The world has anticipated the “rapid exhaustion” of crude oil supplies for at least 100 years.

Will it go on being close to running out of crude for the next 100?

“Peak Oil” — the idea that global oil production will soon reach a maximum and then begin to decline — attracted a significant number of believers in the 1990s and early 2000s.

Then unconventionals happened.

Unconventional resource production blossomed in the United States. With rising crude production, the U.S. stopped soaking up the world’s excess oil supply.

Instead of cutting back crude production to balance the market, Saudi Arabia increased production to protect its market share.

And ta-da! — we got a global glut of crude and liquids, along with a truly major price collapse. Today, you are more likely to hear people talk about a possible worldwide peak in oil demand rather than a peak in oil production.

But the principal arguments for Peak Oil haven’t changed much.

[…]

Doomsday Averted

The concept of Peak Oil developed from a theory put forth by American geoscientist M. King Hubbert. Based on overall reserve estimates and the pattern and history of field discoveries in the United States, Hubbert created a composite, mega-decline curve that predicted U.S. crude oil production would peak in the 1965-70 time period.

And U.S. oil production did reach a peak, a little later than the original Hubbert curve predicted. But with the discovery of North Slope oil in Alaska, production began to increase again. The domestic Peak Oil estimate was re-labeled as a Lower 48 prediction.

Now, it appears that Hubbert’s approach predicts a profile for conventional oil production in a defined geographic area, when technological development and oil prices remain within limited bounds.

“When people ask, ‘How much oil is there?’ the answer is, ‘At what price?,’” Sternbach noted. “Things like tar sands could release huge amounts of oil at the right price.”

Breakthroughs in technology, especially horizontal drilling plus hydraulic fracturing — call it “hydrozontal development” — combined with today’s improved exploration and production tools have reversed the U.S. oil production decline.

In its June energy outlook, the U.S. Energy Information Agency forecast that U.S. crude production will reach an all-time high of more than 10 million barrels per day (b/d) in 2018, along with 4.19 million b/d of natural gas liquids and 1.02 million b/d of ethanol.

Instead of Peak Oil, the world has gotten a peek at a new energy future.

Innovation is “ increasing the value of the resources and it’s reducing the cost of getting to them. When those two things combine, you get to a sweet spot,” Sternbach said. “That’s a paradigm shift that creates waves of increased value.”

Figure 1. The original Hubbert curve displayed with modern graphics (AAPG Explorer)

Hubbert’s original 1956 paper can be accessed here.

Hubbert fits the growth and decay of oil production to a logistic function (Hubbert Math).

“Peak Oil” is a basic function of resource extraction. Peak resource production generally occurs when nearly half of the recoverable resource has been extracted. This example from Eugene Island 330 field in the Gulf of Mexico is a good example:

Figure 2. Eugene Island 330 Field, rate vs cumulative production (Source: The Oil Drum)… (Before anyone prattles on about The Oil Drum being a Peak Oil propaganda site, the EI 330 graph is accurate. I can reproduce it from production data available to anyone with a licence to Lexco’s OWL database.)

EI 330’s first peak occurs at roughly the half-way point in the extraction of the first 250 million barrels of oil. Old fields, particularly large old fields, will often exhibit multiple secondary production peaks. In the case of Eugene Island 330, the secondary peaks were due to a combination of well recompletions, sidetracks and limited recharge of some of the reservoirs (No, this is not evidence of abiotic oil).

The Hubbert equation is a valid method of predicting the peak rate of resource extraction. So, the the fact that “the world keeps not running out of oil” doesn’t invalidate the equation or the concept of “Peak Oil.”

Where Hubbert went wrong:

SEP 8, 2016

Robert Rapier , CONTRIBUTOR

What Hubbert Got Really Wrong About Oil

[…]

Hubbert’s fame in peak oil circles comes primarily from the assertion that he accurately predicted the 1970 U.S. peak. Because of this prediction, Hubbert is widely-regarded among peak oil adherents as a visionary. He has been called an oracle and a prophet. A recently published article — What Hubbert And Pickens Got Right About Oil, And What’s Next — recounts the uncanny accuracy of his prediction.

The truth, however, is much more nuanced. Hubbert got a lot of things tremendously wrong, and his much-heralded 1970 prediction contains a large caveat of which most people are entirely unaware. Here is what his 1956 paper actually stated.

Hubbert estimated that the ultimate potential reserve of the Lower 48 U.S. states and offshore areas was 150 billion barrels of oil. Based on that reserve estimate, the 6.6 million barrels per day (bpd) extraction rate in 1955, and the fact that 52.5 billion barrels of oil had been cumulatively produced in the U.S. already, Hubbert estimated that oil production in the U.S. would reach maximum production in 1965. That was his base prediction. He wrote “the curve must culminate at about 1965 and then must decline at a rate comparable to its earlier rate of growth.” Hubbert illustrated this 1965 peak in his paper:

Source: Nuclear Energy and the Fossil Fuels by M. King Hubbert

As shown in the illustration, Hubbert projected a U.S. oil production peak in 1965 at an annual production rate of about 2.8 billion barrels, or 7.7 million barrels per day (bpd). However, note that there is another curve rising above and extending beyond the 1965 peak. This was Hubbert’s “contingency case.” He calculated that if the U.S. oil reserve was 200 billion barrels, peak production would occur in 1970, a delay of five years from his base case. However, he indicated skepticism about the reserve being that high, noting that this would imply “an amount equal to eight East Texas oil fields” beyond the 150 billion barrel estimate. Nevertheless, if the U.S. reserve was as high as 200 billion barrels Hubbert estimated a 1970 U.S. oil production peak at 3 billion barrels, or 8.2 million bpd. Oil production in the U.S. did in fact peak in 1970, albeit at 9.6 million bpd.

While Hubbert’s prediction was in the ballpark, those who cite him don’t seem to be aware that his “perfect” 1970 prediction was based on a secondary case about which he expressed skepticism, and it was about 15% too low on the production rate. Hubbert’s base case — a prediction made in 1956 of a 1965 peak — was off by 5 years and was 20% too low . Or to put it another way, his base case at that time was that U.S. oil production would peak in 9 years, but it actually peaked after 14 years and at 15% higher production than projected.

My point here is to address his oil production predictions based on what he actually wrote. Still, as someone who frequently makes predictions, I will say that his predictions about U.S. oil production were pretty good. They weren’t prophetic, or nearly as exact as many peak oil adherents claim. But they were in the ballpark.

Yet when we look at what he had to say about global production and natural gas production, his predictions were way off the mark. He arrived at an estimate of the ultimate conventional oil production of the world by comparing a number of estimates. He settled on an estimate of 1.25 trillion barrels for the ultimate potential conventional oil production. We now know that this estimate was far too low. But based on this estimate, Hubbert projected that the global peak in crude oil production would occur around the year 2000 at 34 million bpd . In reality, crude oil production in 2000 was more than twice as high at about 75 million bpd. Further, while conventional crude oil production did flatten around 2005, more than a decade later there is no evidence that it has begun to decline. (Overall global production has continued to grow, primarily because of the rise of shale oil production). So this was a big miss.

Hubbert’s defenders will argue that he only really missed the date of the conventional crude oil peak by 5 years. But, his methodology specifies a peak and decline. That is not what we have seen. In fact, until conventional crude begins to decline in earnest we really don’t know how far off the mark his peak 2000 prediction may be.

Hubbert simply underestimated the total volume of recoverable oil (past production + proved reserves + future discoveries).

Figure 3. Hubbert Curve, US. with 2014 production, reserves and undiscovered estimate.

If we assume that U.S. proved oil reserves and the undiscovered recoverable resource stopped growing, the Hubbert “peak” for the U.S. would have occurred in 2004. Bear in mind that the Hubbert curve is not meant to be an exact fit to the data. “Hubbert math” fits the data to the curve. The “Hubbert peak” would have occurred in between the two actual peaks in the data. An alternative approach would be to break the production down into two phases, with two separate logistic functions. Either way, if proved reserves and the estimated undiscovered recoverable resource stopped growing, we would currently be in the neighborhood of Peak Oil.

