Guest post by David Middleton

America’s Biggest Coal Miner Is Joining the Comeback Under Trump

by Tim Loh

April 3, 2017, 4:28 PM CDT April 4, 2017, 1:14 PM CDT

Peabody Energy Corp., America’s largest coal miner, is back.

After almost a year in bankruptcy, the St. Louis-based giant began trading again on the New York Stock Exchange on Tuesday. Its return to Wall Street comes as the entire U.S. coal sector is staging a comeback amid growing interest from investors.

[…]

Peabody’s relisting comes just months after rival Arch Coal Inc. emerged from bankruptcy. Miner Ramaco Resources Inc. held the industry’s first initial public offering in two years. And Warrior Met Coal LLC is planning its own. They’re all riding a rally in coal prices, which skyrocketed last year after China decided to cut its output. U.S. natural gas futures have meanwhile climbed, making coal a more attractive alternative for power generators, as Trump begins rolling back regulations on the industry in a bid to bring mining jobs back.

The industry’s recovering from a market collapse that, just a year ago, sent coal prices plunging to their lowest level in over a decade. The downturn forced shut hundreds of U.S. mines, leaving thousands out of work. Peabody, which produces more tons of coal than any other U.S. miner, is returning with about a quarter of its old debt levels and plans to focus on the thermal coal used by power plants — a fuel it can extract from mines in Wyoming and Australia that analysts including Clarksons Platou have ranked among the world’s lowest-cost operations.

[…]

Kellow credited Trump’s initiatives, including an executive order repealing one of Barack Obama’s signature environmental measures, with affirming coal’s place in the nation’s energy mix. Eventually, policies out of Washington may delay or defer the expected closing of 50 gigawatts of coal-fired power plant capacity, Kellow said.

“A lot of the regulatory efforts that we’ve seen to date have focused on both job protection and laying the foundation for future growth in jobs,” Kellow said. “I mentioned the 50 gigawatts coming out of the system. The foundation is there to potentially delay or defer or turn that around. That would be the driver of jobs.”

Metallurgical coal rallied by the most in four years after damage from Tropical Cyclone Debbie hit shipments from Australia, the world’s largest producer of the steelmaking component. Spot prices rose 0.6 percent to $176.80 a metric ton Tuesday, after soaring 15 percent a day earlier, according to The Steel Index. Monday’s jump was the biggest daily gain in data going back to May 2013. Thermal coal gained 6.2 percent to $88.05 a ton on Monday.

Peabody may chart a conservative path forward, focusing on keeping debt levels low and staying profitable, Jeremy Sussman, an analyst at Clarksons, said in a note. That means avoiding decisions like a 2011 one to spend $4 billion to acquire Australia’s MacArthur Coal Ltd., an ill-timed, debt-fueled bet that metallurgical coal prices would stay high. Prices promptly crashed, ultimately driving Peabody into bankruptcy.

[…]

U.S. coal production plunged by almost 40 percent under President Barack Obama as the industry faced competition from cheap gas and pressure from tighter regulations on pollution from power plants. Trump has already begun lifting regulations on the coal sector, including a ban on leasing on federal land. He promised during his campaign to bring back mining jobs, a prediction even coal companies have hedged.

“It’s not going to bring back jobs right away,” Robert Murray, the CEO of miner Murray Energy Corp., said of Trump’s initiatives in an interview last month.

Of course the naysayers respond with:

“Trump declares end to ‘war on coal,’ but utilities aren’t listening.“

“Coal is on the way out at electric utilities, no matter what Trump says.“

But, they miss the point. The resurgence of the U.S. coal industry isn’t based on a resurgent domestic demand for coal as a power plant fuel.

Big Coal: Don’t Call It a Comeback

By Liam Denning

[…]

Interviewed at Bloomberg headquarters on Tuesday, CEO Glenn Kellow, to his credit, didn’t try to spin a story of resurgent coal demand. Instead, his mantra is one of keeping costs down, taking opportunities to expand market share, keeping debt manageable and distributing cash to shareholders.

Peabody will also seek to reap the occasional windfall from more volatile international metallurgical coal prices via its Australian assets. In other words, blocking and tackling in a commodity market that is, by and large, not growing much and still facing big challenges.

One of the more telling moments during Tuesday’s interview came toward the beginning, when Kellow was summarizing the events around Peabody’s descent into chapter 11. He noted that, around the same time, U.S. natural gas prices hit a low of $1.67 per million BTUs. He was off by a few a cents — as he acknowledged he might be — at least according to Bloomberg data. Whatever; the point is that the CEO of a coal-mining company who quotes historical natural-gas prices down to the cent clearly knows the enemy.

As I’ve written here and here, the shale boom fracked the ground from underneath the U.S. coal sector. The industry simultaneously self-administered a coup de grâce in the form of ill-timed acquisitions, loading up with debt just as the market went south. President Barack Obama’s tightening of the regulatory screws on coal-fired power essentially closed the door on any revival.

The loosening of those screws doesn’t presage a coal renaissance. Which is why Kellow stresses the competitiveness of Peabody’s coal assets, particularly its mines in the Powder River and Illinois basins. These inland sources of supply enjoy lower costs than Appalachian coal, making them better able to compete with gas in the all-important power-generation sector.

In the chart below, I’ve calculated the price at which generic Powder River Basin coal can be competitive with gas at various price levels:

Those are theoretical numbers, but it’s clear what Peabody is up against. Natural gas futures over the next five years average just $2.97.

Kellow is optimistic the Clean Power Plan’s demise will keep some coal-fired units open that might otherwise have closed. He hopes this will also mean those remaining open will run for more hours every year, pushing utilization up from 50 percent or so to more like 70 percent.

[…]

The resurgence is due to the industry making itself more competitive, in much the same manner that the shale oil & gas players made themselves more competitive in response to a collapse in commodities prices.

The Market for Coal

The demise of the Clean Power Plan (CPP) leads to a 30% increase in U.S. coal demand by 2030 (relative to the expected demand under the CPP):

Coal demand may not be resurgent in the U.S., but it continues to grow in the non-OECD world.

Chapter 4. Coal

Overview

In the IEO2016 Reference case, coal remains the second-largest energy source worldwide—behind petroleum and other liquids—until 2030. From 2030 through 2040, it is the third-largest energy source, behind both liquid fuels and natural gas. World coal consumption increases from 2012 to 2040 at an average rate of 0.6%/year, from 153 quadrillion Btu in 2012 to 169 quadrillion Btu in 2020 and to 180 quadrillion Btu in 2040.

[…]

https://www.eia.gov/outlooks/ieo/images/figure_4-1.png

The coal industry can also take advantage of “climate change” (wink,wink, nudge, nudge):

After Cyclone Debbie, China replaces Australian coal with US cargoes

Tuesday, 4 Apr 2017 | 8:52 PM ET

China, the world’s biggest coking coal importer, is scrambling to cover Australian supply disruptions after Cyclone Debbie knocked out mines and rails by turning to an unusual source: the United States.

Debbie, which hit Australia‘s Queensland state last week, caused the evacuation of several mines and damaged coal trains supplying export terminals, triggering two miners – Yancoal Australia and QCoal – to declare force majeure on its deliveries. With other miners like BHP Billiton and Glencore also affected by the storm’s fallout, more disruptions may follow.

Force majeure is a commercial term that means a buyer or seller cannot fulfill their obligations because of outside forces. It is typically invoked after natural disasters or accidents.

Australia is the world’s biggest coking coal exporter and is China’s largest supplier. With markets there closed on Monday and Tuesday, its steel makers are clambering to find alternative supplies.

“Markets may be closed Monday and Tuesday but there’s certainly activity. The Chinese are fixing cargoes from the United States in order to replace the shortfall from Australia,” one coal trader with knowledge of the matter said, speaking on the condition of anonymity as he was not cleared to talk about commercial deals.

