Audrey Streb

DCNF Energy Reporter

Consumers’ Research sent a letter to several members of the Trump administration Thursday, urging agencies to ditch any association with the company First Street over its allegedly inaccurate climate risk modeling.

In the letter, Consumers’ Research Executive Director Will Hild notes that recent reports captured doubts from homeowners and industry insiders over the reliability of First Street’s flood risk assessments and calls for “an interagency review of how federal collaborations are referenced in First Street press.” Consumers’ Research addressed the letter to the Environmental Protection Agency Administrator Lee Zeldin, Federal Reserve Chair Jerome Powell, Transportation Secretary Sean Duffy and Consumer Financial Protection Board Acting Director Russ Vought, among several other agency heads.

“First Street is attempting to push a radical climate agenda onto consumers by implying federal agencies endorse its politically motivated climate risk models. This practice is purposefully misleading, as First Street’s climate models undermine [Federal Emergency Management Agency] FEMA’s role as the legal and regulatory standard for climate risk scoring and arbitrarily distorts consumer property values,” Hild told the Daily Caller News Foundation. “This is why we are urging these federal agencies clarify they do not endorse First Street and demand the removal of agency branding from all public materials. Consumers’ Research stands with homeowners and buyers who deserve accurate, transparent, and federally-validated information, not metrics driven by climate activists.” (RELATED: EXCLUSIVE: Consumers’ Research Goes After Insurance Giant’s CEO For ‘Sacrificing Kids To Trans Ideology’)

CR Letter to Agencies RE First Street Final by audreystreb

Hild notes in the letter that some federal agency announcements and materials referenced First Street’s risk assessment data and argues that this is a concern due to recent reports and complaints that the company’s data may not accurately reflect flood risks. Major real estate platforms like Zillow, Redfin and Realtor.com have factored First Street’s flood data into their listings, the letter notes.

“Recent reporting and public complaints indicate that First Street’s property‑level scores can be materially wrong and difficult to remedy,” the letter states. “Your agencies’ names and logos — through formal agreements, data integrations, or research use — are cited by First Street as evidence of federal alignment with its property‑level climate risk scores. … I write to urge your agencies to (1) publicly renounce or suspend any partnership language and implied endorsements that lend federal imprimatur to First Street Foundation and its affiliated public‑benefit corporation, First Street Technology, and (2) clearly state that First Street/Risk Factor outputs must not be used in lieu of FEMA flood maps for regulatory, insurance, lending, disclosure, or listing purposes.”

First Street states on its website that the FEMA’s flood risk differs from its estimations as it “calculates flood risk on the property level, accounts for changing climate conditions, and considers the risk of flooding due to high-intensity rainfall,” whereas FEMA “determines flood risk on the community level, their risk projections capture risk from a single 1-in-100 or 1-in-500 event from storm surges and overflowing rivers and streams.”

First Street’s website states that “we exist to make the connection between climate and financial risk at scale for financial institutions, companies and governments.”

Several local homeowners told North Carolina-based ABC News 13 that they believed they were struggling to sell their homes due to receiving high flood warning designations from First Street data. The homeowners argued that the data did not make sense as their close neighbors had vastly different flood warnings despite no seemingly feasible explanation.

One Tennessee-based real estate broker told the DCNF that she believes she and others in the industry have lost sales due to First Street flood data being displayed on real estate platforms.

“Buyer interest dropped off. Before we realized what was going on, we had canceled showings,” Stephanie Cross told the DCNF. “It’s crippling the seller. It’s crippling by putting this misinformation out there — and at the same time, basically devalues the property.”

A spokesperson for Realtor.com referred the DCNF to its flood risk information website page and noted that every listing displays both FEMA data and First Street data.

“A home is often a family’s most valuable asset, which is why Realtor.com believes it’s essential to help homeowners, sellers, buyers and renters understand any potential risks to a property so they can make informed decisions,” the spokesperson told the DCNF. “We think providing both ratings on the property listing paints a clearer picture of potential risks. If a home’s flood ratings appear particularly low or high, or in conflict, consumers are encouraged to consult a real estate agent or local floodplain official for guidance.”

First Street, Zillow and Redfin did not respond to the DCNF’s requests for comment.

All content created by the Daily Caller News Foundation, an independent and nonpartisan newswire service, is available without charge to any legitimate news publisher that can provide a large audience. All republished articles must include our logo, our reporter’s byline and their DCNF affiliation. For any questions about our guidelines or partnering with us, please contact licensing@dailycallernewsfoundation.org.

Aahh ! The ghastly “Daily Caller” strikes again ! Always reads like 50s pulp fiction to me…

Perhaps you can explain, logically, the disparate reports. 🙂 One uses climate models?