The world has anticipated the “rapid exhaustion” of crude oil supplies for at least 100 years.

Will it go on being close to running out of crude for the next 100?

Since proved reserves will likely continue to grow over time and the total undiscovered resource is unlikely to contract, Peak Oil will likely remain just over the horizon for the foreseeable future. So, the answer is a qualified “yes.” People who fail to grasp the concept of Peak Oil will continue to anticipate the “rapid exhaustion” of crude oil for many years to come.

In the interest of full disclosure: I have been employed in the U.S. oil industry as a geophysicist/geologist since 1981, with a six-year exile into management. I have always worked for “little oil” (as opposed to BIG OIL). I am a member of the American Association of Petroleum Geologists (AAPG), Society of Exploration Geophysicists (SEG) and Houston Geological Society (HGS). Despite my penchant for ridiculing greenschist, green is actually my favorite color… Oil is colored green on maps and well logs. Peak Oil is real but not really very relevant, abiotic oil is possible (despite a total lack of evidence for it) and is also irrelevant. Neither the reality of Peak Oil nor the lack of evidence of abiotic oil are part of a conspiracy to keep oil prices high. If it was, it would be a pretty p!$$ poor conspiracy because oil prices have been low for most of my career. And, no, ExxonMobil is not hiding the secret formula for turning (fill in the blank) into oil… But they did know all about Gorebal Warming waaay before Al Gore invented it… They knew it was wrong.

As usual any and all sarcasm was purely intentional… Except for the bit about Gorebal Warming.

Indeed. I remember as a kid that we were going to run out of oil by the year 2000, and had to switch to alternate fuels NOW before it was too late.

In the real world, demand for oil is about to collapse thanks to telepresense, local manufacturing, and similar technologies that eliminate the need to ship people and goods around the planet.

In a few decades, all manufacturing will be local because there’ll be no other choice. If you’re living on an asteroid, you’re not going to spend millions of dollars to ship $10 worth of spare parts from Earth, and, if it was for an essential system, you’d probably be dead before they arrived.

There might be a market for shipping raw materials around, but it’s more likely that people will simply live where the raw materials are.

MarkG, disagree. Raw materials for what, exactly? There are very few, if any, places on Earth that have all materials needed to manufacture anything in its entirety. Different locations, different resources. That’s why trade routes were established millennia ago and still exist.

I think MarkG is referring to the local manufacture of artisan cheeses, craft beers and tourist trinkets. He seems to have little understanding of how the industrial world works.

MarkG, complete and utter BS. There is absolutely nothing on the horizon that is going to cause much of an increase in shipping costs, and many things that could bring shipping costs down.

Communications may reduce the need for personal business travel, however, there will always be a need to ship goods around the world. Local manufacturing will never be creating the same goods everywhere. There is no economy of scale to justify making 100 cars , or any other large durable good for the nearby town in a “local” factory.

There is no economy of scale to justify making 100 cars , or any other large durable good for the nearby town in a “local” factory.

For now.

When nanotech assemblers get going that stuff will also get made anywhere the base materials are available, much like a 3d printer can currently print a model anywhere.

Micro6500, I am rather deeply involved in deposition manufacturing (AKA 3-D printing). I can say with near certainty that this technology is VERY FAR from mass manufacturing or making any durable components let alone assemblies. Anyone who thinks they are competitive has no knowledge of what large scale manufacturing is. True many small parts can be made, yet the engineering quality of these parts leaves much to be desired, and the fabrication rate is incredibly slow. The material strength is poor at best, and no matter the hype, metallic components are far from useful. Yes they can “grow” many parts to make a gun, yet I would not want to be near the thing when it gets tested. The quality of sintered metallic parts is well below that of poor sand castings. Durable….not so much.

Where large scale machine tooling can stamp-out fender after fender and frame after frame the lowly 3-d printer is still “printing” the “scaffolding” needed to support the part it eventually will grow.

Give them a few decades and there will be inroads for plastic components made using this method, however the costs had better come down drastically. They may supply parts to an assembly line, but they will never become an assembly line.

Rocket,

I am familiar with their limitations, I was speaking in longer terms, a few decades (which go by surprisingly fast). Drexler forecasted assemblers by ~2025, and much of his other forecasts have done pretty well. So, it’s only a matter of time before 3d printers converge to the atomic scale, somehow. IMO

RS,

Even if we assume that all of the material limitations with additive manufacturing can be fixed (they probably can), it will still be a niche application for customized, low run-rate parts. You simply can’t beat stamping, molding, or forging standard parts for high volume applications.

I just found this, thought of you 🙂 https://youtu.be/vPv7PwS50OE

3d printed metal parts, suitable for both small scale and small volume manufacturing.

Nowish, as no one as build a factory full of them yet, and even starting now would take a few years.

I still forecast LENR (aka cold fusion) will have two major demonstrations this year. Rossi’s QuarkX and BLP’s SunCell. That at least one of those will become commercial in 2018.

“In the real world, demand for oil is about to collapse thanks to telepresense, local manufacturing, and similar technologies that eliminate the need to ship people and goods around the planet.”

Actually, in the real world, most of the world “exported” their manufacturing capacity to China. It took a few decades, but it is more or less now complete. China now has the critical mass to produce everything. They have a large and growing domestic market which can bootstrap consumption as well as the entire world as their export market. Ever larger container ships lower the cost per unit for freight. Idiotic governmental agreements have done even more. It is cheaper to ship a small package (called an E-Packet) from China to the United States than it is to ship from inside one state to my neighbor next door. Thank your brilliant government negotiators at the US Post Office for that insanity.

The only thing that might disrupt the existing dynamic is additive manufacturing. But we are nowhere near that being able to compete with mass production.

@MarkG:

I would guess you have neither traveled much nor built much.

The majority of folks “on the road” at any time are not doing it for work. Tourism dominates. Of those doing it for work, most are management, sales, training, or actual workers. I’ve been all of them. Tourism doesn’t work remotely…

Training via remote means has existed since the first books. Computer based since the 70s that I know of personally. Yet classes still have instructors… Sales fairly obviously still benefits from personal persuasion.

Management types all learn the value of personal presence. From reading body language to informal side discussions to physical site inspection. Yes, I’ve remotely managed projects and can make it work… for simple things that are well characterized… I’d guess you can get about a 25% reduction in “presence” before it hurts. Then there’s things like equipment installation, repair, and property inspection / buying. Not much can be done to reduce that, or construction travel .

Any drop in those costs from reduced travel will tend to result in more demand (basic economics of price elasticity of demand) for the product until the non-mitigated costs, like travel, establish a new equilibrium at higher levels. (Fancy way of saying cut cost of training 20% folks buy more and even if only the sales part still takes travel, that part of the travel increases.)

So don’t expect travel costs to plunge any time soon. Folks have already harvested most of what can be done as remote work.

Then the idea of manufacture via nanites is going to be real any time soon or local manufacture via robots is going to take over… just silly. Major economies of scale accrue to Finance and Marketing (branding). The Big Guys can buy the same tech, but cheaper, and dominate shelf space and brand preferences. That’s why there is a McDonald’s and Starbucks on every corner, not a million different Mom & Pops. There is no significant economy of scale in restaurant operations beyond one stove and cook, yet magachains dominate outside the top level where exclusivity drives unique product. Most other manufactures have big physical economies of scale.

What sorts them? Tranport costs. For centuries, transport costs have been dropping so centralized manufacturing grows. Megaships and containers now make transport so cheap as to be nearly irrelevant. Note that most oil goes to air and road transport. Ships use the cheapest leftovers ( bunker fuels ) of the refining process. For this reason, despite living where peaches are grown and canned, my local store carries canned peaches from China. Lower cost to make there and transport costs now irrelevant.

Most folks do NOT want to take on the set-up, clean-up, and maintenance of DIY production. You see this in things as simple as cooking and lawn care. We are not going to be making our own shoes like granddad did, even with a robot. Just like we don’t want to mow or make sushi from scratch at home. (I’ve done both, but usually buy when possible). Heck, a home espresso machine is $50 on Amazon. I could pay for it with a half dozen displaced Starbucks visits… yet I keep buying my Mocha… If that’s the case, why would I want to make my own pots and pans at home?