“More will make its way from the U.S. to China very soon,” he said.

[…]

China will remain a huge market for coal for a very long time:

China Ramps Up Coal Power Capacity As UN Climate Talks Kick Off

MICHAEL BASTASCH

2:21 PM 11/07/2016

China’s government announced plans to increase the country’s coal-fired power capacity by as much as 20 percent over the next four years as United Nations delegates meet in Morocco to implement a major global warming agreement.

China’s new five-year plan would “raise coal-fired power capacity from around 900 gigawatts last year to as high as 1,100 gigawatts by 2020,” which is “more than the total power capacity of Canada,” according to The Wall Street Journal.

Officials said they would increase the percentage of its electricity mix it gets from non-fossil fuel sources to 15 percent by 2020. Coal’s share of electricity production would fall to 55 percent, down from more than 65 percent in recent years, though coal-fired power use could rise in absolute terms.

[…]

China consumes as much coal as the rest of the world combined.

China only agreed to sign on to the Paris sham if they didn’t have to begin to decarbonize until after 2030.

Mr. Xi said China would brake the rapid rise in its carbon dioxide emissions, so that they peak “around 2030” and then remain steady or begin to decline. And by then, he promised, 20 percent of China’s energy will be renewable. Analysts said that achieving those goals would require sustained efforts by Beijing to curb the country’s addiction to coal and greatly increase its commitment to energy sources that do not depend on fossil fuels.

And the Trump administration is committed to clearing the obstacles in the way of ramping up coal exports:

DECEMBER 15, 2016 12:10 PM

Trump’s Interior pick could signal revival of Northwest coal export terminal

WASHINGTON

Donald Trump’s nomination of Montana Rep. Ryan Zinke to lead the Interior Department could signal the revival of a much-debated coal-export terminal in Northwest Washington state that’s pitted industry groups and unions against environmental and community groups, and two Indian tribes against each other.

In Congress, Zinke has been a staunch supporter of the Gateway Pacific Terminal, a $600 million facility in Whatcom County, Wash., that would export about 48 million tons a year of coal mined in western states to Pacific Rim markets.

Zinke also wants to lift a moratorium on new leases for coal extraction on federal lands, 90 percent of which takes place in the Powder River Basin in Wyoming and Montana.

[…]

Read more here: http://www.mcclatchydc.com/news/nation-world/national/economy/article121065488.html#storylink=cpy

Competition With Natural Gas

The naysayers generally follow up their “no demand” argument with a “natural gas is cheaper than coal” argument. As Mr. Denning noted, coal is competitive when natural gas prices are above $2.50/mmbtu. Natural gas is very cheap right now. However, it has been rising for more than a year:

The shale boom led to an oversupply and a collapse in natural gas prices over the past decade. Much of this was due to the fact that oil prices remained high until late 2014. Liquid-rich gas was economic at very low gas prices with oil trading at >$100/bbl. The natural gas glut will soon come to an end:

Natural gas oversupply will not last forever: Industry executives

Huileng Tan | Akiko Fujita

Monday, 3 Apr 2017 | 11:02 PM ET

The natural gas industry has been plagued by low prices on the back of massive supplies from mega-projects coming online and low oil prices, but there may well be not enough output to meet growing demand in the longer term, industry executives said Tuesday.

“The industry needs extra supply by the middle of 2022, 2023,” said Jordan Cove LNG president, Elizabeth Spomer.

Current low prices and supply surplus sparks a cycle of slowing production amid growing demand, which will contribute to a future output deficit, she pointed out.

U.S. natural gas prices priced at the benchmark Henry Hub are around $3.15 per million British thermal units (mmBtu), 11 percent lower from a year ago.

Spot prices in Asia for liquefied natural gas (LNG) are above $5 per mmBtu currently and trend higher during winter demand, drawing shipment from the U.S. among other markets. However, Asian buyers have previously preferred longer-term contracts for supply security.

That is the case as well with demand up and coming in China where there is a government push to replace coal-fired plants with cleaner gas-powered electricity plants so as to curb air pollution.

Big buyers are also emerging from the Middle East, Pakistan and Bangladesh will soak up production from projects coming online in Australia and the U.S., said Spomer who was speaking to CNBC on the sidelines of the Gastech conference in the Japanese city of Chiba.

“It takes a while to build these things,” she added.

[…]

Conclusion

The U.S. coal industry is doing exactly what the oil & gas industry did from 2014-2016. In the face of oversupply relative to demand and a collapsing commodity price, the industry is making itself “leaner and meaner.” Mr. Denning referred to natural gas as the “enemy” of coal. That’s funny, I find oil & gas for a living and have never thought of coal or nuclear power as enemies. Fair competition is good for business… And as an electricity consumer, I don’t like paying more than 10¢ per kWh for electricity.

Natural gas prices are unlikely to remain this low for very long. $2.50/mmbtu is uneconomic in most of the shale plays and very uneconomic in the Gulf of Mexico, except on a cost-forward basis. When natural gas production and consumption come back into balance, it will probably be at a price of $3.50 to $5.00/mmbtu. Coal is very competitive with natural gas above $3.50/mmbtu.

I don’t understand why reviving a dirty pollution generating landscape scarring industry is desirable especially one that employ’s fewer people than Arby’s, a minor US fast food chain. https://www.washingtonpost.com/news/wonk/wp/2017/03/31/8-surprisingly-small-industries-that-employ-more-people-than-coal/?utm_term=.305418a0d9f1

The energy industry is not a “jobs program.” Here is a plot of U.S. energy production from oil & gas, coal, wind and solar power in million tonnes of oil equivalent (Mtoe).

[caption id="attachment_167885" align="alignnone" width="960"] Source: BP 2016 Statistical Review of World Energy[/caption]

Source: BP 2016 Statistical Review of World Energy[/caption]

Here is a plot of Mtoe per thousand employees:

[caption id="attachment_167890" align="alignnone" width="960"] Sources: BP 2016 Statistical Review of World Energy, U.S. Bureau of Labor Statistics (via FRED), The Solar Foundation and American Wind Energy Association.[/caption]

Sources: BP 2016 Statistical Review of World Energy, U.S. Bureau of Labor Statistics (via FRED), The Solar Foundation and American Wind Energy Association.[/caption]

Which energy employees are the most productive?

Regarding the “landscape scarring” horse schist, see slides 14-20:

https://www.slideshare.net/tlheadley/special-mountaintop-mining-powerpoint-finished

This Washington Post article is one of the stupidest things I’ve ever read…

Businesses don’t exist to provide jobs for people. They exist for the purpose of making money for their owners.

Arby’s, with its 80,000 employees generated a record $3.6 billion in revenue in 2016.

Peabody Energy, with its 7,100 employees generated $5.6 billion in revenue in the very bad year of 2015.

This chart is moronic:

Is there a requirement for journalists to be mentally deficient?

You are right David…businesses don’t exist to provide jobs…

but this is a political initiative the stated aim of which (or one of them) is to keep and increase jobs in an industry…

Keeping and increasing the jobs and pay in an industry is a byproduct of enabling businesses to grow. Jobs growth is a result, not a cause, of business growth.

If the goal was just to provide jobs, they could do that by subsidizing salaries.

On the other hand, when you remove regulations and allow an industry to grow, then more jobs is an entirely predictable side affect.

Sure it is a jobs producing industry. When you provide very affordable energy for all, that will spur economic activity for all. Dig it, burn it, scrub it and clean up after yourself…there, now President Trump where do collect my consulting fee?

Good point Rick. Cheap, dependable energy enables more job creation throughout the economy.

People who want massive government-funded jobs programs *coughclimatechangecough* characterize private industry job gains as “jobs programs”. Huh.

Next up I guess, is wailing about “subsidies” (AKA legitimate business deductions) and nebulous “externalized costs”.

