Guest “Frackin’ A Bubba ” by David Middleton

Do U.S. Shale Drillers Deserve To Exist In Free Markets?

By Mitchell McGeorge – Apr 18, 2020In the fallout of the current crisis, one more statistic can be added to the toll of Covid-19 – US Energy Independence. The Shale Revolution was responsible for the growth in US oil and gas production that lead to the President, Energy Secretary and industry bodies heralding the era of US energy independence and US energy dominance.

But, with the oil markets in turmoil, US shale producers who account for over two-thirds of US production (and in particular the Permian Basin which accounts for almost forty percent of total US production) have been ‘tapping the mat’ urging President Trump to save the industry through various means of subsidies, bailouts and tariffs. Shale producers have been arm-twisting US politicians into cringeworthy calls with Saudi Arabian officials because of their belief that Saudi Arabia, as a strategic ally, shouldn’t be following free market practices to harm the US Energy Independence narrative they all promoted.

So much for the US being the world’s champion of the ‘free market’!

[…]

Oil Price Dot Com

A more apt question would be: Do “shale” drillers deserve access to an actual free market?

Show the US oil industry where the free market is (or was) and I’m fairly certain we can compete in it. OPEC wouldn’t exist in a free market. Saudi Arabia wouldn’t be able to literally control prices by raising and lowering production rates. Saudi Arabia’s grip on prices only fails when demand is either too high or too low. The ChiCom-19 hostage crisis has dropped demand below everyone’s functional threshold in the global oil market, free or otherwise.

I don’t know of any US oil companies or trade groups, “‘tapping the mat’ urging President Trump to save the industry through various means of subsidies, bailouts and tariffs.” The industry has been very appreciative of his efforts to broker an agreement between the Saudis and Soviets (just honoring Mr. Putin’s wishes) and use the Strategic Petroleum Reserve as a cushion. After congressional Democrats blocked funding for the purchase of domestically produced oil, the President has begun leasing out space in the SPR for storage.

Harold Hamm, CEO of Continental Resources, the biggest Bakken player, has “has encouraged the Commerce Department to initiate a national security investigation into Russia the Soviet Union and Saudi Arabia for ‘excessive dumping’ in oil markets” and use the threat of tariffs and other measures to halt the state-sponsored dumping.

One of the recurring themes from the shale industry since the Oil Price War commenced is putting tariffs on Saudi Arabian oil imports, like some magic silver bullet that will amazingly save an industry that hasn’t had the discipline to push itself away from the debt buffet table. But, how is this going to work and has anybody thought this through beyond an initial ‘emotional’ reaction?

Oil Price Dot Com

I don’t know of any oil company or industry trade group pushing for Saudi-specific tariffs. Mr. McGeorge correctly points out that such a tariff would be pointless. The “push” has been to use the threat of tariffs and embargoes to force Saudi Arabia and the Soviet Union to agree to cut production. This, coupled with the 20-30% short-term reduction in demand due to the ChiCom-19 hostage crisis, seems to have worked. There has been some talk of the Texas Railroad Commission directing oil companies to reduce production in Texas by 20%; but the largest industry trade group opposes even this measure.

With WTI stuck around $20, nearly every producer is a long way from being able to cover costs let alone develop again. In the most recent survey by the Dallas Fed of 92 upstream E&P companies, WTI prices need to be above $50 for almost all plays before wells can be drilled profitably.

The idea that upstream E&P companies will be able to hold out until development wells can be drilled profitably again is tenuous at best. With mounting debt loads, interest and maturities most won’t be able to last beyond the next six months.

If the WTI price continues at $20, Rystad’s predictions show that Lower 48 production could drop to approximately 6 million barrels by the end of next year.

Oil Price Dot Com

That is, indeed, what Rystad’s Energy U Cube model indicates…

Mitchell McGeorge is supposedly some sort of commodities “expert.” Although he strikes me more as an anti-American Putin apologist. As a commodities “expert” he might have taken a look at oil price futures. The May contract, which expires tomorrow, closed at -$37.63/bbl today. However the June contract closed at $20.43/bbl. A nearly $60/bbl spread between the front and second months of WTI futures… A truly bizarre situation. The price yesterday, today or tomorrow isn’t all that relevant, particularly the expiring May contract. What matters is evolution of demand and prices over the next 1-2 years.

The current WTI futures price for the end of next year is around $37/bbl. The odds of WTI being around $20/bbl in late 2021 are very slim. While not sufficient to support much new “shale” development, $35-40/bbl is enough for most companies to hunker down and ride the storm out, particularly for companies with strong hedge positions…

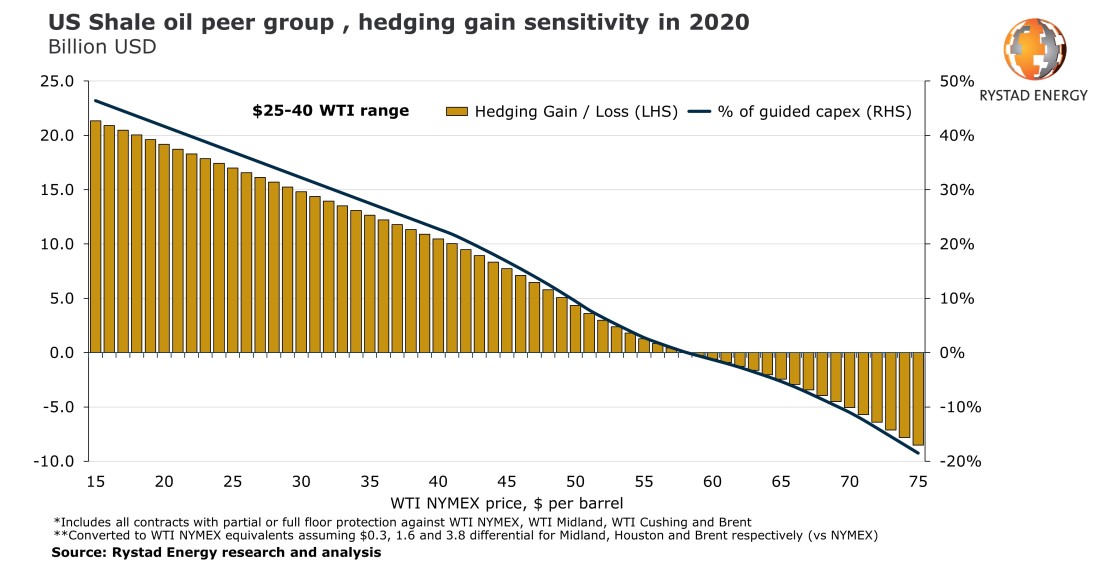

LOW OIL PRICE? NO PROBLEM. US SHALE FIRMS ARE SET TO SAVE UP BILLIONS IN RECORD-HIGH HEDGING GAINS

March 13, 2020Even though oil prices plunged to as low as $30 per barrel this week and are likely to go even lower as OPEC+ plans to increase production from April, US shale oil operators expect to save billions in record-high hedging gains in 2020, a Rystad Energy impact assessment shows.

Rystad Energy’s assessment is based on an analysis of a representative peer group of 30 dedicated US light tight oil firms with a combined output of about 38% of the total expected US oil production in 2020, excluding royalties.

Looking at the hedging positions of the considered companies, we conclude that they hedged almost 50% of their guided 2020 output at an average price floor of $56 per barrel.

[…]

Rystad Energy

Regarding the Rystad chart in Figure 1, it excludes US Gulf of Mexico production, where a lot of deepwater “brownfield” opportunities are fairly attractive at $35-40/bbl. The Gulf of Mexico is currently producing about 2 million bbl/d. I don’t do “shale” – But I like to study it write about it. I work the very different geology of the Gulf of Mexico (GOM). As far as I know GOM players aren’t begging for bailouts or ‘tapping the mat’. Mostly companies are cutting spending, particularly CapEx to ensure positive operating cash flow at $30/bbl. Most GOM companies are also well-hedged. Our sector has been lobbying for royalty suspension until the ChiCom-19 hostage crisis ends… And I hope we are also lobbying for lease extensions and expanded timelines for abandonment and retirement obligations (ARO). Easing up on the administrative cost of doing business is neither a bailout, nor a subsidy. The ChiCom-19 hostage crisis will likely cause GOM production to dip a little bit over the next year or two. Royalty suspension, lease extensions and an expanded ARO timeline, would go a long way toward smoothing out the currently very rough waters.

