Guest Post by Willis Eschenbach

Dramatis Personae:

The “EIA” is the US Energy Information Agency, the US agency in charge of data about energy production, consumption, and use. It has just released its January 2014 Short Term Energy Report, with current and projected oil production figures.

And “M. King” is Marion King Hubbert, the man who famously predicted in 1956 that US annual oil production would peak in 1970, and after that it would gradually decrease.

——–

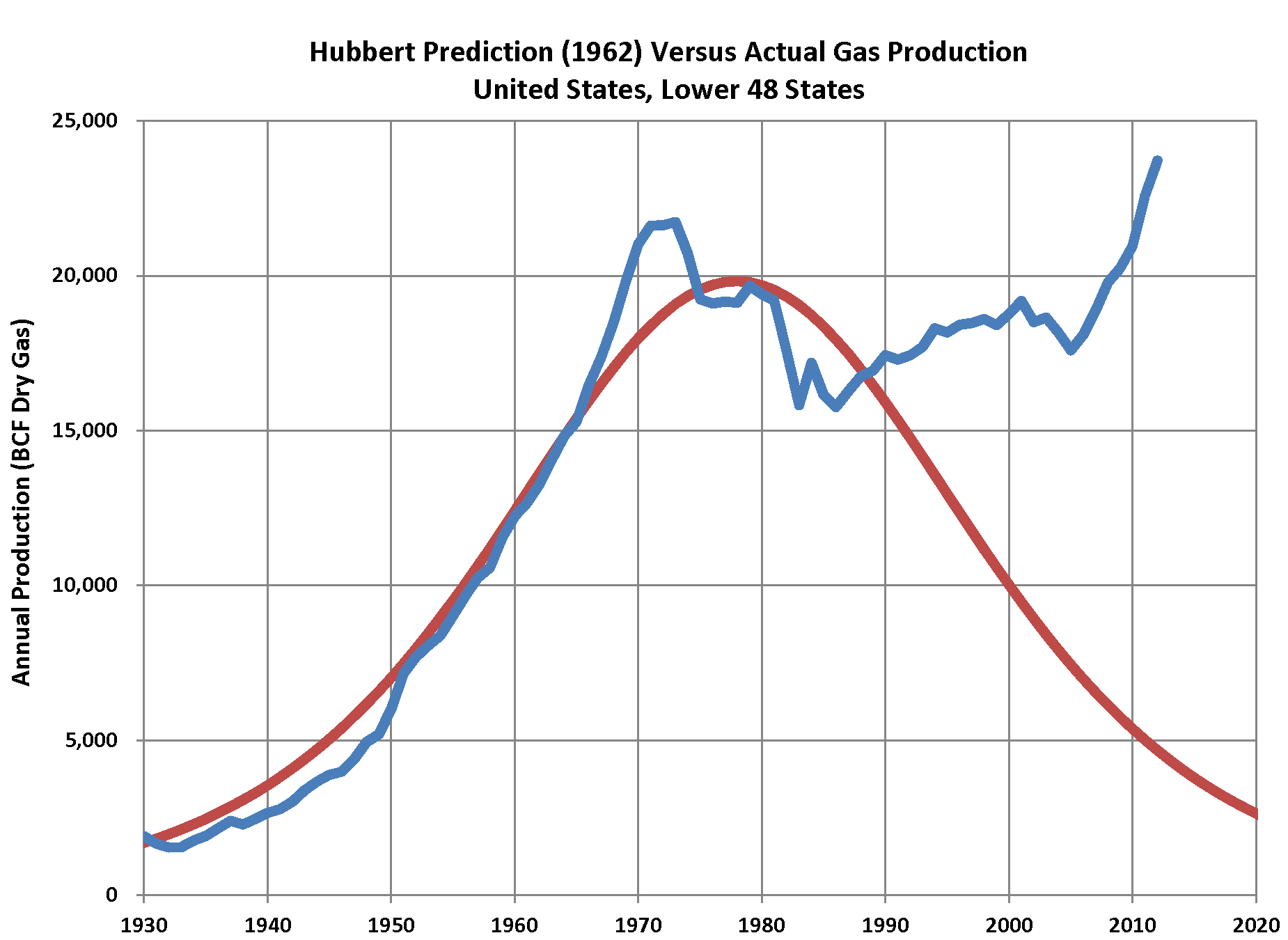

So why is the King meeting the EIA? Figure 1 shows why.

Figure 1. US crude oil production. Data from 1965 to 2013, projections for 2014 and 2015. As is customary, “crude oil production” includes what are called “natural gas liquids”. Data from the BP Statistical Review of World Energy and the EIA.

Figure 1. US crude oil production. Data from 1965 to 2013, projections for 2014 and 2015. As is customary, “crude oil production” includes what are called “natural gas liquids”. Data from the BP Statistical Review of World Energy and the EIA.

Now me, I see that as a testament to human ingenuity, as fantastic news for the planet, and as another example of the futility of betting against said ingenuity. As my dear dad used to say, “Imagination is free.”

I don’t really have much more to say about this great news, other than I see it as a huge opportunity for the poor. The implications are clear. Cheap energy is the salvation of the poor, and this can only be good news for them … not to mention good news for the rest of us as well.

Best regards,

w.

PS—Folks, don’t bother telling me it is “unconventional oil”. That is a meaningless distinction, invented by supporters of Hubbert’s peak oil theory, to try to salvage Hubberts moribund claims. For example, when fracking was done in vertical wells for fifty years, it was counted as “conventional oil” … but now that the drilling is done horizontally, suddenly fracking produces “unconventional oil”. And given that for many centuries oil was collected from surface seeps, in historical terms all modern oil production is “unconventional”. See my post Conventional Wisdom, Unconventional Oil for a full discussion.

PPS—If you disagree with something that I or someone else said, please QUOTE EXACTLY WHAT THE PERSON SAID in the comment where you discuss your objections. I can’t tell you how many times I’ve been attacked over things that I never said … so quote it if you want to discuss it. I’m going to get more hard-headed on this one, I’m tired of picking spitballs off the wall. I’m happy to defend my words if I know which ones you are talking about … but I can’t defend your interpretation of my words. Quote it or lose it.

Odd though, for someone that made a prediction in 1956, he didn’t do to bad. He was right from 1970, until now. I am not sure how much they knew about the abundant shale formations back then?

L. Fletcher Prouty was absolutely correct again. Although by being correct all he did was to quote a petrochemical insider.

When all sources of oil, coal and gas, conventional and unconventional, are exhausted, the USA will still produce petroleum.

Why?

Because petroleum is an awfully convenient way to store large amounts of energy, for small scale use. Petroleum produced by a nuclear reactor will still run your car.

Eh, thas a hockey stick….

i enjoy the “no smoking” sign, with smoke blowing over the rig from what looks like a furnace to power a steam pump in the shack on the left!

w – I never thought I would see the day when you accepted a model prediction instead of waiting till raw data was available. (This model probably is right, though).

I did not know we were producing so little after 1960’s until recently. Imagine if we were allowed to drill federal lands. Just imagine!

This is good news Willis. We don’t need to buy oil overseas if we weren’t so thick headed with Federal policies.

All we need to know is just how bad is it going to get and is it worse than that?

The whole idea of “unconventional” oil is simply and completely ridiculous. If it is an energy source that walks, talks, and is USED for the same purposes there should be no distinction or difference.

Willis said it well: “when you open a barrel of unconventional oil to see what conventions were broken in its creation, you find it is indistinguishable from conventional oil.”

Willis, not sure its quite this simple. Hubbert’s argument was that for a given type of extractive industry, there is a typical curve. What happens is that reserves are found, and extraction proceeds apace, however the industry then starts to find diminishing returns and so we go over the peak and it falls.

Its quite unlike other economic phenomena, for instance the experience curve in manufacturing.

Hubbert would probably argue that exactly the same pattern will follow with natural gas, extracted through fracking or whatever.

To argue the contrary you’d have to argue that reserves are essentially unlimited. Its a possible argument, but it seems a bit unlikely. If you look at the great finds, for instance North Sea, or Saudi, their production does seem to follow Hubbert’s curve. So for instance did UK coal. So probably did South American copper, don’t know the stats.

The case that there is no peak depends on continually finding new fields as the curve on any one particular one goes over the top. There has to be a bound on it. Now, it may not matter economically. We may well find substitutes. But if you think about the increased demand from China, India etc its surely a bit hard to believe that there is going to be enough oil and gas to continue increasing production to meet their demands indefinitely?

