Featured Image

Guest Seinfeld routine by David Middleton

In Part One of this series, we looked at Peak Oil and its irrelevance to energy production and also discussed the relevance of Seinfeld. In Part Deux, we looked at “abiotic oil,” a real(ish) thing that really doesn’t matter outside of academic discussions and SyFy blogs.

Part Trois will explore perhaps the most meaningless notion to ever come out of academia: Energy Returned On Energy Invested (EROEI or EROI depending on spelling skill). EROEI is like what Seinfeld would have been if it was written by Douglas Adams.

EROEI

EROEI is the preferred energy metric for Malthusians, environmental activists, Warmunists and proponents of uneconomic energy sources. Invention of this concept is generally credited to an ecology professor…

Wikipedia

The energy analysis field of study is credited with being popularized by Charles A. S. Hall, a Systems ecology and biophysical economics professor at the State University of New York. Hall applied the biological methodology, developed at an Ecosystems Marine Biological Laboratory, and then adapted that method to research human industrial civilization. The concept would have its greatest exposure in 1984, with a paper by Hall that appeared on the cover of the journal Science.[6][7]

Surprisingly, I find it unsurprising that an ecology professor would come up with such a “brilliant” concept.

While I understand why Malthusians, environmental activists, Warmunists and proponents of uneconomic energy sources would embrace EROEI, I was disappointed to see that the World Nuclear Association was embracing it, although, they do seem to recognize the pitfalls…

The economics of electricity generation are important. If the financial cost of building and operating the plant cannot profitably be recouped by selling the electricity, it is not economically viable. But as energy itself can be a more fundamental unit of accounting than money, it is also essential to know which generating systems produce the best return on the energy invested in them. This energy return on investment (EROI), the ratio of the energy delivered by a process to the energy used directly and indirectly in that process, is part of life-cycle analysis (LCA). Since any energy costs money to buy or harvest, EROI is not divorced from economics. An EROI of about 7 is considered break-even economically for developed countries, providing enough surplus energy output to sustain a complex socioeconomic system. The US average EROI across all generating technologies is about 40. The major published study on EROI, by Weissbach et al (2013, since the early editions of this paper) states: “The results show that nuclear, hydro, coal, and natural gas power systems (in this order) are one order of magnitude more effective than photovoltaics and wind power,” particularly when any energy storage is factored in for intermittent renewables.Analysing this energy balance between inputs and outputs, however, is complex because the inputs are diverse, and it is not always clear how far back they should be taken in any analysis. For instance, oil expended to move coal to a power station, or electricity used to enrich uranium for nuclear fuel, are generally included in the calculations. But what about the energy required to build the train or the enrichment plant? And can the electricity consumed during uranium enrichment be compared with the fossil fuel needed for the train? Many analyses convert kilowatt-hours (kWh) to kilojoules (kJ), or vice versa, in which assumptions must be made about the thermal efficiency of the electricity production.

World Nuclear Association

I love nuclear power. It is the most dependable way to generate electricity at a relatively low cost… apart from the cost of building the power plant. Figure 1 lists the Energy Information Administration’s latest estimates for the levelized cost of electricity from various sources. I did not include the tax credits for wind and solar because electricity consumers and taxpayers are often the same group of people. I converted the costs from $/MWh to $/mmBtu (million British thermal units) to make it easier to compare to the value of petroleum and natural gas, and sorted from lowest to highest cost.

While nuclear power might have a great EROEI value, it’s nearly twice the cost of the least expensive generating source and even more expensive than onshore wind and solar PV. Although the fact that nuclear power plants generate electricity when “the wind don’t blow, and the Sun don’t shine” is very important.

Note that only natural gas combined cycle and geothermal are within 20% of hydroelectric. Geothermal and hydroelectric are great… But they only work in specific locations.

The Anthropological View

So far, EROEI has been a fairly innocuous academic exercise… However, this is what an anthropology professor can do with it:

It is difficult to know whether world industrial society has yet reached the point where the marginal return for its overall pattern of investment has begun to decline. The great sociologist Pitirim Sorokin believed that Western economies had entered such a phase in the early twentieth century ( 1957: 530). Xenophon Zolotas, in contrast, predicts that this point will be reached soon after the year 2000 (1981: 102-3). Even if the point of diminishing returns to our present form of industrialism has not yet been reached, that point will inevitably arrive. Recent history seems to indicate that we have at least reached declining returns for our reliance on fossil fuels, and possibly for some raw materials . A new energy subsidy is necessary if a declining standard of living and a future global collapse are to be averted. A more abundant form of energy might not reverse the declining marginal return on investment in complexity, but it would make it more possible to finance that investment.

Joseph Tainter, The Collapse of Complex Societies, p 215

The phrase “energy subsidy” appears at least 17 times in this book. The general theme is that declining EROEI values forced ancient complex societies to invade other complex societies to steal their energy (an energy subsidy) or collapse. A couple of points:

- Societies don’t produce energy, businesses do.

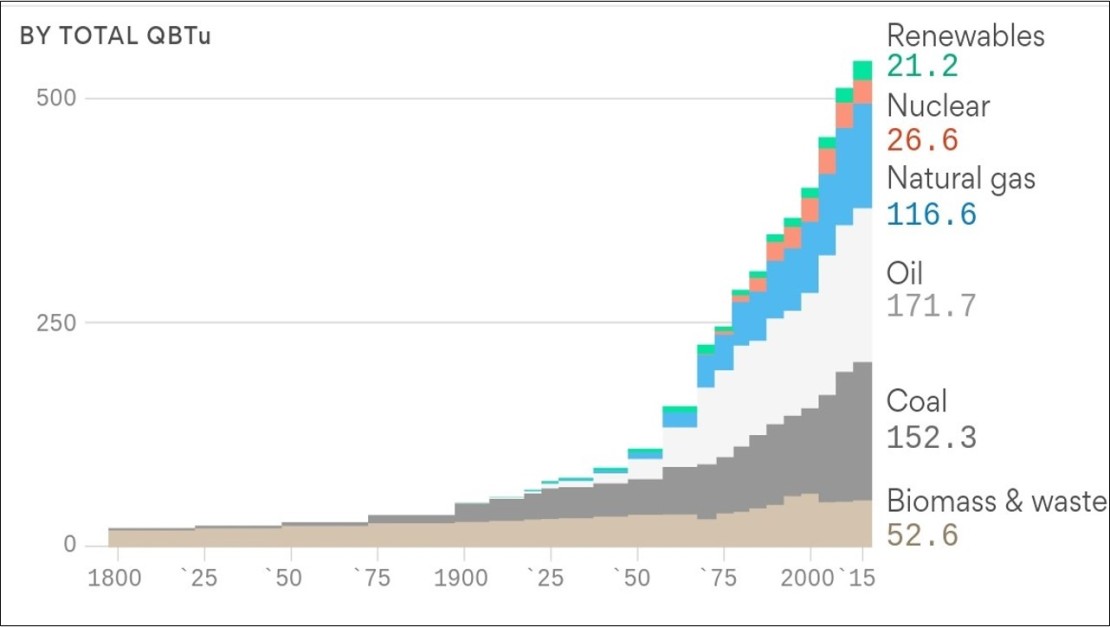

- Up until the Industrial Revolution, there was basically one source of energy: biomass.

While wind, water, animals and slaves were factors, biomass was *the* energy source from the Dawn of Civilization up until the 1800’s.

Joeseph Tainter also authored a 2012 book on the Deepwater Horizon disaster and its supposed relevance to EROEI. His coauthor was Tadeusz Patzek, a professor of petroleum engineering. This is from Chapter 2, The Significance of Oil in the Gulf of Mexico, page 8…

Why would a company like BP build such a monument to technology and ingenuity as the Macondo well in the first place? Why was it necessary to drill for oil one mile beneath the surface of the Gulf of Mexico? Hubris among top management may have minimized the perception of risk, but well-informed employees throughout the organization understood the perils as well as the benefits of deep offshore operations. You may think that the need and motivation for these operations are obvious, but any rationale for drilling in these inhospitable environments must take into account the amount of oil (or energy in some form) that is needed to build and maintain an offshore drilling rig such as the Deepwater Horizon, extract the oil, and transport, store, and bring the precious liquid to market. In other words, large offshore platforms are built and operated using vast quantities of energy in order to find and recover even more. The cost is still higher when you consider the complex management and regulatory structures needed to complement the technology, however poorly you may feel that the responsible people performed in the case of the Deepwater Horizon.Let us begin with fundamentals. First we need to know how much recoverable oil is waiting for us down there, how this amount of oil measures up against demand and total oil use in the United States, and how big the energy profit is after so much energy is expended in exploration, drilling, recovery, refining, and transportation to your local gas station or power plant. In other words, do the benefits outweigh the risks, for whom, and for how long?

