Guest post by David Middleton

From Inverse via Real Clear Energy:

The Answer to What’s Actually Killing Coal is Hopeful and Depressing

The real cause of the decline of coal is the free market.

By Dyani Sabin on June 20, 2017

Filed Under Answers, Donald Trump, Jobs, R&B & Solar Energy

As has been reported a lot recently, the coal industry is dying: jobs are in decline as alternative energy sources are more easily available to the masses, and everything from windows to roofs has become more energy efficient. So while technology is killing the coal industry, so are competitors of coal, which still accounts for an astounding 40 percent of electricity worldwide.

Enter a study paid for by two environmental groups — the American Wind Energy Association and Advanced Energy Economy — and conducted by Analysis Group, a consulting firm, timed to come out ahead of a competing Department of Energy study, and the stage is set to answer the question: What is killing coal? The answers will either be depressing (business-killing policies!) or hopeful (better tech and market competition), or perhaps both.

First up, the private study results released Tuesday found that the decline of coal and nuclear plants in the United States has two main causes: the relatively low cost for natural gas, and the fact that electricity demands have not increased.

[…]

The answer is: Both. So their conclusion that “better tech and market competition” and not “business-killing policies” are killing coal, is “not even wrong.”

The levelized capital costs for conventional coal-fired power plants ranged from $2,800 to $3,200 per kW in 2010. By 2014, the EIA estimated that the levelized capital costs of coal-fired power plants entering service in 2019 would be $6,000 per kW. In the EIA’s most recent LCOE (levelized cost of electricity) analysis, they don’t even include coal-fired power plants without CCS (carbon capture and storage). The levelized capital costs of coal-fired power plants with CCS entering service in 2022 will be $7,800 to $9,500 per kW. Almost all of the increase from $3,000 to $9,500 per kW is due to “business-killing policies”… Or planet-saving policies to warmunists.

Setting aside the fact that “business-killing policies” have definitively driven the cost of coal-fired power plants up to noncompetitive levels, they are correct that “the relatively low cost for natural gas” really hurt the coal industry. The brief plunge in gas prices below $2.00/mcf in 2016 was the “straw that broke the camel’s back” for the largest US coal company, Peabody Energy.

One of the more telling moments during Tuesday’s interview came toward the beginning, when Kellow was summarizing the events around Peabody’s descent into chapter 11. He noted that, around the same time, U.S. natural gas prices hit a low of $1.67 per million BTUs. He was off by a few a cents — as he acknowledged he might be — at least according to Bloomberg data. Whatever; the point is that the CEO of a coal-mining company who quotes historical natural-gas prices down to the cent clearly knows the enemy.

As I’ve written here and here, the shale boom fracked the ground from underneath the U.S. coal sector. The industry simultaneously self-administered a coup de grâce in the form of ill-timed acquisitions, loading up with debt just as the market went south. President Barack Obama’s tightening of the regulatory screws on coal-fired power essentially closed the door on any revival.

Apparently the geniuses at the “two environmental groups” haven’t been “keeping up with current events.”

Natural gas prices are currently in the neighborhood of $3.00/mcf, well above the “killing coal” line (more on this later).

Back to the Inverse article:

It’s not that renewables have become so cheap that they’re killing coal, it’s that our technology has improved so natural gas is having an economic renaissance. It was the financial pressure from natural gas costs, which dropped and stayed low starting in the early 2000s, that delivered coal’s death blow.

Wow! They managed to be “not even wrong” twice in one article!

“It was the financial pressure from natural gas costs, which dropped and stayed low starting in the early 2000s, that delivered coal’s death blow.”

Natural gas “costs” skyrocketed from 2000-2009…

The “death blow” to coal occurred in 2009, when natural gas prices collapsed:

In the Energy Information Administration’s reference case, natural gas prices are forecast to rise to about $4.50/mcf by 2020 and climb above $5.00/mcf by 2030. Coal is extremely competitive with natural gas in EIA’s reference case. It’s even competitive in the “high oil and gas resource technology” scenario.

Unless “death blows” have a recovery rate comparable to extinct Central American toads, Inverse’s “answer to what’s actually killing coal” isn’t even wrong. The same market forces that caused the coal industry to decline over the past decade are already leading to its recovery (The Resurgence of the American Coal Industry, The Resurgence of the American Coal Industry, Part Deux: An Unexpected Ally)

To paraphrase Samuel Clemens: “The reports of coal’s death are greatly exaggerated.”

Chapter 4. Coal

Overview

In the IEO2016 Reference case, coal remains the second-largest energy source worldwide—behind petroleum and other liquids—until 2030. From 2030 through 2040, it is the third-largest energy source, behind both liquid fuels and natural gas. World coal consumption increases from 2012 to 2040 at an average rate of 0.6%/year, from 153 quadrillion Btu in 2012 to 169 quadrillion Btu in 2020 and to 180 quadrillion Btu in 2040.

[…]

As a non-native speaker of the English “language” — I prefer to call it a speech impediment — I wonder: how do you pronounce “AEUHHH”?

Ah, so it is not English, it is duck speak.

Just think of “HHHUEA” but play it backwards.

That sure helps 😉

perhaps the rare earths will save the day?

Maybe…

President Trump has something to say about that:

The trouble with government regulation is how it snowballs. Someone says, ‘there ought to be a law.’ It sounds like a good idea and it kinda works. Then it repeats infinitely. All good ideas and they all kinda work but when you put them all together, the system bogs down and nothing gets done. Not only that but only large companies have the wherewithal to deal with the paperwork. The result is that the smart hardworking person with a better idea can’t even get off the ground. Innovation is killed and the economy is smothered and dies.

Think about it … 29 million bucks … that would get you around a hundred person years of experts. People could spend their whole careers doing paperwork for one short highway. What a waste.

Ya it’s pretty blindingly obvious to most – with the notable exceptions of bureaucrats – that you have to periodically take scythe, chainsaw and flamethrower to bureaucracy and rationalise the whole thing down to bedrock or the life is throttled out of everything indeed.

The more corrupt the state, the more numerous the laws. Tacitus

The more laws and order are made prominent, the more thieves and robbers there will be. Lao Tzu

The more laws and restrictions there are, The poorer people become Lao tzu

History informs that all governments, when founded, are destined to choke and die on the untenable burden that is produced by their own excessive greed, stupidity and incompetence. We are witnessing the process as it currently progressing in that strange little foreign country that is called called The District of Columbia.

