Guest “I couldn’t make this sort of schist up if I was trying” by David Middleton

Apr 5, 2020,07:06pm EDT

After COVID-19, The Oil Industry Will Not Return To “Normal”Wal van Lierop Contributor

EnergyThe coronavirus pandemic has shuttered the world’s economies, overwhelmed healthcare systems and taken loved ones from us. Politicians have promised their citizens a “return to normal” following the pandemic. However understandable, this longing for “normal” will lead us to a mirage. Worse, our recovery from COVID-19 could be a short-lived victory if we aspire only to have a “normal” economy again.

Normal created a climate change timebomb that may make the economic consequences of coronavirus look mild by comparison. Normal would give two brutal dictators the power to topple North America’s fossil fuel industry whenever they feel like it.

Normal also caused the mass destruction of ecosystems, human desperation for animal protein and increased human-wildlife contact. Combined, these factors led to Ebola, Hanta, bird flu, SARS, MERS and now COVID-19 to find a new, more plentiful host in human beings.

Stimulus spending around the world has already eclipsed the 2009 recovery measures and “New Deal” programs of the 1930s. And more spending is inevitable. Will your taxpayer money be wasted on a return to normal? Or, could it be used to…

[…]

Let’s not misuse taxpayer money to rebuild an economy that survives COVID-19 and then succumbs to climate change. Instead, let’s create a future economy with good jobs, a habitable earth and reprieve from the whims of erratic dictators. There is no path back to normal. And we can do much, much better than normal if we refuse to waste this crisis.

Forbes

I called this dude a “futurist” because I couldn’t figure out what he was…

For more than 30 years, I have devoted my career to sourcing, investing in and helping to commercialise breakthrough innovations for energy intensive industries. During this time, I have gained unique industry insights and deep operational experience as a venture capitalist, corporate executive, international consultant and university professor. For the past nearly 20 years, I have been President & CEO at Chrysalix Venture Capital, an award-winning VC firm focused on innovation, sustainability and cleantech, where I have helped raise more than $250M and participated in more than $1B in venture capital funding. Our investments include breakthrough technologies like 3D printing of steel, fast charging electric vehicle infrastructure, emissions-free solar steam, smart mining and nuclear fusion. Before officially joining the corporate world, I spent several years as an Associate Professor at the Vrije Universiteit Amsterdam, where I obtained a PhD in Economics, and consulting to the World Bank and European Union.

Forbes

This has to be the single dumbest sentence ever written by a human being:

Let’s not misuse taxpayer money to rebuild an economy that survives COVID-19 and then succumbs to climate change.

It’s as if the Bozo is saying, “Don’t save the economy from ChiCom-19, because we have to save it from the weather.”

The title of the article was:

After COVID-19, The Oil Industry Will Not Return To “Normal”

“Normal” is boom & bust. Low prices eventually cause high prices and high prices eventually cause low prices.

This is as close as he got to actually discussing the “oil industry”…

There is no return to normal for the shale and oil sands producers. From now on, the fate of the oil industry is tied to the whims of two egomaniacal autocrats. Demand will continue to decrease as low-cost renewables keep pushing the energy transition.

I filled up my Jeep the other day for the first time in three weeks, and paid $1.19/gal (with my $0.20/gal Albertsons/Safeway/Randalls/ Tom Thumb discount). I normally fill it up twice a week. When the ChiCom-19 hostage crisis ends, demand will not continue to decrease; nor will “low-cost renewables” push any sort of transition, much less an energy transition… If for no other reason than the fact that there has never been an energy transition – We convert more biomass into energy now, than we did before we started using fossil fuels.

The ChiCom-19 hostage crisis has caused demand for crude oil to drop by 20-30%. This has caused about a 50% drop in the price of crude oil. At $20/bbl a lot of producing oil fields become uneconomic. Guess what happens when a producing oil well can no longer cover its own lifting costs? Wells get shut in.

