Guest Post by Willis Eschenbach

There’s a discussion over at Judith Curry’s excellent blog, about peak oil. I find the whole madness surrounding peak oil to be one more example of our human love for warnings of future disaster. Few people want to hear that tomorrow will be OK, that things will work out. Instead, most folks want to hear some terrible story about what tomorrow holds, whether it’s peak oil or climate meltdown or the coming ice age. Go figure.

Figure 1. Conventional oil leaking out of the ground near McKittrick, CA.

Figure 1. Conventional oil leaking out of the ground near McKittrick, CA.

One part of the discussion of peak oil that has always bothered me is the division of oil into “conventional oil” and “unconventional oil”. Here’s why I think that division makes no sense with regards to peak oil.

I’ve lived through much of the whole peak oil deal, which near as I can tell has turned into a half-century-long goat roping contest. During the earlier years, people were shouting that the oil would run out, that the top would be very soon now, we’d hit the peak and by gosh, at that point things would turn ugly. Of course, that still hasn’t happened, so the peak oilers were left with the question pondered by failed doomcasters throughout history, viz:

How the heck do I explain the cratering of my position and still maintain some shred of my reputation?

For the peak oil folks, salvation came in the form of “unconventional oil”. Now, we’re assured, oil is still running out, so they were right all along … You see, they say, King Hubbert was right, we’re running out of conventional oil, but as it runs out it is being seamlessly replaced by “unconventional oil”, so we still have oil even though we’re running out of oil. Got it?

The strange part is, when you open a barrel of unconventional oil to see what conventions were broken in its creation, you find it is indistinguishable from conventional oil.

What is unconventional oil? Well, we could start by considering the conventions regarding oil. For literally billions of years the convention was that oil was found in small pools and seeps like you see in Figure 1. Indeed, the discovery of oil in Oil Creek, Pennsylvania, the site of the first US oil well, came about because oil had been seeping out there for untold centuries, and had been known and utilized by the Early Asian Immigrants in the area before the later arrival of the melanin-deficient crowd.

So conventional oil, by ancient hallowed convention handed down through the millennia, is found in tar pits and oil seeps on the surface. Which means that people being so rash as to drill for oil, by definition, would be pumping up “unconventional oil” … but of course, life is not that simple.

As a result, “conventional oil” is not from the conventional method of dipping it up in a bucket from a seep, but by the decidedly unconventional and at that time unheard of method of drilling a hole in the earth to get it to come out …

Things went along just fine like that for years. Then “secondary recovery” methods started to come into use. These were a variety of physical and chemical methods used to squeeze more oil out of existing fields, including fracturing the rock to allow the oil to come out more easily.

Now, about this time, the whole “peak oil” story started to go south, because no matter how much peak oilers howled there was more oil discovered every year. Every year the proved reserves just kept growing. And that process has continued to this very day, with more proved reserves than ever. How were the peak oilers to explain it? Hey, “unconventional oil” to the rescue!

For example, thinner oils were “conventional”, but thicker, more tarry deposits, despite having been utilized by humans for centuries, were “unconventional” oil, so they weren’t counted regarding the peak.

The real laugher, however, the place where you can see the gears stripping, involves the “conventions” about fracturing the rocks to allow more oil to come out, what we call “fracking”. The fracturing technology was developed about forty years ago, and has been used ever since, mostly for secondary recovery. And for all those decades the oil coming from the fractured rocks has been “conventional oil”. But now people have learned to drill wells horizontally and fracture them … and now suddenly after forty years of fracturing the rock, which gave “conventional oil” when it was done from vertical wells, fracking now only delivers “unconventional oil” simply because the drill hole goes horizontally instead of vertically … does this make any sense to anyone?

The classification of oil from fracking as “unconventional oil” shows clearly the ludicrous nature of the dividing line when we are discussing peak oil. Regarding the putative peak, why is oil from a horizontal well “unconventional” and oil from a vertical well “conventional”? It is all gotten by technology, and none of it is any more “unconventional” than the drilling of the first oil well, a most unconventional act …

Calling oil from horizontal wells “unconventional” is crucial for the peak oil folks, however, because if the oil from fracking were classified as conventional oil, the “peak oil” claims and the “peak gas” claims would sink of their own weight …

Look, folks, the ugly truth is that the world is awash with fossil fuels. To start with, The largest single concentration of fossil energy on the planet is the Powder River coal formation in the Northern US. The world has several hundred years worth of coal. The Canadians have huge amounts of oil … of course it too is called “unconventional” oil, because it alone is enough to blow the “peak oil” claims out of the water. Plus now we have the “tight oil”, oil in the rocks that is, of course, unconventional.

Then we have the discovery of the shale gas resources all around the planet. Even Israel finally has some domestic energy resources. How unconventional is that? Australia just announced a huge find. China has massive gas resources. A preliminary assessment says including shale gas we have enough gas for the next couple of hundred years.

And finally, we have the wild card, the methane hydrates, the “ice that burns”. Estimates of the amount of these are all over the map, but all of them share one feature—they are very, very large, on the order of quadrillions of cubic feet. This is rivals the size of the global natural gas resource …

Finally, most of these forms of fossil fuels occur in combination and can be converted into one another. Coal, for example, can be converted to a liquid fuel, or to a gas.

Now, because there never was anyone hollering about “peak coal”, there’s no such thing as “unconventional coal”, despite huge changes in mining technology. Coal mining has changed as much or more than drilling for oil … so why isn’t there “unconventional coal”?

But in that case, since all of the coal on the planet seems to be “conventional” coal, if we convert coal to oil, are we making “conventional oil” or “unconventional oil”? Presumably it would matter whether we converted coal to oil horizontally or vertically …

In summary, once you get past the nonsense of “conventional” and “unconventional”, there’s enough coal and gas for a couple hundred years, and enough oil for a hundred years, just with what we know about now, and that’s not even counting methane hydrates. Which is why I pay no more attention to the peak oil alarmists than I do to the climate alarmists. One group claims we have too much oil and we’re gonna burn it all, the other group claims we’ll soon have too little oil to burn, and I treat those two impostors just the same.

Was the division between “conventional” and “unconventional” oil devised to cover up the failure of the peak oilers? No way. The distinction is useful in a variety of ways for analyzing the world of oil sources. I think that the concept was simply appropriated by the peak oilers because it was very useful to them, since it totally obscured the failure of their peak oil predictions. To me, oil is oil is oil, and if you claim the world will run out of oil, you can’t later say that you have redefined things, and that the oil that proves your prediction wrong is some other special kind of oil that doesn’t count as oil but walks like oil and quacks like oil …

w.

… Oh, yeah, the weather report. Late night again, two AM. The wind has changed and is blowing from the southwest, landcasting the fog and the smells of the ocean. The characteristic sea smells of iodine and dimethyl sulfide in the fog draw my thoughts back, back to the many mornings I spent getting out of bed here on the hill at 4 am and going down to the harbor, rigging the boat and setting out in the dark to have the commercial fishing gear in the water for the dawn salmon bite. Sliding out of Bodega harbor in the half-light with my gorgeous ex-fiancee and my good friend, once again motoring between the rock jetties at the harbor entrance, going out to discuss matters of life and death with the ocean. I love the ocean because it doesn’t give a damn about a man’s position and his power and his pretenses. Knowledge and experience mean nothing to the ocean. After a life at sea, if I put one foot wrong, I get just as wet as the landlubber falling off the dock … I take pleasure in that ultimate equality and justice of the ocean. I know that even if it is a California ocean it would kill me without first asking me to share my feelings, so leaving the safety of the harbor is always sobering moment …

… sneaking out between Bodega Rock and Bodega Head itself, the little shallow passage the fishermen call “between the rock and the hard place”, where once my heart almost stopped with fear, or at least it started with fear, but other emotions got involved. The channel there is shallow, the sport fishing boat “Mary Jane” was capsized in 1986 with the loss of nine souls by a sneaker wave, “full fathom five thy fishermen lie, of their bones are coral made” …

So when I heard a wave break right behind our little fishing boat one afternoon as we were coming in between the rock and the hard place, my first thought was that we were about to join the folks from the Mary Jane.