The energy industry is not a “jobs program.”

==========

turn off the power and see how many people have jobs after 1 week. no energy, no jobs, anywhere.

If the goal was just to provide jobs

==================

provide 100% tax credits to employers for wages. this will grow employment much faster than cutting corporate tax rates. for example:

if an employer pays out $100 in wages, they get to deduct $100 from the corporate taxes they owe. this will grow jobs like nothing has ever done before, and since employees will pay somewhere between $25 and $50 in taxes on the $100 wages, the government will still be getting a huge tax revenue from the extra employment.

as an added bonus, since employees will now effectively cost the employer nothing, humans will now be able to compete with robots. otherwise, since robots collect no wages, and pay no taxes, every robot installed shrinks the tax base, increasing the deficit, and providing no benefit to society. without a tax credit, as more robots are added, more and more of the tax burden falls on increasingly fewer workers than still have jobs, until the system will collapse under the weight of the deficit.

ferd, the argument you make against robots applies equally to every other labor saving device ever invented.

If we followed your advice, we would have to destroy every piece of equipment and go back to farming with sharpened sticks.

Where are Farmer’s on the list?

For that matter, there are only 535 US Congressional Representatives. Too small a number to matter?

How much wealth do those Arby’s and Wal-Mart employees bring home and recirculate within their economies? Now compare that to the wealth taken home by the coal industry employees.

Furthermore, your argument is completely based on that the more jobs a sector employs the more beneficial it is for the economy. So therefore you think that it’d be a huge boon for the economy if Peabody sold off all of their massive electric shovels and hired thousands of minimum wage employees to carry coal with buckets? I’d graph your stupidity, but my computer told me it ran out of virtual memory trying to do so.

Ferd, no business, corporate or otherwise, *ever* pays taxes. The owners, operators and customers all pay the, now hidden, taxes. “Taxing” businesses just makes them government tax collection agents.

Um, because since about 1995 Coal hasn’t been what you say it is?

Or how about, because Arby’s pays way less than Coal?

Or why not, because Coal jobs help make Arby’s jobs possible and not visa versa?

Arby’s doesn’t pay nearly as well as the coal industry.

All jobs are not created equal.

Aaron

Journalism employs even less than either coal or Arby’s.

And the hot air they produce, unlike the coal miners, is of no value to anyone.

Most journalists are not qualified to work at Arby’s… 😉

In college, do those who drop out of the teaching programs go into journalism, or is it the other way around?

Ad hominem attacks are one of the last refuges of someone who doesn’t have a good argument. Are you saying the numbers are wrong? Citations please.

I’m saying that the numbers are idiotically irrelevant.

An excavation company that only uses shovels will employ a lot more people than an excavation company that uses backhoes and bulldozers.

Which one will be more productive?

Businesses don’t exist to provide jobs for people. They exist to make money for their owners. Job growth comes from robust economic growth, which comes from increasing productivity.

David,

My definition of a journalist is a professional, know-nothing, wordsmith whose job is to provide copy to help sell newspapers so that the chain can charge lots of money for advertising. I say “help sell” so that the chains can capture the market of people who don’t need to line the bottom of bird cages or wrap dead fish.

Aaron, your arguments have been well and thoroughly refuted.

PS: I’ve reviewed all of the responses, and I don’t see any ad hominems.

We aren’t saying the numbers are wrong, just irrelevant. There’s a big difference.

Insulting journalism and journalists was certainly ad hominem, uninteresting, and unhelpful. Based on my readings in The Economist, the NYT, the W.P. and the like, flawed but respectable institutions, I understand coal to be an inherently dirty and polluting energy resource which employs very few people. Other resources (including natural gas and nuclear) are preferable for many reasons. A few coal jobs are not worth the environmental cost.

The purpose of coal production is not the maintenance of jobs. The purpose is cheap, dependable energy and other industrial uses of coal.

Now you’re confusing ad hominem, a logical fallacy, with hyperbole, a joke.

Your argument is wrong because it’s fallacious, and that’s been pointed out using logical arguments.

Furthermore, you state, “Based on my readings in The Economist, the NYT, the W.P. and the like”, meaning that everything you know about this subject was garnered from op-eds written by pseudo-journalists (journalists report news, not op-eds, aka fake news). The old quote is more true today than ever before: “The man who reads nothing at all is better educated than the man who reads nothing but newspapers.” — Thomas Jefferson

Aaron, you really should stop while you are behind.

An ad hominem would be attacking you rather than dealing with your argument.

Your argument was dealt with and shredded for good measure.

The side issues of insulting journalists, besides being true, weren’t germane to the issue at all.

Now, why don’t you try to defend your argument, assuming you can, instead of whining about irrelevant attacks on journalists.

The air pollution problem was solved decades ago and the land scarring has been solved as well.

They stopped doing this?

https://www.washingtonpost.com/opinions/the-dirty-effects-of-mountaintop-removal-mining/2014/10/21/851c4236-58a2-11e4-bd61-346aee66ba29_story.html?utm_term=.4b050a8f4d04

First off, that’s an opinion piece.

Secondly, they restore after mining is finished.

Aaron , astounding economic ignorance . A people is not prosperous because of how hard and many person hours they have to work to make what they need and want ; they are prosperous by the amount they make , the less time and work required the better and the more time for fishing .

And bird choppers by their very nature despoil vast landscapes versus any other source of even intermittent energy .

they are prosperous

===========

only 3 human activities create wealth (prosperity). you either dig wealth from the ground, you grow it, or you manufacture it. Every human lives off the wealth created by these 3 activities.

Service industry’s such as Arby’s create very little wealth. They simply redistribute the wealth between their customers and their suppliers, while taking a slice off the top as profits for this service.

That is the fundamental reason why you cannot replace the coal industry with Arbys, because while you are creating jobs you are not creating wealth, and without wealth the country will eventually collapse under a mountain of debt.

This is why the loss of manufacturing to China has had such a devastating effect on Middle America. It is not the loss of jobs. Jobs can always be creating through debt, by printing more money. Think “Stimulus”. Rather, it is the loss of wealth creation, the wealth to back the printed money that fuels the stimulus that is the underlying problem.

That’s an incredibly ignorant view of wealth.

Everything that makes people feel better is wealth.

People buy food from fast food places because they prefer the convenience. They could do it themselves, but in their minds, their time is more valuable than the few dollars they give to Arby’s.

They view themselves better of, not ripped off as you describe.

I suppose even Arby’s is well toward the productive end of the service industries, as even they “manufacture” a product… fast food.

They do manufacture one heck of a roast beef sandwich! And that’s why they do generate some wealth, but not much — manufacturing a sandwich creates miniscule wealth compared to burning a gallon of fuel to dig a tonne of coal.

MarkW, that’s not an ignorant view of wealth, that’s a real economic view of wealth. A back massage creates wealth? It sure makes me feel good. Well that’s all we need in society then, farmers and masseuses.

If both the person who gives the massage and the person who gives it are better off after the transaction, then that is a net increase in wealth.

In the free market, every voluntary transaction increases wealth.

Service industries, like transportation, enable humans to: –

* go to more distant work;

* eat/drink food/beverages produced more than six and two thirds miles from their home [Classic English distance to market, IIRC antedating the Black Death];

* meet mates from more than twenty families, some of whom would already be related by blood;

* enjoy better protections by law and/or constabulary

* employ computer/telecoms specialists, accountants, florists, management specialists, restaureurs, waste removal contractors, tyre fitters, and many others, to help improve the running of their business, whilst they actually d o the business.

Still, if J*r*my C0r8yn gets his way, the state will pretend to pay us, and we will pretend to work.

(Like the USSR in the old (cold) days).

Might, and likely does, apply to others, too, but he is my local bugbear.

Auto, proudly in my 46th year in transportation – writ wide [senso latu, if preferred!].