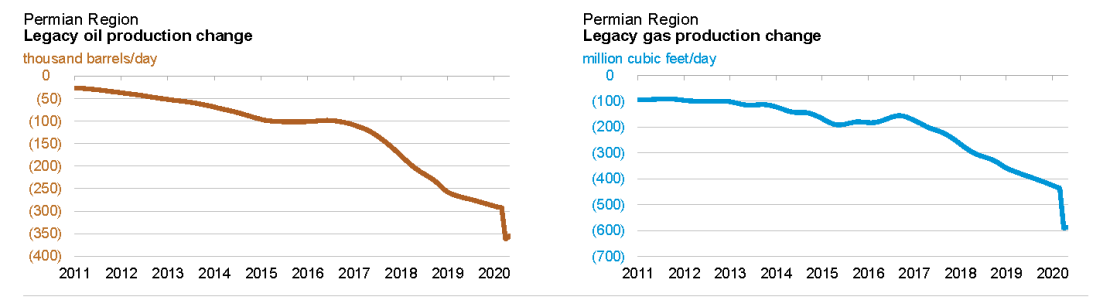

Legacy oil & gas production has dropped rather sharply in every tight/”shale” play in the Lower 48. The drop has been particularly steep in the Permian Basin. Production from new wells was still up, but will soon begin to decline. The legacy production drop in the Permian Basin was so steep that overall production dropped for the first time in a long time.

How long will demand be suppressed? It depends on how long the Fire Marshal Gumps of the world keep us under house arrest. This is the EIA’s latest forecast (which has to be better than a futurist waving his arms)…

Global production will probably dip more the the EIA forecast, but it’s anyone’s guess as to how quickly the over-supply will be worked off.

If oil prices track the current futures market and STEO forecast, the industry will still be in “bust” mode through at least next year. “Shale” players, particularly the smaller ones will be filing for bankruptcy at a record pace. If oil prices track a little above that, $50-60/bbl, the industry will be back to “normal” (somewhere between boom & bust). If prices move toward the upper bound of the confidence interval, the industry will be in “boom” mode (as opitmisic as I am, I don’t see how this can happen in the 2020-2021 time period). If prices, track the lower bound of the confidence interval, we will be in a deep “bust” mode…

Many, if not most oil companies, particularly independents, “hedge” a significant percentage of their production. They effectively sell the oil in advance at a fixed price.

McConn and his team at Enverus and RS Energy Group Intelligence estimated there is 2.5 million barrels per day of aggregate 2020 oil-hedge volumes among public traded North American exploration and production companies at an effective hedge price above $50 West Texas intermediate. Their analysis estimates most oil-weighted E&P companies have hedged between 25 and 90 percent of their anticipated production for the year. They estimate the value of these financial-derivative assets exceeds 10 percent of respective enterprise values for the majority of E&P companies.

Midland Reporter-Telegram

Some companies even have a portion of 2021 production hedged. This buys time for most companies to lower their spending to the point that they can be cash flow-positive at $30/bbl. If oil prices evolve along the lines of current futures contracts, the oil industry will, indeed, return to “normal.” Apparently “futurists” are clueless about what’s “normal” for the oil industry,

Day Whatever of America Held Hostage by ChiCom-19

I’ve lost track of what day of the week it is, so, keeping up with what day of the hostage crisis it is seems pointless.

Fire Marshal Gump was at it again yesterday.

/arc-anglerfish-arc2-prod-dmn.s3.amazonaws.com/public/GEJBBC6Z5ZDNNGXDFWXXKJACGA.JPG?w=1110&ssl=1)

Dallas County to require people to wear masks at essential businesses, on public transportation

An upset Price says Jenkins didn’t consult fellow commissioners on the plan. Meanwhile, the county also reports seven more coronavirus-related deaths.People in Dallas County will soon be required to wear face coverings when they work or shop at essential businesses and use public transit.

The mandate goes into effect at 11:59 p.m. Friday, County Judge Clay Jenkins announced Thursday.

[…]

Dallas Morning News

Gump needs to look at his own fracking data:

| 4/17/2020 | |||

| Dallas County | CHICOM-19 | ||

| Population | Cases | Deaths | |

| 2,637,772 | 2,190 | 55 | 2.5% |

| % of population with | 0.08% | 0.00% | |

| % with, rounded | 0.1% | 0.0% | |

| % without | 99.92% | 100.0% | |

| % without, rounded | 99.9% | 100% | |

| Menodoza Line (.200) | 5/31/2035 | 0.200 |

Thankfully, it appears that the Dallas County Commissioners Court has slapped Gump down again…

Dallas County commissioners vote to scale back countywide mask order, reopen craft stores

The 3-2 vote was made to give county residents access to mask-making materials.Dallas County commissioners voted Friday to reopen craft stores and partially scale back an order requiring residents to wear masks in public.

County Judge Clay Jenkins issued the order Thursday that requires county residents to wear face coverings when working, riding public transit and running essential errands, effective at 11:59 p.m. Friday.

[…]

Dallas Morning News

Just a couple of weeks ago, Gump (Jenkins) made a YUGE production of shutting down Hobby Lobby and other craft stores.

