Nick Pope

Contributor

Available data and recent history contradict one of the key points of the Biden administration’s long-awaited study on liquefied natural gas (LNG) exports and Energy Secretary Jennifer Granholm’s attempt to spin the study into something it is not.

The Department of Energy (DOE) released the study on Tuesday, nearly a year after the Biden administration froze approvals for LNG exports to non-free trade countries in January. The paper stops short of determining that more LNG export capacity is not in the public interest, but it suggests that significant growth in exports will drive up domestic natural gas prices despite all available evidence indicating that the exact opposite is true.

“The U.S. Department of Energy’s updated study finds that a wide range of domestic consumers of natural gas – from households to farmers to heavy industry – would face higher prices from increased exports,” Granholm said in a statement addressing her agency’s report. “The study put forward today finds that unfettered exports of LNG would increase wholesale domestic natural gas prices by over 30%. Unconstrained exports of LNG would increase costs for the average American household by well over $100 more per year by 2050.” (RELATED: ‘That Is Hilarious’: Energy Secretary Cackles When Asked About Rising Gasoline Prices)

Before the Biden admin. decided this week to delay approving the massive CP2 LNG export terminal, White House officials met with a 25-year old TikTok influencer driving an online campaign to kill the project.

Via @DailyCaller News Foundationhttps://t.co/UW6dVVgaS5

— Nick Pope (@realnickpope) January 25, 2024

The study released this week is not the first DOE publication to suggest that growing LNG exports might bring about higher domestic prices: In 2012, the agency’s Energy Information Administration also projected a potential 54% increase in the wellhead price — the price of gas at the point of production — by 2018 in the event of a rapid introduction of new LNG export capacity. Between 2012 and today, a period in which American LNG exports accelerated massively, domestic natural gas prices fell as export volumes increased substantially, according to data analysis from the Chamber of Commerce.

The Shale revolution of the late 2000s and early 2010s prompted massive growth in the U.S. natural gas industry, but American LNG exports were essentially a non-factor prior to 2016, according to the Center for Strategic and International Studies. Today, the U.S. is the world’s leading LNG exporter and is on track to approximately double the LNG export capacity of Qatar — the world’s number two exporter — by 2028.

Granholm actually concedes that higher exports does not mean higher domestic prices in her assessment of the DOE LNG study, writing that “to date, U.S. consumers and businesses have benefited from relatively stable natural gas prices domestically as compared to those in other parts of the world who have faced far greater price volatility.” In effect, Granholm is stating that U.S. natural gas prices have remained “relatively stable” over the same period of time in which the American LNG industry blossomed into the global leader.

“There is zero evidence of any such correlation,” David Blackmon, a 40-year veteran of the oil and gas industry who now writes and consults on the energy sector, told the Daily Caller News Foundation regarding Granholm’s suggestion that more exports could lead to higher domestic prices. “It is abject nonsense.”

Moreover, Granholm also presided over a period of rising energy costs in the U.S., increases that energy market analysts like Travis Fisher, director of energy and environmental policy studies for the Cato Institute, attribute to the Biden administration’s $1 trillion-plus green energy and climate agenda.

“Granholm’s letter, and its leaking to the New York Times, was a cynical and transparent attempt to try to punch up the study’s findings, which actually make the case that continued growth in the LNG export business is in the national interest,” Blackmon said. “It is the sort of political game-playing that has typified the entire Biden presidency, and which probably helped Donald Trump get elected to a second term in office. The public has grown weary of all of this kind of nonsense.”

S&P Global released its own study on the impacts of long-term U.S. LNG export growth on the same day that DOE put out its report. S&P’s analysis found that domestic natural gas prices have not increased despite massive export growth, and that the LNG industry has the potential to contribute $1.3 trillion to U.S. GDP by 2040, in addition to generating enormous tax revenues for the public coffers.

Nevertheless, Granholm contended in her assessment that her agency’s most recent “publication reinforces that a business-as-usual approach is neither sustainable nor advisable.”

