U.S. evolves into coal, gas and oil global energy giant supplying world’s hungry energy markets

David Middleton’s excellent WUWT article addressing the resurgence of the American coal industry as well as the growing role of U.S. natural gas production in creating global gas export markets hits the nail on the head in demonstrating how dominant the U.S. has become in producing and supplying global energy markets at home and abroad with growing demands for fossil fuels.

The IEA agency clearly recognizes the U.S. as the global driver of a huge transformation of the world’s natural gas energy markets.

“The global natural gas market is undergoing a major transformation driven by new supplies coming from the United States to meet growing demand in developing economies and industry surpasses the power sector as the largest source of gas demand growth, according to the IEA’s latest market analysis and five-year forecast on natural gas.

The United States – the world’s largest gas consumer and producer – will account for 40% of the world’s extra gas production to 2022 thanks to the remarkable growth in its domestic shale industry. By 2022, US production will be 890 bcm, or more than a fifth of global gas output.”

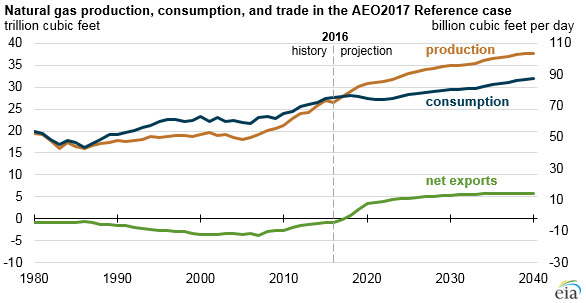

The EIA AEO 2017 report shows the incredible climb of U.S. natural gas production brought about by the use of fracking technology that has made America the world’s largest natural gas consumer and producer.

The U.S. now has more natural gas resources identified and available than ever assessed in the last 52 year history that such estimates have been undertaken.

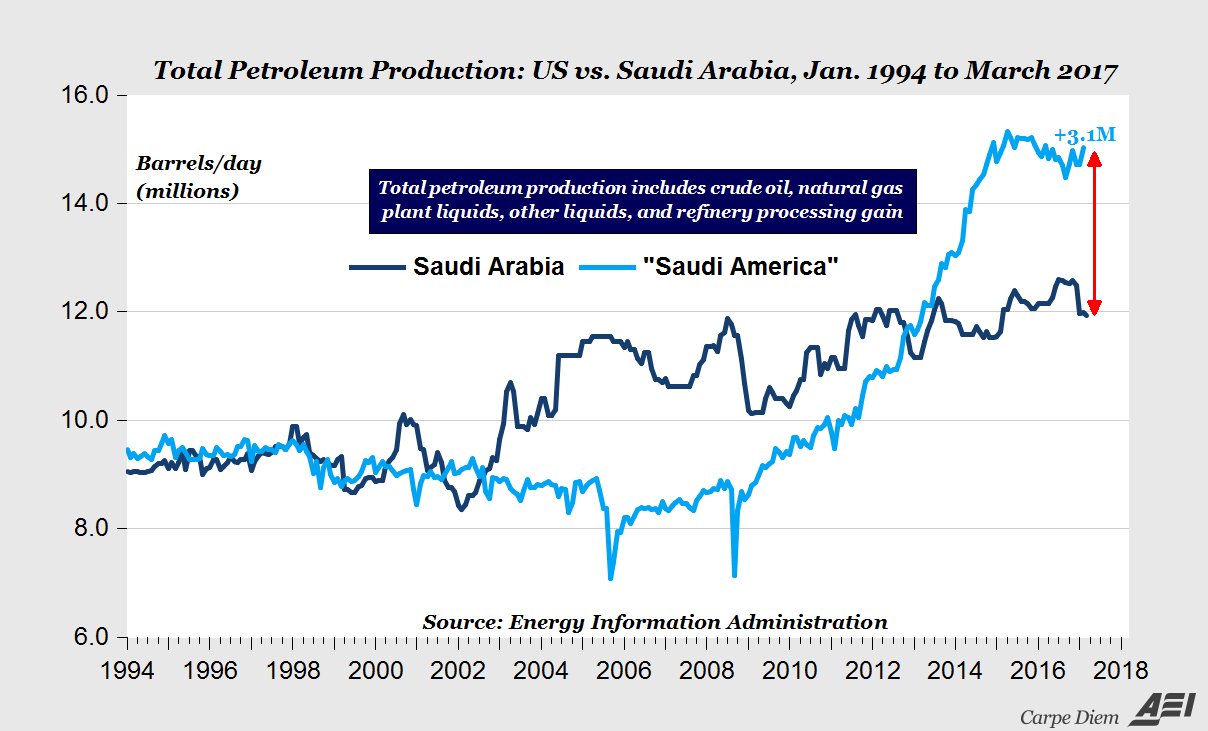

Likewise U.S. oil resource production has climbed dramatically as a result of fracking with American production exceeding that of Saudi Arabia for the last four years.

