Guest “they don’t have a fracking clue” by David Middleton

Oil’s Sudden Rebound Is Exposing the Achilles’ Heel of Shale

By Rachel Adams-Heard, Kevin Crowley, and David Wethe

May 24, 2020Oil prices have surged more than 75% in the U.S. this month. But don’t expect a quick rebound in supply from shale explorers.

The quick turnaround in oil markets is exposing the shale industry’s big weak spot: Lightning-fast production declines. Shale gushers turn to trickles so quickly that explorers must constantly drill new locations to sustain output.

[…]

“We just have no new drilling and these decline curves are going to catch up,” said Mark Rossano, founder and chief executive officer of private-equity firm C6 Capital Holdings LLC. “That hits really fast when you’re not looking at new production.”

[…]

Bloomberg

No schist Sherlock. Oil prices “surged” because production has been cut more quickly than expected. “Shale’s” decline rate is anything but an “Achilles’ Heel.” While some existing production has been shut in, most of it is economic when oil is over $20-30/bbl. If not for “shale’s”steep decline rate, it would be far more difficult to cut production quickly enough to cause oil prices to “surge.” If “shale” had slower decline rates like conventional oil reservoirs, EIA wouldn’t be forecasting production declines. EIA expects US tight/”shale” oil production to decline by nearly 200,000 bbl/d from May to June and a total decline of about 1.3 million bbl/d in 2020-2021.

Interestingly, EIA foresees no decline in Gulf of Mexico or Alaska production, as these play types aren’t as sensitive to short term price swings and have much slower decline rates.

EIA forecasts GOM production to remain relatively flat, averaging 1.9 million b/d in 2020 and 2021, nearly unchanged from its 2019 average. In addition, EIA expects no cancellation in announced GOM projects for 2020 and 2021. EIA forecasts that crude oil production from Alaska will remain at an average of 460,000 b/d in 2020 and that it will increase slightly in 2021.

EIA forecasts U.S. crude oil production to fall in 2020 and 2021

The Bloomberg article proceeded to get even dumber.

