Guest Post by Willis Eschenbach

Dramatis Personae:

The “EIA” is the US Energy Information Agency, the US agency in charge of data about energy production, consumption, and use. It has just released its January 2014 Short Term Energy Report, with current and projected oil production figures.

And “M. King” is Marion King Hubbert, the man who famously predicted in 1956 that US annual oil production would peak in 1970, and after that it would gradually decrease.

——–

So why is the King meeting the EIA? Figure 1 shows why.

Figure 1. US crude oil production. Data from 1965 to 2013, projections for 2014 and 2015. As is customary, “crude oil production” includes what are called “natural gas liquids”. Data from the BP Statistical Review of World Energy and the EIA.

Figure 1. US crude oil production. Data from 1965 to 2013, projections for 2014 and 2015. As is customary, “crude oil production” includes what are called “natural gas liquids”. Data from the BP Statistical Review of World Energy and the EIA.

Now me, I see that as a testament to human ingenuity, as fantastic news for the planet, and as another example of the futility of betting against said ingenuity. As my dear dad used to say, “Imagination is free.”

I don’t really have much more to say about this great news, other than I see it as a huge opportunity for the poor. The implications are clear. Cheap energy is the salvation of the poor, and this can only be good news for them … not to mention good news for the rest of us as well.

Best regards,

w.

PS—Folks, don’t bother telling me it is “unconventional oil”. That is a meaningless distinction, invented by supporters of Hubbert’s peak oil theory, to try to salvage Hubberts moribund claims. For example, when fracking was done in vertical wells for fifty years, it was counted as “conventional oil” … but now that the drilling is done horizontally, suddenly fracking produces “unconventional oil”. And given that for many centuries oil was collected from surface seeps, in historical terms all modern oil production is “unconventional”. See my post Conventional Wisdom, Unconventional Oil for a full discussion.

PPS—If you disagree with something that I or someone else said, please QUOTE EXACTLY WHAT THE PERSON SAID in the comment where you discuss your objections. I can’t tell you how many times I’ve been attacked over things that I never said … so quote it if you want to discuss it. I’m going to get more hard-headed on this one, I’m tired of picking spitballs off the wall. I’m happy to defend my words if I know which ones you are talking about … but I can’t defend your interpretation of my words. Quote it or lose it.

negrum says:

January 12, 2014 at 8:07 am

This does not detract from the useful work that he did for oil companies.

=============

His Peak Oil prediction certainly helped boost oil prices, by creating an expectation of ever increasing oil prices. As we have seen, this has made the oil market a target for speculation. Buy oil today and sit on it. Tomorrow it will be worth more.

Doug says:

January 12, 2014 at 7:55 am

humans have some bizarre love of any doomsday crisis

============

faced with the certain knowledge of our own mortality, we’d like to believe things will all go to hell once we are gone, so we can be sure we won’t be missing out on anything.

“Cheap energy is the salvation of the poor”

What a crock of shit, sorry but if you think oil companies are doing this for the poor or that the poor will benefit in some infinitesimal way I feel sorry for you as you’re deluding yourself, oil companies will sell to the highest bigger full stop, even if it mean shipping that oil overseas.

Regulated price of gasoline for almost 40 years was 22 cents per gallon.

That (compared to when it started) would be $4.50 a gallon now.

When I built Habitat houses in the 90’s, most of the people moving into them were living in a much higher standard (A/C, Automatic Dishwashers, Cable TV, Unlimited L.D. Calling, Water, plumbing, sewage…) than my Grandparents did, and (mostly) my Parents.

And the reason for that: CHEAP ENERGY… now I have to get personal…Have you ever built, designed, fielded ANYTHING like what BP did to “plug the hole”? Could you? (Hint: I have worked on such projects and equipment.) DO YOU KNOW what the % of income BP makes that is profit?

Are you aware that NBC, CBS and ABC tend to make DOUBLE that percentage on their yearly income? STOP BASHING THE OIL COMPANIES and get into reality. (Hard to do, without thinking, reading…and getting away from “popular” culture.)

Oh, sorry to ramble: But I forgot to include, those EEEEEEvil GE’s and Westinghouses…brought the price of electricity down from $1.70 per KWHr in 1926 (I used to have a KC Power and Light bill from that time, about $0.13 per KWHr, look up the CPI)…to 10 cents per KWHr now. Fracking and CH4 will keep it that way for my life.

CHEAP ENERGY IS THE SALVATION OF THE POOR! Preach it Brother!