“Do U.S. Shale Drillers Deserve To Exist In Free Markets?“

It’s an idiotic question. There is no global free market. Saudi Arabia needs $70-90/bbl to balance their budget. The Soviet Union needs $40-50/bbl to balance theirs.

The US, as a nation, has no comparable price. And the budget-balancing price varies widely from company to company. This is Tug Eiden’s estimate of the price required to cover operating costs for a group of independent oil companies, mostly “shale” players.

At ~$20/bbl, no one makes money… Not the “shale” players, not the Saudis and not the Soviets. If oil is around $20/bbl this time next year, there won’t be any oil (only being partially sarcastic).

As demand recovers after the ChiCom-19 hostage crisis ends, OPEC+ will work to bring prices up to where they need them. While this downturn will force a lot, maybe most, “shale” players into Chapter 11, the assets don’t vanish. Most of the companies won’t vanish. Even though proved reserves will have to be taken off the books, the oil won’t go away. When prices rise back into the $40-50/bbl range, US oil production will start to rise again. “Shale” players and most independent US oil companies are somewhat analogous to Yankee Clippers – They aggressively take advantage of economic opportunities in a very un-free market.

To level the playing field, the US government could take reasonable measures to ensure that the United States’ energy security is not impaired and that American Energy dominance carries on… But that’s not a business decision.

Troll Notice #1

I wrote this post yesterday (20 April 2020). Parrot-like comments about prices being different today will be mercilessly ridiculed.

Day Thirty-Something of America Held Hostage by ChiCom-19

| 4/20/2020 | |||

| Dallas County | CHICOM-19 | ||

| Population | Cases | Deaths | |

| 2,637,772 | 2,512 | 60 | 2.4% |

| % of population with | 0.10% | 0.00% | |

| % with, rounded | 0.1% | 0.00% | |

| % without | 99.90% | 100.00% | |

| % without, rounded | 99.9% | 100.0% | |

| Menodoza Line (.200) | 12/21/2034 | 0.200 |

Fire Marshal Gump is apparently unsatisfied…

Dallas County to ‘Scrap and Claw’ for More Testing as 84 More COVID-19 Cases Confirmed Monday

Judge Clay Jenkins warns against rushing back out too soon, continuing to limit essential trips

Published 1 hour agoDallas County Judge Clay Jenkins says they are continuing to fight for more COVID-19 testing in the county as 84 more positive cases of the 2019 novel coronavirus are confirmed Monday.

The latest additions of COVID-19 bring the total case count in Dallas County to 2,512.

For the second straight day, the county did not record any new deaths associated with the virus. That total remains at 60.

[…]

NBC5DFW

Gump clearly needs more cases if he’s going to obstruct the reopening of the economy. Interestingly, in addition to not recording any deaths since April 17, Gump is refusing to record recoveries…

The county said they are not reporting recoveries of the infection because it is not a surveillance variable that is being used nationally by the Centers for Disease Control and Prevention or by state health departments.

NBC5DFW

Recording new cases without recording recoveries is as dishonest as you can get. Can you spot which county is most firmly controlled by Democrats?

| Cases | Deaths | Recovered | Rec:Death | % Rec | |

| Collin County | 527 | 13 | 324 | 25 | 61% |

| Dallas County | 2,512 | 60 | 2 | 0 | 0% |

| Denton County | 593 | 16 | 248 | 16 | 42% |

| Tarrant County | 1,242 | 39 | 189 | 5 | 15% |

| Total | 5,315 | 144 | 822 |

Dallas County, of course.

Collin County, the reddest of the four counties has a 25:1 recovery to death ratio, with a 61% recovery rate, so far. Dallas County, the bluest of the four counties is reporting a 2:60 recovery to death ratio, and a Dean Wormer recovery rate, so far.

Hey Gump! You stink!

/arc-anglerfish-arc2-prod-dmn.s3.amazonaws.com/public/GEJBBC6Z5ZDNNGXDFWXXKJACGA.JPG?w=700&ssl=1)

Gump’s order for everyone to wear masks was shot down by the Dallas County Commissioners court, despite the fact that 4/5 commissioners are Democrats.

Update #1 0545 CST 21 April 2020

Let’s see if this makes the news:

Will the news media breathlessly report that the price of oil rose by more than $30/bbl last night? They were drooling all over it being down over $50/bbl yesterday.

Having a negative futures prices is a nightmare for computer programmers like myself. Thank goodness our fund wasn’t trading that contract. There is a lot of computer code that checks price is > 0 before doing things.

Spread contracts can be negative and we have worked around that before.

Regarding the chicom19 testing in Dallas, Br Birx said that labs quest and labcorp have no backlog in testing. Not sure why Dallas not using them to do testing. Probably some regulation.

The May contract is up about $34/bbl this morning, almost back to $0. The June contract is down about $4/bbl.

The next few months will be exceptionally volatile and ugly… This is why smart oil companies hedge

DM:

“…This is why smart oil companies hedge.”

____________________________

All well and good, until your counter-party goes bust.

Hedging is not as simple as it sounds. Over time, most people learn (the hard way, of course) that there is “no such thing as a perfect hedge.”

From an investor’s perspective, a company pursuing a hedging strategy MUST be consistent in that approach. It is CRITICALLY IMPORTANT that the company continue to hedge in both falling and rising markets. The danger lies when some self-annointed genius decides that he’s smarter than the commodity market and effectively makes a bet on the direction of prices by taking a long or short position.

Plenty of investors own shares of hydrocarbon producers in order to (indirectly) own the commodity. Those kinds of investors (and I hesitate to use the word “investor”— read “Wall Street” with its 15-minute time horizon) will be unhappy when petroleum prices rise and they discover the upside has been hedged away.

Without a doubt there are pitfalls. We lost money on hedges last year as prices were rising. There are also more complicated, less expensive, derivatives that don’t provide as much protection. Many of the smaller “shale” players use three-way collars, which don’t provide total down-side protection.

You have to employ a layering strategy… Kind of like dollar-cost-averaging.

https://pbs.twimg.com/media/EWGniZbUEAIjr41?format=jpg&name=medium

There are two government sponsored test sites in Dallas County. They can each perform 500 tests per day. So far, their testing has been limited to first responders, medical professionals, Parkland Hospital patients and people with symptoms. They are expanding eligibility to food service workers. Two more sites will soon be up and running.

Private labs are also testing as necessary and at the direction of doctors. My wife was tested last month because she has infusion treatments for lupus. She’s been on Plaquenil (hydroxychloroquine) for a couple of years… Pretty well all of the anecdotal studies suggest that she is more or less innoculated.

Only those who test positive need no more testing. The rest needs daily testing because a negative can become a positief the next day.

So how many millions of tests should be performed daily and for how long in a place like the US ?

There are about 330 million Americans and just under 800,000 confirmed cases. About 4 million tests have been performed since March.

We would have to test about 1 million people per day to test everyone once in 1 year. “You can’t get there from here”.

A bipartisan ( bipartisan means spending lots of money ) group of congress said we would need 750,000 tests a day.

That would be great… Why not 330,000,000 test per day? That way, we could know for sure… Better yet…

My nephew tested positive just yesterday. He is 10 years old and family lives in Westchester NY. Even though he was totally in stay at home for weeks he still got it. But his mother is pediatrician and is working. She must have gave it to him somehow although she did not test positive. Maybe through her clothes or touching him. Very odd.

The virus does seem to be persistent. You can even track it into your house on your shoes.

My zip code, 75218, has 1-20 reported cases. The surrounding zip codes range from 1-20 to 41-60…

I’m far more concerned about the small businesses around here than I am about catching ChiCom-19.

“You can track it into your house on your shoes.”

My wife is Chinese. Our “outside” shoes stop in the garage. We switch to our inside shoes which sit on a wooden platform, then go inside the house. Every few days, she disinfects the bottoms of our “outside” shoes. So far, so good. I’ve been lucky enough to be married to one American woman, one English woman, and one Chinese woman (not at the same time of course, that would be careless). Life stays interesting.

My wife is Mexican… We have a similar rule… But we have 11 dogs… Our outside shoes wind up somewhere in the backyard… But only one from each pair… 😉

Dogs:

I believe my dog – – loves to swim in the irrigation ditch – – brought me Giardia,

and thus Giardiasis, popularly known as beaver fever.