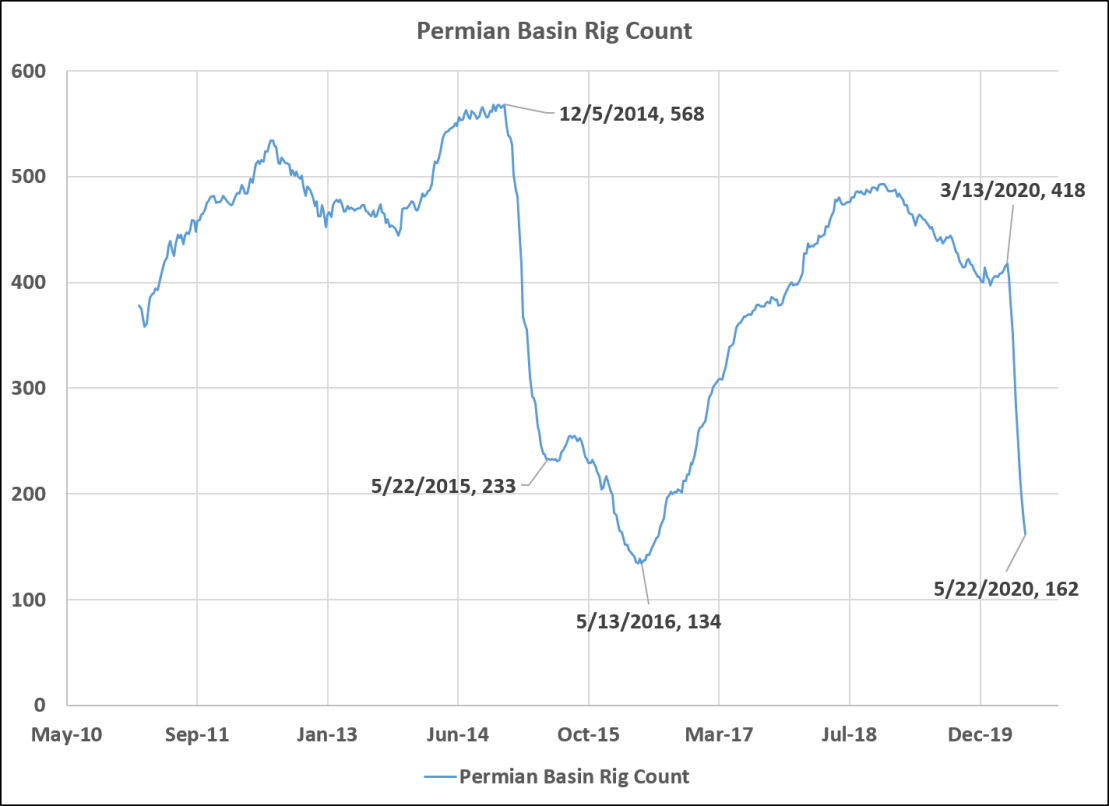

Shale explorers have been turning off rigs at a record pace because the oil rout has gutted cash flow needed to lease the machines and pay wages to crews. Going forward, management teams may be hesitant to rev the rigs back up again despite higher crude prices because of fears of flooding markets with oil once again and triggering yet another crash.

Bloomberg

- “Shale exploers”?

- “Turning off rigs”?

- “Rev the rigs back up again”?

WTF language is this? (Rhetorical question.)

“Shale” plays are resource plays, not exploration plays. Most “shale” reservoirs are the primary source rocks for conventional reservoirs within their respective basins. They were “discovered” many decades ago.

Drilling rigs aren’t power tools that can be turned off or revved up.

When prices make more wells economic to drill, they will get drilled, and production will start rising again.

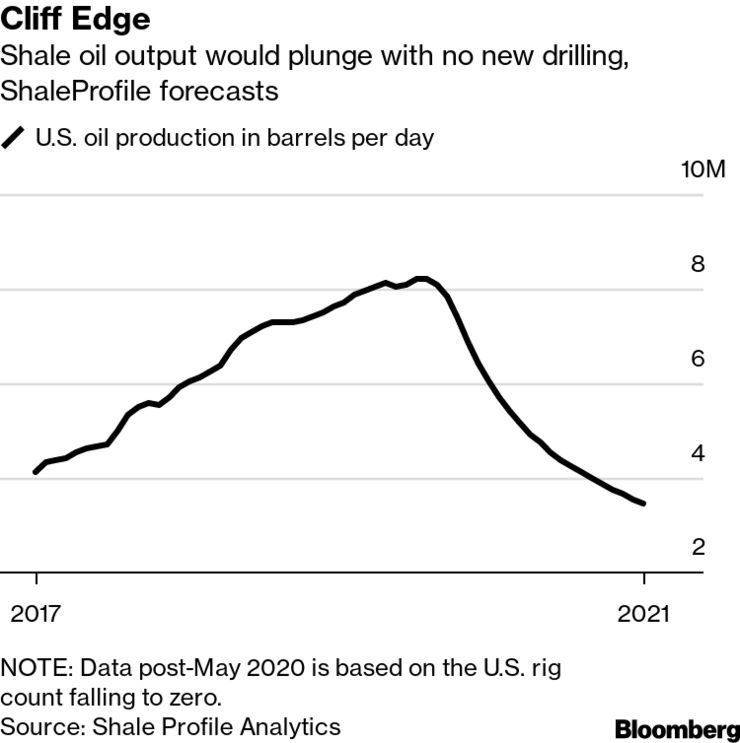

Left unchecked by new drilling, oil production from U.S. shale fields probably would plummet by more than one-third this year to less than 5 million barrels a day, according to data firm ShaleProfile Analytics. That would drastically undercut U.S. influence in world energy markets and deal a major blow to President Donald Trump’s ability to wield crude as a geopolitical weapon.

Bloomberg

- “Left unchecked by new drilling”?

