When President Biden talks, there may or may not be any connection between what he says and the real world. Yes, you need to give every politician some leeway, since most of what any politician says will fall in the general realm of political exaggeration or hyperbole. But even within the disreputable category of politicians, Biden can take the lack of connection with reality to a whole new level.

You may have your own favorite among Biden’s preposterous statements. For me, the very most preposterous is one that he has been making repeatedly for the past several months, namely that his energy plans, including expansion of wind and solar electricity generation together with fossil fuel suppression, will save American families the very specific amount of $500 per year each. This claim has popped up in multiple places and multiple formulations. One example came in the State of the Union speech back in March, where Biden said, “Let’s cut energy costs for families an average of $500 a year by combatting climate change.”

It’s just not possible for anyone who thinks about the subject for even a few minutes to believe that building more and more wind and solar generation facilities as our primary sources of energy will do anything other than vastly increase the costs of energy for the American people. Even in the early phases of the process, where wind and solar generation are well less than half of electricity generation (and electricity is then only about a third of total energy consumption), you obviously need full backup from some dispatchable source, almost always fossil fuels, to make your electricity grid work. That means that you will come to have two fully redundant electricity generation systems, when previously you had only one to produce the same amount of electricity. Two fully redundant systems can’t possibly be cheaper than just one. Then, if you insist on phasing out the fossil fuel backup and replacing it with battery or some other storage, you have to add the cost of that storage to the mix. Readers here know that the cost of backing up wind and solar electricity generation with battery storage is truly monumental, potentially a large multiple of the entire U.S. GDP. For more on that subject, see some of my prior posts, for example here and here.

And this is not just a question of models and projections that can be debated. As more and more wind and solar generation facilities have been added to the electrical grid in various places, the inevitable dramatic rise in cost to the consumer has in fact occurred. Steven Hayward at PowerLine in a post on Wednesday reproduces graphs showing the results for two of the most enthusiastic adopters of the wind and sun for electricity, California and Australia. Here is the chart for California:

As California has added more and more wind and solar generation, its electricity rates to the consumer have followed a sharply increasing pattern, up some 58.3% from 2008 to 2021. Even after adding all that renewable capacity, the percent of California’s electricity production from the wind and sun in 2020 was still only about a third, according to a February 2022 Report from the California Energy Commission. Thus California has not yet even begun to confront the challenge of phasing out fossil fuel production and trying to back up its electricity grid with batteries — that will occur when the percentage of electricity from intermittent renewables gets past 50%. But note that dotted red line near the bottom of the chart: the 41 states with “low penetration” of wind and solar generation only had rate increases of 9.5% between 2008 and 2021.

And here’s the chart for Australia:

After declining gradually for decades, Australia’s consumer electricity prices have about doubled since 2005. The doubling coincides with the rapid addition of new wind and solar generation facilities since that time. And as with California, Australia’s generation from the intermittent renewables remains well below 50% of electricity generation, meaning that again the vast cost increases inherent in phasing out fossil fuel backup have not yet begun to hit to any significant degree.

Similar patterns of electricity prices soaring as renewable generation increases can be found in other places with high penetration of renewables, for example Germany and Denmark.

With these data and plenty more like them out there, Biden continues to double down on his assertion of the supposed $500 per family per year “savings” from his plan for green energy transition. In a an op-ed published in the Wall Street Journal on May 30, Biden put it this way:

A dozen CEOs of America’s largest utility companies told me earlier this year that my plan would reduce the average family’s annual utility bills by $500 and accelerate our transition from energy produced by autocrats.

That line finally got the Washington Post’s “fact checker,” Glenn Kessler, on the job. Kessler’s June 2 piece has the headline “Biden’s fantastical claim of $500 in annual utility savings.” Kessler started by tracking down a White House transcript of the meeting that Biden held in February with the group of utility executives. There was no mention at all of a supposed $500 projected saving in “annual utility bills”:

But when we located the transcript of Biden’s conversation with utility executives on Feb. 9, we found no reference to $500 in utility savings. The figure was also not mentioned in the White House readout of the meeting.

When Kessler asked the White House for the source of Biden’s number, he was then referred to a report of something called Rhodium Group that projected an approximate $500 per household saving by 2030 not from lower utility bills, but largely from consumers switching to electric cars. Putting aside for a moment whether consumers switching to electric cars could save anybody any money as the government strives to destroy the electrical grid, Kessler points to these obvious flaws in Biden’s statement:

But he didn’t hear that [$500 figure] from utility executives. And the report he is citing is not about household utility-bill savings. Most of the claimed savings comes from the reduced cost of driving. And the estimate is for 2030 — when he would no longer be president, even if he served a second term.

Kessler then awards Biden four Pinocchios.

Read the rest of the article here.

Washington Post did the job. No comment needed from me!

“After declining gradually for decades, Australia’s consumer electricity prices have about doubled since 2005. The doubling coincides with the rapid addition of new wind and solar generation facilities since that time”

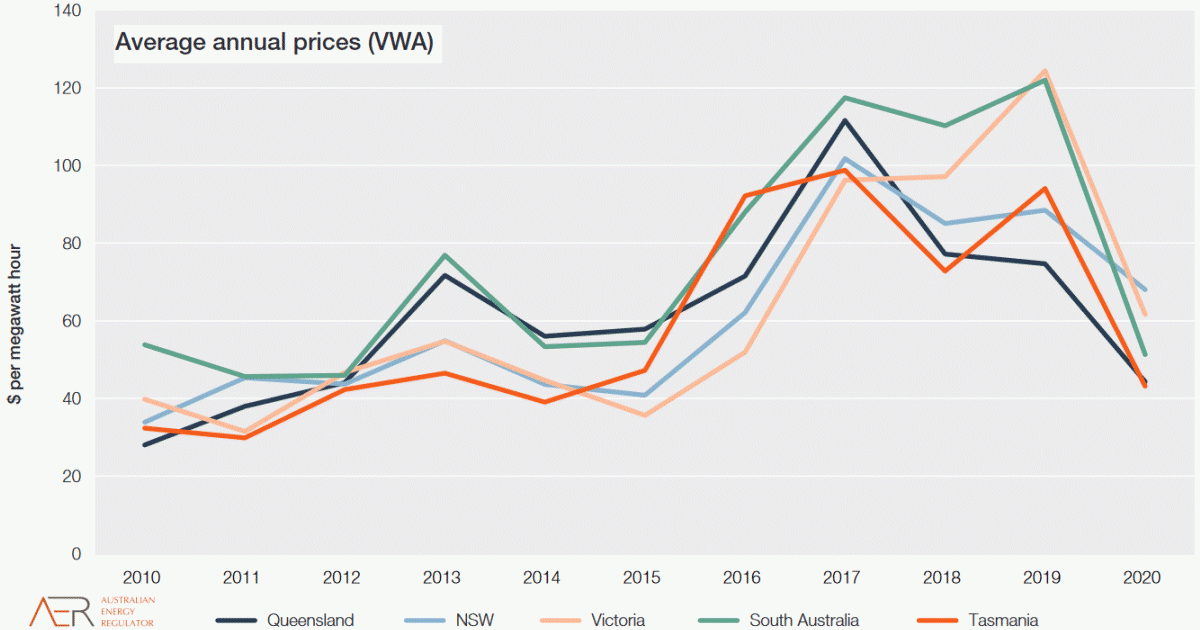

Australia’s states have varied uptake of renewables. South Australia famously is at about 50% renewable, while Qld remains mainly coal. Here is a plot from AER of wholesale prices (annual average 30 min) in the various states:

The yellow line is SA. It used to be the highest. But starting about 2017, declined rapidly to lower mid-range. The blue line is Qld. Now with high export prices, local electricity is the most expensive.

