Guest “BINGO!” by David Middleton

No Oil Bailout Is Worth the Green New Deal

By KEVIN D. WILLIAMSON

May 14, 2020‘Stop trying to help us,’ the industry says

‘Oil is dead.” So goes the wishful thinking of the Left in Canada. And not just in Canada.Canada’s oil industry, like others around the world, has taken a beating: Before the coronavirus epidemic, prices already were low and declining, with U.S. shale producers fracking the world into oil abundance, sending prices down from over $100 a barrel in 2014 to less than $30 a barrel just two years later. The failure of the joint Saudi–Russian effort to cut production sent prices down even more, and then came the coronavirus epidemic, which cut demand off at the legs and sent oil prices all the way down to $0.00 and then briefly into negative territory as oil traders looked to escape paying storage costs for the unprofitable commodity.

[…]

Unlike their Canadian colleagues, the leaders of the U.S. oil industry aren’t really looking for help. They’ve been through a price crash before — it was the stupendous output enabled by the shale revolution, not the epidemic, that brought down oil prices to begin with — and they learned to adjust. The big oil companies have diversified operations, and they do not live or die by the daily price of crude.

“Any effort by government will come with a very high price from the Democrats,” says Thomas Pyle of the American Energy Alliance. “They’ll want to trade that for parts of the Green New Deal, which is a bad deal for us.” Pyle says that some producers, especially smaller firms, might benefit from the same sort of assistance offered to businesses in any other industry, but that protectionist measures such as tariffs and subsidies are help that’s not wanted. Any help that is offered, he argues, should be general rather than industry-specific.

[…]

Conservatives have pointed to the suffering and economic ruination of the coronavirus quarantine as a preview of the so-called Green New Deal, which is less a legislative proposal than a slop bucket into which almost any left-wing priority can be poured. It may be necessary, conservatives say, for government simply to mandate that important economic activities come to a halt, but this is what it looks like.

[…]

The political opportunism here is impossible to miss. Helen Mountford of the World Resources Institute told Bloomberg that the current crisis presents “a great opportunity now to transition more quickly.” The political strategy is to present the coronavirus epidemic and climate change as a continuity of crisis.

[…]

Beating back Green New Deal shenanigans and affirming the role of the oil-and-gas industry ought to be a political dunk for the Trump-era Republican Party. Setting aside the complicating fact that U.S. energy independence is really North American energy independence — Canada and Mexico are our top two national suppliers of petroleum, which the United States continues to import because many of our refineries still are optimized for relatively high-sulfur imported oil rather than the “light sweet” stuff from Texas — this is an opportunity so simple and clear that even Republican candidates for public office should not be able to get it entirely wrong. It pits a successful real-world industry creating and sustaining hundreds of thousands of jobs — many of them in swing states such as Ohio and Pennsylvania — with real-world names and faces attached to them against a pet project of the Davos set, one that has achieved quasi-religious status among affluent elites but hardly registers at all in the polls: In the January Gallup survey of top issues informing voters’ choices in the 2020 election, climate change was second from last, ahead only of gay rights and far behind such concerns as the budget deficit, taxes, and immigration. The question of energy vs. the Green New Deal is a question of real things you can see vs. possible things someone might imagine, your warm house vs. the warm fuzzy feeling of self-righteousness, people you know vs. people you don’t.

“We think these decisions should be made on the basis of financial accounting, not ideological,” says Frank Macchiarola of the American Petroleum Institute.

[…]

The current situation is painful, but the U.S. oil industry believes that in the long term the numbers are on its side: With a growing world population and a growing global middle class, energy consumption is expected to increase by as much as 20 percent in the next 20 years — and half of that energy will come from oil and gas. That matters for the cost of filling up your F-150, but it also matters for the diplomatic, security, and trade position of the United States. The day before yesterday, the big worry was our “dependence on” or “addiction to” despised “foreign oil.” Technological innovations have made the United States the biggest oil and gas producer around, and our short-term problem right now is that we have more oil than anybody wants and nowhere to put it. The problem of depletion has become the problem of superabundance. That’s a better problem to have.

[…]

Even after the long-term decline in prices from the shale boom, the shock of the Saudi–Russian price war, and the cratering demand from the coronavirus shutdown, the major oil producers in the United States are, for the most part, asking to be left alone, or for oil businesses to be treated like any other businesses. There is value in that kind of resilience, which should be even more obvious in uncertain times such as these.

