Guest highlighting by David Middleton

Statistical Review of World Energy

Global primary energy consumption grew strongly in 2017, led by natural gas and renewables, with coal’s share of the energy mix continuing to decline

Energy developments

- Primary energy consumption growth averaged 2.2% in 2017, up from 1.2 % last year and the fastest since 2013. This compares with the 10-year average of 1.7% per year.

- By fuel, natural gas accounted for the largest increment in energy consumption, followed by renewables and then oil.

- Energy consumption rose by 3.1% in China. China was the largest growth market for energy for the 17th consecutive year.

Carbon emissions

- Carbon emissions increased by 1.6%, after little or no growth for the three years from 2014 to 2016.

[…]

Despite the Never-Ending Death of Coal: It’s Still a Fossil Fueled World

53rd Consecutive Year: Peak Oil and Gas Are Still Just Over the Horizon

Note to both Peak Oilers and Abiotic Aficionados: Proved reserves are a fraction of the oil & gas that are likely to be produced from existing wells in existing fields.

New From BP: Minerals Production, Reserves and Prices

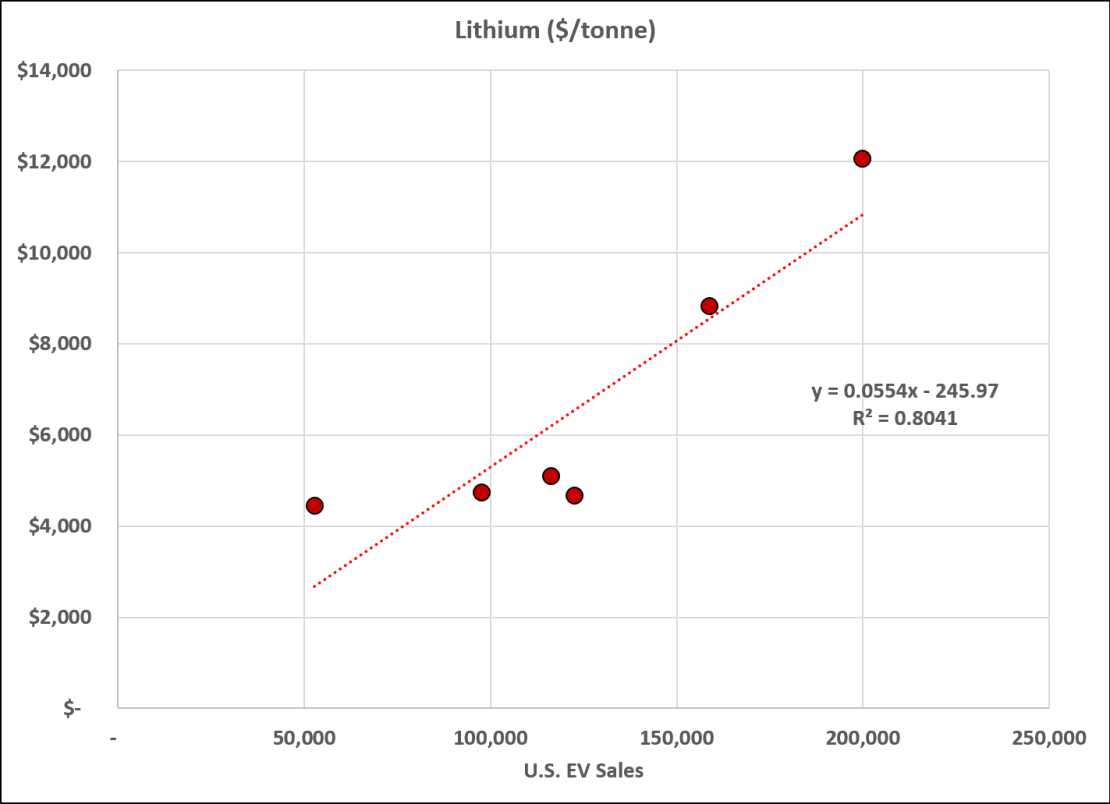

This year, BP has included tabs for Cobalt, Lithium, Graphite and Rare Earth mine production and reserves, a tab with Cobalt and Lithium prices. I cross-plotted Lithium prices with EV sales…

Lithium and all other mineral markets are not straight line constructs. You should know better than that.