We spun around, and aaaah, dear heavens, it wasn’t a breaking wave at all, although a wave was breaking, instead it was my old friend Missus Fishbreath breaking the surface just behind the boat, and breaking my heart with the slow-moving stillness of her majestic beauty, a great gray whale dancing her way three thousand miles from the tropics to Alaska. As we turned and gaped, we were looking her right in the eye, and then she rolled our way and opened her blowhole so close to the boat we could almost look down it, it was as big as a dinner plate, we were close, close enough to count the barnacles clinging to her hull, she was the very picture of natural wildness and glorious beauty and unimaginable power, my heart leapt to see it … and she blew out a great cloud of gagging mist, a noxious enveloping adherent miasma reeking of the million vanished piscatorial souls of her most recent month’s meals, a clogging, thick effluvium that enveloped the boat and then drifted away to leeward as the lovely lady disappeared beneath the waves …

… leaving me in the strangest condition imaginable, with the boat wandering off course, my jaw hanging down to my umbilicus, a pulse rate well into the triple digits, adrenalin-shocked, awed beyond words, smelling like the dumpster behind a cheap fish restaurant, blasted by the natural beauty I had just witnessed, and uncertain whether I was going to vomit or not, but tending toward the former.

I’m not jonesing to visit that particular emotional place again, once was enough for any man. And on a cold night like tonight, I’m glad I’m not rolling out at four am. I fished the Bering Sea as well, and these days I’m just as happy to see the bergy bits and watch the Bering ice on the “Deadliest Catch” TV show from the safety of my couch … but ah, dear friends, mostly I’ve just moved my ocean madness to warmer waters, and I wouldn’t have missed it for rubies and pearls …

Sports and gallantries, the stage, the arts, the antics of dancers,

The exuberant voices of music,

Have charm for children but lack nobility; it is bitter earnestness

That makes beauty; the mind

Knows, grown adult.

A sudden fog-drift muffled the ocean,

A throbbing of engines moved in it,

At length, a stone’s throw out, between the rocks and the vapor,

One by one moved shadows

Out of the mystery, shadows, fishing-boats, trailing each other

Following the cliff for guidance,

Holding a difficult path between the peril of the sea-fog

And the foam on the shore granite.

One by one, trailing their leader, six crept by me,

Out of the vapor and into it,

The throb of their engines subdued by the fog, patient and

cautious,

Coasting all round the peninsula

Back to the buoys in Monterey harbor. A flight of pelicans

Is nothing lovelier to look at;

The flight of the planets is nothing nobler; all the arts lose virtue

Against the essential reality

Of creatures going about their business among the equally

Earnest elements of nature.

Robinson Jeffers saw it … when you read those lists of famous last words, nobody ever says “I wish I’d spent more time at the office”. Don’t mail the envelope in, push the envelope, the journey will end long before any of us wish it to. Live your most impossiblessed dreams, my friends, because any other kind is just a dream. Chance the widdershins steps of the tarantella, lift the ancient curses and look under them for old coins and lost loves and dust bunnies with a vest and a gold pocketwatch, opt for an immediate increase in the uncertainty levels, stay away from the world of adrenalin deficit spending, hold your dearest warm under your heart while you dare the icy seas of life, for the night is assuredly coming …

My very best wishes to all, I’m off to sleep.

Another well written post, Willis. Makes me miss Port Orford…

BTW there is rumors a big Gas find here in NE Oregon….

Certain folks don’t like peace, prosperity, and plenty….

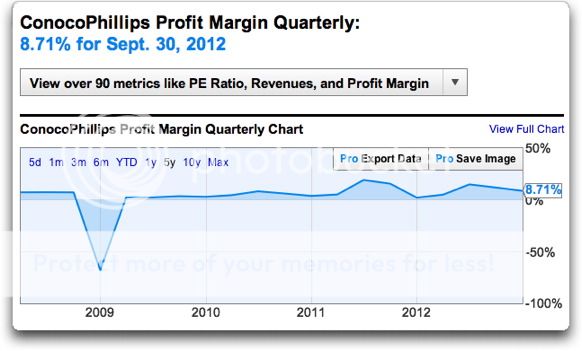

I think a key part of this discussion or any other resource discussion is “price”.

In Peak Oil theory there is a somewhat implied but not stated assumption of constant price – ie , the curve is for a particular price point & what can be produced economically at that price point. If you change the price point, you essentially “re-set the curve” as the resources that are then economic at the new price point changes.

So recall that in 2000, the price of oil was +/- $20/bbl, not the $90-110/bbl we are seeing today. Price has re-set the curve…. and will continue to re-set the curve as long as price changes. What is fair to say is we are running out of barrels that we can develop economically at $20/bbl. If that weren’t the case, oil would still be $20/bbl.

So the good news is , as long as price keeps rising, there will be resources for us to develop economically (for the foreseable future). Of course , at some point, the price becomes increasingly prohibitive for the consumer & we naturally rotate into cheaper sources of energy. We will never “run out ” of oil simply because at some point it will become too expensive & we will use other energy sources long before that point.

Again , the key point being that this discussion with out price considerations is irrelevant.

I used to give a talk on the history of oil explortion in the Powder River Basin of Wyoming.

First, they drilled all the surface anticlines, domes so obvious they just asked the sheepherders where to find them. When all of them were drilled, they declared the PRB drilled up, fired all the geologists and left. Then they found with seismic data, structures could be found which had no surface expression. Another cycle of boom and bust followed, and certainly, this time, all the oil had been found. Then oil was found in stratigraphic traps, where the rock was not folded at all, but things such as buried sand bars, river channels and dunes were found full of oil. The entire basin was drilled up, with oil found everywhere. You might think people would have known better to write the area off, but after the stratigraphic traps played out, people with no imagination then missed the coal bed methane developments, and now only a few are trying to drill the source rocks horizontally. We don’t run out of oil, we just have pauses, waiting for people with vision to come along.

Willis, you are truly a national treasure and I am like the cat that got the cream when I read your musings, please, do continue to share your thoughts with us,

BUD

Thank you, Willis!

A welcome burst of sanity, adventure and poetry.

Ah, the majesty (and smell) of sea creatures…

Kurt in Switzerland

Willis, Great of you to start the discussion here on one of the worlds most visited science blogs. I wanted to add that through newer drilling and mining extraction techniques the worlds current known oil and gas resources now exceed our ability to use it are extended out thousands of years. I know you mentioned you are blessed to have the time to devote full time to these curious endeavors. I invite you to jump in to the world of “shale oil and gas resources”. Once you spend a week or so swimming around in this subject matter I think you’ll understand just how far away we really are from “peak oil”.

Doesn’t matter. The Export Land Model handles all your arguments, right or wrong. It is the thing at the moment in POLand. Buy some.

Willis, I would love to hear your thoughts on Tommy Gold and his theory of oil produced from methane escaping from deep in the mantle,

BUD

We hit peak oil in the mid-1800’s, sperm oil that is. Call me

Ishmaelalarmed.http://en.wikipedia.org/wiki/File:US_Sperm_Oil_Imports_1805-1905.jpg

/sarc

Yep, there are plenty of fossil fuels and when there isn’t any more centuries from now there will be the next thing, perhaps extraterrestrial hydrocarbons.

In my last post , I should have said this more explicitly. An underlying assumption of Peak Oil theory is that all resources can be developed with a similar cost structure. Back Hubbert’s time when he developed the theory, that actually was a reasonable assumption, given the type of resources that were being developed. He didn’t probably even consider this at the time, but it is absolutely built into the theory by the way it is constructed.

Constant price is clearly not a reasonable assumption now and thus, the theory breaks down. It’s really pretty simple from that standpoint. The fact that there is all this hub-bub on both sides of the argument suggests to me few on either side really understand it. For Hubbert’s theory to be useful, you must qualify the resources specifically by their economic price limit – ie – we are running out of oil we can develop at $20 / bbl and we have even less we can develop at $8/bbl (which we used to have in abundance in the past but have very little of today).

The other implication of course is that you can not apply Hubbert’s theory to estimate a total / ultimate resource recovery (worldwide, ultimate recovery) in a changing (especially rising) price environment.

Your writing is inspiring in many ways!

You took a bit of poetic license to fit the situation. In the Tempest, Ariel sings:

“Full fathom five thy father lies; Of his bones are coral made; Those are pearls that were his eyes: Nothing of him that doth fade, But doth suffer a sea-change …”

Agree completely. All forms of fossil fuel, by whatever means of extraction, are fungible, at some cost, including an energy cost.