“Just a couple of weeks ago, Gump (Jenkins) made a YUGE production of shutting down Hobby Lobby and other craft stores. ”

Gee …. wonder why he picked on Hobby Lobby ….

🙂

At least he realizes that China isn’t a “Climate Hero” and neither is Russia but are not but “Egomaniacal Autocracies”

I think he was referring to MBS and Putin.

MBS is the head of a brutal and ruthless absolute monarchy, but as Putin gets elected and is popular I don’t think he really qualifies as a “dictator”.

Proof positive that a coronavirus pandemic causes some people to go insane.

The author says he has been doing this for 30 years so he has apparently been insane for a while.

39 years.

David I have a question. You said when a producing oil well can no longer cover its own lifting costs it gets shut in. When prices go back up can the shut in well be re-opened or do they have to frac it again to resume production?

Mechanically? Yes. Realistically? It depends on a lot of factors.

My brother got rich and retired a decade ago doing that up here in canada, buying closed in wells for pennies on the dollar, getting them producing, eventually the whole lot was purchased by a mid-sized oil company

Retired at 46 and bored

He could come back out of retirement and do it again. Maybe tt won’t work out so well this time and he won’t be bored anymore :>)

Many Billionaires have made their key move during the main phase of a Recession. Remember, the Economics motto is: Buy Low—Sell High! Buying low is possible in many industries right now, so watch for the Mergers and Acquisitions roll call to know where there might be opportunities. Pat from kerbob’s brother is what is known as a “bottom feeder”, which is a derisive term utilized by investors who missed the uptick. Stay sane and safe.

“let’s create a future economy with good jobs”

What is the definition of a good job ?

From my perspective, aside from personal remuneration, a good job is one that either builds wealth for the country or provides services that enable more wealth creation. Good jobs will therefore create or enable more export earnings through innovation, improved efficiency and by lowering the cost of production.

As has already been well documented, green jobs fit into the bad category, by increasing cost and decreasing efficiency. They also rely on large subsidies which removes money from government that could be used to enable wealth creation elsewhere. A lose-lose scenario.

Well . . . hmmm . . . are you sure that labor costs don’t: 1) by definition “export earnings” from the producer to the laborer(s)? And if this is true then doesn’t this also by definition: 2) increase the cost of producing your widget? And if both 1) and 2) are true, doesn’t this contradict your proposition, which would obviously mean therefore that no one could have a good job, either from the perspective of the producer or the laborer?

You mean because that’s what government generally does, i.e., enable wealth creation? E.g., like the following: https://www.wsj.com/articles/tax-revenue-keeps-rising-11557691166

Been there. The Soviet Union was all running on a future economy, with documented results. Surprisingly, there are still comrades who want to repeat the experience. Please count me out. The coronavirus can not compete with horrors of a socialist economy.

Dallas should be grateful Gump’s a serious worrier.. forehead wrinkles to prove it.

God help me, I’m about willing to draw lots, offer myself up as a an old, not too fat sacrificial lamb, just to make this BS end.

Cut my own damn hair last night with a pair of Oster clippers I bought to do the dogs 30 yrs ago. Can’t say I really notice the difference from a salon cut but it’s about time to call enough and go belly up to a Sushi bar with a crowd of recent Asian arrivals. Will admit I gave them the skank eye 6 weeks ago, here in a major college town, but times have changed – we’ve either lived through it or are going to get it.

Given I still hold a lot of oil stocks and bought more almost two weeks ago, I don’t have to say I think the author of the referenced piece is a buffoon. That he’s evidently made a successful living being one seems proof of how much money has been floated out to push this crap.

My wife’s been cutting my hair since 2005…#1 guard makes it easy… 😎

“Anybody that wants a test can get a test”

“If you like your doctor you can keep your doctor.”

“If you like your plan you can keep your plan.”

#RUSSIA

” Guess what happens when a producing oil well can no longer cover its own lifting costs? ”

..

..

Davie collects unemployment?

LOL…..looks like I struck a nerve.

Just giving a troll plenty of rope.

Tell us Davie, how many wells can you drill that will be profitable at less than $20 a bbl?

Read the post.

The post doesn’t mention how many of the fracking drillers with over-leveraged balance sheets are going bankrupt.

The post doesn’t mention many things that are irrelevant to the subject matter of the post.

Just like Solyndra employees?

Thank you, David.

Stay safe and healthy, all.

Bob

https://wattsupwiththat.com/2020/04/06/saudi-soviet-assault-on-us-energy-security-trump-wins/

.