Joseph Tainter and Tadeusz Patzek , Drilling down: The gulf oil debacle and our energy dilemma. p8

A Geological Reply to the Anthropologist

Does anyone else have answers for Dr. Tainter’s questions? Well, I do.

Why would a company like BP build such a monument to technology and ingenuity as the Macondo well in the first place?

Because that’s where the oil was.

Why was it necessary to drill for oil one mile beneath the surface of the Gulf of Mexico?

Because that’s where the oil was.

Hubris among top management may have minimized the perception of risk, but well-informed employees throughout the organization understood the perils as well as the benefits of deep offshore operations.

Dudes! Five companies bid against BP for an opportunity to drill “Macondo”… BP’s high bid barely beat out smaller independent oil company LLOG Exploration…

- BP Exploration & Production Inc. $34,003,428.00

- LLOG Exploration Offshore, Inc. $33,625,000.00

- Noble Energy, Inc. $17,225,650.00

- Red Willow Offshore, LLC $14,075,000.00

- Eni Petroleum US LLC $4,577,115.00

- Anadarko E&P Company LP $2,145,950.00

Only one of BP’s competitors for the lease, Eni, was a major oil company. The rest were small, mid-sized and large independents. Anadarko wound up partnering with BP on the Macondo well. After the Deepwater Horizon disaster, LLOG Exploration was able to take the lease over and successfully drill the prospect.

LLOG Exploration renamed the prospect “Niedermeyer”… part of an Animal House theme.

Niedermeyer was a nice discovery.

- Four wells on MC 208, 209, 252 and 253. Feb. 2015 through July 2017.

- 21.7 million barrels of oil (mmbo) and 57.5 billion cubic feet (bcf) of natural gas.

- MC 252 SS-1 Well: 6.1 mmbo & 15.6 bcf. Oct. 2015 through July 2017. Avg. 9,600 barrels of oil per day (BOPD) and 24 million cubic feet of natural gas per day (mmcf/d).

The Niedermeyer, Marmalard and Son of Bluto 2 fields were completed as subsea tiebacks to LLOG’s “Delta House” floating production system (FPS) on MC 254.

Murphy Oil just bought this and other deepwater assets from LLOG for $1.4 billion. So, I think the industry has a much better grip on the “perils as well as the benefits of deep offshore operations” than an anthropology professor does.

You may think that the need and motivation for these operations are obvious, but any rationale for drilling in these inhospitable environments must take into account the amount of oil (or energy in some form) that is needed to build and maintain an offshore drilling rig such as the Deepwater Horizon, extract the oil, and transport, store, and bring the precious liquid to market.

The “need and motivation for these operations are obvious”… To make money. No oil company or any other type of business would “take into account the amount of oil (or energy in some form) that is needed to build and maintain an offshore drilling rig such as the Deepwater Horizon, extract the oil, and transport, store, and bring the precious liquid to market,” and remain in business.

I can guarantee that we don’t factor the cost of building the drilling rigs that we contract to drill wells in the Gulf of Mexico. We factor in the cost to contract the rig and drill the well.

Nor is the cost of manufacturing the cars and trucks that we commute to work factored in. Nor is the cost to get the turkey sandwich I am about to eat from the various farms that grew the turkey, cheese, bread, jalapeño peppers and mayonnaise, to the Kroger supermarket where I bought them… Because, if I didn’t eat, I wouldn’t be able to explore for oil very well.

We absolutely do not denominate any of the costs in Btu, joules, Watts or any other units of energy measurement. I don’t spend energy to fill my gas tank. I don’t give energy back to the gas & electric companies in exchange for them being nice enough to heat and light my home. My company doesn’t drill for oil & gas to make energy.

I spend money to fill my gas tank. My company drills wells for oil & gas to make money. My gas & electric bills are paid for with money. My pay check, ChevronTexaco, ExxonMobil & Shell credit card statements and checks to the gas & electric companies aren’t denominated in joules, kilowatts or Btu – They are denominated in $.

I don’t give a rat’s @$$ if 1 barrel of amoeba farts uses less energy to produce than 1 barrel of crude oil… Because the barrel of amoeba farts costs $1,100 and can’t be produced in sufficient quantities to be waiting for me at the Chevron, Texaco, Exxon or Shell station when I need it.

If oil companies (or any businesses) used EROEI to guide their investment decisions, they would go out of business, unless the government was footing the bill… And government could only foot the bill for such foolishness until they ran out of OPM (other people’s money).

The most fracking hilarious thing from Tainter’s and Patzek’s book was this Gulf of Mexico production “forecast”…

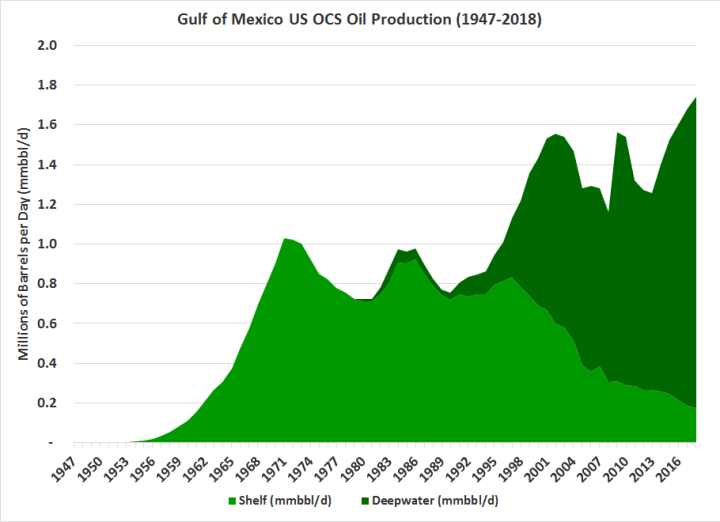

I have no idea what “industry projection” they were referring to. Prior to Macondo deepwater production was forecast to increase sharply because a large number of deepwater discoveries, particularly ultra-deepwater Lower Tertiary discoveries were expected to come online. All of these projects were delayed by the Obama maladministration’s unlawful drilling moratorium and “permt-orium” in the aftermath of Macondo .

Here is a plot of actual Gulf of Mexico production overlaid on “Patzek’s Projection”…

Of course, that’s not how the oil industry would plot the production. This is how we would plot it:

We would also include the natural gas production.

The decline in gas production from the shelf has been more than offset by gas from onshore shale plays, particularly the Marcellus. Gulf of Mexico natural gas prospects are extremely unattractive at <$3.00/mcf.

Some energy numbers:

- 1 barrel of crude oil = 5,722,000 Btu

- 1,000 cubic feet of natural gas = 1,037,000 Btu

Current prices:

- Crude oil (WTI) = $65.82/bbl = $11.50/million Btu

- Natural gas (Henry Hub) = $2.52/mcf = $2.42/million Btu

I could “spend” 2 Btu of natural gas to produce 1 Btu of oil and make over a 2:1 return on capital. The bottom line isn’t denominated in joules, watts or Btu… It’s denominated in $$$.

Offshore oil production facilities are usually powered by diesel fuel or natural gas. Most, if not all, of our offshore platforms consume at least some of the produced natural gas as fuel. Natural gas-fired electricity is cheap. Most of the cost of natural gas-fired electricity generation is the fuel. Not having to purchase the gas for fuel makes it even cheaper.

There’s a growing trend in certain “woke” areas to power offshore oil facilities with “green” electricity.

If you subtract the variable O&M costs (mostly fuel) and transmission costs from natural gas-fired generation, you can get an idea of just how much more expensive it is to power offshore platforms from remote “green” energy sources. (Note: This is not meant to be a definitive calculation, just ballpark numbers).

Considering the fact that you can only sell oil for about $11.50/mmBtu, paying over $38/mmBtu for electricity just seems dumb. Even if I used the Brent price ($73.72/bbl), it’s just $12.88/mmBtu.

Inflation Adjusted Energy Prices

Maybe it’s just me, but I don’t see a clear pattern of rising energy prices.

It kind of sucks that we only get about $2.50/mcf for the gas we produce in the Gulf of Mexico, but I have pay about $10/mcf to the fracking utility company.

If the Obama maladministration hadn’t halted the free-fall in electricity prices, it would be free by now… /SARC

GDPROEP

GDPROEP may not be as “catchy” as EROEI, but GDP Return On Energy Production is actually a meaningful metric.

World Bank/IEA GDP per unit of energy use (constant 2011 PPP $ per kg of oil equivalent)

M’kay?

References

“Delta House Field Development, Gulf of Mexico.” Offshore Technology | Oil and Gas News and Market Analysis, www.offshore-technology.com/projects/delta-house-field-gulf-mexico/.

