Guest Excelling by David Middleton

Jul 1, 2019, 12:03am

New Solar + Battery Price Crushes Fossil Fuels, Buries NuclearJeff McMahon Contributor

Green Tech

From Chicago, I write about climate change, green technology, energy.Los Angeles Power and Water officials have struck a deal on the largest and cheapest solar + battery-storage project in the world, at prices that leave fossil fuels in the dust and may relegate nuclear power to the dustbin.

Later this month the LA Board of Water and Power Commissioners is expected to approve a 25-year contract that will serve 7 percent of the city’s electricity demand at 1.997¢/kwh for solar energy and 1.3¢ for power from batteries.

“This is the lowest solar-photovoltaic price in the United States,” said James Barner, the agency’s manager for strategic initiatives, “and it is the largest and lowest-cost solar and high-capacity battery-storage project in the U.S. and we believe in the world today. So this is, I believe, truly revolutionary in the industry.”

It’s half the estimated cost of power from a new natural gas plant.

Mark Z. Jacobson, the Stanford professor…

[…]

Forbes

That’s where I stopped reading the Forbes article.

Coal and gas on notice, as US big solar and battery deal stuns market

Sophie Vorrath 3 July 2019

A Californian solar and battery storage power purchase agreement is plumbing new lows for the cost of electricity from solar – a US-dollar price of 1.99c/kWh for 400MW of PV and 1.3c/kWh for stored solar power from a co-located 400MW/800MWh battery storage system.The record setting deal, struck by a team at the Los Angeles Department of Water and Power (LADWP) with renewables developer 8minute, seeks to lock-in a two-stage, 25-year contract to serve 7 per cent of L.A.’s electricity demand from the massive solar and battery project.

The project, called the Eland Solar and Storage Center, would be built in two 200MW stages in Kern County north of Los Angeles, with an option to add a further 50MW/200 MWh of energy storage for 0.665 cents per kWh more.

[…]

“This is the lowest solar-photovoltaic price in the United States, and it is the largest and lowest-cost solar and high-capacity battery-storage project in the U.S., and we believe in the world today,” said the LADWP’s manager for strategic initiatives, said James Barner. “So this is, I believe, truly revolutionary in the industry.”

Barner has also noted that the project has been able to make “full use” of a “substantial” federal solar investment tax credit, which amounted to around 30 per cent “basically knocked off the capital cost of the project.”

[…]

Renew Economy

This project would not be feasible without the investment tax credit (ITC). Knocking 30% of the CapEx at the expense of the taxpayer is kind of a big factor here. Tax credits are not the same as tax deductions. Fortunately, the ITC is scheduled to be scaled back over the next few years.

There’s also some confusion about the power purchase agreement.

Los Angeles seeks record setting solar power price under 2¢/kWh

The city’s municipal utility is readying a 25-year power purchase agreement for 400 MWac of solar power at 1.997¢/kWh along with 200 MW / 800 MWh of energy storage at 1.3¢/kWh.

JUNE 28, 2019 JOHN WEAVER[…]

The team told the commissioners that on July 23, they plan to seek approval of a two phase 25-year power purchase agreement (PPA) priced at 1.997¢/kWh for 400 MWac / 530 MWdc of solar electricity delivered at time of generation plus a adder 1.3¢/kWh for the excess electricity later delivered from a co-located 400 MW / 800 MWh energy storage system.

PV Magazine

The green cheerleaders think that the the electricity generated directly by solar generation will be sold for 1.997¢/kwh and the electricity stored in the battery system will be sold as a separate product for 1.3¢/kwh. From the comments section of the PV Magazine article:

NickM

June 28, 2019 at 11:00 am

Wouldn’t the battery power be an additional 1.3 cents/kWh, so ~3.3 cents total? Otherwise the stored energy is selling for less than the directly generated solar — that sounds odd.

John Weaver

June 28, 2019 at 11:03 am

Separate product, so not added on top of it[…]

PV Magazine

The math of a “separate product, so not added on top of it” just doesn’t work.

I have not been able to find any actual numbers for the cost to build this power plant. It seems that they are rarely made public these days. All that’s ever announced are ridiculously low prices in power purchase agreements.

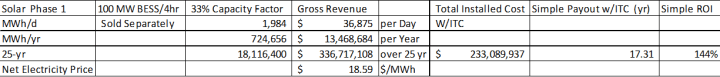

If we assume that they got the installed cost down to $1/W and they manage a 33% capacity factor, like the nearby Springbok 1 facility, the 200 MW Eland Phase 1 solar PV system would cost $200 million. Using NREL’s latest estimate of battery storage costs, a 100 MW, 4-hr system would run about $132 million ($93 million w/ITC),. They would lose money on the sales of battery-stored electricity at 1.3¢/kwh.

Combined, the project has a 144% simple ROI over 25 years, with a 17-yr payout; but this doesn’t include operation and maintenance costs or battery cell replacements. No sane business would risk capital like this; they could generate a 190% ROI from 30-yr Treasuries with virtually no risk. Adding the battery storage at a huge loss doesn’t make any sense. If this was the actual pricing structure, the net price would go down with more battery storage… This simply defies credulity.

The project includes the option to add 50 MW / 200 MWh of energy storage for an additional adder of 0.665¢/kWh.

PV Magazine

If the battery costs are cumulative to the base price, the project would become more profitable with the battery storage system than without. Increasing the battery storage would increase the net price per kW/h and improve the project economics, rather than worsen them.

Solar Phase 1 + 100MW BESS/4-hr –> 3.297¢/kWh.

Solar Phase 1 + 150MW BESS/6-hr –> 3.962¢/kWh.

Summary table with ITC

While these prices are “competitive” with natural gas advanced combined cycle power plants, they entirely dependent on subsidies. Even then, the returns are marginal. A 7% discount rate would kill even the Solar + 150MW BESS/6hr project. There’s got to be another angle.

The other angle

How do project developers use the tax credits?

Many project developers do not have enough taxable income to take full advantage of the tax credits. Instead of using it to lower their own taxes, they use it to secure investment dollars from tax equity investors (typically large financial institutions, and occasionally high-net worth individuals). Tax equity investors will provide the developer with funding in exchange for a share of assets in the project. This enables the investors to receive tax credits for every dollar invested (reducing future tax liability) AND receive a return on their investment from the developer.Typically, all the income for the first five years of a project’s life goes to paying back tax equity investors until they meet their return, at which point the developer will buy out the investor’s stake in the project. Tax equity investment is significant: According to Greentech Media, it makes up 40 to 50 percent of financing for solar projects and 50 to 60 percent for wind projects. The balance of the project’s capital stack comes from equity and debt financiers.

Level 10 Energy

Even if the solar power developer is unprofitable and has little or no Federal tax liability, the ITC can be effectively sold to investors who can take full advantage of the tax credit.

Take away the tax credit and this is a money-loser

Barner has also noted that the project has been able to make “full use” of a “substantial” federal solar investment tax credit, which amounted to around 30 per cent “basically knocked off the capital cost of the project.”

Renew Economy

Summary table without ITC

A discounted cash flow analysis would kill this project in a heartbeat, if not for the investment tax credit (ITC). Without the ITC, they couldn’t bid such low-ball PPA’s and they would have a much more difficult time securing financing.

What effect will the expiration of renewable energy tax credits have on prices?

Without tax credits, developers will need to turn to more expensive sources of financing to get their project built, which could result in an increase in prices. In addition, they will not be able to lower prices as a result of production tax credits.In many cases, tax credits were the driving force behind renewable energy becoming less expensive than coal. It remains to be seen whether the expiration of the ITC and PTC will have a dramatic effect on the price of renewable energy. While it is likely that prices will rise, there are several factors that could mitigate how much they rise:

Lower Costs: Advancements in technology have reduced the cost of building wind turbines, photovoltaic cells and other major components of renewable energy projects. In addition, if the tariffs on solar products and steel are removed, equipment costs could decrease.

Increased Demand: Corporate demand for renewable energy and renewable production standards for city and state governments are increasing the number of buyers in the market and overall demand for clean energy. In addition, policy changes like a carbon tax or passing of the Green New Deal could increase demand.

Level 10 Energy

Reality

Most of the country is not as well-suited for solar PV as the Mojave Desert. Whereas, apart from States with pipeline phobia and Hawaii, natural gas works just about everywhere… Even at night and on cloudy days.

