Guest Post by Willis Eschenbach

Inspired (as I often am) by either the insights or the foolishness of a guest post at Judith Curry’s always-provocative blog, I decided to take a look at the relationship between fuel price and miles driven. My inspiration came from my amusement at the guest author’s use of the following graph to establish a relationship between fuel cost and how much people use their cars. I think a relationship exists, but the graph used by the author doesn’t show it. Figure 1 shows that graph:

Figure 1. Per capita fuel use, compared to the fuel price, for the OECD countries. SOURCE

Figure 1. Per capita fuel use, compared to the fuel price, for the OECD countries. SOURCE

Now, it certainly looks like there’s a clear relationship there, but that’s an illusion. My objection to the graph was, the countries divide into two groups. On the bottom right you have the European OECD countries, plus Japan. Plus one fish.

On the top left, you have the US, Australia, Canada, and New Zealand. What’s not to like?

Well, ignoring fuel price for the moment, who would you think would drive more miles—a citizen of the US, or a citizen of Japan? An Aussie, or a Belgian? A Canadian, or an Italian? So all the guest author has shown in that graph is that the folks in large countries, with miles and miles between cities, drive more than Europeans and Japanese.

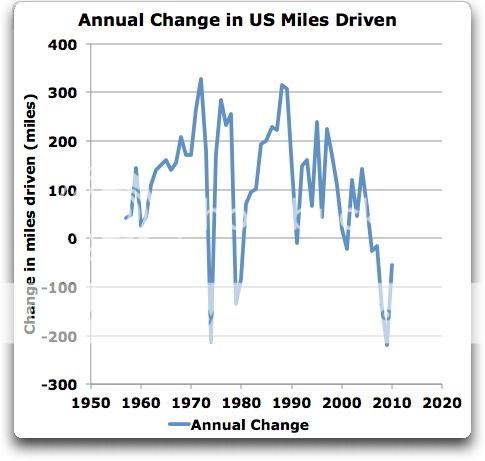

But of course, I couldn’t leave it there, so I linked to the following lovely graph of automobile use in the US that I ran across during my research. It shows, year by year since 1956, how many miles Americans have driven, and what the gas price was during that year.

Figure 2. Miles driven compared to the fuel price. Click to embiggen. SOURCE

Figure 2. Miles driven compared to the fuel price. Click to embiggen. SOURCE

Now that shows some very interesting patterns. The main oddity I noticed is that there is what might be termed a price shock effect—in the year of a big jump in prices, for example 1974, the mileage driven drops compared to the previous year. But then look what happens from 1974 to 1978 … the price stays stable, but the number of miles driven each year goes up steadily, without reversal.

But of course, I couldn’t leave it there. I digitized the data, to see what kind of relationships I could understand and reveal through further analysis. And as usual, I was surprised by what I found.

First, taking the data as it is given, there is no statistically significant relationship between the two variables, pump price and miles driven. The R2 is only 0.03. (“R2” is a measure of the relationship between two datasets, where an R2 of 1.0 indicates a perfectly linear relationship between the two, and an R2 of 0.00 indicates no relationship. So an R2 of 0.03 is … well … pathetic. So as far as a direct relationship between prices and miles driven, not happening.

Once I saw that, I wondered, well, what if I include a temporal trend in the linear regression? The way that I usually do that is simply to include the date as a variable. And to my surprise, the R2 went from 0.03 up to 0.98 … Figure 3 shows an emulation (multiple linear regression result) of the number of miles that Americans drive, versus the value estimated based on year and pump price.

Figure 3. The emulation is a multiple linear regression, using the year and the pump price as independent variables, and the actual average miles driven by Americans as the dependent variable. R2 = 0.98

Figure 3. The emulation is a multiple linear regression, using the year and the pump price as independent variables, and the actual average miles driven by Americans as the dependent variable. R2 = 0.98

Dang, sez I … that’s pretty impressive.