With respect to sustainability, U.S. LNG — which is cleaner than gas from Russia, Qatar and most other places — is thought by analysts to have enormous potential to displace dirtier fuels like coal in other countries, thereby decreasing emissions relative to “business-as-usual” and maintaining energy reliability given the intermittent nature of renewables.

As far as whether or not it is “advisable,” particularly for investors and developers, to expand LNG export capacity, Blackmon said it is not the government’s role to determine which private investments are “advisable” or not. Instead, it’s the private sector’s responsibility to determine which investments make sense and which do not, with those who correctly read the market reaping the benefits while those who make bad investment decisions absorb the consequences of those choices.

“Not only is this not Granholm’s job, the study findings in the report published Tuesday simply do not support any such conclusion,” Blackmon said.

The DOE did not respond immediately to a request for comment.

All content created by the Daily Caller News Foundation, an independent and nonpartisan newswire service, is available without charge to any legitimate news publisher that can provide a large audience. All republished articles must include our logo, our reporter’s byline and their DCNF affiliation. For any questions about our guidelines or partnering with us, please contact licensing@dailycallernewsfoundation.org.

The Biden Administration policy on LNG exports is pure Green New Deal/Net Zero orthodoxy. Any other power source but wind and solar is Evil Personified.

Exports of LNG will, for sure, NOT reduce natural gas prices in the US.

We should not export any of our fossil fuels, because they are needed to empower the US industrial economy.

Not exporting fossil fuels, and drill baby drill, will, for sure, keep energy prices low in the US, which enable companies based in the US to make low-priced products for our own use and for export to Europe and other markets.

That will give steady work to tens of millions of US workers which will strengthen their traditional communities and their way of life.

The only reason we are exporting LNG is per desire of the Deep State, because it wants to play geo-political games to “weaken Russia”, which had the opposite effect of strengthening Russia, and weakening Europe instead.

I agree with many of your points. At the same time, owners of private resources ought to be able to carry out their business plans, so long as they follow relevant rules and regulations.

The U.S. as a whole benefits from selling products that reduce our trade deficit, however, I share your concern fundamentally about the effect of supply and demand on pricing.

In the case of LNG, the political chain pulling damages the businesses operating in this space, and just in general, Granholm is more likely than not to be on the wrong side of what is best for the U.S. If she’s against it, I’m for it and vice versa.

Once we allow fracking in places like NY state- there will be a huge oversupply for American needs.

A lobotomy of Democrat elites would be needed, as a minimum.

We need to get rid of all subsidies for wind, solar, batteries, EV, heat pumps, etc.

They would cease to exist because financing would be unattainable.

In fact, we need to get rid of all subsidies for all sectors of the economy to get the federal government out of the private sector.

NY is so crazy they might just constitutionally ban any resource extraction below the local water table. They are that nutz

The LNG export facilities in Louisiana, etc., received $billions of US subsidies over many years, to enable the Deep State and to enable the LNG infrastructure to thrive.

Owners of private resources should have an America-first mindset, which means US consumption of US resources.

Exports of US fossil fuels and minerals makes the US like a Third World nation.

They should be used by US industrial companies.

Plus, it takes those resources away from the Deep State to play geo-political games.

I know of at least a couple of export facilities that began as import terminals. This illustrates the difficulty of prediction by both public and private finance sectors.

I support natural gas usage by manufacturers in the U.S. as you do, and I certainly favor limiting the DS, but as others have pointed out, we have plenty of natural gas here to go around, and domestic usage will always have the benefit of not needing to be liquefied.

As MarkW points out, trade creates wealth. I support wealth creation too.

Yes, before fracking, the US was running out of gas, so had to import.

Then fracking came along and exports became possible

You have some good points to consider.

I do not agree with all of them, but anything that gets the “Deep State” out of geo-politics I am all in on.

The logic wilpost uses is self refuting.

He claims that exporting fossil fuels causes fossil fuel prices to rise. So we need to stop the export of FF, which will cause FF prices to rise, which makes other stuff cheaper so that we can export more of them.

The reality is that exporting more of these other products makes those other products more expensive, so we need to ban the export of those items too.

The way the logic works, the less the US exports, the richer the US becomes. Which every one should know, is nonsense

Beyond Econ 101.