MarkW – April 6, 2017 at 11:16 am

GEEEEZE, ….. MarkW, ….. me’s beginning ta think you are right …… because Religion makes billions of people feel better ……. and because they “feel better” those Religious believers donate, bequest and contribute “trillions of dollars each and every year” to the Religious group or organization that made them “feel better” ….. and made said Religious group the richest entities of the face of the earth.

Sam, you really should check your sources before making a complete fool of yourself again.

MarkW, are these the sources you are referring to that is responsible for ….. “making a complete fool of myself again”, to wit:

A One Trillion Dollar Hidden Treasure Chamber is Discovered at India’s Sree Padmanabhaswamy Temple

https://www.forbes.com/sites/jimdobson/2015/11/13/a-one-trillion-dollar-hidden-treasure-chamber-is-discovered-at-indias-sree-padmanabhaswam-temple/#318bb5581ba6

The Roman Catholic Church is almost certainly the wealthiest organization in the world. In the United States alone, it is estimated that the Catholic Church has an operating budget of $170 billion. By comparison, in fiscal year 2012, Apple and General Motors each had about $150 billion in revenue worldwide. Dec 16, 2014 http://listverse.com/2014/12/16/10-of-the-richest-tax-exempt-organizations/

Arby’s doesn’t pay $15 to $27 per hour.

As for landscape scarring, wind takes the prize on that one. And doesn’t pay as well, nor provide useful energy. So ban wind and bring back coal to save the landscape.

True.

Also forgotten is the degenerating, pun intended, and abandoned windmills after their twenty or so years lifetime. The odd derelict windmill still standing on an abandoned farmsite may seem quaint and photogenic but 200 or more rusting giants spanning the landscape will be an eyesore to behold. the legal finagling required to assign the responsibility for demolition will be an expense of immense proportions, those orphans will have no takers for sure.

Don’t forget the 100 tons or so of buried concrete base per windmill.

Modern combustion technology and scrubbers eliminates the biggest problem – soot. China and India are large consumers of coal and will be for many years. The export market is huge. BTW, coal mining jobs pay a lot more than Arby jobs…and miners will be voting Republican as long as the Democrat Party spits on the miners. Think Pa.

Aaron Watters, if that’s how you count jobs, see http://quoteinvestigator.com/2011/10/10/spoons-shovels/

It’s the energy from coal that is the main jobs provider, not the production of the coal.

How hard are you prepared to produce each Arby’s burger, in the absence of affordable, reliable, energy?

Oops! Missing word “pedal”!

Keeping good paying jobs is a good thing.

The spin off jobs aren’t bad either.

The dismantling of the existing coal industry under the previous administration, in an effort to move towards renewables, was completely misguided. When it’s necessary to move to a new system, you leverage the existing system to get there. Dismantling the existing system is not the first step.

Consider if the previous administration had established the goal of making Washington D.C. a ‘renewable energy city’, they would need to leverage large amounts of energy to make that transition. You couldn’t put that transition burden on the yet-to-be-established renewable energy sources. The plan could’ve been to temporarily ramp up coal facilities in West Virginia to power through this transition. Then, once complete, they could showcase how the new ‘Electric City’/Washington D.C. is so marvelous. Or, we would see the problems and issues that surface as a result from relying solely on renewables.

Why doesn’t West Virginia have Saudi Arabia like wealth?

Because West Virginia doesn’t have any kings, princes or other royal family members… Or at least hasn’t had any since the death of Sen. Robert “KKK” Byrd.

Per capita GDP

West Virginia $38,567

Saudi Arabia $21,313

Thank you David, I like your ‘per capita GDP’ breakdown. I did not know that.

Back to coal, I understand that underground coal mining has limits on how much coal can be extracted since structural integrity must be maintained. We’ve seen that new methods of accessing oil allows for the extraction of previously unreachable resources. Are there comparable methods in the mining of coal? Are there ways that we can adapt existing coal mines such that we can extract previously ‘unreachable’ coal?

I don’t think there’s a direct analogy. The technology can always be improved to enable coal to be mined more efficiently and with a diminishing impact on the environment.

If coal became expensive enough, you might be able to use artificial columns to replace the coal that is currently being left in place to support the roof.

On the other hand, I doubt coal would ever get that expensive. It would be replaced by something else long before it reached that level.

MarkW – artificial columns?

I was thinking that we’d simply pump some cement like product, possibly mixed with fly ash into an entire mine vein such that we could then, once satisfactorily cured, begin an adjacent vein.

Your solution sounds a lot more expensive than mine.

MarkW – “Your solution sounds a lot more expensive than mine.”

No doubt “artificial columns” would be inexpensive, especially since they wouldn’t support any weight.

Actual structural columns might support some weight but their construction would be labor intensive. My solution is simple, thorough, structurally sound and offers the chance to replace the mine’s discarded material.

Because the government under the auspices of the green movement has constantly sought to diminish the wealth of the Virginia’s.

Yet there is more wealth in the Virginia’s but it is more equitably distributed. The myth of the Saudi wealth is just that, for all the free money they get the Saudi nation is increasingly accumulating national debt on an unsustainable scale.

So you’re saying the iron age didn’t bloom because they outlawed bronze?!

They could employ many more miners if they reversed the trend towards automation and stopped mines being so productive. Trump should also make it illegal for steel mills to become efficient and require them to use much more energy to produce each ton of steel. That will get coal miners back to work.

That would be diametrically opposed to resurgence of either industry and the exact opposite of making America “great again.”

The only path to robust economic growth is through increased productivity.

I think Gareth forgot the SARC tag, David!

Could be… And I often complain that if I have to use a SARC tag, there’s no point in crafting clever sarcasm… 😉

I’m not sure about that. A lot of liberals like Gareth actually believe that reducing efficiency in order to hire more people is a good thing.

A few decades back France dropped the work week to 35 hours to do just that.

there’s no point in crafting clever sarcasm

=============

it allows the rest of us reading the replies to weed out the knuckleheads too thick to recognize sarcasm without a sarc tag.

Excellent article. I co-wrote an article dealing with the same basic issues not too long ago. The US gas-coal situation is not the template for every other country, hence conventional wisdom leaves out the role of exports.

While building new coal facilities in the US can not be supported by the economics, I’m afraid there was an over retirement of already existing coal facilities. Plants that had to be shuttered because they did not make sense under the previous regs and projected regs, might be beneficial to have with this new direction. But the costs of reviving such abandoned facilities are prohibitive although they might have survived with minimal maintenance and paid for themselves along the way.

Predicting the future resource mix has proven to be a very imperfect process where many unanticipated (and perhaps unanticipatable) turns of events. Coal may continue to play a huge role worldwide and could expand. For the US, that looks doubtful. But who 25 years ago would have credibly imagined the abundance of natural gas the US has today? It might sound crazy now, but environmental problems/concerns around fracking/gas could lead to a return to coal even in the US.

The plants will still close… for example:

http://newsroom.fpl.com/2016-12-21-FPL-shuts-down-Cedar-Bay-coal-fired-power-plant-helping-the-environment-and-saving-customers-more-than-70-million

“FPL shuts down Cedar Bay coal-fired power plant, helping the environment and saving customers more than $70 million”

(FPL increasing natural gas, solar power)

and

http://uk.reuters.com/article/usa-coal-closures-idUKL2N1GX123

and

https://www.usnews.com/news/best-states/nevada/articles/2017-03-16/nv-energy-pulling-plug-on-coal-fired-power-plant-near-vegas

and so on

Griff sure loves self serving press releases!

Many years ago the FPL CEO tried to explain that solar was not a good choice for cloudy, humid Florida. The parent company is a leader in solar generation in the southwest US. However, FPL was mandated to do it anyway.

Second, Florida has no coal mines. Coal arrives by ship. Once coal is on a ship, international demand for coal affects the commodity costs.