This is curable, once you know what appears to be killing you.

We keep a case of Panacur® handy. We think one of our 11 is the Typhoid Mary of Giardia.

We all go to the same food stores etc etc etc.

Hopefully your nephew will be OK. This disease doesn’t seem to hit children very hard.

The error rate for negative test results, the false negative, is said to be about 30%. Hopefully the antibody tests will be more reliable.

David Middleton – I’m interested in your comment re Plaquenil. Our local (NSW) chemist has been unable to supply Plaquenil on prescription since the Wuhan virus started – fortunately we do still have about two months’ supply. I wonder whether Plaquenil is still available in the US. The “anecdotal studies” suggesting innoculation sound good – do you have any more detail?

And BTW I am interested in your articles on oil too, as always. It is always curious to me how some people use the “free market” idea so selectively – for example the oil market is a free market if you want to manipulate it, but not a free market when OPEC pushes POO “too high”; the electricity market is a free market if you want to tax it with “carbon credits”, but not a free market when “renewables” generators want to sell their product.

Plaquenil and generics are available, but it’s taking longer to refill prescriptions.

The way the US Dollar is losing purchasing power because of Zimbabwe style Printing, the price in Dollars could be millions before it gets profitably again. A currency not backed by gold has no value.

The price should be in ounces of gold or silver. No country should own the world reserve fiat currency in the same way a citizen can not have his/her/they (+70 more) own printing press.

It’s not that simple… But, inflation could certainly become a problem.

It’s actually a much bigger more complicate discussion than can fit into a single post, certainly a lot bigger and more complicated than your simplistic view Robertvd.

Inflation is always a possibility, but doesn’t seem to be an issue near-term. Part of that is where all the “printed” money is going, the economic conditions it is going into, and how it’s being used.

Case in point: look back at the “Great Recession”. The Fed printed lots of money then (Quantitative Easing, they called it) without the Zimbabwe style inflation showing up. By your simplistic view, we should have had super high inflation to go with all that newly printed money, but we didn’t (indeed inflation was quite subdued during that period). Ever stop and wonder why?

That’s not to say we can’t or won’t end up in a high inflation situation as a result of the latest round of “money printing”, just that it’s not as simple as “print more money automatically means runaway inflation” as you seem to think, there’s a lot more variables at play.

A currency not backed by gold has no value

Many, many decades of having a currency not backed by gold and yet used the world over as a reserve currency says you’re plain wrong. Gold, not backed by people thinking it valuable has no value. You can’t eat it, you can’t drink it, there are plenty of other metals to make things with, really, it’s just a lump of metal with no real value other than that with which people imagine it to have. It’s shiny and looks nice. Big Whoop.

Indeed, I did “stop and wonder why” there was no appreciable increase in the price of commodities during a time when the quantity of money was increasing much faster than the quantity of goods. Then I took a look at the financial sector. In essence, people are trading pieces of paper with “Federal Reserve Note” on them for pieces of paper with company or government names on them (or rather, just entries in computer accounts). Unlimited supply to meet unlimited demand, creating unlimited debt. The new money enters the economy through the Fed to the banks and never leaves the financial sector. The DJI goes from 1k to 30k, the debt goes from $6T to $22T (or $200T, depending on how you count it), and everyone’s happy, until TSHTF.

Your last two paragraphs are correct. There is no such thing as inherent value. “Value” is always subjective. The utility of the “free market” is that it allows disagreements over “value” to result in transactions: the seller “values” the money more than the commodity, the buyer “values” the commodity the more. If the sales price represented an agreed-upon “value”, then both parties would be indifferent to the transaction.

Historically, rarity has been associated with value. This has been the attraction of gold, silver, jewels, etc., to possess something not everyone else has. However, rarity is not a universal measure of “value”. Honesty is a rare virtue. QED!

“Value” to people is a perception. “Value” in economic terms comes from labor: you take raw materials, add labor, and you have something of value. This is why “fiat” money can have value; because it represents labor people have put into making things, whether that is an automobile, or software (or whatever). When the total amount of currency in circulation exceeds the total amount of labor-value, then (generally) you get inflation. But ya, monetary policy is complicated.

As long as the Fed dollars are sent into the black hole of DEBT, they are chasing exactly zero goods. ( And there is lots of debt, trillions in fact).

My guess is that as disparate sectors of the economy ramp up, and the same happens with production and supply chains, we will see a mixed bag, inflation in some items, deflation in other items.

As the infrastructure is still there, as well as the staff, it will balance out with a somewhat persistent decrease in the velocity of money. This is deflationary.

Some businesses will not come back at all, some very slowly. This is deflationary.

We shall see, and I got one, certainly do not know.

re: “As long as the Fed dollars are sent into the black hole of DEBT, they are chasing exactly zero goods.”

Debt “paid back” goes exactly where? a) To the moon, b) pumped down abandoned wells, c) burned for heat, d) Back to those from whom it was borrowed.

If the answer turns out to be “d”, what do those to whom the “debt” is repaid do with said debt (money) repayment? a) Send it to the moon, b) pump it down abandoned wells, c) burn it for heat, d) Invest in new ventures or buy needed goods.

Do you know who owns US debt?

Quick answer: Americans own 70% of U.S. debt, but China, Japan loom large.

By and large, Americans. Some 70% of the national debt is owned by domestic government, institutions investors and the Federal Reserve. A shade under 30% is owned by foreign entities, according to the latest information from the U.S. Treasury.

Data as of August 2018

_Jim, you are assuming

1) All the debt is paid back. The simple fact is some percentage of debt in the economy ends up in default, gets written off in bankruptcy proceedings, etc. and thus never gets paid back.

2) That all lenders are “Invest in new ventures or buy needed goods”. The simple fact is the Fed, the largest lender, isn’t in the business of doing that. They’re creating money out of thin electrons and when/if it’s paid back, in theory, it can be returned to the thin elections from which it came.

as hiskorr correctly observed, the “new money” is staying mostly in the financial sector rather than chasing goods. More than that, however, what amount of it that is escaping the financial sector is chasing goods during a mostly deflationary time (ie the economy has ground to a halt, causing demand to fall for many goods) which can have the effect of holding prices stable (ie the added money having an inflating effect in a deflating economy). And when it’s paid back into the financial sector (and ultimately back to the fed) it will presumably be during an mostly inflationary period (ie the economy is back up and running with relative to now increasing demand for goods) which again can have the effect of stabilizing prices (ie the subtracted money having a deflating effect in an inflating economy).

And that’s just a quick over simplification of a very complex issue. And there are many other variables that could upset the apple cart. The bottom line is, it’s nowhere near as simple as your multiple choice questions try to make it out to be.

Again I refer you to the Great Recession. The Fed pumped a lot of money into the economy, what happened to it all? a) To the moon, b) pumped down abandoned wells, c) burned for heat, d) didn’t create the inflationary doomsday you imagine it would for various and complex economic reasons that, as I previously said to Robertvd, is “actually a much bigger more complicated discussion than can fit into a single post, certainly a lot bigger and more complicated than your simplistic view”.

re: “you are assuming”

Endicott, you pedant, HOW detailed DO YOU THINK I’m going to get in an answer I spend JUST A FEW MINUTES on?

Get real, man. This is NOT a 300 level course … geesh. Get a life!

Endicott, why don’t you USE YOUR BRAIN and address the poster I addressed with your tome? I don’t think a lot of you ‘bright boys’ are that bright after all …

From your ad hominem, _Jim, I accept that you have no valid or cogent response to what was posted.

Exactly, and they don’t even need a printing press anymore. Printing on paper is way too slow and unsophisticated for us modern folks.

Nowadays our fiat currency consists almost entirely of electrons, creating it out of thin air requires little more than the touch of a keyboard. Its fast and highly sophisticated.

We can create as much money as we want, whenever we want it. Wahoo!

What could go wrong?

Robertvd, although your alarm about “US Dollar is losing purchasing power…” is certainly a cautionary tale, but the comment goes against the International Standard of Money, which is the US Dollar. I live in Argentina and vacation in Chile and Florida, and the power of the US Dollar is incredible in both Argentina and Chile, and quite acceptable in Florida. Sure, I would love to have a basement full of Kruggerands, but the US Dollars are actually working great for me. Stay sane and safe.