This article appears as “‘Stop Trying To Help Us,’ Says Oil Business” in the June 1, 2020, print edition of National Review.

KEVIN D. WILLIAMSON is the roving correspondent for National Review and the author of THE SMALLEST MINORITY: INDEPENDENT THINKING IN AN AGE OF MOB POLITICS.

National Review

While there are a lot of things government could do to help the US oil industry weather this storm (like expanding the Strategic Petroleum Reserve), there is nothing government could do, that would be worth accepting any part of the Green New Deal in a compromise. The best thing government can do is to get out of the way of the economy.

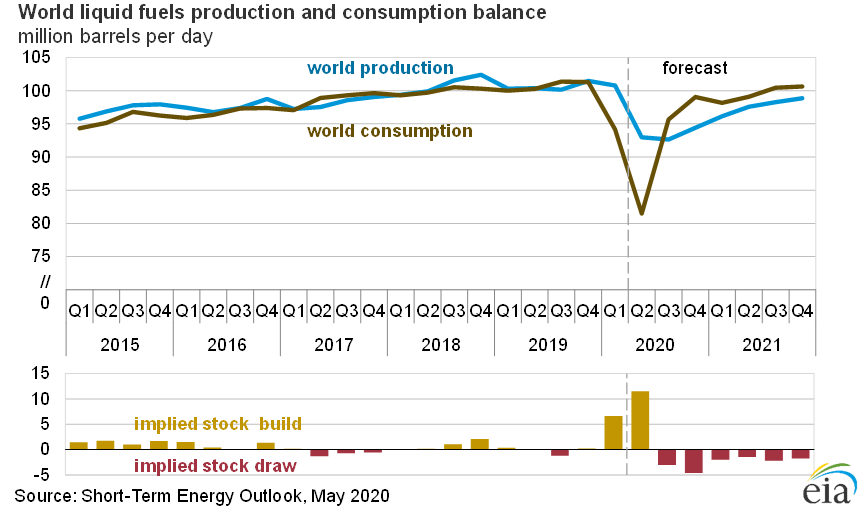

EIA expects US tight/”shale” oil production to decline by nearly 200,000 bbl/d from May to June and a total decline of about 1.3 million bbl/d in 2020-2021.

Interestingly, EIA foresees no decline in Gulf of Mexico or Alaska production, as these play types aren’t as sensitive to short term price swings. Nor, does EIA foresee the cancellation of any announced development projects.

EIA forecasts GOM production to remain relatively flat, averaging 1.9 million b/d in 2020 and 2021, nearly unchanged from its 2019 average. In addition, EIA expects no cancellation in announced GOM projects for 2020 and 2021. EIA forecasts that crude oil production from Alaska will remain at an average of 460,000 b/d in 2020 and that it will increase slightly in 2021.

EIA forecasts U.S. crude oil production to fall in 2020 and 2021

Production cuts, coupled with increasing demand as the economy reopens will drive prices back up. Due to the deeper than previously expected production cuts…

EIA STEO, April 2020

EIA is now forecasting $50/bbl by the end of 2021.

This is up from about $42/bbl in the April STEO.

As prices recover, EIA expects drilling activity to recover in 2021 and for production growth to resume in late 2021.

The improving oil price forecast is currently being driven almost entirely by production cuts. And, oddly enough, the stock market is digging it!

Surging Crude Prices Send Oil Stocks Soaring Today

Crude oil prices in the U.S. rallied back above $30 a barrel.Matthew DiLallo

May 18, 2020What happened

Oil prices started this week with a bang. WTI, the primary U.S. oil price benchmark, had rallied more than 10% by 10:30 a.m. EDT on Monday, to around $32.50 a barrel, while Brent, the global oil price benchmark, jumped more than 7% to nearly $35 a barrel.

The surge in crude prices buoyed most oil stocks. Several rallied by double-digit percentages in early morning trading today, including Apache (NYSE:APA), Callon Petroleum (NYSE:CPE), and Cenovus Energy (NYSE:CVE). Meanwhile, even oil giant ExxonMobil (NYSE:XOM) was in rally mode as its shares surged 5% by midmorning, adding about $10 billion to its market capitalization.