Yes, prediction of the future is hard.

Also, don’t forget the problems with renewables that are showing up in Australian electric supply, or what happened to Germany when they stopped their nukes. As more nations develop, the demand for more, and more reliable energy, will change the mix. In the USA around 1991, the cost for using NG or cheaper coal was the same when costs of cleaning stack gases were compared. IMO, those who point to the demise of coal by way of NG are not looking at world demand.

FF oil is the premium choice for transportation, NG for electricity in most regulated cases, and coal for those who want cheap electricity. The demand, in India, China, and others, increasing will likely increase the price for the premium desired fuel in all categories. At present, except for potential CO2 costs, FF continues to provide far greater energy at far less cost than renewables.

One area that is ignored is that many coal fired boilers are 40+years old. Advances in efficiency and power generation can mean new constructions will favor coal, if regulatory SCC or carbon credit schemes (taxes) are not implemented.

First thing is get off the Carbon bashing bandwagon. CO2 is not a pollutant. Ignoring the technology required to suppress the beneficial CO2 will allow more funding to actually reduce real pollutants such as the Sulphurs and heavy metals.

A more realistic viewpoint concerning the benefits of CO2

http://www.thegwpf.org/patrick-moore-should-we-celebrate-carbon-dioxide/

“…but environmental problems/concerns around fracking/gas could lead to a return to coal even in the US.”

Don’t you mean “…perceived environmental problems…”

It well could be real or perceived problems. I think on my Venn diagram both perceived and imaginary problems would be inside the circle labelled “concerns”. I can’t fault you for expecting that “perceived” problems are more likely to drive the environmental agenda than actual problems.

The environmental agenda is almost totally driven by perceived problems… AKA The Precautionary Principle..

For the US, that looks doubtful.

==================

given the huge coal reserves in the US, predictions of an early demise for coal remain doubtful. there is just too much money involved for coal to sit idle in the long term.

David Middleton, thanks for the very interesting slideshow of the mine-reclamation activities.

beng135

Agreed.

Much appreciated.

Auto

I think the long-term future of coal maybe in converting it to natural gas at it’s source and leaving the real pollutants and ash under ground. With fracking technology this should be possible. It would be safer and less labor intensive and transportation cost via pipelines should less than long coal car trains. The utilities would not have to invest in scrubbers and failing coal ash ponds. This would be applicable to the vast reserves of eastern “dirty” coal. CO2 is not a pollutant!

Outside the USA it still is…

but the extra cost of conversion and pipelines is not going to make it competitive, is it? Renewable costs still falling, gas prices not increasing

David produced an actual real world chart that showed Griff is lying. Again.

The point the numnuts Greenies and climate caterwaulers never seem to get is that coal simply needs a level playing field to compete with NG. May the cheapest one win. That is how free markets work, and how economies can grow unencumbered. Competition is the key.

Natural gas from shale is still going to be cheaper than coal. don’t forget the US govt is also removing restrictions which impose cost on shale gas…

Natural gas is not currently cheaper than coal.

?w=612

?w=612

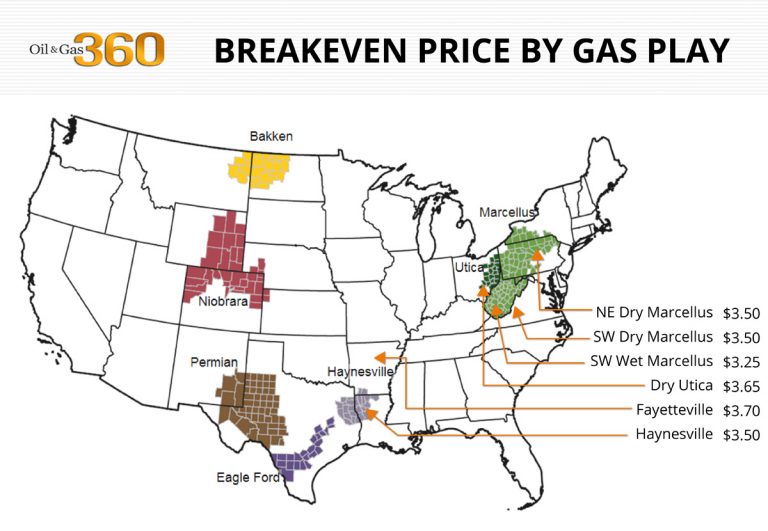

And the average break-even price in the shale basins is at $3.50/mmbtu.

Coal is extremely competitive with gas at >$2.50/mmbtu.

Dave M, can’t you let the Griff have one, you big bully!

( sarc, for those so challenged)

Oh yes it is!

“In a finding that is likely to boost controversy over the future of U.S. energy policy, a comprehensive study of the full levelized cost of energy (LCOE) from various sources of electricity conducted by the University of Texas (UT) at Austin’s Energy Institute found that wind turbines and natural gas combined cycle power plants (CCPPs) provide the least expensive options for new generation across a large majority of U.S. counties.”

http://www.powermag.com/natural-gas-and-wind-are-cheapest-sources-of-power-in-majority-of-u-s/

Griff,

You are once again conflating the cost of power plants with the cost of the fuel. LCOE includes the cost of the power plant, operation & maintenance and the fuel. Pollution regulations have tripled the cost of coal-fired power plants ovee the past 10-20 years.

If you read the post, you would comprehend the fact that the resurgence of the American coal industry is not due to an increase of US coal-fired power plant. Coal is competetive when natural gas is above $2.50/mmbtu. The brief drop in gas prices below $2.00/mmbtu was the proximal cause of Peabody’s bankruptcy. Gas is currently around $3.00/mmbtu. The shalw plays are uneconomic below $3.50/mmbtu.

When the gas market rebalances over the next few years, gas will probably stabilize between $3.50 and $5.00/mmbtu. Couple this with regulatory relief and clearance of export obstacles, and the American coal industry will be booming, albeit on a smaller scale than its heyday.

But if one fuel is far “cleaner” than the other, incentives must exist to encourage it. (I’m not a greenie; I’m a bona fide CAGW Skeptic. But this is pure logic. We should be arguing over the process of measuring the “Cleanliness Factor” of each fuel, and then use that to make a final determination of cost-to-cleanliness ratio. Right now, NG is CHEAPER *and* CLEANER, so there’s no point in a coal renaissance. If coal can be brought to market at half the cost of NG, we might get somewhere. If one fuel is twice the cost of the other, but twice as clean, then the market is even.)

That’s already factored in through the cost of scrubbers and other pollution control equipment.

If we did a proper cost-benefit analysis, every power plant from this point forward would be either natural gas or nuclear powered and every existing solar power plant would be scrapped.

http://images.realclear.com/252491_5_.png

Since the Social Cost of Carbon is less than $0 if a real world 7% discount rate is applied, the only pollution concerns are the real air pollutants (SO2, NO2, O3, PM 2.5, PM 10, etc.) and these have largely been reduced to nearly irreducible levels in coal plants.

Bruckner, you say “we”. You don’t own the power plants or the coal mines or the NG (pumps?). There is no “We”. As long as the producers meet reasonable EPA regulations, what does your or my opinion matter? It is a business decision for the business owners to make.

“The point the numnuts Greenies and climate caterwaulers never seem to get is that coal simply needs a level playing field to compete with NG. May the cheapest one win. That is how free markets work, and how economies can grow unencumbered. Competition is the key.”

Let the markets decide who wins and loses. Governments and politicians should stay out of it as much as possible.

Liberal Arts Major(tm) Here, Brain Cells Be Warned:

With coal having, obviously, high carbon content, is there a side industry potential for simply mixing uneconomic side materials that are high-carbon in with degradable waste in order to create high-quality potting soil and similar products?