Haha yeah I noticed that several websites went down yesterday and others were posting numbers that didn’t make sense.

I had to chuckle yesterday when the oilprice.com displayed a disclaimer “We are sorry, our graphs will be back online tomorrow”.

Sorry Mr Middleton, but after exclaiming that “OPEC wouldn’t exist in a free market” you finish with: “…the US government could take reasonable measures to ensure that the United States’ energy security is not impaired and that American Energy dominance carries on… But that’s not a business decision.” Quite so. Thanks for the equivalence.

But are you not protesting a little too much? Your original premise a few weeks back was that the commies in Russia shot themselves in the foot by…er…refusing to act when the Saudis came knocking rather than actually doing it. I suggested to you at the time that, Geo-strategically speaking, there are multivariate considerations here – some with short, and medium term economic & political considerations, and yet other more important drivers based on long-term geopolitical perspectives. I also (dared) suggest that Russia has – at least in the Putin era – proven itself far more adept at geopolitical chess that the Beltway bubble. And, yeah, I know that makes me a “Putin apologist” – at least in your current mood.

Whatever your rebuttal may be, the fact is that the global energy market has now been fundamentally altered with serious knock-on effects on economics and global allegiances, both present and future – and to suggest or surmise that it will be ‘business as usual for US shale’ just as soon as new investors snap up liquidated assets is, frankly, magical thinking. Russia’s decision to abstain has triggered non-linear effects and (future) responses, but I submit that anyone who thinks they didn’t factor that in hasn’t been paying attention over the past 7 years.

You’re a formidable thinker and writer Mr Middleton but with the greatest respect, it’s evident that you’re succumbing to jingoist nationalism at the expense of serious inquiry and debate and it’s not helping us frame these issues properly on these pages.

What part of “it’s never been a free market” did you miss?

“Do “shale” drillers deserve access to an actual free market?”

Do “shale” drillers deserve to be bailed out?

They aren’t asking to be bailed out.

They probably know they wont have to ask, it’ll just be a given.

By who?

Federal Reserve.

How, exactly, will the Federal Reserve bailout “shale” companies?

Printing more money isn’t a bailout.

Loydo what color is the sky in your world?

And BlackRock now effectively runs the FED.

Ironically enough BlackRock, with major petro interests, seconded the Carney green initiative at Jackson Hole last Aug.

Schizophrenia, anyone?

Fink has gone full greentard…

https://www.forbes.com/sites/davidblackmon/2020/04/18/blackrock-doubles-down-on-climate-pressure-in-the-midst-of-global-crisis/#7d00a7a554fd

Hey at least the product might be useful down the track as opposed to throwing money down the green energy pithole and generally the only product you get is an old rusting monument. How many rusting statues worth billions do we have now?

“We will never let the great US oil and gas industry down,” Trump said

If capitalism is so good why does it need to get bailed out by socialsm every ten years?

Piling a straw man on top of a red herring.

What bail out?

When the government shuts the economy down, efforts to keep it intact until government reopens the economy are antithetical to a bailout.

In 2008-2009, the financial services industry was bailed out because decades of bad loans, insured by complicated derivatives, collapsed like a house of cards. While 4-5 administrations encouraged these bad loans, government didn’t directly cause the collapse. The government spent $700 billion to bail out the financial services industry. Most of that money was paid back. While it can be argued that TARP was unwise, it can also be argued that it prevented a global depression. However, it was a bail out and it had a very large price tag.

So far the oil industry hasn’t asked for a bailout and the Federal government hasn’t spent a dime on bailing it out. This economic collapse was the direct result of global government malfeasance. When the overreaction to the Kung Flu begins to subside in a few weeks, demand for oil will begin to return to normal. How quickly this will happen is anyone’s guess. The degree to which Americans (no one else matters) will be dependent on Saudi Arabia,

StalinPutin and other foreign sources for the lifeblood of our economy will depend on how well domestic oil production survives this government-caused catastrophe.“We will never let the great U.S. Oil & Gas Industry down. I have instructed the Secretary of Energy and Secretary of the Treasury to formulate a plan which will make funds available so that these very important companies and jobs will be secured long into the future!”

Quacks like a bailout.

Only to an idiot.

Loydo,

1) We don’t have capitalism, at best we have a mixed economy, at worst, socialism lite.

2) All the problems you believe are capitalism are being caused by government, IE socialism.

3) Every so called bailout has ended up making the problem worse. Like most socialists the best you can do is kick the can down the road a few years.

More like BlackRock has gone full Mark Carnage….

The part where you seem to imply that free markets DO – or could – exist, David. NO such thing in complex systems so the rhetorical toolkit fails. There are only ideological, cultural/national “preferences” – i.e. biases – about what constitute functional/sustainable markets. You have yours, others have theirs. So to proclaim US shale would prosper in a free market – if such a thing existed – fails the “central interventionist” test on its face. Shale would never have seen such growth had central banks, led by the US Fed, not relentlessly driven real interest rates towards zero – largely to mitigate the cost of rising us debt and fuel unsustainable consumption and military adventures. So the more appropriate question is this: “would US shale have seen the light of day, let alone prosper, in a historically normal interest rate environment”?

That the pejorative rhetoric flies on these pages about the commies and their viruses, the oligarchs, central planners and authoritarians is pretty quaint given how things actually work across the Atlantic.

If you disagree with something I actually wrote, quote the exact words and quote them in context. If you just don’t like my style…

Sorry, in my haste I thought my framing of it was clear and so I didn’t quote exactly. Here then: “Show the US oil industry where the free market is (or was) and I’m fairly certain we can compete in it”.

I followed by asking whether shale would/could have existed or flourished if there hadn’t been decades of manipulation of interest rates and the treasury yield-curves by the Fed.

Oil finds itself downstream from the price of money, after all. So the point is that money markets are manipulated by the US via the Fed. Unless you propose the Fed is “impartial” and purely data driven? Just like oil is (rather haphazardly) manipulated by OPEC.

I am just pointing out, with genuine respect since I have long been a fan of yours, that your rhetoric has taken a hyper-parochial turn of late and I’m not sure it’s consistent with what you’re tried to do here in the past.

Either way, regards

Peter,

Please show the oil industry where an actual free market is.

Oil absolutely follows the money. It’s a capital intensive, generally low margin industry. It always has been.

I have no idea if the Fed is impartial, or even sane. The quantitative easing of 2008-2014 absolutely did create an asset bubble. It fueled $100/bbl oil and the “Bernanke” stock market. Our CEO was once asked, “What was the key technology for the ‘shale’ boom?” His reply was “$100/bbl oil.”

As I said in the post, the “shale” players and independent oil companies, in general, are opportunistic. We can move fast and take advantage of opportunities.

When the Fed started unwinding QE in 2014 and then the Saudis launched a price war, our industry adapted and adjusted to make money at $50-60/bbl.

I don’t think the Fed intended to fuel the “shale” boom.

Regarding hyper-parochial…

re: “and fuel unsustainable consumption and military adventures”

Yet, the roads are paved, the lights are on, running water on tap, roof over one’s head, (most) have an iPhone or Android in hand (I don’t through) – where is the un-sustainability? I remember vacuum tube radios and TeeVees, broadcast television pre-cable and satellite, rotary-dial party-line telephony – we are MILES ahead of that now AND back then the roads were still paved!

Oh, and we freed Europe before all that … The “Arsenal of Democracy” to use the words from a 1940’s FDR.

-Jim

Read some more history Sir. By the time the US and Allies landed in Normandy the bulk of Germany’s elite troops lay dead in Russia. Napoleon suffered the same fate.

you may also want to read how long into the war Wall Street (Prescott Bush included) financed the Nazis. A matter of public record, by the way.

Thesis->antithesis->synthesis will do you well. Try see both sides with minimal bias and then try reach a conclusion. Then rinse, repeat.

Works a treat with decision making under uncertainty

re: “Read some more …”

Lend/lease.

You could stand to ‘read’ a bit more too. Not going to re-litigate this. NOT buying into the one-sided “prosecutor’s case” presented by you either. This is my LAST post in this subject.

Oh, and BTW, streets are still paved here too …

@ _Jim

Telephones and party lines:

When I was young a phone call meant picking up the hand-set and asking an operator to move connections around. Since she knew us and who we called, she was usually a half-step ahead of us.