Lithium was the only one that was. All the others were shotgun scatters.

The correlation is probably a coincidence… but, it’s definitely funny.

Okay

It will be even funnier if the correlation holds into the future and spreads to cobalt… 😉

The bad thing is most cobalt production goes to high speed steel tool production, like the widely used M42 HSS-Co, and in making superalloys used for turbine blades in modern gas turbine engines. Only a small fraction goes to rechargeable battery production.

While most lithium production goes to batteries. Cost increases on lithium primarily are burdens on battery production.

But price increases on cobalt, which most of the world’s production comes from the Congo, where China is unscrupulously trying to take over with bribes, has serious cost implications across many industries.

More of the lithium should go towards combatting global warming hysteria.

You can’t step into the LiIon’s club without stepping in Billy the LiIon’s blood.

“Despite Cleanup Vows, Smartphones and Electric Cars Still Keep Miners Digging by Hand in Congo: Supply chains at Apple, VW and others still include the owner of a mine where workers produce cobalt without safety equipment” By Scott Patterson and Alexandra Wexler on Sept. 13, 2018

https://www.wsj.com/articles/smartphones-electric-cars-keep-miners-digging-by-hand-in-congo-1536835334

Anything you do in the world involves costs. Warmunists are deliberately blind to that truth.

1.2M EVs would be about 1.3% of world auto sales in 2016

So what’s your point, the price of Li only tripled?

🙂

the price of Li only tripled

============

that is a HUGE problem. The battery is already THE major cost component.

not straight line constructs

=====

the US figures would also fit exponential, which is more what you would expect from supply/demand curves.

what it shows is that we are likely to hit peak lithium long before we hit peak oil.

actually the lithium price curve is very bad news for current EV technology. the battery is already a sales killer and the price curve suggest this is only going to get worse.

Better use the Lithium as Fusion reactor cladding for Tritium breeding, instead of EV batteries.

Yup. And more than that, I think? It is also the planned means of extracting heat from fast neutron energy from the fusion, at least in son of ITER (DEMO?) , as I understand it. Which I also assume means it has a high cross section for capture of fast neutron’s at Fusion energies? Probably and tritium formation is one of the results of Li capturing a neutron or two. Need to do some revision…. also gues the Li jacket is cooled by steam and we are back to the same old same old, Hopefully w/o the dumb 20th Century cooling towers. We can afford to power low profile open cycle water cooling withfan arrays and lose the plant behind the trees, guys. Out of sight….

We already use it for tritium breeding in LWRs…so, I guess, yeah. It’s within the realm of hypothetical futures to consider it for the same purposes in some, as-yet-to-be-proven fusion tech.

rip

And for keeping people calm.

Aha! Take your lithium pills..don’t use it for your car battery.

Use corn to feed people, not fermenting it into fuel.

But perhaps it is me that’s crazy?

No you’re not crazy. But I know a few million green-shirts who are.

They are going to need all the lithium they can get once they realize that their plan to abolish fossil fuels is going to fail utterly and completely (and completely and utterly).

Go long on lithium.

If climate change/global warming were ever to be the scariest, deadliest and most urgent matter to be both locally and globally solved, we would have seen – above all in places like Germany or California – a spike in nuclear power generation and a rush to build more and more reactors around. Instead we (the world) are wasting hundreds of billions of $ (€, £) in unefficient wind or solar farms, where anti-nuke environmentalists (usually much or totally ignorant about sciences) have more power in driving our resources and technologies than engineers. This is going to be the biggest fraud ever.