So what

Oil prices in the U.S. rebounded to a two-month high on Monday. Fueling the rally was optimism that demand is beginning to improve as more states reopen their economies now that the COVID-19 pandemic has started waning. On top of that, oil supplies are falling fast because producers trimmed output to combat weaker pricing. Adding to the day’s bullishness was promising data on a leading vaccine candidate and positive commentary by the Federal Reserve chairman over the weekend.

The surge in oil prices was the main factor driving oil stocks higher on Monday. The improved pricing will benefit financially challenged producers like Apache, Callon, and Cenovus. All three have had to make significant spending cuts over the past couple of months to realign their businesses with lower prices.

For example, Apache slashed its dividend 90% and cut capital spending by 40% to conserve cash during the downturn. The company made thosemoves to ensure it had the liquidity to manage $937 million of bonds coming due in 2021 and 2023. Apache might not be able to refinance that debt if market conditions don’t improve because a credit rating agency slashed its debt rating to junk territory. But with oil prices bouncing back today, investors are optimistic that the worst might be over for the oil market, which bodes well for Apache.

[…]

Motley Fool

So… To borrow a phrase from the classic movie, The Treasure of the Sierra Madre…

Thanks, David, once again for an entertaining and enlightening post.

BTW, the “Bailouts? We don’t need no stinkin’ bailouts!” made me laugh. Thanks for that, too.

Stay safe and healthy, all.

Bob

Should that not read “steenkin’ “?

Or is that racist?

I just cut & pasted from IMDB or Wikipedia… I forget which,

Oil & Gas know that this whole panic comes to an end in less than 6 months. They were ready to wait the panic out. That’s the constraint that the left is under. They can hardly perpetuate the panic further IF they win the election and there will be no point to if they don’t. Either way, it will be over in under 6 months.

Companies that are over-leveraged and/or didn’t hedge when oil was over $50/bbl might not be able to wait the panic.

“Or is that racist?”

To me it’s regional dialect. We have regional dialect going on big-time in our household (Spouse from Austin, TX, me from Bozeman, MT)

In Spanish, the ‘I’ is pronounced with the long ‘E’ sound.

My wife occasionally slips up on this one as well.

On the other hand, she always giggles when I try to say something in Spanish.

My wife giggles when I try to say something in Texan ;<)

David,

KDW is a gem! His insights and perspective are always instructive…glad you reposted that piece.

As for government help, clearly the value of oil is such that government intervention isn’t needed, especially when it will most definitely be a trojan gift designed to erode the oil industry through strangulation.

rip

There are a lot of things the government could do administratively, but these would vary depending on jurisdiction.

BOEM/BSEE could suspend royalties, extend lease terms, lengthen abandonment timelines until the pandemic ends or prices recover to a certain level. This could be done without any deal-making in Congress, but would only apply to Federal offshore leases. The Federal government could also impose anti-dumping penalties on Saudi Arabia and Russia, next time they decide to engage in state sponsored dumping. State agencies could do similar things. Oklahoma has already taken measures to allow operators to shut in production without risking losing leases. But, these sorts of things aren’t bailouts.

From the aricle: “Unlike their Canadian colleagues, the leaders of the U.S. oil industry aren’t really looking for help. They’ve been through a price crash before — it was the stupendous output enabled by the shale revolution, not the epidemic, that brought down oil prices to begin with — and they learned to adjust.”

Oklahoma can testify to that. Oil jobs were already being cut in Oklahoma before the Wuhan virus hit. The virus just increased the cuts.

“The best thing government can do is to get out of the way of the economy”

I’ve been saying that to anyone who’ll listen for as long as I care to remember.

The last thing an economy needs is more government intervention.

Yeah, but government only intervenes to redistribute wealth. They do this by severing the wealth from the top three-quarters… and… and… Well everyone becomes poorer but those now in abject poverty at least aren’t as far down the ladder from the top as they were before government help. Moreover, those who lose their jobs get a handout from gov. All the other Western countries have done this so it can’t be all bad.

“It is fascinating to watch politicians come up with ‘solutions’ to problems that are a direct result of their previous solutions. In many cases, the most efficient thing to do would be to repeal their previous solution and stop being so gung-ho for creating new solutions in the future. But, politically, that is the last thing they will do.” Thomas Sowell

The role of government should be to provide the resources and lubricate the regulations, and then get the Hell out of the way.