No, the plunging transort costs mean we buy ever more stuff from Amazon, delivered via transport, that they buy from a big global maker, with centralized economies of scale in finance, marketing, resource buying, equipment buying and operation, and management. Local retail shopping being hit, but not moving us to local making. More transport (goods from China to here and Amazon to the home) less local manufacturing.

Any reduction of fuel costs will increase that trend, too. Your stated crash of oil prices makes for more remote centralized manufacture…

BTW, a massive rise in transport costs could drive manufacturing more locally. But that would require we forget how to build megaships and do containerized shipping… not likely to happen. I’d even go so far as to predict robotic cranes loading robotic ships driving shipping costs even lower…

In the Port of Los Angeles, San Pedro and Long Beach they are transitioning to robotic cranes to load and unload the ships. They also have dedicated rail lines that run 75 miles inland to carry those containers to Amazon, Target, Home Depot and other Mega D.C.’s built where the land is cheap.

Hell, I remember being force-fed stuff like “The Fate of the Earth”, “Entropy”, and “The Day After” (not “The Day After TOMORROW”…that was a different piece of crap) in high school back in the 80s.

Ronnie had his finger on the nuclear trigger, we were running out of EVERYTHING, there were too many people. Etc. Repeat as needed.

I wonder how many of my teachers, who have since gone to a well-funded retirement, have travelled extensively, lived at the cottage in leisure…

Its almost child abuse, when you think about it.

You must be dreaming. Just wait for the US Middle Class to recuperate from the onslought that left them with empty wallets. When America is made Great Again, so will the consumption of energy. Just hammer this into your brain. The wealth and prosperity of a nation is determined by the amount of energy they are able to consume. Energy low, like North Korea, no lights and poverty on the level of starvation. Energy high, rich, prospoerous populations. Also read UN Agenda 21/30 and http://green-agenda.com to understand what really is going on. Absolutly no need for alternate fuels. We have for many hundreds of years coal, oil and gas available so time enough to think of real alternatives that won’t cost us an arm and an leg to no avail, Just saying.

Scott

July 10, 2017 6:39 am

How do interest rates figure into this? The US production curves seem to see a leap coinciding with ZIRP. If interest rates weren’t articicially near zero, are the economics still such that producers would still be able to borrow the sums necessary to develop the unconventional reserves?

‘People who fail to grasp the concept of Peak Oil will continue to anticipate the “rapid exhaustion” of crude oil for many years to come.’

People who use it as a prop to implement their world view will never let it go, either. Peak Oilers WANT us to run out.

There is still oil even the “exhausted” oldest oil fields in Pennsylvania. The oil could be recovered by using a CO2 flood. And then there is even more oil after that, waiting for the right technology and price to produce it.

Perhaps we should consider a Carbon Tax. This could effectively raise the price of oil to the point that the recoverable oil reserve doubles pushing Peak Oil out another couple of centuries

Nearly a century before Hubbert started worrying about the United States running out of oil the British economist William Stanley Jevons was worrying about Britain running out of coal.

The Coal Question https://en.wikipedia.org/wiki/The_Coal_Question I must point out the painful fact that such a rate of growth will before long render our consumption of coal comparable with the total supply. In the increasing depth and difficulty of coal mining we shall meet that vague, but inevitable boundary that will stop our progress.

Although Britain only has a very small coal mining industry today, using open cast pits, deep coal mining did not come to an end because we ran out of coal. It ended partly because other sources of energy such as natural gas were cheaper and partly because of environmental concerns.

The United States Geological Survey (USGS) has conducted a series of studies on the economic accessibility of coal in the major coal producing regions of the country. The studies have typically found that only a small fraction of the coal will be economically accessible at the current price of $10.47/ton. In August 2008, the USGS issued an updated assessment of coal in the Powder River Basin.[7] After considering stripping ratios and production costs, the USGS concluded that at the time of the economic evaluation, only 6 percent of the original resource, or 10.1 billion short tons of coal, was currently economically recoverable. At a price of $60/ton, roughly half (48%) of the coal is economic to produce.

https://en.wikipedia.org/wiki/Powder_River_Basin

PRB Coal = 8,500 btu/lb = 17,000,000 btu/ton

$10.47/ton = $0.62/mmbtu

$60.00/ton = $3.53/mmbtu

Natural gas is currently around $3.00/mmbtu. Most shale plays have a break-even price of ~$3.50/mmbtu and require ~$5.50/mmbtu to generate a decent return on capital.

Coal is a helluva lot more economic than most people think.

Roy and Rob:

Cost and environmental concerns were NOT relevant to the closure of the UK coal mining industry.

Members of the British Association of Colliery Management (BACM) fulfilled the task of closing the UK coal mining industry which was imposed by the then UK government for purely political reasons. At that time UK coal was the cheapest fuel (i.e. both lowest cost and lowest price) available to UK coal-fired power stations.

I was the National Vice-President of BACM.

Richard

See richardscourtney’s comment.

The Stone Age did not end because they ran out of stone, neither did the Iron Age.

It’s either the advent of a new technology and the markets as in the end of the horse or politics as in the UK coal example.

It is the latter route the water melon eco Stalinists have been pushing for some 30 years to get the industrialized democracies to forego the use of hydrocarbon energy sources – by hijacking science for socio- political ends.

The production of any commodity depends on price and cost of production or profit for short. Just look at gold rush on tv. They are recovering gold that 50 years ago would be left in the ground.

The ‘environmental concerns’ were primarily Global Warming, which Thatcher invented because the mining unions were run by raving lefties who’d used their power on many occasions to force the government to give in to their demands (which was one reason that British coal became more expensive than other fuels, including foreign coal).

MarkG:

Thatcher did create the global warming scare but for much more personal reasons than those you assert. However, her political party were willing to accept (at least, to not oppose) her promotion of the global warming scare because they blamed the National Union of Mineworkers (NUM) for the collapse of the extremely incompetent Heath government, and the scare was ‘anti-coal’.

I provide and explain the facts of these matters here.

Richard

Right, but the UK is still importing coal, exporting garbage which is burned in the Netherlands and big, big worries about the liability of the grid. Looks to me the UK desperately needs a renaissence of coal plants. Nobody will notice since modern plants hardly produce any emissions besides a little water vapor.

arthur4563

July 10, 2017 6:44 am

What’s really making this whole issue pretty much irrelevant is the imminent decline of gas powered vehicles. The other day Volvo stated that it will not produce gas powered vehicles after 2018 and BMW announced their new i3 sedan, which will hit the showrooms next month as a Tesla Model 3 fighter, a car that has a waiting list of over 500,000, all putting down a $1,000 deposit and a similar $30K something list price. Also the news that automakers are in the process of creating 135 electric car models, many simply electric versions of existing gas powered models. Almost all of this is due to the current lower battery prices, and very good reason to believe they will fall even further. The fate of gas powered vehicles lies almost entirely in the hands of the price level of lithium batteries.

There are about 2 billion cars in the world. 2 million are electric (0.1%). EV’s are increasing at a global rate of about 230,000 vehicles per year. That puts them on track to cross the 1% mark by 2095.

Even if EV’s expanded at an annual rate of 15%, they won’t hit the 3% mark before 2040.

Wake me up when EV growth ceases to be 1) linear and/or 2) insignificant.

Volco has just passed the bankruptcy. If the great presidents from that large country across the Pacific were not allowed to cheat Volco, it would now be dead. Compared to the major European manufacturers VW, Mercedes-Benz, Audi, Renault, Fiat, Skoda, Volvo is a garden dwarf. But that was also before the almost broke already so.

Volvo has made some great cars over the years. I think that they are going to suffer from this decision to move to all hybrid/EV vehicles in such a short time frame. On the other hand, Tesla is also in for a world of hurt as the competition from established automakers should crimp Musk’s high hopes to dominate the EV market in the US.

This “imminent decline” is driven not so much by market forces as by regulation and taxation. If petrol was not heavily taxed, and CAGW propaganda had not turned everyone’s brain into mush, then electric cars would be irrelevant.