Yep…

You can mostly forget these claimed new nuclear costs – they refer to Gen3+

conventional light water reactors, which are woefully inferior to the SMR molten salt (and Thorium) reactors that will replace them in every instance, for every reason : safety, no need for water for cooling, load following capability, which drastically reduces side effect costs of maintaining peak load generators, total inherent safety, extreme resistance to proliferation, low build costs (1/2the cost of a conventional light water reactor) and low operational costs.

arthur –

I think you may be underestimating the ability of the regulator (government) to regulate away any cost advantages. 🙂

In point of fact, current LWRs suffer from a host factors, which when combined, have pretty much killed their commercial viability. These factors include: low nat gas prices, high fixed (craft) labor costs, high regulatory costs, and subsidized “renewables”. So, despite their many advantages, they’re shutting down left and right. It’s unfortunate, especially when you consider that many of the costs are “sunk” and have long since been paid off. These include things like R&D for basic reactor tech and of course construction costs. Combined with favorable reaction physics and low cost material supply (U238/5), we should be riding these plants for decades to come. But, they’re just not commercially viable right now. (Apparently there’s more money to be made in decommissioning than in operating…talk about perverse economic incentives!)

As for future nuclear, I believe we’ll certainly see a different coolant type, like your aforementioned molten salt, or even high temp gas. Molten salts and gas have decided benefits over the fairly limited physics of water. Note, you “need” a coolant, whether water or otherwise, to move the energy of the reaction to the electricity generator, so it’s not really accurate to talk about “no[t] need[ing] water for cooling”. Salt or gas will perform a similar function in whatever fission plant you design. Their main benefit over water should be a significantly higher thermal capacity as compared to the modest 40(ish) degrees of water (in a PWR). And, as we’ve found out, containing highly pressurized water is an ongoing herculean effort…so, there’s that too.

With regards to thorium, it’s not clear to me that we need to use this as fuel yet. U235 just loves to split apart, and it’s reasonably straightforward to concentrate in sufficient percentages to sustain a chain reaction. The fact that we have yyyuuuge supplies of thorium should be comforting for future generations, who will almost certainly use it. But it may not be the ideal tech to pursue currently. Just my opinion.

rip

It occurs to me that my main point sort of never materialized as I got sidetracked.

I believe that you will still have significant “new nuclear” costs, regardless of the tech. The benefits of SMRs (which still suffer from negative $/kwh costs as compared to standard sized plants …think <50MW vs >900MW) are yet to be proven. And new reactor designs have to be proven, built and still need infrastructure and supply chains to support. So, it seems premature to declare new nuclear costs to be a thing of the past.

rip

When looking at annual benefits I suppose you need to omit the new emissions that result from the construction of a windmill, but the wind and solar capacity costs deserve to include the costs of having a coal plant for backup capacity. But they never do.

Wind and solar work great in the aftermath of hurricanes, however, just look at their performance in Puerto Rico. /s

When one starts discussing EVs, one should always use a picture of children in the Congo mining cobalt. Bathos should not be an exclusive for the green blob.

But, but …….. they’re giving up their youth, happiness, chance of an education, health, their lives even, to save the planet. That makes it OK, doesn’t it? I mean, if birds and bats are necessary sacrifices ……….

BTW some of those Congo mines with the weird mineralogy, had a fair bit of uranium. Poor kids are quite possibly getting irradiated too. Ah well, you can’t make an omelette………

/sarc

I just went by the Port of Corpus Christi, and they are still importing windmill blades. I did not know that fossil fish were so well organized, just like a windmill field. What are we going to do with all of these? They are filling up the cotton fields.

Harvesting those subsidies.

You can see them pretty much every day in the Port of Houston too.

If you ever drive out I10 past Ozona, you’ll see windmills in droves, and they aren’t replacing cotton, cattle, or anything else (except birds) out there.

I hate it when there’s a convoy of blade-haulers headed north on I-45… Makes the drive to from Houston to Dallas even worse than normal.

Love the graphic in the pie-chart for Renewables. By the way, typo alert: “Satistical”.

Should be “sartistical”, to make sure the /sarc tag is applied.

Satanistical?

How are you calculating the proved reserves – years of consumption figures? The oil/gas price assumptions would strongly affect both supply and consumption.

BP reserves are as given by individual countries. Some of them dont adhere to the standard used in the US. For example, Venezuela’s highly touted “biggest reserves in the world are bogus (i would say they are about 250 billion barrels too high.

