By Andy May

“Prediction is very difficult, especially about the future” (old Danish proverb, sometimes attributed to Niels Bohr or Yogi Berra)

In November, 2016 the USGS (United States Geological Survey) reported their assessment of the recent discovery of 20 billion barrels of oil equivalent (technically recoverable) in the Midland Basin of West Texas. About the same time IHS researcher Peter Blomquist published an estimate of 35 billion barrels. Compare these estimates with Ghawar Field in Saudi Arabia, the largest conventional oil field in the world, which contained 80 billion barrels when discovered. There is an old saying in the oil and gas exploration business “big discoveries get bigger and small discoveries get smaller.” As a retired petrophysicist who has been involved with many discoveries of all sizes, I can say this is what I’ve always seen, although I have no statistics to back the statement up. Twenty or thirty years from now when the field is mostly developed, it is very likely the estimated ultimate hydrocarbon recovery from the field will be larger than either of those estimates.

Producing oil and gas from shale was unknown in the 1950’s when the irascible geologist Marion King Hubbert predicted that U.S. oil production would peak in the early 1970’s and decline thereafter. How is that prediction working out? Does the new shale production technology make a difference?

Definition of critical terms

Government regulations impose strict rules on how oil and gas reserves are estimated. Because, proven reserves are used to compute the equity of an oil and gas company, the calculation is very conservative. As long as a company follows the rules (and they do or they risk going to jail) accessing any “booked” proven reserves means drilling a well that is “economic,” completing it and producing the reserves. By economic, we mean the cost of drilling, completing, transporting and selling the oil or gas will pay the company back for its costs and provide a reasonable profit after taxes and royalties to the land owner are paid. Besides proven reserves, most companies keep track of probable reserves and possible reserves, these do not affect the equity of the company, but they can affect how investors value a company, and thus the stock price. Finally, there is one other category, called “technically recoverable reserves.” This is the broadest category, it is simply an estimate of how much oil and gas can be produced using current technology, regardless of cost or profitability.

Estimates of technically recoverable reserves are very broad brush. To make the estimate a geoscientist will typically map an oil or gas bearing formation and use the best estimate of the formations average oil and/or gas content to compute the OIP or oil-in-place after converting the gas to oil-equivalent. Once this volume is computed, it will be reduced by an estimated “recovery factor” to account for the oil left in the ground after the field is abandoned. Generally, very conservative values are used for both the volume of hydrocarbons and the recovery factor.

The US Department of the Interior Bureau of Ocean Energy Management published an estimate of the oil and gas reserves for the Gulf of Mexico Outer Continental Shelf in 2015, here. They estimated that total original reserves of this region of the Gulf of Mexico were 22 billion barrels of oil and 193 trillion cubic feet of gas. How did they define reserves? See figure 1:

Figure 1, source BOEM.

Here, reserves are defined as developed (a well has been drilled and completed that is expected to produce them), proven and undeveloped (field infrastructure has been built, but the well needed to produce the hydrocarbons has not been drilled yet) and justified reserves (these are discovered and mapped and both the government and the company have approved the field for development). The estimate above also includes oil and gas already produced. Contingent resources are mostly producible, but uneconomic, oil and gas left behind in abandoned fields. The undiscovered resources are estimated using statistical techniques, the methodology can be seen here. U.S. onshore reserves are defined differently as are reserves in other countries, but proven, probable and possible “reserves” usually have a commerciality component. Technically recoverable reserves do not have a commerciality hurdle, they only meet a technology hurdle.

Right after a field is discovered a calculation of economically producible reserves must be made because fields are very expensive to develop. Pipelines must be built, wells drilled, facilities constructed and all of this must be done with borrowed money. No oil is produced or sold and no money made until this work is done. As a result, this early assessment will be very conservative. In one field I was involved in, Bohai Bay Block 0436 in China, our initial estimate of proven reserves was only 80 million barrels of oil in the first 20 years. After twenty years, the field had produced 150 million barrels and the field is still producing today. We knew the upside potential of the field at the beginning, but we were only confident enough, with the data we had at the time, in the 80 million barrels. Thus, we used that as the “official” estimate and as the basis for borrowing the development money.

The impact of technology

In the early days of oil and gas, drillers selected the location of their exploration wells based on the presence of oil and gas seeps on the surface, for example the La Brea tar pits in Los Angeles, or the Binagadi tar lake near Baku, Azerbaijan. Figure 2 is a picture of the La Brea tar pits in 1875, you can see the old wooden drilling rigs in the background.

Figure 2, source La Brea Tar Pits Museum.

Once all the seeps had been drilled, early geologists like the legendary Everett Carpenter, found that they could locate anticlinal oil and gas accumulations by mapping surface geology in prospective areas. This new technology was used to find many very large oil fields, like El Dorado in Kansas. Later the development of commercial resistivity surveys (Schlumberger, 1912) and seismic surveys revolutionized oil and gas exploration. Reflection seismic was first tried by Dr. J. C. Archer in 1921 in Oklahoma. It was used to discover oil near Seminole, Oklahoma in 1928 as you can see in figure 3.

Figure 3, source here.

Each of these technologies allow oil and gas to be found and produced that could not have been found before. Other significant discoveries include the Hughes tri-cone drilling bit, patented by Howard Hughes Sr. in 1909. (figure 4).

Figure 4, source Texas Monthly.

That bit allowed wells to be drilled deeper and faster, greatly accelerating field development. These early discoveries were followed by the invention of water flooding old fields, the invention of modern well logging tools in the 1950’s and 1960’s to better assess the production potential of wells, the development of CO2 flooding (1970’s), 3D seismic surveys (1964), horizontal drilling (1980’s) and most recently widespread unconventional shale oil and gas wells (late 1990’s).

At every stage of technology development, it seems, someone says we are going to run out of oil and gas. Near the end of the “drilling surface oil seeps period” in 1885, when it was getting harder and harder to find more oil, the Pennsylvania state geologist proclaimed (according to Daniel Yergin’s The Quest):

“… ‘the amazing exhibition of oil’ was only a ‘temporary and vanishing phenomenon – one which young men will live to see come to its natural end.’ “

That same year John Archbold (Rockefeller’s partner in Standard Oil), when he heard oil had been discovered in Oklahoma, said:

“Why, I’ll drink every gallon of oil found west of the Mississippi.”

Of course, not long after this, modern petroleum geology and Hughes’ famous tri-cone bit revolutionized the oil and gas industry and unimaginable amounts of oil and gas were discovered as a result. And, yes, quite a lot of the oil and gas was found west of the Mississippi River. We have no record of Mr. Archbold drinking any of it, however.

By the end of WW I, the world had entered what Daniel Yergin calls the “Oil Age” and everyone knew it. According to Yergin, Lord Curzon, Great Britain’s foreign secretary once said:

“The Allied cause [in WW I] had floated to victory upon a wave of oil.”

Between 1914 and 1920 the numbers of registered automobiles grew fivefold and the director of the US Bureau of Mines said:

“… the oil fields of this country will reach their maximum production, and from that time on we will face an ever-increasing decline.”

This led President Wilson to say:

“There seemed to be no method by which we could assure ourselves of the necessary supply at home and abroad.”

The entire world came to depend upon oil for its automobiles, trains, ships and for light at night. The Japanese bombed Pearl Harbor for oil, Hitler invaded Russia for oil, the US had a secure supply of oil and prevailed in WW II largely for that reason. What would the world look like today if Hitler had invaded and conquered Azerbaijan and Kazakhstan rather than try and take St. Petersburg and Moscow? Perhaps very different.

At the start of WW II yet another “end of oil” panic started, it even affected the US Department of the Interior which announced:

“American oil supplies will last only another 13 years.”

Then in 1949, the department announced:

“… the end of U.S. oil supplies is in sight.”