I’m not opposed to electric cars in principle – if they work well and can be run at competitive prices, then why not. However, here in Ontario for example our heavily indebted government doles out thousands to every buyer of an electric car. This is lunacy.

I’ll go electric when they produce a vehicle with 3/4 to 1 ton carry capacity and cost less than currently available Pickups/vans. Oh, and not battery dependent, got to have its own electric generator. Till then I will stick to real vehicles, not little charge up toys.

arthur4563 wrote, “The other day Volvo stated that it will not produce gas powered vehicles after 2018 … ”

That is not what Volvo stated. Volvo Cars, the premium car maker, has announced that every Volvo it launches from 2019 will have an electric motor, marking the historic end of cars that only have an internal combustion engine [ … ] Volvo Cars will introduce a portfolio of electrified cars across its model range, embracing fully electric cars, plug in hybrid cars and mild hybrid cars. https://www.media.volvocars.com/us/en-us/media/pressreleases/210058/volvo-cars-to-go-all-electric

Many media outlets were fooled. Volvo Discovers Electric-Vehicle Hype

The Swedish car maker isn’t giving up on gasoline. It’s redefining its niche. https://www.wsj.com/articles/volvo-discovers-electric-vehicle-hype-1499462079

Rv. ” Volvo Cars, the premium car maker, has announced that every Volvo it launches from 2019 will have an electric motor,”.

My 2000 Buick Regal has at least 8 electric motors. My 1966 Impala SS 396 had two electric motors. I guess they could make a heater fan work with vacume motors like our 1955 ford windshield wipers did but I prefer my cars with many electric motors. None of them driving the wheels of course. I did drive my battery powered scooter 1.9 miles to work for a couple of years. Just about the time I was breaking even with saving gas , I had to buy new batterys. The scooter is for sale right now but no one is interested. It’s on it’s fourth set of batterys, about 280 dollars worth. It is my first and last electric vehicle.

Almost every automobile sold today has electric motors (several in fact):

fans, pumps, wiper motors, window mechanisms, mirror actuators, etc.

For that matter all Detroit’s vehicles adhere to Volvo’s announcement.

Lets wait and see how disingenuous Volvo intends to be.

Strange how that works….

Wife had a scooter… when we needed new batteries, it got dumped…

I’ve got 3 laptops with dead batteries. Convinced me to never buy a car with lithium batteries….

I suspect A Lot of folks have personal experiences with battery death ending device life… and remember that when looking at cars….

The early Honda Insight is a fantastic tech demonstrator that got 60 mpg. They show up on Craigslist at about $2000 asking price. Almost all stating either the main battery needs replacing, or was replaced a few years back. It does run with a bad pack, but is just an underpowered 3 cly with ok milage… Battery Packs are not cheap, or I would have bought one… I just look at the ads and remember my laptops…

Battery powered tools!!!!!! Makita, DeWalt, Black&Decker, Porter Cable, etc, definitely influenced my opinion of charged battery systems. Oh, and lets us not be forgetting CELL PHONES and their crappy assed batteries. I run my laptops on cords, majority of time, so they get a pass.

Of course, most Volvo fans have a realistic view on what’s going on and they don’t like electric plug in BS no matter what Volvo states about their client base wishes. They want a tank with a reliable engine and the flexibility to go anywhere without limitations. Yes, I have a Volvo too.

The “latest” numbers (370,000) in the Washington Post article are from over a year ago. Nobody actually knows how many reservations there are for the Tesla Model 3, because they haven’t disclosed that number since last year.

Electric cars won’t be taking over the world until they have a range of 400 miles or so (like a gas/diesel-powered car) and can be “refueled” in 5 minutes like a gas/diesel-powered car.

The 400 mile range can already be accomplished with the Hybrid efficient generator. Probably the majority of Volvo sales will be Hybrids of some form. I think the headline Volvo used was a bit rich implying they were abandoning the ICE engine, but in reality it will just be a smaller more efficient ICE engine running a generator that can charge a smaller battery pack when needed.

Best of both worlds. The hybrid engine runs at max efficiency while making A/C in summer or winter heat viable to heat cabin or battery pack. It also allows for a smaller battery that can still be 100% electric on shorter commuter trips, which the majority of car trips are already, but allows for longer road trips with the aux hybrid generator running. No range anxiety with this alternative to the current status quo.

The plugin hybrid electric car is IMO, the best alternative to what makes practical sense, and one that already has all the infrastructure in place to accommodate. For cities like LA or Beijing with a real air pollution problem, this really makes sense. Plus it is better efficiency overall, so some savings for the consumer on fuel when in hybrid mode and electricity is fairly efficient and can be produced outside of a city by conventional current methods, alleviating a lot of the air pollution for the big city. For these reasons, I think the plugin hybrid is a winner and should be the model we turn to.

Hybrids don’t make practical sense because the battery pack has to be replaced every 7 years or so. That is similar in cost to replacing a car’s gas engine, which typically last 2 to 3 times longer. The modest boost in mpg doesn’t make that extra cost worth it.

Power large construction and farming equipment, powered from lithium batteries? Come on.

Agriculture, 18% of CO2 emissions. What are we going to do stop eating?

Airplanes? (10% of CO2 emissions and steadily growing.)

200 mile limit for all electric vehicle?

If there is no issue with AGW and if it is shown (CO2 levels will fall when the temperature falls) that only 17% of the recent rise in atmospheric CO2 is do the anthropogenic CO2, will it be necessary to force people to purchase tiny electric vehicles that have a range of 200 miles?

Oh and the planet is going to abruptly cool, so the issue of AGW is going to be replaced with what the heck is happening to the sun and the climate.

Correction, post 2018 Volvo will not build any vehicles that do not have an electric drive, but will continue to fit gasoline and diesel engines in the majority of them. Eg hybrids. This is exactly what the European fuel consumption targets are seeking to happen. No surprise, and certainly not evidence of the end of the internal combustion engine.

There are no EU fuel consumption targets, all the BS comes from the UN. EU is totally obsolete and in desperate need to be side tracked and left to die.

“The fate of gas powered vehicles lies almost entirely in the hands of the price level of lithium batteries.”

Uh actually, no. It depends on the development of new feasible battery technology that will make EVs as useful as petroleum fueled cars..

Battery technology is a mature industry – 150 years and counting. Any foreseeable technology increase will be marginal.

Physics and available materials limits any major breakthrough. Batteries already use the optimal available element. Manufactures are already pushing the boundaries of physics – note the amount of battery fires and exploding batteries.

The major breakthrough is in micro technology which require less and less power. Cell technology is made to fit this.

Sheer horsepower requires long life high capacity – inversely related to physics in battery construction

Turbine electric propulsion. Highly efficient, clean burning and practically maintenance free. That is the future. The turbine runs on any fuel. All we need is a small reliable battery able to handle high charging capacities. See Techrules.cn and https://www.youtube.com/watch?v=F4H3FE0Z4QQ

arthur4563

You’re confusing straightforward market segment re-branding on Volvo’s part driven in part by the fact that it’s Chinese owned, with wishful greenie thinking.

Tesla’s Hong Kong sales for June, 2017 fell to zero [0] after the local government canned EV subsidies. Essentially the same thing happened a couple of months ago in Denmark when the government there started imposing the same mind boggling 180% import tax [no Josephine, that’s not a typo..] on EVs as on conventional cars.

Musk is in heading nostril deep into caca doohdooh…

I don’t see much market for purely electric cars. Even the best have too limited a range, even in summer(much less winter) to be used more than just locally. I read one blogger taking their Tesla across country. Every leg of the journey had as much planning as a private pilot has to do for a cross country trip- travel times, traffic, charging stations, price of a charge at an unsubsidized outlet, alternate stops for every stop. Mind boggling.

At this stage of the game, the best alternate is a hybrid vehicle. Unlimited range. The battery recoups a goodly fraction of all the energy spent going up hills, same for regenerative breaking, transparent battery management etc. The only downside is the inflated prices currently being charged. Evidently the car companies are trying to recoup all their development costs in the first couple of years. If BMW and Chrysler can build them as well as Toyota does there will be some real competition.