The “unconventional” thing exists for 1 reason only – to give Greens a second bite at banning it; they’d love to ban all oil, but can’t get even the low info public to buy into that. (By “low info” I include Obama – who ever heard of banning a pipeline because the oil is coming from Alberta sands rather than from Saudi on ships??)

Dear Willis, the graph says it all… All the doomsdayers underestimate human inventivity to overcome problems now and in the future.

I once read a “new” book in our library that was published in 1901 and that they forgot to discard from the stack, about all the “new” inventions of that age, like a “dust sucking broom” (a vacuum cleaner!) just invented then and lots of other things that we now take for granted. If you look at the electronics revolution of the last decades, nobody would have imagined that if you had told them in the 1950’s…

The same for oil and ore exploration…

I once believed in the dire predictions of the Club of Rome, which all are surpassed by reality in the past decade. All predictions were wrong, from the first to the last one…

Brilliant news. Now will this translate into concrete action to help the poor, or will the wealth percolate upwards as usual to the 1%s, & their bankster bosses?

Will the mad US Govt start to make amends for it’s “banning” (through denial of “foreign aid”) of DDT, which was a cheap & most effective anti malarial agent, & not a carcinogen as the murderous head of the EPA, Ruckelshaus claimed. This action has cost in the region of 2 million lives in the 3rd world per year since 1972. That’s ~82 million people, more than Hitler killed.

The mad Marxists of our so-called “green” movements remain true to murderous form.

When/if sanity returns to this world, this will be seen as the greatest tragedy of the 20th century.

& every American who puts Ethanol in his/her gas tank, from land which should be growing food, is complicit in a crime against humanity, right up alongside George W Bush.

Micheal Crichton’s bestselling novel : State of Fear, pages 580-581.

Wildavsky Aaron. But Is It True? A Citizen’s Guide to Environmental Health & Safety Issues.

Cambridge: Harvard University Press, 1995. A professor of political science & public policy at Berkeley, he turned his students loose to research both the history & the scientific status of major environmental issues: DDT, Alar, Love Canal, asbestos, global warming, acid rain. The book is an excellent resource for a more complete discussion of these issues than is usually provided. Pages 55-80 deal with DDT. Wildavsky concludes that nearly all environmental claims have been either untrue or wildly overstated. He argues that resilience is a better strategy than anticipation, & that anticipatory strategies (such as the precautionary principle, so firmly enshrined in the Eugenicist UN Agenda 21) favour the social elite over the mass of poorer people.

Neither book is difficult to get hold of. Both are couched in laymans’ terms that non-scientists such as myself can easily understand, & should be read by all with a claim to a conscience, & passed around to friends, family, workmates etc.

Nice one Willis.

michel says:

January 12, 2014 at 12:52 am

++++++++++

You’re saying essentially that eventually, finite resources will be depleted. No one said there was an unlimited about of oil. However, that is not what the debate is about. It is in fact true that claiming peak oil would occur back in 1970 was incorrect. It was incorrect because the peak has yet to be seen –that is all. Will it peak in the future some day? Yes or course. Just not now and not for a long time.

You write “So for instance did UK coal” That’s because of government sanctions. England has a lot more coal that could be taken, but it is not allowed from what I understand.

Willis,

I have frequently enjoyed your contributions and admired your insight – but in this case I am sorely disappointed, especially since you seemed to have stooped to the “straw man” argument, which I have previously associated with alarmists.

M. King Hubbert never stated that the oil production of the USA would reach its peak in the 1970s and thereafter decline. He estimated that the oil fields of the lower 48 that have been in production in 1956 will reach their peak (production) between 1965 and 1970 – and that prediction turned out to be correct. If you want to invalidate Hubbert’s prediction, you should start by subtracting oil production in Alaska, the Bay of Mexico (US territory) and all other fields that have not been producing oil in 1956 from EIA data on contemporary oil production of the USA.

M. King Hubbert’s discovery was that production of “naturally flowing” oil (i.e., outflow of oil due to internal pressure) follows a Gaussian curve (see equation e.g. here http://en.wikipedia.org/wiki/Gaussian_curve), his conclusion was based from quite geophysical reasoning. By calculating the Gaussian function constants a, b, c and d from (at least 4) measurements during increasing field production, one obtains the shape of the bell-curve and therefore determines the peak of production. While M. King Hubbert’s method has seen some minor seen some corrections since first proposed, the basic reasoning remains valid and the method is routinely used by oil companies to assess the remaining oil reserves in a producing field.

Unfortunately, M. King Hubbert’s name has become associated with predictions of global peak of oil production from all possible sources, including undiscovered fields, shale oil, etc. – I am sure that Hubbert himself would not have been flattered by such “fame”.

The EIA curve of US oil production does not invalidate Hubbert’s conclusions, but it does indicate that Julian Simon’s victory in the famous Simon-Ehrlich wager (see e.g. here http://www.princeton.edu/~achaney/tmve/wiki100k/docs/Simon-Ehrlich_wager.html) was not just a lucky guess.

Mario Lento,

I’m saying like the next poster that the Hubbert argument is probably valid for any particular field. Like North Sea. Yes, there is quite a lot of coal left in the UK, but the problem which makes production follow the Gaussian curve down is that its deeper and deeper and less and less economic to extract. We will never run out, but we have already run out of coal that can economically be used to heat houses, for instance.

I’m just pointing out that the argument globally that there is and will be no peak depends on a premise, that there are more fields to discover. Because it does seem to be true that each field follows Hubbert’s curve.

The key point is that you cannot use Hubbert’s argument to forecast national production unless you are sure there are no more fields to be discovered. And in the US and UK this has probably turned out not to be true. But there is going to be a point, maybe quite soon, when we will have discovered all the big ones, and the Saudi Fields will inevitably turn down, and then what?

fig 1 As is customary, “crude oil production” includes what are called “natural gas liquids”

So what does the graph look like if you don’t count gas as “oil” . Was Hubbert including gas as oil when he made his predictions? Predictions which seems amazingly accurate to me in view of when he wrote it.

If we start converting coal to “unconventional” oil will that again mean he is wrong about oil running out?

Great article, Willis.

Some people praise Hubbert because there was a local peak. I’m not so convinced. The problem with peak theories is that there are so many people making predictions all the time, if natural fluctuations cause a local peak to occur, someone would have “predicted” this.

It’s a bit like a stopped clock being right twice a day. And like most doomsday cults, the peak oil crowd have an awfully large number of “stopped clocks”.

The AGW cult is little different and the continuous failed predictions will just be kicked down the field with the old “prediction was right, timing was wrong” claim. Never once considering that the timing is single most important part of the prediction from a policy perspective.

Michele: What exactly is your point? I responded to exactly what you posted, not what someone else posted. Clearly, we are not running out of oil to the point where production is diminishing right now or in the near future. We are not running out of coal to the point of reduced production either –except that laws don’t allow it in many areas. The way you wrote your post was simplistic and insulting since your argument had nothing to do with any claims made.

Re Willis’s PPS on precise quotation, I can testify to what he says. A few months ago in a really long thread I didn’t keep tracks of exactly who said what and in a comment on the “scientific method” I mistakenly included Willis’s name along with someone else’s. And now I am stacking shelves in the local supermarket…

Rich.

A large part of the case for biofuels was that the US was running out of petroleum, and so its price would rise and it would be necessary to find less expensive substitutes. Now that the US is on its way to petroleum independence, the ethanol mandate percentage should be cut in half.

To Mario Lento above.

The Federal resources are being saved for the 1%s, for the future.

See – owe to Rich says:

January 12, 2014 at 1:41 am

” I mistakenly included Willis’s name along with someone else’s. And now I am stacking shelves in the local supermarket…”

Misquoting Willis gets you a job?

Reblogged this on pdx transport and commented:

Pretty good evidence that peak oil is about to be disproven by reality.

Another prediction of doom crashes to reality.

Man cause global warming is likely next.

Availibility is no problem. The short term problem might be that the exploration rate is able to meet the demand. At the moment there is still a lot of opposition to allow fracking.

Fracking is invigorating the US economy by providing abundant, relatively cheap, energy. While not inexhaustible, tracked gas and oil resources in the US will last for centuries and has the strategic benefit of no longer needing to kowtow to the demands and blackmail of those who live in the lands of sand and camels.

Fracking is the economic vaccine, or antidote, to goofy alarmist policies.

