Guest explaining to the NYT explanatory reporter by David Middleton

More abject nonsense from Hiroko Tabuchi, New York Times climate reporter and “part of the team awarded the 2013 Pulitzer Prize for Explanatory Reporting”…

Government Loophole Gave Oil Companies $18 Billion Windfall

By Hiroko Tabuchi

Published Oct. 24, 2019The United States government has lost billions of dollars of oil and gas revenue to fossil-fuel companies because of a loophole in a decades-old law, a federal watchdog agency said Thursday, offering the first detailed accounting of the consequences of a misstep by lawmakers that is expected to continue costing taxpayers for decades to come.

The loophole dates from an effort in 1995 to encourage drilling in the Gulf of Mexico by offering oil companies a temporary break from paying royalties on the oil produced. However, the rule was poorly written, the very politicians who originally championed it have acknowledged, and the temporary reprieve was accidentally made permanent on some wells.

As a result, some of the biggest oil companies in the world, including Chevron, Shell, BP, Exxon Mobil and others, have avoided paying at least $18 billion in royalties on oil and gas drilled since 1996, according to a new report from the Government Accountability Office, a nonpartisan agency that works for Congress.

[…]

Roughly 22 percent of oil production from federal leases in the Gulf of Mexico was royalty-free in 2018 because of the loophole, the Interior Department said.

The National Ocean Industries Association, which represents the offshore industry, defended the arrangement. “There was no mistake in the law,” said Nicolette Nye, vice president at the association. If not for the law, she said, “we likely would not be producing U.S. oil offshore in record amounts today.”

[…]

Ben Marter, a spokesman for the A.P.I., said companies “took Congress at its word,” and any attempts to revisit the issue would be “engaging in a dangerous game of bait-and-switch.”

[…]

But the new regulations omitted a crucial clause that had been supported by both Republicans and Democrats — that if average prices for oil and gas climbed above a certain threshold, companies would be responsible for paying the royalties. In 2006, when the federal government tried to impose royalties, an oil producer sued and won.

[…]

Hiroko Tabuchi is a climate reporter. She joined The Times in 2008, and was part of the team awarded the 2013 Pulitzer Prize for Explanatory Reporting. She previously wrote about Japanese economics, business and technology from Tokyo.

New York Times

This idiotic article included four paragraphs on climate change, which I did not quote. It also included a lot of Democrat blather about giving money to special interests that don’t need it. And a lot of whining about this not being the intent of the law… Most of which I also didn’t quote.

All that matters:

- The legislation was passed by Congress and signed into law by President Bill Clinton in 1995.

- Its intent was to incentivize deepwater drilling and production in the Gulf of Mexico, and it worked.

- When the government tried to administratively rewrite the law, they were sued and lost.

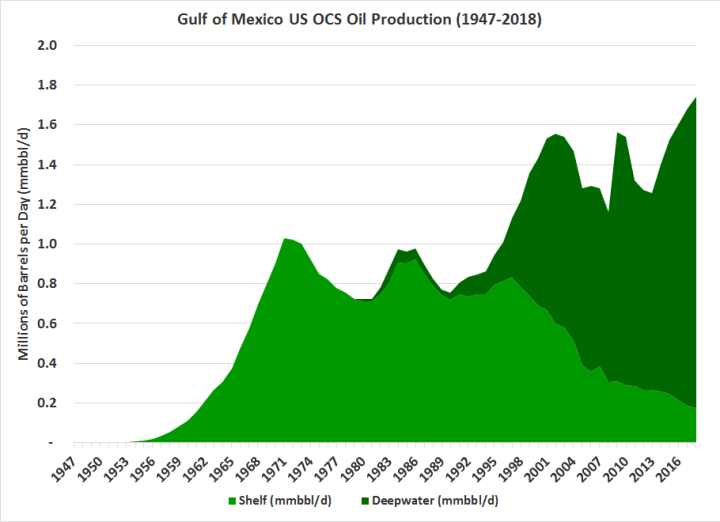

Crude oil production from Federal leases in the Gulf of Mexico has roughly doubled since 1995.

All of this growth was due to deepwater drilling and production.

Would this have happened without the royalty relief legislation? It’s impossible to re-rack history and see how it would have played out otherwise. In the mid 1990’s, it was still unclear whether or not deepwater oil production was economically viable.