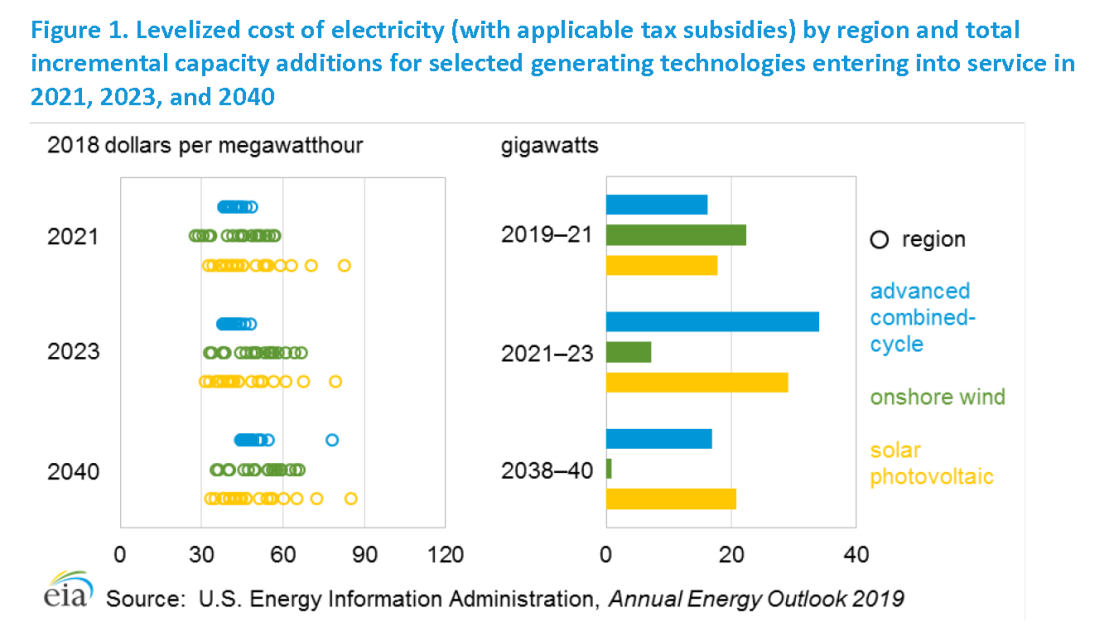

While wind and solar might be competitive in some areas…

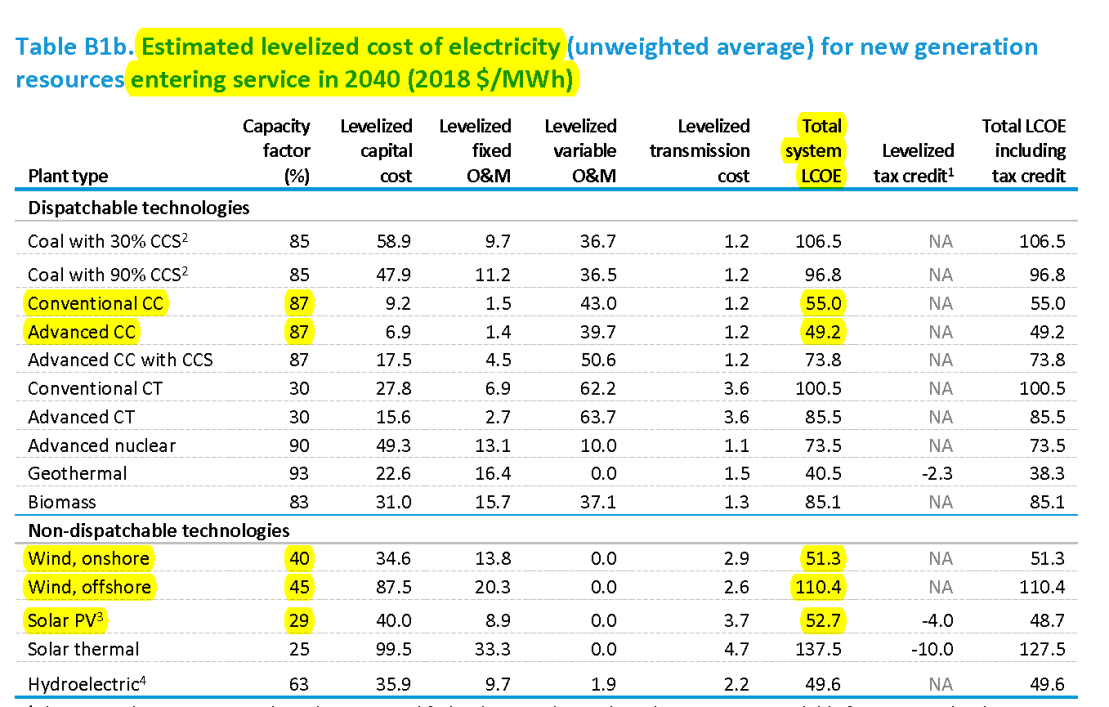

No matter how low the LCOE drops, wind and solar will always be dependent on the wind blowing and Sun shining. Note: The EIA LCOE numbers do not include storage or backup and assume an increase in natural gas prices between 2023 and 2040…

And, if the reduction of carbon emissions was really that important…

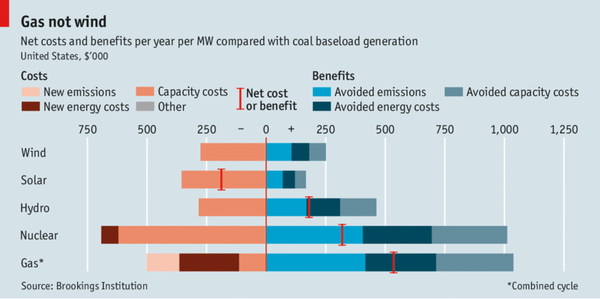

While the cost of wind and solar has declined since this graph was published in 2014 one thing hasn’t changed: Nuclear and natural gas can directly replace coal on a 1 MW per 1 MW basis; while wind and solar will never be able to do so. This assumes that it’s actually necessary to replace coal.

But, but, but… What about fossil fuel subsidies?

What about them?

As the Gipper would say…

Geothermal wins. Why less focus these days? (Especially in California)

Because it only works, where it works.

Rotorua in New Zealand is a classic example of how geothermal changes. The local council banned people from drawing heated water from the ground because they were drawing too much. Now there is more activity and new hot spring pop up now and then.

Come on David, it should work everywhere according to Big Al’s science.

Geothermal Energy Disadvantages (in no particular order)

Location Specific:

Good geothermal reservoirs are hard to come by. Iceland and Philippines meet nearly one-third of their electricity demand with geothermal energy. Prime sites are often far from population centers.

Potential emissions:

Greenhouse gas below Earth’s surface can potentially migrate to the surface and into the atmosphere. Such emissions tend to be higher near geothermal power plants, which are associated with sulfur dioxide and silica emissions. Also, and the reservoirs can contain traces of toxic heavy metals including mercury, arsenic and boron.

Surface Instability:

Construction of geothermal power plants can affect the stability of land. In January 1997, the construction of a geothermal power plant in Switzerland triggered an earthquake with a magnitude of 3.4 on the Richter scale.

Cost of Powering the Pump:

Geothermal heat pumps need a power source.

High cost for electricity:

Total costs usually end up somewhere between $2 – 7 million for a 1 MW geothermal power plant.

High up-front costs for heating and cooling systems:

While there is a predictable ROI, it will not happen quickly.For an average sized home, installation of geothermal heat pumps costs between $10,000 – $20,000 which can pay off itself in another 5-10 years down the line

Distribution costs:

If geothermal energy is transported long distances, cost can become prohibitive.

Sustainability questions:

Some studies show that reservoirs can be depleted if the fluid is removed faster than replaced. This is not an issue for residential geothermal heating and cooling, where geothermal energy is being used differently than in geothermal power plants.

Can Sometimes Run Out of Steam:

You have to be incredibly careful when you are trying to check everything that is related to geothermal energy. Mind must be taken to watch the heat and not to abuse it, because if the heat is not taken care of properly, it can cause a meltdown or other issues where the energy is not properly distributed or used.

~~~~~~~~~~~~

That said in many locations Geothermal Energy is perfectly feasible and a practical method for getting both heating energy and electricity, and should be considered.

You are mixing up geothermal energy and groundwater based heat pumps. Two different technologies and two different energy sources.

Both work well enough, but conditions have to be right and the amount of energy that can be extracted is limited.

Iceland comes to mind.

“Surface Instability:

Construction of geothermal power plants can affect the stability of land. In January 1997, the construction of a geothermal power plant in Switzerland triggered an earthquake with a magnitude of 3.4 on the Richter scale.”

3.4 is NOT an Earthquake, it is nothing more than a light tremor! A large truck passing by would cause more vibration!

At the surface sure. Several kilometres focal depth, bit more than a passing truck.

The Philippines is one of the largest producers of geothermal energy, second only to the United States. With 1896 MW of installed capacity, geothermal energy represents 13% of the Philippines’ power mix. (less than half of your 33% claim-but still growing)

http://large.stanford.edu/courses/2016/ph240/makalinao1/

And there is a small possibility of lava engulfing parts of your facility, as happened a year ago in Hawaii https://en.wikipedia.org/wiki/Puna_Geothermal_Venture

Nonetheless grid scale geothermal is a (mostly) non-greenhouse gas emitting, non-intermittent power source. **IF YOU HAPPEN TO HAVE SUITABLE GEOLOGY**. Most regions don’t.

Yet California DOES have favorable geology. In fact, some of the best in the world. Yet there are 1,000s of MW in the Salton Sea undeveloped.

Yet another subsidy mining project. As if production tax credits are coming from nowhere?

Mining or harvesting?

Depends on whether you view the initial lobbying cost as stripping topsoil, or planting seed.

Let’s not make the same egregious error the alarmists make: a tax credit is just a subtraction from tax one owes; it is not a subsidy.

If I owe $10,000 and get a tax credit of $3300, I now owe only $6700. That doesn’t cost taxpayers anything. It just doesn’t cost me that $3300.

In that case doesn’t it strike you as a bit odd that you can actually sell something that doesn’t exist?

What’s being sold that doesn’t exist. A buyer purchases equipment for which they get a tax credit. They’re not getting a credit for electricity sold, are they?

The tax credit is being “sold.” From the post…

How do project developers use the tax credits?

Many project developers do not have enough taxable income to take full advantage of the tax credits. Instead of using it to lower their own taxes, they use it to secure investment dollars from tax equity investors (typically large financial institutions, and occasionally high-net worth individuals). Tax equity investors will provide the developer with funding in exchange for a share of assets in the project. This enables the investors to receive tax credits for every dollar invested (reducing future tax liability) AND receive a return on their investment from the developer.

Typically, all the income for the first five years of a project’s life goes to paying back tax equity investors until they meet their return, at which point the developer will buy out the investor’s stake in the project. Tax equity investment is significant: According to Greentech Media, it makes up 40 to 50 percent of financing for solar projects and 50 to 60 percent for wind projects. The balance of the project’s capital stack comes from equity and debt financiers.

https://leveltenenergy.com/blog/energy-procurement/renewable-energy-tax-credits/

It’s a subsidy if it’s fully refundable. It’s a subsidy if it’s transferable. A deduction only applies to income.

If you don’t generate taxable income, you still get a check from the government for a fully refundable tax credit, like the Earned Income Tax Credit.

The ITC is transferable. Solar power plant developers “sell” the ITC to investors. They get the tax credit even if they generated no taxable income before applying the tax credit.

“The ITC is transferable. Solar power plant developers “sell” the ITC to investors. ”

It sounds like a scam to me. A pretty good deal for the investors. They get paid regardless of whether the wind blows or the sun shines.

bingo

A subsidy is whatever I say it is. If it’s a corporation and I think they’re destroying America to benefit the rich, it’s a subsidy. It’s a political term. Whether it’s actually refunded, or maybe refunded because of other factors is not a good rule. Prohibiting the transfer of a credit that only impacts 20% of the situations wouldn’t change the substance of a thing.

Remember this: Substance > Form. The ITC transfers part of the cost of something that is owned to someone else. That it misfires some of the time because it has been deemed non-refundable doesn’t change the substance. It only reduces the overall subsidy. It still does that same thing.

What is a not a subsidy: Bonus depreciation. It brings forward a depreciation write off to be used sooner at the cost of using it later. It’s a timing difference and not a subsidy. It is used by leftists to dis energy companies. Even though small businesses doing aroma therapy can use the same write off. Even if it is a subsidy, the reversal in later years should be included in their numbers. This situation demonstrates hack accountants that should not do accounting. Writing off the cost of doing business is not a subsidy. But they clutch at anything to make their point.

I agree that accelerated depreciation is not a subsidy… However, our Federal government considers all “tax expenditures” to be subsidies. And, yes, tax expenditure sure seems like an oxymoron.

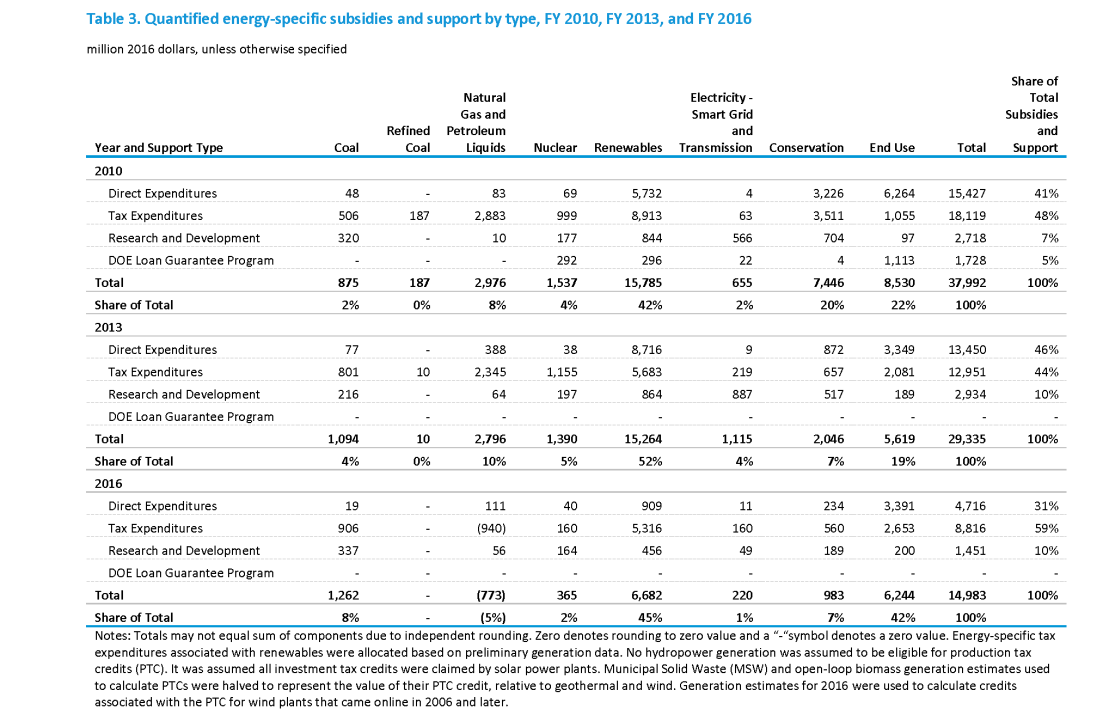

That said, in FY2016, almost all of the energy-specific subsidies went to renewables, oil & gas actually had a negative net subsidy…

“It brings forward a depreciation write off to be used sooner at the cost of using it later. It’s a timing difference and not a subsidy.”

Ragnaar – The Federal government in the past has also allowed “additional” depreciation, such as when newly purchased equipment was permitted to benefit from, say, an additional $10,000 depreciation per piece of machinery for a period of one year.

Decades ago I personally benefited from one of Reagan’s program to that effect.

According to Intuit, the TurboTax people, the tax is not refundable.

“Filing requirements for solar credits

To claim the credit, you must file IRS Form 5695 as part of your tax return; you calculate the credit on the form, and then enter the result on your 1040.

If you end up with a bigger credit than you have income tax due—a $3,000 credit on a $2,500 tax bill, for instance—you can’t use the credit to get money back from the IRS. Instead, generally, you can carry the credit over to the following tax year. However, it is not yet clear whether you can carry unused credits to years after the solar credit expires.”

I didn’t say it was refundable. I said it was transferable.

Don’t know why this is such an issue.

If you get more money back from the government than you pay, you are being subsidized. The money must come from other taxpayers. Period.

If you pay the government more than you get back, but less because of something specific in the tax laws, it’s a tax-break. It does not cost taxpayers anything; it means they have taken less from someone. If your company reduced your salary $100, would you say the company cost you $100? No, you earned $100 less.

The assertion that it is a subsidy because taxpayers must make up the difference sounds good, but is nonsense. I am retired, so I paid no taxes on the earned income I didn’t earn. Did other taxpayers have to pay the taxes I “should” have had I not retired? Am I getting a subsidy? If so, then every non-taxpaying person is being subsidized, and the word loses all meaning – everyone is being subsidized. Whether I do nothing, and pay no taxes, or if someone does something and pays less than expected taxes (or none), is the same wrt other taxpayers; less tax revenue but no cost, no subsidy. There is a huge difference between less in paid in taxes and a subsidy (and, yes, if expenses are not reduced to match revenue, additional money must be obtained elsewhere. That is true whether there is a subsidy, tax break, retirement, bankruptcy, recession, or the business never existed.).

And in some cases NOT getting a tax-break will result in LESS taxes collected. Instead of NY getting about $20 billion from Amazon, now they are getting nothing because of the loss of the tax-break. They were never going to get $28 billion from Amazon; that option never existed. That $8 billion in taxes that A O-C wanted so it could be spent on other things NEVER EXISTED and never would. Good work, A O-C.

It’s just how the government defines subsidies.

https://www.eia.gov/analysis/requests/subsidy/pdf/subsidy.pdf

Of course it does, unless the state then reduces spending – and even then you can argue that we have lost the value of that spending.

If these projects allow those who owe $10,000 to only pay $6,700, then others have to make up the shortfall. In other words, poorer taxpayers pay more tax because richer taxpayers are paying less tax. The supposed lower energy price is entirely wiped out by higher taxes – the classic subsidy problem.

“poorer taxpayers pay more tax because richer taxpayers are paying less tax.”

The real problem is the government spends too much.

Another big problem is socialists think your money is their money to begin with. They don’t think you have a right to your money. They will decide the amount allowed for you, and everyone else, for the “greater good”, of course. Don’t worry, the socialists are very kind and caring, just ask them.

