers whose consumption produce the externalities to pay. Otherwise, why would they consume less (or ore efficiently to put it better), which is part of the point of the tax?

Yes, I did indeed mean it would NOT justify.

Thanks for the catch.

No accurately quantifiable harm? No quantifiable harm at all. It is all a fantasy. I asked a recognized authority, Dr. Richard Tol, for hard numbers for years 2010-2015. His answer: ‘I referred to your “hard numbers instead of estimates”. I assumed you mean “measurements” when you say “hard numbers”. You cannot measure a marginal. You cannot measure the future.’

I agree with you. My opinion–and it’s only an opinion, since there are few hard numbers–is that to really internalize the effect of carbon-dioxide emissions we would have to subsidize fossil-fuel use instead of tax it.

Joe Born January 22, 2017 at 5:50 am

Joe, always good to hear from you. However, it seems you’ve missed my point. It’s not just that a price increase hurts the poor more. That’s true about everything.

It’s that energy is 40% of the budget of the poor. At that point any increase is very hard to bear.

Best regards,

w.

“That’s true about everything.” Not really, the price of yachts, sports cars and champagne has little impact on the poor.

If you’re saying only that the taxes on fossil fuels are harder on the poor than they’d be if fossil fuel ate up only 4% of income rather than 40%, I agree. Certainly, 40% is a great burden. And the magnitude of that share does show how immoral such an action would be without justification. I was merely pointing out that, despite the burden, there would be a justification if fossil-fuel burning really did involve an externality of the type that “carbon”-tax proponents claim.

Say a poor person has to spend $1000 per year on gasoline for his commute because living next to the store where he works would cost him $1500 more a year in rent. But let’s also say that gasoline use involves an externality: his gasoline burning costs neighbors an extra $1000 they have to spend to raise their foundations in response to the consequent sea-level rise. (I know, I know, we’re talking about a parallel universe here.)

We could forgo the carbon tax because it burdens the poor. This would leave the poor person’s neighbors with the burden of their foundation work. Better would be to impose a damage-cost-internalizing gas tax even though that would raise the poor person’s gasoline bill to $2000.

The reason it’s better despite that great burden on the poor person is that the price signal will cause him to move next to his place of employment in order to avoid a $2000 gasoline bill. He would thereby spare his neighbors the $1000 in remediation that burning gasoline for that commute would have necessitated. Out of that $1000 savings, we could have the neighbors pay an extra $750 in general taxes to finance, say, a $750 increase in the poor person’s earned-income credit.

The consequence would be that the poor person’s response to the price signal makes society $500 better off: aggregate housing cost increases $1500, but that is offset by two $1000 reductions, one in fuel and one in foundation work. Society as a whole has an additional $500 to use on winter coats or attic insulation. And appropriate tax adjustment gives the poor person a share of that benefit.

seaice1 January 22, 2017 at 10:32 am

“That’s true about everything.” Not really, the price of yachts, sports cars and champagne has little impact on the poor.

Your ability to be wrong about most everything is impressive. The more affordable yachts, sports cars and champagne are, the larger the percentage of the population who can afford them and so will perhaps buy them. Which creates jobs producing additional units for them. More jobs servicing and maintaining them and refueling them and so on. Nothing helps the poor more than more jobs.

Which is why I said “little impact” and not “zero impact”.

seaice, so in your opinion, for the poor heating your house is the equivalent of buying a yacht?

MarkW, your comment does not make sense to me. Do you mean for the poor heating MY house is like ME buying a yacht, or for the poor heating THEIR house is like THEM buying a yacht? or some other combination?

I suspect that the methodology understates the cost of carbon taxes. There is an energy cost in just about everything, even services. Farm inputs were mentioned above. Every manufactured good entails energy consumption from the mine to the smelter to the assembly plant and in transport. When the price of everything escalates in accord with its fossil fuel content, inflation will be terrible. Goods and services becoming more expensive mean less will be bought. One man’s expenditure is another man’s income. It’s one thing to pay a carbon tax when it is only x% of one’s income. It is quite another when the rising cost of living has obliterated your income because a whole segment of consumers can no longer afford to buy what you were previously selling.