After WW II, the US could no longer produce enough oil and did became a net importer for the first time. This led to worries about supplies and, in response, strong alliances with the major Gulf states of Saudi Arabia and Kuwait were formed to ensure a supply. President Truman was not only worried about losing access to Middle Eastern oil, he was also worried about the Soviets taking over Middle Eastern oil fields, especially in Iran. As a result, he ordered a new plan to be developed, according to the Brookings Institution:

“It is no coincidence that much of the early preoccupation with the potential Soviet threat after the end of World War II centered on the remaining Soviet presence in Iran. But unknown to the public until the recent declassification of National Security Council documents (first uncovered by a reporter for the Kansas City Star, Steve Everly) was the extent of Truman administration concern about the possible Soviet takeover of the oil fields. Equally surprising was that the Truman administration built its strategy not so much on defending the oil fields in the face of a possible Soviet invasion, as on denying the Soviet Union use of the oil fields if it should invade.

The administration quickly developed a detailed plan that was signed by President Truman in 1949 as NSC 26/2 and later supplemented by a series of additional NSC directives. The plan, developed in coordination with the British government and American and British oil companies without the knowledge of governments in the region, called for moving explosives to the Middle East, where they would be stored for use. In case of a Soviet invasion, and as a last resort, the oil installations and refineries would be blown up and oil fields plugged to make it impossible for the Soviet Union to use the oil resources.”

However, the 1950’s saw an explosion of new oil and gas technology, not oil fields. Oil and gas exploration expanded worldwide, particularly offshore, and supplies were abundant until the early 1970’s when Middle Eastern politics caused supplies to tighten, resulting in severe oil shortages. Again, the cries that “the end of oil is near” were heard. This time led by an irascible geologist named Marion King Hubbert. In the late 1950’s, using novel mathematics, he predicted that US oil production would peak in the early 1970’s. The rapid growth in oil and gas technology in the 1950’s was slowing at this time and large discoveries had been made so prices were falling. They stayed low during the 1960’s and by the time of the 1973 Arab-Israeli war, supplies and demand were nearly balanced. These two events allowed the Gulf states to engineer a boycott. Then prices spiraled just as many North American conventional oil fields were on a decline. At the time, it looked like Hubbert was correct.

The late 1960’s and the early 1970’s were filled with ominous predictions, in 1972 the Club of Rome predicted oil and natural gas would run out by 1992, in 1968 Paul Ehrlich predicted “65 million Americans will die of starvation between 1980 and 1989.” In 1978, Glenn Seaborg, chairman of the Atomic Energy Commission wrote:

“We are living in the twilight of the petroleum age.”

With higher oil prices, new oil and gas technology was developed at a frenetic pace. The 1970’s and 1980’s saw the development and implementation of 3-D seismic, deep water drilling, CO2 flooding of old oil fields, horizontal drilling, coal-bed methane production, formation image logs, NMR logging and many other critical technologies. The mid 1970’s and the early 1980’s were a wonderful time to be in the business. The new technology worked well, a lot of oil and gas was found, too much as a matter of fact; and the industry crashed in 1986 with the world awash in oil. It took many years to use up the surplus.

Research did not stop during this period, but it did slow down. In particular, UPR (Union Pacific Resources) perfected drilling and hydraulically fracturing (“fracking”) horizontal wells in a Texas formation called the Austin Chalk. At the same time a small oil and gas company, Mitchell Energy, was developing novel methods of hydraulically fracturing shale reservoirs, in particular, the Barnett Shale in Texas. Mitchell was drilling vertical wells and completing them; but having a hard time making the wells “economic” or profitable. George Mitchell, the owner of Mitchell Energy, was a victim of the low oil prices (as low as $10/barrel) of the late 1990’s and had to sell his company to Devon Energy in 2001. At Devon they combined the horizontal well technology that they had in house, with the novel shale completion techniques developed at Mitchell and were very successful. And, lucky for them, oil and gas prices started to rise, making the technology even more profitable.

The early days of shale completions were slow going, but by about 2005 drilling and completion technology, new petrophysical well evaluation technology, micro-seismic technology and new 3D seismic interpretation techniques had matured and the resulting oil and gas discoveries were huge. Unconventional oil and gas (shale production) is very different from conventional oil and gas. Where conventional reservoirs are small and hard to find, but very high permeability (meaning high oil and gas flow rates per foot of reservoir in the well), unconventional “resource” plays are enormous and cover huge areas, but very low permeability. We know where they are, the work is in figuring out how to drill and complete the wells in a profitable way. The author worked as a shale petrophysicist for Devon Energy and saw that it takes four or five wells (minimum) just to figure out if a shale play will work, sometimes more.

It took 17 dry holes and $10,000,000 for Harold Hamm and Continental Resources to figure out how to drill and complete a profitable well in the prolific Bakken Shale. He didn’t drill all of those wells to find the oil, he knew the oil was there, he drilled them to figure out how to successfully place the well in the formation and complete (“frack”) the well. Today, based on what he learned, we could do it with one well. It’s much more a science and engineering problem than an exploration problem. But, the technology worked and once again we are awash in oil and prices are low. It will continue to work and the technology will spread overseas, greatly increasing global production. As Daniel Yergin points out in The Quest:

“Hubbert got the date right, but his projection on supply was far off. Hubbert greatly underestimated the amount of oil that would be found – and – produced in the United States. By 2010 U.S. production was four times higher than Hubbert had estimated- 5.9 million barrels per day versus Hubbert’s 1971 estimate of no more than 1.5 million barrels per day.”

A comparison of actual oil production versus a version of Hubbert’s curve is shown in figure 5 (slightly different from the one Yergin used):

Figure 5, source

Technically Recoverable Reserves

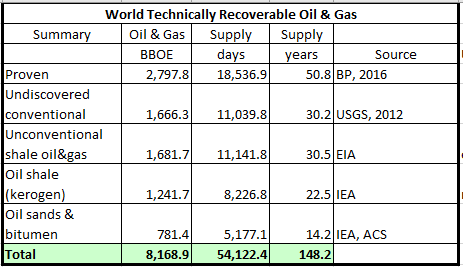

So clearly Hubbert’s Malthusian curve did not predict oil supply correctly, new technology has allowed us to tap into oil that was not part of the potential supply when he did his calculation. Paul Ehrlich’s ominous 1968 prediction in The Population Bomb that 65 million Americans would starve to death in the 1980’s was incorrect for the same reason. He could not have predicted the green technology revolution that included natural gas based fertilizer (the Haber-Bosch process) and Nobel Prize winner Norman Borlaug’s new hybrid strains of wheat, rice and corn. Some might say, well Hubbert was wrong then; but what about tomorrow? Isn’t oil still a finite resource? Let’s examine that idea. Table 1 shows a rough estimate of the technically recoverable reserves of oil and gas known today, using only known oil and gas technology. More deposits will obviously be found and technology will improve in the future.

Table 1

The reserve estimates are in billions of barrels of oil equivalent. NGL and oil volumes are presented as is and natural gas is converted to oil-equivalent using the USGS conversion of 6 MCF to one barrel of oil. The table includes the “proven” worldwide oil, gas and NGL reserves from BP’s 2016 reserves summary. It also includes the 2012 USGS estimate of undiscovered “conventional” oil and gas reserves fully risked, the EIA estimate of unconventional shale oil and gas reserves, and the IEA oil shale (kerogen) and oil sands (bitumen) reserve estimates. Our estimate of 1,682 BBOE in world-wide unconventional shale oil and gas reserves is lower than the IEA estimate of 2,781. The spread in these estimates gives us an idea about how uncertain these numbers are. Our estimate of 781 BBO in oil sand bitumen reserves is lower than the IEA estimate of 1,000 to 1,500 BBO. So, please consider this table very conservative.

The USGS also has a report on oil shale “in-place” kerogen volumes here with different numbers. “Shale oil” is actual oil trapped in shale, for example the Bakken in North Dakota or the Eagle Ford in Texas. “Oil shale” is different, it is kerogen (not oil) trapped in a shale, an example is the Green River Formation in Colorado. Oil shale has been mined in several places around the world since the 1830’s. Shell has completed a pilot production operation, in the Green River oil shale in the Piceance Basin, in Colorado; that proved oil shale could be produced in an environmentally friendly and economic way. They estimate the Green River oil shale could ultimately produce 500 to 1,100 billion barrels of recoverable oil using their technique. Compare that to the 1,242 billion barrel estimate in table 1.