While with the typical course of events, few of us who are alive today are likely to live long enough to witness the final implosion, but then who knows? It could come at any time and bear a resemblance to a high-flying hot air balloon that runs out of fuel………….

“History informs that all governments, when founded, are destined to choke and die on the untenable burden that is produced by their own excessive greed, stupidity and incompetence.” Oop, there it is.

Coal mines are planned on 20-50 year timelines. Hard rock gas wells have a 3-5 year life.

And there is graft..consider Aubrey McLendon thought it better to drive head on into a bridge abutment than be indicted on corruption regarding his tenure at Chesapeake Energy, the main player in the natural gas boom.

Keith what the heck is a “hard rock gas well”? Did u mean tight / tite rock gas well?

And where did you get 3 – 5 years for a well life what pool / formation?

Yeah… In geology, “hard rock” generally refers to igneous and metamorphic rocks.

The length of time that gas wells produce is extremely variable, even within the same reservoir.

And individual gas wells aren’t analogous to coal mines. Gas fields would be more analogous. Many large natural gas and oil fields will produce for well over 50 years.

McLendon’s death was not a suicide. It was an accident.

And his indictment was dropped.

That’s what the necromancer said, anyway, after he called up McLendon to ask.

I’m not sure what graft has to do with a comparison of natural gas vs coal. McClendon used the company as his personal piggy bank, but that related to lack of board oversight rather than the product the company produces.

The indictment had nothing to do with graft and was very flimsy. https://www.forbes.com/sites/christopherhelman/2016/03/01/the-federal-indictment-of-aubrey-mcclendon/#1932aa80574a

https://www.justice.gov/opa/pr/former-ceo-indicted-masterminding-conspiracy-not-compete-oil-and-natural-gas-leases

There is little difference, if any, between McClendon’s alleged crime and standard joint venture agreements.

But so long as coal plants keep closing, with 90% of US coal going to coal power plants, coal will continue to decline.

And coal plant closures have continued to be announced since Trump took office.

The number of already announced coal plant shut downs ensure the decline continues throughout Trumps current term in office (impeachment fantasy aside!)

(Demand too looks like staying flat: energy efficiency like LEDs will ensure that)

A recovery would need more coal power plants to be built and for a substantial hike in the gas price to make that investment worthwhile.

Even with a rise in gas prices, falling solar and battery prices and other developments will ensure renewables continue to provide an increasing chunk of demand – and if gas produced electricity becomes more expensive, fixing your costs with renewables looks more attractive.

I still don’t see this recovery: where is more coal going to get burned, when, and what has to happen to natural gas to make it likely?

(the Trump administration is surely easing, not increasing the costs for gas producers?)

More coal is being produced. I suppose they could just be letting it sit on the ground.

To the extent Trump has rolled back Obama’s regulatory malfeasance, it hasn’t had much effect yet.

More natural gas will be exported.

Renewables can’t replace coal, nuclear or natural gas.

Wrong. Existing coal-fired plants just have to resume running at a higher capacity.

Wrong.

Yayyy! You got something right! Impeachment is a fantasy.

Coal production has increased since Trump’s election…

https://www.eia.gov/coal/production/weekly/

The closure of plants that are barely operating has little effect on coal production.

Griff,

Coal production would grow in the US if we were allowed to export it to China, whose coal is low in BTUs and dirty. They’d rather buy ours, but Oregon won’t allow “death trains” from Wyoming to unload at the Port of Boardman on the Columbia River.

Natural gas is beating out coal for power production in the US, but windmills and solar farms still need fossil fuel backup, often coal.

Gabro:

A good portion of the Wyoming coal is shipped out through the coal terminal south of Vancouver, BC.

That’s right. Canada was happy to handle the coal shipments which OR and WA embargoed.

Except Chinese (thermal) coal use has peaked and is starting a decline…

The inability to distinguish short-term fluctuations from long-term trends is a common trait among Malthusians.

Which is why China is opening coal fired plants as fast as they can be built. Wow, you really shut us up!

China and India.

Griffy,

So much wrong, so I’ll just pick one thing: electricity demand. If you and your eco-friends get you way with electric cars (huge replacement of IC cars), demand will surge in the next decade or two. Energy efficiency won’t put a dent in that.

This month PSEG closed their last two coal fired plants in NJ, they said it’s due to the price of coal being uncompetitive wrt natural gas.

http://www.philly.com/philly/business/energy/pseg-shuts-down-its-last-n-j-coal-plants-its-just-economics-20170530.html

Both power plants were over 50 years old…

10 years ago, natural gas was >$5.00/mcf. Ten years from now, natural gas will probably be approaching $5/mcf.

Had they anticipated the crash in natural gas prices, they wouldn’t have spent $1 billion to comply with “business-killing policies.” They would have shuttered the aging power plants six years ago.

When you sink $1 billion into a pair of 50-60-yr old power plants to comply with “business-killing policies” and six years later can only operate the plant 2 days a year, you don’t have much choice other than to write it off.

Powder River coal is much less expensive than natural gas and Appalachian coal is competitive with natural gas.

https://www.eia.gov/electricity/monthly/update/resource_use.php#tabs_spot-2

The recent rules on coal combustion waste has added just not cost in how the material is disposed, but long term liability for managing the waste. As you are pointing out, it is not just the price of natural gas, but the combination of increased regulation on multiple fronts. Power generators are choosing gas over coal because gas comes with a lot less headaches.

David Middleton June 22, 2017 at 7:51 am

When you sink $1 billion into a pair of 50-60-yr old power plants to comply with “business-killing policies” and six years later can only operate the plant 2 days a year, you don’t have much choice other than to write it off.

The reason they were only operated 2 days a year was because coal was too expensive!

Powder River coal is much less expensive than natural gas and Appalachian coal is competitive with natural gas.

The reason PR coal is that cheap it because its transportation cost are so high (2/3rds of cost at the power station). Also the cost of PR coal will go up because they’ve already mined the easy part, the overburden will increase and therefore the cost of production.

There oughta be a law requiring wind turbine operators to secure bond money for demolition and site reclamation or at a minimum turbine replacement in the event turbines become non-operational for whatever reason (other than of course when the wind stops blowing…). Is there?

