Guest Yogi Berra impression by David Middleton

Last month, Dr. Phillip Verleger, a professional prediction maker, predicted a crash in U.S. crude oil production in 2020. My response was:

Economist Foresees “Quick Decline” in US Oil Production, David Middleton / March 15, 2019

Certainly if prices drop below $50/bbl for a prolonged period of time, Dr. Verleger’s prediction of a decline in US crude oil production will very likely be correct. If prices rise into the $60-80/bbl range, his prediction will very likely be wrong. It all boils down to predicting oil prices and most oil price predictions are wrong the moment they’re made.

Now Dr. Verleger is predicting that sanctions levied against Iran and Venezuela by the U.S. will lead to a 66% increase in oil prices, taking Brent crude to about $120/bbl…

The findings from the model indicate that the current disruption will likely cause prices to increase sixty-six percent at their peak. Roughly speaking, Brent will rise to between $114 and $126 per barrel.

This conclusion results from my calculation that the present episode will take roughly two percent of supply from the market.The reduction will come from falling Venezuelan production, which is also subject to US sanctions, the declining Iranian exports, and a modest cut in Libyan exports.

Oil Price Dot Com

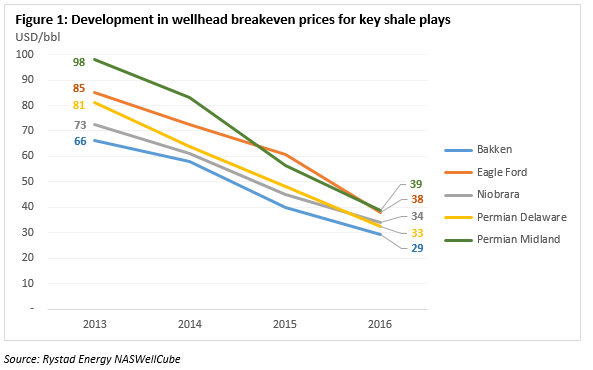

Brent trades at a roughly $10/bbl premium to West Texas Intermediate (WTI), the base price for most U.S. shale producers. A 66% increase would take WTI to $106/bbl. With all of the cost-cutting over the past four years, their break-even prices have fallen to $30-40/bbl…

Shale play breakeven prices. (World Oil)

Dr. Verleger’s forecast for a crash in U.S. oil production was based on a decline in hedging activity, under the misapprehension that hedging was a leading indicator for production. A spike in WTI above $100/bbl would lead to a surge in drilling and the shale players, along with the rest of the industry, would be hedging like crazy.

If it comes to pass, Dr. Verleger’s April 29th prediction would invalidate his March 11th prediction. It just goes to show that…

Or, as Jude Clemente very eloquently put it…

I have learned a very simple truth during my 15-year career in the energy business: one of two things usually happens when you make seriously bold predictions, especially for the longer term.

When the time comes to answer for being wrong, either you are not around to have to respond, or the critics will have forgotten that you ever made the prediction in the first place.

Real Clear Energy

Will the sanctions imposed on Iran push oil over $100/bbl? I have no idea.

As someone who finds oil & gas for a living, $100/bbl oil is great for a few months. Then the cost of doing business skyrockets, rigs are harder to find and it actually becomes more difficult for “Little Oil” to make a profit. This is always followed by a sharp drop in oil prices… which restarts the cycle. As someone who drives vehicles with internal combustion engines (no electric Jeeps for me!), I get p!$$ed off when I have to pay more than $3/gal for gas… FRACKING OIL COMPANIES! (/Sarc… Big time).

Readers of my posts may have noticed that they often revolve around petroleum geology and/or the oil & gas industry… Occasionally one or more of the commentators asks questions like this: “I thought this blog was about climate change… How is the oil & gas industry relevant?” The most obvious answer is the alleged scientific consensus is that climate change is almost entirely caused by greenhouse gas emissions from fossil fuel (oil, natural gas & coal) combustion. RealClearEnergy usually features more articles about climate change than about energy. Justified or not, energy and climate change are “linked at the hip.” But there is a more fundamental relationship between fossil fuels and climate change. Without the rather extreme climate changes that occurred throughout Earth’s geologic history, there would be no coal, no oil and no usable natural gas. There wouldn’t even be much in the way of sedimentary geology.

Now now, don’t be getting all sedimental on us.

Way too Fracking funny

Right on, David! In reference to your comment “energy and climate changes are linked at the hip” I would add, yea, when it’s cold turn up the fossil-fuel furnace! In reference to Jude Clementes comment about when you’re wrong, we probably could both agree (you from the oil side and me from the gold, etc, side) when you say “I’ve studied the geology and recommend you drill here”, and the company drills, two things can happen: 1. you hit a gusher and the company President calls you, or 2. you drill a dry hole and the Human Resources Manager calls you and explains the companies excellent severance package.

Actually hitting a “gusher” is worse than a dry hole… It gets your company on TV.

Yeah, but if your a man named Jed it gets you to be a millionaire. Of course, then your kinfolk are going to want you to move away from there. And Cali is so crazy these days that moving to Beverly (hills that is) is probably not the wisest of moves. So, yeah “gushers” aren’t so good after all.

