Guest MAGA by David Middleton

JULY 8, 2019

U.S. crude oil production surpassed 12 million barrels per day in AprilU.S. crude oil production and lease condensate reached another milestone in April 2019, totaling 12.2 million barrels per day (b/d), according to EIA’s latest Petroleum Supply Monthly. April 2019 marks the first time that monthly U.S. crude oil production levels surpassed 12 million b/d, and this milestone comes less than a year after U.S. crude oil production surpassed 11 million b/d in August 2018.

Texas and the Federal Offshore Gulf of Mexico (GOM), the two largest crude oil production areas in the United States, both reached record levels of production in April at 4.97 million b/d and 1.98 million b/d, respectively. Oklahoma also reached a record production level of 617,000 b/d.

The U.S. onshore crude oil production increase is driven mainly by developing low permeability (tight) formations using horizontal drilling and hydraulic fracturing. EIA estimates that crude oil production from tight formations in April 2019 reached 7.4 million b/d, or 61% of the U.S. total.

[…]

US EIA

Being a naturalized Texan and having worked the Gulf of Mexico since 1988… This bit is really cool to me:

From the EIA…

EIA forecasts GOM production to average 1.9 million b/d in 2019, making this region the second-largest contributor to crude oil production growth from 2018 to 2019. The forecasted growth is driven by 14 new fields brought online in 2018 and 9 new fields expected to come online in 2019. These 23 fields collectively are expected to contribute more than 200,000 b/d of the total 1.9 million b/d of GOM production in 2019.

US EIA

Another 100,000 bbl/d and it’ll be 2 million barrels per day… And I think we’ll get there…

Shell starts production at Appomattox in the Gulf of Mexico

NEWS PROVIDED BY

Shell Offshore Inc.

23 May, 2019First structure in Norphlet comes online ahead of schedule, below FID estimate

HOUSTON, May 23, 2019 /PRNewswire/ — Royal Dutch Shell plc, through its subsidiary Shell Offshore Inc (Shell) announces today that production has started at the Shell-operated Appomattox floating production system months ahead of schedule, opening a new frontier in the deep-water US Gulf of Mexico. Appomattox, which currently has an expected production of 175,000 barrels of oil equivalent per day (boe/d), is the first commercial discovery now brought into production in the deep-water Gulf of Mexico Norphlet formation.[…]

PR Newswire

Appomattox is just the first deepwater Norphlet field to be brought on production… The Norphlet is one of the hottest plays in the Gulf… Hottest activity-wise. It’s actually quite cool geologically – That’s why it’s oil and not gas like the shallow water Norphlet in Mobile Bay. For a detailed discussion of the Norphlet, see “How Climate Change Buried a Desert 20,000 Feet Beneath the Gulf of Mexico Seafloor”.

The GreenSlime (Steyer, Bloomberg, Rockefellers, CERES.ORG) will do everything it can to buy the Democrats who will shut down US energy dominance if they get political power to do so. Energy dominance completely screws their “get richer” renewable schemes of energy poverty for the US middle class..

Voters must send the GreenSlime candidates to the trash heap get as we have their renewable energy mandates.

MAGA.

? 12 MBBL/day , US can can make 13 MBBL/day if the pipelines can get built fast enough, then with robust exports the US can control benchmark prices along with OPEC.

And we not even talking natural gas, which can really “Fuk the GreenSlime.” More so than oil.

Make no mistake, US energy dominance is why the GreenSlime is amping the climate nonsense rhetoric to level 11 now, they desperately need to shut down US energy dominance for their get richer schemes to work. They were banking for a 2 decades on “Peak Oil” delivering the Gold of Soloman to their feet. Oopps.

If I were your government I’d forget about being an ‘energy exporter’. Keep the stuff yourselves, it will last longer. Perhaps export a little, but only to underpin political purposes. Being energy independent will supercharge your economy and *that* will be the real dominance.

It’s not the government’s oil.

MAGA.

Thank the US founders it is not the government’s oil.

Private property rights is what has made the West dominate, while everyone one else was picking lint balls out of their navels and wondering WTF.