But of course, I couldn’t leave it there. A fixed annual increment, a simple trend like I used, is just a way to understand the data. It’s not an explanation involving some plausible mechanism. And more to the point, I also didn’t like those two years up at the top right of Figure 3, which are 2009 and 2010. In those years, Americans drove about a thousand miles less than expected. So I though about why that might be, and even a bear of little brain would go “global financial meltdown, duh”. And that made sense overall as well, because how far I drive doesn’t just depend on the pump price. It also depends in part on how much money I have in my jeans. When I’m flush I drive more, and when times get hard, I drive less regardless of the price of gas.

So I thought that instead of using the year, I’d try using the per-capita GDP as the second independent variable. Figure 4 shows those results.

Figure 4. The emulation is a multiple linear regression, using the real per capita GDP and the pump price as independent variables, and the actual average miles driven by Americans as the dependent variable. R^2 = 0.98 GDP SOURCE

Figure 4. The emulation is a multiple linear regression, using the real per capita GDP and the pump price as independent variables, and the actual average miles driven by Americans as the dependent variable. R^2 = 0.98 GDP SOURCE

Yowzah! Now that’s what I call shaving with Occam’s razor. It turns out that pump price and per capita GDP do an excellent job of estimating the number of miles driven, with very little error.

So, what does the magic equation that gives us the excellent results shown in Figure 4 say about the relationship between miles driven on the one hand, and gas price and per capita GDP on the other?

Well, it says that for every twenty-five-cent increase in the pump price of gas, Americans drive about a hundred miles less. Gas price goes up, miles driven go down. Makes sense.

And it says that for every $430 increase in per capita GDP, Americans drive about a hundred miles more. Wealth goes up, miles driven goes up. Also makes sense.

Now, the “carbon taxes” I’ve seen discussed are on the order of $20-$30 per tonne of CO2. And by coincidence, $28 per tonne of CO2 emitted is equal to twenty-five cents per gallon of gasoline. So if a $28/tonne carbon tax is imposed on gasoline, how much less might Americans drive?

Well … a hundred miles less … wow, such a stupendous gain, be still, my beating heart …

And how much actual change in our driving habits is a hundred miles less per year?

Well … since Americans drive about 10,000 miles per year, it’s a gigantic, massive reduction in miles driven of one percent.

And that, dear friends, is all the bang you get for your twenty-five-cent per gallon carbon based energy tax. A one percent reduction in miles driven. One freaking percent, and they want to impoverish the poor for that? Grrrr ….

So … what does this mean for the debate on carbon-based energy taxes?

First, it means that in the American situation, there is no way that the benefits of energy taxes are worth the cost. Why? Because the effect of a typical CO2-based energy tax on miles driven is minuscule, only a 1% reduction for a $28 per tonne of CO2 energy tax.

Next, a very slight increase in per capita GDP will nullify the energy tax entirely. Also by coincidence, it turns out that if the current per capita GDP goes up by about 1% (~$430), that will increase the mileage driven by 100 miles … so a 1% increase in per capita GDP will completely nullify a $28 per tonne of CO2 energy tax. And the GDP goes up by one percent all the time …

Next, it means that in order to have more than a one-year effect, the tax will have to continually rise.

The problem with a carbon based energy tax can be seen by thinking back to Figure 2, where I noted the “shock effect”, and how after the slight reduction in miles driven as a result of the 1974 big jump in pump price, after that one-year reduction the miles driven went right back to increasing year after year, with no change in the gas price.

So a one-time jump in the price will make little difference, just a one-year reduction in the miles driven. But by the next year or two, assuming that the per-capita GDP continues to rise as it has in the past, the miles driven will be rising again.

Next, it means that a carbon-based gasoline tax is wildly regressive. To see why, let me start with a slight digression, by bringing in a concept from accounting, that of “fixed”, “variable”, and “semi-variable” costs.

Fixed costs are those costs you can’t do anything about. The amounts are fixed, you can’t reduce them, you just have to pay them.. Maybe rent. Taxes.

Variable costs are costs that are entirely optional. Think maybe eating at restaurants. You don’t have to spend a penny on that if you don’t want to.

Semi-variable costs are costs that you can change, but you can’t eliminate entirely. These would be things like food costs. You can run them up or down, but you can’t eliminate them.