Oil sands are normally estimated separately because they are very heavy oil (bitumen) and sometimes mined, rather than produced with wells. Oil sands were produced in China 800 years ago. The most famous oil sands are those in the Athabasca region of Alberta, Canada. They produce economically from a variety of techniques. About 20% of the production is from surface mines and 80% is from in-situ steam flooding.

Using the BP world-wide annual oil and gas consumption rate for 2015 of 151 million barrels of oil-equivalent per day, the table calculates how many days and years each supply will last. These are “technical reserves” and price is not a factor in their calculation, except for the “proven” category. The total reserve is eight trillion barrels of oil-equivalent for the whole world and a supply that should last at least 148 years. The reserve is very conservative since it only relies on existing technology, remember only 132 years ago, a partner in Standard Oil proclaimed he would drink every gallon of oil found west of the Mississippi! It was innovative oil and gas technology that found billions of barrels of oil-equivalent west of the Mississippi. What will we invent and discover over the next 132 years? Consumption of oil and gas will probably increase over the next 25 years according to ExxonMobil’s 2017 Outlook. This is because they do not expect renewables and nuclear to increase in capacity as fast as demand will grow. But, for simplicities sake, I assumed oil and gas consumption would stay flat for this table.

The moral of the story? Never underestimate the ingenuity of mankind and never assume that technology is static. Also, the resources that technology recognizes today are not all the planet’s resources. There is oil west of the Mississippi!

Never underestimate the ingenuity of mankind. Indeed.

… unless they’re liberals …

+10

….and advocacy groups

Actually, I find liberals to be very ingenious. Problem is, all this liberal ingenuity seems to be directed into illegal, inane and nefarious activities.

…which in turn, they project onto conservatives who generally do not engage in such activities to the extent found in liberals.

“It isn’t so much that liberals are ignorant. It’s just that they know so many things that aren’t so.”

Ronald Reagan

Peakless oil!!!!

LOL.

When will we reach peak peaks?

More precisely, multi peak oil.

Let’s have another peak at oil…..

Never under estimate the wrongness of anything Paul Ehrlich says.

+1

I am currently involved in a private, lignite business that separates hydrocarbons from Gippsland lignite.

The process I invented is currently achieving a volatiles separation of greater than 12% hydrocarbons by raw weight from lignite (11 BOE/ton of ROM pad lignite). This is not a chemical process, it uses inexpensive, benign solvents. Hydrocarbons are trapped in the lignite pores.

It is inexpensive, uses small amounts of energy and is easily scalable as an on surface, batch system. It could also be scaled into a continuous process or done in-situ at depths that cannot affect any aquifers.

Petcoke derived from Canadian tar sands is under test using the same solvents. The test aim is to remove sulphur compounds and volatiles to 1%. Results are encouraging.

Solvents used are inexpensive, reusable and benign. There is no added chemicals remaining in the processed coal or in solution in water from the coal. This is a low energy input process.

The major on surface, plant components can be easily moved from pit to pit as suitable coal is depleted.

Raw lignite in Victoria consists of 20% volatiles, 20% carbon, 60% water. The volatile percentage by raw weight does not vary much across the Gippsland Basin. The removal of much of the water and volatiles makes this an inexpensive metallurgical coal with low sulphur and heavy metals content. The remaining carbon becomes hydrophobic.

More energy intensive processing will get a very high percentage of carbon (99.9%) that could be used to make other products, such as very large, power station scale batteries, supercaps and eventually replace many aluminium and high tensile steel products etc. The solvent process can be used on graphite to remove organic impurities or as part of a process to make graphene.

There is 395 Billion tons of suitable lignite on land in Victoria and 1,200 Billion tons under eastern Bass Strait. A similar resource exists in Germany. There are many other suitable, easily mined deposits not counting worldwide peat resources (10% hydrocarbon by weight), tar sands and plants.

The idea that we are going to run out of inexpensive hydrocarbons anytime in the next 20,000 years is stupid. A fantasy promoted by banksters, politicians and weak minded Gaia zealots lead by the former. CO2 toxicity is promoted by rent seekers. Its even possible to derive hydrocarbons from CO2 on a renewable basis. Such a process means that our planet would NEVER run out of hydrocarbons.

Keep up your good work!

And at the same time the Chinese are commercializing on the ground work done in US on atomic reactors!

Geopolitics in the future will be extremely interesting!

Geoff,

I am in Williamstown/Melbourne and would like to know more. My email is anassim at gmail dot com

Thanks,

Alfred

Thanks for an entertaining and informative read from downunder.

Oil’s well that ends well.

Oil get you for that.

Oyl vey! Enough already!

Whale oil beef hooked!

I’m gone now – “oil” be seeing you.

It’s not an either oil situation.

I have seen estimates that old oil fields (even the some of the first ones in Pennsylvania) could produce an amount of oil equal to the original production volumes with CO2 flooding. It just hasn’t been economic to do that. But the oil is still there and can be produced when the need arrives.

To clarify, is IS economic in many fields with a ready source of CO2 and is being done today. But there is much more to be had.

..it IS….

In most conventional fields with permeability > 20 mD or so, primary production can get about 30% and you get another 30% with a water-flood. CO2 can routinely get you an additional 20% to 30%. The CO2 can be expensive, especially the pipeline and the compression. To be pumped efficiently you have to get the CO2 up to 1300 psi. But, once you get the CO2 into an area, it is cheap to get it from field to field. Its all in the infrastructure.

Educate us…why only CO2 and not air or nitrogen etc.??

BFL: CO2 lowers the viscosity of oil and precipitates out the heavier molecules. This makes the oil easier to produce. Air and nitrogen do not have the same effect.

Also, hydrocarbons are soluble in CO2 so the partition ratio into it is high. The partition ratio into N2 is low because vapor pressure of the hydrocarbons are low.

BFL

So now you know why some CEOs in the oil industry support the policy of a carbon tax.

20% to 30% more oil can be extracted by injecting CO2 into the reservoir.

CO2 is expensive.

The government pays for your company to use dangerous CO2 and put it underground.

Less business cost, more profit, what’s not to like?

Great way to do business, be a parasite!

Why don’t we all have subsidies from the tax payer?

Yes, Andy and David. And one way to get it where there are no natural sources is to strip it from the flue gas of coal fired boilers, like they are doing at the Petra Nova project in Texas. But…..it needs to depend solely on the economics of using unsubsidized CO2, which is not quite the case at Petra Nova. DOE kicked in a considerable sum of money to kickstart the technology. Notice any new such projects being announced? We are not at that stage, yet.

oeman50 CO2 can also recover oil from “Residual Oil Zones” (ROZ) – below (tertiary oil recovery) and to the side (quaternary oil recovery) of conventional oil fields. Between conventional CO2-EOR and ROZ EOR, CO2 with extensive horizontal drilling and some chemical enhancements can recover about as much as conventional primary oil production (pumping) and secondary oil recovery (water flood) – together.

What is lacking is the available and cheap CO2.

See: CO2 & ROZ Conference Week Recap – Dec 6-8, 2016 – Midland, Texas

http://www.co2conference.net/

http://www.uwyo.edu/eori/technology-transfer/workshops/melzer%20tensleep%20pres.pdf

As usual, no one is mentioning Julian Simon at this point – though he is a major player in the game with his cornucopia theory.

Briefly, he points out that there will be oil available to us for as long as we want it, because human ingenuity will provide it. The thing driving oil extraction is demand. So long as demand is there, people will extract oil, and will do it at the lowest possible price. At some point in the near future, for instance, it will be profitable to gather hydrocarbons from the methane oceans of Titan. We can already get there, drop a probe, gather samples and return with current technology.

The only thing that would stop us using oil is the discovery of a better energy source – which we will do some day, again, using human ingenuity…

So long as demand is there, people will extract oil, and will do it at the lowest possible price.

Price is the key. Intelligence and innovation, the inexhaustible resource, is key to price.

Will we run out of oil? No.

Will it likely become more expensive as we use up the easy to get stuff and learn to use it more differentially? Yes.

Eventually that new energy source will happen. It may be much sooner than anyone expects. We will still need hydrocarbons for advanced chemistry to produce products yet envisioned like exotic chemicals, lubricants and new pharmaceuticals. The future is limitless.