U.S. oil production and lower prices have resulted in American oil exports climbing to record levels.

While the climate alarmist renewable energy advocacy mainstream media manufactures claim after claim that renewables will dominate global energy markets the reality of world energy use and growth reveals a vastly different picture.

The U.S. has now become and will continue to grow even more so in the future the world’s leading fossil energy producer and exporter to meet the ever increasing demands for economical and useful energy resources needed by the energy hungry nations of the world to achieve growth and prosperity for their peoples.

These are extraordinary and globally significant changes in world energy resource production that the U.S. has created and yet the climate alarmist renewable energy activist mainstream media is absolutely silent on these significant changes and the major and dominant role now played by the U.S. regarding these global markets.

Coal, oil and natural gas meet the great majority of energy needs for global nations today and will continue to do so in the future. U.S. energy policy is on track to support and facilitate our countries role in helping to meet these huge existing and growing global energy market needs.

EIA energy data shows that in 2016 81% of total U.S. energy use was provided by fossil fuels. Even in California the renewable energy hype capital of America total energy use in 2015 was provided 84% by fossil fuels.

It is useful and instructive to compare the energy resource production capabilities of the U.S. with the EU’s renewable energy model of Germany.

An article in the Wall Street Journal exposes that Germany’s energy consumption relies heavily on use of imported fossil fuels and not renewable energy as touted by politicians pushing its Energiewende program.

The Wall Street Journal article notes:

“Germany has developed a reputation as a green-energy superpower, but in many respects it isn’t. Of all the energy used in Germany in 2016, 34% came from oil, 23.6% from coal, 22.7% from natural gas, 7.3% from biomass, 6.9% from nuclear, 2.1% from wind power, and 1.2% from solar. Waste, geothermal and hydropower accounted for the remaining 2%.

All told, Germany derived more than 80% of its total energy consumption from fossil fuels. That’s bad news for a country that depends on imports. About 97% of the oil, 88% of the natural gas and 87% of the hard coal Germans consume are imported.”

The German’s have paid a heavy price for pursuing the government’s Energiewende renewable energy schemes with the WSJ article further noting:

“Though they may find it difficult to swallow, the German people will benefit from Mr. Trump’s efforts to make energy resources accessible and affordable. Germans spent $73.5 billion on imported oil in 2013, when the price of Brent crude averaged approximately $108 a barrel.

Since then, the U.S. embrace of hydraulic fracturing—also known as “fracking”—has resulted in a surge of U.S. crude oil on the world market, causing global oil prices to fall to about $47 per barrel. Some back-of-the-envelope math suggests Germans may now pay $41.5 billion less per year for their oil imports, constituting an average savings of around $1,107 (at current exchange rates) for each of Germany’s 37.5 million households.

Ms. Merkel’s climate and energy policies have caused residential electricity prices in Germany to spike by approximately 47% since 2006, costing the average German household about $380 more a year. The higher prices are largely due to a 10-fold increase in renewable-energy surcharges that guarantee returns for the wind and solar-power industries. These surcharges now make up 23% of German residential electric bills.”

Despite all the claims by government politicians that Germany will lead the way in the EU with reduced emissions because of its focus on costly and unreliable renewables the facts say otherwise as the WSJ article notes:

“The German people are paying far more for their household energy needs under Ms. Merkel, yet they have little to show for it. Since 2009, when Germany began to pursue renewables aggressively, annual CO 2 emissions are down a negligible 0.1%.

Meanwhile, the U.S. experienced year-over-year reductions in CO 2 emissions in 2015 and 2016, and CO 2 emissions have fallen a dramatic 14% since 2005. This has mostly been made possible by fracking—a practice banned in Germany. Fracking has allowed the U.S. natural-gas industry to compete with coal in a way that wasn’t previously possible, lowering costs for everyone.”

Thus Germany the EU model of renewable energy and climate alarmism political correctness has increased energy costs dramatically, failed to reduce emissions anywhere close to what the U.S. has done using free energy market drivers, continues to increase recent emissions because of the need to use coal fuel to meet energy demand, is incredibly dependent on importing the great majority of its energy and fuel from others and even today after spending tens of billions of euros on renewable mandates obtains more than 80% of its energy needs from fossil fuels.

