Guest “Frackin’ A Bubba ” by David Middleton

Do U.S. Shale Drillers Deserve To Exist In Free Markets?

By Mitchell McGeorge – Apr 18, 2020In the fallout of the current crisis, one more statistic can be added to the toll of Covid-19 – US Energy Independence. The Shale Revolution was responsible for the growth in US oil and gas production that lead to the President, Energy Secretary and industry bodies heralding the era of US energy independence and US energy dominance.

But, with the oil markets in turmoil, US shale producers who account for over two-thirds of US production (and in particular the Permian Basin which accounts for almost forty percent of total US production) have been ‘tapping the mat’ urging President Trump to save the industry through various means of subsidies, bailouts and tariffs. Shale producers have been arm-twisting US politicians into cringeworthy calls with Saudi Arabian officials because of their belief that Saudi Arabia, as a strategic ally, shouldn’t be following free market practices to harm the US Energy Independence narrative they all promoted.

So much for the US being the world’s champion of the ‘free market’!

[…]

Oil Price Dot Com

A more apt question would be: Do “shale” drillers deserve access to an actual free market?

Show the US oil industry where the free market is (or was) and I’m fairly certain we can compete in it. OPEC wouldn’t exist in a free market. Saudi Arabia wouldn’t be able to literally control prices by raising and lowering production rates. Saudi Arabia’s grip on prices only fails when demand is either too high or too low. The ChiCom-19 hostage crisis has dropped demand below everyone’s functional threshold in the global oil market, free or otherwise.

I don’t know of any US oil companies or trade groups, “‘tapping the mat’ urging President Trump to save the industry through various means of subsidies, bailouts and tariffs.” The industry has been very appreciative of his efforts to broker an agreement between the Saudis and Soviets (just honoring Mr. Putin’s wishes) and use the Strategic Petroleum Reserve as a cushion. After congressional Democrats blocked funding for the purchase of domestically produced oil, the President has begun leasing out space in the SPR for storage.

Harold Hamm, CEO of Continental Resources, the biggest Bakken player, has “has encouraged the Commerce Department to initiate a national security investigation into Russia the Soviet Union and Saudi Arabia for ‘excessive dumping’ in oil markets” and use the threat of tariffs and other measures to halt the state-sponsored dumping.

One of the recurring themes from the shale industry since the Oil Price War commenced is putting tariffs on Saudi Arabian oil imports, like some magic silver bullet that will amazingly save an industry that hasn’t had the discipline to push itself away from the debt buffet table. But, how is this going to work and has anybody thought this through beyond an initial ‘emotional’ reaction?

Oil Price Dot Com

I don’t know of any oil company or industry trade group pushing for Saudi-specific tariffs. Mr. McGeorge correctly points out that such a tariff would be pointless. The “push” has been to use the threat of tariffs and embargoes to force Saudi Arabia and the Soviet Union to agree to cut production. This, coupled with the 20-30% short-term reduction in demand due to the ChiCom-19 hostage crisis, seems to have worked. There has been some talk of the Texas Railroad Commission directing oil companies to reduce production in Texas by 20%; but the largest industry trade group opposes even this measure.

With WTI stuck around $20, nearly every producer is a long way from being able to cover costs let alone develop again. In the most recent survey by the Dallas Fed of 92 upstream E&P companies, WTI prices need to be above $50 for almost all plays before wells can be drilled profitably.

The idea that upstream E&P companies will be able to hold out until development wells can be drilled profitably again is tenuous at best. With mounting debt loads, interest and maturities most won’t be able to last beyond the next six months.

If the WTI price continues at $20, Rystad’s predictions show that Lower 48 production could drop to approximately 6 million barrels by the end of next year.

Oil Price Dot Com

That is, indeed, what Rystad’s Energy U Cube model indicates…

Mitchell McGeorge is supposedly some sort of commodities “expert.” Although he strikes me more as an anti-American Putin apologist. As a commodities “expert” he might have taken a look at oil price futures. The May contract, which expires tomorrow, closed at -$37.63/bbl today. However the June contract closed at $20.43/bbl. A nearly $60/bbl spread between the front and second months of WTI futures… A truly bizarre situation. The price yesterday, today or tomorrow isn’t all that relevant, particularly the expiring May contract. What matters is evolution of demand and prices over the next 1-2 years.

The current WTI futures price for the end of next year is around $37/bbl. The odds of WTI being around $20/bbl in late 2021 are very slim. While not sufficient to support much new “shale” development, $35-40/bbl is enough for most companies to hunker down and ride the storm out, particularly for companies with strong hedge positions…