The chance that you have ever perused Daily Caller is about the same as my odds of becoming the next Queen of England. Slim or none, take your pick Senor Troll.

And Slim has left the building !! 🙂

So.. too much for you to comprehend ??

Basically , they are saying that the junk model exaggerations of First Street should not be used.

And that realistic scenarios based on actual data are preferable.

Seems pretty much cut and dried to me.

I’m shocked I tell you, shocked! That junk models don’t work!!

If you are into AGW you should be not only used to pulp –

It should be the essence of your life.

But in this case you are even yelling at the wrong cloud,

as it is about Consumers Research – they are the ones behind this story,

the Caller is just the messenger.

First Street Foundation (a/k/a 1 St Street Foundation Inc) is a 501(c)(3) charity in NYC, created to hype unscientific sea-level alarmism. They popped up in late 2017, with an initial paid staff of about ten people, and quickly expanded to fifteen. (Someone obviously wrote a very big check!)

They work with leftist profs at Columbia University, and their MO is to publish junk science in obscure journals, accompanied by flashy press releases, blasted out to every media outlet on the planet, with the general theme that wildly accelerated sea-level rise dooms coastal cities, because of climate change.

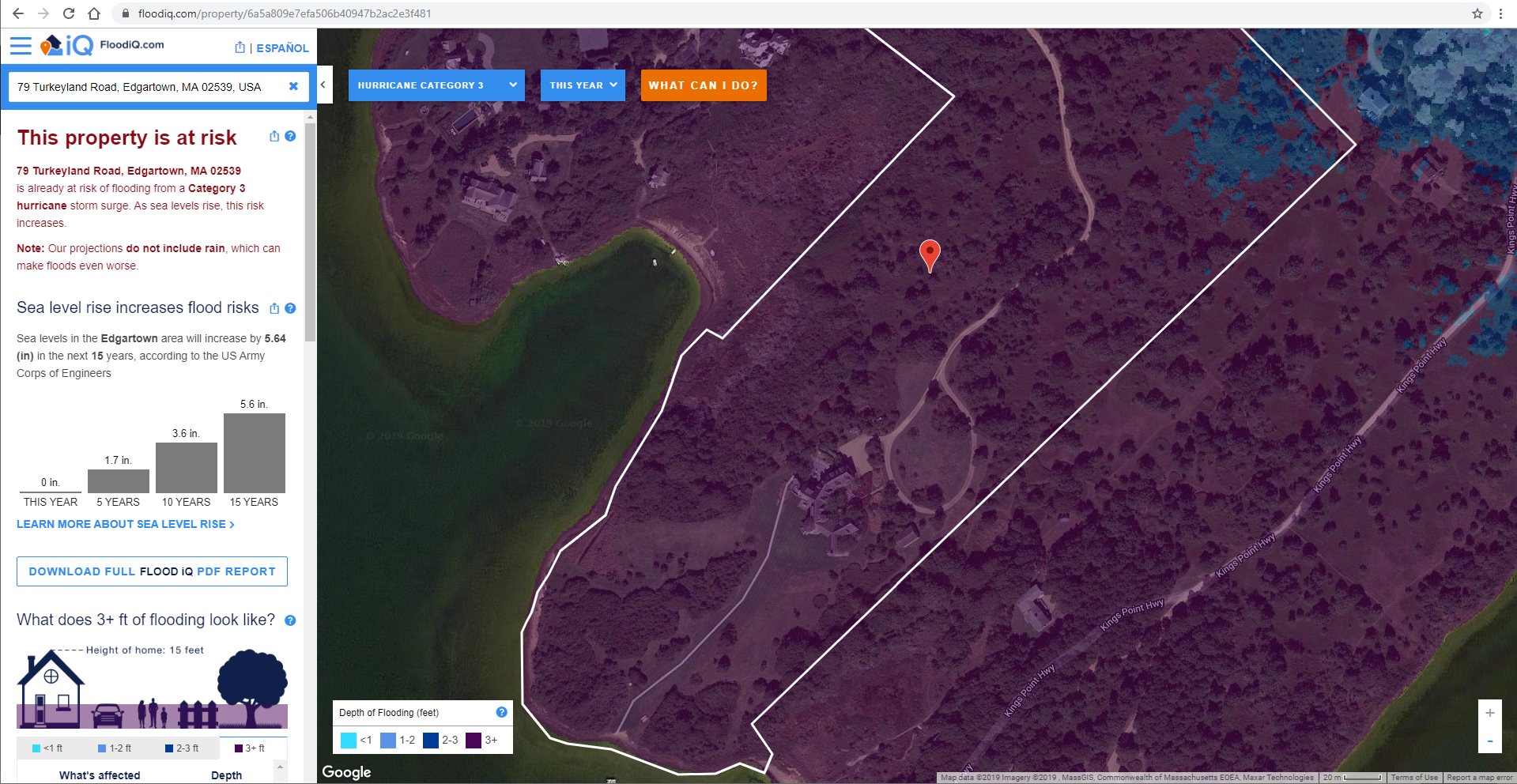

Amusingly, one of their websites claimed that Obama’s villa on Martha’s Vineyard would be under >3 feet of water in a Cat 3 hurricane:

I don’t know whether that’s true, but they also said that my house has a 67% chance of flooding in next 30 years, which certainly is not true. My house is atop a long, rather steep slope, far above any possible flood zone.

It’s been a lucrative grift for them. According to their Form 990s they raked in:

2017: $1,251,100

2018: $4,098,901

2019: $4,577,674

2020: $6,942,000

2021: $8,726,760

2022: $7,679,254

2023: $6,893,556

From that, they’ve been paying their CEO, Matthew Eby, $400,000 per year.

Their funding sources are undisclosed, but almost certainly mostly from climate industry sources.

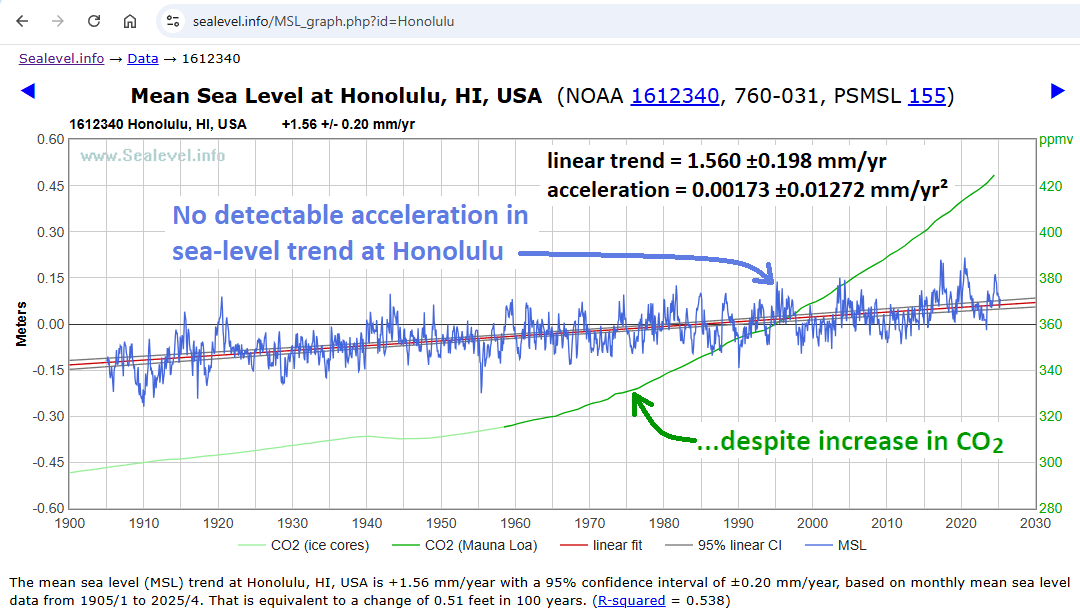

Here’s the reality which First Street denies (the best mid-Pacific sea level measurement record):

https://sealevel.info/MSL_graph.php?id=Honolulu

Assuming that your info is accurate.

How can some random 10-men charity become so influential and powerful within just a few years?

Oh, wait,It’s from NY.

The UN location helping the UN I guess.

Seems that since Epstein talked the Clintons and Gates into Foundations,

the charity trick has become the 5th column.

On their website they have a photo of 29 smiling employees (all of them thirtyish, except for two older men, one of whom is probably Mr. Eby), standing outside their Brooklyn address, a few blocks from the Manhattan Bridge. So it appears that they’ve doubled in size again:

https://firststreet.org/team

Money doesn’t seem to be a problem for them. That page also says:

That link currently shows six job openings.

Tellingly, they chose to locate their HQ at 247 Water Street in Brooklyn, an address which is apparently only 3.2 meters above mean sea level (and the average tide range there is about 1.6 meters). So I don’t think they’re actually as worried about sea-level rise as they pretend to be.

There seems to be a pattern.

a)Those climate experts are all daredevils, as they like to chose locations close to the sea and barely above sea level.

They probably never heard that the High Priest of climate Hansen told Bob Reiss that the West Side Highway will be under water by 2028.