SA, with no useful local fossil fuel supplies, is now a big exporter of power.

“Wholesale prices” says it all. When you introduce subsidies into the equation “pricing” is irrelevant.

The quote and the article were all about how renewables allegedly raise prices. They don’t.

Have you mastered 2 + 2 = 5 yet Nick? Winston found that one the most elusive.

My thing is making supported factual comments. And yours?

Your thing is moving goal posts and answering questions that weren’t asked.

Give credit where credit is due. Engaging Nick is like watching a world class magician – you know for a fact that the assistant isn’t really being sawn in half, but the misdirection is so perfect you can’t help but admire the act.

Very few facts in your comments, Nick !

Nick,

From http://www.safa.sa.gov.au-

“ In just over 15 years South Australia’s energy mix has shifted from below 1% renewables to over 60% of energy generated from wind and solar, supported by innovative battery storage technologies and gas.”( Note the final phrase).

And how does this work in practice at present?

The AEMO data dashboard records the 15 minute blocks of bids for energy from suppliers throughout the National Grid.

The SA figures from AEMO data for recent daylight energy purchases expose the renewables problem.

May 24, (late morning,I recall)- negative $89-00 ( a credit on purchase),

May 31 at 11-20 am- negative $47-51 ( another credit),

June 2 at 16-45 pm- $998-77.( All other States also around $1000).

On June 2, the energy crisis hit and grid figures exploded by a factor of nearly five, including in SA.

Yes, there were multiple factors at play throughout the Grid including Coal plants off line, lack of gas backup, Ukraine and cold snaps but obviously renewables are not protecting SA from outrageous gas spikes.

“Battery storage technologies and gas backups” mentioned by the SA Department are the second systems spoken about by Francis Menton.

June 4 right now

Yes, SA importing about 120Mw..

Thanks for confirming what I just said,.

Yes, strawman facts. See my above comment.

Laughing at you Nick and your pretence your thing has anything to do with relevant facts.

Wake up Nick as SA is already using State Labor’s diesel generators that were installed along with the Hornsdale unicorn Tesla battery at the time-

Government ‘playing roulette’ with Australia’s energy security (msn.com)

Lithium is unaffordable for serious storage as they point out and the brains trust are into flywheels now apparently-

The New World of Renewable Energy Storage (msn.com)

They’re getting more desperate by the day with this thought bubble rubbish..

SA relies on flogging its solar and wind glut to Vic and further to NSW (a direct interconnector to NSW is underway now) and using their brown and black coal insurance but how long will that last as they’re pouring unreliables into their States now. That NSW interconnector will be a white elephant.

“That NSW interconnector will be a white elephant.”

No. As you point out, SA has a solar and wind glut. And they need the coal (or something) backup. The new interconnector will be as useful as the Vic interconnector. And that is very useful indeed.

“SA has a solar and wind glut.”

Only on rare occasions.

Most of the time they use GAS as their main supply, often also using diesel generators.

The amount they can export is very limited.

At the current moment, early afternoon, they are importing about 100MW.

Australia’s shiny new climate changers with the big election plan and listen to them now-

Action is necessary on energy prices, Chris Bowen says (sbs.com.au)

Government engaging with Woodside over gas (yahoo.com)

LOL and they’ll be on the nose like Biden and the Dems by Xmas

Every place it’s been tried, renewables increase prices. The only time they don’t is when subsidies rise even faster.

“They don’t.”

They most certainly do, because they cause massive disruptions to the grid and reliable supply systems.

The current high costs are because coal fired power has not been built to keep up with demand plus some spare

The reason for that is totally because of the AGW agenda and lies.

Everywhere that has a high infection of unreliables (wind and solar) in their grid, has massively high prices.

Nick, your consistent misdirection on WUWT is on display once again: The article was about Consumer Electricity Prices, not your strawman of Wholesale Prices. Also note that the article talked about doubling of prices since 2005: Look at the wholesale prices on your graph from 2005.

Consumer electricity prices reflect unreliables’ impact on the efficiency of utility operations including economic dispatch of resources (think must-take rules for unreliables, among other distortions), the cost of subsidies on consumers’ bills and other direct and indirect costs of unreliables too numerous to list here. This is all without consideration of increased taxes and higher consumer and industrial prices due to higher electricity prices.

Beat me to it Dave. South Australia, with its highest penetration of renewables, also has Australia’s highest energy prices. Exactly the same as California. And recently SA has been forced to use a lot of expensive gas and diesel, further pushing up their energy prices. And finally, SA is not a net importer of power – they cannot produce sufficient power for themselves.

“And finally, SA is not a net importer of power”

I think you mean exporter, and yes, I was slightly out of date. Here is the table re Vic:

Since wind generation really got going about 2017, they went from being big importers to being net exporters for three years, but in 20-21 imports slightly exceeded exports.

You can’t run a power grid on averages. The solar on my roof generates more power across the year than I consume, however it generates zero at night and between 10 and 20% of what I need on cloudy days. Batteries would either be unaffordable or if I only get what I need to survive a day would die from daily deep cycling well before they could pay for their capital cost. The reality is that I am milking the existing fossil fuel based grid when I need it, with no compensation to it for being available whenever I need it. South Australia is doing the same. Politically no one wants to charge SA the appropriate cost for the extra capacity that is being held for it by the other states. The problem is that other states can’t do the same as SA because someone has to keep the lights on.

Europe, mainly Germany, relied oh French Nuclear to keep the lights on on low wind weeks. Unfortunately France made a decision to go Aeolian and Solar and set a target of 40% by 2030. This included phasing out their reliable nuclear generation capacity until Macron realised that it might not be a good idea a couple of years ago. But the hiatus in starting new builds, problems with existing plants and the unreliability on “renewables” means that Germany might be in serious trouble this winter with all the other stuff that’s going on.

2018 France to close 14 nuclear reactors by 2035: Macron

2022 France expects to exceed self-imposed limits on coal usage to avoid power outages.

“Politically no one wants to charge SA the appropriate cost for the extra capacity”

They are charged via market mechanisms. WUWT occasionally writes about the price spikes that occur when wind is low. Someone gets that money, and they are the generators in other states.

There is risk in all forms of supply. WUWT was writing a couple of days ago about 50% of French nukes being off line. The question is whether it makes money overall. Some will survive, some won’t. Renewables are thriving.

Nick claims: “Renewables are thriving.” Remove the subsidies and other guaranteed use and then lets compare the prices.

You failed to answer previous claims that adding renewables always add costs to the grid.

Nick

It is 100% politics driven. If it was market driven there would near zero “renewables”.

RenewablesSubsidies are thriving.Corrected your mistake, Nick. You’re welcome.

Remember the article on this paperhttps://papers.ssrn.com/sol3/papers.cfm?abstract_id=4000800 defining FullCostOfElectricity

Nick also forgets this impact: https://www.windaction.org/posts/34882-negative-electricity-prices-and-the-production-tax-credit

Nick here are a couple of quotes from an online piece written by Professor Dieter Helm, Professor of Economic Policy at Oxford University, earlier this year.

“It is not yet true that renewables are cheaper than the main fossil fuels once intermittency is taken into account. Simply ignoring the need for back up in claims about renewables costs will not make them go away”

“It is nonsense to compare the cost of wind with the cost of gas or nuclear without including the back up costs for wind”

From ‘The first net zero energy crisis – someone has to pay’ published on his blog Jan 7th 2022.