Willis,

I feel your initial graph is misleading. Although the graph title does clearly state that this is projected to 2015, you don’t really discuss this fact & after reading most of the comments, I don’t think hardly anyone recognizes that we have CURRENTLY NOT exceeded the initial peak. I won’t dispute that we probably will -BUT – this is a bit misleading.

Here’s the link to the most current EIA data for annual production (through 2012) & a graph :

http://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=pet&s=mcrfpus1&f=a

In 2012, we were at 2.37 Billion barrels per year vs a peak of 3.52 Billion barrels per year – still 33% below the peak.

To put that in perspective : 3.52 billion barrels per year is ~ 9.6 million barrels per day. 2.37 Billion barrels per year is ~ 6.5 million barrels per day. Now, the shale plays have had huge production growth since 2012. So what does production look like right now ? Here’s the link you need :

http://www.eia.gov/petroleum/supply/weekly/pdf/table1.pdf

If you look on line 1 of Petroleum supply, you will see that the average for the last 4 weeks is ~ 8.1 million barrels per day – a substantial increase from 2012 but still less than the peak of ~ 9.6 million barrels per day ( 16% less). You will also note that the annual increase (also from line 1) is just over 16% – so at the current rate of increase , we should be close to having production exceeding the 1970 peak in about 1 year, all else being equal.

I bring all this up not to dispute your point but in the spirit of full disclosure, which is the root of a good scientific discussion (which we don’t see from alarmists in general)

ATheoK says:

January 12, 2014 at 6:06 am

Are the sources finite? Yes! Do we have a clue what finite means, definitively? No!

=======

spot on.

All that is required to convert CO2 and H2O into hydrocarbons is energy and a favorable environment. Plants have been doing it for quite a long time using solar energy. It is certainly possible that the earth itself creates methane and more complex hydrocarbons on a massive scale, as a result of plate techtonics, recycling limestone and water deep within the earth, using heat and iron from the core.

or are we to believe that all the methane and hydrocarbon we see in on earth and in the universe is a result of decayed dinosaurs?

michel says:

January 12, 2014 at 12:52 am

You are right that it’s not that simple. The reality is that the oil extraction technology changed dramatically, even during Hubbard’s time. So your claim, that his prediction was for a “given type of extractive industry”, is falsified on the face of it by simple history. Hubbert knew that the technology was changing. But he, like many others, vastly underestimated the ingenuity of human beings, and the magnitude of the changes that the technology would bring.

More to the point is that Hubbert’s many followers thought that the “Hubbert curve” written in stone and was independent of technology. As a result, they’ve had to resort to dodges like the claim that some oil is “unconventional” … and at present they are an endangered species.

All the best,

w.

cd says:

January 12, 2014 at 2:30 am

If that is indeed the case about Hubbert’s predictions, then he was wrong about 1970s. Why? Because by the 1970’s nobody was using the 1956 “old school” technonogies.

Nor were the “known resources” the same in in 1956 and 1970.

As a result, if we assume your premise that Hubbard was talking about when we’d run out of oil using 1956 technology … we’ll never know, will we?

Hubbard knew the technology was changing, cd. Your assumption that he didn’t know that paints him as an idiot.

w.

David Wells says:

January 12, 2014 at 4:48 am

You appear to be stuck in a time warp, David, because that claim was made obsolete by Simon’s wager decades ago. If you’re not aware of it, look it up. People like dear Hilary have been predicting doom and disaster from resource lack since forever, and guess what?

Here we still are!

So next time someone unrolls a doomsday scenario for you, David, ask yourself … “If that’s the case, why are raw materials still so cheap?

w.

PS—Most of these bogus “three earths are needed” claims are based on the laughable work of Mathis Wackernagel, with his so-called “ecological footprint”. He’s caused more damage with that BS than most people I know. See here for more.

I think it is unfortunate that Hubbert has been so inextricably linked with Peak Oil alarmists. Back in the day, as a geology major, we learned Hubbert’s theory. It was never presented as anything alarming. It presented as a scientific tool for geoscientists to analyze reserves. I fully believe that was Hubbert intent, based on my studies.

And it works well on different scales, given the proper assumptions. And it is based on the physics & fluid dynamics of hydrocarbon production. You can analyze individual wells, individual fields, individual basins, countries or the world. Now the underlying assumption always was & still is constant technology (which in turn could also be stated as recoverable resource). If you change technology or technically recoverable resource, you have violated the key assumption of the theory and it is inappropriate to apply the theory.

Of course, when you are dealing on a small scale, such as an individual well, it is easy to understand if the assumption is good or not. The larger the scale (such as countries or the world) , the more likely the assumption will be violated. That’s all we are seeing with the current rise in production – technology has improved & recoverable resources have increased.