.

“hopefully not a premature victory lap”

.

.

Yup, you prematurely ejaculated.

Learn how to read…

Oil surges 24% for best day on record after Trump tells CNBC Saudis, Russia reach agreement”

…

Your boy Trump didn’t help at all.

…

WTI closed at $18.12 today

…

Your post shows it closed at $26.21

…

You get your stimulus payment direct deposited yet?

Learn how to read.

Henry, you’re making a fool of yourself. You’re as clever as the guy who notices the temperature at 1 PM is higher than it was at 6 AM and declares he sees evidence of CAGW.

David, you should ignore the ninny. He’s not convincing anyone he has a point. Maybe he’s convincing us he’s had a pint, though.

I don’t think he’s old enough to drink.

ex-KaliforniaKook, Henery most certainly has convinced me he has a point – at the top of his head.

Henry Pool,

Your ignorance is exceeded only by your bad manners and your poor taste.

When you wrote this: https://wattsupwiththat.com/2020/04/06/saudi-soviet-assault-on-us-energy-security-trump-wins/

..

..

There were 18 deaths in Dallas county.

…

Now there are 55, which is a 200% increase in 11 days.

..

What is your projection for the end of April?

Only a total fracking retard wouldn’t realize that deaths are a trailing indicator.

You didn’t answer the question, what is your projection for the number of deaths in Dallas county at the end of April?

0.0%.

0.0% is not a number. Do I have to educate you on what an integer is?

Will it be greater than 100? Will it be less than 500?

HP,

David M might have been referring to the percentage of your intelligence you are applying to the issue. Or the percentage of importance that he is assigning to your responses — yeah, I think that’s it.

David

What are you going to do with the puppy that followed you home and won’t quit pestering you?

Give him enough rope to hang himself.

You seem bitter Henry. Why the angst?

I’m not bitter, I’m just concerned that Middleton will not have a job with oil trading for less than $20 a bbl.

Your inability to read is only surpassed by your inability to read.

Your answer to the question of “how many” with a percentage shows your numerical illiteracy.

It just puts the idiocy of your question into context.

Henry,

Demanding an answer in only one format (integer) indicates your lack of flexibility!

In what grade do teachers introduce real numbers?…third grade?…fourth? Did you skip school after that?

I don’t think he’s managed to get past Kindergarten based on his postings to far.

Seems like the lockdown is causing some mental casualties.

Your style definitely comes across as bitter 🙁

All butt-hurt is an angry mistress.

Only reason your mistress would get angry is because of your premature ejaculation . (see previous post)

You are out of order. https://wattsupwiththat.com/policy/

Henry, what the hell is wrong with you?

He strikes me as one of those people who can’t understand why he isn’t rich and famous.

After all, he works (at least one day a week) and his mother is always telling him how smart he is.

Henry Pool: Now there are 55, which is a 200% increase in 11 days.

On the morning of April 20, 3 days later, Dallas County has reported 60 deaths. That’s 9% in 3 days. I guess the pandemic is over according to your logic.

In Australia, petrol prices at the bowser were A.50 cents a litre in the mid- 1980s, beyond 70 cents a litre in the early 1990s and breached the A$1.00 a litre shortly thereafter.

Like the Author filling his Jeep in delight, I filled my SUV yesterday at A.87.7 cents a litre (after a 4 cents a litre discount from an automobile association membership card).

If my wife and I were not in lockdown, we would party like it was 1990!

Troll bait.

I wasn’t so delighted… 😎

Too funny….you are replying to your own blank comment.

Pardon my cynicism, but “20 years to raise $250 mm” is not very good. Maybe others view that achievement differently?

$250 mm? $250 Million Million? Wouldn’t that be $250 Trillion? Even for governments, that’s a pretty big number.

mm (lower case) usually means million (thousand*thousand).

From the article: “Normal created a climate change timebomb that may make the economic consequences of coronavirus look mild by comparison.”

Ridiculous! There is no evidence that human-caused climate change is real.

David, I filled up my gas tank yesterday at $1.29 per gallon (no discount:)

Here in calgary, 60 cents a liter, converted to usd then liters to gallons that $1.62 usd a gallon

For the land of tax including the stupid carbon tax, that’s pretty good

The tax in this state is at least that much.

Saw that in Weatherford Texas just today.

Here in Germany it is €1.29 a liter. Or $ 5.70 a gallon

To bring economies back to normal it will take available energy sources. Enough said.