Now, think about the corresponding concepts as applied to the subject at hand—fixed, variable, and semi-variable miles driven.

Fixed miles are things like a commute to work. Short of changing your job or your residence, you can’t change that. You just rack up those miles every year.

Variable miles are things on the order of visiting Grandma in Arizona. You love to do it, but you don’t have to go.

Semi-variable miles are things like going to the post office to get your mail. You can cut the trips down, but not to zero.

What this graph shows me is that any energy tax on gasoline will hit the hardest on the poorest, the people who mostly use their car to get to work. The problem is not just that more of the wages of the poor go to energy, although that is also a problem.

But in addition to the higher percentage of their wages going to energy, the majority of their miles are fixed miles, so they can’t cut back on them. They have to drive them, so they have to pay the tax.

For the wealthy, on the other hand, lots of their miles driven are variable or semi-variable, so they can just scale down a bit. The energy tax means nothing to them. But for the poor, it can be a budget-buster.

This is one of the many reason why energy taxes are so regressive—because for the poor, fixed costs for everything squeeze them all the time, not just fixed fuel costs but also the other bills they have to pay every month. So when energy prices go up, Al Gore and James Hansen just cut back on visiting the grandchildren they love to talk about, no problem for them.

But the single mom whose gas budget barely covers getting to work, she can’t cut back on her gas use, it’s already cut to the bone. So when she pays the energy tax, she is forced to cut back on something for either the kids or herself.

And all of that for a pathetic 1% reduction in miles driven. That’s criminal.

Now please, folks, don’t insult my intelligence by claiming that it’s OK to harm the poor because of that well-worn fantasy, the fabulous claim that wealth redistribution will make it all OK. It won’t. Anyone who believes it will make it all OK has not spent enough time around government programs.

To start with, even the best-intentioned programs only reach a percentage of those most affected. Next, the poorer that people are, the less likely they are to hear about such programs. Think people living in apartments versus people living in their cars. Next, the paperwork required is all too often complex, confusing, and intrusive. Next, many of the poorest people are mistrustful of government. Also, immigrants are often equally fearful of government, and many don’t speak the language. Next, the people who end up getting the most benefits are often not those who suffered the most losses. Next, administering such a program requires a large expensive workforce of bureaucrats and paper pushers to make it function. And of course, they’re all Union, can’t be fired, plus we’ll be stuck paying these pluted bloatocrats their megabucks in retirement money ’til they shuffle off to a warmer place … and I’m not thinking Florida. Next, as with any government program, waste will consume more than you imagine. Think IRS conferences in Las Vegas and thousand dollar hammers. Next, parasitic rent-seekers like lawyers and consultants will be circling the honey-pot and making off with some of that good honey. And finally, there’s never been a government program that people didn’t scam, game, and cheat, so somewhere between a little and a lot of money will simply be stolen.

So no, wealth distribution will only make things worse, or on the best day with a following wind it might “break even” by taking from one bunch of the poor and giving to another bunch … and meanwhile the people at the bottom of the economic pile are hit the hardest. And whether you are a conservative or a liberal, that should appall you.

And finally … we’re going to create all that pain and create a giant bureaucracy and waste piles of money for a crappy 1% reduction in miles driven, a temporary reduction that will be wiped out by the next 1% increase in per capita GDP?

Really? That’s the brilliant plan? Screw the poor and the economy for a 1% reduction in miles driven?

Spare me. That’s more than foolish, that’s a crime against the indigent and everyone else in the country. Almost any other conceivable response to the imagined horrors of CO2 would be preferable. Taxes on energy are destructive and damaging to individuals, to businesses, to the environment, to the economy, and more than anything to the poor, and to turn it from mindless idiocy to criminal tragedy, there is nothing to show for it at the end of the day but a temporary 1% reduction in miles driven—from an energy tax, there’s no lasting gain, only lasting pain.

w.

DATA: The spreadsheet with the data and graphs is here.