Terra Preta Do Indio is still in fairly early stages of study, but GOOD SOIL with high carbon content is always in need, and I’ve always wondered why sooty wastes wouldn’t make such stuff unless it’s simply wildly uneconomic as a side-product.

No, because it contains undesirable things like lead, arsenic, mercury and radioactive uranium. However, it is used in concrete, fill for roadbeds and other things.

Radioactive uranium being rather similar to wet water?

Not all uranium is radioactive. Some isotopes are pretty darn stable.

A-10 Warthog GAU-8 30 mm DU ammo…

So the undesirables are either industrial products of their own, or best tucked away?

Thanks, Bruce.

MarkW,

All uranium is radioactive! The level of activity is determined by the half-life of the isotope(s) and the mix of decay products. Natural uranium, as found in coal, is reasonably radioactive. I wouldn’t carry a chunk around in my pants pocket as a good luck charm.

They could use bananas too.

Clyde, it’s only slightly radioactive because it contains both the stable and the unstable isotopes.

carry a chunk around

==========

The big questions is whether low dose radioactivity actually provides immunity against high dose radioactivity. There is plenty of evidence it does, likely as a result of natural selection. For example, it appears that low doses of radon gas provide protection against higher doses. This should not be a surprise, as it is well established that low doses of sunlight give protection against higher doses.

Increasingly, the science suggesting that there is no safe dose of radiation appears wrong. In which case, much of the hysteria over nuclear power is misplaced. The result of poor science, likely a fear/panic reaction to the devastating effects of atomic weapons and high doses of radiation.

The most basic rule about radioactivity is that all atoms heavier than lead are radioactive.

The amount of radioactivity in coal is generally not of concern, it’s actually quite low on the gamma ray response, meaning that the little radioactivity it does have is not harmful unless you go about eating it, but then it’d be the least of your worries. The radioactivity of fly ash is 5-10 times higher than coal, but still not that high. Both are lower than the natural radioactivity of highly organic black shales — hydrocarbon source rocks.

http://www.sciencedirect.com/science/article/pii/S1002007109001579

Funny thing… Shale is radioactive.

And here is the gamma ray response of shales and coals. The gamma ray is on the far left, left on the scale (lower API units) is less radioactive.

You do know that when you look at a tree , it’s almost all CO2 from the air and H2O from the ground , right ?

It’s not clear to me that carbon in the soil matters very much . A few years ago I went looking for the processes which metabolize charcoal back into the biosphere and came up empty . Certainly open faces of coal are highly resistant to biological processes .

I really would some bio-knowledgeable one to present what’s known . How does naked carbon get reabsorbed into the living biosphere ?

the only method I know of is by rapid oxidation. Microbial organisms steer clear of it as it’s of no use to them – us burning it is the best thing we can do for making it available to plants.

Thanks . That’s what I found . But somehow I would expect a much greater accumulation of charcoal given the amount of even natural fires . I think about it as I pass the many hundreds of hectares of still nearly barren charred forest scars in the 100 km between here and Denver .

Coal is not produced by fire, that’s charcoal. Coal is formed by accumulation of woody vegetation is anoxic environments, i.e. a swamp, which are also reducing environments where sulfate reducing bacteria actually play a part in the process.

When coal is formed but then exposed, microbes do in-fact play a role in the oxidation process. Only certain types of bacteria can survive in this environment, because the process results in some very acidic solutions — sometimes even negative ph solutions.

Also there would be much more coal, save for the evolution of fungi that decompose wood sometime around the end of the Paleozoic Era.

PSS. Sorry, I misread when you wrote you thought there’d be more charcoal, I originally read coal.

There aren’t seems of charcoal because most of the products from fire aren’t charcoal, certainly not macro charcoal. I hypothesized during my thesis work that a particular sedimentary cave-fill’s provenance could have been pyrolyzed material washed into the cave, but that wasn’t the point of the work and was left as just a thought. That thought was sparked when I saw a video of ashes from those particular fires you referenced washed away during a flood.

Coal is formed when woody sediment settles into reducing environments and is buried there, whereas charcoal and ash are formed in situ from fire and then are transported to their final burial location, which sorts and mixes them with other sediments.

That is already being done in some industries. I did it in the late 80’s

The industry certainly won’t recover due to increased power plant use of coal…

Even if the 17 state challenge on the rollback of the CPP fails…

http://uk.reuters.com/article/us-usa-trump-climate-lawsuit-idUKKBN1772ZO

This being only one example of why:

https://cleantechnica.com/2017/04/06/huge-us-utility-jabs-trump-ambitious-new-solar-plan/

But there is no market for exports either…

India is banning foreign coal imports in the near future, so is China (non mettallurgical at least).

that report on Chinese coal plants quoted was from before they cancelled 133 new plants (some already under construction)

Europe doesn’t want it – power providers in all EU states except Poland and Greece just agreed to build no more coal plant after 2020 and many have coal plant shut down dates in the 2020s. and it isn’t as if many coal plants are building now.

I suppose a more efficient producer can get more out of a declining market share, but is that what a renaissance is these days?

Black Coal Lives Matter!!

+10 !

China Ramps Up Coal Power Capacity As UN Climate Talks Kick Off

MICHAEL BASTASCH

2:21 PM 11/07/2016

China’s government announced plans to increase the country’s coal-fired power capacity by as much as 20 percent over the next four years as United Nations delegates meet in Morocco to implement a major global warming agreement.

This is out of date as China has since cancelled plans for 103 new Coal power stations.

https://www.nytimes.com/2017/01/18/world/asia/china-coal-power-plants-pollution.html?_r=0

China found that there economy wasn’t growing as fast as expected so they slowed down the number of coal plants they were building.

Note, China is still building coal plants, just not quite as many as originally planned.

Correct, you get the econ prize.

Do I get fries with that?

Let’s see… At the end of 2015, China had plans to build 1,171 new coal-fired power plants.

At the end of 2016, they indicated they would increase their coal-fired generation capacity by 20% over the next four years.

In early 2017, they announced that they had canceled 103 coal-fired plants.

Now, I only minored in math, but only one of those three numbers is trivially small.

+1

and another 30 cancelled just before that you missed…

There is already over capacity: why won’t they cancel more?

As to that chart, EU power companies in 25 out of 27 states have announced no more coal power plants will be built after 2020. That 27 is probably the last set: France, UK, Netherlands have close dates for all coal in the early 2020s and even Germany will close a few by 2020. There is little chance of Japan’s 45 being built. The powers station building in South Africa is well overdue for completion – given the rollout of renewables and even proposed nuclear, more coal does not look likely.

Not building coal power plants as fast as they originally planned is evidence of over capacity?

Griff, as always you see only what you want to see. Or more likely are paid to see.

MarkW April 6, 2017 at 11:18 am

Not building coal power plants as fast as they originally planned is evidence of over capacity?

The fact that the current plants are operating at below 50% capacity is one of the indicators, as is the fact that construction already underway has been stopped.

Phil, I’m guessing that you don’t realize that you haven’t refuted anything I’ve said.

I’m sure there were another 30 previously cancelled…

also IEA says future coal plant ‘makes no economic sense’

https://www.carbonbrief.org/iea-chinas-new-coal-plants-make-no-economic-sense

A politician knows more about China’s economics, than Chinese economists.

As always, Griff sees what he wants to see and ignores the rest.

IEA: Cheaper, more reliable power makes no economic sense.

China: Hahahahaha.

What a difference the positions of the E and the I can make.

IEA = Environmentalist wishful thinking.

EIA = Valid energy statistics.

The Chinese have certainly changed direction on power… and keep changing.

any report or prediction pre-2016 needs to be thrown out and it changes monthly…

There is no getting away from that.

Building 2000 coal plants instead of 2100 sure is a major change in direction.