He was a mainstream expert with correct analysis but trying to be heard among the din of non-experts of armchair energy. They still litter the landscape today but Simon’s work still stands and is carried on by Dan Yergin and others. Of course models and economics don’t work very well with the likes of Venezuela around.

There are also large deposits of methane hydrates on the ocean floor. As of now, there is not a commercially viable way to “mine” this resource, but my bet is that someone will figure it out.

Japan achieves first gas extraction from offshore methane hydrate

A Japanese energy explorer said on Tuesday it extracted gas from offshore methane hydrate deposits for the first time in the world, as part of an attempt to achieve commercial production within six years.

Since 2001, Japan, which imports nearly all of its energy needs, has invested several hundred million dollars in developing technology to tap methane hydrate reserves off its coast that are estimated to be equal to about 11 years of gas consumption.

http://www.reuters.com/article/us-methane-hydrates-japan-idUSBRE92B07620130312

China and India Exploit Icy Energy Reserves

China and India have reported massive finds of frozen methane gas off their coasts, which they hope will satisfy their energy needs. But environmentalists fear that tapping these resources could have adverse effects on the world climate.

http://www.spiegel.de/international/world/warning-signs-on-the-ocean-floor-china-and-india-exploit-icy-energy-reserves-a-523178.html

If so much oil was recently discovered in Texas, the aging ‘mother of the US oil production’, perhaps Rex Tillerson may have known some known unknowns about what might be found under the permafrost of huge Siberia’s expanse.

The Permian Basin oil has been known for a century. What is new is our ability to horizontal drill/frack the several source rock shales in the basin. Upward revisions in that TRR (from zero before the technology was developed) are based not on finding new rock, but on improved recovery factors. There are three contributors. First, closer lateral spacing, as the cannibalism concerns are better understood geologically. That means more rock is tapped. Second, plug and perf replacing sleeve perf, which provides more fracks per lateral distance. Again, more rock tapped. Third, more proppant, which improves recovery per frack. What was a 1.5% recovery factor of OIP is now maybe 3%.

Only 3% recoverability? Does this not auger well for the future given that recoveries should improve with continued innovation?

Tim, no. The average recovery factor for conventional oil (the 2008 IEA survey) is only ~35%. And that is from reservoirs with orders of magnitude higher porosity and permeability. And that recovery factor has improved a grand total of 24% in the last half century, thanks mainly to tertiary CO2 injection into lower API conventional crude fields like Wayburn (in my books as an exeample). Even Ghawar, mightly light sweet crude with ‘easy’ water flood, will only recover ~65%.

Good point – the article is misleading. New deposits of this size haven’t been found in decades, only better extraction methods. They are very good at finding deposits and if they can’t find oil, then shale oil is almost definitely not there.

While the post if, of course, correct, there is a simpler way to see this. The peak oil debate results from incorrect framing of geology. The key fact about mineral resources: there is an inverse relationship between quantity and quality of mineral resources. Low quality deposits are more common than high quality deposits. Over time, the marginal barrel of oil (or ton of copper) becomes more expensive to extract (i.e., more in some combination of capital and operating costs for mines). This is offset by two additional factors.

(1) Ongoing exploration of the world, finding new deposits. This is a one-time process, which eventually will end.

(2) new technology, which has two effects. First, it allows tapping and refining previously unreachable resources (e.g., deepsea oil). Second, it reduces the cost of extracting and refining mineral resources — making uneconomic resources into useful ones (recycling gold tailings)

The bottom line: the long term prices of minerals are difficult to predict, and we’ll never “run out” of any minerals (although the price might increase).

All of this has been known for generations. It’s clearly described in Sir Ronald Prain’s 1975 classic Copper: The anatomy of an industry (see chapter ten — “The Future”, pp 267 – 280). See the relevant excerpt here.

The most deadly phrase in predictions: “all things being equal.”

And “all things being equal” never works in Earth Science.

“All things being equal …”

I just read a story in a 1920 newspaper (they did interesting journalism back then) … The County surveyor asked for a raise to $5/day, and travel reimbursement of $0.12 per mile. So, in 100 years, salary has increased approximately 60X and mileage reimbursment has increased 5X.

few things remain comparitavely equal.

(story stats also indicate how efficient individual transportation has become in last 100 years, as compared to other costs)

Could I suggest a number (3) in regards to higher prices? That would be substitution/replacement.

And just think, most of the world has not even attempted to produce their unconventional resources. The US is drilled like a pin cushion compared to even the other major petroleum regions on Earth. We’ll never run out before it’s obsolete.

Many thanx for the history lesson Andy.

G

And thanx to RAH for his brief review of the history.

It must be at least 5 minutes since I read Andy May’s extensive exposition of the history.

Plenty of old news available here every day.

G

The claim that we are running out of oil is older than anyone alive today!! Just a brief overview of the history.

• 1857 — Romania produces 2,000 barrels of oil, marking the beginning of the modern oil industry.

• 1859, Aug. 25 — Edwin L. Drake strikes oil in Titusville, Pennsylvania

• 1862 — First commercial oil production in Canada, also 1863 in Russia.

• 1862 — Most widely used lamp fuel (camphene) taxed in US at aprox. $1 a gallon; kerosene taxed at 10 cent per gallon.(Kovarik, 1997)

• 1863 — John D. Rockefeller starts the Excelsior Refinery in Cleveland, Ohio.

• 1879 — US Geological Survey formed in part because of fear of oil shortages.

• 1882 — Institute of Mining Engineers estimates 95 million barrels of oil remain.With 25 million barrels per year output, “Some day the cheque will come back indorsed no funds, and we are approaching that day very fast,” Samuel Wrigley says. (Pratt, p. 124).

• 1901 — Spindletop gusher in Texas floods US oil market.

• 1906 — Fears of an oil shortage are confirmed by the U.S. Geological Survey (USGS). Representatives of the Detroit Board of Commerce attended hearings in Washington and told a Senate hearing that car manufacturers worried “not so much [about] cost as … supply.”

• 1919, Scientific American notes that the auto industry could no longer ignore the fact that only 20 years worth of U.S. oil was left. “The burden falls upon the engine. It must adapt itself to less volatile fuel, and it must be made to burn the fuel with less waste…. Automotive engineers must turn their thoughts away from questions of speed and weight… and comfort and endurance, to avert what … will turn out to be a calamity, seriously disorganizing an indispensable system of transportation.”

• 1920 — David White, chief geologist of USGS, estimates total oil remaining in the US at 6.7 billion barrels. “In making this estimate, which included both proved reserves and resources still remaining to be discovered, White conceded that it might well be in error by as much as 25 percent.” (Pratt, p. 125. Emphasis added).

• 1925 — US Commerce Dept. says that while U.S. oil production doubled between 1914 and 1921, it did not kept pace with fuel demand as the number of cars increased.

• 1928 — US analyst Ludwell Denny in his book “We Fight for Oil” noted the domestic oil shortage and says international diplomacy had failed to secure any reliable foreign sources of oil for the United States. Fear of oil shortages would become the most important factor in international relations, even so great as to force the U.S. into war with Great Britain to secure access to oil in the Persian Gulf region, Denny said.

• 1926 — Federal Oil Conservation Board estimates 4.5 billion barrels remain.

• 1930 — Some 25 million American cars are on the road, up from 3 million in 1918.

• 1932 — Federal Oil Conservation Board estimates 10 billion barrels of oil remain.

• 1944 — Petroleum Administrator for War estimates 20 billion barrels of oil remain.

• 1950 — American Petroleum Institute says world oil reserves are at 100 billion barrels. (See Jean Laherre, Forecast of oil and gas supply)

• 1956 — M.King Hubbard predicts peak in US oil production by 1970.

• 1966 – 1977 — 19 billion barrels added to US reserves, most of which was from fields discovered before 1966. (As M.A. Adelman notes: “These fields were no gift of nature. They were a growth of knowledge, paid for by heavy investment.”)

• 1973 — Oil price spike; supply restrictions due to Middle Eastern politics.

• 1978 — Petroleos de Venezuela announces estimated unconventional oil reserve figure for Orinoco heavy oil belt at between three and four trillion barrels. (More recent public estimates are in the one trillion range).

• 1979 — Oil price spike; supply restrictions due to Middle Eastern politics.