About once a week I would run to a neighbor, elderly lady, and knock and shout for her to hang up her phone. Only then could be use our phone. 1955, or so.

Anytime someone starts to complain about “unsustainable consumption”, you know you are dealing with someone who wants government to take money from people who earn it, in order to spend it on him.

Anyone who complains about “military adventures” is probably one of those people who thinks that if only everyone would throw away their guns, crime would end.

Without the British in N. Africa and later American and British forces tying down much of Germany’s forces in Italy and along the Channel, Russia would have fallen.

Ah yes, the old, things are complicated, that’s why we need government to make all the hard decisions for us argument.

The fact is, the more complex the economy, the worse government intervention does.

Thanks for posting some balanced and penetrating analyses and comment, Mr Buchan. Not really a popular approach here, though.

It’s amazing how “balanced and penetrating” always coincides with whatever it is the poster happens to already believe.

Good comments’ Mark.

The ” unsubstainable” assumption was a key indicator of the posters own biased perspective. Also the decades old drive intrest rates down policy is something every business and most every American has taken advantage of to the best they can. David M does a great job of showing the true costs. As to Government action to protect that production capacity, I am not necessarily against that. National security is a real issue. I trust that our current POTUS will do a decent job of it if necessary. The prior President did a great deal to handicap US energy production and jobs.

And when exactly was the last time we had that ‘Free Market’ system ? At least in the US it died with the enactment of the Federal Reserve.

We certainly have a “free-er” market within these United-ish States than we have internationally.

I’d love to live in a libertarian laissez-faire capitalist world… Unfortunately that world doesn’t exist.

North America enjoyed something like laissez-faire between 1620 1775

I don’t think so… https://www.thoughtco.com/timeline-events-leading-to-american-revolution-104296

of course there is no free market or honest money as well– destroyed by WW1.

In 1900 America was still free country and probably economically No1 in the world.

Where was Russia, Saudi Arabia or China ?

Nowhere.

blame your megalomaniac leaders for what you have today.

American people enemy is not over there, they are in Washington DC.

same for Russian people, their enemy is in Kremlin and Chinese people enemy is in Beijing.

https://www.cfr.org/timeline/oil-dependence-and-us-foreign-policy

Even with 3+ years of swamp draining, it’s Mordor on the Potomac.

Only it isn’t called ChiCom-19

It is here, in this post.

The name now changing faster then ‘Global Warming’.

I’m sticking with ChiCom-19.

David is afraid of the Chinese, especially red ones. It might be because when he looks around his house and sees everything marked ‘Made in China’, in horror he realises it is too late and that actually he has been helping them beat the US at its own capitalist game.

Chinese shirt, Chinese glasses, Chinese paper, Chinese ink, Chinese shaver, Chinese comb, Chinese keyboard.

Equals Loydo SPAM.

No Loydo. Shirt was made in the Dominican Republic, The paper came from US trees (not all our trees get burned in the UK) and printed on Canadian presses using Indian ink. etc. China isn’t the only place we import stuff from, you know. And going forward, we just might not be importing as much from China (or at least we’ll likely have less items that we exclusively import from China).

Loydo seems to believe that working and getting paid is all you need to have capitalism.

Don’t bother, David. People (like Loydo) are so stupid that they don’t even realize you are insulting them; it’s just not worth it. When having adult conversations, it is better to just ignore them like small children and imbeciles.

We should all be afraid of XiNN

https://noagendaartgenerator.com/artwork/15962

I see loydo still hasn’t had his access to the real world restored.

It really is amazing how socialists actually seem to believe that anyone who criticizes them is actually afraid of them.

Virus: severe acute respiratory syndrome coronavirus 2; or SARS-CoV-2

Official name of disease: COVID-19

Short name: flu (sic)

Name here: ChiCom-19

Name in Eastern Washington: Wazzu

“When I use a word,” Humpty Dumpty said, in rather a scornful tone,

“it means just what I choose it to mean- neither more nor less.

“The question is,” said Alice, “whether you can make words mean so many different things.”

“The question is,” said Humpty Dumpty, “which is to be master-that’s all.” “

I’ll also accept WuFlu.

Good report, David, and a lot of actual knowledge about the oil industry. When you see the comments from current Democrats, especially “the squad”, you get the idea that they want to go back to the late 1970’s, President Jimmy Carter, and an oil crisis in the other direction. Waiting in a line at a gas station for two hours, then being limited to 10 gallons, then paying an excessive price, yea, that’s my idea of something better. The USA will always do well in free market competition, but there are some bad actors out there, and the timing of Russia vs Saudi Arabia coinciding with the Chicom-19 virus was a costly blunder for both of them. I am in day 32 of quarantine, and the current rule is that anybody 70 or over cannot leave the house. When we are even back to normal it will seem like being on vacation! Stay sane and safe.

The world isn’t a free market… While the US, internally, has a free-ish market, it’s still a long way from laissez-faire capitalism.

The Squad and their ilk demand that businesses function as if we had laissez-faire capitalism, while squashing us with taxes and regulations.

you get the idea that they want to go back to the late 1970’s, President Jimmy Carter, and an oil crisis in the other direction. Waiting in a line at a gas station for two hours, then being limited to 10 gallons, then paying an excessive price, yea, that’s my idea of something better.

And only being allowed to buy on alternate days depending on if you had an odd or even numbered plate number. Those were the days, weren’t they.

Speaking of alternate days…

Monday to Wednesday it’s reserved for the government workers and their families?

That’s when Dallas overpays a minority and/or gender neutral contractor to sanitize the great outdoors… 😎

We should be so lucky. The Green Leap Forward will not take us back to the 1970’s; more like the 1670’s.

Very good article.

It will be up to Russia and the OPEC nations to find the oil production rate/reserves that will sustain the optimum pricing in the market. If you look at your figure 6, I would guess it’s going to be somewhere around $50/bbl. A price that discourages the unfettered development of shale oil.

Saudi Arabia can forget about those heady days when oil was priced at $100/bbl. There’s just too much shale oil that can be produced economically below the $50/bbl price level.

If I were looking to invest money, I’d stay away from the oil producers with production costs exceeding $50/bbl.

As consumers we can look forward to many more years of low priced gasoline. All thanks to American oil and gas industry.

Now if we could just get the state and federal governments to drop of all taxes on oil and gas, get rid of unnecessary regulations on all forms of energy (including coal and nuclear) and drop the incentives for expanding high priced renewables. If this were done business would expand quickly throughout the US as a result of the benefits of really cheap energy. It would cause a return of manufacturing based on low production costs and not just a superficial wish to get manufacturing jobs back. And wouldn’t that piss off AOC.

Everyone can “live happily ever after” with oil prices ranging from $50 to $70/bbl. Only Saudi Arabia has the excess production capacity to keep prices in that range.

That’s probably the range that oil will hit but OPEC and Russia have to be careful. If the price is too high, the shale oil drillers expand reserves and the price goes down and we’re in another cycle. The oil price has to be kept low enough to dis-incentivize the high cost producer and low probability wild catters.

And we (conventional and “shale” players) start layering on hedges, which makes it more difficult for them to hurt us by dropping prices… in normal market conditions.

re: “Now if we could just get the state and federal governments to drop of all taxes on oil and gas”

Facepalm; With your proposal, how are pubic roads/highways to be financed, paid for? Are you unaware of how highways etc are financed in the US*?

.

.

* Notwithstanding MISUSE of “gas taxes” to build bike trails and the like, AND tollways that operate financially in a different manner. So I don’t want to hear those arguments.

Gas taxes are a regressive tax. They hurt the poor much more than the rich. Put all the taxes into income tax and make those taxes progressive. In the end we all save money as all products are cheaper. Much cheaper than the added cost to our income tax.

re: “Gas taxes are a regressive tax. They hurt the poor much more than the rich.”

This is brilliant. Absolutely brilliant. Why did I not think of this! The old socialist “Soak the Rich” trope makes a comeback!

Never mind that the ‘bulk’ of those USING the roads ‘penalized’ by that ‘regressive’ tax are the ‘poor’ as you put it, NOT the ‘rich’ … the POOR are heading to work IN GREAT NUMBERS! They are the ones who NEED those roads! The ‘king’ is already wealthy, in his castle, not needing ‘roads’. Understand that or no? If no: poisoned mind, by socialism and the ‘school of Marx’, which had apparently taken root.

