Guest post by David Middleton

“We produce more oil at home than we have in 15 years.”

–President Obama, Feb. 12, 2013

Yes, Mr. President, we do produce more oil at home than we have in quite a long time. We could actually be producing a lot more than we currently are. See that decline in Federal Gulf of Mexico production from ~1.7 MMbbl/d to ~1.4 MMbbl/d since early 2010? You actually did build that.

It’s no secret in the oil patch that the recent increase in U.S. domestic oil production has occurred almost entirely on State and privately owned mineral leases in Texas and North Dakota and that production from Federal leases has been declining for most of the last four years.

The Congressional Research Service noticed the same pattern…

U.S. Crude Oil and Natural Gas Production in Federal and Non-Federal Areas

Marc Humphries

Specialist in Energy Policy

February 28, 2013

Summary

In 2012, oil prices ranged from $80 to $110 per barrel (West Texas Intermediate spot price) and remain high in early 2013. Congress is faced with proposals designed to increase domestic energy supply, enhance security, and/or amend the requirements of environmental statutes. A key

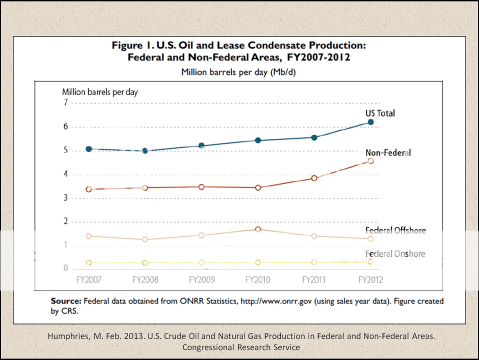

question in this discussion is how much oil and gas is produced each year and how much of that comes from federal and non-federal areas. On non-federal lands, there were modest fluctuations in oil production from fiscal years (FY) 2008-2010, then a significant increase from FY2010 to FY2012 increasing total U.S. oil production by about 1.1 million barrels per day over FY2007 production levels. All of the increase from FY2007 to FY2012 took place on non-federal lands, and the federal share of total U.S. crude oil production fell by about seven percentage points.

Natural gas prices, on the other hand, have remained low for the past several years, allowing gas to become much more competitive with coal for power generation. The shale gas boom has resulted in rising supplies of natural gas. Overall, U.S. natural gas production rose by four trillion cubic feet (tcf) or 20% since 2007, while production on federal lands (onshore and offshore) fell by about 33% and production on non-federal lands grew by 40%. The big shale gas plays are primarily on non-federal lands and are attracting a significant portion of investment for natural gas development.

[…]

Despite the new timeline for review, it took an average of 307 days for all parties to process (approve or deny) an APD in 2011, up from an average of 218 days in 2006.14 The difference however, is that in 2006 it took the BLM an average of 127 days to process an APD, while in 2011 it took BLM 71 days. In 2006, the industry took an average of 91 days to complete an APD, but in 2011, the industry took 236 days. Thus, since 2006, it took the BLM 56 fewer days to process APDs, while it took the industry 145 days longer to submit a completed application.15 The BLM stated in its FY2012 and FY2013 budget justifications that overall processing times per APD have increased because of the complexity of the process.

Some critics of this lengthy timeframe highlight the relatively speedy process for permit processing on private lands. However, crude oil development on federal lands takes place in a wholly different regulatory framework than that of oil development on private lands.16 State agencies permit drilling activity on private lands within their state, with some approving permits within ten business days of submission.

[…]

The permit delays cited by the CRS were just for the BLM (onshore) APD’s (applications for permits to drill). The CRS report did not discuss the even longer offshore delays. POE (Plan of Exploration) or DOCD (Development Operations Coordination Document) applications have to be submitted and approved before the APD. These plan documents used to be reviewed and approved in 30-60 days. Currently, the BOEMRE is taking 180 to more than 300 days to approve POE’s and DOCD’s. Quite often, the BOEMRE will even not “deem” the plan to have been received for more than 30 days. Then it can be another 30-60 days before they let the operator know if the plan is sufficiently completed for review. The 300,000 barrel per day decline can be laid squarely on the unlawful drilling moratorium in the Gulf of Mexico (yes, it was unlawful) and the subsequent “permitorium.” Back in 2007, Gulf of Mexico production was expected to reach 1.8 million bbl/day by 2013, largely on the back of the Lower Tertiary play…

This production was delayed by the moratorium and permitorium. The first field, Cascade/Chinook, has only just recently come on production. Several more fields should come on-line within the next year or two. So the Gulf may actually hit that 1.8 million bbl/day mark before the end of this decade.