There are requirements fornuclear plants to pay a certain portion of each kWhr sale to not only take care of nuclear wastes, but alsoto dismantle the plant when its lifespan is over. In fact, the govt was collecting way more than required for nuclear waste handling ad was ordered by the courts to return billions to the nuclear plant operaters

I can’t say for anywhere else in the world, but for the best part of the world, the TCEQ does not require it for wind, just public drinking water systems, underground petroleum tanks, and waste processing facilities.

https://www.tceq.texas.gov/adminservices/financial-administration/financial-assurance/need_assurance.html

That is the case in the UK

https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/80786/orei_guide.pdf

The guidance document you link applies only to offshore installations and then only if they become “disused” which is undefined. Quite so. Then come the “teeth”, of the guidance document:

“General requirement to remove installations

7.6 Considering our commitments under UNCLOS, and taking account of the IMO

standards as well as the work of OSPAR, we believe it is generally accepted

that the ‘ideal’ decommissioning programme involves removing the whole of all

disused installations and structures. We recognise that extending the life of the

installation, or reusing the infrastructure in a beneficial way, will often be

preferred, and we would wish to encourage this. Nonetheless, there is likely to

come a time when the installation becomes ‘disused’, when extending its life or

finding a beneficial reuse is no longer possible, and, at that point, a

decommissioning programme should be carried out.”

Indeed. If I may translate: “Considering this and taking into account that and someone else’s work we believe it’s generally accepted that the ideal is blah blah blah. Further we recognize that not actually fully decommissioning these unused environmental edifices may in fact be preferable and this we encourage. Even so, in spite of our best efforts to stall there may come a time when even environmentalists cannot with a straight face defend doing anything other than tearing these mistakes completely down. In that event, it SHOULD happen (but still, might not).

A bit different than what I had in mind.

That’s odd; I thought the envirostalinists hated fracking. Yet, they “love” NG because it is helping them to “kill coal”. How convenient.

They prefer NG to coal because it emits 1/2 the CO2. Not very complicated to understand.

Keep your eye on the next-gen coal technology recently launched in Japan, developed by a group of high end engineering firms. It has so far demonstrated cost effective production numbers and CO2 emissions on par with NG. It also happens to have the full backing of the Japanese government which is looking to these clean coal plants to replace nuclear generating capacity lost following Fukushima.

An enemy of my enemy is my friend.

Totally off topic, but too good to pass up. One of the BLM data sets is showing Lake Mead water level at 16,300 above sea level, the California drought is most surely over, forever, as it puts the peak of Whitney more than 1000 feet under water

Mark that 16,300 number is close enough for government work 😉

This talk about future energy power beyond the next decade fails to acknowedge the coming revolution in nuclear power technology : molten salt reactors, which are totally safe, cheaper than any other power technology, easily and quickly built and sited. All talk of future natural gas, coal, wind and sollar is irrelevant.

Arthur4563, how can you say that a MSR can ” easily and quickly built ” when there is not a single commercial plant as yet built?

Just like celluistic ethanol plants would be quickly, cheaply, and easily built 20 years ago, and fusion has been 10 years aways for the past half-century.

The government shouldn’t be picking winners and losers. They have a bad track record of that.

The “upcoming breakthroughs” in Popular Science and the like are, if anything, even worse.

Luis: When I was in my last year of ChE (1952) I was offered a job with (I think) Tennessee Products, to work on molten salt reactors. Turned it down. Maybe that is why the program hasn’t matured…all my fault. (lol)

JimBrock, ChE Auburn 1952; JD Georgetown1960; Order of the Retired, current.

Why must people constantly put forth “the future” of energy claims? That is exactly how we got this wind and solar mess. It was THE FUTURE OF ENERGY. Such claims only strengthen the fantasies of the gullible who then politically press for the ideas. Wind energy sold to the foolish and idealistic because it is the energy of the future (and the past and whatever). There is NO energy of the future. There is only what we have NOW. If a viable energy source is found and is incorporated into the energy mix or replaces most of it, then it is part of NOW. There is no magical energy of the future.

+1M

its amazing that one of the biggest corporate scandals in our lifetime, Enron, was a huge nat gas player … the nat gas market has a history of “interesting” characters and accounting practices … rent seeking nat gas companies have always been the biggest funder and lobbyist for anti-coal regulations and CO2 hysteria …

Hi David,

I assume the tin foil hat is directed at Kaiser Derden, but do you believe the thrust of his remarks are based on fantasy?

What other reason do IOCs vocally support a ‘price on carbon’ and spend so much lobbying for it (even while in the grip of cost/efficiency intiatives during the recent downturn), knowing that it will needlessly inflate the cost of the product? The business case is obvious; replace coal with gas in reliable electricity generation and watch the profits roll in. And to top it off, it’s all a grand and nobleguesture to save the planet; nowt to do with market manipulation or anything like that.

Of course anyone with a brain not swimming in kool-aide knows that if unreliables like wind are the answer, the question wasn’t worth asking, so convincing the likes of Germany to ‘go green’ and also taxing coal out of the equation means importing gas instead of burning indiginous coal. Or asking the last person to leave to please turn off what few lights remain on; a toss up which way the EUssr wants to go in that respect.

For all the bullshit virtue signalling about ‘…not only being part of the problem, but being part of the solution to the biggest challenge of our generation…’, the intent is very thinly veiled. The business case becomes blatantly obvious the moment the speech turns to natural gas being the bridging fuel to the low carbon future usually followed by the reassurances to shareholders that gas demand is going north for the next three decades.

The hypocrisy used to be primarily a European condition, but now that Reg Tillerson has left ExxonMobil, even their official line is straight from the virtue signalling gobshite’s hymn book.

It is and fantasy is too weak of a word.

The major oil companies that support a carbon tax don’t support it because they have bought into the CAGW myth or because they think it is a good idea.

They became convinced that the US government would impose some manner of carbon regulation and realized that a carbon tax would be the least disruptive form. When a company is convinced that the government is about to impose regulations that will harm their business, they have an obligation to lobby for the least harmful form of regulation.

Natural gas has been displacing coal for a decade because:

1) Past environmental regulations have made new coal power plants economically unfeasible.

2) The collapse in natural gas prices.