It does not matter if it is 2100 or 21. Allowing the Market to decide how many to build or decommission is the most efficient way. However, Griff seems to want to dictate to the market what it wants. His ego is not unprecedented. Stalin, Pol Pot, Mao, Hugo Chavez – they have all dictated to the market as well.

And we saw the results.

China, China, China…blah blah blah…

http://joannenova.com.au/2014/11/why-did-china-pick-2030-oh-look/

Spoiler alert

http://www.foxnews.com/politics/2017/04/05/us-coal-companies-reportedly-ask-white-house-to-remain-in-paris-climate-pact.html

http://www.dailywire.com/news/15102/report-trump-considering-left-wing-carbon-tax-frank-camp

You’ve gotta be kidding me right?!

The coal industry will not survive the treaty obligations as stated. Have they forgotten the main idea of the treaty and the CPP was to put them out of business?

The USA will not survive economically under the treaty obligations without coal energy as there is no immediate direct economic substitute.

Will Trump also self-sabotage?

President Trump should be reminded that it was climate skeptics who put him in the WH.

Don’t let us down President Trump.

The Trump administration will be a one-term wonder if he flip-flops and sticks us with a carbon tax and keeps us in the treaty, betraying our trust in him.

Firstly, there are no “treaty obligations.” The Paris Sham is not a treaty under U.S. law.

Secondly, they are simply saying what Rex Tillerson said… We should maintain a “seat at the table:

Regarding the carbon tax BS…

White House Shoots Down Carbon Tax Rumors In The Press, Again

Read more: http://dailycaller.com/2017/04/05/white-house-shoots-down-carbon-tax-rumors-in-the-press-again/#ixzz4dU6kor67

Good to know. Thank you.

I would feel much more confident in the situation if the US and Chinese leaders would come out and agree that weather and climate change is 100% natural, not man-made, and therefore the technical basis for the treaty is null and void

It’s not 100% natural. We do have a minor effect on it. That said, there is no technical or economic basis for the faux treaty and it has no legally binding terms… So, we’d be maintaining a seat at a table simply to steer the future agenda.

Show me a man-made weather effect….

No rush… no one else can either…

it’s always down to the ‘likelihood’ and ‘probability’ blah blah … ie … wishful thinking.

There is 0% proof of man-made influence on weather or climate!

The entire CAGW is a racket – a con job!

Weather and climate change is 100% natural.

Man has been making weather for a very long time.

https://en.wikipedia.org/wiki/Weather_modification

AGW is not a 100% con job. It’s a 67-95% blunder.

It’s always down to the ‘likelihood’ and ‘probability.’

There’s no “proof” of anything when it comes down to weather and climate. Just evidence and probability. Earth and atmospheric sciences are less amenable to proofs than physics or chemistry.

Fact: CO2 is a so-called greenhouse gas.

If more CO2 is added to the atmosphere, the average temperature will go up. How much? Unknown; but all of the evidence points to very little.

Fact: The atmospheric concentration of CO2 has risen over the past 150 years. Humans are responsible for at least half of this rise.

Fact: The average temperature of the Earth has risen a little bit since the mid-1800’s.

Anthropogenic CO2 contributed to this rise to some small degree. Basic physics governs how this affects radiative forcing. The tricky bit is in figuring out how that translates to temperature change. All of the evidence suggests that it is minimal (less than 1.5 C per doubling of atmospheric CO2).

Beyond this, humans alter the weather and climate through land use changes.

Show me a man-made weather effect….

…

Man made lightning: http://physics.stackexchange.com/questions/178506/why-do-nuclear-bomb-explosions-create-an-array-of-visible-electric-discharges-in

That’s funny… let’s fire off some nukes every day to stop extreme events and global warming!

I meant weather events from CO2, but you knew that 😉

Bomb induced lightning: http://lateralscience.blogspot.my/2012/09/nuclear-explosion-induced-lightning.html

Bob Weber said: “No rush… no one else can”…..but I did……

..

..

You’re welcome!!!

OK Mr darby.. you get a star!

But short-term military explosions are not what we’re talking about, but you knew that, right? 😉

David M: We are part of nature. Otherwise, we’re aliens that landed here sometimes in the past.

Even if we were aliens, we’d be part of nature. It is funny how every other life form on Earth can alter the environment and it’s “natural;” whereas when humans alter the environment, it’s a crime against nature.

That the areas downwind of cities got more rain was demonstrated back in the 70’s. It came from the UHI providing an initial lift that helped get rainstorms started.

Another example is the deforestation around Kilimanjaro resulting in less rainfall on the summit and as a result the glaciers there shrinking.

CO2 probably impacts temperatures, however the amount predicted is far enough below natural variability that it is not possible at this time to pick the signal out of the noise.

Bob, so your position that anything that can’t be proven, 100%, must be false?

Nature conforms as expected wrt solar activity, so there’s no call for less than a 100% natural climate.

As far as the CO2 manmade warming everyone is so endeared with, there are three different slopes in the temperature series below while CO2 was increasing, a basic fact that destroys the CO2 warming theory:

http://climate4you.com/images/NCDC%20GlobalMonthlyTempSince1958%20AndCO2.gif

Land use is not climate. The runoff from land use didn’t precipitate the rain that caused it. It didn’t cause the clouds to form, and it didn’t evaporate the water from whence came the rain, and so on. There’s only so much moisture in the soil, and it originally came from the ocean via rain/snow/hail.

The mechanical, repetitive, and predictable nature of solar driven weather and climate precludes any boast of man that all of us or any of us can do any real weather making.

Weather modification is not making the weather, it interferes with the sun’s energy flow to the earth & ocean.

Rainmakers don’t make the water vapor that’s already in the atmosphere.

The SAG plans and activity are in response to what? Solar radiation. doh!

When you learn of and can see for yourself the solar influences, invoking probabilities isn’t necessary since the repetitive nature of the driving solar force and the earthly responses are plainly evident!

Are there examples of actual land use caused weather events, and not using generalities like the IPCC, or an example of verifiable long-term climate WORLDWIDE warming or cooling due to some LOCAL human land usage?

“If more CO2 is added to the atmosphere, the average temperature will go up. How much? Unknown; but all of the evidence points to very little.”

Well, then, how does that cause the climate to change? The increase, if any, has to be in the noise, and how is “in the noise” causing a change in climate big enough to notice?

TA,

If I dump a truckload of sand on a beach, I’ve altered that beach. Within a very short period of time, it will be almost impossible to differniate the anthropogenic from the natural sand… assuming the anthropogenic sand had a similar mineralogy.

Bob Weber,

Your plot of CO2 and temperature just proves what I said. The human effect is extremely minor. The heat retention from a slightly elevated CO2 level is insufficient to overcome decadal and multi-decadal climate oscillations. If you convolve a high amplitude sin wave with a very subtle positive linear trend, you get the same sort of effect.

Earth’s atmosphere has been warming since about 1600. It will continue to warm until the millennial scale climate cycle peaks, probably around 2100. Human GHG’s add a little to that warming trend. AGW might be the reason that the current cool-phase of the 60-yr cycle hasn’t exhibited the same cooling pattern as the mid-20th century. The greenhouse effect doesn’t induce warming. It retards cooling. When the millennial cycle reverses, human GHG’s will hopefully moderate the cooling a bit.

The human effect is like dumping a truckload of sand on a beach. It’s real. It’s just insignificant.

The basic physics is sound.

The translation of the physics into climate science is 67-95% blunder with a dash of hockey stick fraud.

The alarmism is 99% con job & extortion and 1% shear ignorance.

The Fox News article looks like the typical “If I appease people enough, maybe they won’t notice me and I can keep doing what I’m doing” or “Keep feeding the alligator and maybe he won’t eat you” philosophies. Irrational people always believe in appeasement rather than confrontation and are generally the first to go when the appeasement fails. They are in complete denial of this outcome, of course. The “administrators” of the companies want this—no one asked the actual miners. That philosophy of ignoring workers is why Trump is now President. You cannot appease your way through life. Sooner or later, one of the alligators eats you.