In an era of high oil prices and increasing natural gas demand for power generation, it is simply insane that oil & gas production from Federal leases has been declining for most of the last four years…

It’s even more insane for this to be happening at a time when the Federal government claims that it desperately needs more revenue.

The CBO estimates that the full opening of the Outer Continental Shelf (OCS) and ANWR Area 1002 to exploration and production would quickly generate more than $35 billion per year in Federal revenue from lease bonuses and royalties…

On top of that, the BEA estimates that it would also generate more than $24 billion per year in Federal tax revenue…

That’s about $60 billion per year.

Simply allowing oil and gas companies to do their jobs could more than offset all of the real sequestration cuts (~$44 billion per year) without raising taxes on anyone.

Climate Progress and other green activists seem to be blaming geology for the decline in oil production from Federal leases. They must think that organic-rich shale deposition somehow managed to avoid Federal lands…

The shale plays have nothing to do with the decline in oil production from Federal leases. This is not an “either, or” thing. The increase in oil production from shale plays on non-Federal leases is not causing the decline in production from Federal leases.

The decline is entirely due to the drop in Gulf of Mexico production and this decline is entirely due to the moratorium and subsequent permitorium. As recently as 2010, before Macondo and the moratorium, the MMS was forecasting 1.8 million bbl/d from the Gulf by 2013…

Without the moratorium and permitorium, Gulf of Mexico oil production would likely be about 400,000 bbl/d more than it currently is. Possibly even higher, because production was recovering very quickly after the September 2009 economic crash and Hurricane Ike. While it is true that only about 10% of the current shale oil plays are being exploited on Federal lands, half of the shale gas plays in the Western U.S. are under Federally controlled lands.

Beyond that, the hydrocarbon potential under unavailable Federal lands and waters dwarfs the non-Federal shale plays. The undiscovered technically recoverable resource potential of the lower-48 OCS (Eastern Gulf of Mexico, Atlantic and Pacific), ANWR Area 1002 and other unavailable onshore Federal leases exceeds the discovered technically recoverable resource potential of the active shale oil plays by nearly 50%…

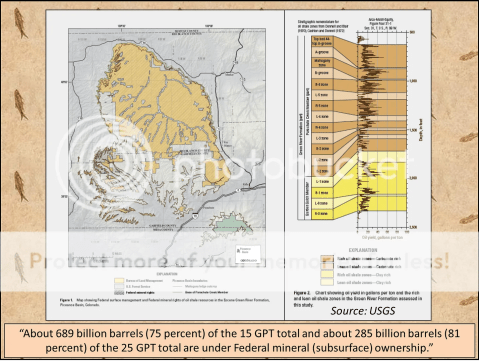

Also, the assertion that Federal leases only cover 10% of the shale oil plays misses the potential “mother-of-all” shale plays: The Green River Oil Shale of the Piceance Basin.

The vast majority of this play is under Federal control and largely unavailable for meaningful exploitation efforts…

While not a conventional oil play, the Green River Oil Shale is now technically and economically exploitable. Last fall the Interior Department announced that it would close off another 1.6 million acres to oil shale development. As it currently stands, very little of this acreage is available for leasing and then only for R&D purposes.

- Gulf of Mexico: 400,000 bbls/d shortfall due to the ongoing permitorium and more difficult lease terms.

- ANWR: 400,000 bbls/d shortfall due to failure to open Area 1002 in a timely manner.

- Green River Oil Shale: 500,000 bbls/d shortfall due to failure to effectively open Federal leases for exploitation.