You are also correct about rapid changes in mining technology. Here in Western Australia, a mine recently opened with no underground workers (the Argyle diamond mine). All machinery is operated remotely. Iron ore trains in the Pilbara are driven by office workers in Perth.

Steps along the road to autonomous robotic mining operations, and then the sky is literally the limit.

One more magnificent piece. You may be getting older Willis, but insofar as your writing is concerned, you are getting better.

I wonder if there will ever come a time of peak alarmism? (oil / climate change / ice age / food/ …, whatever)

I read somewhere once that some Russian scientists believe that oil is not a fossil fuel, that it is made naturally. Any credence to that w.?

Willis, you just don’t understand peak oil do you? So I will give you a simple analogy, the apple tree in my garden has low hanging fruit that I can pick while standing, these are known as “conventional” apples, the rest of the apples I have to use a ladder to pick, these are known as “unconventional” apples. Now do you understand?

Nice story about fishing.

Thanks for another entertaining read, Willis, and thanks for sharing one more of your adventures. I’d like to add that, like nature herself, you produce your share of “Holy crap!” moments for the rest of us, your “Steel Greenhouse” and “Glass Planets” articles being two of mine.

“To him who in the love of Nature holds, she speaks a various language”

For some, Nature’s love is embodied in the language of the sea. Others, the sky or horizon’s to be reached.

For me, the crux, a small boat, sailed on a dark sea by the light of the Milky Way. Rocks and shoals outlined as well as heard by the splash of waves. Past the starboard harbor light, into the swells from yesterday’s storm, mainsheet held tight, heeling to lee, the luff barely aflutter.

I’ve encountered no whales on the Great Lakes. It must be a moving experience!

Willis–Great points about peak oil. And, as always, love the sea stories.

I haven’t exactly had a life of “couch potato”, but your experiences make me feel like I have….

I generally enjoy your writing, Willis, but this one seems to me to be an unnecessary cheap shot.

Hubbart did his work in the 50s. His experience was with drilling down, plus some technological innovation. He made some projections based on what he knew, and he was right about US production reaching a peak once half the oil had been brought to the surface.

That he underestimated what technology was capable of in the long run is a common theme throughout history. (Didn’t the Patent Office Director request that his office be shut down 100 years ago, because just about everything already has been invented?)

I recall a National Geographic article almost 50 years ago discussing shale oil which acknowledged that it would be economically feasible only with a significantly higher price per barrel (very correct it turns out).

Maybe the higher breakeven point could help define conventional vs unconventional – or maybe not. But so what? For his time, given his knowledge base, he was very right. His disciples, later talking about Peak Oil worldwide, also were very right – up until a decade or so ago. In a way, their projections of Peak Oil and the then coming rise in oil prices fueled the innovation which, at the current higher price, has given us the new, huge supply.

Again, my point is that it wasn’t necessary to paint Hubbart and his followers as stupid Malthusians (and CAGW Alarmists by your tone) for their identification of a problem which then allowed for a solution from which we benefit today.

Before Beth corrects my improvisation on Bryant’s poetry:

Quotation by William Cullen Bryant

To him who, in the love of Nature, holds

Communion with her visible forms, she speaks

A various language:

I suppose Green River shale oil could be considered unconventional. Kerogen has to be reprocessed to make it into something similar to conventional oil.

Nice that you were able to view that whale. Has anyone ever thought to thank oil companies for saving the whale? It was only after the discovery of oil at Oil Creek that Kerosene began to be substituted for whale oil. It destroyed the whaling fleets though. All those jobs lost. Maybe we can get BP to pay for that too….sarc off.

That is one fine piece of writing Willis. Been out on the restless ocean fishing for cod in the North Atlantic, iceberg alley. Of real ice bergs floating by on a foggy morning tourists travel thousands of miles to see from the safety of the land. Yep. The sea respect no man what ever his or her station in life means nothing. Out there the world sings a different tune. Back on land, you always look back out there when the ocean meets the sky. Thank God – we didn’t use sail. Gas from oil baby! And I don’t give a damn whether it came from conventional or unconventional – what sane human does?

Willis, I don’t think you express the general peak oil arguments that well. I think Wikipedia gives a pretty good description of them – http://en.wikipedia.org/wiki/Peak_oil

I think one of the overriding factors of ‘peak’ is that it will have economic repercussions due to price effects.

Conventional oil and unconventional oil are essentially the same substance. The only difference between them is the geology of their containment.

Of course one has to ask what is actually meant by ‘fossil’ fuel some of the deep aquifers are said to have ‘fossil’ water. Is oil rather than fossil, really abiogenic and coal plant matter that has been soaked in oil at high pressure? If hydrocarbons are absolutely certainly only ever formed from rotted plant life no other method possible – how come there is methane and ethane on Saturn’s moon Titan?

Jeff L,

Even if that price point is held static, the amount of oil that can be economically produced at that price point increases over time because technology isn’t static. As oil drilling / extracting technology improves the cost of producing a given barrel of oil goes down. Because of this even with a static price point, oil that was uneconomical yesterday can be economical tomorrow.

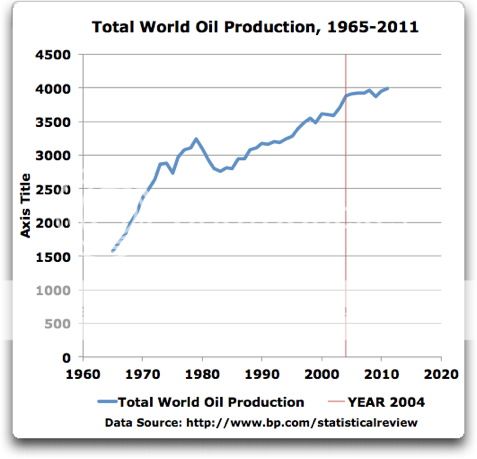

I disagree with the naysayers who doubt peak oil. I expected it to arrive in 2004, and it did. I had bought a ton of futures to back up my view. When you say I am wrong, I just look at my bank account and smile.

Peter Pond,

It would be nice, but alas peak alarmism is just as mythical as peak oil.

I still go by what I read in the Prize twenty years ago, and Twilight in the Desert. The primary issue is not whether the resource is exhausted (it isn’t close), the challenge is output per-day. One commenter above mentions the idea that we’ve run out of $20/bbl. Wrong, we cannot increase flow of $20 bbl/day oil, but we still pump it. The price is set by the cost of the marginal barrel. That marginal barrel of production per day is what’s costing $100.

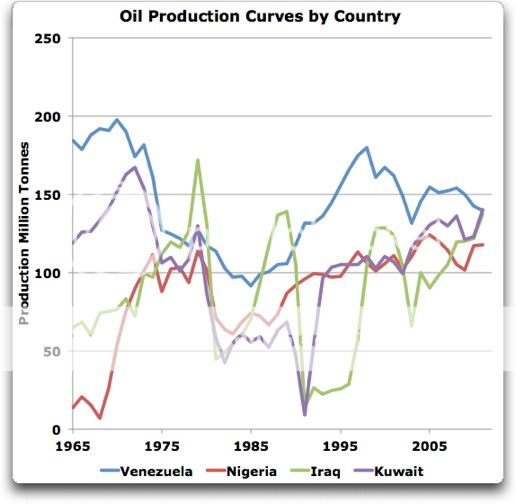

In my career as a geologist looking for oil worldwide over the last 25 yrs, I can tell you that oil is a limited resouce. There is one simple overriding fact we can all ponder when debating this issue and that is many of the great oil basins and countries of the world hit their peak production long ago. If this has happened to many of these great basins, then it is simple logic to assume that it will happen worldwide at some point in the future. One thing I totally agree with, is that I have NO idea when this will occur. New technologies and higher oil prices could delay this for a very long time.

Another very important point is that peak oil is a measurement of the rate of production and not the quantity of hydrocarbons. One may have a very large quantity of reserves in the ground but one may not necessarily be able to extract them at high rates.

William Stanley Jevons (1835–1882)

Peter Pond says (February 2, 2013 at 1:52 pm): “I wonder if there will ever come a time of peak alarmism? (oil / climate change / ice age / food/ …, whatever)”

“Only two things are infinite, the universe and human stupidity, and I’m not sure about the former.” –Albert Einstein

RayG says:

February 2, 2013 at 1:49 pm

And from memory, it continues …

I know and love that bit of Shakescene, and my according to the fine print on my poetic license, it covers me munging Shakespeare to match my tale …

Thanks for recognizing it,

w.