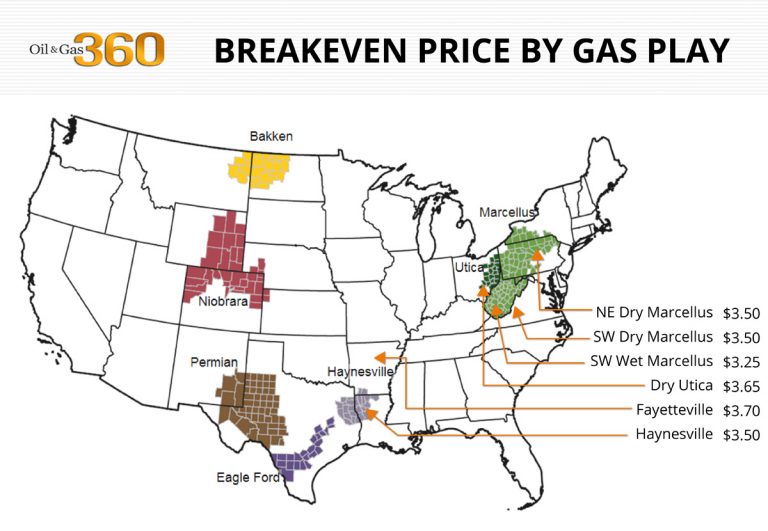

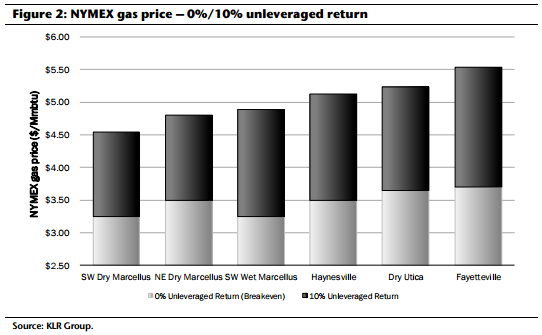

The gradual displacement of coal with natural gas isn’t leading to a “windfall.” At $3.00/mcf no shale play breaks even, much less rolls in profits:

Significant profits don’t begin to “roll in” below $4.50 to $5.50/mcf.

https://www.oilandgas360.com/median-breakeven-price-oil-55-per-barrel-gas-3-50-per-mcfe-klr/

If “big oil” was trying to undercut for big profits, they are doing it wrong.

There was also the fact that continued public opposition to carbon regulation might just lead to a tobacco-style inquisition.

https://www.documentcloud.org/documents/3037155-2006-Senate-Letter-to-ExxonMobil-CEO-Rex-Tillerson.html

While there is no analogy between the tobacco industry and ExxonMobil’s support for the CEI and other skeptical groups, the threat of a Federal inquisition was very real. And there was also a great deal of pressure from Wall Street. Almost all major oil companies are publicly traded and have to kowtow or at least pay lip service to Wall Street.

Rex Tillerson and other major oil company CEO’s did advocate “keeping a seat at the table” in the Paris climate farce,as did several major coal company CEO’s.

This wan’t because they thought Paris was a good deal. It was because they wanted to ensure that support for carbon sequestration remained a priority. In a full-blown decarbonization frenzy, carbon sequestration would be vital to the survival of the entire fossil fuel industry: Coal, oil and gas. And the coal companies view export markets as their primary growth market… Keeping a seat at the table was viewed as being beneficial to their access to export markets. I think they were wrong about the benefits of keeping a seat at the table; but that was their reasoning.

David Middleton it should be noted that you’re in flagrant disregard of everything known about the hydrocarbon industry when you claim they didn’t finance most of the AGW scare. Whatever it is you think propaganda is going to do for you, it’s not going to erase the well known history of Environmentalism in the west,

and Oil companies tight relationship with fake climate pseudo-scientists as revealed in Climategate.

100% bald-faced lies.

“Big Coal” supported staying in the Paris climate farce…

http://www.reuters.com/article/us-usa-trump-coal-idUSKBN1762YY

For the same reason that “Big Natural Gas” supported staying in the Paris Climate Farce…

In the face of impending government regulations, it is essential to maintain a “seat at the table.”

However, the fact that the G-7 and G-20 have failed to put up a united front to isolate the US, it appears that a seat at the Paris table wasn’t all that important.

Mr Middleton those of us who have watched the mass immigration of stupid into what’s claimed as ‘scientific discourse’ in order to turn science into a sewer,

recognize very easily when a claim has reached it’s limits and been debunked.

That’s when the name calling without content begins and you do it pretty frequently.

If you have a point, state it, with the evidence you have for it.

We’ve all gone through the years of arguing with people who can’t take the heat of kitchens they claim to have joined as expert chefs.

On top of it, I have 2 older children who do research here occasionally. I don’t need them believing the way you behave, is the way scientifically literate people are supposed to.

Your delusions about the oil industry have noting to do with science.

You’re precisely right Kaiser Derden. The cozy relationship between hydrocarbon corporations and the environmental movement they founded is the stuff of legend. Its troubling Mr Middleton is so busy calling names and not learning what he’s talking about.

In no particular order here’s a quick spin through the top-of-the-pile information about just who puts all the money into the environmental movement.

https://wattsupwiththat.com/2011/06/29/the-log-in-the-eye-of-greenpeace/

Note in the next article the constant presence of the – Rockefeller brothers. As in ”Rockefeller Oil Empire.”

http://www.sweetliberty.org/issues/un/environment.htm

http://nofrakkingconsensus.blogspot.ca/2010/06/bp-greenpeace-big-oil-jackpot.html

http://www.cnbc.com/2014/09/05/shell-tries-to-spin-oil-into-a-green-as-in-the-environment-future.html

The Oil companies founded the Western environmental movement. They were the people who established all the climate college campuses on university grounds worldwide.

The Rockefeller Foundation is not the oil industry. They are the descendants of the founder of Standard Oil Company of which Exxon and Mobil (now ExxonMobil) were formed.

The Rockefellers are the primary backers of the #ExxonKnew campaign against ExxonMobil for its support of AGW skeptics and a mythical conspiracy that Exxon covered up evidence of AGW.

BP’s “beyond petroleum” ad campaign does not back up any of your scurrilous lies about the oil industry…

The cited Washington Times article notes that BP contributed money to numerous environmental groups; but that their contributions were relatively small relative to the groups’ income…

I’ve contributed to the Nature Conservancy in the past. Why? Because their business model was to purchase property in order to protect habitats. This, in no way, constitutes support of the CAGW myth.

Nothing you have posted supports these scurrilous lies:

I was just wondering why Alfred was continuing to benefit from Evil Petroleum instead of being a True Eco-Hero and showing us all how wonder life is living in the pre-industrial paradise he apparently wants to drag all of us down into? Considered pointing out the blatant lies and stupidity of calling the Rockefeller Foundation “big oil”, but I was in a hurry and gave it a pass.