• 1980 — Remaining proven oil reserves put at 648 billion barrels

• 1993 — Remaining proven oil reserves put at 999 billion barrels

• 2000 — Remaining proven oil reserves put at 1016 billion barrels.

• 2005 — Oil price spike; supply restrictions and heavy new demand

• 2008 — Oil price spike; supply restrictions and heavy new demand, global economies collapse when oil reaches over $140 USD/bbl.

It is never ending BULL HOCKEY! Just like this guy was full of it with his turning the thermostats down and long gas lines:

Thanks RAH, great list.

Your much welcome sir, and thank you for a great informative post.

Jimmy always was, and always will be, a Left Wing nutcase.

Left wing nutcase. Bit redundant, don’t you think?

😉

But, just wait. When Bambi gets warmed up, Jimmy is only going to be the second worst past president.

Or at least he was a puppet to all manner of nut case agendas and special interests. One political Party is very good at covering up its disasters. Look up G. William Miller if you want to see a Jimmy appointment disaster (for re-election purposes) that still does not get enough attention by historians.

RAH Please study particularly the famine and economic failure in North Korea from cutoff of cheap fuel on the fall of the USSR in 1991. Drawing Lessons from Experience; The Agricultural Crises in North Korea and Cuba — Part 1

Then consider the long term impacts of OPEC controlling > 40% of global oil production leading to the OPEC Oil Crisis of 1973/74, and the recent impact of > $100 / bbl oil spiking to $147/bbl. How long with cheap tight oil last?

I would argue that though at the time OPEC did cut the flow of oil to the extent it damaged the economy of some of it’s oil customers, including the US, the gas lines were a direct result of the Federal government attempting to control price. Wage and price Controls first implemented by Nixon and used by Carter and THAT was the key factor that led to gas lines, stagflation, and the “economic malaise” which characterized the Carter economy. The oil was there for the price, and it was a price that could have been paid in a free market with better results than what transpired. We tried not to pay it with terrible results for our economy and Carters energy address was a flat out wrong as history has more than adequately demonstrated.

I would also argue that the way Carter handled the situation, trying to direct it by central planning instead of allowing the US economy to adapt on it’s own, had many other long term side effects. Effects like the great increase in foreign automobiles, particularly those from Japan, gaining a great deal of market share in the US market much earlier and quicker than they otherwise would have. That combined with the dumping of Japanese steel on the US and world markets had a terrible effect on the US steel industry.

Consequent to OPEC’s ’73/74 Oil War, Denmark moved from ~80% oil to ~80% gas, US from oil to coal, France from oil to nuclear, (and Nepal to Hydro). Those massive shifts with increased oil exploration due to high prices caused major reductions in oil demand with higher production and a subsequent oil “glut” – which seriously harmed the oil industry until demand increased with population to where OPEC again began to influence pricing. etc.

Re: “the gas lines were a direct result of the Federal government attempting to control price. ” ?????

Look at the data and the IMMEDIATE impact of OPEC’s Oil War/oil cutoff to US and Denmark. US imports plummeted 46%from 115,905 bbl/d to 62,940 bbl/d. The lines were NOT due to stagflation but to immediate shortages without excess capacity or storage. Total US oil Supply dropped 20% from 401845 bbl/d to 318922 bbl/d! – between Oct. 1973 and Feb. 1974. Look at the impact of the far greater loss of oil to the North Korean economy. They lost the diesel to take the coal from the mines to the fertilizer plants – losing about 74% of fertilizer – and consequently their agricultural production – with consequent famine!

BTW at that time I was a kid attending IU in Bloomington, IN and driving a Chevy Nova with a hopped up 396, positrac rear end, Hurst 4 on the floor, etc. A real hot rod that my girl friend couldn’t drive because the pedal pressure required to operate the heavy duty clutch was just too much.

I don’t know how long cheap oil will last. And I don’t know how much extractable oil there is from all sources on this earth unlike some who to this day pretend to have such knowledge despite the lessons of history.

What I do know is that history demonstrates that when governments become involved in central planning and trying to force the direction of industries, including energy, it generally leads to terrible waste and ineffective solutions. I do know that the killing of coal has greatly damaged our economy for example.

Memory serves, it was during the Carter administration that one of the car magazines — probably Motor Trend or Car And Track — did a list somewhat like yours, although I believe it was a whole series of people predicting we’d be out of oil in the next decade, starting with a quote from the late 1800s and ending with someone current.

OTOH, last summer my dad told me about a fair he went to as a teen, when he saw someone driving an electric tractor that the announcer said would “be in production in the next decade, and replace gas powered ones shortly after that.” (Dad was interested because grandpa lost his hearing after driving tractors all that time, and the electric one was quiet.)

We’ve been a decade away from both running entirely out of oil, and replacing all those evil gas-powered vehicles with electric ones, for more than my entire lifetime, and yet neither one of them ever really happens.

I don’t even remember the source of that list. It is one of those things I came across years ago and saved and have posted several times at different blogs when a discussion about oil reserves comes up.

I was a nerd kid when I built an electric bicycle in 1969 and have been following electric vehicles since. My opinion then has remained unchanged, which is that electric vehicles will happen on a mass scale when battery technology and price become competitive. I think the Lithium battery is the technology needed (lead-acid just doesn’t work, which is the real reason for the failure of GM’s EV1 car) but the price is still too high. Tesla cars are nice, but have been too expensive to go mainstream. The Chevy Bolt has a 230 mile range, but still priced 50% higher than comparable IC engine cars. They have large subsidies to make them somewhat competitive (e.g. the $7500 IRS deduction to buyers, and Tesla got $139 Million last quarter selling pollution credits). I also like the Zero electric motorcycle, but again, it’s priced at 50% more than comparable IC engine bikes. Tesla thinks they can reduce battery price by integrating a large battery factory…. and we’ll see how well that works in another year. But to address Hobbitess’ comment, the biggest tractor that I know of is a battery electric lawn mower.

http://www.homedepot.com/b/Outdoors-Outdoor-Power-Equipment-Lawn-Mowers/Ryobi/Battery/N-5yc1vZc5arZ1awZ1z0ylm1

I never knew that “oil shale” and “shale oil” were two different things.

oil shale is the source, and shale oil is the product.

Not quite. Both oil shale and shale oil formations are generally source rocks.

Oil shale is a shale, marl or other sedimentary rock loaded with kerogen and other solid bituminous material. Shale oil is conventional oil produced from shale and other impermeable sedimentary rocks.

The Bakken and Eagle Ford (shale oil) were the source rocks for many of the conventional reservoirs in their respective basins.

The neat thing about horizontal completions and fracking is the ability to produce from the traditional source rocks. It more or less eliminates exploration risk.

One is oil and the other isn’t. In the case of the Green River oil shale, it’s technically neither oil nor shale.

Better to call them “Tight oil” and “kerogen” to avoid confusion.

Good paper, although I think Hubbert deserves a little bit better press than he’s given. There was nothing wrong with Hubbert’s predictions at all if you add the caveat, “Under current technology”.

At a time when other geologists were predicting a straight line increase on into the future, Hubbert actually made an incredibly accurate prediction for the next 40 years. The problem came when others, coming after Hubbert, bought into his work so completely that they never bothered to understand the assumptions it was based on.

I’m a big fan of Nick Taleb’s work, and one of his key themes is that *all* long term predictions are unreliable, because those things which have the biggest impact on the long term are precisely those things which could never have been reliably predicted.

For a rather trivial but topical example, how many people in 2009 would have predicted that Donald Trump would be the next President after Obama?

Hubbert’s equation is just fine. He just underestimated the total recoverable resource.

David Middleton – Economist James Hamilton clearly shows conventional crude oil production has peaked in each US State except Montana/North Dakota. A similar process will likely occur with for tight oil in each state. Oil Prices, Exhaustible Resources, and Economic Growth. Thus far better to model as Multi-Hubbert with a separate peak for each region and type of resource.

Hubbert was using well data that no longer translates to horizontal shale development. It’s not just a another dimension, it is a different kind of target and resource altogether and different success rates.

Who would have predicted a Trump presidency?