I take solace in this article as whenever the enviro-whackjobs proclaim something it generally can be taken to be the opposite of the truth.

Thinking 2012-2013 and “peak oil” and “the end of oil” and $250usd per barrel as I recall.

Dead wrong then, almost certainly dead wrong now.

As many have pointed out, no energy source humans use has ever gone away, we just add new ones on top

That isn’t about to change

I remember “peak oil” being talked about in the 80s and 90s. This myth, like the Chicken Littles, has always been around.

If there were a flight off this planet on a one-way trip into space, I would take it, just to get away from the idiots.

The comment “the cure for low oil prices is low oil prices” is a true as ever.

Informed opinion, here – if Middleton is working today, he’ll surely be working once we’ve shook off this political campaign to determine who’s going to pick Ruth Bader Ginsberg’s replacement.

Thanks for the time you take to put these posts together, and a small suggestion: you might consider one that examines possible correlation amongst groups as to belief in both the catastrophic effects of climate change and the WuFlu.

Take care.

On my “to do” list.

I’ll ditto john’s kudos, and ask that you also consider a post on catastrophists vs uniformitarians in geology as analogous to climate alarmists vs skeptics.

Many thanks for your time. It helps.

The concepts aren’t analogous in any way, shape or form.

Catastrophic events are also part of uniformitarianism. The notion that these are competing principles dates back to a time when sedimentary rocks were either the result of the Noachian Deluge or a slow, steady process of erosion and deposition.

Climate change skeptics are skeptical about AGW because the science has been politicized for the purpose of scaring the bejesus out of people with physically impossible worst case scenarios to achieve left-wing policy goals. The same sort of people are trying to do the same thing with ChiCom-19.

David,

You have become the new Bob Tisdale, after Bob learned better. 12 charts in this posting? TMI my friend…

Bob’s charts are way better than mine.

Your puns are better than his.

A “futurist” is one that thinks he knows more about the future than anybody does about the present!

It’s really an exercise in futility but it gave me some comic relief!

So, “futurist” = “futilist”? Very possible, I’d say!

If not for petroleum and natural gas (and coal) no one would have been able to shelter in place for a viral epidemic and still enjoy abundant foodl in the grocery stores and electricity from the wall sockets.

Imagine how Saudi Arabia and Russia would be behaving towards the US and Europe if they could control world petroleum supply and thus price pre-frack revolution

It really is as simple as that.

News Flash! Rona is attacking the treclicity grid-

https://www.msn.com/en-au/news/australia/falling-power-use-due-to-coronavirus-risks-system-overload-and-blackouts-experts-warn/ar-BB12NV6b

Quick get in some Green batteries from China and beat the rush.

So environmentally correct solar power in Australia produces electricity at a higher cost than using plentiful domestic coal, and if demand is too high, the lights go out, and if demand is too low the lights go out.

What a moronic power system imposed by a sham religion of AGW.

“Worse, our recovery from COVID-19 could be a short-lived victory if we aspire only to have a “normal” economy again.

Normal created a climate change timebomb that may make the economic consequences of coronavirus look mild by comparison”.

Yes sir. I know exactly what you mean. Thank you for this amazing and far sighted insight.

https://tambonthongchai.com/2019/02/22/old-climate-fears-revisited/

https://tambonthongchai.com/2020/04/12/desperation-eco-wacko-ism/

To DM. Is there anywhere in the world where you can drill and get the oil to flow on it’s own accord?

Like the proverbial gusher.

Is the price of oil a function of the price of capital, over the longer term?

We don’t want gushers. Macondo (Deepwater Horizon) was a gusher.

Conventional reservoirs generally flow “on their own accord,” at least early on in their production life. The Gulf of Mexico and Alaska are mostly conventional reservoirs. Although, eventually, most wells require pumps, gas lift, and other artificial lift mechanisms.

https://en.wikipedia.org/wiki/Artificial_lift

“I called this dude a ‘futurist’ because I couldn’t figure out what he was…”

He’s a programmer.

Persisting on the use of “ChiCom-19” is just as silly as persisting on the use of “anthropocene”

My usage of both, and many other words, is purely for the purpose of ridicule and/or to provide an opportunity for concern trolls to join the discussion.

It seems DM is echoing the British House of Lords line – normal being the “special relationship”.

No, it is highly likely the House’s fears will be confirmed – the new normal will be The USA, Russia and China cooperating with COVID being a good impetus. After all that is President Trump’s stated intention.

Why a US oil-man toes that British line is seemingly incongruous.