Others are not required to make up the shortfall. The government sets tax and then collects what comes in, it does set a goal ahead of time, say $100,000 and assess those taxes out until it gets it’s targeted revenue.

Interesting logic. If a tax credit doesn’t cost anything, why not give everyone a tax credit equal to their tax owed?

It costs taxpayers the $3300 in taxes not collected. No free lunch!

James S

Your analysis is overly simplified.

A) the tax credit is a reduction in the purchase price of the asset

B) the tax credit in reality is a subsidy to the Seller – while on first impression, the tax credit is a subsidy to the buyer, the reality is it is a subsidy to the seller.

This can be seen when you analyze tax credits using the supply and demand curves. Tax credits create an artificial second demand. The buyer is purchasing the product at the lower (left ) demand curve based on the price (less tax credit). The seller is selling the product at the higher (right) demand curve based on the higher subsidized artificial price.

Same issue with all other tax credits (EV’s ) for example

Don’t go into business.

The government (yes, us the tax payers) did not receive the $3300. The amount of funding will now not be available for the public programs it would have supported and must be replaced with funds from elsewhere.

The reasoning behind tax credits is that the government (we the people via policy) have collectively decided that we would like to see our taxes spent on certain projects, and that direct investment by individuals in those certain projects seems more efficient than firstly collecting the taxes from everybody and subsequently spending the funds on those same projects. Therefore to incentivize the private individuals we have permitted them to essentially not pay the portion of taxes that would have been invested by the government in similar projects. The disadvantage is that direct governmental investment usually means subsequent governmental involvement and oversight.

This is the same bogus argument that alarmists make about “subsidies” received by fossil fuel companies. I just spent some time looking up the particulars about the solar ITC, so perhaps some of the economic wizards here can show me where I’ve gone wrong.

The ITC is not refundable. You don’t get a check from the government if that $3000 is more than your tax debt. However, it does carry over, so if your tax debt was $2000, you can use $2000 of the ITC this year and the remaining $1000 the next.

Money I don’t pay and get to keep is NOT money taken away from other taxpayers. We make this argument over and over again when alarmists claim fossil fuel companies are getting “subsidies” when they’re actually taking tax credits or depreciating equipment. I’m amazed that any self-described small government conservative would make this argument.

The supply and demand curve argument seems like circular logic: the seller can’t take a profit on a higher selling price at the same time the seller is getting a percentage of the selling price as a tax credit. Since none of the tax credit is going to the seller, how does he make a profit on “the higher selling price”? Say the seller would sell the system for $10000 if no tax credits are involved. He makes $10,000 and the buyer gets no credit.

Now the credit is in play, and the seller still sells for $10,000, and the buyer gets a $3000 tax credit. The seller makes no extra profit, and the buyer doesn’t pay $3000 of his taxes owed that year.

Now let’s suppose the seller ups the price to $14,286 and tells the buyer that the ITC will lower his actual outlay for the system to $10000 because of the 30% tax credit. The seller has made more profit, the buyer keeps $4285.20 instead of $3000, but its still his money he’s keeping and his money he’s giving to the seller. Still no cost to the taxpayer.

“If tax credits don’t cost anything, why not give everyone a tax credit equal to their tax owed?” Well, you’d have an unfunded government providing no services, but it wouldn’t cost me anything for you to keep your money.

What the government decides to do about shortfalls has nothing to do with the fact that me keeping my money (and you yours) does not cost you/me anything. We’ve made this argument over and over again, but now that the tax credit is going to an “unworthy” cause, it’s suddenly a subsidy.

It wasn’t then, and it isn’t now.

No one said it was refundable. I cited the EITC as an example of a refundable tax credit.

The government considers any “tax expenditure” to be a subsidy.

In the case of fossil fuels, the “subsidies” mostly consist of being able to treat certain capital expenditures as expenses, rather than having to write them off over time. Either way, we get to write these expenses off against income. We can’t sell a depletion allowance or intangible drilling costs to investors.

The ITC is transferable, it can be “sold” to investors. The ITC can be applied to their total income. So, even if the solar power plant generates no income, they can take full advantage of the tax credit by writing it off against other income. It’s one of the main mechanisms of financing solar power plants. The closest thing to a fossil fuel analogy is with pass-through LLC’s. These companies directly pass the income and tax liability on to the owners. If you are an active partner, and your company passes a net loss on to you, you can write that off against ordinary income. However, if you are a passive partner, you can’t write the loss off against ordinary income.

I think any tax dodger would make some such argument. Or bank robber for that matter. –AGF

“…That doesn’t cost taxpayers anything…”

Sure it does. Someone has or will have to cover $3300 in gov’t spending (plus possible interest) that you ordinarily would have. The gov’t doesn’t say, “Well James gets a $3300 tax credit, so we need to counter-balance that by reducing our spending by $3300.”

You are being rather disingenuous. If you have $10 and I have $10 and the government says, “Michael, give me $5 of your money. James, give me $3,” it didn’t cost you anything more for me to only hand over $3. You didn’t give me the $2, and the government didn’t take $7 from you and give me $2.

In your example, the government is paying you $2 to get you to do something ….

They are subsidizing their program to create a certain kind of willful ignorance, and it is working.

I’m not being “disingenuous,” let alone “rather disingenuous.”

It’s really very simple. The gov’t has a spending budget. It is paid for by taxes. A tax credit to you means that someone else’s taxes will have to cover the resulting shortfall created by the credit or that the spending budget will have to be reduced accordingly (which does not happen…hell, the budget is set before tax collections are made). Your example completely ignores this. In order to meet the balance sheet, the gov’t would have to take $7 from me instead of $5, or an extra $2 from someone else out there. Or it would have to reduce spending by $2. Or, more realistically in this day and age, borrow money to cover that $2, which will have to be paid by future taxes (with interest). Your example either pretends that the gov’t budget was $8 all along, that the gov’t has an infinite amount of spending money without any consequences, or some other such nonsense.

You should run for office.

Look at the Federal budget, it’s spending first, what did we collect second and third is borrow the difference. The Feds have been borrowing whatever they feel like and they get to set the interest rates as well. If that doesnt work, they have a printing press. All of your dismissive comments,that is exactly what the Feds do. Here’s what they don’t do: Department B doesnt set higher rates because Department A handed out a tax credit.

how large an area of land would need to be wildlife ‘quarantined’ for this solar station, compared to an equivalent gas fired power station?

The nearby Springbok 1 plant generates 500 MWh/acre… An incredibly p!ss poor power density.

Well said!

I call BS and misinformation. There is no battery system available today to store that much electricity to a grid the size of LA for any significant period of time.

The battery options are either 100MW/400MWh or 150MW/600MWh.

The EOS Aurora 2 can gang up that size for about $40 or $60 million. ($95/KWh for the DC components)

Of course, it wouldn’t be physically small. Their 1MW/4MWh unit is roughly the size of a shipping container. The idea is you place the batteries throughout the solar panel field not group them together. For this many panels, there would be plenty of room for 600 container size batteries.

Of course a 600MWh battery would be close to the world’s largest, if not the world’s largest.

Like I said…..for no significant amount of time. They’re talking about selling electricity from the batteries, not backup. We’re talking a daytime use system with limited backup and not a 24X7 grid connection. No?

I’m sure it’s backup. The extra cost is added to the electric bills during the night and other times when the batteries have to be used. Electric metering in LA is now time based so this is possible.

The batteries are primarily to target 7pm-11pm.

Charge them during the day with surplus power from the panels, then provide the city power in the evening.

Currently, single stage gas turbines are used for the evening power, but they are approaching end of life. Either new turbines need to be built, or an alternate “reliable” 4-hour solution found.

Most electric grids have a 4-hour per day peak need. Batteries can address that more cost effectively than building “gas peaked plants”. Batteries just haven’t yet proven they can have a 15+ year life. If only 10 or less years, they levalized cost is too high.

“..Later this month the LA Board of Water and Power Commissioners is expected to approve a 25-year contract that will serve 7 percent of the city’s electricity demand at 1.997¢/kwh for solar energy and 1.3¢ for power from batteries….”