“Energy Returned on Energy Invested.” Wikipedia, Wikimedia Foundation, 1 Apr. 2019, en.wikipedia.org/wiki/Energy_returned_on_energy_invested.

“Energy Return on Investment.” World Nuclear Association, www.world-nuclear.org/information-library/energy-and-the-environment/energy-return-on-investment.aspx.

“GDP per Unit of Energy Use (Constant 2011 PPP $ per Kg of Oil Equivalent).” Data, data.worldbank.org/indicator/EG.GDP.PUSE.KO.PP.KD?view=chart.

Middleton, David H. “Deepwater Horizon: EpiLLOG.” Watts Up With That?, 20 Oct. 2017, wattsupwiththat.com/2017/10/20/deepwater-horizon-epillog/.

“Murphy Oil Acquires Deepwater GOM Assets from LLOG for $1.375 Billion.” Murphy Oil Acquires Deepwater GOM Assets from LLOG, www.worldoil.com/news/2019/4/23/murphy-oil-acquires-deepwater-gom-assets-from-llog-for-1375-billion.

Newell, Richard, and Daniel Raimi. “Despite Renewables Growth, There Has Never Been an Energy Transition.” Axios, 17 Aug. 2018, www.axios.com/despite-renewables-growth-there-has-never-been-energy-transition-e11b0cf5-ce1d-493c-b1ae-e7dbce483473.html.

“Norway: Equinor to Power Oil & Gas Platforms with 88MW OWF.” Offshore Wind, 28 Aug. 2018, www.offshorewind.biz/2018/08/28/norway-equinor-to-power-oil-gas-platforms-with-88mw-owf/.

“Power Generation for Offshore Environments.” Audubon Companies, 1 June 2015, auduboncompanies.com/power-generation-for-offshore-environments/.

Tainter, Joseph A. The Collapse of Complex Societies. Cambridge University Press, 2011.

Tainter, J. A., & Patzek, T. W. (2012). Drilling down: The gulf oil debacle and our energy dilemma. Springer New York. https://doi.org/10.1007/978-1-4419-7677-2

U.S. Energy Information Administration, “Levelized Cost and Levelized Avoided Cost of New Generation Resources in the Annual Energy Outlook 2019.” Levelized Cost and Levelized Avoided Cost of New Generation Resources in the Annual Energy Outlook 2019, EIA, 2019.

“U.S. Energy Information Administration – EIA – Independent Statistics and Analysis.” Short-Term Energy Outlook – U.S. Energy Information Administration (EIA), www.eia.gov/outlooks/steo/realprices/.

David or CTM

“It kind of sucks that we only get about $2.50/mcf for the gas we produce in the Gulf of Mexico, but I have (to) ? pay about $10/mcf to the fracking utility company.

Another great post, thanks

” I did not include the tax credits for wind and solar because electricity consumers and taxpayers are often the same group of people. ”

What about the subsidies? Take the subsidies off of wind and solar and those industries die tomorrow.

The subsidies currently mostly consist of tax credits.

We all can’t afford to invest in this scam industry and avail ourselves of the tax credits. Those costs should have been included in the table.

Is that why electricity price is so high in California, Germany, and Denmark?

I was referring to the EIA numbers, which are only for the US… Germany and Denmark are so expensive because they have to pay for all of that offshore wind power and massively inefficient solar PV.

California is so expensive because of overall incompetence.

Well, now you need to explain what a “tax credit” is 🙂

Tax credits and mandates to use.

https://longhairedmusings.wordpress.com/2019/03/28/the-ngo-sock-puppet-complex-watts-up-with-that-useful-idiot-of-big-finance-donteatyellowsnow-wrongkindofgreen-conquestofdough/

David ( Mr, Dr, Prof?) Middleton.

GDP itself is a fundamentally unsound metric based as it is even when Inflation Adjusted a purely subjective unit of Account. The question is not one of Political Economy but simple Metrology that is the Science of measuring things.

Lazards produce an excellent report on the levelised cost of Electriciity and Energy production and Dr Tim Morgan, (ex-head of research at Tullett Prebon ( not exactly a bunch of Green Hippy Commies) with his SEEDS energy Database look at surplus energy prodcution and its correlation to prosperity.

https://longhairedmusings.wordpress.com/2019/03/25/energy-economy-renewables-including-nuclear/

Energy Cost of Energy is explained here by Dr Tim Morgan.

“SEEDS uses an alternative measure, ECoE (the Energy Cost of Energy), which expresses cost as a percentage of the gross energy accessed. Because the world economy is a closed system, ECoE is not directly analogous to ‘cost’ in the usual financial sense. Rather, it is an economic rent, limiting the choice we exercise over any given quantity of energy. If we have 100 units of energy, and the ECoE is 5%, we exercise choice (or ‘discretion’) over 95 units. If ECoE rises to 10%, we now have discretion over only 90 units, even though the gross amount remains 100.This is loosely analogous to personal prosperity. If someone’s income remains the same, but the cost of essentials rises, that person is worse off, even though income itself hasn’t changed”.

Understanding ECoEECoE evolves over time. In the early stages of any given resource, ECoE is driven downwards by geographic reach, and by economies of scale. Once maturity is reached, depletion takes over as the driver, pushing ECoE upwards.

In the pre-maturity phase, technology accelerates the fall in ECoE driven by reach and scale. Post-maturity, technology acts to mitigate the rise caused by depletion. But – and this is often misunderstood – the capabilities of technology are limited to the envelope of the physical characteristics of the resource.

https://longhairedmusings.wordpress.com/2018/07/08/redefining-fiscal-conservatism-the-terra-energy-based-fiscal-unit-fores-and-lagom-white-paper-boundary-conditions-for-a-fiscal-conservatism-based-upon-circular-economics-part-one-scope/

WIth FIAT currencies and floating exchange rates, any money based measure that does not have a properly defined referent is sufficient to render any further analysis using it as its basis at best unreliable but in fact worse than useless, corrupted in every sense of the word in fact.

https://longhairedmusings.wordpress.com/2019/04/25/clowns-to-the-left-of-me-jokers-to-the-right-useful-idiots-for-usury-everywhere-watts-up-with-that-limitstonouse/

Dave, David or Middleton all work.

E&P expenditures are in US$ we get paid for oil & gas in US$.

Payment in FIAT or Holding Claims on wealth in FIAT currency is a Bad Idea, DOllars are probably best in that they are backed by the biggest Gun.

There is an old saying Dave, that he who has the Gold makes the Rules, well not any more it’s he who has the Air Support and Aircraft carriers, So that’s good old Uncle Sam.

Never the less, Claims on Wealth, Monetary Debt Instruments have more or less Doubled in The last Ten years, Energy has not become less valuable in that time yet some people have been gifted a larger claim on that Real Wealth.

Real Energy Resources are Wealth as are other resources including Labour time. Money in and of ts self is not wealth it is a Place holder and a variable one one and represents a Token of Deferred.Skin in the Game to most of us but to those who issue the debt instruments that bring money into existence it is a few key strokes on a computer.

If only it was as easy to bring in an Oil Well as it is for a Bank to Issue debt bailments against the Prospect of a discovery.

Investment decisions are best made where a moral hazard attaches to making bad decisions as a Geologist you would not last long if you persisted with prospecting an obviously un suitable geographic location, Too big to Fail and Too big to Jail Bankers were however rewarded for their reckless decisions for a whole series of Years leading up to 2008 and since where they have carried on the same reckless and self-serving policies.

Increased Economic Activity and Prosperity all correlates to our Energy development and Money has been a very good way of harnessing the commerce and levels of luxury high amounts of energy production have enabled, make no mistake though it is the Energy and resources and technology that have driven the possibilities not the Banking System and levels of debt , The Financial System as presently structured is parasitic on the Economy, It is mispriced a Civil Engineer or Oil Technologist contributes far more to our prosperity than a Derivatives Trader broking CDF’s to The Civil Engineers and Technologists Pension Fund manager.

My Objection to the current free lunch the Banksters have and their påropensity to steal everyone else’s Lunch is essential if a working kind of Commerce based Capitalism is to Flourish the current Financialised version is beyond any sort of Capitalism most of us would recognise and in large part welcome.

It is Ironic that the Extinction Rebellion, Not enough time people and Greta Thornberry are all pushing for an Abstract debt based Highly centralised Debt based banking system,

The Banking System presently and they are Stalinist/Fascist in their outlook and levels of proposed and actual unaccountability.

Can you define a US Dollar?