Above I saw a comment that eventually oil reserves are usually higher than initially booked. This is true, but nowadays the industry has a sharper pencil and the amount of future increases will be much less than we have seen in the past.

Another issue which doesnt get mentioned much is that statistics we see include natural gas liquids and other liquids which arent the crude oil and condensate we feed into refineries. The actual volume for refinery feed is a bit less than 82 million barrels of oil per day and is barely increasing. What seems to be happening is a surge in NGL due to much higher gas production, as well as the very high NGL content we see in the light crudes we get from shales (the zones being developed with fractured horizontal wells usually produce light oils because rock quality is really poor, and the commercial producers are rocks with light very low viscosity and overpressured hydrocarbons).

My comment was more theoretical. The question is not ‘how much oil is left,’ but rather, ‘how much is left at $X/bbl.’

A lot…

https://www.forbes.com/sites/judeclemente/2015/06/25/how-much-oil-does-the-world-have-left/#11199eee5b1f

Whether or not the recoverable resources can be converted to reserves depends on product prices and technology.

Proved reserves divided by bbl/yr. This is also called the “RP ratio.”

https://www.bp.com/en/global/corporate/energy-economics/statistical-review-of-world-energy/oil/oil-reserves.html

In the US, proved reserves is the minimum volume of oil that is expected to be produced from a well quantified reservoir. Probable reserves is the most likely volume of oil that is expected to be produced from a well quantified reservoir.

“Proved reserves” are just a tiny fraction of the petroleum resource. It is primarily an accounting measure used in the valuation of oil companies. Publicly traded US oil companies have to “book” proved reserves according to very strict SEC rules.

Here’s a very simplistic example of proved reserves (1P):

Since the well was drilled up-dip to a dry hole with an oil show, the entire volume can be booked as proved because the down-dip well has an oil-water contact.

Here’s a very simplistic example of proved plus probable reserves(2P)

In this scenario, the down-dip well has no oil show, just a wet sandstone. If there is geological or geophysical evidence (e.g. seismic hydrocarbon indicator “HCI”) demonstrating that the hydrocarbon column extends down-dip, the volume below the lowest known oil can be booked as probable reserves. Otherwise, it would have to be categorized as possible reserves.

In some cases, seismic HCI’s can be used to delineate proved reserves.

Proved reserves go up all of the time without additional drilling because well performance converts 2P (50% probability) and some 3P (>10% probability) into 1P. Changing economic conditions can also move contingent resources into the 1P category.

As long as proved reserves and undiscovered resource potential remain steady or rise, each barrel of oil produced pushes Peak Oil further off into the future.

Most reserve additions don’t come from new discoveries. They come from reservoir management and field development operations.

New discoveries are the brown curve at the bottom of the chart.

Most reserve growth comes from revisions and extensions. Revisions can be due to well performance or changes in product prices. Extensions are usually due to step-out, infill drilling and other drilling operations within existing fields. Most of the revisions since 2005 have been product price driven.

A better version of the EIA reserves graph…

This is the point I have been inartfully trying to make – higher energy prices drive spending that increases P1, and it’s not just well performance. On more than one occasion, we shot high-res 3D seismic over fields that had been producing for decades to optimize recovery of the known resource and found significant additional reserves in place.

Just reprocessing 1990’s vintage 3d, over and over again, can do the same trick. We’ve built a couple of companies on that model.

David,

Nice post. Thanks.

But…it’s somewhat depressing to me to see that, from one perspective, you can consider the increase of renewables to have been largely achieved at the expense of nuclear. (“Squinting” at your first chart.) Sigh. You don’t, like, need a strong business development type with nuclear experience in your company, do you?

rip

Yeah. That really sucks. Trading out the most reliable base-load for unicorn farts is not good.

The BP report came out in June. Fossil fuel energy combines the categories coal, oil and gas and can be compared with temperature indices. For example, with Hadcrut4:

Over the last five decades the increase in fossil fuel consumption is dramatic and monotonic, steadily increasing by 227% from 3.5B to 11.5B oil equivalent tons. Meanwhile the GMT record from Hadcrut shows multiple ups and downs with an accumulated rise of 0.9C over 52 years, 6% of the starting value.

https://rclutz.wordpress.com/2018/06/18/2018-update-fossil-fuels-≠-global-warming/

Please don’t compute the percentage increase in temperature in C, from the freezing point. Compute it in K, from absolute zero.