Two words terrify despots: private & property.

More specifically, thanks to Thomas Jefferson.

When I was a boy, I remember the “Energy Crisis.” The government really only did things that prolonged it.

That is generally true of any crisis – government action prolongs it.

When I was a boy in 1973 … a high school Jr. working at Tom Terry’s EXXON station … I had to referee angry motorists queued up in long gas lines for some of our precious gasoline. It sucked. Big time. All Jimmy Carter did was to MAKE ME drive 55, and put on a sweater. What a LOSER!!!

So when MY President has unleashed the shackles on American oil production. And learned that “peak oil” is a moving target at best. And watch as conflict-free oil flows … I get a warm feeling inside, and gun the big V8 in my old Land Rover. It’s a good time to be alive!!!

David…Thanks!…

” Keep the stuff yourselves,”

My guess is that as fracking spreads world wide, the value of our oil will decrease. And eventually fracking will happen all over as people catch on to the green lies.

Of course there will never be a shortage of oil because we can make it like Hitler did to run his war machine. Google Sasol to see a commercial company making oil.

Sasol isn’t commercial in the sense of making money. GTL processing requires high oil prices to be profitable.

Frac’ing tight oil formations doesn’t work everywhere. The vast majority of the unconventional resource potential in the world is in North America.

I agree you’re correct about the fracking doesn’t work everywhere, but not just because the rock is tight. Follow-on thermal events, like volcanism, basins that are actually a collection of sub-basins, and corruption and/or environmentalism run amuck complicate things, like Argentina for example. The price of gold is high and stable, so if you’re a geologist you can choose which way to go. I’m on my way to play golf.

“Shale” formations that are too ductile, too faulted, too folded or too deformed are generally unsuitable for frac’ing. There was a lot of buzz about California’s Monterrey Shale back in 2012… But it’s generally too ductile, too faulted, too folded and too deformed. I once asked a friend of mine, who works unconventional plays, “What do you look for?” He answered, “Nothing”. In conventional plays, you generally look for structural traps. In unconventional plays, you look for structure-less features. I put “shale” in quotation marks because most “shales” aren’t technically shale.

Sasol is primarily a Coal to Liquids company in SA but they do operate a 33,000 bbl/day GTL plant in Qatar with gas prices of about $0.50/MMBtu. An efficient GTL plant takes about 10,000 SCF (10 MMBtu) of NG to produce a barrel of syncrude. This can be turned into jet and diesel fuel that is the cleanest in the world.

However, GTL for fuels is not smart as there are very valuable molecules in F-T syncrude. Shell’s Pearl Project also in Qatar makes highly valuable synthetic base oils from F-T syncrude along with other products including fuels. Just look at Pennzoil and Shell engine oil containers. Some of the high quality product state that they contain GTL base oil. This base oil is better in most ways than Polyalpha Olefin (PAO) base oil as used in Mobil 1. So the Fischer-Tropsch fuel synthesis pathway is viable when you can get cheap gas, and there are places where that is possible.

Shell’s Pearl GTL facility in Qatar basically gets free natural gas and it’s economic at >$40/bbl.

To heck with SASOL lets have cold fusion!

https://www.extremetech.com/extreme/171660-1-megawatt-cold-fusion-power-plant-now-available-yours-for-just-1-5-million 🙂

Rossi has been pushing one scam or another for all of his adult life and has done jail time for it, and yet people keep falling for it. The ECat scam is almost a decade old and has only produced promises and lies – no energy.

R Shearer,

My comment was sarcastic, my feeling on ‘cold fusion’ and Rossi align completely with yours. People people should be warned about and understand who this Rossi jerk is.

GTL economics…

http://gasprocessingnews.com/features/201808/challenges-facing-gtl-rethinking-project-economics-in-2018-and-beyond.aspx

Basically, even with low gas prices, crude oil has to be above $97/bbl for GTL diesel/gasoline to be economic. Although GTL refinery feedstocks, like naptha, can be economic at lower oil prices.