As with past technology, we will see some peak in the future with this new production from shale (due to physics / fluid dynamics & economics) and, as David Middleton states above, this will happen again and again with other new technologically / economically recoverable resources until other fuels are more economic. My favorite quote is we didn’t leave the stone age because we ran out of stone. Similarly, we won’t run out of oil – other sources of fuel will become economic far before then. So, no need for alarm.

Through popular culture, the constant technology / recoverable resource assumption has been lost & Hubbert has morphed into an alarmist Peak Oil theory (because they forgot the assumption along the way). I feel sorry for Hubbert’s legacy as he was a scientist , not an alarmist. Unfortunately, this article further cement’s the image of Hubbert as an alarmist in the public’s mind.

At the top W provides a chart with current and projected oil production figures.

At 8:30 am S provides a (link) chart with “current” field production numbers that is identical out to the red vertical line of the former. Then S says “Your chart is nonsense and not backed by the eia…

Uff da ! [Okay, graphing and units are not the same. Still . . .]

Allan M.R. MacRae says:

January 12, 2014 at 5:24 am

If you think that King Hubbert is a genius as you claim, and you want to convince us that your are as knowledgeable about the oil industry as you claim, you might start by learning to spell his name …

In any case, your claim is that much less than half the original US oil resource remains? Because that’s what Hubbert said. He said US peak oil would occur in 1976, when according to him, half the resource remained … sorry, didn’t happen.

Look at the first image in the movie you posted above, which shows that Hubbert thought that by the year 2000 we’d be well past global peak oil … did that occur? It is that pre-2000 peak that has been heralded every year by the peak oilers … but gosh, Allen, we’re almost a quarter century past Hubbard’s global peak oil prediction, and there’s no peak in sight.

Was Hubbert a brilliant man? Absolutely, his prediction was amazing, and held for years … until, like most geniuses, time caught up with him. Hey, it happened to Newton, it’s no disgrace.

w.

Ahnh, the shale hype strikes again. Why is it good news that capital destruction produces shale oil and gas that can be sold at a price that is below the cost of production? The simple fact is that all that production is not economic and the producers who have been borrowing billions just to stay afloat cannot self-finance any operations outside of a few core areas that are now past their peak. We have seen massive write-downs of shale assets taken by the majors and are seeing a decline of investment from foreign sources. I guess that there are at least a few investors out there who wonder why the accountants only write off a third of the cost of a well when it has produced more than half of all the oil? Or how a sector that uses fairly mature technology that has been in use for more than a decade still can’t figure out how to generate positive cash flows.

I suspect that more than a few readers on this site have forgotten that rational individuals need to remain skeptical. Why is a forecast coming from the EIA, which got the depletion rate so wrong, any more credible than a forecast from the IPCC or the Met Office?

Rud Istvan says:

“The newest 2013 EIA estimate of total US tight shale oil TRR is 24-29bbbl, which less than half of the remaining 1P reserves of the Ghawar field alone. That estimate overstates anything remotely resembling 3P for US tight oil by about half, since it includes 15bBbbl for California’s Monterey shale ( the source rock for most Califonia oil fields). That is because the Montereynis folded and faulted, so horizontal drilling is not possible.”

———————————————————————————————————————

Rud, do you have the imagination to entertain the possibility that the numbers you cite could be proven wrong, and are maybe already well out of date? Pioneer Resources has been perfecting their frack fluids in West Texas, and brought Wolfcamp wells from a few barrels a day to over 1000. Here’s what they say about that unit alone:

t”he company will test 13 zones over the next 3 years. With 50 billion boe in recoverable reserves to date, Wolfcamp is bigger than the Bakken in North Dakota and South Texas’s Eagle Ford shale. Sheffield noted that recoverable reserves are based solely on the Wolfcamp A, B, D, and the Jo Mill. “More reserves are yet to be discovered,” he said.

Geographically, Wolfcamp is comparable to other plays. A unique feature that puts it ahead of other plays is its variety of geological zones. The play contains 3,500-4,000 ft of shales, which is more like 3-4 million acres when considered in 3D space as opposed to 2D space.

“Compare that to the Eagle Ford shale formation, which is about 300 ft deep and the Spraberry Wolfcamp shale, with its 50 billion boe, begins to dwarf the Eagle Ford and the Bakken with 27 billion boe and 13 billion boe, respectively,” Sheffield said.

According to Sheffield, PNR’s success in Eagle Ford has provided a smooth transfer into Wolfcamp. “When compared by phases of development, we see the Wolfcamp trending higher than the Eagle Ford based on activity and production,” Sheffield said.