Using that logic, not exporting anything will make all Americans fabulously wealthy.

The reality is that the fossil fuels belong to the companies that paid for it, and the desire to require them to sacrifice so that those who did nothing to create the wealth, can benefit, is nothing more than socialism writ large.

Myopia regarding trade history abounds, which is not your fault, because the Corporate Media has kept the US people in an Entertainment/Brainwashed coma for many decades.

The US needs to relearn to be a hardball trading nation.

The US lost it way after the “Kennedy Round” in the 1960s

Europe produces many different goods and services for domestic use and export

Those exports pay for the European imports of fossil fuels and minerals.

Europe has over $10 TRILLION invested in the US, which provides Europe with about $1Trillion each year, and has several $TRILLION invested in Canada.

I eat cucumbers grown in Dutch-owned greenhouses in Canada.

These greenhouses have 1000- 1200 ppm CO2 to make things grooooow, and are heated with natural gas.

Much of their operation is automated and computer-controlled

The $1.0 Trillion/y is in addition to a $1.4 TRILLION trade surplus in 2024

The US can do better, and it has to, in order to pay down the US national debt.

The US already has the fossil fuels and can use them to make many different goods and services, for domestic use and export

These goods and services would be cheaper, because our fossil fuels have lower costs

Europe imports fossil fuels and minerals, because it has not enough.

The US/EU duo was hoping to weaken Russia, to get low-cost command/control of Ukraine resources and Russian resources.

That Deep State bucket list item was doomed from the start, as was the planned Color Revolution in Russia in 2000, with Putin as temporary President (Yeltsin resigned in December 1999) and as President after the elections in March 2000.

Are you saying that the US has no investments in other countries bringing in money? I think you would find that if you shut down Amazon and the procurement of cheap junk from China the trade deficit would go away. And we know that Joe Biden and the deep state are in a relationship with China.

So government has conned people into believing that selling stuff that other people want is the way to get rich?

Comparative advantage has been well known since the days of Adam Smith and is no corporate scheme.

You really need to get over your deeply ingrained fear of big business and stop believing that big government cares about you.

I was with you until you put Ukraine and Russia into the conversation. You transitioned from economics to politics.

Exports of LNG will, for sure, NOT reduce natural gas prices in the US.

I guess if you don’t know anything about economics, that’s what you would believe. In a free market economy, which the U.S. ostensibly is, when you sell more of something and more people buy it and more people get in on the game and start making it, the price goes DOWN. When you arbitrarily restrict the sale of that thing, it becomes more scarce and the price goes UP. Got it?

Unfortunately, over the past 4 years, we have been accelerating to a command economy, which also shuts down a free market (supply and demand) economy.

If we look at what has happened to Henry Hub prices over the past 5 years we see that they spent much of this year trading in the 2-3$/MMBtu range, just above the low prices of 2020 when there was a supply glut due to covid lockdowns eating into demand. Prices recently have been creeping up on higher winter demand. In between we had the global energy crisis, which really started because the 2020 supply glut and covid restrictions led to massive underinvestment in maintenance and fresh drilling and exploration in many gas producing areas around the world and consequent shortage, long before the Russian invasion of Ukraine or the blowing up of Nordstream (which more or less marked the peak of the market).

It is likely that in the New Year prices will fall back again as they have in recent years after a November peak, once storage is seen to be adequate to ride out until low demand in the spring. It is arguable that delays to new LNG plants have led to surpluses that built up because new drilling anticipated the demand for LNG that didn’t materialise due to Biden’s interference. It’s also the case that the high prices during the crisis promoted a lot of catch-up investment, producing a hog cycle effect with extra supply. But until available resource becomes a constraint, aside from these effects, you can expect supply to come forth to meet demand for domestic consumption and LNG exports. Global LNG production is expected to result in a glut and lower export prices due to competition. Chinese demand for LNG is already being reduced by supply from the Power of Siberia pipeline. LNG plant has to make a margin to operate, and will therefore pay no more for its gas than makes that possible: that will keep domestic prices in check until the LNG surplus is absorbed.