Just wondering if some here follow the British Scoop Jackson Society effort to sue China for $3 trillion?

Aside from that, the recent WallStreet loosey-goosey money pumping into shale sure made that oil “boom-bust” cycle a real joy-ride?

The loosey-goosey money was pre-2014.

Informative and informed— as is always the case with Middleton-authored WUWT pieces.

Thank you !!

For the haters in the audience, DM is vastly more knowledgeable in things involving producing “Non-Virtual Energy,” Virtual Energy being that supposed energy production which disappears, much like a Fata Morgana, when it is really needed. I “enjoyed” Virtual Energy in June 2003, in Sausalito, California. Temperature 102 degrees Fahrenheit, zero point zero wind over the Altamont Pass, none of the wind turbines rotating, and an ongoing brown out.

Rock on David!

From a “South Dallas”, far North Houston fan.

I’m kind of missing my weekly Dallas-Houston commute… Although saving 500 miles/week on my Jeep and ~$100/week in gasoline is kind of nice. Commuting from the bedroom to the kitchen is easier. Plus, since I tend to eat breakfast and lunch at my desk, the food is better here. Unfortunately, I have to pay rent on a Houston apartment than I probably won’t see in April. Truly interesting times.

If oil production is uneconomic , guess what ,this makes renewables even more uneconomic. Without subsidies no renewable power generation can compete with weak fossil fuel prices . Ironically it will the likely drop off in enthusiasm for renewables and inability of governments to justify propping up renewables that will help fossil fuels to bounce back. With major financial commitments having been made to fight the economic impact of a real emergency the enthusiasm to expend future resources on a fake crisis emergency is likely to wane.

Dave,

“Futurist” is a euphemism for no nothing, generally speaking. I once listened to some oil industry futurist, fifteen years ago, speaking of the near term death of Saudi production because they were already water flooding their fields and had been since day one.

At any rate, your Figure 4 contains a future prediction with error bars. This is exactly what should accompany all projections, as it allows a person to understand, at a glance, how meaningful the projection is. It is what was missing from Neil Ferguson’s projections of COVID deaths. He provided tables of numbers, precise to six figures, of what to expect if certain strategies were followed. Error bounds on each might have made people think for a moment about other important consequences, and come up with more robust plans.

Sorry, “know” not “no”….

Peak Oil took place in late 2018. Peak Car took place in 2017. The coronavirus has just certified it. Many low producing wells will be shut for good in the North Sea, North American shale plays and everywhere else and it won’t make sense to open them again. There is no new discoveries to make up for lost production and decline. We are in for a long and deep economic crisis and globalization has been unraveling slowly since 2013. You will have to reassess everything you thought about this. Eventually oil prices will be high, but by then production destruction will have been profound and we won’t be able to reach previous highs.

Whether solar cycles or peak oil –

“It’s tough to make predictions, especially about the future.”

― Yogi Berra

It’s even tougher when the predictions are based on “what’s happening now.”

How many times have you called Peak Oil so far?

What makes you think this call is any more accurate than your previous ones?

They never give up with the watermelon dribble-

https://www.msn.com/en-au/news/australia/the-worlds-energy-order-is-changing-—-and-china-is-set-to-reap-the-strategic-benefits/ar-BB12QkZ3

Not much of a cartel if your prices crash with demand but economics isn’t their strong point and flog capitalism with a feather with cheap energy. Presumably why they’re so keen on their unreliables for the Revolution to begin and fawning over China all the time.

Now with Covid they’re fretting the deplorables won’t want to jump on their pet public transport system again-

https://www.msn.com/en-au/news/australia/to-avoid-a-return-to-pre-coronavirus-traffic-congestion-experts-want-to-talk-about-change-right-now/ar-BB12Qu9i

They’re getting worse by the day with Covid and relevance deprivation syndrome.

There are two institutions of higher education in Amsterdam: the University of Amsterdam (where yours truly did his PhD research) and the Free (Vrije) University of Amsterdam. The latter institution was founded in the 19th century by strict Protestant groups who were wary of all those new things being discovered and wanted to have some control over the curriculum. The ‘Free’ has a good dose of irony in it. For instance, Darwin was rather ‘problematic’ even far into the last century. It appears that the writer of the Forbes piece was a graduate of that institution.

David,

Your Dallas County CV-19 Hospitalizations and Intensive Care graphs (Figures 2 & 3) indicate how bad CV-19 could have been if the outbreak had occurred at the beginning of flu season – as happened in China.

It probably would have been a lot worse if the peaks were coincident.