Oh, the bureaucrats’ jobs will be secure. It is so hard to fire or lay off a civil servant. It is the “deplorables” who will get the shaft. I hope they understand and vote accordingly. I think they do understand that the good jobs that used to be available moved overseas. I’m not so sure that they understand that the regulatory burdens in the US (and the EU) make it very attractive to move production elsewhere, forget about wage differentials. I believe that DJT gets it and intends to reverse course.

The regressive nature of a carbon tax is why Citizens Climate Lobby recommends a full and equitable rebate to each household of all carbon tax funds collected, in the form of a tax rebate from the IRS. This refund would be based on the number of dependents, up to 2 children.

https://citizensclimatelobby.org/

Larry, that is nice but the whole idea is stupid. Why take money and then give it back?

The answer is obvious and has nothing to do with forcing less energy use. The tax is redistributed to two sectors:

1. The big bureaucracy that must be maintained to manage the tax.

2. A large sector of the population that you want to control.

Up to two children.

The climate N@zis also want to control how many kids you have.

Like Lemiere Jacques, above, I am puzzled by the graph’s unchanging percentage that goes to gasoline. Just eyeballing it, looks like about 30%. But 30% of $120,000 is $40,000 a year. This doesn’t seem to pass the sniff test. What am I missing?

OK, scratch that. First blunder I made all week….

I’m guessing that the rich drive more than do the poor. They also buy cars that get lower gas mileage.

Willis, I like your stuff, but please stop writing about economics.

A regressive tax is not what you think, and is not defined by the percentage of your income you spend on that tax.

It is to do with the tax RATE, not the amount of tax. If the tax rate increases with use or with income, it is progressive. If the tax rate stays the same, it is not progressive, but neither is it regressive.

Thus income tax is usually progressive, but in increments (i,e. your rate goes up at certain thresholds). Fuel taxes are not, neither are they regressive,

Tim, where did you fail economics? I’d like to avoid sending my kids there. Regressive taxation has nothing to do with the rate at which the tax is applied and everything to do with the effect on the percentage of income skimmed off. Please see Investopedia, Wikipedia, or in fact the IRS web site for a definition.

A regressive tax means that the more you earn, the lower % of tax you pay. Tax is money that you can not spend on other things.

The more people earn the lower % of their income they spend on energy: see Willis’ graph. Energy costs are money that you can not spend on other things.

Tim you really need some grade school level education…..

Willis is quite right about the highly regressive nature of a carbon tax. It works by using fossil fuels unaffordable. As there are no near alternatives for most people in terms of costs and convenience that will mean for the vast majority reducing their energy consumption, along with spending more of their income on energy.

How high will the tax have to be to save the planet? Economics Professor Richard Tol estimated in a 2013 paper that a global carbon tax would have to start at $210 tCO2e, rising by 4-6% a year forever. for gasoline that would be over $4 a US Gallon, rising to about $18 in 2050 and over $200 in 2100.

Tol has also stated why in terms of economic theory, why the global carbon tax is the most effective. Alternatives such as regulation and renewables subsidies will be less effective and more costly. See in his recent paper The Structure of the Climate Debate.