WTF language is this? Yes. I realize it’s English. However it is not the language of anyone with the slightest familiarity with the oil & gas industry.

- “oil production from U.S. shale fields probably would plummet by more than one-third this year to less than 5 million barrels a day, according to data firm ShaleProfile Analytics.”

Horst Schist! ShaleProfile Analytics’ model is for what would happen if the rig rate went Dean Wormer.

If the rig count went to zero-point-zero and stayed there, “shale” production would take a nose dive. The rig count isn’t likely to go to zero-point-zero and wouldn’t stay there very long, even if it did.

Such is America’s reliance on new drilling that 55% of the country’s shale production is from wells drilled in the past 14 months, according to ShaleProfile.

Bloomberg

Can you say “circular reasoning”? The idiots seem cluesss to the fact that they wrote this earlier in the article… “Lightning-fast production declines.” If the main source of recent US oil production growth came from plays with “lightning-fast production declines,” a big chunk of the “shale” production would, mathematically, have to come from recently drilled wells…

Which, mathematically, makes it relatively easy for US oil production to be ramped up or down fairly quickly in response to price swings… It’s the exact opposite of an “Achilles’ Heel.”

Enjoyed reading this analysis of the oil and gas business by a geologist who actually understands the oil and gas business from the ground up. Thank you.

The idiocy of “journalists” never ceases to amuse me…😆

Nice play on words!

If you don’t read the newspapers you are uninformed. If you read the newspapers you are misinformed. -Mark Twain, former newspaperman

What gets me is the cheerleading for damage to the US economy and sticking it to the president. Does the Bloom know he would not be a billionaire or even necessarily employed

were it not for the socio-economic climate that he has enjoyed in America.

“That would drastically undercut U.S. influence in world energy markets and deal a major blow to President Donald Trump’s ability to wield crude as a geopolitical weapon.”

Chaamjamal,

Wouldn’t David Middleton be better described as a Geologist who understands Oil and Gas from the Ground DOWN?

I would describe it as “from the subsurface up.”

Oh, to Shale with it

Thi article from Bloomberg does not inform one factually about anything other than the decline in general standard of journalim.

It’s a long period since Bloomberg is more eco-mafia gossip and propaganda than real information, unfortunately. Do you remember the old good times when Business Week used to be part of McGraw &Hill? That was information

Bloomberg might think he is running for the presidency.

After all, slimy, creepy Joe hasn’t got a bloody clue what he is running for.

… or running from.

Planet of the Humans removed from YouTube.

Not! It’s still there, but a little hard to find. https://youtu.be/dxQT3EWlTsg

Apart from being uploaded again by another good soul, see comment from Richard above, the original is pulled.

Now we have to wait and see when they pull “c4NvDaMQs6g”, Which is Sky News Australia’s endorsement of the film.

Oil prices when I just looked at it now is $34 a barrel and $36 a barrel for Brent Crude.

– JPP

Which supports most currently producing wells, keeping most companies in business, but very little new drilling… Exactly what’s needed to push prices higher as demand recovers.

Yes, Jon P, but some oil production companies will have some production sold forward, and now find themselves with some cash flow. As the emergence from a natural resource price negative excursion starts to firm up there are Mergers and Acquisitions, wherein the natural resource company with cash reserve, some cash-flow, and aggressive management, buys discovered resource at significant discount (and very little risk). Fortunes are made and lost right now. For instance, the price of gold is fairly high, as a hedge against uncertainty, and some producers are now selling forward a fair amount of their secure production. My experience with natural resource companies says there’s always some smart ones that motor right on through any difficult times. Watch the M & A activity, it is the indicator for the future. Stay sane and safe.

For several years back in the early 80s I prepared an annual reserve report for a small oil company that made its living drilling Sooner Trend Mississippi limestone wells. Year after year, their annual production remained flat while the remaining reserve of existing wells declined by more than fifty percent per year. As long as they could drill new wells, they sustained their production, but when the oil price crashed in late ’85, the banks cut off their loans, drilling ceased and the company shortly went broke. The tight formation drillers that survived then were those operating with no debt. The only reason that the present circumstances should be different is the old story that if you owe the bank a few thousand dollars that you can’t pay, you have a problem, but if you owe the bank a few billion, it is the bank that has the problem.