Maybe they like to be as close as possible to the danger zone just as those guys who chase after tornados or surfers searching for the perfect wave.

2) They never have money issues and can easily

3)They are on average way too young to be result of any organic growth and dress like teenagers(it always looks like some kind of academic hippie movement – which it kind of is )

5th column for… whom?

Also, what do you think have changed about it?

< /dank moldbuggery >

…because it looks like the more things change, the more their nature is recognizably the same.

The Obama property on Martha’s Vineyard is here:

41.360754, -70.546316

It is next to the Edgartown Great Pond, not on the coast of the ocean. The house is about 10 feet above the level of the Great Atlantic Ocean. Water from a hurricane would have to breach the sand barrier and surge inland above 10 feet to touch the house. Possible, but unlikely at that location.

The Great Obomba would will any hurricane to avoid his property

The barrier island is very low and narrow, and I doubt that it would do as much as they would hope, to impede a big storm. The locals periodically dig a temporary inlet to connect the brackish Edgartown Great Pond to the ocean (3-4 times per year, for about a week each time). This was in March:

https://www.youtube.com/watch?v=p025Om0oC0s

If you view it full screen, is that Obama’s place barely visible in the background?

Here are some pictures of Obama’s place, including some looking out over the water to the barrier island and the ocean beyond:

https://sealevel.info/Obama_seaside_villa_Marthas_Vineyard/

Here’s Google Maps showing the locations of the inlet and Obama’s villa:

https://www.google.com/maps/place/41%C2%B021'38.7%22N+70%C2%B032'46.7%22W/@41.3551048,-70.5572556,15z/data=!4m4!3m3!8m2!3d41.360754!4d-70.546316!5m1!1e4?entry=ttu&g_ep=EgoyMDI1MTExNy4wIKXMDSoASAFQAw%3D%3D

From exactly who?

This sounds as but another way to drive prices down to grab land for cheap.

Good information from the Daily Caller. Geologists actually study Flood Indicators, and commonly find a sequence of categories, by years between events: 10, 20, 50, 100, 500, and 1,000 (a 100 year event means there is a 1% chance of it occurring each year). An example would be Merz, et al, 2007: Flood Risk Mapping at the Local Scale, in ResearchGate.

First street methods might be junk, but the FEMA flood risk map was absolute junk for my island property in the Adirondacks.

When I bought the property 25 years ago, flood insurance was required. It was priced at about $1500 per year.

One could see that “community” risk assessment meant that some jerk with a crayon had gone nuts on the map. I’ll save you lots of details by saying that it would take a Mount St Helens scale event to ever allow that property to flood. It’s above a damn dam, for f&^k’s sake.

After researching, I hired a surveyor to create a bunch of documents blowing the “community assessment” out of the water (see what I did there?).

One of my most satisfying experiences was demanding refund of (and receiving) the last two-years’ Federal Flood Insurance premiums once the slow process played out. The agent was sure I was talking out of my butt, but eventually I got the refund and have saved quite a bit over the years.

The remedy is for people who listed their homes for sale and had the valuation of those homes reduced by First Street’s methodology to file a class action and sue them into insolvency.

That’s all they ever take notice of George –

a threat to their $$$$$$$s.

💰

It’s All About the Benjamins, baby.

The climate grift is ALWAYS About the Benjamins.

No wonder she’s smiling.

Yep.

And we can bet that all the attendees would be there on airfares, accommodation and seats paid for by government agencies / departments / universities (aka – the taxpayers’ teat).

A bargain.

Mitchell Obama gets 750k for 3 speeches – probably the smartest nurse in history.

Based on their risk evaluations, I’d like to get a reduction on my property taxes.

So what was this about COP wanting to eliminate climate disinformation?

Seems low hanging fruit to me.

Like many governments and green product peddlers worldwide, many insurance companies are trying to use the alleged climate crisis as an excuse to raise revenue. Governments see it as an opportunity to raise taxes; the peddlers hope for mandates so they can increase sales of their overpriced manufactures; and insurance companies, who are faced with reimbursing clients for property damage, are claiming that since these replacement costs are rising because of supposedly more frequent climate-related events, are using the excuse that they must raise premiums. So it turns out that the Inconvenient Truth that Al Gore likes to babble about really affects consumers the most since it’s their pockets that are being most inconveniently impacted.

Their website lists a bit about First Street customers:

Our customers: We empower governments at the highest levels to make smart regulations, asset owners and asset managers to make smart investment decisions, banks to assess loan portfolio risk, and corporations to understand exposure to their business. We are relied on every day by:

Link Climate Manager @ur momisugly First Street