Production in the Gulf has increased since 2006. Six years of increasing Gulf production and yet this has done nothing to stabilize the price of oil.

Thanks for the post. I made a comment on another thread that referenced to the Deepwater Horizon spill. It would likely be of interest to many of the WUWT readers to toss in a few articles/posts on the technical aspects (in detail) of deep water wells and discussion of the aspects of what occurred after the blowout. It was fascinating to get the details of what was happening and ways to close the well. Dave Summers (Heading Out) at theoildrum.com comes to mind. I viewed him as the Anthony Watts of the oil patch. I also realize this could be a touchy subject considering the current legal proceedings taking place.

Peak oil: Peek and ye shall find.

The US hasn’t built a new oil refinery since 1976, and the ones in operation are running at near capacity. This is a new disaster waiting to happen.

Elections have consequences

There is a good deal of technically recoverable shale oil that would require more energy to get it out of the ground than could be extracted.

Much of the shale gas development is speculative, wells are not producing at anything like the rates projected when the companies where touting for investment. There is a lot of ‘sub-prime’ shale gas fields out there…

Then there is the effective subsidy that the federal authority gives to the fossil fuel industry by charging such low royalties for oil extraction from public land, income from this source would be much greater if rates where truly market lead.

But all of this is scrabbling after the last few finite dribbles of fossil fuel, certain to run out, reduce in volume and become much more expensive while representing just a few years of supply at present rates of consumption. Its an obsolete technology with a built in and unavoidable endpoint.

Unlike renewable sources of energy like PVs. Reducing in cost every quarter, and with a free and infinite fuel supply.

Slightly OT – some Japanese research suggests gas from methane hydrates could soon be on the menu:

http://www.bbc.co.uk/news/business-21752441

The sad part is that Obama could have his cake and eat it too – by allowing drilling on federal land, it would pay for his pork. Instead, he would rather rob from the children.

Today they are singing his hosannas. Future generations will be reviling him for stealing their prosperity.

An interesting corollary – Climate progress is essentially saying our hydrocarbon based energy is now all about shale plays. And enviros in general are doing everything they can to stop fracking, which is essential to extraction in shale plays, so they are essentially saying the entire hydrocarbon industry should go away. No surprise there, but what the heck do they think will replace it , at least in the short term? There is nothing that can replace it, so they are proposing moving society, literally, back to the dark ages.

What we need to do as an industry is completely shut off our supply for a week & let society see how integrated hydrocarbon based energy is in our way of life. Then, maybe society could see just how silly the enviro idea of eliminating hydrocarbons from our society is & there would be full public support to let the industry go about it’s business.

As such, I appreciate the undertone of moral outrage David brings to this post – we all should be outraged at the left wing greenies trying to obstruct our industry, one which brings so much benefit to society with such little impact.

It takes approximately 6 years to get oil production from a lease on federal land (and the environmentalists are proud it takes so long). On the other hand, my friends in the Bakken field tell me it takes about 90 days to get oil production from a private lease in N. Dakota (and the landowner is more than happy to get the royalty, naturally).

That’s the problem–the Feds with their eco-geek friends are no more interested in production than they are in increasing the CO2 content of the atmosphere. Oh wait! There’s a corollary there. Big surprise. It isn’t geology at all–it’s strong reluctance for any company to invest in drilling when ROI is 6 years away.

A reduction in production from Federal lands? Wonder no more.

Excellent post. It is always a pleasure to see statements of fact backed up by the facts.

As they say down here (or up or over, depending upon where you are), “I wasn’t born in Texas, but I got here as fast as I could.”

As a petroleum engineer I have had the pleasure of working in Wyoming, North Dakota, and Texas. I will have to say that the federal intervention was ever present in Wyoming since most of the fields that Marathon had the BLM also had jurisdiction over. The move to Texas was like night and day. If you had a lease you could get a permit in a couple of days and get to drilling.

Might take a few days more now but that is partly a result of the high volume of APDs. The Feds are of little consequence on-shore.