[UPDATE] I just wondered, how much will the $28 per tonne of CO2 gasoline tax cost per year? Average fuel economy of the US fleet, cars and trucks, is about twenty mpg. Average person drives ten thousand miles, at twenty mpg that’s five hundred gallons. The tax at twenty-five cents per gallon on five hundred gallons is $125 per year.

In response to that tax, we can expect people to cut fuel use by 1%, or 5 gallons per year. Gas is around four bucks a gallon, so that’s $20 worth.

So the plan is to charge the average driver $125 per year in gas tax, and in response to that he’ll use $20 less gas, reducing his bill at the pump from $2,000 per year to $1,980 per year and cutting his CO2 emissions by a whacking great 1% … who thinks these plans up, and how can we catch them and stop them?

[UPDATE 2] I also got to wondering, just how much CO2 would a $28 per tonne of CO2 applied to gasoline consumption actually save? There’s 8.9 kg (19.6 pounds) of CO2 in a gallon of gasoline. Crazy but true, it’s the extra weight of the oxygen. So we’d be saving one whole percent of that, or .089 kg per gallon. Multiply that by the number of gallons of gasoline burned in the US, about 134E+9 gallons, and we end up with 0.01 gigatonnes (billion metric tonnes, E+9 tonnes) of CO2 saved.

And compared to a hundredth of a gigatonne, how large are the global CO2 emissions? Well, it’s about 9 gigatonnes of carbon C emitted per year, so as CO2 the mass is (16 + 16 + 12) / 12 of that to allow for the extra weight of the oxygen, or 33 gigatonnes of CO2 per year.

And the $28 carbon based energy tax would reduce that by 0.01 gigatonnes of CO2, which is a reduction of three hundredths of one percent (0.03%) … folks, have we truly gone so mad that such a trivial gain, three hundredth of one percent reduction in CO2 emissions, so small as to be absolutely unmeasurable, is used to justify this crazy tax?

100% correct. Most Europeans have no concept of how big North America is. I live 45 km from the nearest town, 110 km from the nearest city and 200 km from a city over 100,000 people where major health care exists. I have to drive anywhere from 45 to 200 km for farm equipment parts depending on what I need or have it couriered. Fuel price is just a cost of doing business, or the cost of my horse and skiing addictions so I adjust other “discretionary” expenses to cover my “fuel” costs regardless of the ridiculous amount of “road taxes” we pay. I do, however, avoid travelling in BC as much as possible due to their incredulously higher road taxes. – Hurtin’ Albertan 😏

Good analysis Willis, but you’re missing one thing. Feedback.

1% is first step response. But as the $25 / tn starts to impact the rest of the ecomony, GDP goes down, then mileage goes down again. And it’s not just mileage. People buy less of everything, less GDP, less mileage.

So as carbon tax strangles the life out of an ailing ecomony the “benefits” will be far greater than 1%.

😉

How much of the energy tax will be used up in paying the salaries and expenses of the extra people needed to administer the scheme?

My bet would be “most of it.”

Greg says:

July 10, 2013 at 12:23 am

Thanks, Greg, and that’s true, but for an introduction to price elasticity, it’s too much information.

Remember, I need to not only write this. I have to defend it against all attacks as well. And since I have no figures on the economic slowdown from a carbon-based fuel tax, it becomes speculation. I prefer to stick to things I have actual measurements of, much easier to defend.

w.

Socialist Norway tax the use of cars heavy:

1. About 100% more expensive to buy than in Germany.

2. Fuel prices 2,30 USD a LITER.

3. And a yearly tax of about 500 USD

4. Toll roads are about 1,50 – 3.00 USD per 10 km and pop up everywhere

http://www.nettavisen.no/motor/article3468801.ece

It feels as if the car is public enemy number one?

Well analysed and well said.

Demonstrably true.

Another factor hurting the poor is that rich people drive newer cars and gas is a smaller percentage of their mobility expense. So all they have to do is delay a new car purchase by a few months! Low income people driving 20 year old cars have less money to save by this option. (Average car age in USA is 10 years.)

The greenies say we could just start using transit. But they never look at the numbers, because if they did, they would find a whole lot of transit trips cost more than driving a car you already own. And if many people switched to transit, the system would break down because, in the USA, about 70-80% of transit cost is paid by taxes on non users who would see their taxes skyrocket to pay for all the new riders.