BTW, have you EVER looked who it is that represents the ‘bulk’ of the payers into the US Treasury in the form of income taxes? Have you ever looked? Would you, do you understand numbers? Do you know what the ‘breakdown’ is by earners (demographics), who it is that ‘pays’ the greatest share of the funds flowing into the treasury? Or no?

My point is that if you did not tax companies/corporations/businesses they could compete in the market with the likes of China. If the cost of energy is minimized and taxes eliminated we all benefit. The country is able to build wealth and everyone benefits.

Stay on this point. I’m the last person you should accuse of being a socialist. Socialists see corporations as evil and want to tax them into bankruptcy.

If you want to make the tax “flat” go ahead. But in your world we tax bread and milk to keep people from eating. AOC taxes gasoline to keep people from driving.

There is nothing wrong with a progressive tax. Just as long as it’s not one that disincentivizes work and investment

So get your panties unbunched.

If we want a Free Market we first need Freedom. You can’t have Freedom and Big Government in the same place. Every type of government needs taxes. Indirect like on oil and gas or Direct like on income. Direct taxation gives those in power absolute power and the right to know everything about you. It makes you a slave with or without virus. The only way to limit the power of government is by Indirect taxation. Now the consumer is in control. If prices get to high because of taxation you stop buying the product.

The “free market” of Adam Smith and von Hayek is borrowed from Bernard Mandeville’s Fable of the Bees, a feudal tract from pre-industrial times. Also published as the Grumbling Hive.

As Abraham Lincoln famously said, beavers build houses, but the same model since biblical times. Bees build the same hives since the Paleozoic.

So to be clear, the concept of progress does not exist for Mandeville, Smith, Hayek, the very concept the US is actually based on, the concept Lincoln delivered to the entire world after the CSA was defeated. Germany, Japan picked it up immediately, and today China is carrying the flame.

That’s the problem with “shale” – it is not progress, rather regression. Fusion is progress.

But shale produces usable and affordable energy today, and at scale to meet demand. Fusion does none of these. Are you willing to hold your breath until it does?

[ I hope you aren’t using the word “fusion” when you mean to use “fission” instead]

As near as I can make out from your ramblings, you are proclaiming that capitalism is old school and the only way to “progress” is by getting rid of it?

You are also seem to be proclaiming that in order to progress we need to get rid of something that works “shale” in order to start using something that doesn’t “fusion”.

“ That’s the problem with “shale” – it is not progress, rather regression. Fusion is progress.”

Windmills and solar panels are truly regressive without a non hydro battery. Reading by candlelight harkens back to the time of Dickens.

David,

I don’t need to tell you about self-inflicted barriers to getting the economy moving again, as your comments on Mr. Gump illustrate. Our Governor has stated that we are in phase one of reopening which technically means personal service businesses remain closed, and no gatherings of more than ten persons (we have been in this comparatively relaxed state throughout the crisis, no stay at home here). Yet the next bunch of bureaucrats down impose more severe restrictions within their domains. This blunts the Governor’s orders. Then, the little bullies will report anyone who violates the most restrictive local order available. Finally there is individual fear and superstition to overcome. It is a cascade of problems. I have no idea how long it will take to clear the obstacles away, even if we started today.

Something that would help would be to show that states with the lest restrictive orders are doing as well or better than states with extremely strict orders. This might help overcome some of the fear involved. The press dump on South Dakota, completely misrepresenting the actual situation there, without noting the death rate there is only 9 per million of population is an example. Checking and double checking one’s data and portrayals of it would help a lot, but even here at WUWT things go wrong. The graphic of death per million on the Daily Update Page, for example, is utterly wrong. It shows California and Minnesota, with very restrictive policies, doing far better than the Dakotas, or Wyoming with relaxed policies. In fact, all of these states should be colored the same — white. Having a graphic so in error on a page arguing for letting us get back to work is irony, isn’t it?

Fortunately for us, our governor outranks Fire Marshal Gump… 🙂

The press loves to dump on our governor here in SD, because she is smart, competent and pretty, as well. And a Republican, of course. They hate all of that. Our situation here is totally different than, say NYC. For one thing, we have far more registered cattle than registered voters here, by a wide margin. About half the counties here (including mine) have zero reported cases of covid-19 so far, and the mostly voluntary lockdown is working quite well. The streets are practically deserted. The only downside to all that is we will have very little “herd immunity” when the virus circulates again later, after the rest of the country goes back to work and the tourists show up.

Isn’t oil like crack cocaine for US mobility? Extremely addictive as urban sprawl plus crime pushes people into cars. This oil addiction in return drives part of the US’s abroad unpopular foreign “policies”.

One way to reduce this is railway electrification – using coal / gas power and more electric sub-urban under/over grounds. Another one is city planning. More e-shopping and commerce too.

Long way to go…

A most negative view; look instead at the car as an extension of the horse: mobility is freedom. Oil is just part of the ‘supporting means to get there’ (supporting infrastructure). Any other view, well, is navel (belly-button)-gazing IMO.

Oil is freedom or tie to Arab oil sheikhs?

The horse was perfect for short distances and quite green – grass above gas.

I love it when social planners go out of their way to indicate how incredibly ignorant they are regarding the real world.

1) The horse was very, very expensive. Few people could afford to own one. Heck, in cities only a tiny handful of people even had room to keep one.

2) Back around 1900, NYC was in the midst of a crisis. That crisis being what to do with all the horse shit that was covering their streets and making people sick. The advent of the car was considered a god send since it meant they no longer had to rely on horses for transportation.

Did government bail out the horse driven economy when the virus car entered the scene? How many jobs were lost?

Today’s progressives would never have allowed this change. We would still be using the horse or worse , regulations would have banned the horse too. Walking is so much healthier.

Tell that to the people of the burgeoning cities of the early 1900’s. They were drowning in horse piss and being buried in horse shit, literally, before the automobile saved them.

So instead of every house having a garage, every house would have a stable?

I wonder if regulations would have allowed you to park your horse on the street?

Parking garages for horses?

Oil is nowhere near as addictive as oxygen.

I have to take a hit often and I even inhale.

I hear that rehab will really take your breath away.

People who apply words like “addiction” to necessities like fossil fuels should really demonstrate their pure lack of addiction, by giving up on using both fossil fuels and food as well.

Like most social planners, you have the world backwords. Cars enabled urban “sprawl”, not the other way around. The people, when given the choice, left the cities. Of course those who believe they know better then us can’t tolerate it when people are free to make their own decisions.

It all seems moot to be arguing about shale oil. When the world has a 30% drop in demand, there will need to be a 30% drop in production. Producers everywhere will take a hit sooner or sooner as storage buffers fill up. US producers might get hit the hardest as the US being the World’s largest oil producer and refiner and finished product exporter will be forced to cut back refining proportionately more. The market in all its innate unfairness will do this rationing and there is little governments can do about it.

http://www.worldstopexports.com/refined-oil-exports-by-country/

Ultimately, demand has to recover.

I’m thinking that Dave’s “Fire Marshall Gump” is a take-off of the old Fire Marshall Bill character (from “In Living Color” 1990–2006) played by Jim Carrey:

Bingo!

Jenkins looks like Fire Marshal Bill and talks like Forrest Gump… Hence Fire Marshal Gump.

David:

Your frustration with the lockdown is shared by others:

[youtube https://www.youtube.com/watch?v=dxanH9ejrH0&w=1269&h=714%5D

I’m enjoying setting up my workstation on our large kitchen island and wearing Tommy Bahama t-shirts, gym shorts and Margaritaville shoes to work… I can even watch motivational movies while I’m working: The Big Lebowski, Office Space, Once Upon a Time in Hollywood (love the ending)… But about 60% of people around here can’t work from home. Many small businesses that we support are struggling right now… And that pissed me off.

David,

I’m in the same situation since I work on FAA contracts that are deemed essential, but like you it pisses me off that so many are out of work now. My son had to find a new job after he was laid off, and now it only makes about 70% of what he did. If it were not for our help, he would be in dire circumstances. This madness has to stop; the damage to the economy is already irreparable, at least in the short run, but to continue racking up the damage is just evil. We feed so many people in the third world, but how are we going to do that with a weak/crashed economy? Answer: we won’t, and millions of children will die agonizing deaths as a result. Personally, I’ll risk a 1 or 2 percent chance of death to prevent that.