Having partly grown up in Wyoming is it so annoying that the myopic “greenies” continue to put huge blocks of highly potentially productive oil/gas lands out reach by locking them up in misguided “protected” land status. The groups pushing to lock the land up have no middle ground or common sense. They are more than willing to destroy large blocks of surface area with pie in the sky solar and wind projects in the name of renewables, but try to build a lease road or drilling pad and they act like the world is coming to an end.

It is time for a reasonable balance. We should not be locking up untested areas. We should be at least be able to do some exploration before acting. If the area prove out then they should be developed. If not worthy of production then consider locking them up. Too much knee jerk reaction going on and of course Agenda 21 is always in the background.

When I moved down here in ’81 the sentiment of “Let the bastards freeze in the dark” was common and I think it still makes sense. For those states opposed to drilling and fracing (no k in the word) let them supply their own gas and oil, close the pipelines at the border. Same goes for the offshore drilling bans, if you don’t like it, find your own.

Peak oil is caused by cultural Marxism not by lack of oil

Although I love David’s optimism, on the oil end of unconventional plays, it’s really all about the Bakken & Eagleford, which are in areas of minor federal acreage. See fig 5 of this link:

http://www.ogj.com/articles/print/vol-110/issue-12/exploration-development/evaluating-production-potential-of-mature-us-oil.html

Clearly, all shale plays are not created equal, regardless if they are on private, state or federal minerals.

izen, can you tell us when the fossil fuel will run out? And what is a PV?

“There’s no disputing the fact that our nation’s domestic energy production on federal lands has been stymied by this administration.”

It is interesting that Climate Progress would willing choose to use a quote that was so verifiable true, and then try to prove it false by avoiding the subject of the quote. Why not just leave the quote out and stick to their usual obfuscations and ad hominems?

They aren’t very bright, are they?

In the Gulf, it can take 6 years or more from the time the lease was awarded until first production. Although we have done it in less than 4… Although that was back in 2004-2008.

On the shelf, prospects can be leased, drilled and put on-line in less than 1 year… Well, they could when POE’s, APD’s and DOCD’s could be turned around in less than a month.

Correction: In the Gulf, it can take 6 years or more from the time the lease was awarded until first production in deepwater. Although we have done it in less than 4… Although that was back in 2004-2008.

izen…let me get this straight:

1. Shale gas is not what it is fract up to be.

2. The Feds should collect more royalties to raise more money from the resource they are unnecessarily restricting.

3. We should use PV’s because they are getting cheaper all the time.

Now lets take your comments into the real world. Natural gas is cheap today because the supply is high, largely due to shale gas. Doesn’t really matter if production is living up to the hype if it is living up to our needs.

In the real world, which is better for tax revenue: increasing the tax rate and reducing the number of tax payers, or reducing the tax rate and increasing the number of tax payers? History has shown us time and again that it is far better to reduce the rate and increase the number of payers. Similarly, increasing the royalties charged on energy production on Federal Lands will just send the developers to non-Federal lands, causing revenues to drop. It would be far better to leave the royalties where they are and increase the production, if revenues are a goal.

I am so happy that the price of PVs is getting cheaper all the time. Let me know when PVs are the same price (factoring in all subsidies on both sides) and efficiency and ease of use as fossil fuels and I will gladly use the sun for most of my energy needs. It just doesn’t make any sense to tell me to buy something today that is more expensive and less efficient than what I already have, by arguing that it will be cheaper and more efficient tomorrow. That sounds like an excellent reason to wait for tomorrow, don’t you think?

David Middleton

Thanks for setting the record straight.

Economist James Hamilton writes:

The total US market capitalization (2011) was $15.6 trillion. I.e., oil imports have already drained US wealth worth 2/3rds of total US market capitalization.

At 8.9 million bbl/day imports and $92/bbl = $300 billion/year. Over 40 years current rates would result in $12 trillion balance of wealth transfer overseas.

Business As Usual oil imports alone could lead to a loss of US financial sovereignty over the next generation.

Obama’s cutting oil production and increasing oil imports by red tape is seriously harming US citizens and driving us faster into debt and bankruptcy.

Restore us to fiscal sanity and sound stewardship.