From the article: “The political strategy is to present the coronavirus epidemic and climate change as a continuity of crisis.”

That’s pretty clear.

The only problem for those doing this kind of comparison is, one crisis, the Wuhan virus crisis, is real, and one, the human-caused climate change crisis, is not.

Not one peson has died of human-caused climate change, nor are any likely to do so, now, or ever. The human-caused climate change alarmists have nothing to scare people with but science fiction stories. The Wuhan virus is not science fiction.

Nor would it even be good science fiction… But Michael Bay is making a movie about it anyway…

https://nypost.com/2020/05/20/michael-bay-making-film-about-pandemic-that-never-ends/

Seem more like Roland Emerich material to me… 😉

From the article: “Oil prices in the U.S. rebounded to a two-month high on Monday. Fueling the rally was optimism that demand is beginning to improve as more states reopen their economies now that the COVID-19 pandemic has started waning.”

I think that optimism is justified. I think we are going to see a continuing increase in demand as the economy gets going.

The YUGE production cuts are currently fueling the rally. As demand ramps up, production will fall behind demand. Prices won’t surge too much higher until the over-flowing storage is drawn down.

Yeah, we don’t need no stinkin’ bailouts, and we don’t need no stinkin’ Green New Deal ! 🙂

Good posting of this report, David. The wild card in the oil situation was Russia and Saudi Arabia having an whose the biggest idiot? contest at the worst possible time. By the way, “bingo” is an alarming term for military pilots (first “joker fuel”, then “bingo fuel”). Let’s get this economy thing going again! Trump 2020!

The problem is liberalism attempting to change us, not human caused climate change. They will spare no tax payer dollar for control and personal profit.

Why eliminate oil that is necessary for a good life? There must be a personal interest and it can’t be good.

The solution to low prices is low prices.

(with apologies to T. Boone Pickens)

High prices do the same thing… Only backwards.

DM-

That was Boone Pickens’ wonderfully pithy piece of wisdom and epiphany (for the youthful neophyte that I was):

“The solution to high prices is high prices.”

It is deserving of an entry in Bartlett’s Familiar Quotations.

T. Boone also once said oil would never fall below $100/bbl again. He also said that if oil fell below $80/bbl, it would shut down the Permian Basin.

https://www.cnbc.com/2014/08/19/pickens-oil-is-not-a-free-market-i-see-brent-above-100-forever.html

$40 is the new $80… 😎

DM,

Many, many decades ago I stopped believing the ability of anybody to consistently and accurately predict the short or intermediate course of the stock market, earnings, interest rates, petroleum prices and natural gas prices.

Boone had his merits but crystal ball gazing was not one of them (ask the shareholders of Mesa Petroleum).

Boone Pickens was brilliant oil man and damn good geologist. In my 39 years in the business, I’ve come to realize that the only way to predict oil prices is to hedge your production. Then you at least have some idea what price per barrel you’ll average over the next year or so.

Because Canada has been an important developer and exporter of basic commodities, our currency has be called a “Commodity Currency”.

Understandable, but no longer valid.

The Trudeau government is a gang policy maniacs, and the enduring obsession is “Zero Emissions”.

That has deliberately destroyed Canada’s resource industry, within Canada.

However, there are still many jurisdictions that encourage hard work, mining and the Oil Patch.

It has been all so stupid and destructive.

THE LIBERALS’ COVERT GREEN PLAN FOR CANADA – POVERTY AND DICTATORSHIP

by Allan M.R. MacRae, B.A.Sc., M.Eng., October 1, 2019

https://wattsupwiththat.com/2019/10/01/the-liberals-covert-green-plan-for-canada-poverty-and-dictatorship/

https://climatediscussionnexus.com/2020/05/20/strike-while-the-economy-is-cold/

You can vote your way into command and control communism…. but you’ll have to shoot your way out.

Using a novel virus as an excuse, supply and demand has been subverted to command and control diktats. We are seeing the direct results of command and control Governors selectively ‘locking down’ economic activity, wrecking havoc on nearly every business and individual that supports supply chains and end products in the USA. This is the reality of command and control government.

The November elections are rapidly approaching. Vote like your economic and personal freedoms depends on it. They do.