The alleged “loophole” only applies to leases issued in lease sales from 1996-1999. All other lease sales under the Deepwater Royalty Relief Act (DWRRA), included economic thresholds at which royalty payments would kick in.

As of 2007, only 20 leases, issued in 1998 and 1999, lacked price thresholds for royalty payments to kick in. And, while “DWRRA spurred a surge of interest in deepwater oil and gas development, major production directly related to the act’s incentives has yet to be realized.”

Proponents of these royalty relief measures contend that without incentives, little GOM deepwater or shallow-water, deep-gas drilling would have taken place, because these areas would not have been competitive with foreign offshore prospects (e.g., Brazil and West Africa). Increased GOM drilling enhances U.S. energy security, proponents contend. Critics, during the debate on royalty relief that preceded passage of EPACT-05, charged that the government would forfeit millions of dollars through the subsidy and that drilling costs were already coming down as a result of advances in technology, thus making many deepwater lease tracts economical. According to MMS, deepwater drilling in the Gulf of Mexico has benefitted from a combination of improved technology, higher prices, and royalty reductions.(14)

Deepwater Development

A significant amount of activity is taking place in deepwater GOM. Out of 8,221 active offshore oil and gas leases, 54% are in deep water. Interest surged after enactment of DWRRA, with 3,000 deepwater leases bid between 1996 and 1999.(15) Deepwater oil production rose from 42 million barrels in 1994 to 348 million barrels in 2004. Natural gas production increased from 159 billion cubic feet in 1994 to 1.4 trillion cubic feet in 2004. Within the past two years, there was a 37% increase in the number of producing projects. Deepwater development, however, is facing major challenges. Currently, about 8% of the DWRRA-eligible leases issued between 1996 and 2000 have been drilled, and only a few are in production (because of rig constraints and large lease inventories). In 2004, of the 1,667 leases producing in the GOM, 30 qualified as eligible leases under DWRRA. Since 2004, oil and gas prices rose above the price thresholds, and full payment of royalties became due on 10 of those leases that were issued in 1996, 1997, and 2000. The other 20 were issued in 1998 and 1999 without price thresholds.

MMS maintains that the future of deepwater production looks bright. Proved oil and gas reserve and resource estimates have more than doubled since 2000 (Table 2), discoveries are taking place in much deeper waters since 2000, and development time decreased from 10 years in the mid-1990s to 7 years in 2006. Although DWRRA spurred a surge of interest in deepwater oil and gas development, major production directly related to the act’s incentives has yet to be realized. For leases containing price thresholds, relatively little royalty relief has been granted.

Royalty Relief for U.S. Deepwater Oil and Gas Leases, CRS Report for Congress, December 7, 2007

So. it is incredibly unlikely that “roughly 22 percent of oil production from federal leases in the Gulf of Mexico (GOM) was royalty-free in 2018 because of the loophole.” There are several avenues for royalty relief. In some cases BOEM can waive royalties for fields that would otherwise be uneconomic and have to be abandoned. So, it’s certainly possible that 22% of current GOM production is subject to royalty relief. However, if major production directly related to the DWRRA’s “loophole” had yet to be realized in 2007, it’s doubtful that it’s increased since then.

In 2018, the U.S. Treasury received $4,329,043,081 in royalty payments on 641,503,000 barrels (bbl) of crude oil production from Federal leases in the Gulf of Mexico. The West Texas Intermediate (WTI) spot price averaged $65.06/bbl in 2018 and Brent averaged $71.19. Most offshore production receives a slightly higher price than WTI and slightly lower than Brent. Using a simple average of WTI and Brent, $4.3 billion works out to a 10% average royalty rate. While the statutory royalty rate is 12.5%, actual rates vary from 12.5% to 18.5%. Royalties are a cut of the gross production or gross revenue from the production, not a percentage of net profits.

With average deepwater breakeven prices falling from $70 to $40/bbl over the past few years, but oil prices also falling by about $10/bbl since 2018, it’s not too difficult to grasp the fact that a significant percentage of GOM production wouldn’t have happened with the government taking 12.5% to 18.5% of the gross revenue. 10% of 641.5 million bbl (2018) is just a little bit bigger than 12.5% of 344.3 million bbl (1995).