What really drives me up the walls with the MSM’s solar energy cheer leading is that they never mention in their pieces whether the economics and energy generation numbers for the solar project are based on nameplate capacity or capacity factor. I doubt that they even know the difference between the two or even heard of the terms. I’m still waiting for solar to provide even 2% of the USA’s total electrical energy needs.

The blind leading the blind.

The PPA is for power delivered, not capacity.

But something is still wrong. I agree that the math doesn’t work.

2.3 % currently. Seems to be doubling every couple of years. See Wikipedia

Add enough qualifiers and anything could be made to sound like the cure to all that ails ya’.

Which is why “deeply invested in the renewal scam” Tom Steyer and the rest of the GreenSlime investors work so hard to own the Democrats from Sacramento to DC.

The earliest investors on most schemes are those ones to make out most handsomely, while later investors may lose money. Steyer is an early investor in the renewable scams. But his investments still need those ITC to be renewed in the coming years. Thus he is working desperately hard to own the democrats who he will then expect to renew those expiring credits, to keep imposing renewable mandates on an unwilling voter base of middle class who will get their wealth stolen to make the GreenSlimers even richer.

From an economic standpoint, it is a transfer of risk to the taxpayer with all the rewards going to the GreenSlime investing in these schemes.

“From an economic standpoint, it is a transfer of risk to the taxpayer with all the rewards going to the GreenSlime investing in these schemes.”

That’s exactly what it is. A pretty sweet deal if you can get it and it’s all nice and legal.

Well, the only bright light I see in this picture is the State of Oklahoma which voted last year to end all state subsidies to future windmill farms, saying to continue would bankrupt the state.

The federal government should do the same: End all federal subsidies for Windmill and Industrial Solar Farms. If they can’t make a profit on their own then they should go out of business. Let the Free Market work.

Later this month the LA Board of Water and Power Commissioners is expected to approve a 25-year contract that will serve 7 percent of the city’s electricity demand at 1.997¢/kwh for solar energy and 1.3¢ for power from batteries.

Someone should ask the commissioners what their estimated cost figures would be if 70% of LA’s electricity demand was being supplied from solar and batteries, as opposed to the contracted 7%?

ITCs and PTCs are just using other ways of de-risking renewable energy investments? Shift the investment risks onto the taxpayers?

There are different ways and/or combination of ways of de-risking renewable energy investments. Popular topic (de-risking) renewable energy investments in UN circles at the present time.

I scanned the expenses for property tax on a power class Utility basis, but don’t see anything, so assume it is a 25 year property tax holiday? Same for the land purchase/rental development etc. Who pays the cost of the interconnection/power line? And the inverters/transformers which are a very big cost. Cost of insurance, with liability and destruction like a hail/wind storm? Engineering/management expenses usually costs 10% of a project cost? Maybe these things (and more) are all buried in the cost of the project, I don’t know, but I have a hard time believing these low rates being paid for 25 years without even an inflation escalator. Maybe I missed that part as well…but I sure wouldn’t invest a plug nickel in those PPA rates and this ROI, especially given that the equipment probably won’t last the life time of the asset. After Murphys Law is factored into the equipment lifetime, they will just get the project paid off and the contract expires. Good luck with a new fair contract when you are a stranded asset. Or the Early Buyout Option at market rates will be a big fat Zero, or a liability to just take it off these developer’s hands after the ITC’s have been utilized to the max. Or this just goes bankrupt in a few years after it is built, and oh well…Sorry.

It looks like to me they just give the cost of pertinent assets like the purchased uninstalled cost of the solar off the shelf cost of the panels themselves, but no other logical expenses that will be required to actually construct and operate the project to connect to the grid at their expense. No details on the battery either… We should follow these project details so as to determine the fundamental honesty regarding these IPP contract claims. Something doesn’t add up to me, and I have been involved in the IPP generation electricity business on a small independent scale since the PURPA days 25-30 years ago when all this started in the 1980’s. Without being able to actually see the contract details and an accounting of the true specific subsidies for this project makes this unbelievable in my opinion. If they are lying about this press release regarding the real details, expenses and rates, then they are ripping off the tax paying citizens of the USA and the customers in LA and are really committing a massive fraud. This project should have their feet held to the fire regarding honesty and transparency.

Just for some general information.

UNFCCC

External Press Release / 04 JUN, 2019

“Major Companies Face USD 1 Trillion in Climate Risks”

News article

https://unfccc.int/news/major-companies-face-usd-1-trillion-in-climate-risks

Who are those who will have to pay for stranded assets?

In 20-25 years, all these solar farms and windmills will be stranded assets, just like all the old wind farms from 20-25 years ago we see littering the landscape. In 25 years, we will probably start seeing the new generation of safer design smaller modular nuclear and all the renewables everywhere will be just be garbage with no one to dispose of it, especially when the assets are wore out and need replacing. I really doubt we will see this low capacity intermittent electricity solve much of the global energy issue anywhere except maybe in niche applications for smaller communities perhaps not connected to a grid. Or it becomes a stranded asset/liability because the replacement/maintenance cost is too high and no subsidy will be available in 10-20 years. We will need a solution that solves the majority of the problem, not create new ones with low density energy schemes that can’t pay their own way honestly. And there is a lot of fossil fuels left anyway, so there isn’t really an immediate need just yet.

Don’t forget about the RECs. The extra income stream makes a low PPA possible.

“1.997¢/kwh for solar energy and 1.3¢ for power from batteries.”

Just bill me for the battery power please. Ignore the solar component. 😉

Yeah, me too.

‘Later this month the LA Board of Water and Power Commissioners is expected to approve a 25-year contract that will serve 7 percent of the city’s electricity demand at 1.997¢/kwh for solar energy and 1.3¢ for power from batteries.’

Why not 100 percent and sell the rest? I’m sure people of the world surely had use for that low a price.

Maybe they originally meant battery means additional 3.3 cents? Even that’s a reach.

Power from the batteries is cheap because the input power from the solar panels is correctly priced at $0.00. The instantaneous value of the solar panel power for which there is no demand (noon on a sunny cool day) is at best $0.00/Kwh.

Dennis, it actually a little different than that, but you’re close.

From memory the existing power lines from the location to the city can only carry 400 MW of additional power, but solar panels can’t reliably deliver that, so they are planning to install 600 MW of panels to keep the 400 MW power lines at capacity most of the daylight hours. Thus they expect to have lots of spare (free?) power to charge the batteries with.

400MW (name plate?) plant and an 800MWh storage. So the battery will store 2 hours of power at name plate capacity? Or am I missing something? I’ll tell you one thing. This is the only business type that doesnt have to have auditing. Surely the federal subsidy claim needs proper accounting?

Gary Pearse, No auditing but they make up for that with a model that shows it all works so well, CA will be able to fund state pensions with the $0.013 revenue from the free battery power (it was created by wind, see, which is free!).

Old adage: If it sounds too good to be true, it probably isn’t true.

Another way to say that: if you hear from it before the industry is using it full steam, it’s nothing.

Btw, the only way a rooftop may beat industrial production is subsidy (by directly subsidizing or taxing the other option). Reagan was right about the government.

it’s not like we all don’t wish this. some of us can just do math

Someone along the line slipped a decimal point in their calculations. Tax credits and accelerated depreciation benefits included, you simply cannot build a solar plant of any variety for 1.997-cents per kwh. Ten times that amount is nearer to reality.

You can build a solar power plant for in the Mojave Desert for 1.997-cents per kWh. You’ll just lose money operating it.

+1

Article about energy – oil, solar, whatever – usually are confused about capital costs (construction and financing) and operating costs, and that the construction costs must be recovered during the equipments’ expected lifetime.

This ignorance about accounting is the source of most claims about cheap energy.

Also, there is the “winner’s curse”. Losses are frequent in projects involving open bidding because the winner is often the one who made the biggest errors (overestimating income, underestimating costs). Even in bidding among experts.

This was found in bidding for drilling rights in the a Gulf of Mexico – a game played by pros, where the Curse led to remarkably low returns until the oil companies learned and adjusted.

Given big solar’s brief history, the bidding errors are likely to be big.

Often happens in M&A too… The winner usually paid too much.

If solar were really the cheaper way to go then everyone would be switching to that form of energy and there would be no need to subsidise it. Instead of subsidising it government would be searching for a way to tax it.