That’s not what happens. The lenders take over the assets. They may operate, may sell them. The thing that matters to us though us that the reserves and the equipment remain.

Yep… The rocks don’t go bankrupt.

True, but until the price of oil is high enough to pay for new wells, the oil stays in the rocks.

That or the cost of extracting it comes down… Oddly enough, the cost of just about everything related to extracting it goes up and down with oil prices.

Those certainly are words…

Middleton says: “most of it is economic when oil is over $20-30/bbl.”

…

With the reality of current prices: ” above $30 a barrel….. and well beneath average break-even oil prices in the shale patch”

…

https://www.latimes.com/business/story/2020-05-25/shale-bankruptcies-demand-coronavirus

I was referring to existing production… FRACKING LEARN HOW TO READ!

Shale producers are going bankrupt, no matter how many graphs you toss against the wall.

As are a lot of other business, courtsey of government officials who get their paychecks no matter what and who say, “I can’t tell you when you will be allowed to open up.” (Como, yesterday)

Which has Jack Schist to do with the subject of this post.

Well Middleton, since you are a geologist, and are at a loss when it comes to economics, you will never “get it.”

…

Didn’t they teach you “No drilling if it’s not profitable?”

Which has Jack Schist to do with the subject of this post.

Look up the definition of the word BANKRUPTCY Mr. Middleton.

Which has Jack Schist to do with decline rates.

Shale producers were in financial trouble before the virus and the Saudi/Russian price war.

Which has Jack Schist to do with this post.

Not for operating costs. Learn the different levels of costs.

Pool never learns anything, he just continues with his deranged stalking nonsense. Best to just laugh at the troll and move on.

There are even a few “shale” focussed companies with corporate breakeven costs in the low $30’s. They can’t drill many new wells at $30-40/bbl, but they can “keep the lights on.”

Conventional plays, like the Gulf of Mexico, tend to have lower breakeven prices. We have spent much of the past two months “sharpening the pencil” and reviewing our portfolio. Most of our fields have breakeven prices well below $20/bbl. Most of the marginal fields are below $35/bbl. The prospect inventory is another story. A lot of the smaller, lower risk prospects don’t work below $40-50/bbl; while most of the larger, higher risk prospects work at >$20/bbl.

The old adage, “the greater the risk, the greater the reward,” is very applicable here. “Shale” entails very little, if any, exploration risk… Almost every well is at least an infield single… But extra-base hits are few and far between. With conventional plays, there are opportunities to hit homeruns… But swinging for the fences entails striking out a lot.

Ahah!–NOW I know where to invest next time oil goes over $60/bbl. There’s a lot of profit in that kind of margin. Glad to hear those break-even price points; I’ll copy that and post it on the wall.

It sure will tell me where a bunch of the pump price is going too when it goes to $1.50/litre–along with all the forms of taxation of course. But to hear from inside the industry what the break-even prices are is illuminating, thanks for that.

Breakeven prices vary widely by company and play. Regarding “shale” players, Continental Resources was around $32/bbl, but Chesapeake was somewhere around $70/bbl.

Shouldn’t Bloomberg and the author(s) of that article be called in by the SEC to explain why they are publishing trash like this in a publication used by people looking for investment advice?

Unless I’m mistaken, this guy forgot about the “demand” part of the equation.

“Supply” will ramp up again to meet increased demand, despite the earlier attempts to “flood the market” at the start of the virus overreaction by our “foreign friends”.

Thomas Gillespie linked his article to WUWT a few months ago. I would like to see it on Anthony’s website here so that we can read responses to it. Would that be possible?

https://insuspectterrane.com/2016/05/25/the-petroleum-age-has-just-begun/

With all the embarrassing ‘reporting’ in that Bloomberg piece, there is one crucial, fatally flawed component to these idiots ‘analysis’ … the gross misuse of Enno Peters’ ‘Shale Profile’ numbers.