A serious question, have democratic governors executed policies meant to damage their states and to even kill their most vulnerable constituents? For example:

https://www.detroitnews.com/story/opinion/editorials/2020/05/20/editorial-whitmer-order-endangers-nursing-homes-end-now/5220929002/

I think it’s just gross incompetence combined with the sort of smug arrogance regarding their own brilliance that only a total fracking moron could achieve… 😉

Whoo Boy! That describes japing Jay Inslee – WA perfectly! You can add Tony Evers – WI (#WorstGovEvers!) and Gretchen Whitmer – MI to the miscreant Gov’s list also.

On July 4, 2019, I published the article “THE COST TO SOCIETY OF RADICAL ENVIRONMENTALISM”.

There was a reason why this article was published on July 4. My article begins:

Ever wonder why extremists attack honest scientists who oppose global warming and climate change hysteria? Ever wonder why climate extremists refuse to debate the science?

IT IS BECAUSE GLOBAL WARMING AND CLIMATE CHANGE ALARMISM WAS NEVER ABOUT THE SCIENCE – IT WAS ALWAYS A FALSE NARRATIVE, A SMOKESCREEN FOR THE TOTALITARIAN OBJECTIVES OF THE EXTREME LEFT.

Some people may think this was statement was inaccurate, or that I was being unfair. However, one week after my article was published, Democratic New York Representative Alexandria Ocasio-Cortez’s chief of staff, Saikat Chakrabarti, fully verified my statement. He said, as written in the article below:

“The interesting thing about the Green New Deal, is it wasn’t originally a climate thing at all,” Chakrabarti said… … “Do you guys think of it as a climate thing? Because we really think of it as a how-do-you-change-the-entire-economy thing,” Chakrabarti added.

Following is an excerpt from my July 4 article that demonstrates how utterly impractical the Green New Deal is – the Green New Deal is energy and economic lunacy – it cannot work:

4. Humanity needs modern energy to survive – to grow and transport our food and provide shelter, warmth and ~everything we need to live. Wind and solar power are too intermittent and too diffuse to be practical or effective. Green energy schemes have been costly failures.

Fully ~85% of global primary energy is from fossil fuels – oil, coal and natural gas. The remaining ~15% is almost all nuclear and hydro. Green energy has increased from above 1% to less than 2%, despite many trillions of dollars in wasted subsidies. The 85% fossil fuels component is essentially unchanged in past decades, and is unlikely to significantly change in future decades.

The fatal flaw of grid-connected green energy is that it is not green and produces little useful (dispatchable) energy, primarily due to intermittency – the wind does not blow all the time, and the Sun shines only part of the day. Intermittent grid-connected green energy requires almost 100% backup (‘spinning reserve’) from conventional energy sources. Intermittent wind and solar electrical generation schemes typically do not even significantly reduce CO2 emissions – all they do is increase energy costs and reduce grid reliability.

THE COST TO SOCIETY OF RADICAL ENVIRONMENTALISM

By Allan M.R. MacRae, B.A.Sc., M.Eng., July 4, 2019

https://wattsupwiththat.com/2019/07/04/the-cost-to-society-of-radical-environmentalism/

I agree with Mr. Middleton’s position regarding limited government relief for the oil industry. Perhaps, more specifically, the shale oil business.

But as a cautionary note:

“The nine most terrifying words in the English language are: I’m from the government and I’m here to help.” — Ronald Reagan

Ronald Regan was prescient: “In this present crisis, government is not the solution to our problem; government is the problem.“

Aaaaargh! Fat finger typo….. ‘Reagan’.

The man was a genius… And the best president in US history before Donald J. Trump.

I’d say he’s better. Wonder how far he could have gotten had he had a majority in either house of congress, much less both.

David

My sense is that Reagan had enough humility to know that he didn’t know everything and was not some kind of “stable genius.” Supposedly, for those reasons, he surrounded himself with people who had reputations for being smart, and solicited their recommendations. He then made a decision and took responsibility for it, right or wrong. While he was understandably attacked by Democrats, they had little to support their impotent attacks. He was not his own worst enemy.

So Reagan had smart people who gave recommendations?

Can you name those people and describe their recommendations?

Spain announced an oil and gas exploration embargo-law.

https://apnews.com/74f4a11e36f69fc81a6aad5e34ed9009

Good thing Spain is irrelevant.