What a scam – and this is what the climate alarmist renewable energy activist propagandist mainstream media want for America.

Obama and the rest of the green blob will apologize for mocking “Drill, baby, drill” shortly after Frau Merkel admits the energiewende was a failure.

They won’t. Ever. For anything.

But it isn’t a failure.

German electricity prices hardly increased at all last year… electricity is a low part of German household disposable income and German electricity bills are lower than US households.

The chart shows all energy, when German progress has been greatest in electricity, with transport and heating use lagging. That won’t continue…

35% of electricity from renewables in first half 2017 – another offshore wind farm came online yesterday.

The FIT subsidy regime was overhauled and replaced last year with an auction system for new renewables… which has resulted in subsidy free offshore wind bid this tyear.

Griff,

Still trying to put lipstick on that pig, are we?

I live in Ohio and pay about $.10 per kilowatt. The average price in Germany is .29 Euros per kilowatt. If German bills are lower, it is not because of cheaper energy, but rather because of lower thermostats in winter, lower outside temperatures in summer, no A/C , and smaller apartments in Germany.

350,000 Germans whose electricity was cut off would likely beg to differ with your rosy conclusions.

It hasn’t increased much in the last year. I love the way Griffie cherry picks the data to fit his assumptions.

Griff==>if several hundred percent higher electric prices with no reduction in the evil GHG’s is not a “failure” , pray tell what would be?

Griff

A decade of costly and technically disruptive energiewende for a colossal 0.1% drop in CO2 emissions.

So when you say this is not a failure you are presumably admitting that the CO2 story is just irrelevant window-dressing which no-one really cares about.

It’s a big success for narcissistic green activists / academics, wind and solar cash farm land owners and politicians.

And anyway Germans are all so rich that who cares how much households pay for electricity?

http://www.dw.com/en/german-poverty-rising-despite-economic-growth/a-37787327

https://www.quora.com/Why-do-German-households-use-so-little-electricity-compared-to-those-of-North-America.

If German electricity bills are lower or at least no higher than American ones, it is because they use considerably less electricity than the average American household does. It has to do with lifestyle among other things.

The Quora article lined to above states that Germans generally do no use air conditioners or fans for cooling in the summer as Americans probably do throughout the summer—especially in the central and southern sunbelt U.S. states. If Germany had the kind of persistently hot summers which much of the southern half of the U.S. does, they probably would be using AC as well.

Second, they usually do on use dishwashers or dryers. They wash dishes by hand and dry clothes outside on a line. No one is gong to make me give up my dishwasher. I’ll be damned if I wash them by hand. And I’m probably not alone.

Next, the article states that since German homes are smaller in their towns and cities and are often up against each other, they share radiant heat with each other through their walls, probably much the same as with apartment complexes and condos here in the U.S. We also see this with homes in the older northeast urban areas in the U.S., but not much elsewhere. And finally, the article states that Germans keep lighting in their homes low to save on electricity.

The graph in the article is from 2010, but it shows the avg German household uses about 3,500 KWh of juice in a year versus the average American one which uses about 11,700 KWh.

Nonetheless, the German electricity rate is about 29 eurocents per KWh, considerably higher than in most of the U.S. and the highest in Europe. And none of this supports the notion that wind and solar are capable of scaling up as viable commercial replacements for traditional nuclear and fossil fuel power plants, especially in frequently cloudy Germany. There are a number of studies out there, some of them reported here at WUWT, that they can’t.

The truth is, if indeed wind and solar are driving up electric rates in Germany, German households are still paying more for electricity than the have to. Over time, those high rates really add up.

When New York State allows fracking as with a few others who don’t allow it, natural gas will be even more able to be exported. NY will eventually allow it, especially when the price goes up 10-15% – and a new political party with some common sense takes over…

Just a wee question – but –

“Ms. Merkel’s climate and energy policies have caused residential electricity prices in Germany to spike by approximately 47% since 2006, costing the average German household about $380 more a year. ”

IF the average householder is paying around 47% more than they did, and that amounted to $380 per year, then their monthly power bill must ONLY be around the $65 to $70.

I’d like to pay only that…and I live in NZ where we are already 80 plus percent powered by so those called renewable energy sources.

Did I do my maths wrong?? It is certainly possible

Power is very expensive in New Zealand, even though as you say ~80% renewable, mostly hydro, and it’s just got up to 20% more expensive here in Australia. Mind you we have idiots like Turnbull and Finkle who think it’s great to tax energy.