The Eagle Ford and Bakken had nothing to do with the decline in oil production from Federal leases.

Jesse G. – The US hasn’t allowed itself to build a new refinery since 1976. Another “feel good” (pointless) law went into effect that year which prevents new refineries from being built. Another green failure.

Even if this absurd comment was true, we do this to make money, not to produce a net energy return. The only thing more idiotic than Peak Oil is the concept of EROEI.

EROEI is to accounting what Trofim Lysenko was to science. I don’t spend energy to fill my tank. I don’t give energy back to the gas & electric companies in exchange for them being nice enough to heat and light my home. My company doesn’t drill for oil & gas to make energy.

I spend money to fill my tank. My company drills wells for oil & gas to make money. My gas & electric bills are paid for with money. My pay check, ExxonMobil & Shell credit card statements and checks to the gas & electric companies aren’t denominated in joules, kilowatts or btu – They are denominated in $.

I don’t give a rat’s @$$ if 1 barrel of amoeba flatulence uses less energy to produce than 1 barrel of crude oil… Because the barrel of amoeba flatulence costs $800 and can’t be produced in sufficient quantities to be waiting for me at the Exxon or Shell station when I need it.

If oil companies (or any businesses) used EROEI to guide their investment decisions, they would go out of business (unless the gov’t was footing the bill).

Regarding the Green River Oil Shale of the Piceance Basin, see pages 20-21 and 50-51 of Bartis, James T. 2005. “Oil shale development in the United States : prospects and policy issues.” RAND Corporation.

The in situ recovery process proposed by Shell requires 250-300 kWh of electricity per barrel of oil. That’s roughly 1 million BTU of electricity to produce 5.8 million BTU of oil. Production would require about 1.2 GW of generation capacity per 100,000 BOPD. The electricity could be provided by gas-fired generation, fueled by the associated gas production. The Piceance Basin has more than adequate water supply to support at least 3 million BOPD of production. The primary constraint was water supply infrastructure, currently only capable of supporting ~400,000 BOPD. Water would be the biggest hurdle in the path of growing above 3 million BOPD of production. Hurdles get hurdled all the time.

Assuming we never figured out a more economic energy source, the fossil fuel (petroleum, natural gas and coal) will run out in about 5,000 years.

A PV is one N short of Net Present Value.

I can understand if approval is more cautious in the Gulf of Mexico since the Macondo spill.This article would be a lot more complete if the ramifications of that incident had been addressed fully. Where does caution end and obstruction begin? Does the author think any sort of sober second thought was out of line? I’m not trying to make any particular point here, I just would have like to seen that issue addressed instead of being virtually hidden away.

Bob says:

March 12, 2013 at 4:05 am

“Elections have consequences”

Awww, c’mon, Bob! Given a choice between lower energy costs, which would boost all aspects of the economy, or an Obamaphone, of course the obvious choice is an Obamaphone. Duh! ;o)

To the topic: I think our already obscenely-national-debt-laden unborn grandchildren and great-grandchildren will be grateful that we left all that oil in the ground. They will have the opportunity to thank us for leaving them something with which to pay off their crushing debt. If we are lucky, they might toss a bone to those of us that haven’t frozen to death and throw a little of that scratch into our miniscule Social Security accounts, eh? Or, maybe we could “drill here, drill now” and pay off the debt so they don’t have to wonder why 97% of their earnings go to taxes.

(Oh, forget I said anything. Just tell me where I can go get my Obamaphone, will ya?)

@- Jim Clarke

“I am so happy that the price of PVs is getting cheaper all the time. Let me know when PVs are the same price (factoring in all subsidies on both sides) and efficiency and ease of use as fossil fuels and I will gladly use the sun for most of my energy needs.”

Next year.

Get a EV and you can charge it at home.

http://www.pv-magazine.com/news/details/beitrag/deutsche-bank–sustainable-solar-market-expected-in-2014_100010338/#axzz2LyRXuVHd

@- David Middleton

Assuming we never figured out a more economic energy source, the fossil fuel (petroleum, natural gas and coal) will run out in about 5,000 years.