I’ve been in the oil industry for 36 years, entirely in “smaller companies.” I’ve never seen one scintilla of evidence that “big oil” was manipulating regulations or prices for any reason, much less to stifle competition from “little oil.” “Big oil” and “little oil” generally don’t even play the same game.

All oil companies benefit from smart, consistent regulations. Onerous, dynamic regulatory environments like the Obama administration are tougher on smaller companies than larger companies. However, no oil companies benefit from bad regulations.

BSEE’s idiotic new well control rule hurts everyone working the Gulf of Mexico OCS, from the smallest “bottom feeders” (of which there are dozens) up to ExxonMobil. This rule is hurting smaller companies more than “big oil”…

But the entire industry opposed it…

http://www.rigzone.com/news/oil_gas/a/143989/Exxon_Says_25B_Rule_Will_Sink_Deepwater_Oil_Drilling

“Big oil” funds a lot of things. The ExxonMobil Foundation funds anti-malaria programs, STEM education (particularly for women and minorities). They used to fund the Competitive Enterprise Institute until they were threatened with a tobacco-style inquisition.

https://www.documentcloud.org/documents/3037155-2006-Senate-Letter-to-ExxonMobil-CEO-Rex-Tillerson.html

While there is no analogy between the tobacco industry and ExxonMobil’s support for the CEI and other skeptical groups, the threat of a Federal inquisition was very real. And there was also a great deal of pressure from Wall Street. Almost all major oil companies are publicly traded and have to kowtow or at least pay lip service to Wall Street.

To the extent that “big oil” supports AGW nonsense, it’s through the promotion of natural gas (the “gas” in Oil & Gas Industry is natural gas, not gasoline). ExxonMobil and other members of “big oil” support a carbon tax over cap & trade and other schemes because it is the least damaging to their business… They are convinced that carbon will be regulated and are trying to influence the regulation in their favor – Not because they have bought into AGW. They pay lip service to it because they have to. All industries try to influence regulations in their favor.

There is no evidence at all that the oil industry is the primary or even significant sponsor of research supporting CAGW and very little evidence that they are a primary funder of CAGW skeptics…

Read more at: http://www.nationalreview.com/article/414359/global-warming-follow-money-henry-payne

Grants from publicly traded companies like ExxonMobil are very transparent…

https://www.insidephilanthropy.com/grants-for-higher-education/exxonmobil-grants-for-higher-education.html ?w=635

?w=635

http://cdn.exxonmobil.com/~/media/global/charts/corporate-citizenship-report/2016/community_investments_focus_area_1880x1058-jpg.jpg

http://corporate.exxonmobil.com/en/community/worldwide-giving/worldwide-giving-report/overview

Notably missing: Any reference to climate change research.

A Google of “ExxonMobil climate change research” yields page-after-page of their funding of “climate science denial”…

While ExxonMobil pays “lip service” to the call to reduce GHG emissions, it hardly promotes CAGW alarmism:

https://insideclimatenews.org/news/22122016/rex-tillerson-exxon-climate-change-secretary-state-donald-trump

Regarding a carbon tax and Paris, ExxonMobil had accepted the fact that governments were going to regulate carbon emissions. Their support of such measures was purely to have a “seat at the table” so that they could have some influence in the process to limit the regulatory damage to their business. Coal companies also supported keeping a seat at the table for the same reason.

“Big Coal” supported staying in the Paris climate farce…

http://www.reuters.com/article/us-usa-trump-coal-idUSKBN1762YY

For the same reason that “Big Natural Gas” supported staying in the Paris Climate Farce…

In the face of impending government regulations, it is essential to maintain a “seat at the table.”

However, the fact that the G-7 and G-20 have failed to put up a united front to isolate the US, it appears that a seat at the Paris table wasn’t all that important.

” “Big oil” and “little oil” generally don’t even play the same game. ” Yep, a point most people just can’t wrap their heads around. I know several “little oil” and “little gas” operators in western PA and what they are doing is not even vaguely like what the majority of people think of when they think “oil company” or “gas company”. And the Evil Marcellus Shale has been very, very good to them.

Stating some argument “isn’t even wrong” is a very useful phrase.

Yes a useful concept, been around for a while… From Wikipedia…

The phrase is generally attributed to theoretical physicist Wolfgang Pauli, who was known for his colorful objections to incorrect or sloppy thinking.[1][2] Rudolf Peierls documents an instance in which “a friend showed Pauli the paper of a young physicist which he suspected was not of great value but on which he wanted Pauli’s views. Pauli remarked sadly, ‘It is not even wrong’.”[3] This is also often quoted as “That is not only not right; it is not even wrong,” or “Das ist nicht nur nicht richtig; es ist nicht einmal falsch!” in Pauli’s native German. Peierls remarks that quite a few apocryphal stories of this kind have been circulated and mentions that he listed only the ones personally vouched for by him. He also quotes another example when Pauli replied to Lev Landau, “What you said was so confused that one could not tell whether it was nonsense or not.”[3]

Thanks, I needed that tutorial on “it’s not even wrong”, since I was not familiar with it nor understanding it.

“It’s not even wrong” = “no basis to determine what it is”, … or

“it may as well not exist”, … or

“it’s a non entity, worthy of zero consideration”

right ?

Cool. Sounds like Pauli invented not just one, but two Exclusion Principles. 🙂

The export market of NG will continue to rise, as we build more super tankers that can transport NG to Asia. This will drive up costs for power companies. At some point, clean coal again becomes competitive.

As power costs rise with natural gas price increases, so renewable energy looks like a cheaper option…

Yes, if the cost of every other significant source becomes 100 times more expensive. And if pigs had wings (plus a whole lot of other adaptations), they could fly. (Don’t you just love magical thinking?)

No CEO in his/her right mind would approve building a new coal plant these days. In spite of ultra supercritical technology, the risk is just too great that the next administration will restore the CO2 requirements. So that means we build combined cycle units until they drive up the price of natural gas and everyone goes whoops, I wish we had some of that nasty coal….

Not to mention that roughly 15% of the coal mined annually worldwide goes into producing steel. That can’t be replaced by wind, solar or natural gas.