Prof Helm is by no means a climate change sceptic but much of his academic research has been into energy policy

http://www.dieterhelm.co.uk/energy/

Yes, Helm’s ideas are interesting (rather socialist). Here is a longer quote

“So how to solve the energy price crisis? The answer is to reconstruct the tariffs and charges with an eye to the ability to pay, and to introduce a comprehensive social tariff. That tariff could have several formats. It could be directly related to income, building on the databases for income support and welfare payments. We know broadly who is poor and who is not.

This would address the citizens’ entitlement to the basic social primary good – energy. But it would not address the rest of the distribution of citizens. Remember that net zero is a national project and, like the Second World War, we are in this together, whether we like it or not.

This requires the government to decide what prices should be charged. Fortunately this is aided by the fact identified above that the costs are increasingly fixed and sunk, and they are monopoly costs. Allocating out the capacity and use of system costs is a matter of choice. That is why a social tariff is now plausible. There can be no switching. We are contracted through the state and the regulatory regime to the monopoly costs, and they are most of the costs now.

Some of these fixed and sunk costs are best treated as national investments, and some of them should be passed to the taxpayers. These include the legacy costs. One of the most ludicrous features of the energy bills (the prices) that customers face is that whilst the cost of renewables has been going down, the price of renewables has been inflated by the earlier legacy costs from the much more expensive early investments in renewables. It is like going online to buy a new mobile phone and being told that the price is made up of the sunk costs of making one of the first-generation Nokia models. As costs fall, prices fall in competitive markets.

Market reform is part of this reorientation of pricing. The wholesale market is less and less important (though balancing is more important), as more and more zero marginal costs generation comes onto the systems. The EFP auction approach set out in the Cost of Energy Review can replace the current emphasis on the wholesale market, which in turn means that customers will not be paying the marginal cost of gas on all the electricity they use, irrespective of whether it is zero marginal cost or not.”

One takeaway from that (bolded by me), relevant to discussions below. He refers to renewables as “zero marginal costs generation”. That is he key issue here. It doesn’t mean that there are no costs that we have to cope with, collectively. But it has a big impact on market operation.

We seem to be unable to convince either side of this debate that they are on solid ground, Nick.

There is really only one way to settle this contest over viability / cost of intermittent vs continuous power supply –

give voters what they voted to get – 100% wind & solar generated electricity.

Even give it to them FREE for however long they want to endure this arrangement.

See any downside to this arrangement, Nick?

Do you reckon SA voters would eagerly jump on board with this?

“SA voters”

Well, they voted quite recently, for the Labor party that set up the original transition to renewables. And they seem to have good reason to be happy. From having a way inadequate coal generator and heavy reliance on imported electricity, with the highest rates in the country, they now are able to net export, with rates at mid-range. Wind!

100% wind & solar means no firing up the diesel gennies at night, nor borrowing a cup of power from other states when the wind ain’t blowing and the sun ain’t shining Nick.

I’d give the Crow Eaters less than a month before they pulled the plug on 100% w&s.

He is a socialist from the get go. Here is one quote that tells you just how much he knows about business.

Do you know what the outstanding bond value for Nokia is? It is $500M (millions). Do you think those occurred in just the recent past? How long do you think bonds are issued for. I suspect some of them DID FINANCE the making of the first generation Nokia models. I won’t even bother about looking up Nokia stock. Do you think some of Nokia’s public stock offerings revenues were used to make first generation phones? I am sure they were.

This fellow is just like Obama with GM, screw the little guys that have invested in legacy systems. Their investments mean nothing to the rich fat cats. Guess who got screwed and lost tons of money when GM was allowed to file bankruptcy with no plan to give the little people some value for their investments? The common stock owners! The rich fat cats that had been offered special purchases of preferred stock got their investments rolled over into the new company. This fellow is advocating exactly the same thing.

To hell with that. You need to find another person to roll to reach your nirvana!

Retail prices for the big three in CA have gone up dramatically since AB 32 was signed. The legislature requires a rather detailed brake down of the cost allocations over the years-

https://cliscep.com/2022/05/29/your-lack-of-stature-disturbs-me/#comment-123652

Weren’t “renewables” supposed to lower costs? Don’t you find it odd that as “renewables” are added to the mix the cost is rising?

Let’s pretend for a moment that “renewables” aren’t causing the price increases. If the cost to the consumer is sill rising, then it would appear that “renewables” either aren’t reducing costs, or aren’t reducing them enough to offset whatever else is causing prices to rise.

In either case, failure!

Nick, I think your statement is unsupported. The Texas wind power selling price is famously “lower than coal power” but the vendors get $23 per MWH from the Feds, always have.

They can give away the power. They can pay the grid $3 per MWH to take it! Because it is subsidized. That subsidy is paid for by taxpayers. And that tax is part of the cost of wind power in Texas. Well hidden, I agree, but they pay it all the same.

Plot Western Australia wholesale price against it because we aren’t part of the retarded network

Also know South Australia is a sponge using the other states to prop itself up … watch this space for when electricity supply gets really tight going forward. They are going to kick an own goal like the EU did.

Small task for Nick look up the current rating on risk of blackout per state 🙂

“Plot Western Australia wholesale price against it”

AEMO doesn’t do WA, because, as they say, prices are totally regulated by the state government.

South West Interchange is part of AEMO and we still have a wholesale market look up the price.

Lots of business crooks would love WA to join a National grid but there is hundreds of reasons to stay away from that cesspool

Rubbish Nick. Try Googling “AEMO WA”. You really need to do more research before commenting.

They manage a separate site, WEM. But they do not show WA data on the same site as the others, and that is the reason they give. You can see WA is not shown on any of the AEMO charts I show.

They do that so Eastern State people can’t easily compare or they might start asking questions 🙂

You might want to think about where all the money that AEMO makes goes … start with the budget

https://aemo.com.au/-/media/files/about_aemo/energy_market_budget_and_fees/2021/aemo-2021-22-budget-and-fees.pdf

Table 35 shows the staff rate per hour .. $500 per hour is a good gig hey $20K per week for a 40hr week or $1M per year as a salary. The bigger you can make the bureaucracy the more you can charge if you are at the top.

Wonder who pays for all those staff and salaries … hmmm 🙂

You wonder why Western Australian view it as a cesspool?

Probably should point out why Western Australia numbers are so different

Successive WA governments have stopped the pork barrelling on renewables.

WA Synergy buyback is 7c/unit.

“is now a big exporter of power.”

RUBBISH.

The amount they export in minimal compared to what Victoria uses.

Maximum 200-300MW out of 5-6000 MW.

At the moment, they are importing about 120MW

Nick is wrong once again and behind the times. Over an entire 12 months, South Australia is a net importer. 2020 was the last year that SA was a net exporter.

And of course the other day we had this

South Australia 1128MW Gas, 223MW Diesel, 187MW Interconnects (import), 54MW Solar, 35MW wind !

Wind in SA is a total JOKE !

Well, as of right now (14.35) SA is 93% wind. Price is -$44.83/MwH

Nick, did you ever wonder what effects negative wholesale prices have on the economics of operating generation resources that have no subsidies nor special payment schemes? You apparently don’t understand the arguments you are making and their implications.

Yes, it means that wind is the cheapest thing going, and should be used. That isn’t a matter of subsidy; it’s just that they have no marginal cost, wind being free. And yes, that takes business away from gas and coal.

But the system is set up to be competitive. If coal can’t outbid gas, coal has to wind down too.

Nick, you can’t be this stupid. Or can you?