Here is a whole web site dedicated to the Fact that a satisfactory definition is not presently possible the COncept of a Dollar is a Faith-Based one at this point enforced in much the same way as the Spanish Inquisition.

https://www.moneytransparency.com/core-misrepresentation

https://longhairedmusings.wordpress.com/2017/08/06/the-paper-aristocracy-from-william-111-to-the-present-day-william-cobbett-against-gold/

Payment in FIAT or Holding Claims on wealth in FIAT currency is a Bad Idea, DOllars are probably best in that they are backed by the biggest Gun. There is an old saying Dave, that he who has the Gold makes the Rules, well not any more it’s he who has the Air Support and Aircraft carriers, So that’s good old Uncle Sam. Never the less, Claims on Wealth, Monetary Debt Instruments have more or less Doubled in The last Ten years, Energy has not become less valuable in that time yet some people have been gifted a larger claim on that Real Wealth. Real Energy Resources are Wealth as are other resources including Labour time. Money in and of ts self is not wealth it is a Place holder and a variable one and represents a Token of Deferred. Skin in the Game to most of us but to those who issue the debt instruments that bring money into existence it is a few key strokes on a computer. If only it was as easy to bring in an Oil Well as it is for a Bank to Issue debt bailments against the Prospect of a discovery. Investment decisions are best made where a moral hazard attaches to making bad decisions as a Geologist you would not last long if you persisted with prospecting an obviously unsuitable geographic location, Too Big to Fail and Too big to Jail Bankers were however rewarded for their reckless decisions for a whole series of Years leading up to 2008 and since where they have carried on the same reckless and self-serving policies. Increased Economic Activity and Prosperity all correlates to our Energy development and Money has been a very good way of harnessing the commerce and levels of luxury high amounts of energy production have enabled, make no mistake though it is the Energy and resources and technology that have driven the possibilities not the Banking System and levels of debt , The Financial System as presently structured is parasitic on the Economy, It is mispriced a Civil Engineer or Oil Technologist contributes far more to our prosperity than a Derivatives Trader broking CDF’s to The Civil Engineers and Technologists Pension Fund manager. My Objection to the current free lunch the Banksters have and their påropensity to steal everyone else’s Lunch is essential if a working kind of Commerce based Capitalism is to Flourish the current Financialised version is beyond any sort of Capitalism most of us would recognise and in large part welcome. It is Ironic that the Extinction Rebellion, Not enough time people and Greta Thornberry are all pushing for an Abstract debt based Highly centralised Debt based banking system, The Banking System presently and they are Stalinist/Fascist in their outlook and levels of proposed and actual unaccountability. Can you define a US Dollar? Here is a whole web site dedicated to the Fact that a satisfactory definition is not presently possible the COncept of a Dollar is a Faith-Based one at this point enforced in much the same way as the Spanish Inquisition. https://www.moneytransparency.com/core-misrepresentation https://longhairedmusings.wordpress.com/2017/08/06/the-paper-aristocracy-from-william-111-to-the-present-day-william-cobbett-against-gold/

But… That’s what we actually have to use to pay our bills… and how we actually get paid for the oil & gas.

RGL: “Payment in FIAT or Holding Claims on wealth in FIAT currency is a Bad Idea, ”

One flaw in your logic is that the payment for E&P is made in a fiat currency; the “payment” for E&P is crude oil and natural gas much like the payment for gold mining is gold. You then have the option to convert all or part of it to a fiat currency, if you so choose.

Can you define a US Dollar?

simples: The US Dollar is the currency of the United States of America

Any other silly questions?

Craig:One flaw in your logic is that the payment for E&P is *NOT* made in a fiat currency; the “payment” for E&P is crude oil and natural gas

I believe you left out an important word, so I fixed it for you.

We pay for services and materials with the same money as everyone else… fiat currency. I think Craig is pointing out that, as physical commodities, oil & gas have intrinsic value like gold… Although, oil is traded in US$.

Until you start reading the assumptions. They include the dubious “Cost of Carbon”, assume wind have a capacity factor of “45% – 55% for “Americas includes Argentina and Brazil”. They also assume a natural gas price of $3.45 per MMBtu. About a $1 to high.

On generating plants they assume:

Coal – 20 years (average age of existing plants is over 40 years)

Gas Combined Cycle – 20 years

Gas Peaking – 20 years

The report is basically a marketing brochure dressed up as an engineering report.

Money creation is much like making sausage, when you know how its made you are very careful about the Brand you use. With FIAT currency always ask what the Beef Content is, is there any there-there?

RGL: “Can you define a US Dollar?”

I’ll give it a shot. The ‘dollar’ is the basic monetary unit of the United States.

That’s all. ‘Monetary’ is the adjective meaning “having to do with ‘money.'”

‘Money’ is a convenient means of transacting commerce, the value of which means are agreed upon by the transacting parties. That’s all.

The description of money and its history is a bit more complex; these are some highlights:

While various commonly valued items could serve as money, like salt, animal skins, and so on, the material of highest value per mass but still in reasonable supply has been metallic, mainly gold, silver, copper, and iron, though not always in that order of evaluation (by weight). Various stages in the evolution of money may be described:

1. Units of weight (e.g., ‘talents’) were agreed upon, by progressively larger communities.

2. Items were produced convenient for carriage, like perforated disks or rings that could be strung and worn as jewelry.

3. Forgoing perforation, at around 600 BC the weight of the disks was stamped on one side, then two, then with a symbol of the authority of the stamping entity or government. When the weight and content of the coin could be trusted, denominations evolved with names. Until modern times there was some equivalence between the stamped value of the coin and its melted value, but of course there was no absolute value for anything. For example, within a few decades of silver mining of the mountain in Potosi the value of silver declined by half globally.

In the absence of such convenient means for exchange, promissory agreements served as well. These could be verbal, made in the presence of reliable witnesses if necessary, and, or, in literate societies, notarized with a written document.

Paper money combines the utility of both means of exchange, first appearing as the equivalent of a promissory note for the value of a dollar or so many dollars of silver (hence tied to the value of silver), then floating independently of any material backing, but rather dependent on the trust of the issuing bank or government.

As paper money has no intrinsic value, but functions in practice as a promissory note, it paved the way for digital transactions, then bitcoins, which exist in cyberspace and human minds, but function just as well.

The takeaway: supply and demand is a law of nature, not of economists. Nothing has invariable intrinsic value. Without trust paper money is no better than toilet paper, and in time of famine you can’t eat paper, or gold. –AGF

Hi Arthur, a Valliant effort although I prefer Soddys Little Ryme,

“Money is the Nothing you get for something before you can buy anything”.

Frederick Soddy

in time of famine you can’t eat paper, or gold

well you can (paper easily enough – just chew and swallow, gold however would take some creative methods, like shaving off really small flakes to swallow), but digestion issues and lack of nutritional value means that eating it won’t do you any good.

And mandates requiring utilities to buy useless intermittent power that increases the price of electricity across the board, since without the “mandate” there wouldn’t be any buyers for most or quite possibly all of what wind mills and solar panels “produce.”

Government doing what government does.

The costs for coal seem very high?

The coal is cheap. The cost to make coal-fired power plants comply with the CAA is what’s high. That’s why natural gas currently has a big advantage… It’s just about as cheap and the power plants are less expensive to build.

What about the cost of backup power for the non-reliable sources, either battery or thermal plant? If you include that, then wind and solar are much more expensive.

Twenty nine states have required minimum purchase levels of “green” wind and solar mandated by law. Here is an article about the situation. http://www.ncsl.org/research/energy/renewable-portfolio-standards.aspx. This is a de facto subsidy since the renewables have guaranteed purchases of their products regardless of the grid demand. Remove the guaranteed sales then wind and solar would crash and burn in less than 18 months.

David:

1) Love your posts.

2) Need more pictures of your dogs in costumes – ARCI (Amusement Returned on Costumes Invested).

https://www.facebook.com/david.h.middleton/videos/10208249643430610/

Even to a person who left school at 14 its simple. A source of energy is

in a certain location. As long as the cost of extraction is less than the final

cash return to the company, everyone should be happy.

One does not need to be a Professor to inform us about something as simple

as that.

MJE VK5ELL

Truth is often funnier than fiction… 😉

While economics rule there is some value in considering EROEI. The presenation and debate here:

http://euanmearns.com/eroei-for-beginners/

is useful

It’s absolutely useful… Almost as useful as discussions about evidence on Beatles album covers and song lyrics that Paul McCartney was dead. From 1976-1980, I considered this far more than I considered EROEI… 😉

https://longhairedmusings.wordpress.com/2019/03/04/the-big-apple-plan-wesley-freeburg-why-abstract-currencies-fail%e2%80%8a/ The unit of account in a Fiat money system is an arbitrary unit

basing a unit of account upon an SI Unit of energy makes a great deal of sense if you do not wish to be robbed of your skin in the game by the money laundering Banksters-

Sadly the Author of this piece has gone off at half cock failing to define terms and set boundary conditions.