Willis, I’ve always enjoyed your writing about CAGW, but I’m afraid that the more that you write about Peak Oil, the more your ignorance is showing. In contrast to CAGW hypotheses the observations about Peak Oil are amply borne out by experience and data. I repeat the point I made at Dr Curry’s site: sceptics need to come up with a more plausible explanation than geological constraints for the plateauing of oil production despite a sustained tripling of the price. Most of the commentary is hand-waving. I admit that I had hoped for better.

RobB says:

At February 2, 2013 at 2:17 pm you say

No, you are possibly unaware that Willis covered that when he wrote

The Liquid Solvent Extraction (LSE) process has been capable of producing synthetic crude oil (i.e. syncrude) from coal at competitive cost (n.b. cost and not price) with crude oil since 1994.

We proved the technical and economic abilities of the LSE process with a demonstration plant at Point Of Ayr in North Wales.

Syncrude has been made from coal whenever the supply of crude has been constrained. The Germans did it during WW2 (which is why we bombed the Ruhr valley) and apartheid South Africa used Sasol which was a development of that German process.

However, prior to LSE it was always more costly to mine, transport and convert coal to syncrude than to drill and transport crude. LSE has reversed those relative costs.

The surprising economics of LSE derive from two facts.

1.

LSE consumes sulphur-rich bottoms which have disposal cost for oil refineries.

2.

LSE can be ‘tuned’ to provide hydrocarbons which reduce need for blending.

An oil refinery separates the components of crude oil by distilling the crude. The separated components are products which must match market demand; e.g. producing the required amount of benzene must not result in producing too much or too little petroleum. This match of products to market demand is obtained by blending (i.e. mixing) different crude oils for distillation: crudes from different places contain different proportions of hydrocarbons.

Blending is expensive. It requires a variety of crudes to be transported and stored then mixed in controlled ratios.

This need for blending is why Brent Crude is so valuable. Saudi crude is the cheapest crude, and blending Saudi and Brent crudes in a ratio of about 2:1 provides a blend that nearly matches market demand for its distillates.

The LSE process can be ‘tuned’ such that it outputs a syncrude which can provide distillates which match market demand and, thus, removes the need for expensive blending. This is achieved as follows.

(a)

An LSE plant dissolves coal in a solvent in an ebulating bed at controlled temperature and pressure.

(b)

The resulting solution is converted to hydrocarbons by exposure to hydrogen gas (produced by coal using a water-gas shift) in the presence of catalysts and at variable temperature and pressure. Adjusting the temperature and pressure determines the resulting proportions of hydrocarbons.

(c)

Changing the temperature and pressure causes the hydrocarbons to come out of solution and the solvent is separated then reused in the process.

(d)

The remaining solids (mostly ash minerals) are removed by filtration as a cake.

Conversion efficiency is greater than 98%. And the not-converted residue can be burned as a fuel.

The UK’s Coal Research Establishment (CRE) invented, developed and demonstrated the LSE process. CRE was owned by British Coal which was owned by UK government. Ownership of the LSE Process remained with the government when British Coal was closed in 1995.

The LSE Process is owned by UK Government. Patents on the process were taken out but details of the process are a UK State Secret. Adoption of the LSE Process would collapse the value of Brent Crude, and the sale of Brent Crude is important income for the UK.

However, the existence of the LSE Process constrains the true price of crude oil. If that price were to rise sufficiently then it would pay the UK to adopt the LSE Process or to license it to other countries for production of syncrude. Hence, the existence of the LSE process has a strategic value as a result of its constraint on the true oil price.

And the UK may adopt the LSE Process when Brent Crude is exhausted.

However, frack-gas may remove need to adopt the LSE Process for use although its strategic constraint on oil price will remain.

Richard

As Jeff L @ 1:19 explains:

The oil companies just love it when peak-oil scaremongering occurs.

It conditions the punters to willingly accept higher prices.

Then, there’s the ‘Price of Discovery’, (or rather, the Price of Announcement of Discovery). All those (unannounced) proven reserves they’re sitting on, just waiting for the price to rise high enough to make extraction (more) profitable.

I’ve lived through much of the whole peak oil deal, which near as I can tell has turned into a half-century-long goat roping contest.

Oh, much longer than that, Willis.

How many people are aware that once upon a time, starting around 1851 in fact, Scotland was the World’s leading petroleum export country – and it was exporting shale oil?

http://www.scottishshale.co.uk/

And guess what – it wasn’t long before the ‘peak oilers’ of their day were prophesying that it was going to run out, well before the end of the 19th century.

There’s nothing new under the Sun.

One thing I feel I can prophecy quite safely though, we will never reach peak BS!

President Wilson appointed a board to help plan the US response to running out of oil after WWI.

In the 1970’s, very wise and smart geologists were explaining how we would be out of oil by the mid-1980’s.

There is some poster over at climate etc. who *knows* we are running out of oil. He names himself after a space telescope and one of his best pals over there is a self-tracking idiot. Somehow it seems approrpriate.

We are no where close to running out of oil. Or coal. Or gas. Or cropland.

Nor are we near to running out of apocalyptic jive artists who make their living or get their jollies pushing doom scenarios.

Ooops – unfinished posting above. Contrary to what you claim, Willis, in your beautifully-written piece, there were people howling about peak coal. William Stanley Jevons (1835–1882) was an English economist who predicted that economically viable coal in Britain would have been mined out by around 1970. He made this prediction in 1865 in his book, The Coal Question. I am not sure, between miners’ strikes, the 1955 (or thereabouts) Clean Air Act, natural gas, and Margaret Thatcher’s actions to shut down the miners’ unions if this was prescience or coincidence, as the coal mining industry has all but disappeared in my ancestral country of Wales.

MattS says:

February 2, 2013 at 2:30 pm

Even if that price point is held static, the amount of oil that can be economically produced at that price point increases over time because technology isn’t static.

I’m old enough to remember 29 cent/gallon gasoline. The only question as to ‘peak oil’ is at what price will either a substitute be cheaper or people will stop using it because of price.

I used to own a car that got 6 MPG.

I can no longer afford to drive such a wonderfully comfortable vehicle.

As far as my personal consumption of oil…’peak’ occurred when the price was around 40 cents/gallon.

MattS says:

February 2, 2013 at 2:30 pm

“Even if that price point is held static, the amount of oil that can be economically produced at that price point increases over time because technology isn’t static. ”

Agreed – again, at the end of the day it is a question of economics, but the implied assumption of Hubbert was constant economics – I pointed out the price side & you point out the cost side, but we would be both more correct together & say “constant economics assumption – no change in price & no change in technology” – if you change either, you re-set the curve of what’s an economically extractable resource.

I will still stick with the fact that there is a whole lot less oil that can be economically produced today at $20/bbl than there was 50 years ago – thus there was a peak of the resource with that particular economic thresh hold. What Hubbert didn’t take into account is that the economic thresh hold of his day would change, both due to increase in price & an increase in technology, and thus continually re-set the curve.

Of course the two greatest sources of unconventional oil are the tar sands of Canada and the Green River Formation in Utah, Colorado and Wyoming. The Peciance Basin in NW Colorado contains 1.5 trillion barrels of karogen. At 1 million barrels per day it will last for 4000 years.

Willis,

I’ve always liked this graph: http://rankexploits.com/musings/2011/an-interesting-chart/

Bob Shapiro says:

February 2, 2013 at 2:12 pm

I fear you missed my point, Bob, sorry for the lack of clarity. The peak oil folks still hold Hubbert’s work as the gold standard. They still think that his point of view and his formulas are uncontested and totally correct … now I know that you don’t think that, but to call it a “cheap shot” to discuss the claims that thousands of people are screaming about today, that strikes me as … well … a cheap shot.

I also notice that you didn’t find a single thing wrong with my analysis, you just didn’t like fact that I pointed out that Hubbert was wrong … so sue me, Bob, but he was still wrong, and the madness unleashed by that wrongness is still crashing around us today.

So your theory is that if King Hubbert hadn’t said that the US would hit peak oil, we wouldn’t have developed horizontal fracking and the thousands of other technologies? People would never have worked to make oil recovery more economical without Hubbert and his many followers?