I spent a career in electric power generation, transmission and distribution, retiring as CEO/GM of an electric utility. I developed and managed wholesale and retail rate-setting. I participated in designing and implementing competitive electric generation marketing schemes, beginning with California’s disastrous market scheme in the late 1970s.

I tell you that neither Australia nor other countries’ wholesale electric marketing schemes are anything remotely resembling competitive markets. They all are rigged to funnel ratepayer cash into the pockets of ruinables crony capitalists.

Additionally, haven’t you ever wondered why market operators would have to pay somebody to take something “free” like wind and solar electric generation? Wouldn’t something like “market distortions” immediately pop into your mind? Wouldn’t a sane market just shut down excess generation instead of continuing to pay them above-market rates for such excess generation?

Nick, you have no idea as to the complexities and realities of electric system technical and economical operations. Please quit beclowning yourself. You are not convincing anybody.

“Additionally, haven’t you ever wondered why market

operators would have to pay somebody to take something

“free” like wind and solar electric generation?”

The operators don’t pay; the “sellers” do. They don’t pay cash, but they give credits. That can only be because it is a cheaper option for them than shutting down.

Nick, I’m not going to waste time on schooling you as to the technical, economic, and market realities of electric power generation and dispatch. You have decided to disrupt rational conversations on WUWT for ideological reasons; there is no way anybody can carry on an honest discussion with you. Goodbye.

There is always a marginal cost of wind. Massive batteries have to be used to keep everything stable.

The system is NOT set up to be competitive, Its nowhere near a level playing field. You must know that, so stop lying . !

I really suggest you go and do some basic homework about how the grid operates, because you are currently showing that you don’t have a clue. !

Negative prices mean that have to sell their electricity and that no-one wants it !

From your screen-capture, you can see that they are importing, (brown coal electricity) rather than use gas and diesel generators.

When wind dies down, as it regularly does, for days at a time, SA price skyrockets, and it also effects the whole NEM because the NEM is so close to failure due to a deficit of reliable power supplies, and has to bring expensive peaking sources on line, so the whole Eastern seaboard price goes very high.

If we had an extra HELE high capacity coal fired power station in each eastern state, maybe 2 in NSW, none of this would be happening, and prices would be far lower, all the time.

The whole knife-edge balancing and extreme cost rises is totally due to the anti-CO2 agenda.

Those who have pushed and supported this AGW nonsense are the ones totally responsible for the current situation. That is people like you, Nick.

And I bet you are proud of the damage you have done.

“If coal can’t outbid gas, coal has to wind down too.”

Wrong again, Nick.

Coal just keeps following it nice steady pre-planned daily routine.

Its expensive gas that has to be used (or diesel as well in SA).. and everyone gets paid at that rate.

You really are showing just how ignorant you are about this topic, (like you are on many other topics)

Did you see the other day

South Australia 1128MW Gas, 223MW Diesel, 187MW Interconnects (import), 54MW Solar, 35MW wind

And this occurs very often especially at that evening peak

Thank goodness SA has plenty of GAS , hey Nick.

What would they use if they didn’t ?

“Its expensive gas that has to be used (or diesel as well in SA)”

Yes, I’ve been mentioning this rather significant difference. But still, if gas outbids coal, coal goes quiet. And consumers have to pay for the gas.

“Did you see the other day”

OK, forget odd days, here is the last 3 months average for SA:

So why is the cost of electricity still going up if they’re getting so much “free” energy from wind and solar?

LOL, Nick shows a graphic that proves SA CANNOT EXIST without GAS.

Well done Nick 🙂

Hint, little boy.. stop digging yourself in deeper.

“coal goes quiet.”

UTTER RUBBISH..

Show us where “coal goes quiet” on that 48 hour graph

You are just making carp up, as you seem to do on a very regular basis. !

Its all about the total unreliability of wind and solar.. That is what causes the high prices.

If there was sufficient coal fired power left for peak times, those prices would remain low and consistent.

The reason there is insufficient coal fired power is the anti-CO2 agenda, which you keep backing to the hilt with your ignorance.

You, and people like you, are totally to blame for the current electricity cost situation.

Wind the cheapest thing going? Not really. When you compare the FCOE for all energy types over the FULL lifetime of the longest-duration source, I.e., Nuclear, wind and solar work out at TWICE the cost of nuclear, coal and gas. Add the required firming/backup and wind/solar costs blow out to more than THREE times. And that’s without considering the additional transmission lines required for wind/solar farms.

“When you compare the FCOE…”

I doubt your arithmetic there. But anyway, it’s marginal cost that matters in bidding. A fueled station can’t bid lower than the cost of fuel. A wind generator has no such limit.

ROI and Operating expenses are not a thing for renewable because they have unicorn parts and costs … no limits everything is free 🙂

I doubt your arithmetic and economic knowledge but please do show us the world according to Stokes always fun.

Nick, “I doubt your arithmetic there.”, it was from a peer reviewed paper. How often is there peer review of your personal opinions? Other than on blogs like this, where your thoughts are being trounced by facts.

Renewables are never ever free!

Nick, have you ever, ever ran a business that needed to meet expenses and payroll? There are always marginal costs that a business must budget for and cover. Depreciation, accrued maintenance, payroll, property taxes, etc. don’t go away, ever. Fuel costs, i.e., wind and sun are just a small piece of the marginal costs a business has whether it produces nothing or the maximum possible.

Yes, wind & solar have all the usual Fixed Costs to cover before they get anything “free”.

I doubt that hydro power generators call their water usage “free”.

Nick, You wrote “wind being free.”.

Wind is “free” only because nobody has put a charge on it. It comes wandering past an opportunistic windmill and is used.

But, take gas as an example. Gas can be free also. It comes out of a hole in the ground, after you turn on the tap. It comes wandering into an opportunistic electricity turbine and is used. (But someone has put a price on it.)

Nick, this seems like a trivial exercise in logic, but it is really important to note that the ultimate measure is best in a form like this:

“Can an operating company use the technique to make a consistent profit, unaided by artificial subsidies?”

That is the question that renewables people mostly decline to answer. All of the AEMO analyses I have read specifically include not only subsidies, but also state that the analysis is tailored to fit government decisions of “net zero carbon” by specific dates (or partial achievement at earlier dates.) AEMO largely exclude operation costs related to intermittency.

Geoff S

LOL… And Nick posts a graphic showing SA is importing electricity

Not very intelligent, Nick !

The prices don’t make any sense – demand is outstripping supply but the price is negative??

Better to use what the homeowners actually pay than the wholesale spot prices, there’s too much going on behind the curtain (subsidies, mandates, contracts, etc) for spot prices to really reflect the bottom line price.

Also isn’t the high price of coal on the environmentalists? If they didn’t force ridiculous limitations on its production and use their would be greater supply and hence a lower equilibrium price.

And it’s high price is also due to the complete failure of wind and solar in Europe to provide their share of power, causing Europeans to stoke the fires again, driving up demand.

What’s Australia going to due during its winter coming soon, when wind and solar hibernates?

It is really stupid betting your life on weather dependent energy sources.

I believe Victoria also runs a clandestine fleet of diesel generators.

“SA, with no useful local fossil fuel supplies”

Another piece of total BS.

SA regularly runs on high percentages of GAS, and often diesel, when the wind doesn’t blow.

GAS and diesel are the fuels that allow SA relies on to keep functioning.

Bull.

Around 40% of South Australian households have rooftop solar PV, an additional installation maintenance and replacement cost to householders that is not included in the relative costs:

South Australians are charged the highest electricity rates in the country, so it’s no wonder that nearly one in three SA households have installed solar panels.