You mean besides the writers of The Simpsons, Oprah Winfrey, Howard Stern, Ronald Reagan, and Trump himself?

This is another good installment in the ongoing oil education effort.

I just wanted to add a few points to round out the exercise.

1) It is the free capital markets and depth of capital that produced the condition in the U.S. of more dry holes than any other place on earth in the era of vertical drilling that Hubbert worked with statistically. (You would be surprised by the numbers of students that think the U.S. grew because of being blessed by chance in abundant resources or that slavery did it or that this or that accounted for it.) That deep capital market and free flow of investment decision making also unleashed the whirlwind when the tech model of completing the shale wells was established. Fortunately it was under privately held land or it might not have happened at all.

2) The shale revolution has also altered the economies of the world by taking oil off the list of risk factors for recessions in major economies. It is now essentially a just-in-time sector as compared to the 10-year adjustment process of offshore drilling programs. Therefore the historic pattern of economic cycles with significant numbers of oil shocks in the record is now out the window. The stock market may still boom and bust but the externality of oil shocks is over.

3) Renewable energy tech and oil tech will grow alongside each other in a more stable economic expansion path. We just don’t need to force feed the renewable demonstration projects and worst of breed highest cost versions of renewables with current tax incentives and agency waste. This is where the “c” word needs to be repeated over and over again in the face of advocates. It is cost.

Nicely done.

Folks tend to miss that reserves are price dependent. Raise the price, you get more reserves (without doing ANYTHING else…)

Also forgotten is that as price rises, new technologies (or old technologies that were too costly) become productive to exploit the more diffuse resource. So much more natural supply becomes reserves. You see this in oil where as the conventional oil dropped in supply, price rose, and the more diffuse resource of shale oil and oil shale become worth exploiting. We knew that oil was in that deposit, but it “didn’t exit” for use as a reserve until the price rose enough to fund that technology.

As diffuse resources are exponentially more than concentrated resources, this has an exponential impact on supply. This is a Very Important Thing.

Take Uranium as an example. The economic land based reserves at present prices are good for maybe a few hundred years. The economic land based reserves at reasonable prices are good for about 10,000 years. But raise the price to about 4 x present levels, and an already established technique for harvesting U from the ocean kicks in and we have millions of years of supply available. That price is still ‘way cheap’ for the energy delivered. There is exponentially more U in the highly diffuse resource of the ocean, and not much price rise needed to turn it into a reserve.

Which brings up the point that there is “oil as energy source” and there is “oil as fuel supply”. We can manufacture oil from any carbon source. Even plants and garbage. Once the price is about $100 / bbl.

Similarly, folks like to float the EROEI canard. Energy Return On Energy Invested. This ignores that the oil is not just wanted for an energy source, but as a FUEL and that fuel value is high… So we can run electric oil well pumps and steam generators to lift oil to make it into motor fuel long after that oil takes more energy to lift than is in the oil because Nuclear is unlimited and turning it into motor fuel is valuable. There is roughly as much oil left in the ground as is pumped out of it in established fields, all of it available to future lifting technology and future negative energy cost lifting.

Note that every oil refinery runs at a negative EROEI yet we don’t shut them down. It is the FUEL that is the value, not the crude oil

So sometime a few hundred years from now, when oil production goes into negative EROEI and supplies are running low, we will start converting nuclear power into motor fuels via a variety of means, that can well include nuclear electric oil pumping, refining, and fuel production.

https://chiefio.wordpress.com/2009/05/29/ulum-ultra-large-uranium-miner-ship/

https://chiefio.wordpress.com/2009/03/20/there-is-no-energy-shortage/

https://chiefio.wordpress.com/2009/05/08/there-is-no-shortage-of-stuff/

Note that every oil refinery runs at a negative EROEI

I like this observation.

It isn’t the Energy. It is the FORM of the stored energy.

1. EROI is a lifecycle calculation. It is well above 10:1 for the full path from crude oil to refined petroleum fuel. Of course, each step in a lifecycle process consumes some useful energy and increases entropy. So the observation that a refinery has a less than unity EROI is hardly worth stating,

2. It is the full path to the end fuel, not just the “form” of the end fuel that matters. One can produce ASTM spec gasoline from pulp wood (or any carbohydrate feedstock), but it is exquisitely expensive and has a huge negative energy balance. That gasoline is not economically or energetically viable, while the exact same formulation made from crude oil is.

Agree, but we will also see a significant quantity of battery powered cars being recharged by nuclear generated electricity. Plug-in cars just last year passed the 1% of total market sales, and there are 60 large nuke power plants currently being constructed around the world.

http://www.world-nuclear.org/information-library/facts-and-figures/world-nuclear-power-reactors-and-uranium-requireme.aspx

Everywhere we look we see energy on scales so titanic and in amounts so vast the mind boggles, and yet people worry about running out of energy.

No chance of that.

The big danger is that we somehow lose the ability to use technology.

Asking will we run is not the most important question. It is far more important to focus on the cost of the fuels that we need to run our economy and our lives.

This is because our biosphere is literally awash in hydrocarbons from which these fuels can be refined. People do not buy oil. In fact, it is very difficult for a person to buy a gallon of crude oil. But it is as easy as pie to buy a gallon of gasoline or diesel fuel. These are each highly technical products that are currently made by rearranging the atoms and molecules found in crude oil. But these products could also be made from the oils found in whales, or soybeans.

So as crude oil becomes more expensive to extract, then other hydrocarbon feedstocks will be able to compete. In a free market there will always be substitution. The main issue is the price. We will always have all the gasoline we care to purchase even as we may no longer decide that we like the price. That is unless government intervenes and ruins the free market like it has done so many times in the past.

BINGO!

I’ve got an interesting book from the ’70s oil embargo days. VW did a study on future fuel supply. They found that coal to methanol conversion was economical using nuclear process heat at about $2.70 per gallon of gasoline equivalent (IIRC it was 50 ¢ / gallon of methanol at that time).

Mobile Oil developed a process using a zeolite catalyst for turning methane and methanol into gasoline.. (Used in New Zealand who had a big off shore gas field, but little oil).

Marry those and you get effectively unlimited gasoline supply using most any carbon source, and at prices below current sales prices in Europe (that are mostly taxes) but a little above the present US price.

Several companies have technology to produce oil from coal, natural gas, and even garbage ( I’ve owned stock in some of them from time to time). This isn’t hypothetical, this is on the ground factories were built. Unfortunately, prices under $50 / bbl drove most of them into other businesses, but the technology still exists should we ever need it.

There is no shortage of oil. There is no shortage of fuels, and there never will be – as long as governments get out of the way…

BW, essay Bugs, Roots, and Biofuels does the necessary calculations based optimistically on the now failed KiOR process yield. The most the Earth could provide is about half of what is now consumed annually in liquid fuels. That includes sustainable logging of all wilderness everywhere. NPP*additional harvestable* conversion yield.

It isn’t about how much oil… it is about how much economically recoverable oil there is.

shale oil and oil from the arctic costs more to extract and oil companies will only extract it if the price covers their costs.

Demand must fall too: EVs are being sold in increasing numbers (and there are electric buses, methane powered trucks and hydrogen out there too).

wow, you almost sound like a oil industry realist there, Griff! That’s what we’ve been saying all along!!!

You do know that methane is a hydrocarbon that comes out of wells just like oil, right? And that hydrogen, wherever its used, is just a derivative of methane (natural gas)? Because it’s too expensive to produce any other way,

So true and gets at one of my pet peeves when people wax poetically about hydrogen fuel cell powered vehicles. The hydrogen comes from natural gas (CH4) produced by O&G wells, although if we had cheap enough electricity we could crack it from water.

I am a realist in all things… especially power production and climate change.

But no, hydrogen can now be made in power to gas units, using renewable (wind energy) when output high and demand low.

Quite a lot of this in Germany…

http://www.powerengineeringint.com/articles/2015/08/rwe-launches-power-to-gas-plant-in-germany.html

Though the hydrogen is as often pumped into the natural gas network as used in cars or trains.

Then there’s this production of hydrogen on trial basis for use in a steel plant:

http://www.kallanishenergy.com/2017/02/10/voestalpine-builds-hydrogen-fuel-test-facility-at-linz/

“I am a realist in all things… especially power production and climate change.”