Some of it can…

https://www.ft.com/content/3600e838-9139-11e6-8df8-d3778b55a923?mhq5j=e3

“He proposed gradually replacing its towering twin blast furnaces, which convert raw materials into molten iron, with smaller, electric-powered arc furnaces that melt down scrap. By using domestic feedstock and renewable energy, this is a model Mr Gupta believes can rejuvenate the industry.

“The UK has the opportunity to become a major steel producer but the opportunity is in the space of ‘green steel’, which means using an abundant resource available domestically in the form of steel scrap, which is going to grow,” he explains.”

http://www.powerengineeringint.com/articles/2017/02/hydrogen-power-project-planned-in-austria.html

“The companies hope to use excess power generated by renewable energy sources to create hydrogen from water with electrolysis. The hydrogen can then be stored for reconversion into power or for direct industrial use, with the aim of eventually replacing coal power in the steel making process altogether. “

Griff:

Both of those methods use electric furnaces to recycle scrap steel. This is already in widespread use, although the electric energy comes from conventional generation sources. New (primary) steel making requires a source of carbon, which is most commonly derived using coked coal.

I don’t know offhand how much electrical energy is required to recycle a tonne of scrap steel, but I do know it takes 13 megawatt hours to smelt a tonne of aluminum, and all the renewable power generated in the whole world in 2014 was not enough to replace just the coal-generated portion (about 58%) of total energy used to produce 53 million metric tonnes that year. Since steel production in the same year was just under 1.6 billion tonnes, I suspect all the renewable energy generated by the whole planet from now through 2030 (when China has agreed to start reducing their CO2 emissions) would not be enough to provide for a single year’s production.

The other problem is there is not enough scrap steel, even if you recycled 100% of it, to supply the annual demand. Steel has a relatively long life: somewhere I found figures on how long steel lasts in different uses before it becomes reclaimable, but I can’t find it now. Structural steel for buildings is 100% recyclable, but you have to wait 40-70 years to get it back. Automotive steel is recoverable in less time, but you’re still looking at 10 years or more before you get 50% of it back.

China produces just under 50% of the world’s steel annually — more than the next 9 largest producers put together; they use coal. All the growth in steel production since 1980 has come from developing countries, especially in Asia. Below are figures for 1980 and 2016 (million tonnes):

China: 37.1 -> 808.4

India: 9.5 -> 95.6

S. Korea: 8.5 -> 68.6

Turkey: 2.5 -> 33.2

Brazil: 15.3 -> 30.2

Mexico: 7.1 -> 19.0

In contrast, the developed countries have all declined:

US: 101.4 -> 78.7

Germany: 51.1 -> 42.1 (don’t know if this is combined East+West Germany for 1980 figure)

Italy: 26.5 -> 23.3

France: 23.1 -> 14.7

UK: 11.3 -> 5.8

The EU as a whole went from 208.0 to 162.3.

The UK (referenced in the link to Gupta’s article) accounted for a small fraction of the world’s steel in 1980 and a much smaller fraction today. The assertion the UK could become a “major” steel producer by recycling is pretty close to pure fantasy, especially as the UK grid is running with almost no reserve at present. Perhaps in another 10 years or so they will have a fair amount of scrap steel to recycle from derelict wind turbine towers, but they’ll have to buy power from French nuclear or perhaps Norwegian hydro to do so.

Alan

Gupta proposes to build the renewable energy locally via a tidal lagoon… which would produce known amounts of electricity at defined times

Griff:

I found this on Electric Arc Furnace steel recycling at the ever-reliable Wikipedia:

If you do the math, to supply 132 MWh over 37 minutes requires input at a steady 214 MW (neglecting transformer losses). You can scale it down for smaller furnaces of course, although I assume that when everything is taken into account, the larger furnaces are more efficient.

I can’t read the Gupta article without a subscription to the Financial Times, but I repeat: his assertion that UK could become a “major” steel producer by recycling steel is not even remotely credible.

In 1967 the UK produced 24.4 million tonnes of steel (MToS), or 4.88% of the world total of 497.2 MToS. In 1980 that had dropped to 11.3 MToS, or 1.58% of the world total of 716.4. By 2000 the UK had surged to produce 15.16 MToS, which was 1.78% of the world total (850.1). The surge was short-lived as in 2010 the UK had fallen to produce 9.7 MToS which was a pathetic 0.69% of the world production (1,413.6). The relative decline continues as in 2015 the UK produced 10.86 MToS, or (drum roll please) 0.67% of the world total of 1,620.4 MToS. That was also a temporary surge as their 2016 production was just 7.58 MToS. For perspective, the 2015 figure puts them handily behind such industrial behemoths as Iran and Mexico. Figures are from Wikipedia again.

To account for even 1% of world steel production, the UK would have to produce 16.2 MToS, or 8.62 more than 2016. If it takes 132 MWh to produce 300 tonnes from scrap, the increase would require 28,733 MWh of steady reliable power. Double that for “all green” steel production. I don’t consider 1% to be a “major” producer. They’d have to at least break into the top 10 to qualify for that and #10 in 2016 production was Ukraine at 24.22 MToS, slightly more than three times the UK.

Keep in mind that if you keep one of those 300-tonne furnaces busy 100% of the time, getting 300 tonnes of steel every 37 minutes, the annual output is 300 * 60 / 37 * 24 * 265 or 4,261,621 tonnes annual output (4.26 MToS), and requiring continuous input of 214 MW. Multiply that times six to get the UK into the top 10 steel producers and I’ll agree to the “major” label.

So: how much power does Gupta think he can get from tidal lagoons and how much will it cost to build per MW of steady output?

There are constraints on NG people may not be aware of, namely the infrastructure required. But in order for the infrastructure to be built, there has to be demand, so there’s a bit of a chicken-and-egg thing going on. The point being, not all areas have access to NG. https://www.forbes.com/sites/judeclemente/2016/06/26/new-englands-known-need-for-more-natural-gas-pipelines/#228aeeec30a0

Well, it doesn’t matter in Oregon, because they won’t let natural gas in either.

Why is anyone selling Oregon power or buying power from Oregon?

Because they have an abundance of hydroelectric power.

https://www.eia.gov/state/?sid=OR#tabs-4

David: Thanks for the informative article. Some comments:

The EIA’s estimates of LCOE include a higher cost of capital for fossil fuel plants to “compensate for the risk that a carbon tax will be imposed”. And their LCOE assumes capital costs are expensed over 20 years, which is optimistic for wind and ridiculously short for coal. The average coal power plant in the US is 42 years old.