I was talking to my energy supplier the other night to find out why my power bill jumped to AU$575 for 57 days of supply. I was asked, almost immediately, am I calling about issues with payment. I wasn’t. But I mentioned that, as of July 1st 2017, energy costs rose by up to 20%, and that calls like mine will be come more common. The chap I spoke to said that it was already happening and he had a pile of issue on his desk on that very subject. Once this bites fully, and next year when there is apparently a similar rise, there’s going to be lots of angry people not able to pay their bills.

There are some important differences between Australia and Germany:

1) Australia is extremely rich in fossil fuel natural resources; Germany is extremely poor.

2) Austraila aspired to be one of the world’s leading energy exporters (coal and LNG). Germany is trying to wean itself off of imported energy.

However, they do have some things in common:

1) Germany banned fracking, as did Victoria. Other states in Australia have implemented regulatory hurdles that make developing new natural gas resources extremely difficult and slow. So both Germany and Australia are very anti-natural gas.

2) Australia and German policymakers both believe they can painlessly transition away from fossil fuels to renewables.

3) Australia and Germany both lavished enormous subsidies on wind and energy.

4) South Australia and Germany have some of the highest electric rates in the world.

What is so remarkable is that Australia, being a nation that, unlike Germany, is so enormously rich in fossil fuels, would follow the same energy politics that a country like Germany that is so fossil fuel poor did.

Even some liberals in Australia have wandered off the anti-fracking reservation:

http://www.2gb.com/podcast/craig-kelly/

And it’s not just households that suffer from high electricity rates. Small businesses suffer too, as this interview with Australia Council of Small Business CEO Peter Strong explains.

http://www.2gb.com/podcast/skyrocketing-power-bills/

Australian blogs like Macrobusiness do a great job of fanning the anti-fracking fervor. It is now advocating that the government step in and force Australia’s LNG exporters to break their contractual agreements with other nations, an idea that Turnbull has adopted.

https://www.macrobusiness.com.au/2017/07/asian-households-warm-up-on-aussie-gas-as-locals-freeze/

The IEA predicted just last week that Australia, Qatar and the USA would be locked in a three-way race in a few years to see who would be the world’s largest LNG exporter.

I was joking with some of my oil and gas buddies that we ought to pass the plate and take up a collection for Australian blogs like Macrobusiness, the same way Putin allegedly funds anti-fracking activists in the United States (in order to break the knees of the competition).

“PUTIN IS FUNDING GREEN GROUPS TO DISCREDIT NATURAL GAS FRACKING”

http://www.newsweek.com/putin-funding-green-groups-discredit-natural-gas-fracking-635052

I live in NZ too – my latest monthly account =US $276 for an ordinary 2 person insulated home. And yes – most of our electricity is hydro i.e. renewable. Would love to have Germany’s rates

My last bill from Contact (NZ)

309 kWh @ $0.25.648 pkWh anytime

306 kWh @ $0.19.14 pkWh economy

615 kWh @ $0.0.160 pkWh Levy

34 days.

$212.08 less prompt payment discount

$165.42

Stuck with Contact as it is still the cheapest providor where I am

With all that hydro NZ has why are the prices so high?

“Vald July 26, 2017 at 3:33 am”

Stupidity of the green “image”. But you drive over the Rimutakka Hill road on SH1 north of Welington, see the number of discarded McDonalds cartons…

Such comparisons are misleading for several reasons.

House size, if single family stand alone, is different. Is there centralized heating in a community with multi-family units. In the USA, most houses and apartments are independently heated. Ours is 100% electric. Many neighbors use propane. What about the appliances? Washing machines, microwave ovens, air conditioning? Are these similar in size and efficiency; and adoption rates? Our rate (Washington State) is about 1/3 that of those in California. We also have fixed monthly fee plus an energy usage charge. Are such fees common? If a rate is published, is the fee included?

Anyone trying to compare costs ought nought to just pluck numbers from reports and think they are measuring the same thing.

@ John F Hultquist

Agreed – also in NZ for instance, the country stretches over a large latitude – I live below 46 degrees south while I would guess Warren could be north of 33 degrees.It is brrr territory here with regular frosts and quite a bit of snow- so more electricity needed for heating. My place is all electric. Also I notice that even though we use the same utility company, the rates apart from the Electricity Authority levy are at variance – not a lot but significant.. So apples and cucumbers perhaps.None the less, the Germans are on a pig’s back compared with NZ.

What matters is amount of household disposable income is spent on electricity – that’s a comparable figure.