More utter drivel.

You know less about climate science and power production than my cat – by several orders of magnitude.

Have you apologised to Dr. Crockford yet?

Hydrogen as a fuel is a dumb and dangerous technology. It is far better to sew up the H with a bunch of nearly free carbon. Hydrogen walks through walls.

Ethanol fuel cells (ethanol to electricity) are a better bet. Cell phones have been created with a small tank containing a few drops of ethanol.

Hydrogen is a good rocket fuel, though.

But costs and tech innovation in oil fields are not static. Productivity rates in energy extraction are some of the highest rates in the economy, unlike health services, educational services, and government. Again, you live in a bubble where cost does not exist and it warps you thinking and exaggerates your claims.

EVs are less than 1% of the global market. Increase or not, that isn’t affecting demand for oil. Disposable income has a far greater effect on oil demand.

“Demand must fall too …”.

====================

Not will fall — but must fall.

There speaks a true statist.

I live smack dab in the middle of oil country here in W Texas. There’s oil under my property, my home, my barn. Frack drilling came to a halt when the price of crude dropped to under $30 year before last. But quickly resumed once it reached about $38. So the cost to produce is probably lower than the lowest when you factor out profit. The need to drill many holes has been replaced by drilling one hole every several miles then side drilling for miles. It cuts cost dramatically. Supply is still way above need and will more than likely continue that way for many many years as competition drills new and pumps out of old wells as soon as profit is possible. Incidentally, the technology just parks on the side of the road, lowers a plate to the ground underneath and sizes up the layer or layers for many miles in all directions. The technology is so good that accurate maps can and are produced showing the location of the various layers and their depths. Drilling occurs where 2 or 3 of these layers overlap (at different depths) which further reduces cost. (One hole, many side drilling tunnels, various depths). Fracking merely pumps high pressure water and granules into these wells to crack the shale deposits that contain the oil so the oil drips into the tunnels and one well, where it is then pumped to the surface. Natural gas is also collected at each vertical well. The granules basically hold the newly fracked cracks open so they cannot close back up and block the oil. And to the fellow that says you can’t buy crude oil:) I laugh. You can get it for free around here just for the asking. The real value comes after it is refined both at the well site as well as the refinery plant. As the oil comes to the surface it contains water and other debris. It is pumped into holding tanks with sight glasses to see the level of separation. Someone manually goes out to all these wells to open a valve and bleed off the water/debris mixture into another tank. Both the more pure crude and the water are transported by truck to appropriate locations. The waste is treated and released. The crude is stored in large above ground storage containers until needed by the refinery. There are companies that specialize in picking up the debris/water and treating it for release. There are companies that pick up the crude. Other companies that produce the refined products we use. And many independent drillers who compete with land owners to set up and drill. In just the last few years the industry has been transformed vastly. Fields full of well heads have been replaced with just one for many square miles. You can’t find them unless you know where to look. Environmental concerns are addressed as well with zero leakage into the earth. Lined catch ponds are used to house the well opening, storage tanks etc and are routinely inspected for problems. Well pump motors are 3 phase and placed on a timed switch to allow pumping only when there is enough oil to make the pump use worth moving. It is a very organized business with more economy coming all the time. Costs are going down, not up. Any effort to control the cost of fuel will soon find themselves awash in a glut of the stuff as there are many known reserves ready to be pumped (wells already in place). Well pumps are just switched off during dips in price to stabilize price. No cost is involved to sit on the reserves. With the new technology in production there are over 500 years of world consumption available just in this one (Permean Basin) deposit and more being discovered all the time. Don’t fret over future price gouging, lack of supply or any other concern regarding crude oil and it’s by-products. Only gov shut down or national disaster could affect any of this and even then it would be difficult.

We need to show you how to make a paragraph.

The need to drill many holes has been replaced by drilling one hole every several miles then side drilling for miles.

Not quite. Best practice today is to build a drill pad of 30-40 acres from which 20 wells will be drilled directionally to space out each parallel horizontal leg is about 500 feet apart

“Two miles down, Two miles horizontal, twenty days. Repeat”

The drilling pads is a 400 day factory floor.

Addendum: From this drilling pad, you should be able to drill out and produce from about 4 square miles.

A Day. Great post. Yes, costs are going down and it only takes 20 or so days to drill these wells, a few years ago, it took a month to 45 days.

Javert Chip: To coin a phrase, “Weee don’t need no stiiiiinkiiiing paragraphs” when we have a depth of knowledge like this.

Stephen Rasey: Not only 20 wells, tapping 4 sections, but that is assuming all 20 at a single depth. The Rail Road Commission is allowing stacked laterals (think layer cake with 20 straws stuck through one icing layer, repeated again and again at each layer of icing, creating a stack of straws, horizontally and vertically) so those 20 initial wells could grow.

EV’s. Mmmm. Just where does the E for those V’s come from? Out of a plug in the wall??

Sunshine extracted from cucumbers, of course.

In GriffWorld, at any rate.

“Demand must fall too”

More drivel.

BP disagree with you, out to 2035 at any rate.

http://www.bp.com/content/bp/en/global/corporate/bp-magazine/conversations/chief-economist-on-energy-outlook/jcr:content/article_dropzone/article_dropzone/image.img.840.high.png/1441621163539.png

http://www.bp.com/en/global/corporate/bp-magazine/conversations/chief-economist-on-energy-outlook.html

Did anyone ever tell you that a 100% increase in Sweet FA is still pretty much Sweet FA? Because that’s where your precious ‘Unreliables’ are going.

As for China:

http://chinaenergyportal.org/wp-content/uploads/2017/01/YoY-2016.png

http://chinaenergyportal.org/wp-content/uploads/2017/01/Mix-2016.png

http://chinaenergyportal.org/en/2016-detailed-electricity-statistics/

You’re going to be sleeping on that incontinence sheet for a few decades yet, skanky.

Tell us, have you apologised to Dr. Crockford yet?

“Finally, there is one other category, called “technically recoverable reserves.” This is the broadest category, it is simply an estimate of how much oil and gas can be produced using current technology, regardless of cost or profitability.”

This definition was coined by myself and co-author Gary Nash in ~1978 in a well received Canadian Institute of Mining and Metallurgy Bulletin (CIM bulletin) ‘debate’ series of discussion articles reviewing “reserves and resources” terminology (Reserves and Resources Expanded) of the time, which we found deficient for purpose. We were working for the the Canadian Gov. Energy Mines and Resources and were “spoken to” because this area wasn’t in our job description. This part of the discussion concerned the idea that looking at global resources and geopolitical aspects, what might be called reserves in the USSR and other parts of the world, might not qualifiy in North America. The idea was that what was important from an economic and global viewpoint for comparability was” what volume of resources could be produced using ‘todays’ extractive technology. The choice of how much could be produced at a given price was a derivative of this larger basic number. For governments during, say, wartime, how much can we get with a subsidy of such and such – a very practical matter, indeed.

The USGS was the first to respond, coming up with a substitue name “reserve base” and conveniently didn’t reference Gary’s and my work. Similarly, and with the same non- recognition of source, it was adopted by the UN and, I suppose other jurisdictions. We did get referenced in the text “Selected Readings in Mineral Economics” ten years later although of limited circulation (see first three or four chapters).

http://www.sciencedirect.com/science/book/9780080358642

I’m pleased to lay claim to this important ‘modern’ idea for my friend and I here at WUWT.

Thanks you for letting us know. I did not know you were the author of the phrase. I’ve used it for decades, shame on me.

Contingent resource is kind of synonymous with technically recoverable reserves. We can’t actually book technically recoverable reserves because they are reserves under SEC rules. They are a contingent resource…

We will never run out of oil as long as the earth exists. It is simple economics. As less supply is provided at a certain price point, the price goes up. When the price goes up people consume less, when the price goes up a lot, people find alternative sources of energy, or alternative production methods. High prices a few years back brought us lateral drilling of shale deposits which brought us more oil and actually significantly lower prices. When oil gets to $250 per bbl, maybe electric cars will come in vogue, using atomic power, or hydro power as the base energy source, or maybe coal, which will be converted to oil, Natural gas to ethanol, etc.