However, the age of the average coal plant is a sign that the industry has over the past few decades (ie independent of the party controlling the EPA) has been reluctant to invest in coal. There may be two reasons:

1) Coal produces more conventional air pollution than natural gas.

2) If you are a lukewarmer, there are benefits to burning natural gas now and waiting to see how bad climate change will be in a few decades and whether new technology will help in the future.

1) Which led to much of this:

http://www.heritage.org/environment/report/the-assault-coal-and-american-consumers

2) N2N (natural gas to nuclear) is the only viable “just in case” scenario:

http://images.realclear.com/252491_5_.png

http://www.realclearenergy.org/charticles/2014/08/01/solar_and_wind_more_expensive_than_realized_107939.html

What killed/is killing coal? The answer is plain as day. Electricity was being delivered to many millions of Americans at home for less than 10c a kwhr in the early 1990s. At 10c a kwhr coal can compete with anything. The only thing that had happened since then to increase the price has been massively increased regulation not a shortage of coal supply.We have already demonstrated on a massive scale what the true cost of electricity from coal should be.. not the bogus numbers in this article.

What killed/is killing coal? The answer is plain as day. Electricity was being delivered to many millions of Americans at home for less than 10c a kwhr in the early 1990s. At 10c a kwhr coal can compete with anything. The only thing that had happened since then to increase the price has been massively increased regulation not a shortage of coal supply.We have already demonstrated on a massive scale what the true cost of electricity from coal should be.. not the bogus numbers in this article.

funny – I could have told you this, and I didn’t even get paid to do a study.

I will add – natural gas does have some value over and above the cost for construction. It is more dispatchable, and overall better at managing loads. Less air permitting and disposal issues. Natural gas allows more differing sources of energy to be successfully added to the mix – without natural gas, wind would be a non-starter for example. For that reason, many utilities would think natural gas power is still attractive even at a somewhat higher cost than coal – it has a premium value in the marketplace.

Also, fair to point out, if Sandia’s supercritical carbon dioxide experiment is successful, in 10 years natural gas generation costs could take another very steep drop. This would increase efficiency from 33 to 50%. A one percent efficiency improvement in a power plant translates into millions of dollars because less fuel is burned to make the same amount of electricity. A one percent improvement in efficiency also reduces greenhouse gases by about 2.9 percent. Increasing efficiency to 50 percent reduces emissions by 34 percent. These are just huge changes – image using 17% less fuel, to generate the same electricity.

For any coal or natural gas power plant, 1/3 the cost is capital, 1/3 fuel, and 1/3 interest. Dropping power plant costs also drop interest costs, meaning a natural gas power plant costs could drop in prices 20%, with 1/3 less emissions. Oh yeah, this would be a “bolt on” system – old power plants could be easily retrofitted with the new generator, leaving the boiler and everything else intact.

This is what bugs me about environmentalists – this is a huge change and likely to rapidly cut emissions faster than every wind farm and solar panel in existence, at very low cost. every hear them mention it?

You mean an experiment in wasting tax dollars? We already know how to run CO2 in a Brayton cycle. And CCGT is already at 50% efficiency.

tsk: why are you against

saving money?

“market forces” Wow, yet another name for Donald Trump! And here I thought “market forces” was Barri Obama’s nickname.

Nobody knows what the real price of energy of some sources due to distortions caused by government direct and indirect subsidies. Just look at what percent of Elon Musk’s revenues are attributable to government. It is the butt of jokes and the joke is on all of us.

I did look at Tesla subsidy and found this:

https://www.quora.com/How-much-money-from-the-government-is-subsidized-to-tesla

If government is forcing automakers to purchase ZEV credits, they are imposing a tax on them. It is idiotic to say that it is paid for “by other automakers, not tax payers.” The other automakers are taxpayers.

This is beyond idiotic. If a customer purchases a Tesla for $100,000, Tesla gets $100,000. The $7,500 Federal tax credit may go to the purchaser of the Tesla. But this just means that the customer paid $92,500 and taxpayers picked up the other $7,500.

Tesla would not be in business without massive injections of corporate welfare.

https://seekingalpha.com/article/4043401-teslas-projected-earnings-sensitive-zev-credits-go-away

The more revenue Tesla generates, the more money they lose…

https://finance.yahoo.com/quote/TSLA/financials?p=TSLA

This is a business model which can only function with massive infusions of OPM.

Subsidies to the company and to its buyers and sales of credits to other makers via government mandate make all the economic difference to that company.

Nobody knows what the real price of energy of some sources due to distortions caused by government direct and indirect subsidies. Just look at what percent of Elon Musk’s revenues are attributable to government. It is the butt of jokes and the joke is on all of us.

Add in extremely expensive “carbon capture and storage” and behold! Coal is uneconomic. How surprising.

Here at WUWT we have facts, facts, facts. This has made us the world’s leading climate website, but we still have profoundly expensive attacks on the source of life. Facts cannot hold a candle to emotions.

I have an Eastern European professor friend whose English as a second language is better than an American University graduate. When I brought up the value of carbon dioxide in a discussion, he said that just as we must expel “poop,” it was necessary to get rid of carbon dioxide. The reality is that our body uses the carbon dioxide produced in metabolism as carbonic acid to maintain blood pH. You could not live one second without this factor.

But I have a master’s in animal physiology. I know this stuff. Most people think in the crude terms used by my friend. We think of CO2 as equivalent to “poop,” at best. That is if we can tell the difference between CO2 and CO, which is the gas that kills you in a closed garage with the engine running.

We at WUWT talk all the time about the economic devastation wrought by the econazis. But really, wouldn’t you pay that price to avoid breathing toxic poop?

You can call CO2 PLANT food all you like, but I am not a plant. I am a mammal and a human. I want a world free of all the pesticides and other poisons used in modern agriculture. So do many others, including many of those who think the source of life is a poison.

If we are to recovery sanity and our freedom, we have to counter hysteria with emotion of our own. There is PLENTY of emotion in this subject for me, because health and well being will INCREASE with more carbon dioxide in the atmosphere.

We are NEVER going to win this debate with chatter about temperatures.

Let’s put out more plant food! Lady life grow!

trouble is, we cannot put out

more “plant food” without

increasing the planet’s temperature.

and many plants do not like

a higher temperature.