You have a erroneous extra zero in that answer, and it is only the coal which would last that long, 500yrs. Oil has less than fifty years at present consumption rates.

But long before that the cost of seeking those last dregs of fossil fuel will far exceed the cost of other energy sources, they will be extracted as organic feedstuff, not for their energy content.

@-“I spend money to fill my tank. My company drills wells for oil & gas to make money. My gas & electric bills are paid for with money. My pay check, ExxonMobil & Shell credit card statements and checks to the gas & electric companies aren’t denominated in joules, kilowatts or btu – They are denominated in $.”

If other sources of energy are cheaper per mile then you would have to be some sort of luddite to still use fossil fuels to run your vehicle.

But then the are still people who ride horses I suppose….

“fossil fuels” are chemical fuels whose feedstock traditionally has been fossil material. There is no reason to believe we need ever run out of liquid or gaseous carbon based high density fuels to power some of our machines should we wish to keep using them. But whether the real answer is 5000 years, or even with an order of maginitude error 500 years, concern is theological, not practical.

How many catastrophic spills from drilling and production operations in the Gulf occurred prior to Macondo?

This was on the MMS website up until a few weeks after the Deepwater Horizon explosion…

I wish I had screen-capped it.

From the time the first OCS well (Odeco A-1 in Eugene Island Block 94) was spudded in the Gulf of Mexico on May 10, 1947 up until Macondo… 99,718 miles of measured depth hole were drilled without a catastrophic failure like BP’s, almost 100,000 miles of drilling.

While there were some positive changes after Macondo… Every company went to great lengths to restate their “All Stop” policies… And there were a few sensible changes – Like ensuring that you never had drill pipe in the hole so strong that the shear rams couldn’t cut it.

But, 99% of the reaction was idiotic. It just made it more expensive to do everything and it lengthened permit and plan approval times from 30-60 days to 6 months to 2 years.

Dave Middleton: “I wish I had screen-capped it”

Thanks very much for your reply. That is exactly what I was looking for…

“Japan Cracks Methane Hydrate In Dramatic Leap For Global Energy”

http://www.thegwpf.org/japan-cracks-methane-hydrate-dramatic-leap-global-energy/

“Japan has extracted natural “ice” gas from methane hydrates beneath the sea off its coasts in a technological coup, opening up a super-resource that could meet the country’s gas needs for the next century and radically change the world’s energy outlook.”

izen says (March 12, 2013 at 9:22 am): “If other sources of energy are cheaper per mile then you would have to be some sort of luddite to still use fossil fuels to run your vehicle.”

And if fossil fuels are cheaper, you’d have to be some kind of idiot to insist people use more expensive “alternative” energy sources.

Or a politician. But I repeat myself.

David Middleton says:

March 12, 2013 at 7:46 am

“The Eagle Ford and Bakken had nothing to do with the decline in oil production from Federal leases.”

But these 2 plays do largely explain why non-federal acreage oil production is climbing. Without those 2 plays, federal & non-federal production profiles would not look that dissimilar.

There are plenty of shale plays that have been tried &/or are producing on federal acreage – the Niobrara, Mowry, Heath, Lewis, Pierre, Mancos, Manning Canyon, Cane Creek, Monterey / McClure to name a few, but they just don’t have the same quality as the Bakken or Eagleford. Thus my comment – all shale plays aren’t created equal. It’s hard to argue any of these plays would be producing as well as the Bakken with a more favorable regulatory environment.

Don’t get me wrong – I agree with your premise that federal regulation is stymieing production on federal lands – no doubt that is true – however, I also think it is unfair to suggest there would be a play equivalent to the Bakken or Eagleford that would be contributing similar production under a different regulatory environment.

If you feel there is such a play out there on federal lands, I would like to take this conversation off line & talk to you about investing in it :))

If I knew where the next Eagle Ford was, I wouldn’t be working the Gulf of Mexico!

Apart from the Green River Oil Shale, I wasn’t implying that there was a quality shale oil play, ready and waiting, under unavailable Federal lands.