David,

Keep in mind that there are vast coal reserves with cheap coal readily available, especially now with many coal fired power plants converting to NG. CTL is not cheap technology but if the feedstock is cheap, it can be made to work and the products are outstanding Fischer-‘Tropsch liquids (essentially 100% paraffin and isoparaffin hydrocarbons).

Powder River Basin coal is about $12.30/ton which is about $9-10/bbl RM costs. At current crude pricing, this is close to economical and depends on CapEx/OpEx issues to know if it is really viable.

CTL produces large amounts of CO2 which is worth $20-40/ton used for EOR. There is a high demand for CO2 in the Permian Basin to enhance oil production in older fields. This alone could push CTL over the edge making it viable. Time will tell.

There’s certainly a win-win possibility… However, it all hinges on oil prices.

The smart thing to do with any mineral wealth is to sell it, and use that money to invest.

Keeping it in the ground is a fools game.

I have some sentiment for keeping the oil domestic, but what is more important is that the United States be a “market maker” in the international oil market. That gives the U. S. more leverage & control over world oil markets.

To be a market maker it is necessary to both buy & sell oil on the world market.

Yes, it is the same idea as a “market maker” in the stock market. Market makers have a large impact on the overall market. Market makers always both buy & sell and are ready to do so at all times.

Fact is that oil is an important element in backing the dollar’s monetary value internationally: the dollar will buy you a certain amount of energy.

Interestingly enough, the lower the price per barrel of oil the stronger the value of the dollar and that’s a good thing in my opinion.

Keep in mind that there are 4.8 MM bbl/day in Natural Gas Liquids produced as well. Most people forget these products but they are vital to the chemical industry for cracking to olefins and other uses. This brings total crude production to nearly 17 MM bbl/day, which is just about our crude consumption too. So we are near or at a balance of production vs use.

https://www.eia.gov/dnav/pet/PET_PNP_GP_DC_NUS_MBBLPD_M.htm

I’m pretty sure that the 12 MM barrel per day includes the NGLs as well as the oil equivalent of the natural gas produced.

Loren,

my reading of the DOE EIA definitions indicates that NGPL is not included in crude production volumes. Thus I add them together in my analysis. Correct me if this is not right.

Natural gas plant liquids (NGPL): Those hydrocarbons in natural gas that are separated as liquids at natural gas processing plants, fractionating and cycling plants. Products obtained include ethane, liquefied petroleum gases (propane and butanes), and pentanes plus. Component products may be fractionated or mixed. Lease condensate is excluded.

Field Production of Crude Oil: Represents crude oil production on leases, including lease condensate. Excludes plant condensate and other processed liquids.

Note: NGLP is no longer considered field production.

https://www.eia.gov/petroleum/workshop/ngl/pdf/definitions061413.pdf

Every time the oil and gas production topic comes up and I hear phrases like “GreenSlime is amping the climate nonsense rhetoric to level 11……”, I think of this 2012 Obama gem of deceit: “We can’t just drill our way to lower gas prices!” Priceless! Lest we forget: https://youtu.be/Z96ZiaQbwqw

PS I am a native Texan, born iin Lubbock. GRADUATED HS Texas. Family are all Texans.

It’s not just reliable energy the Left want to take to payoff their Slime masters.. It”s basic freedom in the Bill of Rights the Left hates.

“Come and Take It” sticker on my truck’s back window.

https://youtu.be/vo_ZiCF2sc4

“Come and Take It.”

There are No federal lands involved in the Texas Permian Basin.

Let’s see Bernie or Pochantas try to stop that.

There are other opinions.

“…The fairy-tale narrative since then (2008) is that technology rode to the rescue. The shale oil miracle “solved” the energy-in problem. Sure seems like it. But lots of things aren’t what they seem to be.”

Excerpt from here: https://kunstler.com/clusterfuck-nation/what-looms-behind/

You are welcome to your opinions, no matter how wrong they are. But when someone tries to use the force of government to force their opinions down my throat, then we have a problem.

“CF-nation” sounds like leftists in control.