I’d qualify Yogi Berra’s statement: ” It’s tough to make (ACCURATE) predictions..”

There are ample examples of INACCURATE predictions, among them, the winner of the 2016 Presidential election.

http://www.abovetopsecret.com/forum/thread1234793/pg1

Indeed. It’s dead easy to make predictions, making predictions that prove to be accurate on the other hand is where things get tough.

I consider myself a Lawrence Berra expert, and have read many books by and about him. I was actually sad the day he died.

Berra is my favorite philosopher.

But the “predictions” quote is definitely not something he made up, and the grammar is too good to sound like him — the real Berra quotes are not what anyone else would say, and only make sense when you think about them for a few seconds.

Berra was one of the most optimistic people in the world — a high school dropout who achieved a lot in baseball.

There are so many quotes misattributed to Berra, it’s hard to know what he actually said, except by reading books with his name as “author”.

As Berra wrote in one of his book titles, so I’ll give him credit for it:

“I really didn’t say everything I said.”

My prediction is that 97% of the predictions will be incorrect.

73.6% of all statistics are made up. 😉

(including that one). 😀

i prefer the prediction made at the start of Stingray that anything could happen in the next half hour and it usually did the more exciting and fantastic the better.

https://www.youtube.com/watch?v=q3qfXpoScxw

James Bull

Sturgeon’s Law: Ninety percent of everything is cr*p.

What is a sure thing is that the sanctions are not going to reduce the price of crude oil.

I wouldn’t bet on it… either way.

After control of Venezuela is achieved by the current leader apparent ?

How could that affect supply and prices in the short medium term ?

Regards

It will take quite a while to repair 20+ years of damage.

The key will be summer 2020, not summer 2019.

Trump has about 10 months to get Venezuela righted and headed on a new vector.

And he has about 12 months to get Iran’s government to get replaced.

Putin will oppose him on both, because Iranian and Venezuelan oil off the market keeps prices up for Russian oil to Europe.

If the prospect of Venezuelan and Iranian oil coming back to the market are back in the table by then, oil futures will fall dramatically.

Oil prices dropped sharply today after this news.

So far down for the new trading day as well.

US output is surging, supplies are increasing.

When I proposed for my thesis (many years ago) that OPEC would succumb to loss of market share when they imposed their production controls and fixed price in the 70s I was told to go back and rethink my terms of reference because oil was only going to go up and cost well over $400/barrel by the 80s (everyone know this). I argued that OPEC would simply empower technological changes that would confirm what those Ukrainians had proposed 20 years earlier about the tectonic relationship for oil, inducing alternative oil production techniques and locations, but I was told this was wrong because all oil came from biological matter (hence fossil fuels).

The last drop in oil price, according to the usual suspects, would drive out the frackers because they would not be able to compete. Obviously there was an under-estimation of price driving innovation again.

All oil and almost all natural gas does come from biological sources.

Even the oil in the Ukraine.

Don’t come to California. We are over $4 a gallon

$2.80-$2.90 across the state line in Arizona.

$1.99 for a short while here, too. Then it zipped right back up.

Why? No new crisis in foreign crude oil producers, after all. Simple. Refinery maintenance after a long, cold winter in the Midwest.

North of $4 a gallon is the result of electing moonbats to State offices.

Gasoline prices are only approximately correlated to crude prices.

On a pre-tax basis, crude and gasoline prices are highly correlated.

Wow, this guy is smart. Super smart. He has a computer model that can predict the thinking of all of the worlds oil traders, producers, and consumers combined. He must have a brain the size of a planet and also be extremely generous to imbue us with his wisdom for no charge or personal gain.

Or maybe not.

I always love central planner economists who give you blank stares when you inform them that their theories are in direct confrontation to all the tenets of information theory. They just can’t comprehend that the economy is made up of the billions of individual decisions made by every human being on the planet, and that there is absolutely no way for them to possibly calculate that to more than a very crude order of magnitude or two of error.

I think that is why big companies inevitably run into problems. They start to exceed the processing capability for their markets and fail to anticipate consumer needs.

Regarding: ” Occasionally one or more of the commentators asks questions like this: “I thought this blog was about climate change… How is the oil & gas industry relevant?” The most obvious answer is . . . ”

Years ago, WUWT had a slightly different text at the top. It is still available on the About Page, namely . . .

About Watts Up With That? News and commentary on puzzling things in life, nature, science, weather, climate change, technology, and recent news by Anthony Watts

Works for me.

“I thought this blog was about climate change…

Right from the beginning this blog was about things that interested Anthony or his readers.

https://wattsupwiththat.com/2006/11/17/welcome-to-watts-up-with-that/

If you’ve ever wondered about something puzzling, anything, or how things work, or why certain things are the way they are instead of some other way that might appear to make more sense, this is the place to pose the question. Hopefully I and others can supply an answer. Nothing is off-limits except crude language or personal attacks.

Climate change became a focus because of his background and profession and his discovery that something immensely fishy was going on.

Is Mr. Verlenger aware of what is going on in Venezuela right now? I should think that would skew his projections considerably.