The most hilarious thing is that I have no doubt that Ms. Tabuchi and all of the enviro-nitwits whining about the Fed’s only getting 10% of 641.5 million bbl/yr would prefer to see the Fed’s taking 100% of 0 bbl/yr of GOM crude oil production.

A little off topic but I am watching a film called “Downsizing” where a person of 1.8m is reduced to 39mm. Think how that could save the world.

Please don’t let AOC know about it.

As Earth returns to ice age conditions,sizes are likely to increase, not decrease.

Downsizing sounds like a means to destroy mankind.

Especially as downsizing human brains to monkey size reduces the gray matter.

Why would an ice age increase the size of humans. When food is scarce the opposite happens.

https://www.livescience.com/24916-animal-size-versus-climate.html

Interesting but as I said when food is scarce the opposite happens and an ice age would make food scarce.

Recently I came across an excellent article on that but I can’t remember the source or much detail.

Technically Earth has been in an ice age since the Early Oligocene (34-35 million years ago).

The size-vs-climate relationship is generally thought to be due to the ability of larger animals to retain heat… Bergmann’s rule. Larger animals have a better chance of surviving to procreate in colder climates than smaller animals do.

It may well be that the animals are larger in a cold climate but that there are fewer of them due to diminished food resources. In an environment of selective pressures which act in different directions evolutionary selection is often best viewed as acting on a population, not for the benefit of any one individual.

Yep.

Bodies get smaller but heads and brains stay large. Nose and ears disappear. Why do you think that Area 51 ET looks like it does?

Is it cold there?

Aren’t we witnessing a downsizing of brains?

If big-heads are likely to increase in a colder world, why are all the current crop of big-heads banging on about global warming ?

there is something basically wrong with this theory.

I propose that we put all the big-heads on Antartica, after all, it’s going to be the only place that mankind can live on in a few years.

mikebartnz, are you talking about “road pizza”? That’s the process where some critter, say a deer, runs across a road and a truck squashes it, the result being a “road pizza”. Tasty and free!

heh heh

17 kinds of meat 🙂

Red Green show is brilliant. One can view the brilliance on YouTube.

I got the 15 season plus extra box set given to me as gift. iso files stored on NAS units. love the show

Thanks! I miss the Red Green show….

cant remember the title or author but…someone wrote a book about that in the 60s?

breed smaller people so they can stack n pack em into more floors in skyscrapers etc

In 1972 Loudon Wainwright III wrote a song about a dead skunk.

I’ve spent time on Tokyo, where they seem to be trying that scheme. But for many worker zombies it’s apparently cheaper to just spend the night drinking and playing in a Pachinko parlor than get a bed.

Living style in Tokyo is just different than most in the west are accustomed to. Don’t think that your apartment is 10sqm, think that your bedroom is 10sqm and your apartment is the entire city.

Living in Tokyo you spend ALL of your time outside your apartment. Want to play a video game? Go to an Internet cafe and rent high end gaming hardware by the hour, with room service food. Want more kids, but not sure how with your others in the same room? Go to a love hotel (which is aimed at spousal conjugation, not for-hire fun).

The idea of Uber, where you rent an item only for so long as you need it (like AmazonTool will be, with hourly rentals of food tools delivered by drone as soon as the FAA stops being dumb), or how pizza already gets delivered by drone in nations without idiots stopping it, has been alive in Tokyo for decades – everything you want is readily available, so you don’t need much “living” space – it’s all a around you, that’s why you live in Tokyo.

Note: I assume Hong Kong, Taipei, etc are similar. If you’ve been to NYC it’s only a fraction of where Tokyo is – but if you’ve lived in a little flat in Paris it’s surprisingly close to that.

As usual its all swings and roundabouts.

So the government misses out on some royalties, but with the development of deep water drilling they have gained overall.

Compared to the massive waste re. CC its peanuts.

MJE VK5ELL

Wonder how much additional benefit in terms of increased economic activity, jobs and other federal taxes all this extra “tax avoided” oil actually created?

Perhaps it helped fund the reported extraordinary salary Chelsea Clinton’s first job had attached to it – certainly puts the salaries of teachers and nurses into perspective.