And more amazingly, your claim is that King Hubbert “identified” the problem that over time, oil would be more difficult and expensive to find, so that we could find a solution to that, and so we should be grateful to the peak oilers??!?!

Words fail me … if King Hubbert and his ideas were never invented, the US domestic oil production still would have peaked in 1970s. Do you think no one would have noticed, and thought “hey, we need to find more oil, it’s getting harder to obtain”? In fact, people knew about and were aware of and working on the problem of oil being more difficult and expensive to obtain before King Hubbert was born, that problem starts on Day One of any extractive industry, Hubbert didn’t “identify” that problem.

Did you ever wonder how the coal folks managed to make all of those changes in coal mining technology without having “peak coal” folks to spur them on? … it must have been tough for them, since nobody had “identified a problem” for their industry like Hubbert did for the oil industry, praises to his name …

Bob, people have had jobs finding and extracting oil for over a century. They want what they have always wanted, to do it at the cheapest cost. It’s a profit deal, as Steve Martin said. So no matter what the peak oil folks rave about, the people doing the actual work are just going to go and invent things and solve problems and lower costs and find new sources, in short, do their jobs as they have done for over a century. The idea that we need the peak oil folks to spur us to look for better ways to find energy is a madcap reversal of reality, an idea so outré that you would have to carefully shield it from the actual world in order to hold it for more than ten minutes. That claim can’t survive past the point where you think “ummm … if that’s true, then how did the coal industry do it without “peak coal” people to help them?”. So you’d have to be very careful to keep that idea well insulated from the actual world, it’s extremely fragile.

It is delusions like that which characterize the peak oil movement. Thank you for providing an excellent example for the good folks in the cheap seats, so they can see just how far from reality you guys really are … thank the peak oilers for their contribution? Not on my watch …

w.

I’d call it more like something else involving goats, which our Drill Sgt used to yell at us all the time. It’s something nice people don’t say, so it fits the peak oil situation perfectly.

Jeff L: A $20 barrel of oil in 1970, using normal inflation figures, is equivalent to approx $125 today. Brent is currently at $116, so even ‘peak cheap oil’ is not a reality, never mind peak oil.

Wonderful piece again, Willis. Even though I have lived a similar life to yours, I certainly cannot write about it as you do yours. Would you be my ‘ghost writer’ (for a fee, of course)?

SMS says:

February 2, 2013 at 2:15 pm

I know you speak in jest, SMS, but people are always wanting to monetize the unaccounted for costs of oil … see my post, “Monetizing the cost of carbon“. I objected in that post to the fact that people who want to monetize the costs of oil rarely want to monetize the benefits of oil.

In that post, I used the example of CO2 fertilization, a huge and totally un-monetized benefit of oil. However, in some ways I like your example better, it’s like the freakin’ polar bears, it has visceral appeal, it’s not abstract … so I plan to shamelessly steal it. I’d love to attribute it to you, but that’s one of the big downsides of posting anonymously … you don’t get to claim credit for your ideas.

Many thanks,

w.

RobB says:

February 2, 2013 at 2:17 pm

Your idea of adding to the conversation is to tell me I’m doing it wrong and point me to Wikipedia?

Really?

If you disagree with something I said, quote it and tell me why I’m wrong. A vague “you’re wrong” and a referral to Wikipedia is pathetic. I suspect you can do better than that, and that you can up your game to the level played here … we’ll see.

w.

Willis

I enjoyed reading the article. I think Jeff raised the point about price – which I think is the crux of the issue.

One of the thing the “peak oilers” don’t say is that the argument comes with the implicit caveat that with “given technology, proven reserves and current price then…”.

As you say the world is awash with oil but of course some of it would cost too much to extract – at current prices and technologies. Furthermore, exploration takes a long time to get started in a new – venture – region. We know that there are other big finds out there but the paper work needs to be done first and with political instability in some regions, companies are playing a “wait and see” game.

Your point about conventionals and unconventionals is a good one. But again this is largely a result of economics. In general terms, both have been exploited historically with conventionals winning through due to ease of extraction – why would a company go for the higher fruits first?

And as you say directional drilling has been revelation to both conventional and unconventional reservoirs; improving recovery rates. Other things 3D/4D seismic, microseismic, more stimulation options etc. In short the “peak oilers”, ignore the caveats.

Finally, as demand increases prices go up, if prices go up then marginal fields become economic. Oil companies (particularly private firms) then develop these fields all the while improving the engineering and driving down price.

It’s fun to search for oil production projections in books.google.com. Since the early 1900s there have been predictions that peak production was just a few years away. For over 100 years the peak has been right around the corner.

It really is nice to know that the head of the IPCC, Dr. Rajendra Kumar Pachauri , helped us to prolong our use of dirty, co2 emitting OIL. He set up Glori Oil, now Glori Energy, which is a residual oil extraction technology company. He was its scientific advisor while being head of the IPCC. Al Gore and Pachauri are seeped in oil and are both utter hypocrites of the highest order.

Oil will never run out. This is because by the time reserves get to dangerously low levels we humans would have moved on, like we have always done. There are alternatives which we can’t be bothered with too much at the moment such as Algae fuel.

Further reading:

George Monbiot – Guardian – 2012

“We were wrong on peak oil. There’s enough to fry us all

A boom in oil production has made a mockery of our predictions.”

Business Week

“Everything You Know About Peak Oil Is Wrong“

We’re supposed to have hit ‘peak gold’ too, but I am not buying it.

But I don’t suppose if the temperature levels off, we will get have ‘peak climate’, because that would put alot of alarmists out of work.

Peak oil is a myth.

The average production price of a liter of oil has not risen much.

The cost of producing 1 barrel of oil (about 159 liters) is between US$2.00 and US$15.

While new extraction methods or technology will be more expensive to start off with, they will drop when adopted whole scale.

The price of petrol is a political construct…..

The price of crude oil is not determined by the market but determined by a cartel (OPEC) which sets the bottom price. Price fluctuations are above this bottom price.

http://sovereign-investor.com/2012/12/18/oil-prices-are-headed-higher/

The price of petrol for the end user is also determined by politics.

Governments are heavily dependent on the tax on petrol to fund their election bribes.

Taxes on petrol are also used to subsidize public transport projects. The price needs to be high enough for public transport to ‘compete’.

They are also pressured to keep the price artificially high to appease the ‘environmental’ activists who want to phase out fossil fuels.

For example, some 60 per cent of the pump price in Britain is down to tax and duties.

Petrol is a cash cow.

On top of that, some are wondering if the cost of oil has actually risen at all….

Due to inflation it is very hard to gauge whether oil prices themselves are rising or falling.

Measured in gold, the price seems pretty stable and is currently below average.

Measured in gold, the oil price today is only 82% of its average over the past 41+ years.

http://www.forbes.com/sites/louiswoodhill/2012/02/22/gasoline-prices-are-not-rising-the-dollar-is-falling/

Ed_B says:

February 2, 2013 at 2:31 pm

See, that’s where we’re different. I actually look at the data before making my claims. So when some smug fool comes in to tell me that the world production of oil peaked in 2004, and to gloat unpleasantly about how much wealthier s/he is than us common folks, boasting that s/he has a ton of spare money laying around to purchase “a ton of energy futures”, I just ask her/him to point out the peak …

w.

Why are we skeptics generally such optimists and Warmists tend to be such such doom mongers? They draw a straight line. Let’s look at the peak horsesh!t problem of the late 19th century.

Vrooom, vroooom. Problem solved.

Porpoises leaping through the moon’s track at midnight off the Needles…. I still see it 60 years later.

“Knowledge and experience mean nothing to the ocean. After a life at sea, if I put one foot wrong, I get just as wet as the landlubber falling off the dock”

But after a life at sea, you are surely a lot less likely to put a foot wrong than a landlubber is.

The way I see it, most of this future doomsaying comes about from people making linear extrapolations of current trends. The predictions of doom would come to pass if human beings never changed the way we did things. But we change. Old methods give way to new methods. Discoveries are made. Technologies are invented and the technologies of today fade into irrelevance in the not so distant future. And so the predictions of doom fail to materialize when the future arrives because we adapt and invent. The doomsayers fail to recognize that they can’t predict the future but continue to be given undue importance because they attract a legion of followers.