Because of the cost of liquifying LNG and transportation costs NG will always be cheaper at the point of production. The only thing that will raise the price is lack of pipeline capacity in certain areas.

And the continued restrictions on fracking in places like NY state.

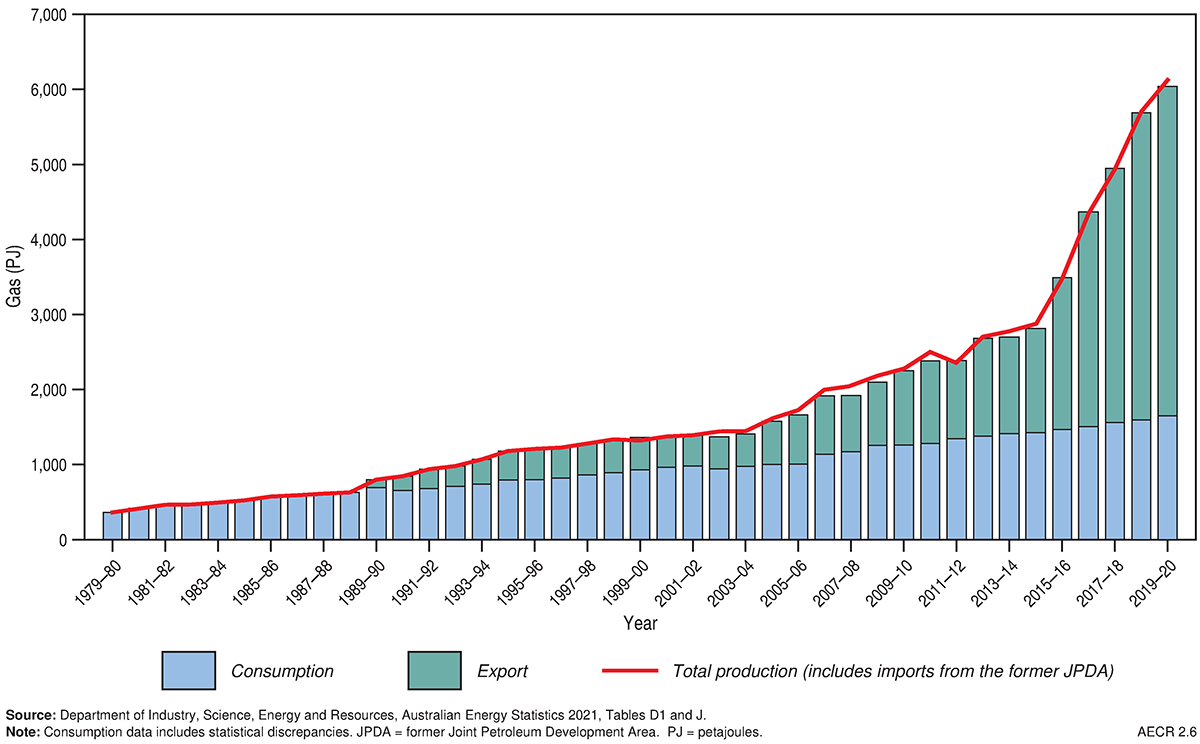

In Australia, large international gas contracts were negotiated years ago at a price that now seems low. We export a lot of gas. However, the domestic market was underserved and when it grew, producers wanted domestic prices to match export prices. As these domestic markets grew, the price rose quite a lot (as Granholm models) except in West Aust where provision was made.

But this is too simple an analysis. We have different types of gas, some offshore, some on land, we have costs of terminals for export gas greater than for domestic, and more factors.

On top of that, our mineral rights are vested in the states, but the Feds get a policy say at the edges that overrides state. Some states have fracking bans, some have exploration bans. Because of the stupidity of a federal policy of net zero carbon by 2050, from a conservative federal government, unbelievable, gas is heavily badmouthed and fringe groups like indigenous are encouraged to ban gas. We are in danger of future blackouts because there will not be enough gas firming installed.

If ever you want an example of why politicians should be invited to shut up, the Australian gas industry encapsulates most of the harmful ways that pollies can dream up. And this, 20 years ago, was a country that excelled in and profited from mineral exploration and development.