Watch Glassmans talk and slide show and try again-

https://www.bitchute.com/video/dv8avoovsHqr/

No, because it assumes there is a consistent and stable value for the unit of energy – but there is not. A gallon of petrol (gasoline) is worth a vast amount in a Mad Max world and zero in a world that has banned cars.

Natural gas is worth nothing at many oil rigs, so they flare it. At my cooker hob it’s worth far more.

Unlike electronic dollars, moving energy from place to place costs money and energy.

So you didn’t read it.

I like this bit…

The rest is about as useful as looking for “Paul is dead” clues on Beatles albums.

“Society” doesn’t “gather” energy… Businesses do.

I really like this bit too…

http://euanmearns.com/blog-rules/

I don’t totally disagree with Euan Mearns, Art Berman and other veterans of The Oil Drum. I actually agree with them most of the time. As I explained in Part One of this series, Peak Oil is a real thing… I just don’t think it matters and explained why.

EROEI is a real equation. The problems with it are:

1) Where does the “invested” energy inventory start?

2) Investment in energy production is denominated in $ and other currencies.

3) Return on investment in energy production is denominated in $ and other currencies.

So, it’s a lot like sitting around looking for clues that “Paul is dead” on Beatles albums and song lyrics… It’s like playing Revolution Number 9 backwards.

That’s a good one :

“It’s like playing Revolution Number 9 backwards.”

backwards of backwards = highest speed at velocity 0.

@It Doesn’t add up, of course, I read it and I disagree with the fundamental premise that a Dollar based unit of account that is not merely ill-defined but Undefined and arbitrary can be relied upon to pay full market value for our most precious resource, Energy.

Our “most precious resource” is air. Try living more than a few minutes without it.

Yet air is, for the most part, free. Why? Because it’s so abundant that no one can make money developing the means to collect it and distribute it. They would have no buyers at any price. So the price of air, zero dollars, tells you exactly what our “most precious resource” is worth despite its importance to life on earth.

And yes, there are exceptions, but they make the case. Spending time underwater requires a source of air. So people are paid to collect it and distribute it. The dollar cost of such air reflects the effort and resources put into making it available despite the air itself being a freely available resource.

The dollar, you see, is a means of comparing apples to oranges, oil to gas, wind power to oil, etc. We muck up the system completely when we start adding value judgements to the process, as we’ve been doing by subsidizing whatever is in favor at the time (wind, solar) and penalizing what is out of favor (coal, nuclear). Let free market prices perform their invaluable function of offering accurate comparisons and get of the way. The rest will take care of itself.

Oil is priced only in the US Dollar. That would make it the logical unit of account.

Every bit of energy expended has a cost, and nobody in the supply chain is ignoring their costs (at least not for long), so every bit of EROEI is accounted for, along with a lot of other important information, in ROI.

By definition, EROEI disregards critical information. Why would you use such a metric? The only reason I can think of is to support an agenda that can’t be supported when all the information is considered.

What is the cost of coal without the carbon capture technology BUT with advanced pollution abatement technology?

I don’t know. The EIA LCOE reports only cover coal with CCS over the past few years. My guess would be around $25/mmBtu.

Coal used to be the cheapest cost of energy . Why would it be so high? The coal plant in Texarkana with the best pollution abatement technology wouldn’t have gotten investors unless they thought that their return would be near the top of investments in energy.

Compliance with the EPA’s ever-expanding definition of the Clean Air Act is why coal-fired power plants became so expensive.

The capital cost of processing and transporting solids prior to combustion is much higher than those for plants handling liquids and gases.

Subtract the pipeline tariffs & production handling fees, and the price of oil ($/mmBtu) is still much higher than natural gas.

(Reading this in context made me realize that my reply doesn’t make sense. As an author, I have access to a different way to view and reply to comments and it often lacks proper context.)

And becoming extinct.

What’s the cost of coal if burned in a Chinese power plant in Africa?

Nice report, David, but “amoeba farts”? Maybe you should have a couple of beers with that sandwich. The impact of the Obama administration is quite obvious, what will the charts for the Trump administration look like in a couple of years? MAGA!

I haven’t been able to drink beer at lunch since the early 2000’s… It’s tough enough for me to not need a siesta without alcohol.

I guess that is my gripe with LEED certification for green building construction. It is this complicated scoring of not only the direct energy consumption but the building materials (wood, good, I guess, but not if it is tropically sourced wood).

How about scoring LEED by capital and operating costs? How about scoring wind and solar by cost (see the sister article on WUWT on wind/solar mandates raising electric rates).

The is the wonders of the Capitalist System, or at least of markets and prices. They are a way of capturing not only the direct costs but also the how much you have to pay David Middleton to work for you energy company, so he in turn can afford his ham-sandwich lunch, which reflects the money required to obtain the energy resources to fertilize the crop that feeds the pigs and so on.

Use cost as a guide as to whether an energy-saving appliance, a fuel-saving car (or an electric car), a renewable or a non-renewable energy source should be pursued. Anything else is substituting this massive LEED-like point system for market prices, which have all of the indirect energy consumptions priced into them.

To me LEED certification means that we get a lot of annoying emails from building management and cardboard boxes for paper recycling… I make it a point to throw the cardboard box into the regular trash bin whenever they put one in my office.

The utility of EROEI is as a club.

It has the same value as the “Average of the IPCC’s computer projections”.

Using the propagandists own values to mock their fiscal ineptitude.

Given we want X KW/hrs of energy available to serve our diverse needs, it is mind-blowingly stupid to use thousands of gallons of diesel oil to create a fragile system of intermittent power,when for a fraction of the combined cost one could simply use a diesel generator and burn a few hundred gallons per year.

Especially when the “approved clean energy” system will require a diesel back up system.

Worse still,the eco-warriors do an inordinate amount of collateral damage to the very “environment” they so claim to be “saving”.

Penny wise and Mega pound foolish.

Nice racket if you get a percentage of the capital cost.

David

I think that something you are overlooking in your analysis is that the energy density and abundance of fossil fuels is so great that the relationship between energy-in to energy-out is not a significant concern. It is the classic embarrassment of riches. However, when it comes to so-called renewables, there are legitimate concerns about whether or not they will return as much energy as was required to build the systems. In that sense, the energy ratios need to be considered. If the world population continues to expand, it will be necessary to increase energy production. Fossil fuel production can be ramped up to meet increased demand. However, for windmills and solar PV systems, there is little excess — little margin for error. Once all the best sites for windmills and solar panels are developed, which is basically the situation currently for hydroelectric power, there is little opportunity to ramp up output, should there be a need. If renewables don’t even produce enough energy to replace them when they wear out, where will the energy come from to replace them? So, the risk is that if the environmentalists/alarmists ban fossil fuels without the foresight to be sure that their renewables can be replaced multiple times (let alone expanded) it would seem to me that we would be on a slippery slope of declining energy per capita, and a declining standard of living. I’m reminded of the bit of Edgar Rice Burroughs’ wisdom as provided through Tarzan when he asks what good gold is when you can’t eat it or make a house out of it. No matter what you are willing to pay for electricity, if there isn’t enough to meet demand, some people will have to do without. That has been one of the problems with communism. Without incentives to produce efficiently, the common people have a low standard of living. With renewables, we DO have to be concerned about return on energy investment.

Clyde,

Energy density and, more importantly, power density are very different concepts… And very relevant to energy production.

David

I was hoping for something a little less enigmatic. 🙂

Thanks Clyde, I thought it was just me.

Energy density is in the diesel tank.

power density is in the spring.

If renewables cannot produce enough energy to reproduce themselves people will simply turn to another energy source. At some point it will become apparent to the most obtuse politician or the least educated customer that they are paying exorbitant costs for nothing. ERoEI is more or less a measure of how deep a hole renewables are digging before people realize they aren’t getting anything for money spent.

Excellent post. I’ve been trying to get across the concept of cost and price as the actual metrics for assessing energy schemes for years. One of the problems with this is the market distortion of subsidies. Otherwise, one really doesn’t need to worry about EROEI…it’s inherently captured in profitability.

And EROEI utterly ignores simple things like the value of assets based on who is willing to pay what amount to use them. Which is why price works best. It doesn’t matter how much energy it “cost” to make my train, the value now is what somebody will pay me to use it.

A very good summary and a great destruction of how some so called experts think.

Luckily people in the USA and a great number of other countries still have free enterprise and market led economies.

These University professors and other academics would like to enforce demand economies where all major decisions are made by the ruling elite and nameless bureaucrats .

Free enterprise and free market economies are the only way to make real economic progress in the wider world society .