Dr. Bob

July 10, 2017 6:49 am

One way to look at crude is the economic cost in real terms. Correction of the value of crude for inflation gives a societal cost of the commodity. In this case, crude has not changed in value significantly since the 1980’s.

Using USinflationcalculator.com data from 1913 to present and august 1983 = 100 CPI, crude is now worth $20.15/bbl for Brent and slightly less for WTI. This is essentially the same price in the late 1980’s.

I wanted to post a chart but I cannot copy and past into this site. Suggestions on how to paste images into a reply would be helpful.

That there will come a time when there is no more oil at a price that is competitive with the alternatives is a given.

When that time will come is anybody’s guess. And that’s all that people are doing.

It really amazes me how emotionally committed some people are to the notion that we are about to run out of oil.

I don’t know, there must have been some survivors of ship B as I think I just saw one on CNN and there’s one talking on Fox News business channel right now!

Peak oil is not about the amount of reserves in the ground.

Its defined as the period where it takes the an uneconomical amount of energy to get one barrel of oil out of the reserve to the end user.

This ratio has been narrowing down for years.

– As the famous saying goes – The easy oil is gone.

The current “tight and unconventional”oil is propped up by the money printing press conjuring up dollars out of thin air.

Alternatitive energy can’t exist without fossil fuels.

And then. You have better get used to living like Fred Flinstone. Your whole lifestyle is made up of fossil fuel derived products – plastics. Have a look around you and check how much plastic is in your lives.

EROI has not been monotonically declining for Oil. It goes down and up as a dance between depletion of certain geographic resources and progress in extraction technology and infrastructure and other fruit of capital investment. The first U.S. commercial oil at 70 foot depth was not easy to extract as drilling was done by 5 men bobbing a fishtail bit up and down on a spring pole in a laborious effort that could only make 2 feet/day through rock. Oil at 1,000 feet was much easier when accessed with rotary rigs powered by steam engines driving bi-conic bits. And as we drill deeper, the oil reservoirs tend to be come larger and the oil lighter and sweeter, with higher ratios of cleaner-burning and incredibly versatile industrial feedstock natural gas. The chart many comments above that shows declining break-even prices for shale plays illustrates how the march of technology and capital investment can increase EROI even as resources become inherently more challenging. We haven’t but begun to tap global tight oil resources, let alone deepwater and sub-salt oil or methane hydrates.

@DM

The energy economy underpins the fiscal economy. EROI theory was born out of the study of biological systems (i.e., biodynamics, ecology, biophysical economics). A civilization has to consume energy and manage waste just like any living organism. It can only afford to use a fraction of today’s finished energy supply (i.e., food on the shelf), to supply the energy necessary to forage for and collect and refine a renewed supply of food for tomorrow. Humans living in agricultural civilizations with a 2:1 EROI or less essentially spend their entire day on subsistence tasks to feed themselves. First draft animals and later coal and the steam engine brought improvement to EROI, and freed up some human labor to be available for non-subsistence tasks such as education, tinkering and innovation, the arts, pure research, etc. The fruit of such bonus of “free” time is an upward spiraling of science and technology and productivity that increases the EROI of developing nations even further. Energy is the real currency that is necessary to extract raw materials from the ground and add value to them in manufacturing, and thereby increase the wealth of civilization. Energy and what it delivers is tangible wealth. Money is just an intangible denomination of wealth.

Based on EROI and historical analysis, I began in 2012 predicting a coming oil & gas price collapse while the most vocal voices were calling peak oil and prices that could only continue upward. Based on EROI and historical analysis, I also predicted that we would enter a battle for market share and a period of mergers and acquisitions that would see OPEC and Russia increase production and E&P operations be gobbled up by O&G majors with refining operations to sustain them with downstream profits while the upstream side returns dried up. I also continue to predict, based on EROI and efficiency gains and elasticity of supply, that the current price of oil and gas is the new norm that will endure for a decade or more (with of course the superposition of spikes due to geopolitical events).

Smart bankers and investors will look at the energy bottom line below the fiscal bottom line, because it will tell them where the fiscal economy is going to be tomorrow.

Whether or not oil is a renewable resource or not, modern society will not evolve to the next “spacefaring” level of society on chemical energy, nor will we conquer the stars on solar. We have to learn to safely use the power of the atom, or society will be a failure, just sitting here waiting to die.

Tom Halla

July 10, 2017 7:03 am

I had a very sincere instructor in college during the first oil crisis who was absolutely sure that oil prices would never, ever, come down, and we should just get used to scarcity. The greens have the same attitude still, but keep putting the fulfillment of their prediction into the future.

If there’s one thing that I have learned about oil prices over the last 36 years, it’s this:

Whenever someone tells you that they know what oil prices are going to be in the future, they are wrong… 😉

I recall hearing an oil industry insider proclaim: “There are two kinds of people predicting the price of oil. Those who don’t know what they are talking about, and….. no…..wait….. I guess there is only one kind”

One thing I do know, is that in relative terms to inflation, oil/gasoline has never been cheaper in real terms. One of my first jobs was pumping gas in 1972, when minimum wage was about $1.25 an hour, and a gallon of gas was about .50 cents. Now minimum wage is anywhere from $8/$10 an hour, and as high as $15/hr in some places, and a gallon of gas is only $2.75, so if anything, gas prices are as low as they have ever been. Relative to inflation of course. Gasoline will be hard to replace, on a power/density scale for the price we pay.

On January 3rd, 2014, when Cushing WTI was $93.66/bbl and NYMEX Brent Crude was $106.57/bbl and U.S. daily production was 7.8 MMBPD, I made an exact prediction: U.S. production would climb to a peak of 9.5 MMBPD, and this would coincide with a collapse in global oil prices to the $50-$60 per barrel range, which would be the new enduring norm. I further predicted that this would happen between summer of 2014 and summer of 2016 ( http://www.ourenergypolicy.org/should-the-crude-oil-export-ban-be-lifted/#comment-1724 ). I have not yet found another prediction that far in advance that called subsequent events more accurately. I still have a bet to collect from a peak oil.

That’s an awesome prediction. Although prices did collapse to below $30/bbl in early 2016 before recovering.

When will oil be back over $70/bbl? Or under $30/bbl? Personally, I think the trading range will be $45-$55 for the next year or so and then rise to $70+/bbl over the next few years as the lack of capital investment rears its ugly head.

Have you read Art Berman’s explanation as to why the collapse in prices proves “Peak Oil”? It’s hilarious. I’l try to find a link to it. Art is the Godfather of Peak Oil.

Peak Oil is a function of resource depletion. It’s a real thing. I’s just not a terribly relevant thing.

We may have already hit peak oil or we may not hit it for 100 years or more. We won’t know we hit it until we are way past it. And it really won’t matter that much.

About 10 years ago the experts were saying that we would never see oil trade under 100 per barrel in our lifetime. This time it’s different they said. It will be the new normal. I was on the kitco discussion board calling BS and being attacked for my opinion that, when the experts are making bold predictions, do the opposite and start buying cheap deep out of the money put options on oil futures.

Being a contrarian pays well. The same was being said about gold. It’s a useless relic and banks are getting rid of it because it has no intrinsic value. It went close to 2000 dollars a decade later

Let’s say everyone should have access to free gasoline and the government should put programs in place to ensure that this is a right for even the poorest among us. Then, where will the price go?

Latitude

July 10, 2017 7:05 am

…and then consider all the places that are off limits or just haven’t been developed for one reason or the other

There is a techique called creaming curves that can be applied to basins. It says that about 76% of all the oil ever to be discovered already has been. And of the worlds largest oil fields, Ghawar is 2/3 depleted and Samotlar is 85% depleted.

ristvan

It’s all a matter of price. The Canadian oil sands proved reserves @ 180 billion barrels continue to make money even at USD 40-45 – an idea that had many rolling in the aisles just a few years ago. In fact a significant uptick in output is coming on line in 2018.

Ask oil patch insiders and they’ll tell you that at USD 60 and above the proved number would go up by a good multiple [how does 2+ sound..] as new in-situ extraction and other technologies coming on line serve to contain “well-head” costs. Again, folks in the know have been heard to talk about “undiscovered technically recoverable” oil sand reserve estimates north of 500 billion barrels…

How much of that ever makes it out of the ground is a matter of price. Peak oil it is not.