Enno collects production data from the various states’ reporting agencies as they are compiled on a CALENDAR BASIS, NOT actual days online producing.

Wells that are offline for 5 straight months, or produce 5 days per month are ALL treated the same in Enno’s presentations.

He – Enno – got into a big cyber spat with a well known Bakken analyst – Mike Filloon – over this very thing.

The assumptions made using calendar based reports are meaningless when attempting to evaluate a ‘real world’ profile – or potential – of an oil/gas well.

“Enno collects production data from the various states’ reporting agencies as they are compiled on a CALENDAR BASIS, NOT actual days online producing.

Wells that are offline for 5 straight months, or produce 5 days per month are ALL treated the same in Enno’s presentations.”

Thanks for showing us one of the tricks they use, Joe.

What’s the old saying: Lies, Damn Lies, and Statistics.

a four second “mining” clip!

26 May: Yahoo: The Wrap: Michael Moore-Produced ‘Planet of the Humans’ Doc Pulled From YouTube, Director Cries ‘Censorship’

by Thom Geier

The Michael Moore-produced documentary “Planet of the Humans” was pulled from YouTube overnight due to a “copyright claim by a third party” — prompting writer-director Jeff Gibbs to denounced the removal as a “blatant act of censorship.”

“It is a misuse of copyright law to shutdown a film that has opened a serious conversation about how parts of the environmental movement have gotten into bed with Wall Street and so-called ‘green capitalists,’” Gibbs said in a statement Monday. “There is absolutely no copyright violation in my film. This is just another attempt by the film’s opponents to subvert the right to free speech.”…

According to the film’s rep, the copyright claim stems from a four-second video clip of mining that Gibbs considered to be “fair use” and not requiring any special permission in a nonfiction documentary such as his…

https://www.yahoo.com/entertainment/michael-moore-produced-planet-humans-010151029.html

“The Michael Moore-produced documentary “Planet of the Humans” was pulled from YouTube overnight due to a “copyright claim by a third party” — prompting writer-director Jeff Gibbs to denounced the removal as a “blatant act of censorship.”

Well, here is your next project, Michael and Jeff: Do an expose’ on the censorship practiced by all the Leftwing social media platforms.

Michael and Jeff now understand what we are talking about, as they have now fallen victim to Leftwing Thought Police, themselves.

Expose those Leftwing Thought Police, Michael and Jeff! Do a service for humanity and freedom of expression.

Meanwhile in Europe, the prices on the oil marked have very limited ups and downs.

For example here in Sweden we are down 15% from the beginning of the year.

Diesel in Sweden is currently ~13.5kr per liter (~$4.83 per US gallon).

When taxes are in $/gal and the largest component of the price by a wide margin, the price of oil has trouble moving the pump price.

Texas has 187,000 oil wells that produce an average of about 18 bpd. Basically all stripper wells that have been producing oil for decades now. Slowly but surely wins the race.

https://www.rrc.state.tx.us/oil-gas/research-and-statistics/production-data/historical-production-data/crude-oil-production-and-well-counts-since-1935/

Plenty of supply in Texas. In 1895 it was believed by oil explorers that there was no oil west of the Mississippi until some wildcatters moved to Beaumont and discovered Spindletop.

In 1820 or so, some 100,000 whales were harvested each year out of the oceans to light oil lamps. Crude oil saved the whales’ hides. After a few more years, peak whale oil was here.

I drive by a small oil field in the Bakken a couple of times each week. There are maybe ten wells that have been drilled in the past ten years, other wells in the field were drilled years ago. All but two have been shut. They are in the Bakken, but are drilled to the Madison formation which is above the Bakken shale layers. Two completely different oils from different formations.

The Williston Basin has some fifteen thousand wells (all formations), they produce about 90 bpd average.

Some wells produce a lot of oil, probably from accumulated units. A few years ago there was a natural gas flare that was about two hundred feet tall and a good 75 feet wide burning like crazy, could be seen from four miles away.