The truth is that we can’t stop the spread of these kind of viruses. We can barely slow them down. At this point we’ve done the best we could to slow down this virus to allow our health care systems to prepare. It’s time to stop worrying about dying and get on with living. We are like a person holding their breath as they try to get out of a smoky building: at some point you have to start breathing again, even though it means taking in some smoke, or you just end up passing out anyways.

Damn. How do I get videos URLs to embed? I can’t find Ric Werme’s guide any more.

If it’s a YouTube video you can often just post the link.

This might help…

https://www.thesitewizard.com/html-tutorial/insert-video-using-html5.shtml

“Our sector has been lobbying for royalty suspension until the ChiCom-19 hostage crisis ends… And I hope we are also lobbying for lease extensions and expanded timelines for abandonment and retirement obligations (ARO). Easing up on the administrative cost of doing business is neither a bailout, nor a subsidy. ”

Now that’s funny

It’s just a fact. When government shuts down the economy, the government also needs to suspend as much as possible, the burden of government on businesses.

To a socialist, the purpose of government is to make sure that after taxes, nobody has more than they do.

Damned straight. My family owns commercial property in Seattle and all of our tenants have been forced to close; they can’t function effectively (or at all) by working from home. So they have no income, which means we don’t get paid. So far the only relief we’re getting from King County is property tax payments are deferred until June. Meanwhile Seattle is going ahead with a $160 million waterfront improvement project, which means the LID (Local Improvement District) final tax assessments were scheduled hit property owners in March, with an option to finance payments over 18 years.

When government shuts businesses down so they have no income it is not a good time to levy new taxes. Besides, there’s no point in improving the waterfront when you won’t allow people to enjoy it.

So you admit that you find reality funny. The rest of us figured that out about you years ago.

Says the court jester.

I’ve written elsewhere that the issues U. S. citizens now face are a result of

the actions taken by governors and mayors.

Let’s call these actions Panic 2020 .

As an example: Washington State started with a tragic beginning in an elderly care facility.

Officials failed in intelligence and mental acuity, and then panicked.

Lockdown and spend.

Newest headline: “People accidentally poisoned by household cleaners spike since stay-home order ”

Just one of many results of Panic 2020 .

If lockdowns keep up the states will start really feeling the squeeze of lower tax revenue. The states can’t print their own money.

Dear David,

Another interesting article, although I am not sure how informative it is.

And I suppose that you will consider me to be a troll, after my comments to your article of April 5 suggesting that the idea of tariffs was misinformed, and which comments you so energetically tried to dismiss. As I said then, tariffs on imported oil would hurt the U.S. oil industry more than they would help. If that were not the case the tariffs would already be in place.

Regarding the present article, I would like to make a few comments in the spirit of open debate.

1. Regarding whether the U.S. shale industry would survive in a ‘free market’?

Of course it wouldn’t, and for the following reasons :

Any industry with a high capital cost component tends to be highly cyclical, with prices swinging from the marginal cost of production, at the low end, to the fully absorbed cost of production at the high end (with some overshoot at each end caused by the time it takes to react to the price swings). The wider the spread between these two costs, the wider the swing in prices.

U.S. shale wells, with a very short half life, have by far the highest marginal costs of production, as the marginal cost is essentially equal to the fully absorbed cost, at such a short half life.

All of the other players, including oil sands, have long life assets for which the marginal costs are much lower. Your Figure 5 is irrelevant. At any price above the marginal cost of production, which for some is as low as a few dollars/bbl, will bring them positive cash flow.

Thus, in a ‘free market’ the U.S. shale industry would be the first to go down in any oil price cycle.

But fortunately (at least up until now), for the shale industry, the world wide oil industry is not a free market. Opec and Opec+ have been for years propping up the prices, by colluding to cut production, at prices well above their marginal costs of production. And the U.S. shale industry has essentially been getting a ‘free ride’, getting the benefits of a supported price, with no contribution.

In addition to the free ride from OPEC+, they have also gotten a ‘free ride’ from the FED, whose QE money printing fueled the Shale Boom with excess liquidity that had no place else to go.

2. I think that your article misses the broader point of what this oil price collapse was all about.

The U.S. has been at war with Russia ever since Russia interfered with their plans in Syria beginning in the autumn of 2013.

The war has been fought militarily, mostly through proxies, and financially, through sanctions, attacks on the Ruble, etc.

Militarily, the U.S. has by and large lost every encounter (i.e. Eastern Ukraine, Crimea, Syria, Venezuela, etc.)

Financially, none of the sanctions or other attacks have had any lasting success. Arguably, Russia is financially stronger and more secure now than it was in 2013,

But the U.S. never quits, with every defeat it doubles down, trying to find a new front to take Russia down (such as Nordstream 2).

The U.S.’ principal source of financial power is the status of the $U.S. as the world’s reserve currency. (It has already been equaled ,and some say surpassed, militarily). However, the Achilles heel of this financial power is an overly leveraged financial system, and the Achilles heel of this financial system is, in turn, the overly leveraged Shale Industry.

Ending support for the price of oil at the time when this support was most needed has caused a debt crisis in the Shale Industry, which quickly spread to the rest of the financial system.

While events have still to play out, the current financial crisis puts at serious risk, and could spell the end of, the US$ as the world’s reserve currency, and with it the end of U.S. financial power, and by extension its ability to wage financial war on Russia.

This in my opinion was the reason for Russia acting as it did.

Having achieved its goal, of creating a debt crisis in the US$ financial system, Russia has no reason to continue to depress the price of oil. And, in a few months, I expect that the oil price will rebound, and when Covid-19 is only an unpleasant memory, the price of oil may indeed reach new highs.

And I agree with you that the Shale Industry will rebound, as the oil in the ground and the technology to produce it will not go away. However, I expect that this rebound will be slow, as the industry will now be forced to live within its cash flow. I doubt that, following the current financial crisis, financing will be readily available.

In this sense it may even be in the interest of Russia and Saudi to see the current industry players survive, as these players will not only be forced to live within operating cash flow, but within operating cash flow after servicing their existing debts.

Where have I advocated for tariffs? From the post:

The main threat is the embargo. We stop buying their oil, they run out of places to put it faster than we do.

That said, the ChiCom-19 20-30% drop in demand has everyone looking for places to store oil.

The entire point of the post is that there isn’t a free market for oil. OPEC wouldn’t exist in a free market. There hasn’t been a free market since “Dad” Joiner discovered the East Texas Field 90 years ago.

Embargo, tariff, what’s the difference?

The objective of both is to disrupt imports. As I said in my comments to your previous paper, this will hurt the U.S. oil industry more than it will help. And as I said in the above comment, if a tariff (same goes for an embargo) could work, it would already be implemented.

And yes there is no free market for oil, but the U.S. Shale Industry has been the beneficiary, not the victim, of this situation.

The objective is to nullify state-sponsored product dumping.

And because of the complex web of product flows, which are not readily substitutible, this objective is unlikely to be met, and is much more likely to back-fire!

With the currently reduced demand, the US could halt all imports not from Canada and Mexico. Any shortfall of heavy/sour crude could be made up by swapping light/sweet new production for SPR heavy/sour. 2/3 of the SPR’s current inventory is heavy/sour. We could half all non-North American imports for a long time.

In an ideal world, we wouldn’t do that… Or even think about it.

David,

What is approximate construction cost/gallon for tank farm storage? … construction cost only.

potable water costs less than $2/gallon (incl regulatory crap … done in about a year … excl land … ). Ongoing operation costs (for storage, not associated distribution) are very low, pennies per gallon.

Then look at the operational/regulatory/tax cost as associated with your industry for just for having the (tank) storage.

Initial construction cost for water storage is probably less than annual overhead cost of just having oil tanks just sitting there, with or without oil in them …?

Not my bailiwick. But if it made economic/operational sense, companies would already be doing it.

The storage “crisis” will likely be over long before storage capacity could be expanded.

Sorry to hear that, and sorry the price has gone positive. I was planning to buy 1,000 barrels when the price was -$35 each. It comes in the barrel, right? I was going to put them in the back field.

If anybody wants to sell cars or trucks for -$20,000 apiece, I’m interested. Plenty of parking spaces here.