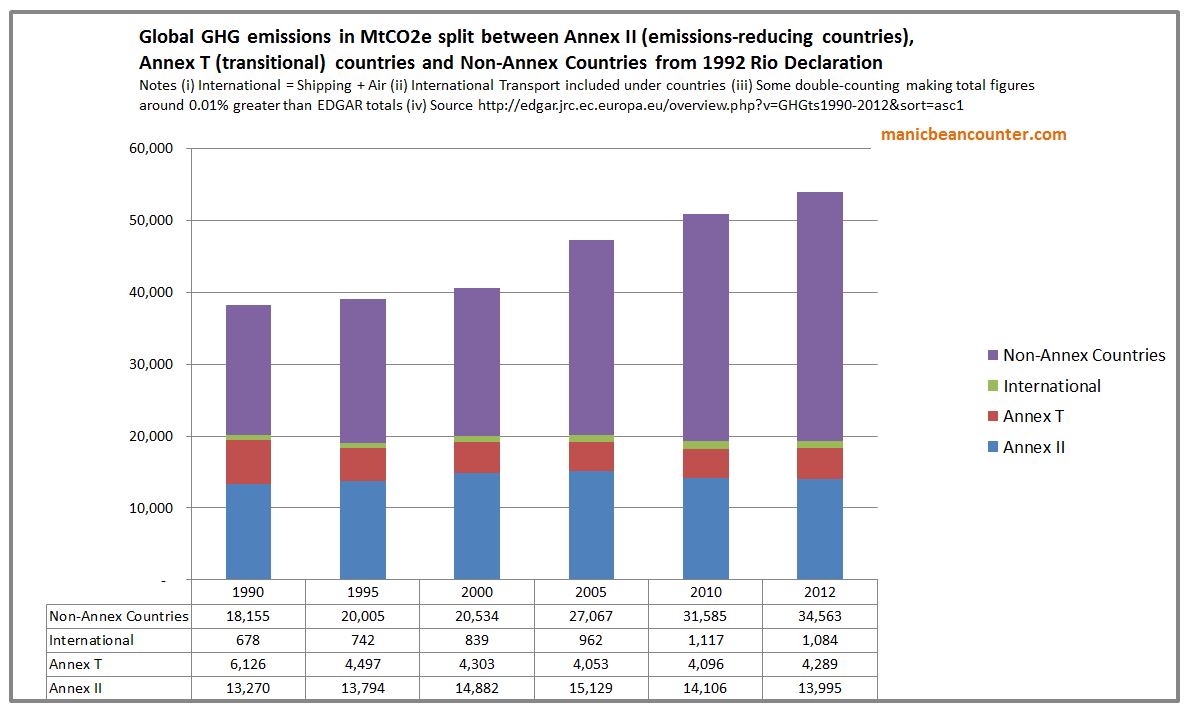

However, a Global Carbon Tax will never be applied, as developing countries with 84% of the global population and two-thirds of GHG emissions are exempt for a primary obligation to cut emissions. These non-Annex countries under the 1992 Rio Declaration accounted for all the global growth in emissions between 1990 and 2012.

To “save the planet” – i.e, stop temperatures rising beyond 2C – requires cutting global emissions by at least 80% by 2050. Anyone doing the math can see it is impossible. So a carbon tax will just impoverish the poor of the US and any other policy country. Such a tax could also destroy US manufacturing industry.

Manicbeancounter. “Such a tax could also destroy US manufacturing industry. ” my guess is that destroying industry is the goal. When industry and the jobs that go with them are gone then a whole lot of fossil fuel use will be too.

James

The climate alarmists only hold some sway in a limited number of countries. They do not have much influence in most of Asia, which contains over half the global population.

manicbeancounter January 22, 2017 at 3:37 pm

Your response makes little sense, as Asians (Read China and India) are beneficiaries of the carbon taxes. Therefore, Climate alarmists are working on their behalf in the destruction of US manufacturing.

Worth repeating from manicbeancounter:

Why is this so difficult for some people to grasp ? … The parts of the world emitting the most CO2 are the parts of the world most unlikely to do anything to change this habit, and so anything that the CO2-conscious USA could do to reduce its own emissions would do NOTHING to offset these overwhelmingly greater emissions from the rest of the world.

http://www.telegraph.co.uk/news/weather/11382808/Winter-death-toll-to-exceed-40000.html

http://www.vtpi.org/tdm/tdm17_02.gif

https://www.jrf.org.uk/sites/default/files/jrf/migrated/files/fuel-poverty-policy-summary.pdf

Average net pay here at $11.00/hr is $1200/ month.