BTW, the other thing the greenies ignore is that transit uses MORE energy per passenger-mile than modern cars.

Thanks

JK

Willis for President

The only thing achieved by taxes generally is the redistribution of poverty.

Willis, the fallacy in your otherwise splendid analysis is that you ascribe the motivation for the tax is to reduce the level of that lovely plant food known as CO2.

Realists know that the real motivation of governments in instituting these rip-offs is money. Money that they can spend on more socialist nanny state nonsense. CO2 reduction is just a convenient excuse that has the support of greens who are married to the CAGW ideology.

If you want to fix it you have to get rid of the socialists and the green left.

Jim

That’s interesting. Do you have data for that?

Bula, Willis

“And how much actual change in our driving habits is a hundred miles less per year?

Well … since Americans drive about 10,000 miles per year, it’s a gigantic, massive reduction in miles driven of one percent.”

Kerekere, do this calculation again? Vinaka.

Dave

New Zealand does not exactly count as a big country. It’s smaller than Japan.

My opinion is, there is some truth to the initial graph. But the dependency is not straightforward.

Willis says;

“and how can we catch them and stop them?”

You can’t. It’s probably a lost battle. It was lost the day the Vikings stopped traveling to the “Ting” and discussing/voting on important issues. When they decided to leave that to “others”. The political classes emerged.

FijiDave says:

July 10, 2013 at 1:30 am

Hey, Dave, good to hear from you. The calculation?

100/10000 = 1%

w.

Kasuha says:

July 10, 2013 at 1:34 am

Thanks, Kasuha. Normally, you would just control for country size … but whoever made the graph didn’t do that.

w.

Another factor behind figure 1 is the difference in public transportation between those countries. Americans do not have the same extensive public transportation systems as they have in Europa. You can easily get around via rail in Europa whereas in the US it’s not as convenient.

Willis, thanks. My bad. Must’ve been something in the soup! 🙂

Kasuha said:

July 10, 2013 at 1:34 am

“New Zealand does not exactly count as a big country. It’s smaller than Japan.

My opinion is, there is some truth to the initial graph. But the dependency is not straightforward.”

***

I live in New Zealand. It is indeed a relatively small country, but it also has a relatively low population density. That may be a better pointer than country size.

More speculatively, while New Zealand is not as wealthy per capita as the USA, it is not poor, and people have enough money to travel for leisure activities in the great outdoors, something which NZ has in superabundance (ski-ing, hiking, fishing, hunting, boating, beaches, scenery, etc.).

All the best.

I’m sorry, but this article is even more misleading to ones which have the author refers in the beginning.

The author argues: “Well, ignoring fuel price for the moment, who would you think would drive more miles—a citizen of the US, or a citizen of Japan?” However he failed to make a comparison Sweden to New Zealand, Iceland to USA or Canada, what has very similar population density. The total size of country doesn’t matter as very few people rides by car from one side to another anyway.

Population density could matter much more. Sweden has about 20 inhabitants pet km2, while USA have a little more than 30. Even more, most of people live in rather densely populated sates, like California or New York. In fact more than 50% live in states which is more densely populated than Ireland and about 85% live in states which is more densely populated than Sweden.

However even states like Texas most of people don’t have to cover great distances as they live in a city. Even in Texas about 80% of people live in large metropolitan areas, where, if they were reasonably designed, there wouldn’t be need for car.

The author see the trees, but miss the forest. The life in USA is as it is because of cheap petrol everybody have adopted to it. The period when it was expensive was very short and people didn’t change their behavior to adopt to new situation. However in Europe most of people has adopted to take train to work if it is great distance or to cycle if it is short distance or to take a bus or metro if it is medium distance. When You drive, it is a work, when You go by train, You may do other things, like read news, play games, chat with other people, whatever You wish. If the petrol price would be in Europe for 20 years much would change and there would be much more people who would drop driving 3 hours a day.