I doubt any of the May contract trades over the past couple of days were for physical delivery.

I wasn’t thinking that there was any kind of opportunity for anyone to add storage, I just wondered what the cost of storage is.

Everyone likes to take a cut … property/equipment tax on the tanks, licensing/inspection, emergency services, etc. Where there is decent profit in a ‘free market’ you will soon find the local, regional, state, & special districts taking a decent cut.

There are lots of cyclical industries. They have all figured out ways to survive through the cycles.

The fact that you can’t see any solution other than government to these problems indicates that you have never had much experience with actual economics.

Hmmm

What’s your thoughts on this David?

surely a lot of US shale players will bite the dust?

https://www.forbes.com/sites/christopherhelman/2020/03/12/deathwatch-begins-for-the-subprime-of-shale-oil-drilling/#2985160a73ab

David,

I note that while Berman says storage isn’t full – there are others saying it is (nearly): https://oilprice.com/Energy/Oil-Prices/Brent-Crude-Oil-Prices-Fall-20-In-Early-Trading-As-Panic-Sweeps-The-Market.html

“From Asia to North America, all over the world oil producers and traders are looking for just one thing – a place to put their unwanted products.

Supertankers are in high demand and often left idling offshore as on-shore facilities are out of space. In the North Sea, for example, vessels have been parked for days, loaded with gasoline and jet fuel with nowhere to go.

Even the world’s largest oil storage firm, Vopak, which operates three main facilities in Singapore, Rotterdam and Fujairah, is saying they’re at capacity.

Gerard Paulides, the chief financial officer of Rotterdam-based Royal Vopak NV, noted that “For Vopak, worldwide available capacity that is not in maintenance is almost all gone and from what I hear elsewhere in the world we’re not the only ones.”

Certainly tanker prices have gone way up: both storage and transport.

In a free market, Saudi Arabia is perfectly free, to vary its output, to alter prices.

In a free market, Saudi Arabia wouldn’t control oil production or prices. Aramco would have to operate like a business, accountable to shareholders.

Trump is saying now that he wants to help the oil industry. No details yet.

He will probably get questions about it today at his news conference since giving money to oil companies is bound to trigger the leftwing journalists and those they represent.

The best way the President could help the oil industry would be to fire up the rest of the economy.

That’s true.

One thing a lot of people are missing is when the shale industry gets into trouble, it tends to increase the rate of technological advancement and the lower the (per unit) of cost. While many companies are suffering and some will not make it, oil prices in the future will inevitably go up. The shale industry will rise up as a stronger competitor – it always does. The beauty of capitalism is this ability to adapt. There is little reason to change when everything is good, it takes bad times to push change.

So laugh at the suffering shale oil companies if you will…some will survive and become stronger.

Always loved the Getty quote: ‘The meek may inherit the earth, but not the mineral rights.”

The assets of the shale players that don’t make it won’t disappear with them. I expect Chevron, Exxon, Shell to eventually pick up some for eating later, when the price of oil is at a point that they’ll make money off of when current frac technology at that time is able to make them profitable.

Bad news for those who wish to use this crisis to sell renewables to woke fools, but a simple fact. Hydrocarbons will rule economies way past the life of those who wish to make lots of money off substituting themselves for fossil fuel companies.

Which brings up a question for Mr. Middleton: I haven’t been keeping up for the last 4 or 5 years, and never worked shale. How many (if any) shale plays are unitized? Plugging and mineral rights reverting to the landowner ain’t really in it, under unitization. One well producing on a fieldwide unit holds it all.

I don’t know. I don’t do shale and I haven’t worked onshore since 1988 in East Texas. My recollection that we needed a lot more landmen onshore than we do offshore. I have been working on unitizing three producing leases, all 100% WI, all the producing wells drilled from the same platform… However each block has a different royalty rate, complicating operations. It’s been like filling out tax forms for a year.

In the Gulf of Mexico, we mostly deal with one minerals owner: the US government, and to a much less extent Texas & Louisiana in state waters.

Some cases, Haynesville gas and Permian, those that were drilled in existing units, I’d guess they’ll perpetuate as long as there’s production from one of them or from one from the primary units still producing. Marcellus, Bakken, etc. maybe not.

Or, maybe they will… new areas of production aren’t usually as nit-picking as to lease terms as S La eventually ended up being. Model lease is the term I remember landmen using to describe what an oil company would prefer.

The reply is only to run it out, rather than to beat it in the ground.

Said it before but I’ll say it again – enjoy your posts and hope you prosper.

Correcting my above comments, because I realized they’re mostly wrong.

One producing well can hold vast amounts of acreage but only if there has been a field wide unit established for the horizon it’s producing from. While there could be other reasons for establishing a field wide unit, the only one I recall at the moment is a pressure maintenance or secondary recovery project. Neither of which would apply to shale plays.

Terms of the base mineral lease dictate when a well becomes a technically non-performer and the mineral rights revert back to the landowner. While there are ways to delay this they typically require some effort on the part of the oil company…. “no longer than 90 days between operations..”, etc.

(Apologies for running it in the ground but I do hate leaving something behind that I know to be bs.)

“There is little reason to change when everything is good”

The only companies that think that way are companies that won’t be in business long.

There is always reason to change, because there are always hungry competitors who will do whatever it takes to take your market share away from you. They do that by finding better ways to do whatever it is your company does.

Under capitalism, the only way to survive long term is to find those better ways before your competitors do. If you wait till afterwords, it’s too late.

Under socialism, you can survive by out competing your competitors, but it’s usually cheaper to just buy a couple of senators.

As a citizen of the United sates of America, I have a problem with my legislators and executive branch working with the Saudis to control oil prices. Price-fixing is illegal in the US, unless, it appears, my government decides to do it. The Saudis aren’t “dumping” oil, they can produce it for a lower cost than $30 a barrel. Their problem (and ours) is that they have had control over the market for years but the equilibrium price is well below where they would like it. As soon as they restrict production to bring the price up, many other producers increase, because they all have fields that can be profitably developed at the higher price.

From out in a deepwater field in GOM–

We’re still cranking out wells! Sure, the mood is a little depressed. My company recently laid off a lot of the people I signed on with. I’ve been lucky enough to avoid the chopping block so far, but there is still work going on. “I’m not dead yet!”

We’re not dead either, But we have already had to defer most of our 2020 drilling program and are having to very quickly decide what we have to shut in. Shutting in production for hurricanes is SOP. Shutting it in for a ChiCom/Soviet/Saudi assault on our economy is a whole other matter,

The article by David Middleton left me somewhat confused. After attributing the crisis in the oil industry to “Chicom-19”, some strange phenomenon which I never heard of before, he then tells us that Russian oil must cost between 40 and 50 dollars per barrel in order to “balance their budget”. The figure quoted for Saudi Arabia was 70 to 90 dollars. By the same token, assuming production costs were zero, I wondered how much a barrel of oil must cost for the United States of America to balance its budget. Over the last 10 years, that country has increased the public proportion of its national debt by something over one trillion dollars per year. On the other hand, it has been producing something like 5 billion barrels of oil per year. Dividing the one by the other we arrive at the figure of 200 dollars per barrel needed to balance their budget.

All of this is explained in the post. Try reading it before making any more moronic comments.

“Recording new cases without recording recoveries is as dishonest as you can get. Can you spot which county is most firmly controlled by Democrats?”

_____________________________

Ummm … if you’ve been following the numbers, you should have realized by now that almost nowhere in the world are they properly reporting recoveries. One chart I found from Germany specifically said “No duty to report,” but I’ve seen discussion of the issue several other places.

As such, both the “Recovered” numbers and the “Active Cases” numbers are bullshit. Any attempt to use “deaths/resolved” is futile because we simply don’t have real recovery numbers … anywhere. I don’t know why they keep putting them on the various tacking sites.

*tracking

I stopped following the numbers outside of Texas quite some time ago. Fortunately, every 3-4 days, Dallas County HHS publishes a report which includes a comparison of influenza and ChiCom-19 weekly hospital and ICU admissions. The sharp decline in both types of admissions over the past few weeks is a pretty good indication that a lot more than 2 Dallas County residents have recovered.

If I didn’t know better, I would say that everyone from Fauci on down doesn’t want this to end. They either seem to be enjoying their 15 minutes of fame and/or power trips just a bit too much.