Good comment, David. Let’s face it, the average person has no idea how to incentivize the (potentially beneficial) undertaking of a costly and risky venture. Ms. Tabuchi probably thinks making a decision between latte and capachino is courageous. Allowing some royalty-free ventures to get underway is no different than a 10 year tax free incentive to construct and operate an auto plant facility in Tennessee, or an Amazon center in new York City (oops!), for example.

I can’t comment on the content of this article but I am intrigued that the author has been awarded a prize for “Explanatory Reporting” Is that not what reporting is supposed to be?

I thought reporting was supposed to be straight facts not opinions

maybe it was, once?…

however “explanatory reporting” is prob newspeak for Dumbing Down. which it appears she excelled at

Explanatory reporting reminds me of an old East German joke:

Comrade Mittag, the Chief Economist, sits at the entrance of the Central Committee and cries. Comrade Honecker, the Secretary General, stops by and says: Comrade Mittag, people know you, when they see you crying, they’ll think that our economy is in trouble. Why are you crying?

– I cry, because I can’t understand how our economy works.

– Don’t worry, come with me, I’ll explain it to you.

– Please don’t. I am explaining it all the time.

In a similar vein, “Investigative Journalist” sticks in my craw.

Tenacious Journalist has always seemed more appropriate. Many people, not just journalists, give up early into anything.

I have heard similar “whining” for years, here in central WV.

The descendent children are always “whining” about those bad ole NG producers only paying their grandparents a few hundred dollars, a hundred years ago, for the “mineral rights” (NG) beneath their property when they are worth THOU$ANDS of dollars today.

Writing legislation is something like writing government contracts. It’s really hard to write a government contract that doesn’t backfire somehow.

The trick when bidding on a government contract is to fulfill the contract exactly as written. There will almost always be problems that the contract didn’t envision. Fixing those oversights, for outrageous fees, is where your profit lies.

When the government tried to administratively rewrite the handful of leases that lacked economic thresholds for royalty relief, Kerr-McGee (now part of Oxy) sued and won. The courts ruled that the oil companies based their bids on the lease terms as they were offered in those lease sales. When one party simply decides to rewrite the terms of a contract, the other party generally sues and wins.

The World Series games in Houston between Stros and Nats … regular TV shots shows the big-ass Oxy sign on the wall in the stadium outfield.

Wonder how many snowflakes would be triggered if they knew that’s an oil company??

An oil company in Houston? The mind boggles.

Isn’t possible for our government to create a new tax or the equivalent of it was motivated to do so? That way it could do “an end around” of the lease agreement. I doubt the government’s hands are tied in this situation.

Not without getting their @$$es sued off.

Only Congress can rewrite the law.

Only Congress can rewrite the law

And even then there would be lawsuits. Laws get challenged all the time. The only difference being congress writing/rewriting the law at least has a chance of being a winning hand for the government in any such lawsuit whereas the president attempting to rewrite the law on his own initiative is practically a sure loser.

David A Bidwell, the government would have to pass a law (IE congress would have to pass legislation that the president would then sign). The president can’t write/rewrite laws all on his own. If he tries, the result will be a lawsuit that the government will loose (as was the case that David cited)

France did it a couple times… all we got is blood in the streets.

Yes, the government can in the US pass a new law.

But that isn’t what happened. Instead, the Executive Branch of government tried to unilaterally enact a regulation that wasn’t authorized by law because they didn’t like the result. Accordingly, they lost.

Had the Congress passed a new law it would have survived, unless they wrote it poorly (which happens frequently).

David

“The alleged “loophole” only applies to leases issued in lease sales from 1996-1999. All other leases

sales</strike sail under the Deepwater Royalty Relief Act (DWRRA), included economic thresholds at which royalty payments would kick in.The typo was “leases”. Should have been…

All other lease sales under the Deepwater Royalty Relief Act (DWRRA), included economic thresholds at which royalty payments would kick in.

Please send coffee…. : )

I laughed when he has to be introduced as one of the team of winners, it’s a bit like Mann and his Nobel prize.

When you bring up the link for the prize and look at the 2013 win

https://en.wikipedia.org/wiki/Pulitzer_Prize_for_Explanatory_Reporting

The ones in red are those not consider important enough for wikipedia to even bother giving a page.