I read the kunstler.com link that Loydo provided. It’s fact-free, so it’s not at all convincing when it claims that shale producers “can’t make a red cent” and tries to draw a parallel with 2008 (to my mind a very different situation). Yes, humans are very good at stuffing up, but they can be very good at not stuffing up too. The best place to see things clearly is in the rear view mirror. Looking forwards, it has always been difficult to see clearly.

Have we hit peak oil yet 🙂

We won’t know until it’s in the rearview mirror.

It could be argued that Peak Oil, as seen by Hubbert, is indeed in the rear-view mirror. Looking at the US production curves, the impression is that King Hubbert was right for 40 years after I heard him give his Peak Oil talk in 1973, and the production followed his prediction–until the successful development of technology he did not or could not have foreseen. To be right for 40 years–that gets awfully close to the longevity of, for example, geosynclinal theory. Not all that bad in our field.

So I’m not dissing the concept at all; tight-formation production will likely also follow the same production/time curve, and price always drives new technology. And once we crack the secret of extracting Green River hydrocarbons the games goes back to the first inning–but then it will also follow the same production curve, with its own peak.

Not to mention the rest of the planet.

Hubbert math is perfectly sound. However, unless you know what the total recoverable resource is, you can’t calculate a firm answer.

My gut predicts that peak demand will come before peak supply. As such I bet peak oil is a non-issue.

If we put sufficiently narrow parameters around a prediction we can all look like amazing forecasters, but it doesn’t necessarily make the prediction useful.

I have.

“For a detailed discussion of the Norphlet, see “How Climate Change Buried a Desert 20,000 Feet Beneath the Gulf of Mexico Seafloor”.”

A better title would have been: “How Mother Nature Buried a Desert 20,000 Feet Beneath the Gulf of Mexico Seafloor”.

A sign of the times, i guess. 🙂

The Anchor project from Chevron will be using 20,000 psi hardware.

If the operation is successful, a whole lot more prospective acreage will open up for development.

David,

This may have been written up in WuWT before or in comments, but what is your view on the economic viability of the fracking portion of present US oil production?

Articles are saying that the majority of the industry is losing money with every barrel on average. Just how much of the 12 Mbpd is basically uneconomic? Just your estimation.