Based on recoverable reserves, the Wolfcamp is second only the Ghawar field in Saudi Arabia. “We believe this field will reach 100 billion boe recoverable reserves at some point in time,” Sheffield said.”

SideShowBob says:

January 12, 2014 at 5:27 am

Of course oil companies are not doing this for the poor. They are doing it because everyone is willing to spend money for oil. Why? Because it is so useful, it allows our modern lifestyle, and keeps us from freezing and the like.

For the poor cheap energy is even more important, because they are down near the edge, living in the zone where a cold winter leaves them shivering in fuel poverty.

As to whether the poor benefit from cheap energy, if you think they won’t, then you’ve never been anything even approximating poor …

Next time, put on your sideshow with some facts, “Bob”, it’s ever so much more entertaining that way.

w.

Doug says:

January 12, 2014 at 7:55 am

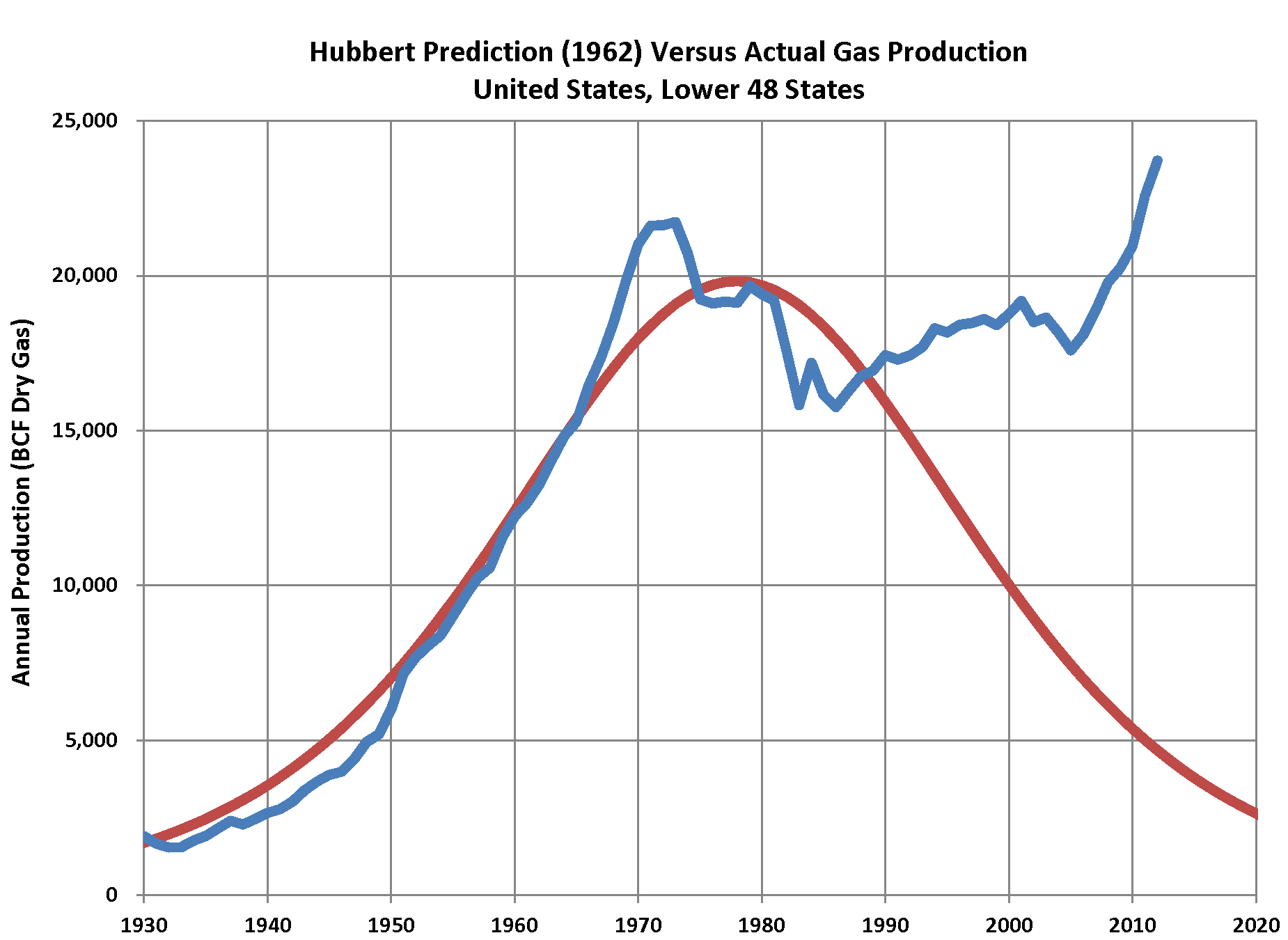

Thanks, Doug. Although Hubbert was correct about the 1976 peak, his idea that decline after the peak would be symmetrical to ramp-up before the peak has proven to be … well … spectacularly wrong.