So America has shown the way. Fracking is hugely beneficial and the nonsense alarmist claims of associated earthquakes and groundwater pollution have been demonstrated to be be grossly exaggerated.

So now let’s turn to Europe and its geriatric approach to anything which makes economic and environmental sense, it has decided to heed the voices of the ecoloons and make the lives of those who wish to provide cheap and reliable energy, through fracking, as difficult as possible.

So Europe will continue its decline as it smugly watches a resurgent America, happy to strut its supposedly green credentials and tut tutting about how much wiser it is for the planet to depend on unreliable expensive wind power than cheap, reliable oil and gas from fracking. Most (not all) European countries have huge untapped resources of oil and gas shales.

It is no coincidence that those people who oppose fracking and cheap reliable energy are the same as those who support expensive unreliable wind energy. Americans rightly complain about the ecoloon policies of its EPA , but these are relatively benign compared to those of the European Union.

So America, it will not be long before Europe comes cap in hand to you seeking the equivalent of a new Marshall Aid Plan.

Given technology can convert between light and heavy hydrocarbons, and even sythesise oil, and further given that there is a moon of Jupiter that has oceans of methane, my guess is we wont run out of the stuff for hundreds of thousands of years

Simon’s name is the one to mention here – as it has been further up, for all that the miserabilists tried to brush it out of history.

I think we are approaching resource shortage from the wrong angle. As was also mentioned earlier, we currently know that hydrocarbon liquids are a good way to store portable energy. Therefore, so long as we use hydrocarbon-powered vehicles, for instance, we will need to produce hydrocarbons. And we will.

We will dig them from the ground using surface seepage, deep wells or fracking. We will get them from under the sea and ice. We will reconstitute them from coal, plastics and individual atoms if we have to. The driving force is not the existence of current reservoirs that we know how to exploit – it’s our need for them.

And when that need diminishes – perhaps we invent teleportation or something, or invent an even better way of storing portable energy – THEN the production will fall to minimal amounts. It is the need for an item, NOT the current method of obtaining it, which drives an item’s existence….

The argument of a curve for a particular extractive industry is irrelevant. Extraction is not the only factor. Willis notes correctly that extraction techniques are vastly improved on 50 years ago. Ironically, the major reason this is so is because production was falling and the price rising. That’s just simple supply and demand laws at work. But rising prices also spur improvements in usage efficiency. So that the exact same production level of 20 years ago, today allows airline to fly more people over a greater distance, and etc.

And what this highlights is something the malthusian finite resource scaremongers have never understood: which is that, absent humans, there are no resources. Without human oil-burning technologies, oil was a pollutant that upset farmers. Without human nuclear technologies, uranium is just a rock.

Which further highlights the hugely destructive aspect of the malthusians, which is that they will happily sacrifice the only true resource there is on this planet – human minds – in order to preserve for themselves the things they consider to be resources.

Frankly, they disgust me.

Willis, like many you misrepresent the original peak oil argument. It was implicit that:

“…given current technologies and known resources…”

Miso points out that Hubbert’s name and work has been abused by many vested interests, in ways he would likely not have agreed with.

Along the lines of John Ralston Saul’s “Voltaire’s Bastards”, perhaps it might be better to have a title to this article of:

“Hubbert’s Bastards meet the EIA” …

perhaps we invent teleportation or something

We are well on the way to that effect wit Skype. Telepresence will complete the function.

“F. King Hubbert’s Bastards meet the EIA” …

Just a little amusement.

Scuzza

I couldnt agree more. Hubbert acknowledged many of the shortcomings in his model of oil production such as how to predict technology, he later as fas I am aware assumed a constant rate of improvement and of course resources which he had to assume. Then from resource to reserves and put all this together to estimate recoverable reserves.

Thanks Willis, reading Russian research they have evidence that some oil deposits are from depth in the mantle, a combination of the CO2 and water in the rocks there together with the heat and pressures that are available at those depths. I have not seen all the evidence so cannot verify that it is true but it sounds interesting. Petroleum can be made from wood chips, in fact this method has been used to produce a flamable gas to run ICE’s, but cost is 3-4x that of conventional oil. The people doing this claim no environmental impact apart from felling hundreds of trees that is. I would have thought that biodigesting waste to produce methane to use direct or react methane to more complex hydrocarbons would be cheaper and use household waste instead of filling landfill sites. The remaining waste can be put on the land as a fertilizer. Win-win all round.

michel:

In your post at January 12, 2014 at 12:52 am you assert

And that is your error.

For all practical purposes any resource can be considered to be infinite.

I recently explained this in another WUWT thread where my explanation used the effectively infinite availability of crude oil as illustration. The explanation concludes saying

This link is to that explanation.

http://wattsupwiththat.com/2014/01/05/overpopulation-the-fallacy-behind-the-fallacy-of-global-warming/#comment-1526318

Richard

The real fossil fuel boom in the U.S. is in natural gas.

According to the EIA the current surge in petroleum production n only temporary for this decade and then trail off again. Natural gas, on thre other hand, is a long term boom that will last for many decades to come.

The EIA has also identified enormous untapped shale deposits globally, especially in China, that can be developed and provide enough fossil fuels through at least the rest of this century until other alternative energy sources can become economically feasible.

Johnmarshall

I have heard these points about deep crust/mantle sources of HC. It seems possible but petroleum has a d13C signature that would indicateiy is a fossil fuel. Also it is possible to source the petroleum and it is largely from organic rich shales.

We often hear that, to maintain or increase curent levels of oil production, we will have to keep finding new fields or sources. This overlooks the fact that we know today – with almost 100% certainty – where to find three or four times more than the entire oil production to date. It is still in those producing fields.

Current recoveries are around 25-30% of the oil in place, as I understand it – less for shale. As technology improves, I would not want to bet against our ingenuity finding ways to improve those recovery rates.

Miso

Like you i think Hubbert has been misrepresented. One point where i disagree with you is in predicting field production. This comes from economic models derived from reservoir models which are in turn built from reservoir property models tied to geological models. They are generally bell-shaped because the distribution of properties in each model are and behave in a Gaussian fashion. Plus uncertainty and inference works best with normality.

Hubbert’s “Peak Oil” prediction was based on the assumption that the total recoverable resource potential in the US and our OCS (offshore) was only 150-200 billion barrels. The current DOE estimate is 400 billion barrels. This estimate was before 2006 and the shale boom and it didn’t include unconventional resource potential (which dwarfs the conventional potential). Shale oil like the Bakken and Eagle Ford is not unconventional oil. It is plain old crude oil. The recovery is unconventional because it’s different than the prior norm; hence they are described as unconventional resources. Oil shale (Green River) and tar sands (Athabasca oil sands) are unconventional oils because they are bitumous kerogens – essentially incompletely formed crude oil.

Since the industry continuously finds more original oil in place and manages to recover a higher percentage of the OOIP, the total recoverable resource potential is always better than previously thought… The opposite of CAGW… 😉

We’ll eventually run out of places to look and reach a point where the diminishing returns of technology hits the economic wall. That’s when we’ll see Hubbert’s Peak. The odds are that “peak demand” will obviate “peak oil.” Some day in the future coal, gasoline, natural gas, nuclear fission and just about every other power generation source will be replaced by something that delivers more value to the economy… Real value… Measured in $$$. Not phony value like “social cost of carbon,” EROEI or fill-in-the-blank averted. That day is not here yet.

Man did not leave the Stone Age because of a stone shortage. Man did not advance from the Chalcolithic to the Bronze Age because brilliant government bureaucrats forced coppersmiths to purchase bronze credits.

Once a practical battery comes to market, ,most demand for crude disappears. Nuclear can provide all the energy the world will ever need,and for millions of years (the oceans are full of uranium) and fast reactors can extract 40 times more energy from uranium than current reactors –

the energy that still remains in our nuclear waste is enough to provide all the energy this country needs for the next 1000 years. When you move into advanced nuclear power, there is no practical limit on energy resources – they will last as long as our sun. I have to laugh when folks get concerned about “finite energy resources.” Finite coal, oil, etc, yes, but not finite energy.

As for gasoline being a “concentrated energy source,” I disagree. Electricity has no mass or weight and thus is the most concentrated energy source available. It’s only the storage batteries that have weight in an electric car. But that weight has come down drastically over the years and continues to do so. And gas powered cars require lots of heavy (and complicated) machinery to

extract and convert energy from gasoline that electric cars do not require. An electric car is intrinsically more reliable, simple, and will be less expensive once battery costs are conquered.