These plants like higher temperature. This greenhouse in Japan pipe in exhaust gas from an industrial engine to feed the plants. They eat 0.5 ton of CO2 per hour. Boy they love it! They grow twice faster than plants outside the greenhouse.

http://www.k-takatsuki.co.jp/tomato/img/tomato_index_slider3.jpg

Costs for new coal plants doubling from 2010 to 2014 makes the combination of politics and junk science scares the predominant market factor in our energy market through federal, state and municipal interference. And yet they purport to protect the consumer. No. They project their power.

coach: it’s now cheaper to

generate power with natural

gas.

so why would any utility

build another

coal plant?

The fact that natural gas is cheaper today doesn’t mean that it will maintain this advantage indefinitely into the future. The current oversupply of cheap gas invites inventions to take advantage of the cheap gas; cng long distance trucks, exporting of gas from the U.S. to other nations using new LNG facilities, etc. At some point the price of natural gas may increase due to market forces, which will then make coal more attractive than it is today. Also, the new Panama Canal expansion makes it easier to export American coal to Asia.

Because natural gas won’t be this cheap much longer.

richard wright – so you want utility people to make decisions

based not on what’s most affordable

now — or, since they clearly do a detailed

market analysis — what’s cheapest over

the next many years, but on what mighta maybe

could possibly come true.

do you own shares in a coal company,

richard?

seriously.

https://friendsofsciencecalgary.wordpress.com/2016/08/29/the-levelized-cost-of-electricity-from-existing-generation-sources/

Existing combined cycle natural gas power plants are only slightly less expensive (~$34/MWh) with natural gas selling for ~$3.00/mcf. Natural gas can’t stay this cheap much longer… Coal can stay this cheap for hundreds of years.

I don’t have any financial interest in the coal industry, beyond being an electricity consumer. I make my living finding oil and natural gas.

Actually, David, investing in coal right now is a good idea.

It may very-well be a good idea.

Some days I can see why emails on unlimited free energy could be very lucrative. Electricity is invisible and “magic”. Between tax support, regulations, and politics, there is no reality in the costs of energy nor the effectiveness. It’s link-for-link matched by contradictory information. If we were to determine what is really the most effective, least costly energy form, I foresee centuries of trying to wade through all the contradictory data. It’s just more of the “there is no reality” world we are now living in.

sheri: people who are aware

and care

know the price of electricity

and the price of what

generates it

including the external price

that we all pay

The “external price” is $0.00 or less.

https://wattsupwiththat.com/2017/03/15/discounting-away-the-social-cost-of-carbon-the-fast-lane-to-undoing-obamas-climate-regulations/

It’s not the price of NG alone, but the popular and mature combined cycle designs.

A NG fired CCPP operates at an efficiency of about 60% as opposed to the 35% of straight Rankine coal power.

In a CCPP about 10% goes up the stack, about 30% is CT electrical power, about 30% is ST electrical power, about 30% is rejected heat from the Rankine side of the cycle.

NG fired CCPP’s are much simpler to design, approve, site and build. A CCPP produces about a third as much CO2/MWh as coal.

About 15% or so of coal fired capacity will be retired because of age, high heat rates, AQCS costs, but the newer plants and supercritical designs will press on.

I’d prefer to see the actual capital costs of the new HELE coal fired plants being built in Asia and elsewhere rather than the US EIA figures ( especially when they are figures produced during the Obama administration time).

coal pollutes.

it’s dirty and filthy and nasty.

its an 19th century fuel,

full of soot and toxins

and should be eliminated

even without any considerations

of its terrible impact

on the climate.

http://aemstatic-ww1.azureedge.net/content/dam/pe/print-articles/2014/07/pg28-fig1.jpg

http://instituteforenergyresearch.org/wp-content/uploads/2009/06/emisscoal.png

Middleton, as usual in your posts, you completely miss the point. This one is a howler.

Coal-fired power plants in the US are closing in record numbers because the US EPA finally closed the loopholes that allowed existing plants to operate without expensive pollution control devices. Coal power plant owners refuse to install the equipment and elect to close down the plants.

By the late 1960s, the US environment became an issue and the Clean Air Act was passed in 1970. However, coal-fired power plants were exempted from most of the provisions of the CAA by various means. In practice, while other industries such as smelters, chemical plants, and refineries were required to install air pollution abatement systems, the coal-fired power plants did not. This, as it turned out, was a mistake.

Coal-fired power plants, and nuclear power plants enjoyed substantial profits while their chief rival, natural gas, was at a high price during the decades after passage of the CAA. That was the time to spend some of the profits to install pollution reduction systems. Now, when natural gas prices are low, coal-fired plants cannot afford the pollution reduction systems. Also, the US EPA has finally closed the loopholes on coal-fired power plants and required them to reduce their air pollution. see link to “The Tragic Flaw of the Clean Air Act.” http://www.regblog.org/2016/05/17/revesz-lienke-tragic-flaw-clean-air-act/

The response, predictably, is for the owners of the coal-fired power plants to close the plants. (Note the rapid decline in coal percentage in the graph above, from 2005-2015; from 50 percent to 38 percent) see link to SLB article “Coal Power Plant Shutdowns Ahead of Pace in 2015: Gas and Renewables Replace the Coal Power.” http://sowellslawblog.blogspot.com/2016/04/coal-power-plant-shutdowns-ahead-of.html

Rog,

This was one of the two points of my post:

I think you’re the first anti-coalers to get this bit right.

🖒🖒

The exact same thing happened in the UK – UK coal plant owners were unwilling to pay for additional anti pollution (non-CO2 related) measures under the LCPD directive and the plants therefore had to close. Not only that, but most closed earlier than required after being run at max permitted hours for short term profit.

Hence the phrase: “business-killing policies”.

My favorite part of this meme is how EPA and the various state epa clones have responded to coal plant operators who have designed and built emissions control systems which met the standards EPA and its clones had set. They collectively refused to accept the remediation implemented by these plants, even though it met the standards THEY had set. This is a typical leftist tactic, moving the goal posts, or as it is known, the “Lucy Effect”. Leftists never accept anything that does not advance their anti-technology, anti-science and anti-American agenda.

Yep,

Power plant operators spent billions to comply with steadily tightening air pollution rules…

Only to have the rug pulled out from under them with CCS requirements. The collapse in natural gas prices was just icing on the cake. Without the dynamic regulatory goal posts, utilities could have survived a decade of low natural gas prices.