LOL we reached peak oil in 2004? News to me. I guess those massive reserves of shale in australia are just illusory.

Oil produced from vertical wells is defined as “conventional oil”, but oil produced by rotating the drill 90 degrees (horizontal wells) is something other than conventional oil. Engineers have a term for a 90 degree rotation, which is multiplying by the square root of negative one. Now mathematicians refer to this as “imaginary” components, but engineers prefer the term “complex” component. It looks like any petroleum product gathered from horizontal drilling is either “imaginary” or “complex”. If this is the case, imaginary petroleum when burned makes imaginary CO2 and leads to imaginary global warming. Or if the petroleum is “complex” it leads to complex global warming.

It is fairly easy to postulate that the environmentalists will never be a party to “imaginary” global warming. Noting that the warmists explanations of the mechanism for global warming are so complex no human can understand them now, they will not promote any further addition of complex terms. So the Global Climate Change Alarmists will simply call all petroleum products “dirty oil”.

It isn’t just “peak oil” projections that have repeatedly come a cropper. In the 70’s we were certain we were already into that long slow decline to the next Ice Age. By the 90’s, we were all about to burn up and die. For a quarter century it was illegal to build a natural gas fired power plant in the U.S. because we “knew” that all our natural gas was pretty much used up and we wished to save what was left for higher uses. The list goes on and on and yet here we go with yet another set of confident announcements about the future, all based on what “we know”. It seems to me that this endless cycle of faulty prognostication could be ended if we simply came to appreciate the immense expanse of “what we do not know” and weighed it against the relatively frail body of “what we do know”.

So there’s life around an oil puddle after all…

That’s a rather obtuse question don’t you think?

Good post Willis.

it’s not often mentioned that “fossil fuels” are composed of CO2 that has been taken out of the atmosphere over hundreds of millions of years. If the earth now is experiencing any serious imbalance – it’s the lack of CO2 in the atmosphere.

Willis Eschenbach says:

February 2, 2013 at 4:02 pm

Ed_B, I’m glad you made money and I wish you the joy of it, but before you strain your shoulder patting yourself on the back for your predictive abilities, consider how much money you might have made.

I mean, if only you had incorrectly identified peak oil as being in 1998, instead of incorrectly identifying it as being in 2004, you could have bought in for $17 a barrel instead of $40 dollars a barrel … just sayin’, you wasted a full six years of money-making chances, you financial wizard, you …

Willis writes “I actually look at the data before making my claims.”

And what do you see there Willis? Are you splitting hairs about whether peak is actually 96 million barrels or 97 million barrels per day?

Peak oil is not about and has never been about reserves or technology. Its about peak production and so if you look at the larger picture, the 60s and 70s saw massive growth in the West supported by huge increases in oil usage. The last 20 years has seen massive growth in the East unsupported by the same oil production increases. And what has happened? Prices are increasing faster now and oil usage efficiencies are increasing to compensate both from a “forced” reduced usage per increase in growth and increased production cost points of view.

We may not be precisely at peak oil and we may even flatline or even slightly increase for a while but we’re not going to get large increases like we did in the 60s and 70s and instead we’re going to be doing all we can to keep our heads above water as the conventional sources continue to slow their production rates.

And yes, the data does support that at the moment.

Remember the California gold rush? Well….. http://money.cnn.com/2013/01/14/news/economy/california-oil-boom/index.html

@Willis:

Wasn’t the first fracked well in the USA in 1947 or some such? I make that about 66 years…

If you allow for using explosives instead of hydraulics, I think it goes back to about the Civil War…

Oh,and on Hubbert being “right” in N. America: It is worth pointing out that it is largely due to putting off limits giant tracks of land on all 4 coasts ( Pacific, Arctic, Atlantic, Gulf) and a giant chunk of oil land in Alaska ( the “Naval Reserve”).

Then there is that well in the Gulf of Mexico that keep filling back up from somewhere lower down… and the one where Standard Oil found oil at depths that were theoretically too deep and too hot. Yet the oil is there.

@Alfred Ledner W:

We can make oil. Take CO2, add Hydrogen (often from water) and heat. You can reduce the heat needed with various catalysts (some are Iron based, others us Nickle or Chrome or various mixes; there are even rock based types – Zeolyte) You get various mixes of gasoline, kerosene, Diesel, heavy oils.

Now picture subducting sea floor (say, off California) taking a load of sea bottom mud (with water) and loads of carbonate rock to great depths (magma heated depths). We know what chemical reactions can happen. We admit that in the extreme case it releases the CO2 (why do you think volcanoes behind subduction zones get CO2 vents?) It all “works”.

Yet we staunchly assert that the oil and gas found in the California fields in front of the volcanoes are due to dead critters and not a product of the subducting goo prior to getting fully vaporized.

Now look where lots of oil is found. Tends to be near subduction zones or old plate impact zones. No, not all cases; just a lot of them…

IMHO oil comes from two places. Fermented algae (such as North Sea oil deposits) and subjection / collision of plates (such as California / Saudi). Otherwise California oil doesn’t make much sense. Much of California was only lifted out of the sea recently in geologic terms. It was ‘ocean bottom scrapings’ and not a lot of time for sediment trapping and kerogen breakdown…

So ‘conventional’ theory says dead stuff gets hauled down under rocks and slowly baked to make kerogene then cooked some more to make oil. Too far down it is destroyed, to far up it doesn’t become oil and stays “bitumen sands”. This ignores that wet carbonate rock sucked down to heat and pressure ought to cook out oil…. And when we look around the solar system we find complex hydrocarbons all over the place. No dead animals there….

IMHO the “dead animals” theory only accounts for a minor part of the oil.

http://chiefio.wordpress.com/2012/03/25/did-crude-oil-rain-from-the-sky/

Oh, it is also worth a mention that oil was recently found on the ocean bottom near mid ocean ridges. Loads of it. The stuff is everywhere…

http://chiefio.wordpress.com/2012/09/16/theres-oil-on-that-ocean-bottom/

Oh, and on the “Energy return for energy invested” argument (that inevitably comes up):

One can use very cheap nuclear electricity to raise oil due to the FORM being worth more. We want liquid fuels. If the oil source is cheap than making synthetic from scratch, we will still pump the oil and refine it. (So, for example, if it took 60 kW-hrs to make a unit of synthetic oil but I could raise that oil with 50 kW-hrs it would still be pumped. Even if the energy in that final product were only 40 kW-hr (presuming that 10 kW-hrs is lost in trying to charge / discharge e-car batteries or that I want plastics…) The end result would just be building more nukes so I could put that energy in my gas tank in a convenient form. (This is happening today with the use of Natural Gas to create ‘unconventional oil’ from tar sands. The oil form is worth more than the gas form.)

We can already turn coal and nuclear process heat into ‘oil’ if desired. Make synthesis gas from coal (or trash or chicken feathers) and use nuclear heat to F-T process it into oils and gasoline.

So we will never run out of oil. We will just get it from ever more interesting places. Including our own garbage. (Being done today, BTW.)

Here is something on the history of conventional / unconventional [delete as necessary] small / big oil.

Bitumen and Petroleum in Antiquity

Brill Archive, 1955 – 194 pages

http://tinyurl.com/a7aewhh

Guest Post by Willis Eschenbach: “Few people want to hear that tomorrow will be OK, that things will work out. Instead, most folks want to hear some terrible story about what tomorrow holds, whether it’s peak oil or climate meltdown or the coming ice age.”

===========================================================

Willis, how do you know that about “most folks”? Any scientific evidence?

Is is not that some people invent lies and spread them around as scientific facts and others simply believe the “experts”?

As Jeff L mentioned, the determinant is price that justifies the recovery. I like to think of it as “easy” oil vs. “hard” oil. Most, but not all of the easy oil has been found. There may still be places that have been closed to drilling where easy oil may lurk. But of the places that are open, easy oil is the past tense. If you want to cook oil sands, drill horizontally and frack, drill in deep water, and other things that may become possible in the future, oil can still be retrieved. It will just not be cheap to do so. This is the “hard” oil. Because we are running on harder oil all the time, it will make sense that the price goes up in line the recovery costs. That should be sufficient to limit oil to those things where it is a good choice. Oil/petroleum products are nice to use for plastics, and their energy density and storage characteristics make them nice to use other places. The market will decide the outcome. If not in places like the US, then globally.