This is bad news!!!! This shows that even more evil CO2 will be released from it’s underground prison via burning oil/natural gas. /sarc

Mario Lento

I’m not insulting anyone or anything! I’m also not a Malthusian.

It does seem if you look at oil and gas fields that they do follow the Hubbert curve.

However it is also true that if you look at total US petrochemical production, it does not, and this is because more fields have been discovered.

I do think there are limits, not to growth, but to extractive industries. The reason there are not limits to growth is that substitution takes place. But if we were to try to raise UK coal production to the peak levels, its doubtful it would be possible at all, and the costs would be astronomical. And because of substitution it would be pointless. Actually what killed UK coal was refusal to subsidize, not government action against mining.

I find the argument that Saudi oil production is peaking to be quite persuasive. Yes, we can get higher rates of extraction, yes we can extract shale oil. Yes, we can use fiber instead of copper for telecoms. Yes, we may be able to find new ore deposits. But I don’t believe that either for oil or copper this process of new discoveries can go on indefnitely, and I do think it will probably follow the Hubbert curve for any well explored area.

http://www.hubbertpeak.com/hubbert/1956/1956.pdf

In hindsight, it appears that Hubbert under-estimated the total global amount of available petroleum resources and the efficiency of the techniques for extracting them.

Mods – Please snip previous post – slip of the macro 🙂

[Done. -w.]

Adherents of the various “peak” production theories claim the fact that production actually decreases at some point validates their theory. I say the key distinction is whether we can’t produce any more, or simply that we don’t need to. We reached “peak whale oil” sometime in the 19th century and production has dropped to essentially zero today, but we still have lights and all our machinery is still lubricated.

michel:

In your post at January 12, 2014 at 4:05 am you write

Your words I have here quoted make two points.

Firstly, if “substitution takes place” then that removes any limits to needed extraction because the need is removed. I again suggest that you read my post in another thread which explains this and I linked above. Here is the link again

http://wattsupwiththat.com/2014/01/05/overpopulation-the-fallacy-behind-the-fallacy-of-global-warming/#comment-1526318

Secondly, I know for certain fact that your assertions concerning closure of the UK coal industry are very wrong (I was the Vice President of the British Association of Colliery Management). Discussion of that would be off-topic on this thread but I explained it on another WUWT thread. This link is to that explanation.

http://wattsupwiththat.com/2013/04/13/weekend-open-thread-6/#comment-1274534

Richard

If Kings forecast in 1956 was a peak of oil production 15 years later he was amazingly accurate, one of the best predictions I have seen on such a complex issue.

It held for over 40 years before the technological and political development had obsoleted the basis of analysis. I don’t call that being wrong, i call that being temporarily right on as scale I or most other (say IPCC?) should stride for and respect. 🙂

Considering that hydrogen is the most common stuff in the universe, and carbon is one of the top five, I shouldn’t wonder if the entire planet is laced with H and C being cooked together.

My concern is not the availability of hydrocarbon fuels, but the energy cost of extracting them. Seems to me there is a physical, entropic lower limit (unless you’re a New Ager and believe in “zero-point” energy, or energy “free” from “the void” or something) to how much energy must be spent in order to extract (and prepare) an energy source to be used. When it “costs” one barrel of oil (or the like) to extract a one-barrel-equivalent of energy to be used, there will be no point in even bothering no matter how much oil/gas/tar/whatever is there. Yeah, yeah, ingenuity comes up with a more efficient (needs less energy to implement) production method and we’re back in business, but there’s going to be a bottom limit to that — again, absent NewAge “zero point energy” fantasies, where “nothing in” yields “as-much-as-you-could-possibly-want out”.

My second concern is thermodynamic: all energy devolves ultimately into heat.

http://physics.ucsd.edu/do-the-math/2011/07/galactic-scale-energy/

Be careful what you wish for, hey?

Dancing on the head of a pin. Conventional, unconventional, tight, loose, renewable or not, Hilary Benn at the Bali Conference made the only honest statement a socialist MP has ever made that at our current rate of extraction of finite resources we need three planets and we only have one. The arguments are confused, not thought through by politicians or greens by deceit or design who knows but what is true is that at some point in time our planets precious finite resources will become extinct, fact. What is also true is that you cannot manufacture a replacement to fossil fuel without having access to finite resources metals, chemicals and fusion if possible the same is true. What we care to describe as economics is a euphemism for financial manipulation which if practised by banks means you would go to jail, semantics. To try and manufacture sufficient volumes of synthetic equivalents to fossil fuel would most likely consume whatever finite resources of metals and rare materials currently remaining. Now you could say I am a pessimist that technology will find and answer, sorry that argument might satisfy your concerns using the green argument what about our children and our childrens children but it does not resolve the absolute fact that you cannot make something out of nothing with nothing. As a planet we are in denial, the Earth is finite its like China wanting to become as powerful as America militarily speaking picking a fight with Japan over some rocks seemingly forgetting that if they supplant America they also lose their biggest customer and $17 trillion in the process which would sort of upset financial markets for just a moment. We like to think we really are quite bright but of course we have always live a fantasy existence and green BS just adds to the mix. Provided its about increasing air quality then we can consume huge quantities of finite resources as though they were not but burn fossil fuel to keep warm in winter and you are committing a crime against humanity. Who gives a flying f.. about Hubbert and his curve, when its gone its gone and unless there is some genius out there who genuinely magic oil from the wind and p… that Obama flogs to the planet on a daily basis then yes at some time the gave is up. Is what we are experiencing now extreme weather or just weather, its just weather, if you get hit by a flood you get hit by a flood get over it at least most are still around to complain, whinge and moan about the consequences of being alive. With about 7 billion left think if a few billion were to be consumed by a huge crack in a tectonic plate every bleeding heart hand wringing twit from Oxfam, FOE, Greenpeace, UN EU and LibDem crackpots would be on the BBC and CNN 24/7 weeping and moaning and asking stupid questions about “how do you feel about losing 50 million relatives” whilst out of the corner of their eye watching their ratings. It was and remains a fact that you have to live in whilst you are here but of course most don’t even those who have huge amounts of cash currently lent to every country on the planet to maintain each and every political system and bribe people with their own and inevitably someone elses money to maintain their green and the economy, they just want more cash. Warren Buffet is a classic example he has lived in the same house and drives the same car whilst having $50 billion plus, even refused to buy his own daughter a new kitchen wouldn’t even lend her the money but wants to give it all away when he dies so he can go home every night and count his gold and persuade himself that his pathetic little life has not been wasted. At some point in time planet earth will be consumed I just hope it waits until my existence is up but it will happen one way of the other the laws of physics will prevail they travel in one direct only from birth through life to death it is happening as I write, being green is just a road sign along with way to extinction, get over it.

just wait until i get my Flux capacitor is up and running, it will run on all house hold goods.

Most people think of oil and gas only as energy sources but they are much more than that. Yesterday’s Wall Street Journal had an interview with Jim Ratcliffe, chairman and CEO of Ineos Group Holdings …

Most people think of oil and gas as fuels, but to Ineos they’re “feedstocks” for making things. Ineos turns petrochemicals into plastics and related materials in massive plants known in the business as “crackers.” Cracking is the chemical process by which natural gas and crude oil are broken down into ethylene. From ethylene, Mr. Ratcliffe says, “you produce polyethylene, polyester, PVC—all the world’s biggest plastics,” which make up the stuff of modern life. Everything from soda bottles and fleece jackets to car bumpers and computer cases comes ultimately from the natural gas or oil that petroleum companies pull out of the ground.

Oil and gas and human ingenuity are fuels for jobs, economic growth and better lives. Unfortunately, the good news isn’t evenly distributed because some countries don’t think that fracking is a good thing.

Extractive industry curves, Gaussian curves, extraction costs are all irrelevant as David Middleton cogently points out. We won’t ever run out of oil, we’ll just run out of the need to burn it. Innovation trumps Cassandra repeatedly, and as Willis has pointed out, smooth curves suddenly get interesting.

Run out of the need to burn oil, in your dreams. Tell me how you feed 7 billion people with harvesting raw materials moving them across oceans even allowing greens to pose as the saviours of our planet whilst consuming vast quantities of kerosene in the process, you are in denial. Oil is 95% of everything we do from synthetic materials for Dreamliners – lighter weight supposedly to save burning fossil fuel. Even more disturbing is F1 saying its cars need to be more relevant so they become hybrid machines again forgetting the huge volumes of kerosene used to airfreight the cars, components and teams across the continents and oceans. Given two slices of bread we still seem unable to make a sandwich. Oil is not replaceable there is no other form of fuel which provides the portability necessary to find the raw materials we need to support our current civilisation unless of course reverting to the stone age is your solution.