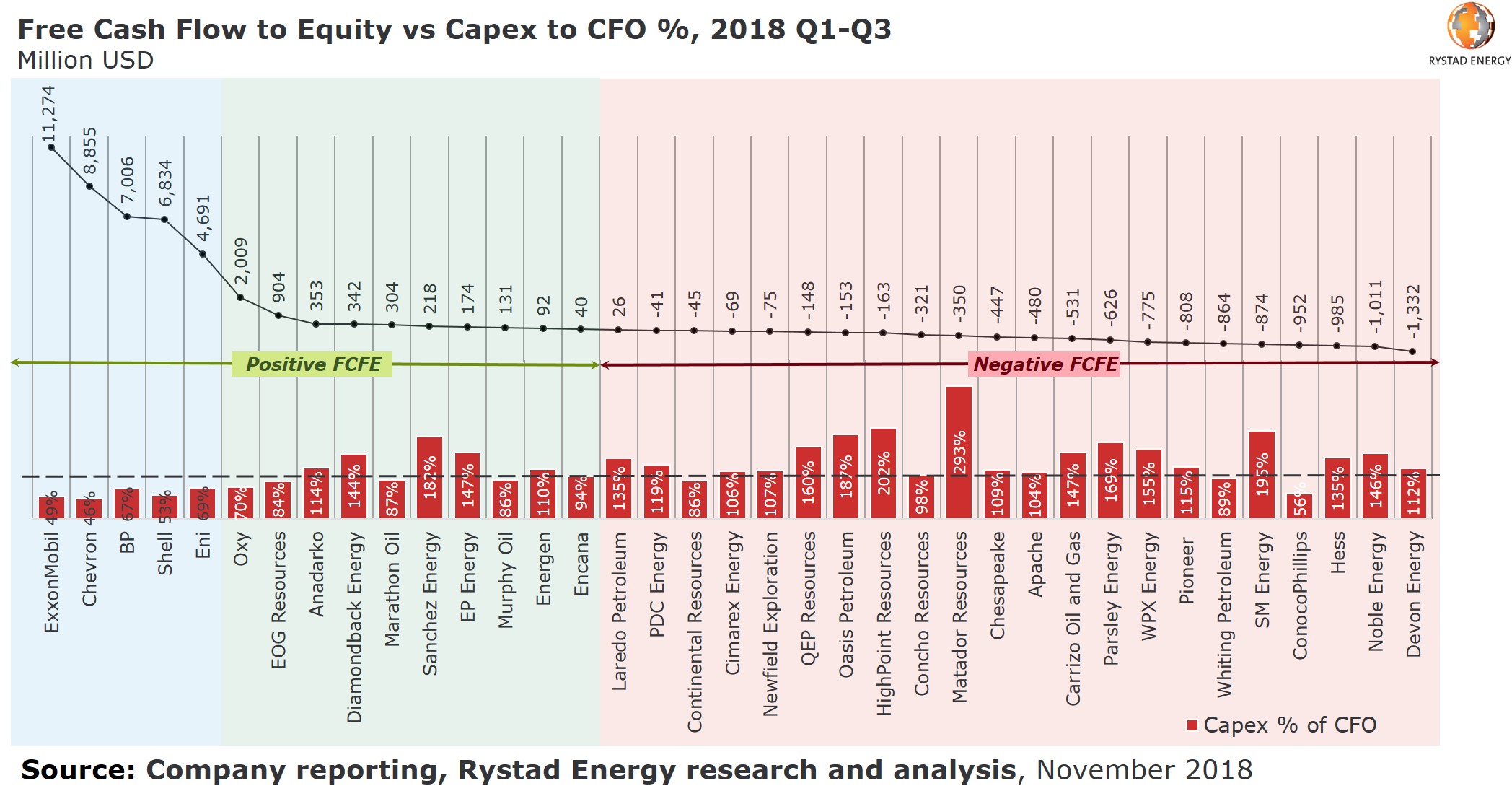

It’s not easy to make money in this business, conventional or unconventional. And it was actually more difficult for the shale players to make money when oil was around $100/bbl than it is now.

Continental Resources, the leading Bakken player, has generated positive operating cash flow every year since 2014 and three straight years of positive free cash flow 2016-2018.

EOG Resources, the leading shale player nationwide, has generated positive operating cash flow every year since 2014 and positive free cash flow in 2014 and 2017-2018.

Chevron, the top US oil producer and major Permian Basin player has generated positive operating cash flow every year since 2014 and positive free cash flow 2017-2018.

Thank you. If I understand correctly, the major players lose money at GAAP accounting for $40/barrel but are able to generate positive free cash flow even at that level.

At present prices, they are presumably still doing so.

Meaning at least a significant portion of the shale oil production is sustainable from a business perspective?

Why was it harder for shale players to make money when oil was $100/bbl? Operating costs were much higher due to higher competing demand for drilling rigs etc?

The cost of everything was a lot higher and impossible to control. I have some more information on this, I’ll try to dig it up.

I work the Gulf of Mexico… I *wish* that shale was unsustainable… 😉

EOG is the biggest “shale player” in the industry. Note how they have reduced debt since 2016, increased shareholder equity and have generated positive free cash flow…

https://www.marketwatch.com/investing/stock/eog

Shale isn’t a panacea… But the margins aren’t that much different than conventional plays.

https://www.rystadenergy.com/newsevents/news/press-releases/Shale-companies-ready-to-show-they-can-grow-within-cash-flow/

The “shale revolution” coincided with the 2006-2014 period of generally high oil prices. It’s often said that $100/bbl oil was a bigger factor than horizontal drilling and frac’ing. This is true to a point. However, the collapse in oil prices since 2014 forced the shale players and the rest of the oil industry to reduce costs… And the industry did this “with a vengeance.”

Shale play breakeven prices. (World Oil)

When oil prices go up, costs go up. Everything from rig day rates, to frac fluids & sand, to offshore workboats, to motel rooms in the Permian Basin. $100 oil kicked off the “shale revolution”… But wasn’t necessary to sustain it.