LOW OIL PRICE? NO PROBLEM. US SHALE FIRMS ARE SET TO SAVE UP BILLIONS IN RECORD-HIGH HEDGING GAINS

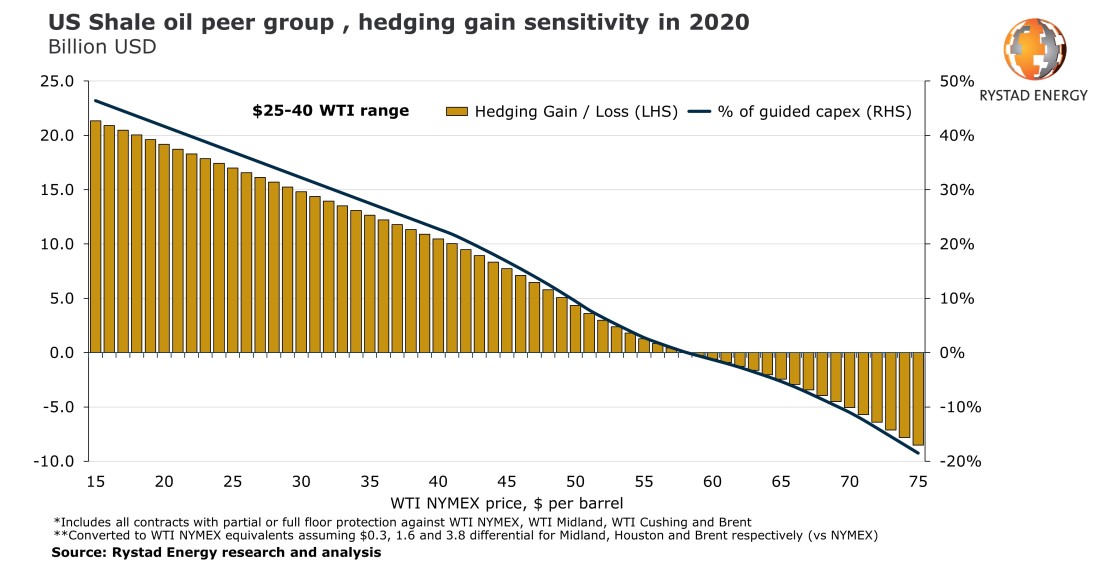

March 13, 2020Even though oil prices plunged to as low as $30 per barrel this week and are likely to go even lower as OPEC+ plans to increase production from April, US shale oil operators expect to save billions in record-high hedging gains in 2020, a Rystad Energy impact assessment shows.

Rystad Energy’s assessment is based on an analysis of a representative peer group of 30 dedicated US light tight oil firms with a combined output of about 38% of the total expected US oil production in 2020, excluding royalties.

Looking at the hedging positions of the considered companies, we conclude that they hedged almost 50% of their guided 2020 output at an average price floor of $56 per barrel.

[…]

Rystad Energy

Regarding the Rystad chart in Figure 1, it excludes US Gulf of Mexico production, where a lot of deepwater “brownfield” opportunities are fairly attractive at $35-40/bbl. The Gulf of Mexico is currently producing about 2 million bbl/d. I don’t do “shale” – But I like to study it write about it. I work the very different geology of the Gulf of Mexico (GOM). As far as I know GOM players aren’t begging for bailouts or ‘tapping the mat’. Mostly companies are cutting spending, particularly CapEx to ensure positive operating cash flow at $30/bbl. Most GOM companies are also well-hedged. Our sector has been lobbying for royalty suspension until the ChiCom-19 hostage crisis ends… And I hope we are also lobbying for lease extensions and expanded timelines for abandonment and retirement obligations (ARO). Easing up on the administrative cost of doing business is neither a bailout, nor a subsidy. The ChiCom-19 hostage crisis will likely cause GOM production to dip a little bit over the next year or two. Royalty suspension, lease extensions and an expanded ARO timeline, would go a long way toward smoothing out the currently very rough waters.

“Do U.S. Shale Drillers Deserve To Exist In Free Markets?“

It’s an idiotic question. There is no global free market. Saudi Arabia needs $70-90/bbl to balance their budget. The Soviet Union needs $40-50/bbl to balance theirs.

The US, as a nation, has no comparable price. And the budget-balancing price varies widely from company to company. This is Tug Eiden’s estimate of the price required to cover operating costs for a group of independent oil companies, mostly “shale” players.

At ~$20/bbl, no one makes money… Not the “shale” players, not the Saudis and not the Soviets. If oil is around $20/bbl this time next year, there won’t be any oil (only being partially sarcastic).

As demand recovers after the ChiCom-19 hostage crisis ends, OPEC+ will work to bring prices up to where they need them. While this downturn will force a lot, maybe most, “shale” players into Chapter 11, the assets don’t vanish. Most of the companies won’t vanish. Even though proved reserves will have to be taken off the books, the oil won’t go away. When prices rise back into the $40-50/bbl range, US oil production will start to rise again. “Shale” players and most independent US oil companies are somewhat analogous to Yankee Clippers – They aggressively take advantage of economic opportunities in a very un-free market.

To level the playing field, the US government could take reasonable measures to ensure that the United States’ energy security is not impaired and that American Energy dominance carries on… But that’s not a business decision.

Troll Notice #1

I wrote this post yesterday (20 April 2020). Parrot-like comments about prices being different today will be mercilessly ridiculed.