“The average cost of living is 211% of the national average, slightly lower than Boston, but still plenty high. The average rent for one-bedroom apartment rentals is $1,400, two-bedroom apartments go for $1,725, and three-bedroom apartments go for $2,300.

Actually, many municipal utilities have a tiered system for energy costs. Try increasing the top usage tier pricing, and you’ll hear the howling for leagues.

Taxing private planes, jet fuel, iPhones, homes over 6000 square feet, there are all manner of progressive taxes.

Sadly, that’s why the 1% ensure politicians are in their same approximate economic class.

93% of World Population earns less than $ 20,000 a year.

Earning 50 dollar a day is called ‘high income’. 50 dollar a day = 365 x 50 = 18,250 a year. Only 7% of the World populations earns more than 50 dollar a day.

Source: http://www.pewglobal.org/interactives/global-population-by-income/

Typo: 7% of the World Population

Awesome, so I can call them racists too. And, bird killers.

Thanks for the information Willis, very revealing and a nice summary of the intent of CAGW.

Robbing the many for the benefit of the well connected few.

Ain’t Kleptocracy grand?

The problem with jurisdictions having carbon taxes imposed on their populations already is the fact that they haven’t published (or never considered) the “metrics” for a reduction in the tax rate in the future if the global temperature show a cooling. The public should demand that governments publish the tax rate reduction if the climate doesn’t respond. Also rural property and farmers need a process to submit their carbon sequestering resource (trees and crop composition and area) for credit on the tax they are paying. The governments have forgotten about the sequestering end of private property – carbon dioxide fixing resources and the public should demand compensation for this. This brings up and entirely different topic of private property rights.

I have read a story recently online called The Secret Shame of Middle-Class Americans and recently watched a show on 20/20 called My Reality:A Hidden America (links below).

Although there are problems with both the article and the show they did have one thing very much in common. If you are not smart with your money or have a good job field to make decent money the chances are your life is very difficult in the hours you have to work to make ends meet or is very scary as you are living paycheck to paycheck or both.

I have been fortunate enough to have a field where I have been able to support my family and have been lucky enough to survive economic downturns and corporate mergers but there were a lot of times (way to many actually) where it was paycheck to paycheck and praying that if something cam up to cards wouldn’t get maxed out.

Although what Willis shows is true I feel that the Middle-Class families are also in the same spot with energy taxes as the poor are. How many people did you know that lost their homes in the last downturn and it surprised you as you thought they were doing well?

I feel that the majority of people on this site are smart and have college degrees and probably have good financial smarts too. But there are so many others out there that look like they have it together and are so close to losing it all. So much of this country is teetering on the brink of financial ruin just as our government is.

We like to bang on taxes and government mismanagement but our government is a reflection of our own lives. Those of us who get it need to keeping telling the rest to save more spend less and borrow only if absolutely necessary. I feel that what the US and Great Britain have just voted for is a step in the right direction but I don’t know if it will truly stem the tide.

http://www.theatlantic.com/magazine/archive/2016/05/my-secret-shame/476415/

http://abcnews.go.com/US/deepdive/diane-sawyer-income-inequality-my-reality-hidden-america-44770807

One quibble. I’m not lucky to be in the field that I am in. I worked my butt of in high school and college to get where I am.

What is ” poverty” and who qualifies because they put in zero. For those that wish to and are prevented ( who are they) help is required .

The world owes no one a living. Help where possible but succour the idle, never.

In the US, the poverty line is defined as a percentage (20%?) of the median income. So as income goes up, so does the poverty line.

A regressive extortion is one that hampers and harms those who produce the most value, and the more value each produces, the more that individual is penalized. Because regressives do not want general prosperity, those who produce more value must be punished more severely, whereas, e.g. under “negative income extortion” or EITC those who do not produce are rewarded with some of the booty, plus additional value loaded onto later generations as debt.