GDP measures economical activity, not the welfare, You may do many things what doesn’t give any actual service to You nor society, spending 3 hours a day in a car is one example. More miles doesn’t mean better life, it could mean opposite actually. It really doesn’t matter how much You earn, it matter, what can You do and when You waste most of time to ride, You don’t have any left.

For example I cycle to work and hardly ever use car as there is sufficient infrastructure of public transport and daily life is organised in a reasonable way. I benefit from physical activities, I benefit from short travel times.

In short term the increase of price will hurt the poor, but in long run they would be forced to change their habits and they may even benefit from the increase.

Since the figure is “per capita” I assume its not “per capita of car owners” and so one possible confounding factor to your analysis is increasing car ownership (even by the poor) means increasing miles per capita with no individual driving more or less.

The other confounding factor is increasing efficiency over that period where for the same gallon of gas you get to drive further.

@Wayne Delbeke

Wayne, Most Europeans don’t even know how big EUROPE is. I can fly for 5 hours east of the UK and still be in “Europe”. Most think it ends somewhere like Poland.

The other thing of note about that graph is that throughout the entire time shown 1956-2010 there has always been an increasing number of miles driven with the few exceptions being single years of slight decrease at times of economic hardship and in one case two years.

For the years 2006 onwards (ie through 2010 as shown), there has been constant decrease.

Pretty simple take all taxpayer funded cars off the road first, make the legislators experience the gain and the pain for a full 12 months. All the walking and experience of public transport will orientate their thinking. Now thinking of Al Gore and his level of fuelled use……

Australia is a big country with a relative low population which means auto travel is essential, At once stage, nearly two decades ago, I was clocking up 40,000 klms per year. With only one long trip of play. I was travelling in the outback, an odd property or two were 100 klms (60 miles) from the main highway, then there was further travelling to a town! That is not unusual in the outback, some properties far exceed these distances. You simply cannot get around auto use.

Nice post, Willis.

It is also worth noting (as someone mentioned above) that population density affects car use significantly. In the medium sized town where my relatives live in The Netherlands, just about everything they need is a walk or a short bike ride away. Large countries like the US, Canada and Australia typically have much lower population densities, not least because they can. If you run out of milk, or have a doctor’s appointment, or just have to go to and from work, the distances and inflexibility/absence of public transport mean that using your car is the only option for many people, including the poor.

One thing missing from your post is the effect of greatly improved fuel efficiency in modern cars, which has mitigated the effect of fuel price rises. I have looked around, but can’t find anything reliable in the way of numbers on this, and am not criticising you at all. But the point is, with ever increasing taxes on rising base prices, people who can afford to buy modern cars (not the poor, BTW) have had the impoverishing effect of higher prices hidden from them. They should be financially a lot better off than they were ten years ago for the same number of miles driven, but those gains have been imperceptibly snatched from them, mostly by governments.

Near the beginning of your article you state

“And more to the point, I also didn’t like those two years up at the top right of Figure 3, which are 2009 and 2010. In those years, Americans drove about a thousand miles less than expected. So I though about why that might be, and even a bear of little brain would go “global financial meltdown, duh”. And that made sense overall as well, because how far I drive doesn’t just depend on the pump price. It also depends in part on how much money I have in my jeans. When I’m flush I drive more, and when times get hard, I drive less regardless of the price of gas.”

This perhaps misses a lot of the basic phenomenon, which is that many jobs were lost, so that much less commuting to and from work took place. Lots miles are driven because people have to go somewhere rather than because they want to go somewhere, with going to work at the top of the list.

I admire your willingness to jump right in and start analyzing things that interest you, but what you are trying to do now looks like stone-cold economic analysis. The track record of economics since the discipline was invented several centuries ago does not inspire confidence.

D. Cohen says:

July 10, 2013 at 2:59 am

Me, I admire your willingness to offer up vague criticisms without actually specifying a single error I’ve made …

w.

JohnM says (July 10, 2013 at 1:27 am ):

Jim

That’s interesting. Do you have data for that?