In 2007 there were 303 Bakken wells, today there are 13,780 wells that produce about 1.4 million bpd.

You’re drilling a thousand wells each year at that pace. There has got to be oil down there ten thousand feet deep in the lithosphere.

Henry Bakken’s well pumped for 28 years before it finally quit. Oil sold for much less back then, still drilled for the stuff anyway. I have been acquainted with Bakken family members for many years.

13,780 wells producing oil for 28 years is going to be a big number.

https://www.dmr.nd.gov/oilgas/stats/historicalbakkenoilstats.pdf

Oil prices by state: https://www.oilmonster.com/crude-oil-prices/united-states/1

http://www.searchanddiscovery.com/

Bloomberg got it right in spite of their maldescription of job titles. New shale laterals will have to stand not only the decreased EUR’s from incestuous infilling and frac hits, but inevitably increased service rates as the aged out, cannibalized, frac fleet has to be replaced. Frac workers will also go back to selling hot tubs at county fairs, since it’s less dangerous, closer to home, and less chance of a wage cut. In other words, the $20 -30/bbl break even cost is a past dream of an industry that was always a hot house flower.

Of course, I’m skipping over the 10-11 figure (mostly shirked) current asset retirement obligation to P&A tens of thousands of hydraulically incompetent, lateral snake piles. Many will require hyper high $ tractoring Many will be plugged at near surface in frustration after failure of squeeze tests down hole, so we’ll only be able to guess at migration out of interval. New laterals will obviously only add to this communized cost.

The good news? it will be back (a little) when the lower CAPEX and OPEX/boe mideast and FSU oil is finally produced off. I.e., in well over a decade..

Mr. Middleton, how’s your company’s quest for viable development well candidates at $30/bo coming along? No sarc – good well ideas are good for all of us.

Bloomberg didn’t touch on any of that, much less get anything right.

We’re rocking and rolling.

“Bloomberg didn’t touch on any of that, much less get anything right.”

They did, without my expansion. What falsity is in the Bloomberg clip you featured? Or in my post?

And do you actually have a spudded well on? One I could find in a BOEM or comparable activity update? Or is your rockin’ and rollin’ of the “We’re almost, nearly, just about, to take bids, and then hope that management will fund it” variety?

The falsity is that “shale’s” steep decline rate is an Achilles Heel. It’s also just about the only subject discussed in the Bloomberg article, that you clearly didn’t read.

Rocking and rolling is drilling deepwater PUD locations with a platform rig and a subsea water flood well for a 100 million bbl deepwater reservoir, while building an inventory of shelf wells that can be drilled from platforms for a 2021 jackup program and an inventory of deepwater PUD and develo-cat wells for either a continuation of the current platform rig program or a 2021 program. It mostly entails whittling down the current, large, prospect portfolio. And… Evaluating a growing list of acquisition opportunities.

Maintaining a strong liquidity position and aggressively hedging, while avoiding over leveraging during good times, makes hard times easier to navigate.

“The falsity is that “shale’s” steep decline rate is an Achilles Heel.”

It’s only false in the sense that there are other such “Achilles Heels”, not just that one. Completion risk, IP, decline, GOR humping, repeated production problems such as fines migration induced perm reduction, competitive drainage, price risk, etc. All figure into whether you will end up with economic production schedules or not. For modern shale liquids exploitation, not.

“Rocking and rolling is drilling deepwater PUD locations with a platform rig and a subsea water flood well for a 100 million bbl deepwater reservoir, while building an inventory of shelf wells that can be drilled from platforms for a 2021 jackup program and an inventory of deepwater PUD and develo-cat wells for either a continuation of the current platform rig program or a 2021 program. It mostly entails whittling down the current, large, prospect portfolio.”