Day Thirty-Something of America Held Hostage by ChiCom-19

| 4/20/2020 | |||

| Dallas County | CHICOM-19 | ||

| Population | Cases | Deaths | |

| 2,637,772 | 2,512 | 60 | 2.4% |

| % of population with | 0.10% | 0.00% | |

| % with, rounded | 0.1% | 0.00% | |

| % without | 99.90% | 100.00% | |

| % without, rounded | 99.9% | 100.0% | |

| Menodoza Line (.200) | 12/21/2034 | 0.200 |

Fire Marshal Gump is apparently unsatisfied…

Dallas County to ‘Scrap and Claw’ for More Testing as 84 More COVID-19 Cases Confirmed Monday

Judge Clay Jenkins warns against rushing back out too soon, continuing to limit essential trips

Published 1 hour agoDallas County Judge Clay Jenkins says they are continuing to fight for more COVID-19 testing in the county as 84 more positive cases of the 2019 novel coronavirus are confirmed Monday.

The latest additions of COVID-19 bring the total case count in Dallas County to 2,512.

For the second straight day, the county did not record any new deaths associated with the virus. That total remains at 60.

[…]

NBC5DFW

Gump clearly needs more cases if he’s going to obstruct the reopening of the economy. Interestingly, in addition to not recording any deaths since April 17, Gump is refusing to record recoveries…

The county said they are not reporting recoveries of the infection because it is not a surveillance variable that is being used nationally by the Centers for Disease Control and Prevention or by state health departments.

NBC5DFW

Recording new cases without recording recoveries is as dishonest as you can get. Can you spot which county is most firmly controlled by Democrats?

| Cases | Deaths | Recovered | Rec:Death | % Rec | |

| Collin County | 527 | 13 | 324 | 25 | 61% |

| Dallas County | 2,512 | 60 | 2 | 0 | 0% |

| Denton County | 593 | 16 | 248 | 16 | 42% |

| Tarrant County | 1,242 | 39 | 189 | 5 | 15% |

| Total | 5,315 | 144 | 822 |

Dallas County, of course.

Collin County, the reddest of the four counties has a 25:1 recovery to death ratio, with a 61% recovery rate, so far. Dallas County, the bluest of the four counties is reporting a 2:60 recovery to death ratio, and a Dean Wormer recovery rate, so far.

Hey Gump! You stink!

/arc-anglerfish-arc2-prod-dmn.s3.amazonaws.com/public/GEJBBC6Z5ZDNNGXDFWXXKJACGA.JPG?w=700&ssl=1)

Gump’s order for everyone to wear masks was shot down by the Dallas County Commissioners court, despite the fact that 4/5 commissioners are Democrats.

Update #1 0545 CST 21 April 2020

Let’s see if this makes the news:

Will the news media breathlessly report that the price of oil rose by more than $30/bbl last night? They were drooling all over it being down over $50/bbl yesterday.

The article by David Middleton left me somewhat confused. After attributing the crisis in the oil industry to “Chicom-19”, some strange phenomenon which I never heard of before, he then tells us that Russian oil must cost between 40 and 50 dollars per barrel in order to “balance their budget”. The figure quoted for Saudi Arabia was 70 to 90 dollars. By the same token, assuming production costs were zero, I wondered how much a barrel of oil must cost for the United States of America to balance its budget. Over the last 10 years, that country has increased the public proportion of its national debt by something over one trillion dollars per year. On the other hand, it has been producing something like 5 billion barrels of oil per year. Dividing the one by the other we arrive at the figure of 200 dollars per barrel needed to balance their budget.

All of this is explained in the post. Try reading it before making any more moronic comments.

“Recording new cases without recording recoveries is as dishonest as you can get. Can you spot which county is most firmly controlled by Democrats?”

_____________________________

Ummm … if you’ve been following the numbers, you should have realized by now that almost nowhere in the world are they properly reporting recoveries. One chart I found from Germany specifically said “No duty to report,” but I’ve seen discussion of the issue several other places.

As such, both the “Recovered” numbers and the “Active Cases” numbers are bullshit. Any attempt to use “deaths/resolved” is futile because we simply don’t have real recovery numbers … anywhere. I don’t know why they keep putting them on the various tacking sites.

*tracking

I stopped following the numbers outside of Texas quite some time ago. Fortunately, every 3-4 days, Dallas County HHS publishes a report which includes a comparison of influenza and ChiCom-19 weekly hospital and ICU admissions. The sharp decline in both types of admissions over the past few weeks is a pretty good indication that a lot more than 2 Dallas County residents have recovered.

If I didn’t know better, I would say that everyone from Fauci on down doesn’t want this to end. They either seem to be enjoying their 15 minutes of fame and/or power trips just a bit too much.

They hurt the poor much more than the rich. Put all the taxes into income tax and make those taxes progressive. In the end we all save money as all products are cheaper. Much cheaper than the added cost to our income tax. Its complicated

re: ” Put all the taxes into income tax and make those taxes progressive. ”

NOT a student of history, nor economics, eh? We had that in place, once upon a time when the top marginal rate hit 92%. I hate it when idiocy raises its stupid head and speaks …

https://www.politifact.com/factchecks/2015/nov/15/bernie-sanders/income-tax-rates-were-90-percent-under-eisenhower-/