Utility ratepayers subsidize rooftop solar; its in the rates. Uncontrolled rooftop solar contributes to the times the system has to pay wholesale “buyers” to accept excess generation. Eventually, utilities will stop subsidizing rooftop solar altogether.

Many are starting to lower feed-in tariffs already.

All that rooftop solar also adds significant frequency instability.

The “big battery” owners are making a motza just acting to stop the whole SA grid from collapsing at a moments notice. After all, they can never create any electricity of their own.

Political climate emergency

This is the WHOLESALE price. Consumers pay the RETAIL price. The transfer payments awarded W&S, stability costs, reliability costs, transmission costs, distribution costs, GST and retail margin are all added to that to get to the retail price.

South Australia has world record retail prices. This data a bit dated being April 2022:

StateAverage Electricity Usage Rates (per Wh)

VIC. 19.77c/kWh

QLD. 19.97c/kWh

NSW. 22.74c/kWh

SA. 31.52c/kWh

“Consumers pay the RETAIL price.”

The difference between modes of generation shows up in the wholesale price. The retail price basically reflects how much retailers are allowed to rip off customers under the various privatisation arrangements. But consumers don’t pay the retail prices you quoted. No-one actually surveyed what they are actually paying. Your numbers come from a player in the market – Camstar Blue. They say “This was done by calculating the average usage rates of flagship market offer contracts from five leading electricity retailers”.

Nick you have lost your mind.

This statements highlights your lack of understanding.

The mandated transfer payments from consumers to the W&S generators are all applied at the retail level. LGCs are currently priced at $47/MWh. That means W&S can run at minus $40/MWh and still generate revenue.

The transmission costs have increased tremendously in Australia. There are three reasons for this – more lines to connect low CF generators in remote locations that are poorly utilised; stronger distribution networks with automatic voltage regulation to handle the daily reversal in power flow when rooftops kick in and turn off; stronger interconnections between regions so intermittent energy from South Australia can destroy the economics of generation in other states.

There are the stability services that are levied after the wholesale price – there are a whole raft of these lumped under the term FCAS that range from seconds to minutes for both voltage and frequency, then the cost of synchronous condensers to provide the rotating inertia for stability in the millisecond domain, then the cost of orders where gas plants are required to operate below their bid price to provide running reserve; then payments for demand management to avoid the lights going out that go to large consumers to compensate them for the inconvenience.

There are already dispatchable reserve payments but these will be formalised in 2025 through a market system that will pay dispatchable plant to be available but to sit idle. Batteries could earn this fee if they are prepared to leave a nominated portion of their capacity in reserve. HPR already operates this way.

The adverse consequences across the network caused by non-dispatchable generators have been an economic disaster for Australia. Fortunately, it does not take much energy to put coal and iron ore onto ships and these basic resources will be in ever increasing demand as China steps up to build all the woke symbols of faith to the weather gods demanded by the west.

Poor Nick, having to DENY every bit of FACT put in front of you.

You really are embarrassing yourself. !

You are a human 💩. How do you live with yourself?

So you’re ignoring completely that prices overall have soared, Nick. Here in Europe people are having to make real choices between keeping their kids warm or feeding them; and the 100% root cause of that is the drive to net zero. On top of that we have Putin’s assault on Ukraine funded by Europe’s drive to net zero.

Despite ALL of this, you believe the above graph is good news because of what’s happened in SA?!?!?!

I seriously have no idea how you can come out with such comments.

In this study of European electricity prices, the more renewables that a country has installed, the higher the electricity price. Europe was chosen specifically so that a fair comparison could be made among similar countries.

https://wryheat.wordpress.com/2018/02/27/the-high-cost-of-electricity-from-wind-and-solar-generation/

Give Joe a break.

He’s only doing what all proponents of manmade CO2 warming and wind & solar have done from the get go –

pulled number$ out of his arse.

(but as the WaPo realized, sometimes it’s just SO BLATANT, they can’t ignore it. Won’t stop The Guardian though.)

Indeed. WaPo realized it. SO BLATANT as you mentioned.

“…One example came in the State of the Union speech back in March, where Biden said, “Let’s cut energy costs for families an average of $500 a year by combatting climate change.””

Not just the WaPo, even the cartoon world wasn’t buying the SOTU speech.

with apologies to The Loud House.

Joe has always been an asswipe even when he had half of a mind. I wouldn’t throw water on him if he was on fire !

What is not listed are the thing that caused electricity rate increases before 2006.

Each rate increase resulted in jobs going to places like China. My last job was at a nuke plant in China. The reactor vessels were forged for US plant that did not get built.

Let’s go Brandon!

I interpret that as FJB and agree.

What’s happening in the UK right now is a lovely example of why/how Brandon is talking from his derrière.

In UK, ‘energy’ prices are rising rapidly, esp electricity.

Main reason for that being the skyrocket price of natural gas – gas is used to make electrikerie

Basically, if gas, for whatever reason ‘just suddenly disappeared’ and the power it created went with it there’s be a massive shortfall in electricity production

UK has lots of windmills and highly productive solar farms so you’d imagine they, with their zero-cost fuel, would step in and fill the void.

But they’re not doing that.

And it is because of the way the contracts the windfarms and solars operate under, they can sell their power onto the Spot Market (where the price is determined by gas) and are thus now making insane profits.

Because Gov has also mandated they get priority access to the grid to sell their power, they can gouge the market.

They can ‘say’ that so-and-so windfarm has had to disconnect (create a false shortage) and thus lift the price on the spot market.

Because electric has such an inelastic price/demand curve, also like petrol/diesel) it works a treat. Prices skyrocket

Yet the muppets who engineered that market are labouring under the delusion that ‘the wind always blows somewhere‘ and that ‘the wind is free‘ but much much worse, they think that ‘The Market’ will respond to price rises and create more supply.

There is the inherent fault – rising electricity prices will NOT make the wind blow or the sun come out in the same way they will drill/pump/burn more coal or gas

Even worse, only the windfarm operators ‘know’ if the wind is blowing anywhere. Picture a market with only windfarms making electric, the farm owners can set up a nice little cartel = where each/every/any one of them can, for a few days or so, play the role of the bogey-man that gas is presently playing and manipulate the market.

(Big banks in the City of London were found guilty of exactly that behaviour just a few years ago. Was it Barclays ‘fixing’ the LIBOR rate?)

e.g. if a gas fired power station or its supply pipeline blows up, everyone can see that and ‘understand’ if the price of power spikes for a few hours or days.

The renewable generators have been handed all the aces.

But if the wind ‘blows down’ a few hundred miles offshore – who is to know?

Good grief, how on Earth did Barclays succesfully mange to fool the market about the supply of printed money?

Passing a few little porkies about whether the wind is blowing in places no-one ever visits will be a piece of piss

There is the fault with windmills – there is the lie that Biden, and Bojo and the whole goddam lot of them are telling.

= that windmills are engineered to be money printing machines and thus do nothing except cause inflation and raise prices – and they can do that if the wind is actually blowing or not.

Are they really that stupid – where does the ‘Don’t attribute malice where stupidity would suffice’ cliche fit in around here

your “There is the fault with windmills – there is the lie that Biden, and Bojo and the whole goddam lot of them are telling.” right on the money!

Wind and solar are garbage.

Surely Kessler ought to be cancelled for unspecified crimes against wokeness, and for saying something ‘inappropriate’…?