Poor fella, my country. Geoff S

“However, the domestic market was underserved and when it grew, producers wanted domestic prices to match export prices. As these domestic markets grew, the price rose quite a lot (as Granholm models)”

Yes,of course producers sell to the highest bidder. And as with the US, Australia had relatively low domestic prices, which then moved up to nearly match the export price. Meanwhile, Australian productionwent up and up, but the new production all went for export. And then some.

Production and export:

Wholesale price for domestic:

Yet I bet you are right behind blocking new gas that is destined for the Australian market.

Australia has HUGE gas reserves but the idiotic and slimy greenies that you represent, won’t allow it do be accessed.

They would rather totally destroy the Australian countryside with unreliable wind and solar factories.

bnice2000,

Nick Stokes was closer to data than I was when I wrote here away from my PC, and he has illustrated data that I would have liked to show. Thank you, Nick.

It is not kosher in my view to “imagine” Nick’s intentions. I think that you should apologize for writing “I bet you are right behind blocking new gas that is destined for the Australian market” unless you have credible, direct evidence to support this.

There is a diversity of views on our future gas development. We must recognize that freedom to express views is fundamentally important in a democracy.

The wider problem is the post-modern science distortions feeding into the minds of politicians and “influencers” of thoughts that for one thing have downplayed the lessons of history. Exploration for natural resources is a hard scientific endeavour that is best left little interrupted by untrained decision-makers. Our national economy surged, we possibly all benefited, in the 1970-90 era when government intervention was less than now and private enterprise was more free to do what it does well.

Geoff S

Nick is a far leftist/marxist pseudo-greenie that worships wind and solar.

He almost certainly wants all new gas and coal blocked.

He is welcome to express his views, I am welcome to say they are junk. !

Even a clock that has stopped working is right twice a day.

Dismiss the invalid points, not the person, is, IMHO, best.

However, the domestic market was underserved and when it grew…

Gas exports from the Australian east coast were allowed to go ahead with the full knowledge that Qld, NSW and Vic had sufficient undeveloped gas resources that could easily satisfy east coast domestic demand. All that was needed was exploration and development approvals by the relevant states and additional pipeline infrastructure to bring this resource to market.

Instead, exploration bans, fracking bans, badmouthing, pipeline disruptions, net zero, bla bla bla have cancelled years of sensible infrastructure planning by earlier state governments.

Now, net zero relies on natural gas for renewable backup and there is talk of building an LNG import terminal in Vic, when this State has excellent reserves that are blocked from development!

Sheesh…

“there is talk of building an LNG import terminal in Vic, when this State has excellent reserves that are blocked from development”

The State had excellent reserves that supplied us for fifty years. But when the pipelines went through to the LNG gas terminals in Qld, there went all our gas. And up went prices.

The notion that blocking gas field development is the problem is a nonsense. Production has been going up and up. The problem is that the increase goes to export. That is where the money is. And further increase in production, if it could be achieved, would just be exported too.

The notion that blocking gas field development is the problem is a nonsense.

I don’t recall your presence in the industry at the time these decisions were made.

“I don’t recall your presence in the industry at the time these decisions were made”

I don’t recall anyone outside the industry being consulted when these decisions were made. We had gas fields, still productive; then whoosh, it all went to Qld, and we are being told we need an LNG import terminal.

Yet there is still plenty of gas under the ground in Victoria.

It was all just greenie/leftist politics not allowing access to it…

…. and you are obviously a greenie/leftist.

That means you voted for it.

We had gas fields, still productive; then whoosh, it all went to Qld.

Not quite Nick – check out the Victoria Gas Programme overview. In summary:

In 2017, the State Government directed the Geological Survey of Victoria (GSV) to undertake a scientific analysis of the prospective resource volumes of undiscovered onshore conventional gas and offshore gas available to the state.

Looking for onshore unconventional gas (fracking and coal seam gas) is not included because it was banned in Victoria in 2017.

There is no indication that Victorian gas was exported – it was needed for domestic use for NSW/ACT and SA.