So, lots of “inventory building” and deepwater drilling that(1) you are probably obligated to drill and (2) you can’t link us to in any public activity update. But nothing wrong with that whittling. Since you don’t whittle away economic prospects, let us know when you dig out those ponies…

FYI, since you live in Dallas area. SMU exec MBA program was once mostly cliented by Chesapeake and Anadarko. They enrolled mid level fast trackers as an inducement to keeping them around. No oil $ from them or any of their counterparts for over 5 years.

It’s false in the sense than an Achilles’ Heel is a fatal hidden flaw in something that is otherwise invincible. Resource plays have plenty of challenges. Rapid decline rates are one of many. If “shale” plays typically had 5-15% decline rates, it would be impossible to rapidly reduce production without shutting in lots of producing wells.

All plays have strengths and challenges.

Regarding specifics of our operations, I am not posting as a representative of my company. I don’t discuss specifics or even identify my current or past two employers in this forum because there were the result of an M&A string. I’ve worked for 5 companies since 1981. Enserch Exploration (1981-1997), Chieftain International (1997-2001). Company #3 (2001-2006), Company #4 acquired Company #3 in 2006 and Company #5 acquired Company #4 in 2012. Unless we sell Company #5, I’ll probably finish out my 60’s there. It’s just a matter of whether I die working on Landmark or SMT.

“Regarding specifics of our operations, I am not posting as a representative of my company. I don’t discuss specifics or even identify my current or past two employers in this forum because there were the result of an M&A string.”

This is completely valid and in hindsight my request was unfair. Not to mention snarky in that I do not dispute your truthfulness of having wells on. I apologize for it. Additionally, the BOEM GOM activity update took me 30 seconds to find, and there is plenty of current deepwater activity for you to be a part of.

Yor inventory is another matter. Unless you can extend your hedges beyond what you have previously described, I’m guessing that those goe justifications will stay in that inventory, and you will stay in PDP harvest mode, until a major supply disruption occurs. I’m glad you have a benevolent employer who will pay you to wait on that….

From the article: “Which, mathematically, makes it relatively easy for US oil production to be ramped up or down fairly quickly in response to price swings… It’s the exact opposite of an “Achilles’ Heel.”

That’s right. Oklahoma oil workers were being laid off before the Wuhan virus hit, and it was done because of the economics of the situation at the time.

Whe oil production ramps back up, those laid-off workers will go back to work. It looks like demand is picking up nicely. We know what follows that. 🙂

“That’s right. Oklahoma oil workers were being laid off before the Wuhan virus hit, and it was done because of the economics of the situation at the time.”

I agree, but not the whole story. When will these “economics of the situation at the time” get any better? Hint: Not in this decade.

“Whe oil production ramps back up, those laid-off workers will go back to work. It looks like demand is picking up nicely. We know what follows that. ”

Nope. Let me know when we get anything like even the “demand” that resulted in this (pre pandemic):

http://www.okenergytoday.com/2020/03/stunning-loss-of-11000-oil-field-jobs-in-oklahoma-since-january-2019/

Oilfield optimism folks. Gotta love it. Even when selling extended auto warranties over the phone, they just KNOW it’s gonna come back….

Drilling never stops completely. Production companies are committed to drilling wells (in most instances) to maintain their leases; even if the price of oil makes the project unviable.

Recessions are a good thing, especially in the oil industry. It gets rid of the weak and inefficient and lets the healthier, low cost operating companies move in. Those leases currently held by high cost drillers will be taken over and drilled by the more efficient operating companies. And in the end the U.S. will end up with more recoverable reserves.

Which makes what the Russians and Saudis have done to force out the U.S. shale drillers look even more pathetic.

It’s Bloomberg, not necessary to say more.

Being super-reactive to market developments is not an Achilles heel – its the secret strength of shale. While all the others still look at the market stunted and dazed puzzling what to do, shale is already kicking the hatches down. Shale also cleans out the duds from the healthy companies ensuring that when it comes back (and it will come back with a vengeance) it will be in even better shape. So, I have a message for conventional oil. Get a piece of paper and a pen as you will have to number your bones. Shale will give a good hammering when it gets under steam again. Feigning sedation won’t help you …