Natural gas liquids are condensible higher molecular weight hydrocarbons. Economics dictates whether they are collected and sold or flared off.

Video of King Hubbard

Willis, I will not pick apart your words. However, I will comment as follows.

I have spent most of my career in the energy industry and my technical and fiscal initiatives have made major contributions to the North American economy.

Nobody that I know of predicted the huge drop in North American natural gas prices caused by shale fracking. Many thousands of financial commentators and industry analysts missed this “sea change” in our industry..

The same goes for the recent spike in North American oil production from oil shale fracking. Almost nobody predicted it would happen significantly before it actually did.

I regard King Hubbard as a true genius, and I do not use that description more than once every decade or so.

Hubbard was a practical man, and came up with a practical hypothesis:

“The Earth’s endowment of crude oil is finite, that the rate of oil production reaches a maximum (i.e., peaks) when approximately half of the original resource remains, and thereafter goes into irreversible decline.”

So, if you develop a new unforeseen technology that makes a previously untapped resource economic, then you just start another Hubbard’s curve.

Popular criticism of Hubbard is usually based on people extending his hypothesis beyond what he actually said.

Jakehig: “we know today – with almost 100% certainty – where to find three or four times more than the entire oil production to date.”

And if our energy use is increasing at a modest 2.3% per year (some sources say 2.9%, but let’s remain modest for now), then our energy use DOUBLES every 32 years. So that 3x-entire to-date production will last us 64 more years — one “entire to-date production” between 2014 and 2046, and two from 2046-2078 . If it is 2.9%, that knocks it back to 48 years.

Speed: “some countries don’t think that fracking is a good thing.”

Some people don’t believe any technology could ever be toxic; or, even if it is, that “toxic” is a bad thing. They’re like the guy who cooked me a marvelous gourmet meal — while managing to use and dirty every single utensil, spoon, fork, cup, bowl, knife, pot, pan, grill and flat surface in my kitchen. I got a lovely 1000 cal out of the meal and spent 2000 cal cleaning up so I could use my kitchen again, but it wasn’t his problem, was it?

“Shut up and drink your 4-methylcyclohexane methanol — at least you’ve got an electric light, you ingrate!” OK, that’s not fracking, but the fracking chemicals are not identified for proprietary reasons, yah?

Are the energy costs of cleaning up (including medical treatments) included in the “how much energy does it cost to obtain a barrel of usable energy” calculation, or do we just ignore those like my chef friend?

Corexit, the oil-cleanup chemical, attempts to destroy the oil. One simple oil-mining technique might be to use, say, straw to absorb the oil, sweep the straw into a facility, and recover the oil. Cheap AND nontoxic. Say what you like about human ingenuity, you’ll always have human stupidity working against you.

“Cheap energy is the salvation of the poor”

What a crock of shit, sorry but if you think oil companies are doing this for the poor or that the poor will benefit in some infinitesimal way I feel sorry for you as you’re deluding yourself, oil companies will sell to the highest bigger full stop, even if it mean shipping that oil overseas.

Secondly I’m sure that when Hubbert made his predictions he made clear it was a just a model, with assumptions, it does not include the spike in oil price, of course there are reserves out there, vast reserves but at what cost do you get them out! It use to be you stuck a pipe in the ground and out it came. That’s what’s made this resurgence possible – the oil price http://www.wtrg.com/oil_graphs/oilprice1947.gif not some great ingenuity of man

Without the spike none of what’s happening now would ave happened… and that’s why I’m so pessimistic about fossil fuels, what renewable will do in the near future is put a ceiling on energy pricing, the moment they start lowering energy, fossils will be in big trouble, renewable like wind and solar are now mostly cheaper than new coal and gas plants, in the future they will be much cheaper, would you still think expensive oil will be good for the poor then?

The curve in the Figure is also affected by the price of crude oil, which dictates the amount of oil production, the source of oil and the techniques used to recover it. Directional drilling and fracking were known technologies and oil shales and sands were known repositories. It wasn’t economical to recover that oil, other oil was easier and cheaper to get. In 1980 I was involved in a crash program to develop, produce and ship enhanced oil recovery chemicals. Within two years we pretty much went out of that business and assigned 3-4 dozen rail tank cars to other service. The price of crude oil dropped and economics ruled. Some of the drop in US production between the early ’80’s and the 2000 was due to crude oil price.

Willis, you said ” … in historical terms all modern oil production is “unconventional”” … totally agree. I have to wonder how the fracking bans are going given that ‘well servicing’ has been part of oil and gas extraction … forever. My bet is they are marginal areas and political expedience feeding ignorance is the order of the day there. The combination of a couple of old techniques done in a specific manner was an evolutionary process. It’s like the Cambrian in the Western Canadian Sedimentary Basin … suddenly old is new again and the relative success leads you to causal ‘short cuts’ and slogans, like ‘fracking’ … which has simply been part of drilling an oil or gas well where I live for decades. Another example would be the Bitumen deposits which with a couple of tweaks to pump technology can simply be pumped out of the ground … suddenly deposits with a low enough viscosity and no cap rock are accessible, should we call that ‘pumping’? … and make broad declarations on the subject?

“Once upon a time, Marion King Hubbert made a presentation to an oil industry gathering about ‘peak oil’…”

The key phrase is ‘once upon a time’!

At the time Marion King Hubbert made his presentation, he had the data, he had the calculations to back his prediction up. He shocked and woke up the oil industry! M King’s words were unwelcome and confrontational, at the time!

At that time, oil seekers sunk wells in potential fields; many were dry wells. The oil industry learned to listen to scientists of the geological, physics, electronics, etc… They’ve developed and purchased quite an array of search mechanisms; some of which are now being used for others minerals, (e.g. gold, diamonds). Science did not stand still, shake with fear and cry alarmingly for government to ‘do something, anything just so it’s expensive’.

Are the sources finite? Yes! Do we have a clue what finite means, definitively? No! Earth is a terrifically big ball of minerals. After that, then their are sources within our solar system. Can we mine these source today? No. But in twenty – thirty years, who knows what science will yield?

That is, so long as we humans find ways to keep science honest.

Great article Willis! Alarmist twists and turns when trying to invoke public fear are always best fought with honest knowledge presented concisely!

North Dakota is now producing 1.0 million barrels of oil per day from the horizontal, fracked wells in the Bakken oil shale. In the year 2000, ND only produced 87,000 barrels per day. The Bakken was know about in 1953 but thought to be inaccessible.

https://www.dmr.nd.gov/oilgas/stats/historicaloilprodstats.pdf

Meet the man who revolutionized oil and gas production around the world. Richard Findley, who decided to try horizontal drilling and fracking in a near-by related formation at Elm Coulee, Montana.

And this was just the year 2000. Although horizontal drilling and fracking has been done for decades, it was Findley who decided to try both together. The result is the reason for the fracking revolution.

http://www.petroleumnews.com/pntruncate/968299281.shtml

This new methodology is only 13 years old. Almost every single oil and gas field in the world will eventually get the same treatment. On my grandfather’s farm, there is 8 wells which have been producing heavy oil for more than 50 years (no, don’t have the mineral rights and 50 years is a long, long time). One of the wells was recently re-drilled horizontal and fracked. The oil company is planning to do the rest now and they just bumped up the surface rights lease payments without being required to do so.

mellyrn wrote, ” I got a lovely 1000 cal out of the meal and spent 2000 cal cleaning up so I could use my kitchen again, but it wasn’t his problem, was it?”

In the International System of Units, energy is measured in joules (J) or its multiples; the kilojoule (kJ) is most often used for food-related quantities. An older metric system unit of energy, still widely used in food-related contexts, is the calorie; more precisely, the “food calorie”, “large calorie” or kilocalorie (kcal or Cal), equal to 4.184 kilojoules. (It should not be confused with the “small calorie” (cal) that is often used in chemistry and physics, equal to 1/1000 of a food calorie.)

http://en.wikipedia.org/wiki/Food_energy

Using your numbers, it wasn’t his problem, your problem or anyone’s problem.