Some will argue otherwise and there is a growing push against capitalism in the left leaning media and some universities around the world are pushing this fable.

I will always argue that a countries energy supply should be provided as cheaply as possible with out constraints so that basic living expenses are not inflated by government interference and that the costs of goods and services are not unduly taxed .

Here in New Zealand we to export food ,timber and many other primary exports to all parts of the world and

we import manufactured goods from around the world cheaper than we could produce them for a small market .

High energy costs erode returns to exporters and every one in the country is affected .

Plentiful affordable energy is the life blood of every modern country and the free market economy will make the best use of this and other resources.

EROEI is an interesting academic concept, but one that is mostly meaningless when you dive into the details. There simply is no way to calculate with any degree of accuracy, and as the David pointed out, completely beside the point (I had not thought of using cheaper fuel to mine a more expensive fuel, that was interesting). It is so subjective that anyone can use it to prove any energy is better than some other by just messing with the assumptions. But profits…now that is measurable.

I know I have become a damn broken record, but nuclear energy is the key to the future. Nuclear power costs so much because we have regulated it into near extinction. We need to be working on, improving upon, and then building advanced nuclear power plants. We can’t build anything new in the U.S. because of all the regulation around it, so they have to be built in other countries – and that is going to put us behind if we want to compete. When we get to advanced reactors, the costs are going to drop (assuming again that the regulation jungle is thinned). Base energy production is so much smarter than intermittent.

All this cheap oil and gas around is great while it lasts, and it will last a while longer yet, but eventually it is going to cost a lot more – its simple economics. Disasters happen. Wars happen. If a large producer is impacted, prices will soar.

Thanks David, very interesting series.

The problem with nuclear energy (fission) is that industry is not optimized as there are special interest groups that do not want a change to a no fuel rod, no water, reactor as it will obvious adversely affect them commercially.

Optimizing in this case will mean the end of the fuel rod, water cooled, pressurized reactor industry.

We are using an obsolete fission reactor design, that is very expensive, for the comparison.

The other issue is we only have red book, 80 years of uranium reservers (there are likely significantly more).

It is pathetic that there is a reactor design that six times more fuel efficient, that was tested 50 years ago and almost no one knows about.

Our entire civilization is dependent on energy and the cult of CAGW are forcing use to spend trillions of dollars on green stuff that does not work.

The problem with nuclear regulations is rather than change fission reactor designs the regulatory agency came up with hundred of thousands of regulations. The silly game is the regulatory agency does not support a change either.

Pressure water fuel rod fission reactors are too expensive as they have catastrophic failure modes which require a containment building and complex systems to protect against coolant failures, pressure failures, and so on.

★★★★★

Wonderful. Thank you !!

Thanks, David. Free learning is always good, you make it fun.

By the way, Kroger’s my favorite food store, too. 😁

Usually, the best prices on everything… Even if I account for the fact that I could walk to HEB.

Or, you could ride to HEB…

Kroger must be much lower price where you live. HEB is significantly lower down here south of Houston – and you don’t have to agree to have your shopping habits tracked to get the lowest price at HEB.

I live in Dallas and have been working in Houston since 2016. In Dallas, we mostly shop at Albertson’s or Tome Thumb (same company as Randall’s) mostly because my wife hates Kroger and because it gets me a $0.20/gal discount at Texaco stations.. There’s an HEB right across the street from my apartment complex in Houston… Great store, but usually more expensive than the Kroger about 1 mile east or the Randall’s about 1 mile west.

Having to use the Kroger card and/or app is annoying… But I put up with it.

When you have perfessers counting Angels on the head of a pin, the biggest pinhead wins.

Embarrassingly bad treatment of an important subject.

John Goodrum

So, when do we get your treatment of the subject?

If it’s such an embarrassingly bad treatment, then I’m sure you should have no problem pointing out, in detail, everything bad about it. And yet you didn’t do that. One has to wonder why.

Someone finally got the Seinfeld connection!

The Largely Ignored Problem Of Global Peak Oil Will Seriously Hit In A Few Years

April 18th, 2019 by The Beam

What most folks fail to realize is that there is lots of new investment. But outside the USA, and the shale boom, it’s all infill drilling. Hardly any new fields to be found.

New discoveries don’t drive reserve growth. Ghawar has doubled in size since it was discovered. Most reserve additions don’t come from new discoveries. They come from reservoir management and field development operations.

Here’s that bar chart at the same scale as global crude oil production and reserve growth.

There’s an old saying in the oil patch: “Big fields get bigger.” The biggest field in the world, Saudi Arabia’s Ghawar oil field was discovered in 1948. When first discovered, the estimated ultimate recovery (EUR) was in the neighborhood of 60 Bbbl. It has produced over 65 Bbbl and it is estimated to have more than 50 Bbbl remaining (EUR >115 Bbbl). Only about half of Ghawar’s EUR was recognized at its discovery. Half of it, or more, will be the result of field development and reservoir management.

Saudi Arabia’s current proved reserves are enough to support a 12 million bbl/d output for 50 years. Proved reserves are the 90% probability volume. The most likely volume, proved + probable, is enough for more than 70 years.

More than once, we re-shot fields with the goal of better understanding the known reserve and found additional reserves that more than paid for the seismic.

When the field is big enough, it’s worth it. There’s a field in East Cameron South Addition, in about 300′ water depth, that I have worked since 1988 for four different companies (long story). Due to over-pressured shales around the salt diapir and shallow oil & gas sands, the main oil reservoir is poorly imaged. The 1990’s vintage WesternGeco and PGS 3d surveys are much better than the old proprietary survey we had at Enserch in 1988. A few years ago, we contracted PGS to reprocess all of the data. By merging, the WesternGeco data (shot N-S) with the PGS (old Diamond) (shot NW-SE) we obtained something like a wide-azimuth (WAZ) survey. A big improvement, but still doesn’t image an area where I am convinced there’s at least one more well to drill. A few years ago, I looked into re-shooting it with a nodal survey and get full-azimuth, full-waveform data… But the acquisition cost alone was more than the cost of drilling a well. Maybe someday before I retire… 😉

Funny you say that. We shot the seismic over Davy Jones after McMoRan drilled it.

I’m guessing that it showed a big-@$$ deep structure… Jim Bob was a great salesman.

Enserch’s first deepwater fiasco in the early 1980’s was a Placid-operated “discovery” in Green Canyon… They were shooting the 3d while they were drilling two wells with two Penrod rigs… We were pretty low on the “learning curve” back then.

David,

You need to be clearer on why coal appears to be so much more expensive (LCOE).

Those numbers are for a new unit coming on line in 2023, where the EPA requires new coal units have CCS. The note in the EIA report you reference has this:

Today’s conventional coal-generated electricity is only slightly higher today than nat gas, and probably cheaper in Wyoming and Montana.

We just need to kill the NSPS from the EPA. CO2 is our friend.

The NSPS in EPA CAA 111(b) guidance came out of the Obama maladministration in 2014 as part of Obama’s CPP and climate change agenda

It’s now under-review:

https://www.countoncoal.org/2018/12/epa-proposes-111b-revisions-to-advance-clean-energy-technology/

Clowns to the left of me Jokers to the Right. Useful idiots for usury everywhere. Watts up With That #LimitstoNouse

https://longhairedmusings.wordpress.com/2019/04/25/clowns-to-the-left-of-me-jokers-to-the-right-useful-idiots-for-usury-everywhere-watts-up-with-that-limitstonouse/

The Author lets us all down that insist that empirical evidence must be respected in The Debate about climate.

Economics and Political Economy are imprecise pseudo scientific priesthoods every bit as manufactured and absurd as Micheal Mann and his desperado band of cultist cool-aid hawkers.

Steelers Wheel sums it up really. QUite one of the worse articles I have read here.

Roger,

Your post has the same level of intellectual depth as an AO-C interview on US fiscal policy.

(Cue the Dean Wormer video-snippet.)

Joel O’Bryan April 24, 2019 at 9:19 pm

See above, Joel, I am happy to engage in Argument.

Roger April 24, 2019 at 8:38 pm

https://longhairedmusings.wordpress.com/2019/03/04/the-big-apple-plan-wesley-freeburg-why-abstract-currencies-fail%e2%80%8a/ The unit of account in a Fiat money system is an arbitrary unit

basing a unit of account upon an SI Unit of energy makes a great deal of sense if you do not wish to be robbed of your skin in the game by the money laundering Banksters-

Sadly the Author of this piece has gone off at half cock failing to define terms and set boundary conditions.

Watch Glassmans talk and slide show and try again-

https://www.bitchute.com/video/dv8avoovsHqr/

Roger G Lewis Your comment is awaiting moderation.