Those who run most major corporations have a fiduciary duty to maximize the companies profitability.

Taking the lead in opposing government action is rarely good for your bottom line.

Fox News Channel has a bad habit of allowing the Leftwing News Media to set the daily narrative about what is reported as news and what is not. Fox News is a follower, not a leader, in this kind of thing.

In this case, they ran with a story from a dubious source.

Rex Tillerson said… We should maintain a “seat at the table:

==============

very bad idea if what they are serving is tainted.

There has been talk in the past about authorizing countries to start imposing tariffs on countries that don’t penalize energy production sufficiently.

Whenever such nonsense gets discussed, I would prefer to be at the table.

“The Trump administration will be a one-term wonder if he flip-flops and sticks us with a carbon tax and keeps us in the treaty, betraying our trust in him.”

Trump wants to lower taxes. I doubt seriously that he would be in favor of a carbon tax.

I hope you’re right TA.

Something that those advocating the abandonment of fossil fuels overlooks is that metallurgical-grade coal provides unique properties for making steel. However, it contributes CO2 to the atmosphere just as surely as thermal coal, fermentation, calcining of limestone, and digestion of sewage does.

“China only agreed to sign on to the Paris sham if they didn’t have to begin to decarbonize until after 2030.”

They’re not stupid, their scientists know that CO2 is mostly benign relative to the climate and are betting that the CAGW scare will be over by 2030. Until then, they want the competitive advantage of cheap energy.

Metallurgical coke is also a byproduct of oil refining.

Pet Coke is useful for increasing carbon in a melt or reducing atmosphere but not very useful for burden support and providing BTU’s for melting and reduction all by itself.

“Officials said they would increase the percentage of its electricity mix it gets from non-fossil fuel sources to 15 percent by 2020. ”

Sure they will. They’ll build them, claim them in the statistics, then quietly turn them off. It’s becoming a bit of a local tradition.

You can increase the percentage of generating capacity from wind and solar without putting a dent into fossil fuel consumption…

Greenies were licking their lips at the prospect of dancing on King Coal’s grave. Seems Trump has thrown a monkey wrench into their planned celebrations. Too bad, so sad.

Fossil Fuels are fungible. So the insane actions by one country is not going to change the world. Steyers sought to take the US out of the supply market to drive up the price for his coal. He almost succeeded. I suspect he is not going to have as much money to spend on mischief the next 4-8 years.

They could strive to catch up to Indonesia and Australia for global coal exports, if they could get past the coal shipping port blockades.

https://www.eia.gov/beta/international/rankings/#?prodact=7-4&cy=2014

Well, Australia’s market for coal for power plants is non-existent in the future… no market in India or China.

India is building the largest export coal facility at Abbots Point. You know nothing about what is going on in Aus.

China is still building thousands of coal plants and has thousands more that are currently in use.

That’s a market for coal, both now and well into the future.

https://www.bloomberg.com/news/articles/2016-04-25/india-s-energy-minister-wants-to-cut-coal-imports-to-nothing

“India has some bad news for the world’s struggling miners: it doesn’t want foreign coal.

“I’m trying to find new reserves so I can remove my dependence on imports,” the country’s coal and power minister Piyush Goyal said in an interview Friday at Bloomberg’s headquarters in New York. Asked when India might stop importing the power-plant fuel altogether, Goyal said “I wish it was yesterday. Maybe two or three years.” ”

I don’t think the expansion has any ‘point’

“Griff April 7, 2017 at 12:11 pm”

Again, you have no idea what you are talking about here in Australia. Abbots Point, India is investing over AU$20billion. I don’t care what bloomberg says, protesters on the ground here are trying to stop it, but it’s going ahead regardless.

I found a real article to refute your Bloomberg rubbish. Read it and weep!

http://www.smh.com.au/business/mining-and-resources/the-coal-war-inside-the-fight-against-adanis-plans-to-build-australias-biggest-coal-mine-20170213-gubn21.html

I was wrong about the location of the mine, Abbots Point is the terminal. The mine is 400km away. So, India is clearly NOT moving away from Australian coal. Hurricane Debbie has interrupted supply and both China and India are looking at other sources to secure their demand. Once Queensland mines are fully operational again, coal mining and exports to India AND China will resume. You can rest assured the Queensland state Govn’t is not going to walk away from that revenue stream.

China turned to US coal in response to Debbie.

All your article does Patrick is underline the domestic opposition to the mine… there is still no market even if it is built.

“Griff April 8, 2017 at 10:41 am”

Yes, it did mention domestic opposition, like all environmentalists, they are uninformed. The article also mentions the support for the mine, I guess you didn’t read that bit.

If there is no market, the market will decide that. not some pencil necked bureaucrat that has the brains of a squid.

And that is the way it should be. Get over it.

Another issue that no one has yet mentioned is several LNG export terminals coming on line in the past few years. This should result in the US domestic price of natural gas converging on the world price, thus making the comparison of coal v. gas more favorable for coal. As is, the estimates given in the article predict stable demand for coal in the US, given Trump’s policies. Those estimates are price dependent.

Trumps plan to bring back coal was nothing short of a vote buying scam. A plan to fool the foolish and consequently trade the health and well being of future generations. What a guy…

Clearly you do not read the post.

Simple Simon actually believes that coal causes health problems.

Yep I do….. Burning of it domestically is banned in many cities around the world for that very reason. What planet do you live on?

Of course it does…

https://noharm-uscanada.org/sites/default/files/documents-files/828/Health_Effects_Coal_Use_Energy_Generation.pdf

ain’t that good news.

Griff on April 7, 2017 at 4:33 am

I took a look at how many coal power plants are going to be built in the US.

__________________________________________

I took a look at how many coal power plants are going to be built in China:

https://www.google.at/amp/s/wattsupwiththat.com/2015/12/02/the-truth-about-china-2400-new-coal-plants-will-thwart-any-paris-cop21-pledges/amp/

Griff, let me share:

What [ still ] makes you ticking.

https://www.google.at/search?client=ms-android-samsung&ei=34DrWNbiGMuAU-GfveAE&q=how+many+coal+power+plants+are+built+in+china&oq=I+took+a+look+at+how+many+coal+power+plants+are+going+to+be+built+in+China&gs_l=mobile-gws-serp.

I took a look at how many coal power plants are going to be built in the US

The most optimistic assessment I could find is contained in this recent report:

http://www.utahfoundation.org/reports/utahs-coal-counties-part-i-coal-energy-production-future/

“Between 2016 and 2020, the U.S. expects the development of five new coal plants, but 93 closures, for a

net loss of 88 plants losing generating capacity of 16,192 gigawatts.

Over this period, there is an expected net gain of 281 natural gas plants with a generating capacity of 54,872 gigawatts, 178 utility-sized wind projects with a generating capacity of 22,544 gigawatts, and 563 utility-sized solar projects with a generating capacity of 14,493 gigawatts. Rooftop solar is also accelerating across the nation and generates almost two thirds of the electricity as utility-sized solar projects”

I have found several announcements of new closures since the Trump administration came in, but no new build proposals. On court case which has delayed a power plant got thrown out (but will they build it now?)

In the U.S., over 90% of coal is used in the electric power sector…. it isn’t coming back, is it?

As always, Griff honestly believes that all trends that currently exist must continue forever.

Well you tell me when the trend will reverse then, eh?

I just gave you the evidence it isn’t during Trump’s term of office. And that there is no change in the rate of closure, rate of new construction or investment in renewables since the new administration got in.

More alarmist garbage from the SMH in Austraila…

http://www.smh.com.au/environment/abbot-point-coal-terminal-water-spill-to-cause-significant-damage-20170410-gvht8u.html