There are 20,000+ Cubans there, working the oil platforms. There is rioting in the streets of Caracas, supporting Juan Guaido and calling for Maduro’s ouster. All Venezuelan air traffic has been essentially grounded, over concerns about ground-to-air rocket attacks. SecState Pompeo has discussed this morning and evening what the USA may/may not do, and the denials coming from Maduro are the result of whatever Russians have been advising him, and they’ve been there for a few weeks now.

I think that perhaps Mr. Verlenger should revise his statement quickly, and take into account that when a flailing dictator, who has ruined the economy of his own country, is refusing to let go of his seat when he should vacate it, the likelihood of Venezuelan oil having an influence on the markets will be influenced by what happens in Caracas.

Furthermore, Russia has the largest shale oil reserves on the planet. Has Verlenger taken that into account at all? If Putin ever finds an engineer who knows how to do what American oil companies do – FRACKING – he will never run out of money as long as oil and gas are available. Putin has people in Venezuela because he hasn’t figured this out just yet, and he’s looking for cash, too.

Putin is trying to keep his hold on Venezuela, because Venezuela under Chavez/Maduro has been a huge prop for Cuba. If Venezuela returns to true Western Democracy, then Cuba will come under intense economic pressure.

Russia doesn’t have any shale oil “reserves.” And their shale oil resource is, at best, tenuous. Couple that with the fact that Russia pretty well sucks at everything it does, without the help of the US oil industry.

What shale oil reserves that they do have are thousands of miles from where it is needed-a big problem. The U.S. is uniquely blessed in that all our energy resources (with the exception of Alaska) are either co-located or very close to the end consumer.

No they are not, the are mostly in flyover country. What we have is a wonderful info structure of pipe lines that get the product to market. Something the left is trying to destroy. New York is not allow new pipe lines. How do the people in New England think they are going to get natural gas to the homes? Even replacing an aging pipeline in the people republic of Minnesota is being held up. Minnesota has no oil gas or coal. What do they think they are going to burn in the winter wood? If they they are going to expand the Minnesota prairies all the way to Grand Portage!

They don’t have any significant shale oil reserves. Resource potential isn’t reserves.

Sara – Russia has been Fracturing wells for decades in its conventional reserves in Western Siberia…. (they invented fracturing but lacked the equipment technologies of pumps etcetera to effectively apply the technology until Canadian Fracmaster moved in the 1990″s !!). The problem Russia has with exploiting reserves in Eastern Siberia and unconventional resources such as oil-shale is the lack of infrastructure (such as roads, towns, airports) therefore an oil price above $70 a barrel (2005 figures) is required to fund the infrastructure development. With such massive conventional oil and gas reserves shale fracturing except in Western Siberia is probably not interesting at this time.

RE – That Jude Clemente quote in the head post: Edit the word energy to read ‘climate’ and you have a perfectly serviceable quote for a whole different subject!

Yogi Berra was a smart guy!

Make a different prediction every month, no one will take note of all the likely failures. But eventually, like the blind squirrel, you’ll occasionally score a nut.

Then Show off your nuts and and everyone thinks you’re a genius (or a nut).

If so then Vladimir Putin and Russia will be the big winners, the huge production capacity with a modest domestic consumption.

First of all it’s Dr. Phillip Verleger, not Verlenger.

The problem with commodity model predictions has always been the linkage or lack thereof with macro economies. What do you suppose will happen to consumers and already weakened export dependent industrial sectors of Germany and east Asia with $100 Brent for any sustained period of more than a few weeks? Does the model know that Europe is running on negative interest rates currently and has few monetary support tools to work with for stabilization? Does the model know the true conditions in China’s economy beyond the State plan for growth? Is the energy model really a hedge fund expert? I respect Dr. Verleger, but perhaps this is one of the alternative scenarios being discussed here….along with the misspelled name.

I actually changed it to Verlenger because I thought Verleger was wrong. I’ll change it back.

I don’t think Brent will top $100. The Saudis want oil in the $80-90 range. They have the excess production capacity to “manage” the disruption of Iranian oil exports. Also, the shale players can move very quickly. If WTI climbs into the $70’s, they will go into overdrive. This could all outweigh the supply disruption.

Yep….

https://www.cnbc.com/2019/05/02/oil-market-us-sanctions-on-iran-venezuela-crisis-in-focus.html

“Verleger” is a job description meaning “publisher”:

That’s german “Verleger ( plural )”: publishers:

https://www.google.com/search?q=german+media+publishers&oq=german+media+publisher&aqs=chrome.

Predictions – how many big names have already had their faces full of egg after a prediction that not only missed but really bombed? I remember when I was working at a gas trading company, we had an oil price wager running and the one who got closest, got the pot. I took it once but the coffee lady had it 2 or 3 times. She bested our best traders and analysts, and she beat the industry grandees. It’s not because she was so good but because she was luckier than the others. This means all this prediction woo woo is just that, no more than an old lady throwing some chicken bones. My recommendation: get good at what you do and be ready to deal with everything that may happen – it matters far less what the future holds then. You will be ready.