1. Make them stick to the price they are quoting for the 25 years.

2. Only allow tax credits to be used for building the generating plant.

Well, as a retired lawyer, I would like to review the entire contract. I’d bet that there are a few provisions that would increase the price. Inflation protection, assuredly. Other provisions to cover expected problems (outages, strikes and labor costs, damage from natural occurrences, loss of subsidies, etc.). Construction delays, unexpected costs (!). And probably a few more that I can’t think of because I am so damn old.

Has anyone seen the actual contract?

It isn’t yet contracted. A bidder came and made a presentation/proposal.

I don’t know if the proposal is available for review or not.

Well, as a retired lawyer, I would like to review the entire contract. I’d bet that there are a few provisions that would increase the price. Inflation protection, assuredly. Other provisions to cover expected problems (outages, strikes and labor costs, damage from natural occurrences, loss of subsidies, etc.). Construction delays, unexpected costs (!). And probably a few more that I can’t think of because I am so damn old.

Has anyone seen the actual contract?

Who needs maths that work when you have ‘fairy dust ‘ !

Will it ever get built has claimed or will its be tax credit cut and run ?

Will the state still need to get most of its power from ‘evil fossil fuels ‘ or nuclear , even if supplied out of state,for many years to come despite this miracle?

Will the states big tech still make dam sure they have a A LOT of backup generators?

I think we know the answer to these question !

solar electricity delivered at time of generation !

Really ?

Once again we have arguments about future energy without considering the 800 pound gorilla sitting in the corner – molten salt small modular reactors. THI is the advanced nuclear technology, certainly NOT the quoted “Advanced nuclear” (light water Gen 3+). Molten salt generation is estimated to explode circa 2024 by investor experts. Not only can these SMRs be constructed rapidly in factories and assembled on sites virtually anywhere , requiring no bodies of water for cooling and very minimal site preparation, but the estimated levelized costs of the power they produce is $40 per MWhr. And since these reactors can load follow (vary output depending upon demand) they have little need for peak load fossil fuel generation. Totally , intrinsically safe (low operating pressures, no possibility of a meltdown, no need for cooling water), these plants can do it all, and very cheaply.

ALL HEAT ENGINES NEED A COOLING POOL. Molten salt does not change the operation of the heat engine, it only changes how the hot portion is fed. You still have a steam turbine plant attached to the salt radiator to produce the actual electricity. It will have the same cooling requirements as a like-sized coal plant. The plant operates on the difference in temperature between the hot side and the cold side, the cooler the cold side, the more efficient the heat engine.

Can’t be bothered adjusting the mirrors and blowing the smoke away. This contract is little more than a fraud upon the the people of Los Angeles.

Once you realise 1) That the consumer and the taxpayer are the same people and 2) That the true costs of backup are not included. – the whole thing goes down the tube.

If I recall correctly, the 7% only get the benefit of wind and solar during the day- 7am to 7pm- after that they shift to fossil fuels since battery power is not feasible.

So it is a house of cards.

After searching the web for lowest cost deep cycle batteries, and reading the literature on useful lifetime, I calculated the cost of present technology batteries is over $0.25 per kW-hr. over the life of the batteries. Lead acid were the lowest cost, even though they has shorter life. Lithium based batteries are longer lasting, but much more expensive. If there is a present technology lower cost, I would like to know about it.

It doesn’t matter how much taxpayers money governments throw at renewable., only God can make the Sun shine and the wind blow.

Currently UK wind and Solar are supplying just over 21% of demand, wind a measly 2.1% Dutch and French interconnectors, coal and nuclear, 8.1%. UK Nuclear 14.9%, UK gas 46.88% says it all. The Anemoi aren’t cooperating today.

Solar is supplying that much for the UK? There has to be some humongous solar farms somewhere taking up a huge amount of land. Of course, your numbers are taken from the max-solar time of day….

At 0.02 per kwh, 25 years,365 days/year, 8 hours per day the company would receive $1.46 per watt of solar panel.

At 10 years, $0.58.

More than a little fishy.

I upgraded my system last summer with Trojan’s new Smart Carbon batteries. I’ve only had my backup generator run for about 10 hours since May.

https://www.trojanbattery.com/pdf/SmartCarbon_Brchr_TriFold_Prn_Handout.pdf

6V batteries…. Does that mean you need 40 batteries to run 240V equipment?

24 VDC then the inverter converts it to 115 VAC 60 HZ. I have 16 batteries in a 4X4 array.

Actually, the math DOES add up. Your headline and post itself are very misleading.

Investment tax credits are equally applied to any business capital investment, not just solar. So it applies to new coal plants, new gas plants, new nuke plants, etc. This is the government that purposely favors business investments in new plants and equipment, as a means of stimulating the overall economy.

Secondly, the battery storage component of the price is an add-on, nobody is pretending that it is not. But it is not an add on to all power generated, since the capacity of the battery storage is far less than that of the PV output. Therefore the storage adder only applies to the battery-delivered power, so that the total is not 1.997 plus 1.2, but 1.997 plus 1.2 on that portion of the power that is battery delivered.

The total capacity of the battery system is 800 MH-H. The total capacity of a 400 MW PV that operates, on average 12 hours per day is approx. 400 x 12 or 4,800 MW-Hr. So the battery storage fee only applies to approx. 1/6 of the total power generated, meaning the total average price with storage is about 2.2 cents/KW-hr, which is still far below the cost of any hydrocarbon or nuclear fueled power plant.

Duane, as one of their justifications for closing Diablo Canyon, PG&E has said that achieving 70% renewable electricity for California by 2030 is easily done — just what California’s politicians and green energy activists want to hear.

What would the cost figures be if 70% — not 7% — of LA’s electricity demand was being supplied from solar, wind, and batteries while future total demand remained at current levels and the target date for full implementation was January 1st, 2030?

If you, Duane, were to be placed in charge of performing the cost analysis work, what estimating tools and techniques would you be using? To what level of detail would your cost estimate be done, and at what level of confidence?

What specific kinds of planning assumptions concerning the pace of technology advancement, future socio-economic conditions, future power demand patterns, and the impacts of regulatory review processes would you be making?

I believe your math is correct but conclusion is wrong. The battery that is not included in the calculation is the fossil fuel power plant running (inefficiently) in the back ground to support the solar power plant when clouds appear and night falls. This is a cost that must be added to the cost of unreliable renewable power to properly make any comparison.

The framework of Duane’s analysis — and the LA Commission’s analysis — cherry picks the cost data and the engineering feasibility data in ways that drastically underestimate the true costs of reaching California’s long term renewable energy targets.

Forget for a moment the issue of whether AGW is real or it isn’t. California is embarked on a course of action where many billions of dollars will be spent in a useless attempt at achieving a low carbon or no carbon energy mix but without nuclear. Just like what has happened in Germany.

No cherry picking … the data are the data.

In point of fact, PV plants do not have very much of an “intermittency problem”, because virtually every electrical power generation and distribution system experienced peak power consumption in the daytime, not the night time when the PVs aren’t working. Which is why the power companies offer various inducements to customers to reduce their power consumption during peak daylight hours and swich to night time peak power demand.

PV plants have a very serious “intermittency problem”, which worsens as more solar power is added to the grid.

It’s called “The Duck Curve”. Peak demand occurs early in the evening. Peak solar output occurs at mid-day…

https://en.wikipedia.org/wiki/Duck_curve

The more solar power added to the grid, the worse the problem gets…

https://www.nrel.gov/news/program/2018/10-years-duck-curve.html

Duane: “No cherry picking … the data are the data.”

The low costs the LA Commission is advertising for the 7% contract are intended to convince the public that solar PV backed by sufficient battery storage can strongly undercut both nuclear and natural gas as a relatively cheap future source of electricity for southern California’s long term needs.

You also apparently believe that solar PV backed by sufficient battery storage can strongly undercut competing sources of electricity.

And so I ask you once again, what would the cost figures be if 70% — not 7% — of LA’s electricity demand was being supplied from solar, wind, and batteries while future total demand remained at current levels and the target date for full implementation was January 1st, 2030?

If you don’t have the estimated cost figures for 70% by 2030 at your fingertips, then how specifically would you go about determining what the actual costs might be?

Any fossil fuel power plant operates “efficiently” regardless of the total power output. Efficiency of steam driven generataors is driven by characteristics the rankine cycle, which is a function of operating temperature range, not the electrical or mechanical power output.