More here …

http://en.wikipedia.org/wiki/Calorie

This post is likely redundant at some level, but as a geosciensist and petroleum industry insider I feel compelled to add my 2 cents. First, as so many others have opined, Hubbert did his evaluation based on rates of new field discoveries and economic divers evaluated for that time period. Times change and this “prediction” has proven to be premature or even wrong. Many “predictions” suffer similar fates when the underlying factors change (see Matthaeus,Club of Rome, Al Gore, etc). Second, the terms “conventional” vs, “unconventional” are mostly geojargon; primarily used to distinguish petroleum hydrocarbon accumulations that fit a traditional oil field definitional, such as “pool”, “trap”, etc.(conventional) and opposed to continuous accumulations (unconventional), where no real “trap” contains the resource. Tight oil and natural gas (shale gas) as such unconventional resources, as is coal-bed methane, oil-shale (US Green River Formation) or even offshore gas- / methane-hydrates, for example. Essentially we are now manufacturing oil and gas reservoirs with improved technologies, as opposed to tapping a “pool” The media mostly do not understand these terms or the technological changes and often spread misinformation. Third, resource volume is always changing based on the economics. Gold, for instance is a relatively rare resource based on current value. But if economic were of no issue, the amount of gold extractable from seawater would make gold plentiful. The ‘real world”; however, is constrained by economics. If you pay more for the resource than you ever recover when compensated, you fail. The recent explosive growth in US natural gas and oil production is a reflection of economics. Geologists has long recognized these “tight” resources but the economics to produce them where not there.

BTW – The domestic O&G industry is responsible for 3% of current GDP (around $500 billion, if my math is correct). Due to new production, we have decreased oil imports approximately 10% and with continued domestic production growth, recent new opportunities with Mexico, and continued favorable oil trade with Canada, we may actually see US involvement in trading with OPEC countries (those unstable places that we waste money on) ending.

I’ll vouch for Allan MacRae’s contributions…our paths crossed some three+ decades ago when Alberta’s Oil Sands were much less of a sure thing. He helped us move forward.

What strikes me about this “Peak*.*” debate is that we can each take approximately the same facts and reach different conclusions from them. The limit seems to be more about the spirit of the observer than anything else. MKH’s analysis was both bold and correct within his limits, and he can be forgiven for not knowing what was beyond his limits.

“M. King Hubbert’s discovery was that production of “naturally flowing” oil (i.e., outflow of oil due to internal pressure) follows a Gaussian curve”

——————————————————————————————————————–

His theory was built upon nothing of the sort. It was an absurd hypothesis that drilling, and production (pumped or flowing) rates on the upside would be symmetrical to the decline on the downside, without any regard to the hundreds of technical, economic and geologic factors he was recklessly mixing together. I wrote on another board years ago that sustained high prices would warp his curves beyond recognition. I had no idea just how correct I was.

The only reason King’s ideas ever became so popular is that humans have some bizarre love of any doomsday crisis, hence we get the Club of Rome, Y2K, Peak Oil, AWG etc.

Miso says:

January 12, 2014 at 1:10 am

“…M. King Hubbert never stated that the oil production of the USA would reach its peak in the 1970s and thereafter decline. ”

—-l

Are you sure? He seems to clarify his views here – the following statement by Hubbert in 1974 seems pretty definite that petroleum production had reached its peak in the USA in the 1970’s:

From: http://www.resilience.org/stories/2007-02-27/hubbert-nature-growth

Testimony to Hearing on the National Energy Conservation Policy Act of 1974, hearings before the Subcommittee on the Environment of the committee on Interior and Insular Affairs House of Representatives. June 6, 1974.

” … What is most strikingly shown by these complete-cycle curves is the brevity of the period during which petroleum can serve as a major source of energy. The peak in the production rate for the United States has already occurred three years ago in 1970.The peak in the production rate for the world based upon the high estimate of 2100 billion barrels, will occur about the year 2000. ”

Notice the use of the word petroleum. He might have started out with conservative predictions about oil wells, but by 1974 he seemed quite comfortable with such a sweeping statement. Not that I feel his work was not useful, but his predictions seem to have taken on a Messaiah-like quality to many people, which I think is not a good thing. Perhaps Willis is doing something useful when pointing out the falsification of one of Hubbert’s predictions?

—-l

Unfortunately, M. King Hubbert’s name has become associated with predictions of global peak of oil production from all possible sources.

—-l

If you read the rest of his testimony, it does seem that he makes predictions in regard to the global peak of oil production. Perhaps you could clarify this seeming discrepancy between his statements and yours? If you feel that the above statements are not from an authoritative source, please supply one you consider better.

Of particular interest is the QA session:

” Mr. UDALL. Do you foresee, even with the best scenario, the most optimistic luck offshore, turning to oil shale, these kinds of things, do you think we will ever again exceed the rate of production, domestic production of oil from all sources that we had in 1970?

Dr. HUBBERT. I doubt it. The argument is made, wait until Alaska comes on stream, and all that. More than likely that will merely slow down the rate of decline. The amounts of oil that are postulated to be discovered off the Atlantic seaboard I am very, very dubious about. And so my best guess is, on the basis of the information at hand, that the peak of 1970 is the all time peak. And the other things that we would do would be merely to slowdown the rate of decline rather than to reverse it. I won’t say it is impossible to reverse it, but I am very dubious that we can. ”

You will note that he actively discounts the possibility of reversing the USA oil production trend, even considering resources such as oil shale. I think he answered the questions honestly and to the best of his capabilities, but in the final analysis I would say Willis is right: Hubbert’s opinion, that the USA will never again exceed the rate of domestic production of oil from all sources that it had in 1970, was not correct, as indicated by the top graph.

This does not detract from the useful work that he did for oil companies.

I see some of the Running Out!!!! Casandras are starting to fret. OK, you have shown you can put an exponential next to a linear growth curve and show the exponential grows faster. Now you ought to take a look at the real world.

In the real world, resource demand does not grow exponentially. It grows in an S curve. In the real world, population does not grow exponentially (or even linearly…); populations grow in an S shaped curve too.

Now the start of an S shaped curve can LOOK like an exponential, so it’s understandable that you get mislead; but do look further.

Now, resourseS are NOT LIMITED. Any given resource can have a limit (such as easily mined copper) but the total resource pool constantly changes. New things become resources, old things stop being resources. It’s all very dynamic. What is a resource, and how much of it we “have”, is a direct function of price. As easily mined, harvested, or manufactured resources rise in price, we find more and better ways to make it and, presto! There is more economic resource created. So, for example, the price of oil rose and TRILLIONS of barrels of “oil” became available. It was always there, only it turned from a non-resource into a resource. (There is actually a pedantic difference between a resource, a reserve, a … but since nobody but a few Engineers and Economists seems to care, I’m skipping over that. In this usage “resource” is being used to mean ‘economically recoverable’ or ‘reserve’ as most common use is that way.)

One simple and one complicated example:

Copper. When we have “used up” all the copper, where did it go? It didn’t leave the planet unless we put it on a rocket. The simple fact is that the copper didn’t leave the planet. It is all still here. That copper can be used until the end of the planet. As often and as long as we like. The ore being used today was NOT a resource in the past. Over time, we find ever better ways to get copper out of ever more dilute source at an economic return. Heck, as of now, we can get more energy from a ton of granite than from a ton of coal. (U vs C) We don’t do it because the coal is cheaper to mine; not because the Uranium is unavailable to us.

Hydrocarbon: Above we have the usual EROEI argument, but hiding without the name of it used. This ignores the point that petroleum products are the desired result. It does not matter if we “waste” energy creating them. The EROEI of an oil refinery is negative. LESS energy comes out in the products than went in as crude.

We simply do not care that the “Energy return on energy invested” is negative. Similarly, oil in California is pumped with electric motors in many cases. Until recently, they used a lot of nuclear to make that power. Now it is in ever larger amount based on hydro, solar, wind, etc. etc. So that gasoline and oil product I buy has an ever larger component of solar and wind in it. Do I care? Nope. I would be quite happy to have a negative EROEI as long as the gasoline is cheap enough as a product to give me the transportation service I desire.

In fact, we could look at the carbon and hydrogen from those hydrocarbons and realize that they don’t “go away” either. They get recombined into new HC compounds by plants. The whole biofuel industry is an existence proof that the H and C didn’t go away.