2.3 percent in Germany (2015 figure)

https://www.cleanenergywire.org/factsheets/what-german-households-pay-power

(A German household in 2014 used less than a third of the power of an equivalent household in the US, and also less than other major industrial countries in Europe such as France, Britain and Spain)

“Griff July 26, 2017 at 12:35 am”

You seem to have a lot of disposable income. My power bill just in is, more or less, DOUBLE what it was same period last year. I wonder why that is?

“What matters is amount of household disposable income is spent on electricity – that’s a comparable figure.”

Griff,

Sez you. What a ridiculous contention, money is money. You’re spinning as fast as you can? Going to have to do better than that.

Why do you bother to continue to embarrass yourself here? Are you “literally too stupid to insult?”

DBH,

Be careful what you wish for as the German rates are about $0.30/kWh. The only reason the cost per month is lower is that their consumption is lower. While some of the lower consumption may be due to greater efficiency, I suspect much of it is driven by self imposed conservation, ie. uncomfortable thermostat settings, to avoid the high cost of energy consumption.

Check the link posted by Griff, it includes a chart by country showing rates, consumption, and cost that includes NZ.

My monthly electric bill ranges from $20 to $40 dollars.

Funny how it is with fossil fuels…the more we use, the more we have!

But it is just about to start running out.

I know this is true, because a democrat told me so in 2008.

Remember that year?

Drill baby drill?

And the lame responses:

“There is not enough oil and gas in the US to make it worth looking or digging it up, and besides it takes a long time between looking for it and having it to use.”

The funny thing is that people who have been wrong about every thing, have lost every argument in the end when they were proven to be completely wrong…that these are the people who somehow feel smugly confident that they are so smart, and the people who were right all along about virtually every argument are somehow, in their minds, clueless.

Trump stood up to the alarmists and the US is in the energy driver’s seat. It won’t take long for other countries to see where this is going and want to join in as well. The whole wealth redistribution plan is coming apart at the seams. Soon everyone will turn on the the CAGW narrative to justify helping themselves to the spoils. The straw that broke the camel’s back.

And it looks like the UK is need of a new Government before 2040. I read somewhere they will be banning petroleum sales so everyone has to go electric. Hopefully the US can just get on showing the world that CAGW is rubbish and that we’ve been swindled.

Yes, just announced this morning – no new petrol/diesel car sales from 2040.

Macron announced same in France recently. The Indians are aiming for 2030… China is requiring 1 in 12 new cars be electric going forward…

Fake news…

https://www.theguardian.com/politics/2017/jul/25/britain-to-ban-sale-of-all-diesel-and-petrol-cars-and-vans-from-2040

“Yes, just announced this morning – no new petrol/diesel car sales from 2040.

Macron announced same in France recently. The Indians are aiming for 2030… China is requiring 1 in 12 new cars be electric going forward…”

Good! That means there will be less demand for gasoline which means the price will go down and the supply will be extended, and Americans and their gasoline vehicles will be happy as larks.

The future is looking bright. 🙂

In Griffies world, a politician making an announcement if proof that it will work.

Griff, Middletons post is a classic ” dig here” you failed to do.

BTW, India is building lots of coal to provide tgeir power needs!

Do you ever learn?

Announcement today 26th July in the UK MSM that all new diesel and petrol car sales are to be banned from 2040.

What they don’t say is whether that will include hybrids, at least not the MSM.

All this to free the country from air pollution, which really only exists in city centres. So once again, the urban elite dictate terms to the rest of the country.

Air pollution in the UK evidently causes 40,000 premature deaths. What they also don’t tell us is that this number is calculated at something like 3.5 hours off each of those 40,000 lives. Perhaps an urban myth, but once again, the term urban raises its ugly head.

According to this source it will include hybrids.

https://www.theguardian.com/politics/2017/jul/25/britain-to-ban-sale-of-all-diesel-and-petrol-cars-and-vans-from-2040

The city centers want the countryside devoid of people – except for the hidden getaways of the elite.

“All animals are equal, but some are more equal than others” isn’t just a quote from a book, it’s a axiom to live by.

“Hopefully the US can just get on showing the world that CAGW is rubbish and that we’ve been swindled.”

Swindled! We don’t use that word enough in relation to the CAGW lie. The whole world has been swindled by the CAGW promoters.

The trouble is that petroleum exports push the dollar up and make American manufactured goods less competitive. It’s called Dutch Disease.

The Donald should try not to go too nuts with petroleum exports or it will upset his plan to bring back manufacturing.

But, but ………….. the commentary stated …………

Even if the price of oil were zero it could cause the dollar to strengthen by improving the balance of payments. It’s complicated.

As the above link notes, the problem is to get our manufacturing back from China. The President has the right idea.

Won’t happen until the tax and regulatory issues are resolved.