Creaming curves indeed apply to already discovered producing basins not to basins that have yet to be explored. So the 76% you quote is probably applicable to the former only.

empire sentry

July 10, 2017 7:06 am

The (_______Insert doomsday scenario here) is approaching in 30 years.

Act now or we will pass the tipping point of No Return.

YOU must put us in charge to fix this.

We will philanthropically act on your behalf to save you but you must contribute via your taxes, jobs and life. We can’t say what steps we will take but we are smarter than you rubes.

The world will not stop consuming oil even after oil reserves have been depleted. We will turn natural gas into liquid fuel via gas-to-liquid (GTL) process. Shell has the biggest GTL plant in Qatar. When the world ran out of natural gas, we will turn coal into synthetic diesel via Fischer-Tropsch (FT) process. The Nazis did that during World War 2. So let’s sing “FUEL” with Avril Lavigne!!

Along that same line of thought, I never supported recycling my beer cans. We should send them to the landfills where in the not to distant future they will make it profitable to mine the landfills for several resources including plastics.

@ Joe Crawford…back in the 1970s I was living in the mountains of Northern California. My friends who were born in that area would toss their beer cans out the window when driving down the road. They used to joke that one day people would come to ‘mine’ all of the aluminum cans. I didn’t find it very funny at the time, but in the long run they were right. Almost all of those empty beer cans were cleaned up over the last several decades.

Goldminer,

When I lived in the mountains of Colorado we use to call those people who walking the roadsides picking up cans ‘Aluminum Miners’.

2hotel9

July 10, 2017 7:23 am

Funny, the same people who claim to be able to accurately predict the weather in 100 years are the same ones who keep telling us there is no more oil or coal to be found. Makes me wonder how many of their grandparents insisting on continuing to make buggy whips and tallow candles well into the 20th Century.

I wish I could get in on that action! I would be able to generate oil & gas prospects, collect my bonuses and then retire before any of those prospects were drilled… 😉

The difference between industry and academia was thoroughly explained by Dan Akroyd in Ghostbusters…

Yep, I been hearing all my life about how everything is running out and its all going to come crashing down in ruins. The only things I have seen run out or crash into ruins came to that end at the hands of academics and politicians. They are the only people who can “build” something with lies. I can’t build a house with lies, or plant crops with lies, or raise livestock with lies, etc etc, but those two groups certainly make themselves fat and rich with nothing else. Funny, that.

Peter Morris

July 10, 2017 7:23 am

I’m 41 years old and have been hearing about how we’ll run out of oil literally any minute all my life. Not from my parents, mind you, who are imminently practical and great critical thinkers, but from people who in one way or another are trying to sell me something.

Now, I’m pretty sure there is a finite supply of oil, but there seems to be such a huge amount of it that it seems like we’ll still be using it when after my great grandchildren are gone.

Yep. Although, I think the people preaching about imminently running out of oil are trying to control what you can purchase. Apart from bad ideas, they don’t really have anything to sell.

“Yes. It’s possible. There’s just no evidence of it and it wouldn’t be relevant if it was.”

Actually it would be very relevant. Just depends on re-charge vs. discharge rates. Also, depending on where it’s found, it could change the geopolitics of the world drastically.

However it originally formed, oil has to be found in economic accumulations. Igneous and metamorphic rocks are rarely porous and permeable… And rarely contain crude oil. Even if oil was commonly formed inorganically… It wouldn’t alter how and where oil companies look for oil. It still has to be trapped in porous and permeable reservoirs – Sandstones, limestones, shales and other sedimentary rocks. Even the oil that’s trapped in fractured granites and other basement rocks, had to migrate through and be trapped by sedimentary rocks.

The sourcing of the oil wouldn’t alter how it accumulates in economically recoverable reservoirs.

This is the decline curve for EI 330 field, often cited as evidence of abiogenic oil, where some reservoir recharge has actually been observed…

If the Earth was generating oil at a rate comparable to our production, the curve would be more of a flat line. The field, one of the largest in the Gulf of Mexico, has been producing since 1972.

Most large fields produce for decades. Many are now monitored with 4d seismic. If they were recharging at an economically meaningful rate, there would be some evidence of this.

Many of the larger fields have been monitored with 4d for nearly 20 years. If the Earth was recharging the reservoirs at a rate comparable to production, you would “see” it on the 4d seismic… You don’t see this happening.

Every oil field in the world exhibits a decline curve. If fields were recharging at a rate comparable to production, there would be no decline curves.

The hydrocarbons of Titan are evidence of abiogenic oil. Similarly, we know that carbonate rocks under enough heat and pressure can make methane, and that CO2 +H2 (from water) under heat and pressure (or more easily with zeolite rocks near) can make oil (FT process).

So yes it is possible and yes there is evidence it is possible.

There just isn’t much evidence for it happening on earth in nature. Yet.

It could be (lots of oil seems to be near subduction zones, like California) but far more likely it is ancient ocean algae cooking out oil. Some algae, if nitrogen starved, make up to 50 percent oil by wt. Sunk in hypoxic traps and buried under mud is the most likely source of oil. This can also explain California (and better explains Texas). It is pretty much proven North Sea oil is an ocean trap process.

Yet there are hard to explain things, like oil seeps center of the ocean where it ought not be possible and at rock depths where theory says it ought not be. But by definition, we don’t know what causes them, so can’t say if abiotic or not.

Basically, nobody can prove either way, so it ends up in a shouting match.

But invest in the oil companies looking for biotic oil… they tend to find it…

Methane isn’t oil… Not even close. Abiotic methane is massively abundant throughout the Solar System and beyond.

There are no oceanic oil seeps where there isn’t sedimentary rock present.

Oil is not found “at rock depths where theory says it ought not be.”

The generally accepted theory explains all of the observations. The abiotic hypothesis explains very few of the observations. There is no way to prove either theory/hypothesis.

The conventional theory was derived from over 100 years of exploring for and producing oil. The theory was derived from oil exploration. We don’t explore for oil under the constraints of the theory.

There’s no “shouting match.” There’s just a lot of shouting from abiotic oil aficionados who would like to believe that there is a limitless supply of oil or that the conventional theory is part of a conspiracy to prop up oil prices.

Coal, the major fossil fuel, contains fossilized remnants of the plants from which it formed, many times visible with the naked eye in the form of leafs, bark, even logs, etc. In addition, it contains molecular remnants that are analogues of lignin, cellulose, etc. Coal is found in sedimentary strata. Crude oil contains bio-markers, molecular remnants of the material from which it formed also, including those that resemble fatty acids, sterols, isopreneoids, etc. Both source and reservoir formations of crude oil occur in sedimentary strata. There are many reasons to conclude that coal and oil are fossil derived.

“Titan is just covered in carbon-bearing material — it’s a giant factory of organic chemicals,” said Lorenz. “This vast carbon inventory is an important window into the geology and climate history of Titan.”

At a balmy minus 179 degrees Celsius (minus 290 degrees Fahrenheit), Titan is a far cry from Earth. Instead of water, liquid hydrocarbons in the form of methane and ethane are present on the moon’s surface, and tholins probably make up its dunes. The term “tholins”was coined by Carl Sagan in 1979 to describe the complex organic molecules at the heart of prebiotic chemistry.

Cassini has mapped about 20 percent of Titan’s surface with radar. Several hundred lakes and seas have been observed, with each of several dozen estimated to contain more hydrocarbon liquid than Earth’s oil and gas reserves. The dark dunes that run along the equator contain a volume of organics several hundred times larger than Earth’s coal reserves.

https://en.wikipedia.org/wiki/Tholin

Says it it a long list of complex chemicals. Besides, methane isn’t found in “dunes” of hydrocarbons…

Since the entire ocean bottom has some amount of sediments on it, your statement amounts to a tautology and isn’t useful for finding any answers. But we are finding oil, and even asphalt “volcanoes” in unexpected places. https://chiefio.wordpress.com/2012/09/16/theres-oil-on-that-ocean-bottom/

Now, yes, “you got me” on the statement about theory. I ought to have phrased it better:

“We keep finding oil in places prior theory said was impossible so after new extemporaneous extensions are added we now find oil where theory says it is ok.”