TimTheToolMan says:

February 2, 2013 at 4:32 pm

Hmmmm … Tim again. Welcome back, Tim. We’ll see how this works out …

Tim, are you seriously looking at that chart and claiming that oil production peaked in 2004 like Ed_B claims? Because as you correctly point out, peak oil is about one thing only—peak oil production. So let’s look at that, shall we?

We have produced more oil than we did in 2004 every single year since then except 2009, and that was likely due to reduced demand. We have had six years of increasing production since 2004, 2011 production was a full three percent higher than in 2004, and you call 2004 the peak year? What part of the word “peak” are you not understanding?

Again, thanks for providing another example of the degree to which peak oilers will go to “support” their claims, even to the surprising extent of claiming that the year of peak oil production was a year where six of the seven following years had higher production … yeah, that’s the ticket, that’ll show the peak oil doubters, all right …

w.

Willis: I realize you are probably using the terms “conventional oil” and “unconventional oil” facetiously but to a geologist those terms have very specific meanings. When a geologist speaks of “conventional oil” he is describing a system which has a source rock (typically a carbon rich shale), a reservoir rock, (typically a sandstone, limestone or dolostone) into which the oil (or gas) has migrated and a trapping mechanism; This is a means to prevent the oil or gas from escaping to the surface and disappearing These include an impermeable non porous layer (shale) capping domes/anticlines, pinch outs,, fault boundaries. Traps all have one essential feature, They all prevent the migration of oil. In short you have: source rock, reservoir rock and trap.

Unconventional oil (or gas) is different in that “the source rock and the reservoir rock” are one and the same. That is the major difference between the two. The Barnett Shale, The Marcellus Shale, The Athabasca Tar Sands etc. are examples of “unconventional” oil/gas.

Peter Terence Kirby says:

February 2, 2013 at 4:07 pm

Thanks, Peter. Sounds stunning … and where might the Needles be when they are at home?

w.

This is a wierd post. Chief stirrer Willis, while delightfully eloquent as always, is chucking in a few straw men and red herrings to make his point : Peak Oil is a “terrible story”, oil is “running out”, peak oil folks think Hubbert was totally correct, “Peak Oil” relies on “unconventional” oil being different to “conventional” oil, huge/massive amounts of coal, gas and methane hydrates prove we’re not at peak oil, etc.

Peak Oil means Peak Oil. That is, the point at which annual oil production, for whatever reason, ceases to increase. When you get to Peak Oil, you haven’t run out of oil. You still have lots of oil. All it means is that you can’t or won’t produce oil at a faster rate than before.

If energy demand keeps increasing – and I certainly hope that in the free world at least it does – and if oil gets more costly and/or difficult to produce (which it is), then other forms of energy will become more competitive. If lots of energy is available from other sources (which it is) then increasing energy demand will at some point all be satisfied from energy sources other than oil. If the changes are smooth, it’s a non-event. But it’s still Peak Oil.

IMHO, we have reached or are about to reach that point. Have we run out of oil? No. Are we on the brink of disaster? No. The USA hit its own Peak Oil in 1970, one of the two dates predicted by Hubbert. Now Hubbert seriously underestimated the amount of oil that would be found in the US, he seriously overestimated the rate of decline following the peak, but by luck or judgement he got the date right. Did the US run out of oil? No. Was it a disaster? No. What happened was that the US satisfied its rising energy demands from other sources. Those other sources, then, included non-US oil. But it was still the US’s Peak Oil.

OK, maybe it isn’t the US’s Peak Oil yet. Maybe all the new oil finds will allow US oil production to exceed the 1970 figure. To do that, US annual oil production has to rise 44% from the 2011 level. You see, even though Hubbert got his supply figures badly wrong, US annual oil production has fallen quite a long way since 1970. Will it go up 45% and stay up there for a few years? Maybe, but I wouldn’t bet on it. My guess is that to achieve that figure the oil price would have to rise so that the increased oil production is economic, and it would have to fall so that oil remains competitive with alternatives.

I would be happy to be proved wrong, but it looks to me like 1970 was the US’s Peak Oil, and the world’s Peak Oil might not be all that far away.

RoHa says:

February 2, 2013 at 4:09 pm

I certainly keep telling myself that …

w.

Willis,

It is rare to find a practising scientist who is proficient, let alone poetic, in their expression. Perhaps it is a function of age. But then I am an old curmudgeon become mathist who was fortunate to have been educated (in England) when my science subject teachers would criticise the writing as well as the technical content of my work. Reading your articles is always a joy. Thank you.

Back to the subject in hand. I only properly understood the fallacy of peak [insert current doom here] when I read http://remittanceman.blogspot.co.uk/2008/02/mineral-reserves-and-resources-what.html?zx=d5d0af80de1f9e64 (ignore scary warning). Written by a horny-handed* mining engineer. Simple and easy to understand. I’ve yet to see a better description.

* I hope this doesn’t mis-translate in Amerenglish. On the right side of the water there is an expression ‘horny-handed son of the soil’, meaning someone whose hands are hardened and calloused from a lifetime of working the land. I believe that horny might be misinterpreted beyond ~70 degreesW

Willis, Hemingway I say. Only better.

@TimTheToolMan:

It isn’t a ‘peak’ until the production curve is lower on the right side than to the left. So far the right side is still higher.

BTW, whenever that day comes, there are a dozen good ways to make “oil products” without oil. Rentech RTK is doing it today commercially as is Sasol in South Africa. Sasol is using coal, but Rentech is using trash. I don’t think we are in danger of running out of trash any time soon.

One could also use wood ( we can produce it at about 25 dry ton / acre – Eucalyptus in Florida have done that as IIRC has Hybrid Poplar) and other carbon sinks; but first we have to use up Old Trash Mountain….

Even if we had declining production of oil starting today, there would not be a crisis. We would just need to start building synfuels plants.

Those are not the only two companies, BTW, there’s a dozen or so others. Just waiting for the day oil prices stay high for a while. ( The real problem is that OPEC crashes price and puts folks out of business whenever someone starts producing in quantity. You will know “peak oil” really arrived when they can no longer do that and synthetic oil is a growing commodity.)

Willis writes “Tim, are you seriously looking at that chart and claiming that oil production peaked in 2004 like Ed_B claims?”

No. I’m saying production has levelled out. Especially when you take continued growth, especially in the East into account. The actual peak obviously wasn’t 2004. Why would you suggest I would think that? Are you making another strawman argument from another poster’s comment and applying it to my post?

TimTheToolMan

Peak oil is not about and has never been about reserves or technology. Its about peak production and so if you look at the larger picture, the 60s and 70s saw massive growth in the West supported by huge increases in oil usage….The last 20 years has seen massive growth in the East unsupported by the same oil production increases. And what has happened?

Production is determined by price and demand as well as capacity (both upstream and downstream). OPEC have a duty to themselves and their customers. They cannot change capacity Willy-Nilly else they destabilise their own economies. Therefore, there will be times that demand exceeds output, while others when demand does not. This is reflected in the oil price and there’s typically a lag between both when prices generally plateau. Remember prior to the 1970s crisis the West basically determined capacity. Post 1970 that changed. So it is hardly surprising that OPEC acts in self-interest if they don’t up supply they can cause a global recession (demand drops and they lose trade) they increase supply to quickly they do themselves out of pocket. They play balancing game. Essentially your point is wrong.

E.M.Smith says:

“IMHO oil comes from two places. Fermented algae (such as North Sea oil deposits) and subjection / collision of plates (such as California / Saudi). Otherwise California oil doesn’t make much sense. Much of California was only lifted out of the sea recently in geologic terms. It was ‘ocean bottom scrapings’ and not a lot of time for sediment trapping and kerogen breakdown…”

===================================================================

I knew it would not take long for the abiotic crowd to clog up this fine post. All this horizontal fractured shale is proving once more that oil comes from organic rich source rocks. If California oil makes no sense to you you might google “source rocks California”, and start by reading this:

http://pubs.usgs.gov/pp/pp1713/11/pp1713_ch11.pdf

The Monterey has long been recognized as a rich source rock, and a fair bit of work is going into producing directly from it.

http://www.aapg.org/explorer/2012/11nov/monterey1112.cfm

Conventional wisdom is scientifically incorrect. I have researched this subject in depth and can continue to provide additional information and logic, until ever one acknowledges conventional wisdom is incorrect. For example I found, a very interesting set of papers published in the 1970’s by the API (American Petroleum Institute) on the formation of oil. (A better title of the collection of papers would be “the unexplained problems with the conventional formation of oil from plants and marine animals”, rather than “the formation of oil”). An example of the unanswered problems in the collection is how to explain the finding of massive oil reserves at the continental shelf. What is the source of the hydrocarbons? Marine environments are very efficient. There is very little plant or animal residue that is deposited on the ocean’s surface. A second primary issue is pressure does not convert long chain plant or animal hydrocarbons to short chain light oil molecules.