It’s a matter of Yuge debate because lots of people hate the idea that The Donald might be right. There’s data that suggests that, in the short term at least, jobs are coming back. link

For sure production is coming back. link Because of automation, lots of people think the plants will return without creating any jobs. It’s complicated well beyond my pay grade.

@ commieBob

Not that it really matters but it appears to me that the math in your It’s complicated cited link is wrong, to wit:

Actually, 2016 petroleum trade contributed $63 billion to the trade deficit, right?

July 26, 2017 at 4:07 pm

Returning plants will create a few jobs, mostly in management, supervisory and material handling, ….. but not a great horde of jobs on the assembly lines like there were previously. Simply because the manufacturing floor has to be automated with robots. Robots work 24-7-365 without complaining.

The “catch-22” is, any foreign production goods being transferred to the US for production …… has to be produced at a manufacturing cost that makes it possible for that “production item” to be sold at a “retail price” that the American public is use to, ….. or was willing to, …… pay for the “imported item”.

And when American management is forced to pay $35 to $50 per/hour (that includes, wages, entitlement, rents, insurance, taxes, etc.) for each and every factory floor, assembly line and transportation employee, ……. then there is no way in hell the “sale price” of the “human” manufactured items can compete with the “robot” manufactured items.

“HA”, if the US auto manufactures did not use any “robots” in their manufacturing process, …… all “new” cars would surely cost 3X (three times) what they currently sell for …… and the majority of the American public could not afford to purchase one.

Ells bells, iffen the banks and finance companies were not now offering “7 year (84 month) new car loans/financing” …… probably 60% of the “new car” buyers couldn’t afford to buy one.

Developing oil and gas products is manufacturing.

Any connection to NASA appearing to also show a decline in sea-level rise recently?

https://climate.nasa.gov/vital-signs/sea-level/

I’m sure CNN will be onto it either way to clarify what to think.

…think?

…feel.

Quite.

@markl. I hope you are right. Researchers have an escape clause ready for them – ‘Oh, look, there might be a pause after all. What a surprise! We need a lot of money to research this aspect of the changing climate.’

Do we expect the wealth redistribution gangs ever to surrender? Their schemes will be replaced with a wealth creation scheme that will do far more good for everyone. But don’t expect cheers from the mob who are into redistribution at any cost. Theirs is a desultory perspective. It’ll be interesting to see how they handle it.

Today UK announced an end to new petrol and diesel cars sales in 2040. Macron announced the same for France last week.

UK and France have announced dates for close of all coal power plants…

Europe is moving away from fossil fuels… India and china are meeting expansion with renewables.

where, just where, is the market for US oil and coal exports?

Gas has a market – including for non-power uses. for now.

The French president says he wants to ban gasoline and diesel cars by 2040. The Grauniad hopes that the Environment Minister’s plan will call for an unenforceable ban of ban gasoline and diesel cars after 2040.

The UK and France are an insignificant segment of the Energy market.

With much of Europe dependent on imports for most of their fossil fuel consumption, Europe is not moving away from fossil fuels at a meaningful rate.

India and China aren’t even coming close to meeting expansion with renewables.

The rate of energy demand growth in China and India is about twice their total wind and solar output.

The growth market for U.S. coal is in non-OECD countries.

The market for U.S. crude oil, refined products and natural gas is the entire world.

“Global oil supply to lag demand after 2020 unless new investments are approved soon”

https://www.iea.org/newsroom/news/2017/march/global-oil-supply-to-lag-demand-after-2020-unless-new-investments-are-approved-so.html

Crude oil demand growth isn’t being driven by passenger vehicles….

http://www.iea.org/media/news/2017/170327OIldemandbysector.png

http://www.iea.org/newsroom/news/2017/march/commentary-running-fast-to-stand-still-.html

“Griff July 26, 2017 at 12:29 am

where, just where, is the market for US oil and coal exports?”

Everywhere else it is not being sought.

I hope I live long enough to see this ten wheeled battery powered artic

The crazy thing is that the U.S. fossil fuel industries were able to accomplish much of this expansion during an 8-yr period in which the U.S. government was waging a “greenhad” against fossil fuels.

Fortunately, the Obama maladministration lacked the legal authority to seriously interfere with oil & gas operations on private & State lands, FERC was statutorily bound to approve almoat all energy infrastructure (like LNG export terminals) and Obama was willing to trade the crude oil export ban for an extension of wind & solar tax credits.