My point was that the Bakken and Eagle Ford didn’t cause the production from Federal leases to drop by ~300,000 bbl/d since 2010. That decline was caused by the moratorium and permitorium.

How many catastrophic spills from drilling and production operations in the Gulf occurred prior to Macondo?

Mr. Middleton, there was one “catastrophic spill” pre-Macondo; the Ixtoc 1 well in the bay of Campeche spilled about 3.3 million barrells of oil in 1979 before finally being brought under control with relief wells. Notwithstanding that oversight, your basic point is sound; The safety record of oil and gas drilling in the GOM is pretty darn good, especially in light of the difficult engineering issues involved in extracting hydrocarbons from deep wells in deep water. it’s a shame the average citizen can’t travel to some of the rigs or platforms in the GOM to witness and get some basic understanding of what is involved in the process. i hope they, like i always am, would be amazed at human ingenuity in the modern world.

David Middleton says:

March 12, 2013 at 12:18 pm

“My point was that the Bakken and Eagle Ford didn’t cause the production from Federal leases to drop by ~300,000 bbl/d since 2010. That decline was caused by the moratorium and permitorium.”

Agreed !!!

I was discussing the U.S. OCS portion of the Gulf of Mexico.

Ixtoc was really bad. But the Bay of Campeche is not part of the U.S. OCS, not regulated by the MMS (now BOEMRE) and USCG, nor is Pemex a competent operator.

Mr. Middleton,

I find it interesting about this 300 Mbbl/day figure you mention since it matches up pretty well with the exact difference in the BP oil production in the GOM prior to and after their accident/oil spill in April 2010: http://www.rbnenergy.com/bridge-over-troubled-water-gulf-of-mexico-oi-production-recovering

That specific drop in BP oil production couldn’t have anything to do with the fact that BP itself was under criminal investigations and reviews of safety and environmental procedures regarding the accident and deaths and it was therefore prevented from drilling until those criminal investigations and reviews had been completed could it?

By the way, that forecast of 1.8 MMbbl/day you brought up was already proven to be wrong as GOM production had already dropped by 2 Mbbl/day well before the April 2010 BP oil spill incident: http://www.rbnenergy.com/sites/default/files/styles/extra_large/public/field/image/chart2_2.png?itok=vdU7VHQ-

Back in February 2009, before any BP oil spill/accident or moratorium, there was already a discussion that the long-term GOM oil production trend would continue on a general decline from its 2002 peak: http://www.theoildrum.com/node/5081

In regards to the moratorium, it was fully lifted by March 2011: http://bizmology.hoovers.com/2011/03/24/deepwater-drilling-permits-in-the-gulf-of-mexico-get-the-green-light/

and BP was granted a deepwater drilling permit in November 2011: http://bizmology.hoovers.com/2011/11/01/bp-wins-permission-to-drill-in-the-deepwater-gulf-of-mexico/

It was after the granting of that deepwater drilling permit that GOM oil production actually dropped by about that additional 300 Mbbl/day figure soon thereafter.

As you already generally noted, crude oil production in the GOM production is still forecasted to slowly increase to 1.5 MMbbl/day by the end of 2014: http://www.rbnenergy.com/sites/default/files/styles/extra_large/public/field/image/chart2_2.png?itok=vdU7VHQ-

as the number of oil rigs in the GOM has now fully returned levels just below where they were before the BP accident: http://www.rbnenergy.com/sites/default/files/styles/extra_large/public/field/image/chart3_0.png?itok=gBbQM3Xn

But again the forecasted GOM production trendline is generally downward based on the information provided in that February 2009 report, and that was well before this hype about the moratorium and permitorium ever came into play.

People who say that increased US oil production has done NOTHING to reduce the price of oil need to look at the price spread between WTI oil and Brent oil.

It’s impressive.

@Sceptical:

” stabilize the price of oil.”

Don’t know much about commodities or oil, I see. There’s this thing called OPEC that “stabilizes the price of oil” at high prices. Though even there, the fundamental nature of commodity markets is to be unstable, so they have challenges.

The goal is not to “stabilize the price of oil”, the goal is to keep US $$$ in the USA and Canada, not send them to OPEC members.