Turbo charged, common rail Diesels are the ticket:

http://www.auto-types.com/autonews/volkswagen-passat-tdi-set-a-record-in-the-us-7799-mpg-or-30-liters-100-km-10381.html

There’s something off with the original graph imho. Average miles per car in the uk (second hand prie guides) is 9000-12000 miles per annum. Everyone in the UK knows the price of fuel is a function of govenrment policy to squeeze the pips until they squeak, it has zero to do with demographics – more to do with fuel protests that have brought the country to a halt in the recent past.

Moreover what is the relevance of fuel cost per capita? Japan, Switzerland and the Nordic states are reputeded to have the best mass transit rail systems which will be mostly electric.

I suggest the graph was chosen to support an argument rather than vice versa.

JohnM says (July 10, 2013 at 1:27 am ):

Jim – That’s interesting. Do you have data for that?

JK—Look at the line labeled”Purchase expenditure One car$” at http://www.portlandfacts.com/carcost.html

Annual car purchase costs varies from $571 to $1734 as income goes from $5000 to $70,000+/yr while the operation cost (on the next line) only varies from $2127 to $2570. (I guess the older cars are driven less and have more repairs.)

(sorry about the incomplete post above)

Wayne Delbeke says:

July 10, 2013 at 12:06 am

” Most Europeans have no concept of how big North America is.”

Most Americans don’t know how big America is . In fact most New Yorkers don’t even know that there is an America outside of New York City. Not too sure about the Hollywood liberals either when it comes to where the normal people live.

John says:

July 10, 2013 at 2:12 am

“In short term the increase of price will hurt the poor, but in long run they would be forced to change their habits and they may even benefit from the increase.”

They will die, which is what you want. Less people less pollution.

Any time I see an article or story based on the idea of “Other countries do this, therefore America should do that……….”.

I stop reading.

Good work Willis.

My miles driven for the past 10 years is almost the same each year because no matter what the cost of fuel, I have to get to work.

Mikeyj says:

July 10, 2013 at 4:11 am

Most Americans don’t know how big America is . In fact most New Yorkers don’t even know that there is an America outside of New York City. Not too sure about the Hollywood liberals either when it comes to where the normal people live.

=======================================================================

Most of America is “Flyover country” for East coast Liberals and West coast Liberals.

Willis wrote in part:

“What this graph shows me is that any energy tax on gasoline will hit the hardest on the poorest, the people who mostly use their car to get to work. The problem is not just that more of the wages of the poor go to energy, although that is also a problem.”

==========================================================

A-a-a-nd… it’s to save the grandchildren from the oceans boiling away and the oceans flooding everywhere (wish they’d make up their minds). Woopsie. Kill off enough people and there won’t be any grandchildren to worry about…

Wait up! Problem solved. I guess government can come up with a solution after all, when they put their minds to it. (/bitter sarc really necessary?)

I didn’t know that anybody needs a car to survive. I wonder how people survived 100 years ago.

I would say that at least 80% of poor people wouldn’t need a car if there would be sufficient public transport system. They would save money as well and could afford more and could have better life, but it is

USA shouldn’t do anything because other countries do something in a different way. However, everybody should understand why inhabitants of USA drive so much. It doesn’t have to do anything with the size of country, but first, culture, and second, lack of public transportation.

I just wonder, does the car owners pay that much money to maintain roads?

The interstate highway system, authorized in 1956, was a definite factor in the acceleration of miles driven. According to wikibooks, the interstate road system grew to 10k by 1960, 20k by 1965 and 30k in 1970.

As a little kid I still vaguely remember what driving was like just before the interstate roads were built – kind of like what driving in Ireland is still like today.