That said, $100/bbl oil fueled this “revolution.” The crash in oil prices was driven by OPEC’s (Saudi Arabia’s) efforts to kill the U.S. shale industry, when they ramped up production in late 2014 and 2015. Like the Obama maladministration, the Saudis failed to recognize the fact that the oil industry can adapt and innovate far more rapidly than governments can…

http://www.worldoil.com/news/2017/2/28/rystad-examines-what-to-expect-from-us-shale-break-even-prices-in-2017

http://www.visualcapitalist.com/countries-suffering-low-oil-prices/

There is evidence that the well productivity gains will continue:

EIA DRILLING PRODUCTIVITY REPORT MISLEADING THE MARKET?

https://btuanalytics.com/eia-drilling-productivity-report-misleading-market/

Let’s all give a salute to the Great Communicator, yes that one, Ronald Reagan. He said if you look for it you will find it. At the time,I thought he was senile (actually the Alzheimers was statring to set in).How could he know more than the titans leading Exxon, Mobile, Chevron, Texaco, et al? Well (with a pause, as only he could say), I guess they don’t know everything (see Tillerson on CAGW). Since the November election, maybe Dutch is having the last laugh!

Peak oil is merely a function of price. OPEC found out that there is still a lot of it out there if the price is right. Basically it priced itself out of its control.

I’m not sure what the numbers quoted here are showing as oil exports but the US is still importing about 7.7 million barrels a day and so there are no net exports occurring. Also the oil production is not around 15 million a day but is 9.4 million barrels a day. I think they are using a BOE and converting natural gas to barrels of oil equivalent to try and spin huge oil production.

Check it out at https://www.eia.gov/dnav/pet/pet_sum_sndw_dcus_nus_w.htm

Data Series Area

GraphClear 06/09/17 06/16/17 06/23/17 06/30/17 07/07/17 07/14/17 View

History

Crude Oil Production

Domestic Production

9,330 9,350 9,250 9,338 9,397 9,429 1983-2017

Refiner Inputs and Utilization

Crude Oil Inputs

17,256 17,152 16,890 17,141 17,244 17,119 1982-2017

Gross Inputs

17,572 17,494 17,216 17,422 17,603 17,500 1990-2017

Operable Capacity (Calendar Day)

18,621 18,621 18,621 18,621 18,621 18,621 1990-2017

Percent Operable Utilization

94.4 94.0 92.5 93.6 94.5 94.0

The post refers to “petroleum resource production.” The graph by Mark Perry includes natural gas liquids and refinery gains…

Current natural gas production is about 90 bcf/day (15 million BOE). Total crude oil & natural gas field production is ~24 million BOE.

The greens always try to make it about oil independence. This is a red herring.

Most EIA scenarios, including the reference case, predict the US will become energy independent in the next few years.

Personally I prefer “energy dominance” to “energy independence”… But I’m from Texas (since 1981).

@ David Middleton,

Well the EIA’s most recent missives (the graph is from several months ago) certainly seem to indicate we’re on the “High Oil and Gas Resource and Technology” curve, which is consistent with “energy dominance.”

For someone like myself that’s been retired from the oil and gas upstream industry for many moons, what these young bucks and does are doing these days is nothing short of unbelievable. And there seems to be no let up in the speed with which the drilling and completion technology is advancing.

There’s still a lot of us old-timers (young bucks & does in the 1980’s) doodlebugging & poking holes in the ground.

Here are the US weekly oil imports and it is around 7.7 to 8 million barrels a day.

https://www.eia.gov/dnav/pet/pet_move_wkly_dc_NUS-Z00_mbblpd_w.htm

From the article: “U.S. evolves into coal, gas and oil global energy giant supplying world’s hungry energy markets”

Yes, and all that took was a little bit of leadership. Give the American economy a free hand and look out!

From the article: “EIA energy data shows that in 2016 81% of total U.S. energy use was provided by fossil fuels. Even in California the renewable energy hype capital of America total energy use in 2015 was provided 84% by fossil fuels.”

That’s odd. The U.S. in general uses fossil fuels for 81% of its energy, but California, the supposedly greenest State in the Union, gets 84% of its energy from fossil fuels.

That is similar to Germany where they are ruining their economy with renewables in order to cut down on CO2 but the reality is their CO2 emission are increasing.

“Spinning your wheels” comes to mind.

When people finally figure out their poor economies and tough times are attributable to the dishonesty of the CAGW narrative, they are going to be really angry.

From the article: “Some back-of-the-envelope math suggests Germans may now pay $41.5 billion less per year for their oil imports, constituting an average savings of around $1,107 (at current exchange rates) for each of Germany’s 37.5 million households.”

Thank you, Mr. Trump, and all you frackers out there!