April 24, 2019 at 10:27 pm

https://longhairedmusings.wordpress.com/2019/03/28/the-ngo-sock-puppet-complex-watts-up-with-that-useful-idiot-of-big-finance-donteatyellowsnow-wrongkindofgreen-conquestofdough/

David ( Mr, Dr, Prof?) Middleton.

GDP itself is a fundamentally unsound metric based as it is even when Inflation Adjusted a purely subjective unit of Account. The question is not one of Political Economy but simple Metrology that is the Science of measuring things.

Lazards produce an excellent report on the levelised cost of Electriciity and Energy production and Dr Tim Morgan, (ex-head of research at Tullett Prebon ( not exactly a bunch of Green Hippy Commies) with his SEEDS energy Database look at surplus energy prodcution and its correlation to prosperity.

https://longhairedmusings.wordpress.com/2019/03/25/energy-economy-renewables-including-nuclear/

Energy Cost of Energy is explained here by Dr Tim Morgan.

“SEEDS uses an alternative measure, ECoE (the Energy Cost of Energy), which expresses cost as a percentage of the gross energy accessed. Because the world economy is a closed system, ECoE is not directly analogous to ‘cost’ in the usual financial sense. Rather, it is an economic rent, limiting the choice we exercise over any given quantity of energy. If we have 100 units of energy, and the ECoE is 5%, we exercise choice (or ‘discretion’) over 95 units. If ECoE rises to 10%, we now have discretion over only 90 units, even though the gross amount remains 100.This is loosely analogous to personal prosperity. If someone’s income remains the same, but the cost of essentials rises, that person is worse off, even though income itself hasn’t changed”.

Understanding ECoEECoE evolves over time. In the early stages of any given resource, ECoE is driven downwards by geographic reach, and by economies of scale. Once maturity is reached, depletion takes over as the driver, pushing ECoE upwards.

In the pre-maturity phase, technology accelerates the fall in ECoE driven by reach and scale. Post-maturity, technology acts to mitigate the rise caused by depletion. But – and this is often misunderstood – the capabilities of technology are limited to the envelope of the physical characteristics of the resource.

https://longhairedmusings.wordpress.com/2018/07/08/redefining-fiscal-conservatism-the-terra-energy-based-fiscal-unit-fores-and-lagom-white-paper-boundary-conditions-for-a-fiscal-conservatism-based-upon-circular-economics-part-one-scope/

WIth FIAT currencies and floating exchange rates, any money based measure that does not have a properly defined referent is sufficient to render any further analysis using it as its basis at best unreliable but in fact worse than useless, corrupted in every sense of the word in fact.

https://longhairedmusings.wordpress.com/2019/04/25/clowns-to-the-left-of-me-jokers-to-the-right-useful-idiots-for-usury-everywhere-watts-up-with-that-limitstonouse/

I look forward to a fruitful Discussion perhaps you will be good enough to expand upon your Critique? 😉

Roger, what in the world are you yapping about? AOC has it all over you.

beng135, Yapping? I suspect what you are describing fits rater better your short snappy interjection. My own Long Winded efforts may be boring, tedious and ultimately nonsense but Yapping They are not.

Heres the Multi-Media Web Site for my Novel Conquest of Dough,

https://theconquestofdough.weebly.com/the-conquest-of-dough.html

My own Long Winded efforts may be boring, tedious and ultimately nonsense

Well, at least you have some self-awareness. Kudos for that. (though I don’t think there’s any “may” about it).

FIAT currencies – which are actually fiat currencies BTW – BAD BAD BAD.

There we go, shortened your rantings.

A price captures what you need to know – what people are willing to pay for something. A unit of energy does not. Ergo, a unit of energy is a dumb way of working out whether people are doing the right thing economically. I would trade a vast amount of oil for a bottle of water if I was stranded in a desert by a big oil-field, and vice versa if stranded in the desert with a taker full of water and out of petrol.

Succinctly put and much more coherent that the long form rantings it shortened. Thanks Pheonix44.

Try paying the IRS with non fiat money

You miss the point completely.

A FIAT Currency is absolutely fine what the problem is is the USe of the Fiat currency where the unit of account is not well defined. All Fiat currencies are at present ill-defined rendering all objective pricing and valuation meaningless to the point of absurdity.

See Wes Freeberg #Quanta

https://twitter.com/i/moments/938457795816579084

https://twitter.com/wesfree/status/938560790117998592 do look at the full link but this is a bumper sticker

David,

If you use 2J of natural gas to produce 1J of oil then you are essentially making a non-renewable battery

and converting energy from a form that you can’t use easily to one that you can. So it makes sense while

natural gas is cheap to use it to produce petrol for cars but it would make no sense to use the resulting

petrol for power stations. EROEI becomes important when there is a shortage of fuel. At the moment we

have more than enough that we can waste some to convert energy to a easily portable and useable form.

But it is not sustainable.

If the price of natural gas energy was 8 times the price of oil energy, you could “spend” 2 J of oil to produce 1 J of natural gas and make more than a 2:1 return on capital.

It doesn’t matter either way.

Not at all. Price will tell you everything you need to know. That’s why systems without prices – the USSR, the NHS in the UK – struggle to udnerstand what to do.

We use untold amounts of energy to produce near unimaginable numbers of things that produce zero energy. Why? Because it makes economic sense to do so. Why would we look at the production of energy differently than we do the production of anything else?

+42 spot on Craig. From Izaak’s own example, we use nat. gas energy to produce oil because the economics of oil make it worth doing. Oil is a very versatile and useful substance, we use it for lots of things (plastics & petrol being two of the big ones). If it wasn’t so useful we wouldn’t see enough value in it to make it worth using the energy we do to produce it.

Another excellent article, David! The profit motive is what drives all exchange of foods and services. Let Capitalism reign free!

Aaaargh…. s/b ‘goods and services’. I really miss ‘edit’!

Recently I carried out a feasibility study for a solar PV facility in an area with sunshine levels similar to, say, California. The LCOE from the facility was lower than all other forms of electricity production except for lower costing CCGT plants (data from latest Lazard LCOE report). In fact, the LCOE of the electricity was lower than the marginal cost of many fossil fueled electricity sources. There were absolutely NO subsidies or tax credits included in the calculations and it was based on latest market prices of panels etc. I also assumed a shorter technical life of 25 years with light induced degradation of 2% pa.

Unless your capacity factor was >80%, your LCOE would need to be a lot “lower than the marginal cost of many fossil fueled electricity sources.”

Battery backup would roughly double your LCOE and “peaker” type power plants tend to have very high LCOE’s.

That said, solar does make sense in places with a whole lot of sunshine and where other options are prohibitively expensive (Hawai’i).

Agreed. Much enjoyed the article and the comments.

Another excellent presentation by David Middleton. Thank you.

a Systems ecology and biophysical economics professor

Where do they come up w/these excremental “degrees”? I guess it started w/basket-weaving in the 60s & took off from there.

I hate this constant fighting that goes no where.

There are real breakthroughs in every field, reality changing discoveries that exist because our institutions are silly, stupid ineffective.

There is a fission reactor design that is as cheap as coal to build, that does not have catastrophic failure modes, that is six times more fuel efficient, that can be mass produced, that was built and tested 50 years ago.

We need a conceptual summary of fission reactor ‘design’ and the monkey business that has been going on in the US driven nuclear ‘industry’.

A NASA engineer (12 years ago) while looking for a fission reactor to use on the moon re-discovered a fission reactor design (that was built and tested 50 years ago by the designer of the light water reactor) that cannot have fuel rod melt downs as it does not have fuel rods and that does not have endothermic reactions or phase changes to blow the reactor apart.

The ‘new’ design operates at atmospheric pressure rather than 150 atmospheres.

The molten salt reactor produces heat at 600C (47% thermal efficiency) rather than 320C (Pressure water reactor, 36% efficiency) which enables the use of standard steam turbines rather than custom turbines which only the ‘nuclear’ industry uses.

The ‘new’ fission reactor is roughly 1/3th the cost of the old pressure water reactors, it six times more fuel efficient, it produces 1/9 th amount of long lived radioactive waste and it can be mass produced.

The new reactor system is sealed so it possible to have very near zero radioactive material release under any imaginable normal or accident scenario.

The new reactor design is something that everyone would rather have near them as opposed to a coal fired power station, natural gas power plant, or hundreds of wind turbines.

Fuel rod, water cooled reactors are very expensive as it is an engineering fact that that design has multiple catastrophic failure modes which require an expensive containment building and expensive systems to avoid melt downs and explosions.

1. Low water flow. Fuel rods melt down

2. Loss of water flow (pumps fail, valve fails, power failure, piping failure, and so on). Fuel rods melt down in roughly 12 minutes.

3. Low level. Fuel rods melt down and zircon cladding covering the fuel rods reacts with air to create hydrogen gas which blows up.