$Trillions and decades later and wind and solar are a blip on the radar screen of energy consumption. And an unreliable blip at that.

“Primary energy consumption growth averaged 2.2% in 2017, up from 1.2 % last year and the fastest since 2013.” How is this average computed? I would simply add all the energy used world-wide and then compare that value to last year’s (2016) and compute the percent increase. It would not be properly an average. Does this imply that the authors averaged all the % growths across all the countries of the world? is that the most reasonable way to determine this value? A small country could double its energy usage, producing a growth of 100%, bias the average, but not really change the totals significantly.

It is ridiculous to even suggest that one would average each country and then take the average of the averages. Go back to algebra101 or maybe arithmetric 101. The overall world average is computed exactly the way you said it is in your 2nd sentence.

Ha ha! Love the unicorn in the background for renewables on the primary energy world consumption chart.

Climate alarmism has accomplished nothing except to displace nuclear power, the one CO2 free baseload power source.

It’s almost funny.

When one looks at the German experience, given the need for fossil fuel back up, it does not appear that wind has achieved any avoidable emissions.

Germany’s CO2 emissions have remained static these past 9 years, even though wind generation capacity has more than doubled in this time,

I have not got a copy of the latest data, but here is the data through to 2016:

http://notrickszone.com/wp-content/uploads/2017/11/Germany-2017-co2-emissions2.png

Has Germany’s GDP remained static these past 9 years?

And what does that have to do with the price of cabbages? Perhaps you would like to tell us what German GDP would have been if CO2 emissions had gone up, or down?

The point being made was that CO2 emissions in Germany had not fallen, when reduction of emissions was supposed to be the point of the enormously expensive exercise.

a picture is worth a thousand words.

Same for graphics. Thx.

Reality sometimes has its somber side.

Data is from EIA. Oil production is monthly crude + condensate 13-month averaged. Export and price data (inflation adjusted from S. Louis Fed) are annual.

Most of the world does not produce oil, and when things are going well oil exports grow. It requires affordable oil prices. Between 2005 and 2014 oil exports did not increase indicating a serious situation to many oil importers.

Since late 2015 we have hit a plateau in oil (C+C) production around 81 mbpd. The increase in demand fueled by affordable oil prices is not producing a corresponding increase in production, and as a result oil price is increasing. Some economies are already slowing as a result, and oil exports will once again stall. The situation in Venezuela and renewed sanctions on Iran are making things worse. Another crisis should ensue in a couple of years unless conditions change.

A look at OPEC spare capacity doesn’t allow for much optimism either. It is very low and at levels that usually support further price increases.

http://www.energyeconomist.com/a6257783p/world/outlook/graphs/clopspar.gif

Remember that Peak Oil is not about how much oil there is in the ground. It is about how much oil we get out of the ground. They are two different things.

Peak oil will occur approximately when we’ve recovered half of the oil we’ll ever recover. We’ve only produced about 17% of the recoverable resources.

That is just a belief. A Seneca cliff is also possible.

That’s the definition of Peak Oil…

https://debunkhouse.files.wordpress.com/2017/03/1956_hubbert.pdf

First we have to agree on definitions. To me (and most people), Peak Oil takes place when oil production reaches its highest level, usually on monthly or annual data.

With your definition of half of the oil recovered, Peak Oil might not coincide with the time of maximal production, and for as long as there is production it is not possible to determine when Peak Oil took place, as the half point keeps moving.

Oil production is currently around 95 million bbl/d.

https://www.eia.gov/tools/faqs/faq.php?id=709&t=6

Condensate is a natural gas liquid recovered at the wellhead, rather than midstream. It’s all counted as oil production.

Crude oil is the strictest definition, but some sources do not separate crude oil from condensate, so we only have a number for C+C. NGL are not the same thing, they are short C-chain molecules that can be gas or liquid depending on conditions.

https://www.eia.gov/totalenergy/data/browser/index.php?tbl=T11.01B#/?f=M&start=200001

World Crude Oil Production (table 11b) for May 2018 is 81.223 mbpd. It was 81.229 for November 2015.