Well, its obvious!! Taken from the perspective of where he intends to push energy prices with a combination of Carbon Charges, and strangulation of supply, easy to manipulate the price of energy as high as is needed to ensure the statement is correct. Obama said so!!

I am not familiar with Australian situation, but thought this was worth discussing in a new thread.

Nick Stokes wrote as follows:

This is surely wrong. Wind in itself, if all you measure is the total cost of an installation versus the total power generated over its life, may indeed be cheaper than coal.

But the products from wind and from coal are not the same. The problem is intermittency. One is wildly fluctuating and uncontrollable, regardless of demand. The other is controllable and consistent.

I don’t understand why people don’t just admit this, because its so obvious. Its like a supermarket buying lettuce or some other perishable food. One supplier A delivers when he feels like it, unpredictably, and its sometimes 50kg, sometimes 5, sometimes nothing. Another B delivers 10kg every Saturday week in week out, and more if the store requests it with some notice.

If you talk to the supermarket buyer, these are not the same product, and the fact that supplier A charges less per item doesn’t mean he is a better supplier than B.

Another analogy would be comparing two bonds. One is 20 year fixed rate, the other is one year which has to be rolled over when it expires. You cannot compare the interest rates as if the two were the same product.

If Nick wants to compare the cost of coal versus wind generation, the first thing you have to do is make the products the same. This means removing intermittency from wind. Could use batteries, could use gas generation.

The second thing wrong with Nick’s argument is the claim that wind is free. The problem is not what the wind generation supply costs to make. Its what it costs to use. This is the other side of the intermittency problem.

When using an intermittent supply, the costs for making it usable fall on the buyer. Its the buyer who has to install or contract for gas backup, or install and run a battery backup. When you take all these costs into account wind is not at all cheap, its very expensive.

Nick’s basic argument is the LCOE argument. That is, take the discounted total costs of the installation, take lifetime power generated, divide, and that’s the cost.

No, it isn’t. This is being in denial about intermittency. Intermittency imposes a huge level of additional costs, and these will be paid by the end user. They may occur in the supply chain at the level of the wind operator, if he is obliged to make his supply consistent.

Or they may occur at the level of the network operator, if he is obliged to arrange for backup or storage.

Or they may even theoretically I suppose be born by the end user, if they are obliged to install customer premise equipment to deal with a wildly fluctuating supply.

But there is no escaping them, they are going to be paid by someone, and that is why wind is not the cheapest thing going.

As the first country or region that attempts to run its grid solely on wind and solar will find out, very fast. And that looks like being a region in Australia. Looking forward to how it works out….!

Nick obfuscates very well. Those type of people are very dangerous.

“But the products from wind and from coal are not the same.”

For the consumer, they are. The NEM is an auction market, and the units are MW supplied for 30 minutes. That is what you bid for, and you don’t care about controllability etc. To take your supermarket analogy, a lettuce supplier may be unreliable, but as a customer, you probably don’t even know about that. You select the best lettuce that is there on the shelf.

“The problem is not what the wind generation supply costs to make. Its what it costs to use.”

No, it is the cost to make. This is the basic issue of marginal cost. The wind producer is bidding to sell a MwH. The cost of his equipment, wires etc won’t change, whether he sells that MwH or not. Anything he gains from that single sale is profit. And that governs what he can bid. The gas or coal generator has an inbuilt marginal cost, the cost of fuel. He will go broke selling MwHs if he doesn’t cover that fuel cost.

“obliged to install customer premise equipment to deal with a wildly fluctuating supply”

That assumes that the customer is making a long term contract with the wind supplier. But people generally don’t. They buy through the market. Prices may fluctuate, but the supply doesn’t. And prices will fluctuate anyway. You may have completely predictable suppliers, but demand inevitably varies (weather, competing businesses etc).

” Looking forward to how it works out….!”

Well, as I tried to show with data above, we’re seeing that. SA is not yet an energy cornucopia, but it is a lot better off that it was a few years ago, when it was still trying to keep its coal power stations going. It’s a windfall!

Have you ever ran a business? Anything gained from a single sale is profit? Sorry, you need to learn what profit is. First, thing is to learn what depreciation allowance is and how it is recovered. Maybe you can explain how a sale doesn’t cover that single expense. Then tell us about other fixed costs that must be covered by that “sale”.

“First, thing is to learn what depreciation allowance is”

That is nonsense. The issue is whether he bids for that MwH or not. If he does, he gets his $100 or whatever, without extra costs. If he doesn’t, he doesn’t. The depreciation allowance is the same whatever choice he makes.

Wow! Exactly what covers that expense. If you owned that windmill, you had better put some of that $100 away to cover your fixed costs. If you put $100 in your profit bin you will have nothing left to pay yourself or other expenses. If you use it all to invest more you’ll be running a pryamid scheme.

Nick let’s try to make this really simple. You could supply all your electricity needs from coal/gas /nuclear and not require any wind or solar at all. But if you use wind and solar you have to have coal/gas/nuclear as well to provide your electricity when the wind isn’t blowing and the sun isn’t shining. You therefore end up paying far more for your electricity because you are running two systems rather than one.

And as for storage back up for wind and solar it will never come anywhere near as inexpensive as, for example, the diesel generators that many hospitals currently use when needed.

“because you are running two systems rather than one”

We are running many systems now. But in the spirit of real simplicity, if you run just gas, you get a huge gas bill. If you run the gas half the time, wind half the time, you get half the gas bill.

Strawman argument alert!

If wind/solar were so great, then why do we need many systems? Could it be that “renewables” aren’t reliable?

But the actual cost of electricity to the consumer isn’t dropping. Weird. It’s almost like “renewables” aren’t really cheaper.

“why do we need many systems”

We’ve always had many systems. Gas, oil, coal, nuclear, hydro. They don’t operate all at once.

“But the actual cost of electricity to the consumer isn’t dropping.”

No. It goes up with the price of coal and gas. Not with the price of sun and wind.

Nearly all of them did. That’s one of the reasons why the grid was stable. Now the politicians, who don’t understand how things actually work, dictate that reliable supplies like coal, oil, and gas must be decommissioned in favor of unreliable supplies like wind and solar.

The price of coal and gas fluctuates. The price of wind and solar was always, and will always be, expensive in relation to coal and gas.

Are we talking directly burning gas for heating|cooking + electricity generated from wind, or electricity generation in both cases?

If it’s electricity, you have to distinguish between the thermal efficiency of CCGT vs OCGT. There will be a point at which CCGT is cheaper over a 24 hour period than wind + OCGT.

Nick, have you really stopped to think about the situation? Electricity prices are rising at the same time the share of “renewables” is increasing.

Doesn’t that strike you as being odd? Why would this be? If “renewables” were so cheap, then why are rates rising ALL OVER THE WORLD as the share of “renewables” INCREASE?

So either the consumers are lying and rates aren’t rising, or the proponents of “renewables” are lying and wind/solar are not cheaper than coal or natural gas.

Can’t have it both ways.

The very obvious reason for the current rise in prices is the rise in the price of gas and coal. Not a rise in the price of wind. Fuels costs are rising especially because of the war in Ukraine, following the ups and downs of covid.

Fuel costs were rising long before Putin invaded Ukraine.

And if the “obvious” reason for the increase in the price of electricity was entirely because of the price of coal and gas, then why were electric rates rising long before the recent increases in coal as gas prices?

“why were electric rates rising long before the recent increases in coal as gas prices?”

Were they? Evidence? Here is a plot of prices in Australia to 2020. There was a rise from 2015-2017, but not much after that. Hard to correlate that with renewables.

No, stop displaying your ignorance.. its unseemly.