4. Overpressure. Reactor blows up.

5. Loss of pressure. Fuel rods melt down and zircon cladding covering the fuel rods reacts with air to create hydrogen gas which blows up.

Getting rid of the fuel rods and using a salt that melts at 400C and boils at 1400C is the solution to building the best theoretically possible thermal spectrum fission reactor.

This story needs to told.

There is a fission reactor design that is as cheap as coal to build, that does not have catastrophic failure modes, that is six times more fuel efficient, that can be mass produced, that was built and tested 50 years ago…..

Great, show me one in commercial operation so I can validate that your assertions are true in reality. Oh wait, what’s that you say? there *isn’t* any in commercial operation? Then, sorry, you are blowing smoke. All you’ve said is hype about vapor ware. Get back to us when you have one (just one, that’s not too much to ask is it?) in commercial operation so that the hype can be compared to reality.

The Royal Society’s Newton said to Frenchman Papin’s Proposition, that a steam engine would cost too much, in 1707. Nothing happened until Benjamin Franklin intervened with Watt decades later. Papin was disappeared.

Since then Britain has lost control of technology, and now China is simply ignoring the Newtons of to today. The Royal Mint’s Newton would likely have praised wind generators “cheapness”.

What is your point?

That politicians are miss informed? There is no official documentation summarizing the reactor test 50 years ago.

That the nuclear ‘industry’ is fixed where breakthroughs sit around (are hidden from the public) for 50 years. That it is obvious that the Department of Energy is not interested in a ‘breakthrough’ fission reactor design.

Duh. Is CAGW a real worry or not? Are the cult of CAGW interested in a solution that will cost effectively reduce CO2 emissions.

Why are we spending trillions of dollars on green stuff that does not work to reduce CO2 emissions, when there is a fission reactor design that is six times more fuel efficient, that does not have catastrophic failure modes, and so on?

Terrestrial Energy has a molten salt reactor that has reached Canada regulator phase 2 approval.

Terrestrial Energy

https://www.youtube.com/watch?v=OgTgV3Kq49U

https://www.technologyreview.com/s/609194/advanced-nuclear-finds-a-more-welcome-home-in-canada/

The point is: You are making a lot of statements of fact that are not facts because what you are shilling doesn’t actually exist in commercial operation where such “facts” would be verified. Stop hyping the vapor ware as if it really existed in reality. MSR sounds good on paper, I’d love to see it live up to the hype but all we have so far is the hype. that’s it. Get back to us when you can show one in commercial operation. One should not be too much to ask for something that you endlessly talk about as if it’s ready to go into operation at the flip of a switch.

There is no official documentation summarizing the reactor test 50 years ago.

And yet you spout a lot of “facts” about something that you admit has no official documentation and still is not in commercial operation many decades after those tests. Like a said, lots of hype little in the way of real world validation.

John,

The official documentation of the test was found.

The test was a complete success. There are no significant technical issues with building the no water, no fuel rod, no catastrophic failure mode design tomorrow.

The NASA engineer meet with some of the retired engineers and scientists that worked on the test. They all said it was successful and they did not understand why the cheap as coal, no failure mode reactor design is not used today.

There has a PBS nuclear special that discussed the test and had film coverage of the meeting of the NASA engineer and the original test workers.

The problem is we are installing green stuff that does not work when there is a real solution that does work.

William you said “There is no official documentation summarizing the reactor test 50 years ago” now you say “The official documentation of the test was found” those two sentences contradict each other. Pick one story and stick to it please.

The test was a complete success. There are no significant technical issues with building the no water, no fuel rod, no catastrophic failure mode design tomorrow.

Great, then you should have no problems showing me one (just one, that’s all I ask) in commercial operation. Eh? what’s that? there aren’t *ANY* in commercial operation? Then you are once again pushing hype not reality.

The NASA engineer meet with some of the retired engineers and scientists that worked on the test….

blah, blah, blah. Enough hype, show me the reality in commercial operation.

The problem is we are installing green stuff that does not work when there is a real solution that does work.

You are half right. We are installing unreliable green stuff, but the “real solution” you keep pushing is vapor ware until you can show just one in commercial operation. And you can’t, because there are none in commercial operation. So stop lying about how great and power your vapor ware is. Seeing is believing and you have nothing to see. Only when you have something to show (one, just one will do, in commercial operation) then and only then can you say how great and wonderful they are because then and only then can everyone see how the hype stands up to the reality.

https://www.bitchute.com/video/2mMsqFAIdsE/ This is in french there is an abridged English language version on YouTube then there is this.

http://euanmearns.com/thorcon-molten-salt-fission-power-plant/

http://euanmearns.com/the-uks-small-modular-reactor-competition/

https://topdocumentaryfilms.com/thorium-nasa/ This is a 6-hour Thorium Reactor video,

Roger your links suffer the same problem as William’s posts: all hype, no actual commercially operating reactors to look at. Lot’s of “plans” and “projects” but still no actual commercially operating reactors. Get back to us when you have one (just one, that’s really, really not too much to ask) that is online and in commercial operation so that the hype can be compared to the reality.

Actually John the Indonesian Trial RIg is I believe in Testing and of cource Weinbergs Rig worked perfectly well back in the late 60’s and ran successfully for several years.

The dISCUSSION ON eUAN mEANS SITE IS VERY INTERESTING WHERE SOME CONVENTIONAL nUCLEAR ENGINEERS QUESTION THE LOW-LEVEL WASTE TREATMENT ( sorry caps came on pushed for time so leaving)

http://thorconpower.com/project/

So actually it seems very promising the other area of interesting is battery storage at a large scale this Project is fascinating in that regard.

https://www.youtube.com/watch?v=Sddb0Khx0yA

2012 ted talk and the commercialisation

https://www.greentechmedia.com/articles/read/german-firm-turns-aluminum-smelter-into-huge-battery

https://www.youtube.com/watch?v=tyDbq5HRs0o

Original Public Info film from Oakridge Laboratory

Actually John the Indonesian Trial RIg is I believe in Testing and of cource Weinbergs Rig worked perfectly well back in the late 60’s and ran successfully for several years.

Roger, Testing and actual commercial operation are *two different things*. There are many, many products that have made it to the testing phase that never progress beyond to become commercial (case in point the 1960s tests you speak of never resulted in a commercially operating reactor). Testing is, in part, where you learn if the product is viable enough to attempt commercial application. So again, get back to us when you have one (Just One, that’s all that is being asked of you, that shouldn’t be too much to ask if it’s everything the hype you’ve been shoveling is to be believed) in commercial operation so that the hype can be compared to actual operating reality.

John,

The Chinese are going ahead with this technology as are the French and the Indonesians are also looking at having commercially operating Thorncon plants working by 2022. Oakridge produced Electricity for several years the reason the project was not commercialised is simply to do with by-products suitable for weapons use, Thorium does not have that by-product and its really that simple.

Thorium offers cheap and abundant Electricity which would change the Energy sectors Scarcity based model quite a lot that is also an objection to it from the Oil and Gas sector.

Here are Dr Tim Morgans Dangerous Exponentials and Perfect Storm reports. They bear watching Even the Oil and Gas industry are not immune from the Exponential function and for prosperity to grow so too does surplus available energy have to grow.

https://surplusenergyeconomics.wordpress.com/resources/

https://longhairedmusings.wordpress.com/2016/11/21/climate-change-agw-and-all-points-from-activism-to-skepticism/

A section on my PDF on Climate science.

https://drive.google.com/file/d/0B6ZHfkDjveZzYXU3UHhLem1HQms/view

reproduces Bob parkers excellent article on the Petro Dollar whys and wherefores.

http://priceofoil.org/content/uploads/2011/01/DrillingIntoDebt.pdf

Robert Parker, CEO of Holborn Assets in Dubai

Answered Sep 17, 2016

Originally Answered: Why is oil priced in US dollars?

Well, in order to understand it, you can read this article that is available on Holborn Assets official website: Why is the US Dollar Still the Reserve Currency of the World

In this article you will find out:

why the USD has the world currency status?

what was the Nixon shock and why it happened?

how the USD got to the petrodollar system?

what is the main oil producer that collaborates with the US?

You will discover that the USD gave up the gold standard and tried to replace the gold with oil, so they made a deal with the Saudi Arabia, and later with other OPEC countries, to sell their oil exclusively in exchange for the USD. In this way, the USD demand was maintained and the US currency is still the world reserve currency today.

Happy reading!

Regards,

Bob Parker

Holborn Assets About Us

715 views · View Upvoters · Answer may need improvement

Roger Lewis

Recommended

All

Robert Parker, CEO of Holborn Assets in Dubai

Answered Sep 17, 2016