So Steve Lohr, Bill Vlasic and Hiroko Tabuchi were obviously the team pizza goffers in the team 🙂

Eighteen Billion dollars will pay for a lot of well exploration.

Do Windmill companies pay royalties to the government?

They make lease payments to the land owner whether private or government owned.

A recently touted wind farm approval here in AZ south of Winslow will pay lease payments to State of Az that also leases the land to ranchers for grazing.

https://chevelonbuttewind.spower.com/wp-content/uploads/2019/10/S-Power_Chevelon_HandoutV3_Digital.pdf

Of course the windfarms wouldn’t be built at all if not for the federal government “paying” ITC and PTC to the owners. They are harvesting tax credits not wind power.

Perhaps the Government should implement a wind tax – claim that they own the wind and the charge the windmill for using it.

It is amazing to me how the author seems to start from the position that all money belongs to the government first, and any that remains in the hands of those who produced/earned it, is lost. SMH and GMT both at the same time.

P.S. GMT = Grinding My Teeth

And are royalties deductible from profits for other taxes? If so, having no royalties means higher corporation tax receipts for the government.

Royalties are paid from the gross income or production.

In the case of Federal leases, the royalty payment is made directly to the government.

If a well on a Federal lease in the Gulf of Mexico, with a 12.5% royalty produced 2,000 bbl/d with an average price of $50/bbl and total expenses of $40/bbl, the Federal government would make $2.38 for every $1.00 of after tax net profit for the oil company.

The production company pays the federal government the royalty + tax, I’m sure the refinery pays tax on their revenue, when I buy a gallon of gasoline there’s another federal and state tax/gal (fixed regardless of sales price?), and some states then add sales tax on top of that, the trucker has to pay taxes on his revenue as well as pay the tax/gal of fuel he uses to deliver that gasoline to the retailer, does anyone know how many and where more taxes are wrung out of that poor defenseless hydrocarbon product? And the envious cries from our readers in other countries, “At least you don’t have a VAT!” Oh yes we do, even if no one calls it that. 🙁

NY democrats are also whining incessantly about loss of their unlimited state and local tax deduction on their federal taxes starting in 2018. Taxpayers in Florida, Nevada, Texas, Wyoming, Washington are no longer subsidizing the taxpayers in the high state-tax states.

One person’s tax deduction is another person’s tax loophole. It’s called envy.

Indeed. Rather than bemoan the loss of an unlimited deduction on their federal taxes, they should be complaining about their State/local taxes being so high in the first place – because that’s the source of their problem.

18 billion dollars over the course of 20 years. Is this for real? Do they realize how fast the federal government in the US blows through money? This amount of money probably wouldn’t pay for the pentagon’s copy paper.

Based on the planned FY2020 fiscal budget of $4.75 trillion, that’s about enough for 1.4 days.

The Congress “miswrote” a law? Would have thought it?

Retired_Engineer_Jim

Tabuchi is complaining that it was poorly written. Yet, Clinton signed it. Didn’t he have a responsibility to recognize a poorly written law, veto it, and tell Congress to try again and do it right? After all, he had Al Gore at his elbow to advise him on how poorly it was written. Do liberals take no responsibility for things happening that they aren’t happy with? It is easier to whine.

Sorry, waaaay off topic, but perhaps of some interest.

Driving on NY State Rt. 177, East of Barnes Corners, through Maple Ridge Windfarm, earlier this week, I observed the aftermath of what looked like a catastrophic rotor failure. One of the three “vanes” was snapped off jaggedly at about its midpoint. Being old, I did not bother to photograph.

Not news, apparently.

Found it. Search on “Morning storm left a Copenhagen Wind Farm Turbine short a blade”.

1 thanks for the chuckle.

2 now I’m explaining wind farms, sheer strength, and metallurgy to my 3.5 year old. He’s enjoying this too. Might get into laminates, but that’s for next summers canoe project.

Why?

I wonder how many dollars in federal and state taxes were generated from all of this royalty free oil? It has to be in the billions.

In some cases BOEM can waive royalties for fields that would otherwise be uneconomic and have to be abandoned. –>

In some cases BOEM: Bureau of Ocean Energy Management (US DOI) can waive royalties for fields that would otherwise be uneconomic and have to be abandoned.