The solution proposed in the API paper has the word “time” in quotations, however chemical reactions from a lower to a higher state do not proceed as water does not flow uphill regardless of the amount of time that passes. A chemical reaction that does not take place is at the conditions where the oil is found is a show stopper for the biological source hypothesis.

A third is why are there heavy elements in the oil? Think of the competing hypothesis for the formation of oil where the hydrocarbon comes from deep in the earth and hence picks up the sulfur and heavy metals as it migrates through the crust. The deep earth hypothesis and migrations explains why unconnected oil fields across vast geological regions have similar amounts of heavy metals and sulfur.

Raise the question to a higher level. What is source of hydrocarbons on this planet’s surface? Roughly 70% of the earth’s surface is covered by water. Where and when did that water come from? As almost no one is aware the solar wind strips water from the atmosphere. If there was no new source of hydrogen this planet would be dry and lifeless.

There are a number of commercial changes concerning the amount of oil and gas in recent years.

For those who have not noticed, for example, Canada is now constructing a LNG (Liquefied natural gas) export terminal at its West Coast to export natural gas. A few years ago Canada was planning to construct a port at the same location on its West coast to import LNG. What has changed? The discovery of massive reserves of deep earth CH4. North America suddenly has a massive surplus of “natural gas”. Why? Russian natural gas reserves are now the largest in the world. Why? The Russians have perfected deep earth drillin techniques. Why? What is the standard theory for the formation of “natural gas” CH4 and oil in Russia and the old east block countries?

Saudi Arabia has 25% of the planet’s oil reserves half of which is contained in only eight fields. Half of Saudi Arabia production comes from a single field the Ghawar. Again why?

As most are aware a large mars sized object struck the earth roughly 500 million years after the formation of the solar system. The impact formed the moon and stripped the planet’s mantel of most of the volatile lighter elements. As 70% of the planet’s surface is covered by water a natural question to ask is: Where did the water come from, as the earth’s mantle contains almost no water or hydro carbon?

There are two theories to explain how water and hydrocarbons came onto the earth: the late veneer theory and the deep CH4 theory. The late veneer theory hypothesis: Comets struck the early earth after the big splat event covering the very hot earth with hydrocarbons. The late veneer hypothesis requires that the earth had a Venus like atmosphere (atmospheric pressure of say 60 atmospheres) for the early earth, except with methane.

There are multiple problems with that hypothesis (See Thomas Gold’s Book Deep Hot Biosphere for details. One of the key problems is the observation that the percentage of heavy gaseous elements in the earth’s current atmosphere does not match that of comets (Comets are residues of the early solar systems. The comet elemental composition does match that of the sun). The late veneer theory’s explanation for the miss match of isotopes in the earth’s atmosphere to that of comets is that the early solar system had a close encounter with another solar system which temporary provided a limited source of comets to cover the earth but not significantly change the element composition of the sun.

The second hypothesis is the deep earth hydrocarbon theory. This theory hypothesizes that massive amounts of hydrocarbons (5% of the total core mass) are located in the earth’s core. As the core cools these hydrocarbon (CH4) are released. At very high pressures the CH4 forms longer chain molecules.

The release of CH4 is still occurring as the upper surface of the ocean is saturated with CH4 which indicates that CH4 is being released from some source.

See Carnegie Institute of Sciences Deep Carbon Workshop presentations if you interested in this subject.

https://www.gl.ciw.edu/workshops/sloan_deep_carbon_workshop_may_2008

and…

http://www.sciencedaily.com/releases/2009/09/090910084259.htm

http://www.nature.com/ngeo/journal/v2/n8/abs/ngeo591.html

Mike Jonas says:

February 2, 2013 at 4:53 pm

I don’t get the point of this comment. First you accuse me of being a “stirrer”, not a pleasant reference. Then you accuse me of tossing in “straw men”, but you think that saying that peak oil is a “terrible story” is somehow a straw man.

Peak oil has been beaten to death by the environmental movement in order to try to raise the price of oil and discourage people from using it. That is not a straw man, it is the environmentalists pushing a tale of future gloom and doom to advance their own interests.

Yes, peak oil means peak oil. No, it doesn’t mean we’re running out of oil. Yes, after peak you still have oil. Yes, it means peak production rate … what is all this? Somehow, you seem to think you are here to school me in some kind of first grade class about what peak oil is. I know what it is, you know what it is, everyone knows what the peak of the production of anything is … well, not everyone, TimTheTool and Ed_B think a year followed by six years of increased production is the peak, but everyone but Tim and Ed_B know what peak productions is. And I assure you that I do.

If you have a substantial point in there, Mike, I’m sorry but I couldn’t find it. Maybe if you boil it down to the essence and try again.

w.

Those who seek to justify the peak oil meme in terms of rising oil prices are missing the point. Firstly, the real cost of oil on world markets has not risen in the same way as US prices have. The steady weakening of the purchasing power of the $US over a long period has made imported oil more expensive for Americans, but less expensive for some other countries. Further, changes in the world oil price have little to do with availability, and a great deal to do with political instability in all sorts of places – the Middle East, Venezuela and Iran/Iraq for example.

For an excellent potted history of world oil prices and their effect on the US, see:

http://www.wtrg.com/prices.htm

As the article points out, US oil exploration for anything but the easiest fields was discouraged until 1971, when domestic price controls were lifted. Previously, US companies had to supply the domestic market at below world prices. It was unlucky timing for the oil industry too – just as they gained incentives to look beyond the easiest pickings, the environmental movement took off.

Another consideration is that we in the West are far wealthier than people were in the days of very cheap oil, and drive much more fuel efficient cars. So, even though the graphs of rising prices look dramatic, most people can afford the same or a better lifestyle without making sacrifices. Indeed, not only are our cars more efficient, they have dozens of features which only limousines might have had 50 years ago, if they existed at all. Nor is there any evidence that rises in the cost of petrochemicals have had any appreciable impact on us, for similar reasons.

As others have pointed out, peak oil is a chimera designed to scare us into subsidising certain people’s pet projects, and is in any event irrelevant as the planet is awash with other kinds of hydrocarbons.

Oh, and nice Kipling reference, Willis.

I sometimes wonder if a certain crowd of Big-and-Powerful people planned on “Peak Oil” happening, thinking it was a reality, and decided to use up the rest of the world’s oil first, thus eventually putting the USA in a position of great power, “The One Nation With Oil Left.” In order to achieve this end they needed to manipulate data and make it unprofitable to produce domestic oil. Now, after all that work, they are very old (or dead,) and discover the Peak Oil premise was incorrect in the first place. Oops.

An interesting tidbit of history to look at is the history of the Suez Crisis in 1956. It was a sort of make-or-break moment for the Brittish Empire, and the USA messed up their plans by stating we wouldn’t export any more oil to England if they didn’t calm down. (We were an exporter at that time.) Yet England’s involvement in the Middle East was all about oil, and energy. (It was originally energy in the form of coal, (and knowing how to use it,) that helped make England a world power in the first place.)

Energy is important to the bigwigs who think they, and not the Power that made and rules the sea, are boss.

I still remember as a young engineer in the oil industry being told that it was a wonderful industry, “but you know that in 10 years time oil will start to run out”. And every ten years the same story would be repeated! In 1979-1980 the Iran/Iraq conflict led to an oil price shock with prices hitting more than $50/barrel with plenty of predictions that by the mid 80’s oil would be over $100/barrel. Instead it dropped back to around $10/barrel. “Prediction is difficult, especially about the future” (Niels Bohr).

I must go down to the sea again

To the lonely sea and the sky

I left some socks and panties there

I wonder if they’re dry.

William Shakespeare (or maybe not).