Think about that for a moment. $41.5 billion is one heck of a lot of savings. And these kinds of savings apply to every nation on Earth including the U.S., since everyone is paying less for oil.

Low oil prices are good for everyone, except the oil companies, but as long as the oil companies can make money, they will be happy. We are in the sweet spot right here where the oil companies can make money and the rest of us can benefit from low oil and gasoline prices.

Every $0.80 reduction in the price of a gallon of gasoline increases U.S. GDP by about one percent. Trump wants to increase the GDP of the U.S. from the current 2% annually to 3% annually. He could get that done by lowering the gasoline price by $0.80. That’s how significant lower gasoline prices could be to our economy, and every economy on the planet. The lower the gasoline prices, the better.

TA,

Low oil prices are not good for oil exporting countries. Goldman Sachs did a great video that explains who the winners are who are the losers are from the shale revolution:

Lower for Longer? The Impact of the New Oil Order: Goldman Sachs

I would suggest those oil exporting countries diversify a little more, Glenn. Putting all their eggs in one basket is not a good policy.

“TA July 26, 2017 at 11:38 am”

That is why the UAE has built those artificial islands, to attract tourists as the oil will run out one day.

Monty Python, your man in charge at the department of Silly Walks has apparently gone off the deep end extending his sphere of influence to all transportation. To wit, no fossil fuels after 2040. That would indeed be Silly Transportation. Thank goodness it can’t happen. If you try it you will very rapidly fall into obsolescence, third world status and very likely come under shariah law. The rest of the world will continue on with a virtually endless supply of fossil fuels. People with no means of transportation will gravitate to England . . . can’t take your fossil fuel vehicle there.

It is always amusing when politicians pass a law to take effect many years in the future.

Imagine that in 1970 when the oil crisis hit that politicians back then had passed a law outlawing gasoline and diesel cars in 2020.

Laws written today to take effect far in the future are a complete nonsense because no one knows what developments will take place before then.

That’s odd. The U.S. in general uses fossil fuels for 81% of its energy, but California, the supposedly greenest State in the Union, gets 84% of its energy from fossil fuels.

≠=========

Arny and Gerry. Style over substance. Watch what I say, not what I do.

good

Proponents / defenders of wind/solar energy (such as Griff) often cite the statistic that electricity bills are smaller in Germany 🇩🇪 than in USA 🇺🇸. This is not really true and it ignores the fact that dwellings on average are 2.5 times bigger (floor space) in the US than in Germany.

It would be better to talk about the average price per year of electricity per m2 of floor space. This statistic gives the following values:

Germany: 16.96 US dollars

USA: 5.48 US dollars

Here are the raw data numbers.

In Germany the average electricity cost per residence per year is 1450 euros or 1696 US dollars.

Source:

https://tranio.com/germany/maintenance/

The average area of dwellings in Germany was

89.9 m2 in 2006.

Source:

https://www.bmwfw.gv.at/Wirtschaftspolitik/Wohnungspolitik/Documents/housing_statistics_in_the_european_union_2010.pdf

However since this was a decade ago we will generously assume that today the average is a round 100 m2.

Thus in Germany the annual electricity per m2 dwelling is 14.5 euro or 16.96 usd.

Meanwhile in the USA, the average cost per month for all utilities – electricity, heating, water and garbage, is 147.88 usd, or annually, 1,774.56 usd.

Source:

https://www.numbeo.com/cost-of-living/country_result.jsp?country=United+States

But for electricity only per month it is on average 114.09 usd, or an annual 1369 usd.

Source:

https://smartasset.com/personal-finance/how-much-is-the-average-electric-bill

Dwellings are much larger in the US than in Germany or Europe as a whole. The average dwelling in the USA has floor area of 2687 square feet, or 249.6 m2.

Source:

https://www.fatherly.com/love-and-money/family-finance/average-size-houses-us/

Thus in the US the annual electricity price per m2 of dwelling is 5.48 usd.

Note finally that in Germany it is much more common for people to live in apartments within large multi-storey apartment blocks, than in the US. This is especially so in the formerly communist east Germany. According to the report below, at German reunification in 1992, the average dwelling floor areas were in west and east Germany was 82.7 and 64.5 m2, respectively.

Source:

http://countrystudies.us/germany/93.htm

In 1992 united Germany had approximately 34.5 million dwellings with 149 million rooms, for a total of 2.8 billion square meters of living space. Dwellings in the west were larger than those in the east. In 1992 dwellings in the old Länder had an average floor space of 82.7 square meters for an average of 35.1 square meters per person, compared with 64.5 square meters and an average of 29.0 square meters per person in the new Länder.