And by the way, all steam plants are relatively inefficient .. with typical efficiencies, as defined by mechanical power output (such as shaft horsepower of a turbine generator) ivided by the thermal power input. Most steam plants operate in the 35-45% range, with nuke plants being on the low end and gas or coal fired superheated boilers being at the upper end of that range.

Electrical generating plants are nothing like internal combustion engines which only operate efficiently within a narrow RPM range, and so require multi-speed transmissions to operate efficiently .. and even RPM is not a linear relationship with output power either.

Duane, where do you dredge up your logic? Manpower is not reduced, turbines are not shut down, the capital costs and wear are not reduced during periods of reduced power output. Mechanical inefficiencies do not change, but when the power is reduced are now a greater part of the total inefficiencies. These costs continue and must be absorbed by the rate payer.

You need to revisit the near disaster that South Australia experienced on February 24th of this year. For five hours the power grid was stressed to its max. As the evening wore on, no power was generated by solar and a minimum by wind but the demand did not decrease at the sun set and the wind died down. SA power had all its steam generation at max, CCGT units at max, OCGTunits at max, Diesel generators at max with little or none coming over the interconnector or from its massive battery. SA power was shutting down users. The estimated cost to the rate payer at that time was $13,500/mwhr.

He just makes it up as he goes.

After all, data is data.

So the cost will be less because the lights will go out?

“…Secondly, the battery storage component of the price is an add-on, nobody is pretending that it is not…”

Ummm…did you read it? Skip to the last line below if you need to.

NickM

June 28, 2019 at 11:00 am

Wouldn’t the battery power be an additional 1.3 cents/kWh, so ~3.3 cents total? Otherwise the stored energy is selling for less than the directly generated solar — that sounds odd.

John Weaver

June 28, 2019 at 11:03 am

Separate product, so not added on top of it

12 hours a day! Go to PVWATTS at NCSTATE, the National Renewable Energy Laboratory. https://pvwatts.nrel.gov/pvwatts.php

In Dec. LA averages 4.07 hours a day TSI at name plate rated under STC.

In Aug. LA averages 7.55 hours a day TCI at name plate rated under STC.

664.502 MWH annual production. You just calculated 1,752,000 MWH’s annually.

That is before round turn losses, panel degradation and battery degradation. O&M downtime…

I’ll like to have an insight of their preventive maintenance schedule and Time Before Overhaul. That’s a massive battery and 25 years is a very long time for chemistries.

If they deep cycle it every night, then the mass is said in about a year, give or take some quarters.

Zzzzzzzzz. Wake me up when there’s ONE single neighborhood in the 1st world disconnected from public utilities and living/operating normally from just sun panels and batteries.

I think your $200 Million is way low. I believe that is just the material cost for the cells. Throw in all the copper needed to tie these cells together, inverters, switch gear, controls, site prep, and structural steel to get the true material cost. Add in labor, engineering, equipment, construction management, taxes, shipping, profit, and overhead. I think the real price is $700 Million. On top of that you have to run transmission lines to get this power onto the grid.

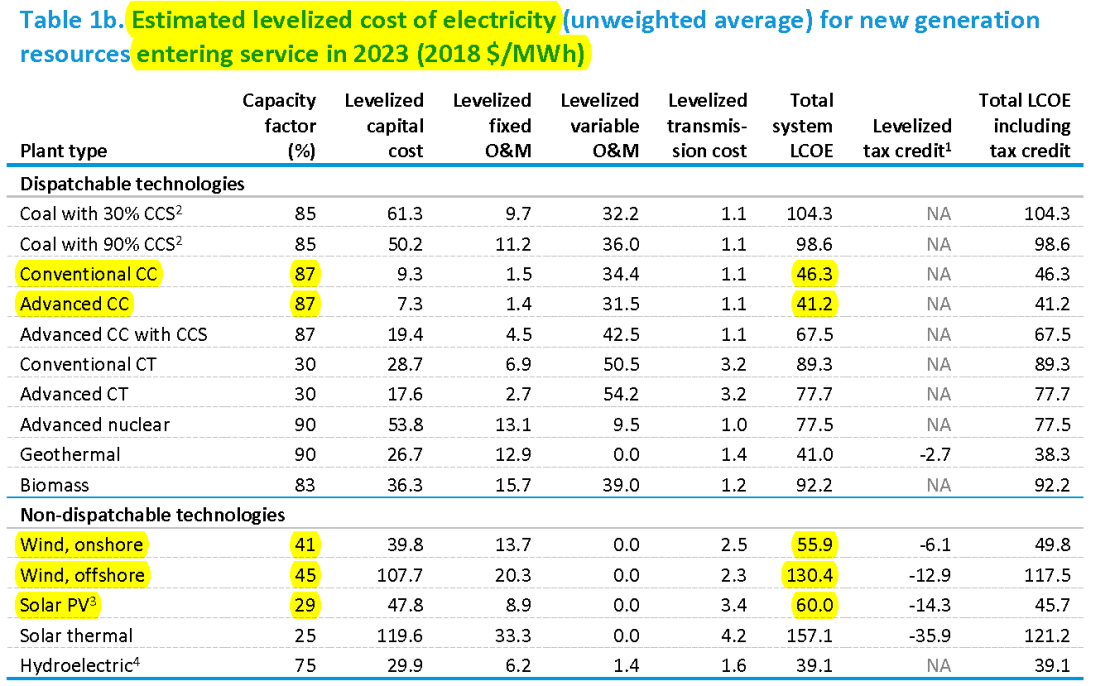

The EIA’s levelized cost numbers assume all generating plants have the same expected lifetime. Thus, they understate the levelized costs of wind and solar.

David, you never explained in your previous post why you used Table 1b (unweighted average values) rather than presenting Table 1a (capacity-weighted average values). Why did you use Table 1b, rather than Table 1a?

For those who are interested, the Table 1a values for capacity factors (in percent) and LCOE (in $/MWh) from same EIA analysis are:

Conventional CC: 87%, 42.8

Advanced CC: 87%, 40.2

Wind onshore: 44%, 42.8

Photovoltaic: 29%, 48.8

You also never explained why think it’s appropriate to base the LCOEs for combined cycle (CC) plants on a capacity factor of 87 percent. For example, what was the average capacity factors for CC plants installed from, say, 2015 to 2017? Was it 87 percent? Or was it considerably lower?

I use 1b because it includes coal.

For those who are interested, here is Table 1a…

I haven’t looked at the plant-specific EIA data for every solar PV facility, but the highest capacity factor I can remember was in Arizona, where it topped 40%. Springbok 1 is a new facility near the site of the proposed Eland facility. It has only achieved 33%.

Combined cycle natural gas power plants have had an 87% capacity factor as long as I can remember. This is from the 2014 EIA LCOE report…

Riiigghht. That’s the reason! It wasn’t because the LCOE for photovoltaics in Table 1a is $48.8/MWh or that the LCOE for onshore wind in Table 1a is $42.8/MWh.

Tell me David, since you obviously consider yourself an expert on technology and technology trends related to the electric power industry:

How many gigawatts of coal-fired utility power plants are you expecting to be installed from 2021-2030, and then from 2031-2040?

Perhaps in the EIA’s “Fantasy Land” (your words). But what about in the real world? Or don’t you know the difference? As I asked, but you never answered, what were average capacity factors for natural gas CC plants installed in the last few years? Were the average capacity factors above or below 87% in actual real-world operation? What sort of number would be produced for LCOE if you used a real-world average capacity factor for natural gas CC plants installed in the last few years?

P.S. By the way, you never took me up on my proposed wind turbine capacity factor bet. Why not?

There really is no issue here: in California, the Public Utilities Commission (PUC) routinely rubber-stamps any request for electricity rate increases based on any reason offered by the owners/operators of electricity generation and distribution facilities.

So, “Sorry that we claimed we would sell electricity for $0.013-0.020 per kWh, but after spending around $300 million to bring the system on-line, we found that this was erroneous and we now have sell the system’s electricity at $0.20-0.30 per kWh. Please.” To which the PUC replies, “OK, sounds reasonable to us!”

The Great Mojave Subsidy Farm.

Are they peeing on my foot while pretending that it is raining?

The biggest battery on Earth (in Australia, made by Tesla) can replace a two-unit nuclear plant for about four and a half minutes. The improvement in battery technology needed to make storage competitive is about like the gap between the Sopwith Camel and the F-22.

So, if this is the gross wholesale generation rate that LADWP pays, (cost) then what will happen to the retail rate in LA after transmission and distribution? Does it lower electricity rates for the consumers in LA, even if it is only supplying 7% of the electricity? It seems to me this press release is being used as a propaganda piece to install in the mind of activists, alarmists and even skeptics that the solution is indeed solar and look how cheap it is…much cheaper than any other alternative. Which we already know isn’t the case because they are comparing apples and oranges and not telling the entire cost story. This is just another Fake News headline by omission to secure climate policies for such a scheme that really isn’t true or as advertised.

“00MW of PV and …. stored solar power from a co-located 400MW/800MWh battery storage system..”

do people reading this understand what it means??

Look at the “Duck Curve.” For a few hours a day the PV will provide 400 MW per hour to the grid. The average for the time the sun is shinning (12 hours) will be about 200 MW. the average for the day will be about 100 MW. That 100 MWs is the number that should be used to determine what the total PV system is worth.

The 400MW/800MWh battery storage system means that the maximum guaranteed and warranted instantaneous output is 400MW over a one hour period. Exceeding this void the warranty and significantly exceeding it will cause serious damage. The “800MWh means that you can extract 800 MWh of electricity. Since you are limited by the 400 MWH rating that means TWO hours at 400 MW or 800 hours at one MWH.

The loss of a typical gas powered power plant would exceed the power capacity of the battery system and would only provide limited help in such an event.

How much CO2 emissions does this scheme offset per dollar saved? How much more must be spent to get to zero?

The scheme is dead on arrival for a multitude of reasons which is made worse by phoney government project estimating about CO2 savings, green scheme efficiency, and all costs.

The idiots are also pretending that there would be no economic consequences to force trillions of dollars to be spent on making our electricity and industrial heat sources ridiculously expensive.

The engineering reality is it is impossible to get to zero CO2 emissions or even a 50% reduction using wind and sun gathering.

The amount of batteries required increases exponential as the forced reduction increases.

The scheme does not include the energy cost to produce the green stuff and replace the green stuff when it wears out.

Battery storage for a few hours is OK for daily load shifting. The problem is days and weeks of electrical power storage which is ridiculous for large states. Think of running a steel plant on batteries or power New York city for a few days using batteries.

The denoument of all this is going to be like that of Enron only many times larger.

Hilarious it will certainly be.

These very progressive Californian turkeys are marching headlong to a very traditional Christmas.

“…The math of a ‘separate product, so not added on top of it’ just doesn’t work…”

The assumption seems to be that solar will power the batteries…what if it is something else?