The majority of gas exported from Qld comes from Coal Seams (CSG). It is the recent shutdown of coal-fired generators in NSW and Vic, together with the construction of intermittent use peaker gas generators to support renewables that has strained NSW/Vic supplies.

“There is no indication that Victorian gas was exported – it was needed for domestic use for NSW/ACT and SA.”

Well, gas is fungible. But NSW and SA were previously well supplied via Moomba, with pipelines built for the purpose. Now Victoria has has to take up that role, while Moomba gas goes for export.

AS to victorian gas exported, here is the AEMO 2021 Q1 report

Gas is coming in from the south to Qld. As the text says, that has to be Victorian gas.

If you have industry insight, perhaps you can explain how it makes sense to bring LNG to Vic when it is connected by pipeline to Qld, which is exporting on a massive scale (including, at lest in the past, Vic gas).

If you have industry insight, perhaps you can explain how it makes sense to bring LNG to Vic

It does not.

NSW could be very well supplied by gas from the Pillaga/Narrabri area, also giving employment to the people living out there.

The Narrabri Gas Project could supply up to half of the natural gas used by NSW homes.

It is being blocked by Marxist greenie anti-progress tactics and lies.

But you are well aware of that, aren’t you Nick..!

Yet they ARE blocking gas fields, and it IS a problem. !

You are demonstrably totally wrong… as usual !

It’s going to be a busy time for Trump’s administration from day one. Here’s hoping he kills AGW instead of kicking the can down the road. Unfortunately it’s not a high priority for Americans so probably the best we can hope for is EOs during his tenure undoing some of the harmful edicts of his predecessor.

Energy costs and inflation are priorities for the second Trump admin.

We have a huge balance of trade deficit. We must export more and import less.

The theory that by exporting less, we can make all Americans richer, is self refuting.

And higher value products will shrink the deficit faster. Instead of natural gas export plastic, fertilizer and chemicals.

Higher total margins will shrink the deficit faster. If there is a market for high margin items and the volume is high then your statement is correct. If there is no market for those items overseas and the smaller margins on a larger volume of natural gas brings in more total marginal dollars than you are incorrect. It’s difficult to say which is true. That’s why the market oscillates so much.

An exported higher value product will have a higher margin than exported natural gas or it would not be exported. If the product is not exported then the overseas customer would have to buy the same amount of lower margin natural gas as the domestic manufacturer would use to produce the product, resulting in a smaller reduction in the deficit.

Why do I never see in such commentaries the issue of “gas flaring”?

“Gas flaring is the burning of the natural gas associated with oil extraction. The practice has persisted from the beginning of oil production over 160 years ago. It takes place due to …”

Because cleaning and transporting gas from remote locations costs more than the gas can be sold for.

Correct. But I think the anti-CO2 types might go apoplectic.

We can only hope that leads to them getting the help they need.

To continue perpetrating the Green New deal & Net Zero perpetual deceit is required.

Trump will use common sense and honesty to reverse course.

Liberal government guiding principle is “if it makes good economic sense, tax it or better yet, ban it.” Lib Dem minds are not capable of understand the whole scientific and economic analysis it takes to make wise decisions.

Liberals / “progressives” need to start approaching governance by addressing Mazlow’s Heirarchy Of Needs using the base rung of the pyramid as first priorities and working up the needs ladder.

Instead of what they do now, which is treating the topmost echelons of the pyramid as priorities (particularly favoring minority groups based on race)

Very nice Nick. This is all that needs to be said:

“As far as whether or not it is “advisable,” particularly for investors and developers, to expand LNG export capacity, Blackmon said it is not the government’s role to determine which private investments are “advisable” or not. Instead, it’s the private sector’s responsibility to determine which investments make sense and which do not, with those who correctly read the market reaping the benefits while those who make bad investment decisions absorb the consequences of those choices.”

I would guess that government interference is the number one reason for price and cost irregularities. They don’t know what they are doing, they need to get the hell out of the way.

Right now, 100$ rise by 2030 would be less than 10%. It went up 20$/ month when my annualized cost plan renewed in August. 100$/yr is supposed to scare us but those who use gas know it might be unaffordable before then.