It correlates with the closure of coal fired power stations (bar the drop at the end with is totally unrelated)

“It correlates with the closure of coal fired power stations”

Well, that isn’t with renewables. And it went down after 2017, while renewables were growing rapidly.

Nick, I do not know Australia’s situation.

Are you saying that wind in Australia gets absolutely no subsidies of any kind?

A wind supplier just erects a facility, then offers his power to network operators who sell to end users. They are under no obligation to buy from him, there’s no government funding anyplace in the supply? All the sales are freely entered into solely on their merits by both parties?

If so it is very different from the UK. In the UK it costs a great deal to use wind because of its intermittency. Some of these costs are made up by subsidy, others are passed on to end users.

The one who pays in the end for the costs of intermittency, in the UK, is the end user. They are paid in the form of higher prices. This is why I say that what counts is not what it costs to produce but what it costs to use. Wind is part of a system supplying power to end users. End users are paying higher prices because using intermittent sources costs more, and this can only in the end be paid for either by the end user purchaser or the taxpayer. In the UK its both.

Are you saying that in Australia none of this happens? There is no equivalent of the contracts for difference, and no renewable purchase obligation? Investors are just putting up wind farms and then selling their product on its merits to network operators who are under no obligation to buy it unless its economically advantageous for them?

“All the sales are freely entered into solely on their merits by both parties?”

The sales are freely entered into. Because they don’t have fuel cost, the wind suppliers can underbid the others, when they have wind. The subsidy came in the form of a renewable energy target, which required suppliers to supply a certain fraction of their business as renewable energy, or buy from someone else a certificate representing their production of renewables. This scheme was designed to taper off once the target had been reached, and that is happening. The market price of the certificates comes down.

You’re right that overall intermittency imposes a cost that in the end is paid by consumers. But they also pay the cost of gas or coal. And the costs of intermittency can be reduced by expanding the market.

Coal and gas are not intermittent sources. Natural gas plants can be ramped up and down relatively quickly, but only because the operators wish them to do so.

Coal and gas plants don’t shut down at night or on windless days because coal and gas supplies disappear.

“Coal and gas are not intermittent sources.”

No. But they are expensive.

“But they are expensive.”

No they are not. Grid scale coal is far cheaper than grid scale wind, because of the problems that wind and solar cause to the grid.

Every country or region that has a hig infection of wind, has the corresponding high electricity price.

That is the facts..

No amount of petty distraction from you is going to change that.

Well, to justify your claim, this is what you will have to show.

You will have to start from a given level and pattern of demand. This is the really critical point.

Then show that meeting this pattern entirely with conventional generation, in this case coal, is more expensive than meeting it with a mixture of wind and coal.

I don’t believe this can be shown, don’t believe it is true. If it were, there would be no need for the UK renewables obligation and the contracts for difference.

But cite a proper study that shows it, and I am prepared to consider it.

The fundamental problem is intermittency, which results in large amounts of wind power being generated when its neither needed nor usable. This leads to the UK system of paying wind farms not to supply. Then it also results in periods when the power is desperately needed and is simply not available because of a calm.

This occurs typically in the UK every winter when there is a period of blocking high, cold calm weather, when solar generation is very low.

In the past, power generation was planned around forecasted demand, which was fairly easy with coal and is now even easier with gas. The changes in seasonal demand were pretty regular and predictable.

The problem with combining coal and wind is that a stable system (coal) which cannot be turned up or down at the same rate as wind fluctuates. And of course wind supply is uncontrollable and not very predictable.

Take the two problems of oversupply and undersupply and mismatch to demand, and the conclusion any network planner would come to, in the absence of legal constraints such as exist in the UK and apparently Australia too, is that he doesn’t need any wind supply. The price he will offer is way under what would pay for the costs of the wind operator.

In your scenario of a totally open market, the wind operator would end up only selling when a demand peak coincided with one of his generation peaks, very rare. What you use for this is rapid start natural gas generation. You cannot use wind for this.

Still, if you know of a study showing that total system cost for an all or substantial wind based system is lower than that for a coal based one, I would be interested to read it.

But it cannot be the LCOE type of justification which focuses on production and doesn’t consider the real cost of meeting demand. It has to address specifically meeting a known pattern of demand close to what we know happens in Western societies.

See also this: https://gridwatch.co.uk/WIND. Which makes the point perfectly plain.

Nick, you are a competent mathematician, but it’s rather obvious that your economics/accounting background is rather limited.

or, in the words of Inigo Montoya, “you keep using that word, but I do not think it means what you think it means”

To get back to the basics, marginal cost is the cost of producing an additional unit of output at the margins. Economies of scale apply when the marginal cost decreases, In thermal electricity generation, this comes from increasing the capacity of the generating units, increasing the thermal efficiency, or adding more units. Basically, the first unit of output has to cover the operational costs, but the operational costs are largely constant so the second unit of output then becomes “free” as well. That is a rather extreme case, of course.

What is not often realised is that the marginal cost includes a “normal” profit. “Normal” profit is dependent on risk, and must be at least the risk-free time value of money.

In practice, it is far more complex, because all costs have to be covered in the longer term, so NPV is the appropriate metric.

At a pinch, a business can come out ahead by selling additional units of output above the instantaneous marginal cost,

Another attribute of marginal cost is that it is constrained by the availability of excess capacity. Once the excess production capacity has been exhausted, additional capacity must be added. This causes a step increase in the marginal cost, because that additional unit of output must pay for the capacity increase, which brings us back to the start.

The bottom line is that the “zero marginal cost” of wind or solar electricity generation is a rather dubious approximation as time intervals approach zero, because at a bare minimum the wear and tear on the equipment and “normal” profit have to be taken into account, and there is comparatively little excess capacity available in a single wind generator or bank of solar panels.

“at a bare minimum the wear and tear on the equipment and “normal” profit have to be taken into account, and there is comparatively little excess capacity available in a single wind generator or bank of solar panels.”

No, the windmills are spinning anyway, and the solar panels don’t have wear and tear caused by extra current. You either sell the extra power and get paid, or you don’t. There is no role for “normal” profit there. A wind generator produces whatever it produces; the only decision is whether to sell the product at the going price, or not. And there is no reason not to sell.

A free-wheeling wind generator, at a minimum, puts less load on the bearings than one generating to capacity, so the marginal cost of production is always non-zero. Instantaneous marginal cost can approach zero, but you of all people should be aware that Lim X -> 0 != 0 except in very specific cases.

You seem to be conflating the spot sale price with the actual marginal cost of production.

A claim that the instantaneous marginal cost of production for a wind generator running below capacity is very close to zero would be a more correct premise.

BTW, I should ha pointed out that “the windmills are spinning anyway” and “wind generator produces whatever it produces” just mean that there is very limited control over the output in the time interval of interest, which has nothing to do with the MCP. If it’s producing anyway, any sale at a price above the transaction cost is positive revenue.

Yes. The problem with “the windmills are spinning anyway” argument is that it does not take account of the costs of trying to use that supply. You are trying to combine a stable generation base from coal with an unstable and wildly fluctuating supply from wind.

Someone then says that the wind supply is cheaper. But that is irrelevant. What counts is total system cost of the two alternatives, coal by itself or coal with the fluctuating wind added to it.

Here is the problem with your analysis. If you are saying that marginal costs are already paid for and that the “fuel” is free for the next produced unit, then there is no reason that the next unit sale price can’t be less than any other provider.