So we can re-create those petroleum products by any of several means whenever the prices justify it. Biofuels can be run through zeolite catalysts and turned into real gasoline. We do not need to re-make all our cars to use methanol or ethanol; nor do we need to put up with sputtery engines and fuels that are more corrosive than hydrocarbons. We can take coal, or tar sands or oil shale or natural gas or land fill trash and turn it into gasoline, diesel, jet fuel, plastics, “whatever”. ALL that technology exists today and much of it is in use, or has been in use at some time in the past. It is just a question of what is cheapest and most reasonable to do at this time.

Now this inevitably causes the Energy Casandra’s to start moaning about “running out” of energy and limited energy supply. There is no limit on energy supply unless we choose to put one in place politically. Yes, that’s a big statement. It is also true.

Nuclear power is functionally unlimited. Doesn’t matter if you are talking Uranium or Thorium. (I’m fond of Thorium, but it doesn’t need whole new reactor designs to work. Like the MSR. It can be put into CANDU reactors today – and has been.) The limit case is using up all the relatively cheap land based Uranium Ore. What happens then? Well, remember that granite? The world has a lot of it. It erodes. The U washes into the oceans (as does Th). Some clever Japanese have figured out a way to extract it using plastic mats. It is HIGHLY positive on energy gain, and only slightly uneconomical at present due to very low yellowcake prices. Let the U ore rise just a bit, total “Uranium Resources” become infinite for all practical purposes. ( More U erodes into the ocean each year than would need to be extracted each year to power the entire planet).

Now realize I am NOT advocating for a Uranium driven total energy system. (I think a free market driven one is better with a lot of supply diversity). I AM pointing out that functionally infinite energy is available at about present retail electricity prices for much of the world. With that, we can make all the “fresh water” we want, all the gasoline and Diesel fuel we want (even if from trash as is presently being done near Los Angeles), all the plastics we want, and with that make all the greenhouses we want to have food for another 20 Billion people.

The fantasy of “running out” and “overpopulation” is just that. It is an unfounded fear.

http://chiefio.wordpress.com/2009/05/29/ulum-ultra-large-uranium-miner-ship/

http://chiefio.wordpress.com/2009/05/08/there-is-no-shortage-of-stuff/

http://chiefio.wordpress.com/2009/03/20/there-is-no-energy-shortage/

Now, per King… I’ve read his stuff. He very clearly stated that the advance of future technologies was an unknown and that the curve would need changing over the years as tech developed. Even made a couple of suggestions about how the predictive method might be changed. He also clearly understood that if we ever found a way to extract shale oil that would be a new “field” and start a new curve. It is a bit wrong to paint HIM with the brush of “being wrong”. It is the folks who seized on his work about predicting production curves and warped it into a “running out” scare, and promoted it as a proof of “limited resources” that were wrong; and they DO deserve the ridicule. That comes close to happening in pointing out that I really don’t care if my gasoline comes from conventional or unconventional or even synthetic oil.

But though I would defend the man as not deserving of the attack, the attack on Peak Oil as commonly pushed is well justified.

In essence: We will never run out of “stuff” or of “energy” or energy products as long as Engineers are allowed to work and politicians are kept in check. If you would like a decent life, reward the Engineers and tell the politicians to shut up and sit down. Like your modern conveniences and cushy life? Kiss an Engineer…

In terms of “cheap” oil, oil $$ over the next few years will be more a product of the types and quantity of autos people in China and India buy. That is, the demand will prob’ly still outstrip demand, and our fracking oil will as expensive as ever.

In terms of the US fracking spike, I look at it sort of as licking the bowl after making a cake…and we have a lot of used bowls at the moment. The real question is how quickly will the fracking peak fall?

Willis Eschenbach, E.M Smith and Richard Courtney, bravo.

cd says:

January 12, 2014 at 2:30 am

“…given current technologies and known resources…”

==============

when predicting the future, technology is not longer current, it is future technology and resources are no longer known resources, they are unknown resources. thus both givens are inherently false when talking about the future.

Your chart is nonsense and not backed by the eia… the current oil production is about 2/3rd’s of it’s peak in the 1970’s. compare to the actual chart oil production. http://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=pet&s=mcrfpus1&f=a

To the layman rationale behind Hubbard’s peak oil prediction will be difficult to discuss, but suffice to say that Hubbards model was limited to existing petroleum basins of the lower 48 states with existing recovery costs and technology. In short, in a virgin basin the bigger oil fields are found first because they are bigger and easier to find (Duh!). Once these fields are fully developed and begin to decline then the smaller fields will be unable to produce enough to offset the declining production production rate from the large fields.Adding in a new basin, Prudoe Bay, does not change this analysis as Hubbard’s study was limited to the lower 48 states onshore production.

The advent of the “shale oil” is like adding a virgin basin to the curve and is therefore not applicable to refute Hubbard’s analysis. However the Hubbard analysis is applicable to the “New” basin discovered by the application of combining old technology-directional drilling and hydraulic fracturing. I refrain from calling it “fracking” as this term is not industry standard and is used by the greens because it starts with “F” and ends in “K” implying another verb. If one observes the production trends of the shale wells then the Hubbard analysis will shortly become not only true but accelerated, because of the rapid decline rate that the “shale” wells exhibit. Although not due to large discoveries being replaced by smaller discoveries the rapid decline rates will reach a point at which continued drilling will only be able to maintain the increase in production and it will no longer continue to increase at the current pace, unless there is an increase in well completions equal to the total number of accumulated producing wells . Since the “shale wells” have 80-90% first year decline decline( 1000 bopd=100 to 200 bopd in 12 months), then to sustain production they must all be replaced every year. As is currently occurring the replacement of the “old” wells with new wells has continued such that we are actually drilling more wells that currently exist. As the number of old wells adds up and exceeds the capacity to 100% replace (i.e. it is possible to drill 1000 wells per year, but not possible to drill 10,000 wells per year) then the rapid rise in production will cease and at best flatten out and begin a decline. The result will be an accelerated Hubbard projection, since conventional reservoirs did not decline at the extremely high rates experienced by shale wells. Since the projects are also expensive an oil price drop causing the drilling to stop will result in a rapid production decrease as rapidly as it increased.

Here’s the most interesting oil story I’ve seen lately:

http://bravenewclimate.com/2013/01/16/zero-emission-synfuel-from-seawater/

http://defensetech.org/2012/10/02/converting-sea-water-to-navy-jet-fuel/

Willis, you confound the conventional/unconventional oil definitions. Conventional oil of all grades (light, heavy, sweet, sour) is extracted from a reservoir where it pooled after formation, but where it did not form. Unconventional oil is one of two things: bitumen (Athabascan tar sands) which is not any longer oil but can be upgraded back into syncrude via hydro treating, Or oil from source rock (I.e. shale). Source rock has much less permeability and porosity than reservoir rock. After EOR, the average OIP technically recoverable from conventional reservoirs is 24% (IHS survey of 11,000 fields to 34% (IEA survey of 800 largest fields). The present average TRR for all five producing US tight oil shale fields is 3.5% with best practices fracking. Geophysics.

The newest 2013 EIA estimate of total US tight shale oil TRR is 24-29bbbl, which less than half of the remaining 1P reserves of the Ghawar field alone. That estimate overstates anything remotely resembling 3P for US tight oil by about half, since it includes 15bBbbl for California’s Monterey shale ( the source rock for most Califonia oil fields). That is because the Montereynis folded and faulted, so horizontal drilling is not possible.

And, if you read further into the newest EIA estimates for US crude production by type, you will see that tight oil is projected to peak between 2017 and 2020, with a steep falloff thereafter because of the steep decline curves to such wells (the Bakken is presently 85-90% decline in 3 years to stripper status).

Your EIA chart is correct for the moment, but says nothing about either global or US long tern annual production of crude from all sources. Most authorities including BP expect peak,global production between 2020 and 2030; there is debate about the rate of ensuing decline. Right now global conventional existing fields have peaked, and are declining at a rate of 6.7% pa. The balance is being made up by new deep water (Brazil’s Campos basin), Athabasca tar sands, and US fracked shale. But just to offset the existing conventional decline, new economically producible reserves equivalent to 4 Saudi Arabia’s (9.6 mbpd) need to be found and put into production by 2030. There are three ways ( best is the hyperbolic creaming curve) to show that will not be possible. And that reeplacement reserve ignores future growth in demand from BRICs, especially China.

When you dig into CERES data looking for tropical cloud thermoregulation, you do magnificent work. Taking a short term US projection and extrapolating tothe world without the above context is not so good work. Sort of like confusing weather with climate. You seem to fall into some of the same fact error traps that Maugeri did in his grossly erroneous report from Harvard last year. You can read a detailed critique posted over at Climate Etc. Also an exhaustive analysis of what the 2008 IEA survey and subsequent annual outlooks actually said when you strip away all the subsequent PC stuff they did for damage control–Peak global production about 2020.