Condensate and some other NGL’s are effectively natural gasoline and superior refinery feedstock.

You can break the production down anyway you wanr, but the current global oil production is around 95 million bbl/d.

https://www.eia.gov/tools/faqs/faq.php?id=709&t=6

This includes crude oil of all types, diluted bitumen (dilbit), wellhead condensate and NGL.

The concept is “Peak Oil”… not “Peak Crude Oil”, “Peak Conventional Oil” or “Peak Onshore Oil.”

https://debunkhouse.files.wordpress.com/2017/03/1956_hubbert.pdf

It is not me that breaks down production that way:

“Crude oil is a mixture of hydrocarbons that exists as a liquid in underground geologic formations and remains a liquid when brought to the surface. Petroleum products are produced from the processing of crude oil and other liquids at petroleum refineries, from the extraction of liquid hydrocarbons at natural gas processing plants, and from the production of finished petroleum products at blending facilities. Petroleum is a broad category that includes both crude oil and petroleum products. The terms oil and petroleum are sometimes used interchangeably.”

https://www.eia.gov/tools/faqs/faq.php?id=40&t=6

Crude oil is the stuff we have been extracting since the 19th C. Peak Oil was defined on that, since at the time the other liquids were negligible. While our economy can accept the addition of other liquids, it is like adding alcohol to gasoline, only to a certain point. That’s why I think it makes more sense to track crude oil, and the EIA does that in its table 11b.

https://www.eia.gov/totalenergy/data/browser/index.php?tbl=T11.01B#/?f=M&start=200001

And I don’t think you get to decide which concepts fly and which don’t. Each concept has its usefulness and conveys information. The important thing is to define and use them properly, not to confound people.

One man’s crisis is another man’s bull market.

Always is.

I am sure a few people made a fortune during the Great Depression, but for the great majority it was a very tough period.

I was recently learning more about the various methods of mining coal from under the ground, and never realized an obvious truth: Much, and in many cases most, of the coal in a coal seam is never brought to the surface…to do so is too dangerous.

Long wall mining can removed a larger percentage than other methods, but even then a lot of coal has to be left behind to prevent the miners from being burred alive in a cave in.

And deeper seams of coal, especially those that are below a given thickness or purity level, are uneconomical to mine at all.

And so, it seems that at some point old closed mines will become targets of new methodology to get what is there out of the ground.

The more one considers the limitations of even the most modern methods and efforts to get fossil fuels out of the ground, the more obvious it is, without even asserting that official estimates of total untapped resources in the ground are absurdly low, that we will not be running out, in any strict meaning of the phrase, for a very long time.

If one is so inclined, I ask that someone comment on whether, regarding the following, I am on the right track:

This is regarding the above image titled: 53rd Consecutive Year: Peak Oil and Gas Are Still Just Over the Horizon

It shows that, at current rates of crude consumption, globally, we have 47 years of proved reserves. OTOH, estimated crude resources — and I do appreciate the fact that, by definition, getting a good handle on such is a magnitude is a much more challenging effort — may suggest that, over time, with market, technical innovation and other changes taken into account, we have well more than 100-200 years of global production life?

This is assuming that currently, we have a fair estimate of maximum ultimate resource volume; with the big questions being … what are to be the future drivers of both production and consumption? Ultimately, such drivers will be the demand [and this implies competition from other energy types, and, above all, economics] and potential new technology.

PS: many years ago, when I first became interested in petroleum geology, I will always remember the professor telling us: the petroleum business — actually, all extractive industry businesses — will start to go out of business as soon as the first barrel-full, bucket-full or etc … came out of the ground. Such has not changed; it’s largely a matter of time and human innovation … and needs.

PS: Dave, as usual: very good post! Thank you.

Sent a link to DERSPIEGEL now.

http://www.spiegel.de/wissenschaft/technik/co2-speicherung-peter-altmaier-laesst-umstrittene-technik-pruefen-a-1226697.html