In order to use this logic you must also indicate what portion of the output is dedicated to recovering all the costs associated with the business. You can’t run a business otherwise. If wind and solar can’t produce this “base line” power consistently, then more must be charged at the margin to recover the expenses when power is below the base line. Or, more must be charged for the power as produced to make up the difference. That is the penalty that unreliability produces.

Yet what the market has done is to prevent coal and gas from recovering their costs except when wind and solar are not capable of producing enough power. That means they must recover their fixed costs when wind and solar are not producing, artificially raising the price they must charge. Whereas, if they could produce constantly, which they can, their prices are minimized and are probably below wind and solar.

Nick, the question is about total system cost.

Is a system consisting of coal and wind cheaper to build and run than one consisting solely of coal?

I think not. But lets see a proper study, if there is one, which can be claimed to show the opposite and we can consider it.

The issue is not the marginal cost of production of one or the other. The issue is the cost of the system as a whole.

“But lets see a proper study”

Well, OK, let’s see it. I think you mistake the burden of proof here. Renewables are being built, privately funded. They are connected to the grid under current rules. You apparently want some action taken to prevent that. Let’s see a proper study.

The fact is that renewables have a very obvious advantage in cost of fuel. The disadvantages in cost terms of needing backup etc are more nebulous. Let’s see the balance quantified.

No, the question is whether a wind + coal system is cheaper to build and run than a coal only system. The fact that the breeze is free is irrelevant.

Wind farms are being built today on the basis of legal compulsions to buy their product. And in many cases price guarantees and subsidies. Paul Homewood has documented this for the UK. The renewables subsidy in the UK is about 450 Sterling a year per household.

All the studies I know of say that when the product is made comparable wind costs at least double what conventional generation costs.

If wind is not made comparable, ie the supply remains intermittent, its still far more expensive, but this time the costs are incurred as system costs to deal with the fact that a big chunk of supply is intermittent.

You keep saying that the wind is free. Yes, of course it is. That does not mean that the product delivered by using it is cost effective. It is not.

Your argument would justify sailing ships. Yes, the wind used is free. But this doesn’t mean they are cost effective alternatives to oil fired ships, and in fact they are not.

Nick, you’re a very intelligent guy. Just think it through. Think through the full implications of intermittency. Admit them. At the moment your arguments are a real disappointment.

michel

“No, the question is whether a wind + coal system is cheaper to build and run than a coal only system. The fact that the breeze is free is irrelevant.”

Of course the difference in fuel cost is relevant. And you really need to quantify some of these assertions. There is a IEA LCOE calculator here https://www.iea.org/articles/levelised-cost-of-electricity-calculator

I’ve rearranged it a bit to show relevant cases for Australia (but in USD/MwH). It is 2020 data, so fuel costs are probably doubled since then. But even then they were very high. eg for CCGT gas fuel cost is $56.04, out of a total of $73.75 (omitting carbon cost). And it dwarfs the total cost of $33.69/MwH for onshore wind.

Excellent!

The various governments have rigged the wholesale electric market to favor wind and solar. A combination of taxpayer and ratepayer payments to ruinables, plus governmental distortion of what would otherwise be a true, efficient market’s operation results in far greater overall costs to society.

Yes in the UK the subsidies to unreliables make up almost 25% of electricity bills.

Two more quotes from Prof Helm who I referenced earlier

(This is for Nick)

“It is not true that we can bask in cheap offshore wind. On the contrary two inconvenient facts remain. First, whilst intermittency was not much of a problem when there was very little wind capacity in the system, it now very much is. Second these subsidies still have to be paid”

“In the old fossil fuel – nuclear system, total capacity requirements were of the order of 70-80 GW. For a system where the wind sometimes can produce all energy desired and sometimes very little, that firm capacity has to remain in place, plus the wind turbines too. We need a great deal more capacity to meet any given demand.This has to be paid for by someone”

Now what is happening in the Netherlands, as wind and solar generation have increased dramatically: the moment the sun shines, electricity prices plummet, and solar generators can’t earn a penny. Same for wind. When it is dark and windless, the fossil generators do not earn enough to make up their losses on sunny and windy days.

wind and solar generation are well less than half of electricity generation

More like a small fraction of electricity generation for the entire United States, 12% in 2021, though it’s much higher in some states.

Thankfully it is as low as it is, otherwise the cost of electricity would be much higher!

Biden’s energy policy is a classic pushmi-pullyu – a two-headed beast from “Dr. Dolittle” with each head pointed in the opposite direction. The more they try to make it go, the more it struggles. Hilarious to watch.

There is really only one way to settle this contest over intermittent vs continuous power supply –

give voters what they voted to get – 100% wind & solar generated electricity.

Even give it to them FREE for however long they want to endure this arrangement.

My bet is that within 2 months or less the punters will start denying that they ever voted for 100% wind & solar, all they ever wanted was a little bit every 2nd Sunday afternoon.

California.

California ISO – Supply, Today’s Outlook

Over the past week, the amount of power imported into the state has not dropped to zero, night or day. What’s going to happen when summer comes and the out-of-state suppliers don’t have an excess?

Blackouts?

Why are California politicians (among others) trying so hard to force their citizens back into the dark ages? Bicycles, walking, solar power, wind power – it’s almost like they all want us to go back to living in huts and caves again.

So, to save $500 per year in energy costs we need to buy $50,000 vehicles.

With a break-even point of 100 years. Not impressed.

Only in Biden’s LibWorld does spending $50,000 to save $500 per yer make sense.

Even if he HAD heard that claim from utility executives, that wouldn’t necessarily make it true. Given the way utility regulation works, they might have wanted higher asset bases in order to justify higher profits, or might have just been sucking up to the president. Biden had plenty of resources he could have used to analyze this claim.

Biden is surrounded by zealots who believe their own craziness . Remember when Doris kearn’s book came out pointing out how one of Lincoln’s greatest leadership qualities was stacking his cabinet with people with a variety of contrarian beliefs . But then joe isn’t the sharpest knife in the drawer , is he ?

Can’t resist commenting on Nick Stokes beliefs. I am willing to bet he does not live off grid. I will mention relevance at the end.

I live off grid in a small off grid community. We get “free” energy from Renewables. It’s a lifestyle thing. How much does it cost?.

I have over a ton of old fashioned unfashionable batteries. They weigh more than Lithium, but there is lower fire risk, they are resilient to over/under charging and they last triple the life span of modern batteries.

Solar panels, I recently doubled the panels to cope with cloudy/raining days. Don’t believe the manufacturers, they need replacing every ten to 15 years.

We use a petrol back up generator. Some people use diesel. Some people just use generators because it’s a fraction of the price of a solar system.

No one puts in wind any more. Horrendously expensive, and wind produces too little if any charging. ie, wind is useless.

There are no poor people living here. There are no desk jockies either, everyone is handy. Houses are cheap, but off grid energy and water is expensive. Mostly trades people, they can do a lot of maintenance themselves cutting costs.

Relevance. The free energy from Renewables is very expensive. The costs must be factored into the equation. My oversized system still needs fossil fuel backup. It’s not a one off cost, batteries and Solar lose capacity over time, and need replacement. Renewables means sacrifices, we use ‘biomass’ in a wood heater, gas for cooking, no air conditioning in tropical summers.

I am willing to bet the Nick Stokes of this world do not live off grid, have no idea of amortising costs up front costs, and have no idea on compromises.

There is always something to learn from the other countries that have better progress in this field like Sweden and Norway. For example, 90% of people in Norway drive an electro car on their way to kontorhotell Oslo. And in Sweden, for instance, many coworking Stockholm spaces are using very good cost-saving eco-friendly technologies.