Mr. Middleton: Wait, you DON”T want your industry subsidized? Wonder why we have not heard from the shallow Pool?

It will not be long in the scheme of things that begging for oil will become the norm.

I’m going to go with the oil companies: stop giving them taxpayer money.

I’ll go one more: stop giving coal companies (well, their owners) taxpayer money.

from a libertarian (guilty!) perspective, STOP GIVING ANY COMPANY TAXPAYER MONEY!

Oil companies don’t get any net “taxpayer money”.

https://wattsupwiththat.com/2019/05/15/fossil-fuel-fake-subsidies-top-5-trillion-in-2017/

But David, their tax rate is less than 100%, doesn’t that count as a subsidy?

chris

Is taking less money from a company the same as giving them money?

They aren’t even taking away less money. They aren’t taking away more money now, just to repay some of it over time.

The Great American Shale Oil & Gas Bust: Fracking Gushes Bankruptcies, Defaulted Debt, and Worthless Shares by Wolf Richter • Jan 22, 2020 •

Texas at the epicenter. We’re witnessing the destruction of money that loosey-goosey monetary policies encouraged.

https://wolfstreet.com/2020/01/22/the-great-american-shale-oil-gas-bust-fracking-gushes-bankruptcies-defaulted-debt-and-worthless-shares/

This has to do with central bank monetary policy, since the 2008 blowout, not “taxpayers”. The debt involved in these bankruptcies in 2019 doubled from 2018 to $35 billion. This pushed the total debt listed in these bankruptcy filings since 2015 to $207 billion. The chart there shows the cumulative total debt involved in these bankruptcies since 2015.

And shareholders, bondholders took the hit.

Wall Street’s Loosey-goosey monetary policy is the problem, and shale is where money goes to die every time.

David, the Mayor of Tulsa just had a Tesla logo painted on the chest of the Golden Driller! I haven’t seen it, but it’s online, not painted on the actual statue. At least not yet.

The mayor is trying to entice Elon Musk to move some of his manufacturing to Tulsa.

Will this new Tesla plant in Tulsa produce Tusla cars?

“Will this new Tesla plant in Tulsa produce Tusla cars?”

I’m not sure. When Tesla was closed down in California, Musk started talking to places like Texas and Oklahoma for alternatives if he couldn’t get his manufacturing facilities going in California. But now that California has allowed Tesla to reopen, I’m not sure what Tesla and Tulsa are talking about doing, if anything, considering Tesla is up and running in California.

I assume they are still talking about something because the Tulsa Mayor is still trying to influence Musk with public relations campaigns.

“No Oil Bailout Is Worth the Green New Deal”

I still don’t understand the Headline . . . Worth?

– JPP

It is worth noting that the Canadian oil industry was suffering from low prices long before Covid hit the scene. The lack of egress for it’s heavy oil essentially created a buyers market at PADD III. As a consequence Canadian heavy oil (needed to blend with US LTO to meet refinery specs) was trading at a significant discount to US oil. Once Covid demand destruction hit and the double whammy caused by the Saudis opening the taps the price for Canadian oil dropped so far that it was costing some companies more to transport their oil than they made selling it. So the situation is far worse in Canada and has been for a lot longer, thanks mainly to the current government which is comprised of green know it alls with nary a science course amongst them.

As to the situation in the US I don’t think I was ever worried that the industry wouldn’t make it through this without any help, what worried me was that it would end up being a small group of large oil and gas companies (Exxon Mobil, Shell, etc) that are poorly equipped to advance the tight oil and gas plays given they have never learned properly to cut operating costs. The shale plays were invented and made happen by the small players who were innovative with technology and supply chains and attempts by the large companies to “buy” that knowledge and expertise just hasn’t panned out all that well. An industry with only the large companies is not desireable to my mind.

Here in canada we have a clown based government that is doing its level best to destroy the energy industry, I hope we survive but roughly 60% of Canadians identify as mentally retarded, sorry I meant Progressive.

Weep for us

At a secret meeting of countries:

World: “We need someone to cut Canada’s throat.”

Canada: “I’ll do it.”

Read an article last night about one of the co-founders of Wikipedia complaining that the site was no longer strives for neutrality and had been taken over by leftists.