… have struck a deal on the largest and cheapest solar + battery-storage project in the world …

They may have “large” or they may have “cheap” – but both at the same time? Why do I have doubts…..

I am not an electricity man so I could never have done this myself, but I recognize a turd when I smell it. Remember when I hinted that something is wrong here and I asked all of you to help me out? I was viciously attacked for it. Now we know why – their business model turns into dogcrap when all those tricks are being pulled.

Dave: I respectfully disagree with some of your information and the conclusions you have reached.

The first problem is that you are citing DOE UNWEIGHTED information from Table 1b of the January 2019 report rather than Table 1a (weighted). The DOE summarized information from all recently completed projects (presumably 2018 and possibly 2017). Suppose there were three such projects: a virtue-signally small solar farm with poor sunshine with a contract to supply a California tech company locally generated electricity for $100/MWh and two facilities 10X bigger with excellent sunshine producing electricity for $40/MWh, the DoE would report an unweighted average of $60/MWh and a weighted (by capacity) average of $42.8/MWh. When evaluating the credibility this LA contract, you should be citing the weighted average of $45.9/MWh for the fixed cost of solar or even the lowest known fixed cost $40.3/MWh, not $60/MWh.

If you look at the cost of electricity from solar in 2014, the weighted average was $126/MWh, 3-fold higher. Costs are changing rapidly and the information in the “2019” report is at least a year old. In their 2014 report, the DOE applied an after tax cost of capital of 6.5% to all energy project, similar to the 7% discount rate you cite above. In their 2019 report, they are using only 4.2%. Since this report was being drafted, the 10-year T-bill has fallen from 3% to 2% and there are negative real interest rates for government debt in many countries. The cost of capital for the LA could be significantly lower than the 4.2%. The price of solar panels has also dropped. So the company contracting to deliver electricity from a solar farm to LA is certainly well below $40/WMh. That company, 8minuteenergy, is the largest producer of electricity from solar panels in the country.

Several other companies offered to supply solar electricity to LA for basically the same price as 8minuteenergy, so the going rate with subsidizes is $20/MWh (2 cents/kWh). The 30% federal production tax credit (PTC) for renewable energy will apply for the lifetime of this project, so the price without this subsidy is $28.6/MWh. (I presume the accountants will find some scheme that allows them to make full use of this credit. There is an investment tax credit (ITC) that applies to all businesses, but I’m not sure how it figures in the DoE numbers and would apply to electricity from natural gas too. So, while it may be somewhat remarkable that many companies are able to bid under $30/MWh (without PTC subsidy) when the lowest price in the January 2019 DoE report was $40.3, falling prices for solar panels, falling interest rates and the PTC certainly have gotten the cost electricity from this solar farm near the $20/MWh reported price.

Therefore I think it is absurd to suggest that the report prices are financially ludicrous. (You need to recognize that the cost of capital is a lot lower today than it used to be.)

David: Continuing my comments even though Part 1 hasn’t posted yet.

According to the 2019 DOE report (weighted numbers), a new advanced CC natural gas plant has fixed costs of $8.5/MWh that must be paid whether the plant is generating electricity or not and variable costs (mostly fuel) of $30.7/MWh. So the total cost would be $39.2/MWh anytime. Older plants have higher fixed costs because interest rates were higher when those plants were being built. When the sun is shining brightly, LA can turn off the gas (saving $30.7/MWh), directly use solar from this new farm for the subsidized price of $20.0/MWh, while always paying the fixed cost of the natural gas plant. That is a great deal for LA. The US taxpayers at providing a subsidy (via the PTC) of $8.5/MWh – a lousy deal for them – but the unsubsidized price of using a gas+solar combination is now lower than natural gas alone! Taken in isolation, the net cost of reducing CO2 emissions by 30% using solar farms is zero in Southern California compared with natural gas alone.

California has a 30% tax credit for storage of renewable energy. The battery adds a subsidized $13/MWh to the cost of electricity from from the solar farm, raising the total cost to $33/MWh, a little more than from a brand new gas plant, but probably less than the cost of existing gas plants. Without both subsidies, this battery add $18.5/MWh to the unsubsidized price of $28.6/MWh for a total of $47.1/MWh, almost 50% higher than the $30.7/MWh variable (fuel) cost of electricity from natural gas. Without subsidies, adding the battery costs more money.

It is sunny in the Mohave desert about 75% of the time. If you stored 3 MWh in a battery ($56/3 MWh) for every 1 MWh directly delivered, stored power would certainly cover a full 24 hour on the average sunny day. If one stored 2 MWh of solar generation (added unsubsidized cost $37/2 MWh) in a battery for every 1 MWh directly delivered, it might be possible to rely on solar power for 24 hour on many SUNNY days. Let’s pick the cheaper option and rely on natural gas when storage falls a little short. 100% backup (fixed cost $8.5/MWh) by natural gas would needed for nights following cloudy days and occasional nights when there is a shortage of power stored in batteries. The result would be an 80% reduction in the CO2 emissions for an unsubsidized cost of about $75/MWh, a little less than twice what natural gas from a new plant costs today and perhaps only 50% more than the existing mix of natural gas plants built when interest rates were higher. This is much cheaper than the DOE’s $126/MWh cost of ordinary solar power without storage just 5 years ago.

With the low fixed cost of 100% backup by natural gas and the likely high cost of storage, it is never going to make financial sense to reach for 100% renewable power

Solar PV plants in the Mojave desert only deliver 33% capacity factors.

The LCOE for CapEx, Fixed O&M and Transmission are never “turned off.” The LCOE fore Variable O&M is only incurred while the plant is generating electricity.

This solar PV plant is barely competitive with natural gas entirely due to the subsidies.

David: 100% renewably electricity is an unrealistic concept right now. Every number I calculated included the LCOE for CapEx and Fixed O&M (fixed costs) for the gas plants needed to provide 100% of LA’s needs. That cost was $8.5/MWh in the DoE’s 2019 report. For the older plants serving CA that were built when interest rates were higher, CapEx is higher. These fixed costs must be paid whether LA is powered 100% by natural gas or by a mix of gas and solar. (Transmission costs must also be paid in both scenarios, but don’t necessarily favor one generation technology over the other. California relies on a lot of out-of-state plants to meet variable demand.)

With subsidies, LA can turn off the gas to gas plants on sunny days saving the $30.7/MWh VARIABLE cost of gas and pay $20/MWh to the owner to this solar farm whenever it is delivering power directly to the grid. That certainly isn’t “barely” competitive. That’s 33% CHEAPER! Admittedly, the savings come from US taxpayers.

When the sun is shining, natural gas is “barely competitive” with the UNSUBSIDIZED cost of this solar farm. If one assigns any value to reducing CO2 emissions or to not depleting a finite natural resource needed in less sunny locations, then the unsubsidized solar farm is a winner. (If you think in terms of negative externalities, the same thing is likely true. Discussing the negative externalities of natural gas and covering the desert with PV panels is beyond my expertise.)

Citing data from 2014 article from Real Clear Energy was grossly misleading when the DoE tells you the price of solar has declined 75% since then. So is saying CapEx is 7% today. Subsidies are confusing: There is an ITC every business can use when investing that shouldn’t be counted. Renewables can take advantage of a 30% Production Tax Credit (PTC) that is simple to analyze or a Solar Investment Tax Credit that is much less transparent. I calculated unsubsidized prices based on the PTC.

Now that solar is as cheap as gas when the sun is shining (which is about 30% of the time), the question becomes how much more does it cost to store renewable energy so solar can provide more than 30% of the power. Since storage is expensive, no one can afford to get rid of gas generation capable of handling any intermittence. IMO, we are always going to need the capacity to meet 100% of demand with natural gas. However, the fixed cost associate with that capacity is cheap – less than $10/MWh. Even with today’s low gas prices – about 75% of the cost is the fuel. So anytime you turn the gas off and replace it with wind or solar that costs less than about $30/MWh, you SAVE money. The critical question then becomes, how much does storage add to the cost of renewables? If you consume 1 MWh from solar immediately and store 2 MWh to be consumed at night, in the early morning and late after noon, you have a system that can get almost 100% of its electricity from solar on sunny days, perhaps 30% of its electricity from solar on cloudy days, and still able to meet 100% of demand with natural gas (because the fixed cost of natural gas is so cheap). If the liberals in California want to pay the higher cost of this system, the price appears to be similar to electricity from nuclear and far below what the idiots in Germany are paying today.

The fossil fuel companies get huge subsidies too:

” In the 2015-2016 election cycle oil, gas, and coal companies spent $354 million in campaign contributions and lobbying and received $29.4 billion in federal subsidies in total over those same years “