Regards

negrum says:

January 12, 2014 at 8:07 am

This does not detract from the useful work that he did for oil companies.

=============

His Peak Oil prediction certainly helped boost oil prices, by creating an expectation of ever increasing oil prices. As we have seen, this has made the oil market a target for speculation. Buy oil today and sit on it. Tomorrow it will be worth more.

Doug says:

January 12, 2014 at 7:55 am

humans have some bizarre love of any doomsday crisis

============

faced with the certain knowledge of our own mortality, we’d like to believe things will all go to hell once we are gone, so we can be sure we won’t be missing out on anything.

“Cheap energy is the salvation of the poor”

What a crock of shit, sorry but if you think oil companies are doing this for the poor or that the poor will benefit in some infinitesimal way I feel sorry for you as you’re deluding yourself, oil companies will sell to the highest bigger full stop, even if it mean shipping that oil overseas.

Regulated price of gasoline for almost 40 years was 22 cents per gallon.

That (compared to when it started) would be $4.50 a gallon now.

When I built Habitat houses in the 90’s, most of the people moving into them were living in a much higher standard (A/C, Automatic Dishwashers, Cable TV, Unlimited L.D. Calling, Water, plumbing, sewage…) than my Grandparents did, and (mostly) my Parents.

And the reason for that: CHEAP ENERGY… now I have to get personal…Have you ever built, designed, fielded ANYTHING like what BP did to “plug the hole”? Could you? (Hint: I have worked on such projects and equipment.) DO YOU KNOW what the % of income BP makes that is profit?

Are you aware that NBC, CBS and ABC tend to make DOUBLE that percentage on their yearly income? STOP BASHING THE OIL COMPANIES and get into reality. (Hard to do, without thinking, reading…and getting away from “popular” culture.)

Oh, sorry to ramble: But I forgot to include, those EEEEEEvil GE’s and Westinghouses…brought the price of electricity down from $1.70 per KWHr in 1926 (I used to have a KC Power and Light bill from that time, about $0.13 per KWHr, look up the CPI)…to 10 cents per KWHr now. Fracking and CH4 will keep it that way for my life.

CHEAP ENERGY IS THE SALVATION OF THE POOR! Preach it Brother!

Willis,

I feel your initial graph is misleading. Although the graph title does clearly state that this is projected to 2015, you don’t really discuss this fact & after reading most of the comments, I don’t think hardly anyone recognizes that we have CURRENTLY NOT exceeded the initial peak. I won’t dispute that we probably will -BUT – this is a bit misleading.

Here’s the link to the most current EIA data for annual production (through 2012) & a graph :

http://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=pet&s=mcrfpus1&f=a

In 2012, we were at 2.37 Billion barrels per year vs a peak of 3.52 Billion barrels per year – still 33% below the peak.

To put that in perspective : 3.52 billion barrels per year is ~ 9.6 million barrels per day. 2.37 Billion barrels per year is ~ 6.5 million barrels per day. Now, the shale plays have had huge production growth since 2012. So what does production look like right now ? Here’s the link you need :

http://www.eia.gov/petroleum/supply/weekly/pdf/table1.pdf

If you look on line 1 of Petroleum supply, you will see that the average for the last 4 weeks is ~ 8.1 million barrels per day – a substantial increase from 2012 but still less than the peak of ~ 9.6 million barrels per day ( 16% less). You will also note that the annual increase (also from line 1) is just over 16% – so at the current rate of increase , we should be close to having production exceeding the 1970 peak in about 1 year, all else being equal.

I bring all this up not to dispute your point but in the spirit of full disclosure, which is the root of a good scientific discussion (which we don’t see from alarmists in general)

ATheoK says:

January 12, 2014 at 6:06 am

Are the sources finite? Yes! Do we have a clue what finite means, definitively? No!

=======

spot on.

All that is required to convert CO2 and H2O into hydrocarbons is energy and a favorable environment. Plants have been doing it for quite a long time using solar energy. It is certainly possible that the earth itself creates methane and more complex hydrocarbons on a massive scale, as a result of plate techtonics, recycling limestone and water deep within the earth, using heat and iron from the core.

or are we to believe that all the methane and hydrocarbon we see in on earth and in the universe is a result of decayed dinosaurs?

michel says:

January 12, 2014 at 12:52 am

You are right that it’s not that simple. The reality is that the oil extraction technology changed dramatically, even during Hubbard’s time. So your claim, that his prediction was for a “given type of extractive industry”, is falsified on the face of it by simple history. Hubbert knew that the technology was changing. But he, like many others, vastly underestimated the ingenuity of human beings, and the magnitude of the changes that the technology would bring.

More to the point is that Hubbert’s many followers thought that the “Hubbert curve” written in stone and was independent of technology. As a result, they’ve had to resort to dodges like the claim that some oil is “unconventional” … and at present they are an endangered species.

All the best,

w.

cd says:

January 12, 2014 at 2:30 am

If that is indeed the case about Hubbert’s predictions, then he was wrong about 1970s. Why? Because by the 1970’s nobody was using the 1956 “old school” technonogies.

Nor were the “known resources” the same in in 1956 and 1970.

As a result, if we assume your premise that Hubbard was talking about when we’d run out of oil using 1956 technology … we’ll never know, will we?

Hubbard knew the technology was changing, cd. Your assumption that he didn’t know that paints him as an idiot.

w.

David Wells says:

January 12, 2014 at 4:48 am

You appear to be stuck in a time warp, David, because that claim was made obsolete by Simon’s wager decades ago. If you’re not aware of it, look it up. People like dear Hilary have been predicting doom and disaster from resource lack since forever, and guess what?

Here we still are!

So next time someone unrolls a doomsday scenario for you, David, ask yourself … “If that’s the case, why are raw materials still so cheap?

w.

PS—Most of these bogus “three earths are needed” claims are based on the laughable work of Mathis Wackernagel, with his so-called “ecological footprint”. He’s caused more damage with that BS than most people I know. See here for more.

I think it is unfortunate that Hubbert has been so inextricably linked with Peak Oil alarmists. Back in the day, as a geology major, we learned Hubbert’s theory. It was never presented as anything alarming. It presented as a scientific tool for geoscientists to analyze reserves. I fully believe that was Hubbert intent, based on my studies.

And it works well on different scales, given the proper assumptions. And it is based on the physics & fluid dynamics of hydrocarbon production. You can analyze individual wells, individual fields, individual basins, countries or the world. Now the underlying assumption always was & still is constant technology (which in turn could also be stated as recoverable resource). If you change technology or technically recoverable resource, you have violated the key assumption of the theory and it is inappropriate to apply the theory.

Of course, when you are dealing on a small scale, such as an individual well, it is easy to understand if the assumption is good or not. The larger the scale (such as countries or the world) , the more likely the assumption will be violated. That’s all we are seeing with the current rise in production – technology has improved & recoverable resources have increased.

As with past technology, we will see some peak in the future with this new production from shale (due to physics / fluid dynamics & economics) and, as David Middleton states above, this will happen again and again with other new technologically / economically recoverable resources until other fuels are more economic. My favorite quote is we didn’t leave the stone age because we ran out of stone. Similarly, we won’t run out of oil – other sources of fuel will become economic far before then. So, no need for alarm.

Through popular culture, the constant technology / recoverable resource assumption has been lost & Hubbert has morphed into an alarmist Peak Oil theory (because they forgot the assumption along the way). I feel sorry for Hubbert’s legacy as he was a scientist , not an alarmist. Unfortunately, this article further cement’s the image of Hubbert as an alarmist in the public’s mind.

At the top W provides a chart with current and projected oil production figures.

At 8:30 am S provides a (link) chart with “current” field production numbers that is identical out to the red vertical line of the former. Then S says “Your chart is nonsense and not backed by the eia…

Uff da ! [Okay, graphing and units are not the same. Still . . .]

Allan M.R. MacRae says:

January 12, 2014 at 5:24 am

If you think that King Hubbert is a genius as you claim, and you want to convince us that your are as knowledgeable about the oil industry as you claim, you might start by learning to spell his name …

In any case, your claim is that much less than half the original US oil resource remains? Because that’s what Hubbert said. He said US peak oil would occur in 1976, when according to him, half the resource remained … sorry, didn’t happen.