Happy? The last two I remember was rock so deep that breakdown to methane was predicted (so some idea was cooked up like maybe deep ocean floor is cooler); and when Petrobras found oil when everyone was laughing at them for wasting their money. Something like 25000 ft & offshore “too far”. But I’m sure now theory says that’s fine…

Per shouting match: Might I suggest you inspect your, um, strident tone…

Look, I’m NOT advocating for abiotic oil. But since we know the chemistry exists, it must be a comparative rate problem. IMHO, it is most likely that only small amounts of primative tholins or FT from rocks makes up modern oil. Inspection of oil shows biomarkers, but how much is contamination? But that is just my oppinion. We don’t have enough information to say with certainty what the abiotic rate vs life rate is, let alone was in the deep past.

Sidebar: Now both sides can commence tossing rocks at me, since everyone likes to feel right and nobody is happy with “we can’t say for certain right now, but bet on biotic drillers”.

Titan has methane and other simple hydrocarbons, like PAH’s. Crude oil is a mixture of complex hydrocarbons.

From your own blog post …

A number of abyssal basins on both sides of the Mid-Atlantic Ridge and bounded by east-west fractures hold substantial thickness of sedimentation and hydrocarbon-rich black shales. The named basins shown here are in water depths of 4,000-5,000 meters.

There are no mid-ocean oil seeps where there aren’t sedimentary rocks. If oil was forming in the mantle, there should be oil seeps on the mid-Atlantic Ridge. Methane and traces of heavier simple hydrocarbons aren’t oil.

Petrobras did not find oil in “rock so deep that breakdown to methane was predicted” and no one was laughing at them.

The last two I remember was rock so deep that breakdown to methane was predicted (so some idea was cooked up like maybe deep ocean floor is cooler); and when Petrobras found oil when everyone was laughing at them for wasting their money. Something like 25000 ft & offshore “too far”. But I’m sure now theory says that’s fine…

The ultradeep oil is in ultradeep water, generally under thick salt layers. The key parameters of the oil window are pressure and temperature. When the overburden is comprised of things less dense than rock (like water and salt), the oil window is deeper than it otherwise would be. Petrobras and other companies found oil in subsalt formations at temperatures and pressures within the oil window. The also found gas when they drilled formations that were outside the oil window. This has also been the case in the Gulf of Mexico:

The “surprise” in the ultradeepwater of the Gulf of Mexico wasn’t oil. The surpeise was Lower Tertiary reservoir-quality sandstone

It’s an interesting observation to note that the only things we’ve ever exhausted are renewable, e.g. some fisheries.

Thomas Homer

July 10, 2017 7:32 am

It is a noble effort to continually extract as much efficiency from our use of oil. However, we are living in the Oil Age. And, we should expect mankind to consume all accessible Oil. We have the extraction and distribution infrastructure in place now, we need to leverage it while it exists.

The true value of Oil is in the individual consumption. That’s why we have such an elaborate distribution infrastructure. Hoarding Oil does not establish wealth in the same way as hoarding gold.

We can marvel at the engineering that has established the extraction and distribution infrastructure which makes Oil available for individual consumption.

I wonder whether whales would have been hunted to extinction had it not been for the technical development of kerosene from crude oil.

Robert Doyle

July 10, 2017 7:33 am

From the Wayback Machine:

A Hat Tip to President Carter!

Address to the Nation on Energy and National Goals: “The Malaise Speech”

July 15, 1979

“So, the solution of our energy crisis can also help us to conquer the crisis of the spirit in our country. It can rekindle our sense of unity, our confidence in the future, and give our Nation and all of us individually a new sense of purpose.

You know we can do it. We have the natural resources. We have more oil in our shale alone than several Saudi Arabias. We have more coal than any nation on Earth.”

This is the president that created the policy of not reprocessing nuke power plant waste. Reprocessing cuts the amount of waste that needs to be stored by about a factor of 10.

Wise Dan,

The justification given by Carter was to make it impossible for terrorists to get their hands on reprocessed fuel. Yet, France is reprocessing their own fuel, and providing the service for other countries, and shipping it around the world. Carter’s action is a bit like someone who owns a male and female cat, and to prevent his female from getting pregnant, neuters the male cat. However, he still lets the female go outside. Jimmy Boy should have just been a peanut farmer.

““So, the solution of our energy crisis can also help us to conquer the crisis of the spirit in our country.”

Carter and the Left were the only ones with a crisis of spirit.

This is all very well and good, but in the good all days we used to poke the ground at the right places and oil would just come out by its own pressure. Nowadays we have to resort to breaking the rocks with high pressure hydraulic fracturing to get small streams of too light oil and making thousands of wells to get the oil that we used to get from a few wells. Or to apply a complex high energy treatment to oil sands to extract too heavy oil. Or to drill in deep oceans from expensive platforms and equipment.

Along the way the cost of producing the oil has been increasing, and the energy return on energy invested decreasing.

All along the number of countries that are net exporters of oil keeps reducing. Egypt, Syria, Yemen, Indonesia are no longer net exporting countries and it is common that former exporting countries are in a quite bad situation.

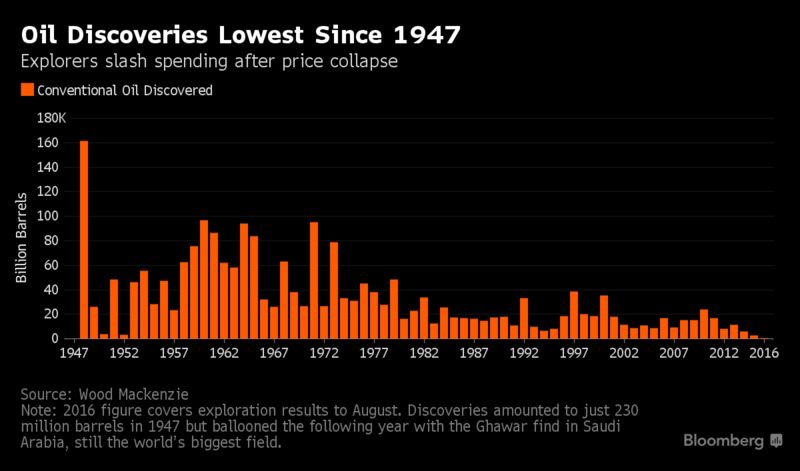

So while oil reserves keep increasing. That is just numbers on a piece of paper. Would anyone be surprised to know that some countries are overstating their reserves? Meanwhile the trend in oil discoveries is unmistakable.

The trends are all very clear, and they point towards a future peak in oil production. That earlier predictions have failed says nothing about a different final outcome. Peak oil is a question of when, not a question of if.

Javier,

In the “good old days,” you found oil based on surface geology… Look for a big bump on the ground with oil leaking out of it.

When I started working, you found oil with a handful of 2d seismic profiles.

Now, I have access to nearly continuous 3d seismic data over most of the Gulf of Mexico.

We have the ability to find and develop accumulations of oil that we couldn’t even guess were present in the “good old days.”

There are a lot of areas that have never been explored with modern seismic and drilling technology

New discoveries generally comprise a small fraction of proved reserve growth (or contraction). Most of the changes come from extensions of existing fields, well performance and economic revisions. U.S. proved reserves declined from 2014-2015 simply due to economic revisions (low prices)…

A sustained low price environment in 2015 caused the large volume of negative net revisions and also reduced the annual volume of extensions to existing fields (Figure 9b).

David,

I think something to consider is that as geophysical techniques have become more powerful and readily available, the discoveries (as illustrated by Javier above) have gone down. That is, it would appear that we have reached a point of diminishing returns in exploration.

As I recollect (it has been quite a few years), Hubbert based his production curve on the rate of discovery, which he sensibly used as a leading indicator. That gets no mention in your article.