So basically as supplies get more scare, price goes up, causing less purchase. At some point small amounts will be delivered and small amounts consumed.

When people say there is a shortage of something, it usually isn’t the case. Supply and demand balance out. What they mean is there is a shortage of the product, at the price point they would like see it at. There is a shortage of natural gas, we heard 10 years ago. But really it was a shortage of NG at the reporters predetermined favorite price of $1 per 100 CU. None of us actually ran out of natural gas. (house was cold though)

The upshot is, you have to define what run out is, and it doesn’t mean that pumped supplies are going down. Is run out, defined as the point at which it is no longer economical to use oil to run cars? – as an example.

Andy May. Thanks for the review.

1) Please focus on and address the constraints of MAXIMUM production under “PEAK oil” – that is when the economic crunch hits – NOT when we “run out”. While peak production is nominally half of the full, the economic constraints disruptions begin at in rising inflection point when we can no longer grow as fast as desired.

Thus the need to focus on BEFORE the HALF the life of those amounts for the critical economic impacts or 25% – one QUARTER of those durations.

2) Please examine Multi-Hubbert type analyses. e.g., see Patzek: Peak, Peak What?

http://4.bp.blogspot.com/-G0vfwamxqrc/UJXj2oosHuI/AAAAAAAAAWA/O40KnHB5aqo/s1600/USRatePlusANWAR.jpg

Reynolds 2013 World Oil Production Trend: How U.S. Shale Oil Production Changes the Trend

3) It often takes > 40 years for major energy technologies to penetrate. So we need to look at peak less 40 years to get started on sustainable replacement fuels- i.e. NOW.

DH, agree. See more extensive comments below.

David, believe it or not, with the right incentives $$$$$$ things can change a lot faster than you think or expect. Think of the internet, cell phones, etc. A free market will respond very quickly and as needed when it makes economic sense, IF governments do not put a stop to it. “So we” (as in governments) do not need to get involved at all. They need to stay out of the way, and not force a technology (wind and solar and bio-fuels) that does not make economic sense.

When I was in graduate school for chemical physics, we learned that when it comes to analyzing empirical data curves, there are three kinds of liars: liars, damned liars, and ‘deconvoluters’. This chart on ‘world oil production trend’ from 2013 is in the ‘deconvoluter’ category. It predicts(?) the size and duration of a ‘Hubbert cycle’ beginning no earlier than 2015, peaking in 2035, and completing in about 2050. It wold seem that the source of the data for this cycle was a seance.

tadchem having studied pchem, I find second order models by Patzek and Reynolds more insightful than your no order dart board model.

Remember “we can’t drill our way out of this””even if we start drilling now it would be twenty years before it had any impact and that impact will be very small”

For ten years I heard this on every news out let as a reason to not drill on government land. Oil was going to be $100 barrel plus forever, so said every liberal and there was nothing we could do about it.

Then N.D. Fields that the government couldn’t stop and in the blink of an eye $30 oil. OPEC in ruins and still the liberals found a way to screw up the world.

US BLM controls 243 million acres in the West. Time to turn that back to the States.

Necessity is the mother of invention.

NEWS: Senate confirms Scott Pruitt to lead Environmental Protection Agency

https://www.nytimes.com/2017/02/17/us/politics/scott-pruitt-environmental-protection-agency.html?_r=0

Wonderful! Common sense at last.

And laziness is the father.

As far as the need for oil as a combustible fuel for transportation, I only see its continued use

extending for airplane fuel beyond, say, the next 10 years or so. Electric cars are clearly coming into widespread, dominating use in the future and the dropping cost and improved performance of batteries is going to force that transition. Electric drivetrains are simply far more economical, maintenance free, cheaper to build and a WHOLE lot cheaper to repair. Every man his own mechanic is the way I see it.

EVs make up a little less than 1% of the market share in the U.S. so I’d give it longer than 10 years.

Also, the real cost of driving an EV depends on local electricity costs, i.e. a 40 mpg ICE in Hawaii is actually cheaper to fuel than an EV at today’s gas/electric price. Spikes in electricity price are becoming common in places with a heavy investment in renewable energies, i.e. the $30/kWh spike in Brussels last week, $13+ spikes in Australia — that’d really hurt the wallet if charging EVs in that time.

The only reason EVs are even cost effective in much of Europe is due to the government incentives, including free charging stations. You don’t need a degree in economics to know that incentives won’t be sustainable if everyone were to actually were to use them. The latest EV test (BMW i3) on The Grand Tour clearly demonstrates the current impracticality of owning an EV for most consumers.

Ironically, the idea that fueling EVs is cheaper than modern ICEs hinges on electricity production from coal.

Great informative post and discussion !

I don’t see 18-wheelers , agricultural or industrial equipment shifting from petroleum for much longer than that . Nor for necessarily 4WD SUVs here where the next gas station to the north is ~ 75km away .

Electrics are great for commuting in Silicon Valley .

Pretty much nailed it. As one who worked his way through college driving a semi interstate, and son of a trucker still driving at age 83, we follow truck tech. There is a company selling CNG-powered trucks, but to get customers, they offer on e year free fuel. Of course, that means your routes and destinations have to be regular and near known CNG stations.

And you have to be willing to spend 3 times the price of a similarly equipped and powered diesel.

No sight nor sound of electric semis.

NEWS FLASH – NEWS FLASH – NEWS FLASH

SCOTT PRUITT CONFIRMED!!!

This day needs to be marked in history as the the climate realists D-Day!

It is the Beginning of the End for the Warmist movement!

WWS This day will live in infamy.

E.P.A. Workers Try to Block Pruitt in Show of Defiance: https://www.nytimes.com/2017/02/16/us/politics/scott-pruitt-environmental-protection-agency.html

If they called on their office phones, during work hours, they have just nominated themselves to be the first ones let go.

Is it true that there was a time, just after railroads were laid from East to West across the US, when those trains would stop upon sighting a herd of bison (buffalo)…

When they did, the train would stop and anybody/everybody on that train who had a firearm of any sort, would blast away at that herd until nothing was left standing.

This was OK because they were in the sure and certain knowledge that when the train next came along, there’d be another herd to ‘ entertain’ the passengers.

If that was really true and in conjunction with this article, we really should be scared sh1tless – carbon dioxide is the very least of our problems.

The idea was to get rid of the buffalo. Once their major resource was gone, the indians would compliantly move on to the reservations.

Very true, the decimations of the buffalo was to “fix the Indian problem.” Generals Sherman and Sheridan considered killing all of the buffalo “the critical line of attack” against the Indians, especially the Comanche. See here: http://history.msu.edu/hst321/files/2010/07/smits-on-bison.pdf

Sherman succeeded Grant as army commanding general after Grant became President and in 1868 he proposed to annihilate the buffalo.

I’ve been told you can see the rise and fall of oil prices by driving by an oil field and assessing how many pumps are working. Marginal wells pump at higher prices ….otherwise are shut down. True??

Only if you’re in a very marginal field, and even then it will change on a well by well basis. A well that is bringing up as much salt water as oil is a lot more expensive to operate than one that produces 90% oil, and that can happen on two wells that are side by side.

I would have thought they cost about the same to operate, however the revenue from the first would be a lot lower.

You can walk around inside my house in the Permian Basin and see 8 pump jacks from my windows. Most (all?) of them run on start/stop cycles of about 10 minutes. They have various sensors to tell them when to start and stop. So, no, you can’t tell from driving through and seeing some running and some stopped. I don’t know when these particular wells were drilled (I’ve only lived here for a year) but there are several drill rigs within a few miles.

Two observations.

1.Green River kerogen will likely never be produced. Depending on production details, each barrel of resulting syncrude takes 3-5 barrels of water. The formation covers parts of three states, the ‘upper’ portion of the Colorado compact. The formation is named after the Green river that cuts through it, the major Colorado river tributary. All the water in the Colorado rivershed has been bespoke since the 1921 Compact, and the bespoke amount was overesrimated by about 15%. If Green River oil shale goes into any significant production, then prepare to abandon Phoenix, Las Vegas, and parts of southern California. Never going to happen. Water, not kerogen, was the reason Reagan stopped all federal Green River oil shale research.