SOURE: Wikimedia

Was Hubbert a genius? Undoubtedly. Were his predictions right? See the graphic above.

w.

Doug says:

January 12, 2014 at 9:42 am

We believe this field will reach 100 billion boe recoverable reserves at some point in time,” Sheffield said.”

______________________

Considering all the factors at play in our nation’s future, if $1 tax were added to the price of each barrel recovered from Wolfcamp in order to reduce the current national debt, we would be free of about 1/2 of 1% of debt.

Forget Hubbert.

The curves that most affect us politically today are the Club of Rome’s “Limits to Growth” (Meadows 1972). There they explicitly stated that growth in technology will not change the outcome. “Our attempts to use even the most optimistic estimates of the benefits of technology in the model did not prevent the ultimate decline of population and industry, and in fact did not in any case postpone the collapse beyond the year 2100. (Source)

LTG is still respected by some:

The Contrarian view:

Some of the comments indicate a lack of understanding of Figure 1.

Willis clearly states in the caption that this is inclusive of natural gas liquids. EIA crude oil production includes gas condensate produced at the wellhead; but it does not include natural gas liquids from gas processing or refinery gains, the total of which is ~4 to 5 million barrels per day. The boom in domestic natural gas production has tremendously increased the production of gas plant liquids. NGL and condensate are generally worth more than crude oil because they are naturally “refined” to the point where some can be used as motor fuel right out of the wellhead… Although such use might void your warranty… 😉

W

Rud Istvan says:

January 12, 2014 at 8:51 am

Thanks, Rud. Did you even read the head post? Those are not my extrapolations, they were done by the EIA. If you have a problem with them, don’t come bitching to me, go talk to the EIA. I was very careful not to do any “extrapolating” myself, because I knew someone like you would bust me for it. I just posted the EIA data, and let your wild fantasies take over.

In other words, I see you don’t like the EIA message … but don’t shoot the messenger.

w.

And if the supply-demand curve pushes up the price of oil high enough, we’ll start using coal as part of the feedstock for liquid fuels, using the Fischer-Tropsch process that the Germany used in the early 1940s.

David Middleton says:

January 12, 2014 at 10:00 am

The boom in domestic natural gas production has tremendously increased the production of gas plant liquids. NGL and condensate are generally worth more than crude oil because they are naturally “refined” to the point where some can be used as motor fuel right out of the wellhead… Although such use might void your warranty… 😉

_____________________________

None of the ornery boys I knew while growing up in the world’s third largest producing oilfield [knew] anything at all about drip gas. Nothing, I tell you.

@SideShowBob at 5:27 am

Two points here.

First, the concept of price itself is a product of man’s ingenuity. It is one of man’s greatest inventions, second only to the concept that the price can vary.

Second, Hubbert’s curves were derived during a time of historically low and stable oil prices. There were more price crashes than price spikes. So an environment where prices would rise 10x and 20x would test the assumptions Hubbert used.

Hubbert’s curves gave warning that prices must rise.

GlynnMhor:

At January 12, 2014 at 10:19 am you say

Not Fischer-Tropsch but LSE. Other than that, yes.

See

http://wattsupwiththat.com/2014/01/10/natural-gas-switch-from-coal-brings-power-plant-emissions-down/#comment-1532437

Richard

Thanks for an excellent post, one of many, from the author.

Some weeks ago, I read about ‘crude oil’ made in a lab from algae.

http://www.pnnl.gov/news/release.aspx?id=1029

If true, then I could imagine a world where, all people who would need fuel for any reason, would have a device that would,on demand(relatively),create usable fuel from algae…?

Now that would be something,even if it was scaled to town size or scaled up to world size, whatever…just speculating.

I think that point about peak whatever(temp. comes to mind…) changing over time, is the reality of the situation and i think all this debate is over who/what is going to be in control of it. I did notice that that press release did not get much coverage.Who knows, maybe it’s not true? If we can reproduce natural processes, then, what does that do to the status quo?

Thanks for the interesting articles and comments

SideShowBob suggests: “… what renewable will do in the near future is put a ceiling on energy pricing.”

That’s hardly likely given the unreliability and higher cost of ‘renewables’.