…

Very interesting, thank you!

The development of electric vehicles could eventually contain oil demand. Just need cheap source of lithium. It’s probably not a coincidence that Tesla built Gigafactory north of Clayton Valley and south of the McDermott Caldera. No one ever accused Musk of being dumb.

Lithium doesn’t exist in nature. Li cations have to first be separated then reduced. Unreliables are unlikely to be significantly more than a nuisance like they are now, actually increasing CO2 emissions. EVs need a primary energy source and batteries aren’t.

Yes, but I said oil demand. I didn’t discuss electricity generation. Unlike AC in summer or heat in winter, battery charging can be done off-peak.

We have some of the largest and least expensive to extract lithium deposits in the world in Northern Nevada and Southern Oregon. New mines are going through environmental impact review at the moment.

It’s the McDermitt caldera complex and be careful of penny stock scams.

I don’t buy mining stocks. Too speculative. However, the owner isn’t really a penny stock. Listed on NYSE . $300+ million market cap. Will it succeed? I haven’t got a clue. Apparently looking for government money.

I have seen preaching about “peak oil” all my adult life. Looks like most other predictions of the green blob.

Technical change tends to do that and depart radically from Peak Oil models of decline using different technology and even different drilling targets with vastly different success rates. The country with the most dry holes has transitioned to the highest success rate.

I’m pretty sure that the 12 MM barrel per day includes the NGLs as well as the oil equivalent of the natural gas produced.

Nope. 12mm bbl/d is crude and condensate. It does not include NGL’s.

Drill, baby, Drill…

My only complaint on the fossil fuel industry is they are flaring off a lot of natural gas in west Texas. Surely they could find something useful to do with all that energy. Like use it to desalinate water pumped up with the oil? Who cares if it isn’t the most efficient way to desalinate…clean water is precious in West Texas.

There has to be SOMETHING…that or build more pipes.

At least we are using less Bonneville hydropower to make polysilicon to ship to China. (They are wasting energy of their own.)

https://www.pv-tech.org/news/rec-silicon-sheds-more-jobs-in-us

We keep running into oil… That has squeezed out much of the profiteering in oil prices. The idea that we will shortly be in total decline in production was a meme that consistently bid the price up or was used to attempt to bid the price up. Right now the price of oil is mostly determined by actual physical production costs (outside of Saudi Arabia, Iraq, and formerly Libya).

Question: when will it be apparent that oil & gas are so plentiful that so-called “fossil fuel” theory simply doesn’t account for the abundance of oil & gas world-wide?

“Source rock”? No, residue rock… Its becoming increasingly clear that “source rock” can not account for the abundance of oil & gas in the Earth’s crust.

So-called “source rock” consists in some percentage of heavy hydrocarbons. Heavy hydrocarbons, long-chain hydrocarbons are more easily filtered out of the hydrocarbon suite (oil consists of a continuum of short-chain to long-chain hydrocarbons) in different layers of rock. short-chains hydrocarbons, i.e. methane travel more easily through various rock compositions until they hit non- permeable trap rock while heavy hydrocarbons often get filtered out farther down in the geologic column.

David,

Here’s an excellent new video from the WSJ about Permian Basin oil production.

Not paywalled. No propaganda. Excellent information and videos and graphics.

https://www.wsj.com/video/how-the-permian-basin-became-north-americas-hottest-oilfield/FFF97526-6513-4884-B315-94A46E923507.html

Petty well done.

That old chestnut, permeability. (here with getting more oil out of low permeability formations, which few predicted).

I’m having trouble convincing people it works in gold exploration as well. I’m currently evaluating a resource of gold in a more permeable rock to those surrounding it, which gold apparently shouldn’t be there, or must have formed some other way. Except the difference with the oil above, was the rock was much hotter when it was more permeable and when the gold entered it. But permeability it still important, whether at 50 degrees or 500 degrees, or oil or with gold.

The question is not “Is there gold there?”, but “Is the gold there recoverable at $1,200 oz to make a profit?”

No different than any other mineral play.