A basic assumption implicitly made by Hubbert was that conventional oil was the only thing economically viable, and his model was based on pooled oil from traps. An important point is that before Hubbert did his work in forecasting, few if any people gave any thought to doing things any differently to produce oil. With the Sword of Damocles (perhaps I should call that the Sword of Hubbert) hanging over the industries’ heads, the industry looked for new ways to find and produce oil. The increase in the price of oil (in part a result of oil production peaking in the US) and innovations in technology leading to ‘fracking,’ is now allowing plentiful production of hydrocarbons. However, one might legitimately consider ‘fracking’ as fundamentally the result of technological invention similar to manufacturing biofuels, or synthesizing liquid fuels from coal or natural gas. Basically, they are only feasible with the high prices provided by increasing demand and supply straining to keep up. There are no more Spindletops, and probably no more ‘Elephants’ to be found. We are busily trying to find and round up all the baby hippos!

Lastly, if Hubbert’s logistic model is valid for individual fields or regions, I don’t see why it isn’t valid for a finite Earth. As with many things, a rigorous, specific definition is required before claiming that Hubbert’s methodology doesn’t apply to Earth. I think it can be a useful tool if applied appropriately. We have yet to see what the longevity is of the newly developed ‘fracking’ fields.

Clyde Spencer July 10, 2017 at 12:27 pm

David,

I think something to consider is that as geophysical techniques have become more powerful and readily available, the discoveries (as illustrated by Javier above) have gone down. That is, it would appear that we have reached a point of diminishing returns in exploration.

Geophysical advances enable us to “see” and economically exploit things that we couldn’t “see” with less advanced geophysical imaging.

That said, most of the really huge accumulations didn’t require advanced geophysical imaging. They were fairly obvious.

And discoveries are just a small factor in reserve growth. Most of the growth comes from well performance, field extensions and economic revisions.

As I recollect (it has been quite a few years), Hubbert based his production curve on the rate of discovery, which he sensibly used as a leading indicator. That gets no mention in your article.

The “rate of discovery” is not a factor in the equation.

• t is time in years

• Q(t) is cumulative production in billion barrels at year t.

• Q∞ is the ultimate recoverable resource.

• P(t) = d Q/dt is production in billion barrels/year at year t.

• τ is the year at which production peaks.

• ω is an inverse decay time (imaginary frequency).

Basically, once you have some production history (t, Q(t), Q∞ and P(t)), you can make a reasonable calculation of τ (the year at which production peaks).

A basic assumption implicitly made by Hubbert was that conventional oil was the only thing economically viable, and his model was based on pooled oil from traps. An important point is that before Hubbert did his work in forecasting, few if any people gave any thought to doing things any differently to produce oil. With the Sword of Damocles (perhaps I should call that the Sword of Hubbert) hanging over the industries’ heads, the industry looked for new ways to find and produce oil. The increase in the price of oil (in part a result of oil production peaking in the US) and innovations in technology leading to ‘fracking,’ is now allowing plentiful production of hydrocarbons. However, one might legitimately consider ‘fracking’ as fundamentally the result of technological invention similar to manufacturing biofuels, or synthesizing liquid fuels from coal or natural gas. Basically, they are only feasible with the high prices provided by increasing demand and supply straining to keep up. There are no more Spindletops, and probably no more ‘Elephants’ to be found. We are busily trying to find and round up all the baby hippos!

Hubbert simply made an assumption of the total recoverable resource based on what was known in 1956. Had he envisioned the recovery of large volumes of oil from source rocks (shale frac’ing), he would have used a much bigger number for Q∞.

Lastly, if Hubbert’s logistic model is valid for individual fields or regions, I don’t see why it isn’t valid for a finite Earth. As with many things, a rigorous, specific definition is required before claiming that Hubbert’s methodology doesn’t apply to Earth. I think it can be a useful tool if applied appropriately. We have yet to see what the longevity is of the newly developed ‘fracking’ fields.

It is valid. We just still don’t know what Q∞ is because it keeps getting bigger. And so long as Q∞ continues to grow, τ will remain just over the horizon.

This chart doesn’t quite fit what we know, but it’s Bloomberg’s chart, so one can put a certain filter on the information it holds. I find no hint as to where the Bakken Field discovery is indicated. Whether it is in the early 1950s when first reported, or in the late ’90s when exploratory drilling started, or in the early 21st century when production started, there should be a blip indicating from 150 – 500 billion barrels (BOE).

Horizontal drilling is getting additional oil out of old fields as well, not just shale. If the porosity of the sandstone is relatively low, or the drive is weak, then horizontal will get increased production. My friends in the patch tell me that they are targeting <$10/bbl as a production target. There are some really sharp people figuring out how to get viscous fluids out of the ground.

The problem is that the Bakken, Eagle Ford, etc. aren’t fields per se. They are plays. Technically, they were “discovered” a long time ago. So, they would not be displayed on a chart of new field discoveries. The Permian Basin is also often referred to as a “field.” The Permian Basin is a collection of plays.

Precision directional drilling and frac’ing have dramatically increased production from these plays.

Javier’s chart is probably reasonably accurate… But, like Peak Oil, it’s not all that relevant. Many of the mega-giant oil fields were literally found when people tripped over them. However, there are many areas of the word that have never been explored with modern technology. Even in the Gulf of Mexico… the Mexico side of the Gulf is just now beginning to be explored and exploited with modern technology by real oil companies.

I had uncles and cousins who worked for PeMex in the ’80s and they all threw their hands up in disgust and went back to Brown&Root, Haliburton, Schlumberger and Exxon.

Today’s horizontal wells do not have slow trickles of oil coming out, each well in the Bakken is now averaging over 100 bbl per day for over a year.

The number of wells to develop a field has not increased, it has decreased dramatically. Before 3D seismic, a field was developed by simply drilling out the field based on suggested well spacing, and field were commonly over drilled, but now each compartment of oil is targeted with precision.

David,

I don’t want to spend a lot of time researching to defend my statement about discovery rates. However, in the related Wikipedia articles, they state the following:

“By observing past DISCOVERIES and production levels, and predicting future DISCOVERY trends, the geoscientist M. King Hubbert used statistical modelling in 1956 to accurately[15] predict that United States oil production would peak between 1965 and 1971.” [ https://en.wikipedia.org/wiki/Peak_oil ]

“Choosing a particular curve determines a point of maximum production based on DISCOVERY rates, production rates and cumulative production. Early in the curve (pre-peak), the production rate increases due to the DISCOVERY rate and the addition of infrastructure.”

“The Hubbert peak theory is based on the observation that the amount of oil under the ground in any region is finite, therefore the rate of DISCOVERY which initially increases quickly must reach a maximum and decline. In the US, oil extraction followed the DISCOVERY curve after a time lag of 32 to 35 years.”

“In 1956, Hubbert proposed that fossil fuel production in a given region over time would follow a roughly bell-shaped curve without giving a precise formula; he later used the Hubbert curve, the derivative of the logistic curve,[5][6] for estimating future production using past observed DISCOVERIES.”

[ https://en.wikipedia.org/wiki/Hubbert_peak_theory ]

I distinctly remember having seen both the discovery and production curves for the US on the same graph, at some point in the past, in a discussion of the Hubbert Curve. I don’t think that it is worth my time digging through my books in my library. Even if I find what I remember, you may not have the same reference. I’m presenting this only to point out that the importance of the discovery curve is not a figment of my imagination.

I provided a link to Hubbert’s paper. https://debunkhouse.files.wordpress.com/2017/03/1956_hubbert.pdf

Hubbert would seem to be the best source on Hubbert.

And a very simple explanation of the equations… http://sepwww.stanford.edu/sep/jon/hubbert.pdf

Past discoveries are where these numbers come from:

• t is time in years

• Q(t) is cumulative production in billion barrels at year t.

• Q∞ is the ultimate recoverable resource.

• P(t) = d Q/dt is production in billion barrels/year at year t.

Proved reserves plus future discoveries at tine t plus Q(t) gives you Q∞.

David,

I agree that the best source on Hubbert is Hubbert. However, the 1956 paper is his first attempt at articulating what was, at the time, a semi-quantitative approach. Over the next several years he refined his theory and attempted to make it more quantitative.