@Izen:

“Unlike renewable sources of energy like PVs. Reducing in cost every quarter, and with a free and infinite fuel supply.”

Yet more extreme lack of understanding. First off, PV isn’t free. There isn’t any “fuel supply” to it, it is all sunk cost capital. Photovoltaics are pricy. Second, take a look at where oil goes. It goes into transportation. Then look at where electricity goes. It does NOT go into transportation. That means you need “fleet change” if you wish to use electricity to do transportation. That runs into $Trillions for the nation. Now look at ‘vehicle lifetime’. AVERAGE is now about 12 years for “light duty cars and trucks”. Heavy vehicles even longer. Even IF every single new vehicle being sold today were an electric, it would be a dozen years to turnover 1/2 of them. Oh, and we can’t make them that fast. (Hint: Look at copper supply… and lithium… and …)

Next look at things like ships, trains, and airplanes. You know, things that take a LOT of that oil. And large trucks. And farm and construction equipment. Now where are you going to buy your electric container ship? Your electric 787? Do you know the cost to electrify 3000 miles of train track for just ONE of the cross country lines? There’s a reason they run on Diesel. Trains migrate to the lowest cost energy source. In small urban areas with light trains and frequent start stop, that is electricity (so subways are often electric). For long haul it’s not electric. (Though if we built a load of nuclear power plants like in France and Japan it can become economical).

Now compare that with solar at God Awful per kW-hr (about 40 cents instead of 4 to 8 for bulk nuke baseload). No way any train is going to be using that stuff. It would be more economical to go back to coal and steam engines. (Better is just to use F-T and convert coal to Diesel and keep the rolling stock the same).

So we’re going to be using oil products in that transportation fleet for a very long time. We may make them from coal, or even garbage, or even “pond scum” (all of which are proven) but we will not be using solar PV for transportation in any significant amount. Just not going to happen.

There’s a nice US Govt graph of where energy comes from and goes to in this article (about using a coal /water slurry in Diesel engines):

http://chiefio.wordpress.com/2013/03/09/chws-charcoal-liquid-diesel-fuel/

Interesting article, btw, the author of the quoted paper finds he can make charcoal into Diesel fuel with ash levels suited to heavy machinery use. Yes, charcoal. So we can, at lower costs than present, BTW, use wood farms to replace oil. As trees are more energy efficient than corn ethanol, likely at a much better energy efficiency too.

Oh, and I see you trolled the “too much energy to lift it” line. That is a Red Herring. The form of the energy matters. Just as we take natural gas that we have in excess (and often stranded for lack of pipelines) and use it to cook tar sands for oil to make liquid fuels, we can use natural gas or nuclear electricity to “lift” oil long after it is a net energy consumer, because we want the liquid fuels it produces. We never run out of nuclear power (and it can be made quite cheaply) so we will be using it to lift oil for a long time to come. (The oil wells along Hwy 101 in California are running on electric motors now, and we get nuclear power shipped in from Palo Verde plant in Arizona, so this is NOT a hypothetical.)

http://chiefio.wordpress.com/2009/05/29/ulum-ultra-large-uranium-miner-ship/

@Phlogiston:

Japan has started the first test production. It will take a while to find out how well it goes:

http://chiefio.wordpress.com/2010/11/30/clathrate-to-production/

Ultimate resource is gigantic. Haven’t kept up on the newest news, so maybe time to go looking again.

I am guessing not many are following this post at this point, but I thought I would post this link , which just got this morning, but is a 3rd party opinion in lock-step with David’s thesis of the federal government being a significant impedance to production on federal lands:

http://www.epmag.com/Production/Production-Declines-Pose-Challenge-Gulf-Mexico_113649?utm_source=sp&utm_medium=em&utm_campaign=5772917-March%2014,%202013&utm_term=EP%20Buzz%20March%2014%202013%20Auto%20(1)&utm_content=578623&spMailingID=5772917&spUserID=MTc3Nzg4NzE1MAS2&spJobID=68534813&spReportId=Njg1MzQ4MTMS1

Awesome. Thanks David! Please keep it up!