Don’t tell the green hoaxsters that they could make a HUGE dent in US CO2 emissions, avoid raising taxes and save billions in highway maintenance costs all at the same time, (to spend on more EBT cards) – simply shut down all the interstate roadways! Then they’ll REALLY be “popular” for stopping this nasty claimte change we’re all suffering…

Population density on its own shows nothing – if we have a population density of 1 per square mile, but also a density of 1 per square mile of every conceivable service or amenity (assuming no need for travel to run them) and assuming that these distributions are evenly spread, then there would be minimal travel. But normally a population density of 1 per square mile would imply extensive travel as services and amenities are not that common…

To take a real example, John’s comparison of Sweden and New Zealand, then Sweden does have lower population density. This may be a factoring of averages though, as Sweden has large basically unoccupied tracts of wilderness along it’s western border and to the north (apologies to any Sami reading who may wish to point out this is perfectly habitable and pleasant non-wilderness), and a concentration of population in the flatter and fertile south and east, whereas New Zealand’s population are spread around most of the coasts of the islands (its wilderness tends to be the middle bits, so are more evenly distributed and have larger distances to travel between them. Population density does not show this, but a bit of basic knowledge does.

The qualifying measure should probably be something like average distance from home to [basket of destinations/frequency of use of these destinations], which would probably be a rather epic effort to pull together with any accuracy, especially as the usage pattern of say hospitals or supermarkets varies between each country involved. But then again, if you want to make the case for a tax with obvious negative risks, then perhaps you should be prepared to do this sort of work rather than simply graph price versus distance (which looks to be a secondary/high school exercise rather than a serious attempt to make a case). To actually put some intellectual effort into your case (a la Willis) is the least people can do – the failure to do so marks so many suggestions for action, rather worryingly.

This is a great article because it shows us something we did not know or understand before about something important. Every reader should now have a much better understanding. Good job Willis.

But, how come we have never seen the proponents of a Carbon tax do an analysis like this. They have responsibility to do so. But then, they don’t care what the impact is. They just know they want a Carbon tax.

I can only offer anecdotal evidence, not hard numbers. I work in an inner city legal aid office. Our clients can get to us by bus, by car, by foot or by bicycle. Most clients have physical problems as well as financial issues. Bicycling or walking would be difficult for most of them, even if the roads were bike or foot friendly. They are left with the bus or a car. So far I have seen one client who used public transit to get to us, and he could not drive because of his eyesight. The rest have a car, or a friend with a car. Bottom line–gas prices are a big deal to these folks, and any increase hits very hard. Willis is absolutely right about the impact of an energy tax on the poor.

John says:

July 10, 2013 at 2:12 am

In short term the increase of price will hurt the poor, but in long run they would be forced to change their habits and they may even benefit from the increase.

I call that the “let them eat cake” theory of economics. Using the same “logic” one could argue that raising food prices could also be a good thing, since many poor people are overweight, and would be forced to eat less.

“John says:

July 10, 2013 at 4:58 am

I didn’t know that anybody needs a car to survive. I wonder how people survived 100 years ago.”

Or a computer, or a phone, or electricity, or petro-chemicals, or pharmaceuticals, or air travel, or things like TV. Really, do you read what you write?

“John says:

July 10, 2013 at 4:58 am

I would say that at least 80% of poor people wouldn’t need a car if there would be sufficient public transport system.”

I would say you have no idea what poor really means. Try not only not being able to afford a car, let alone affording petrol to run it, but living in such poor conditions (Countries) that NO PUBLIC TRANSPORT EXISTS! Let’s not mention being able to afford food every day!

I don’t lose it often, but “John” is an idiot!

John says: “I wonder how people survived 100 years ago. ”

Wonder no more, the answer is – no where NEAR as well as today!

In 1913 most everyone still got around by horse power, cars were a novelty with hardly any roads suitable for driving. Yeah, some cities were starting to get electric trolley service but still, in just about any US city in the summer time, as a great uncle told me way back when, THE STENCH WAS HORRENDOUS! People still had to get in to the city by horse. You couldn’t escape the smell or the heat because no one had air conditioning yet either. On top of that horse flies were everywhere, they got into everything – including your food which relied on a horse drawn ice carriage to stay fresh until you ate it.

If people from back then are up there listening to people today whining about ‘climate change’ I can’t imagine how hard they are laughing.

http://www.post-gazette.com/stories/opinion/perspectives/the-next-page-the-city-horse-time-for-a-comeback-399466/

Population density shows more than area of a country.

To be honest, in my opinion density and size of country plays secondary role to determine fuel consumption. The affluence, the alternatives and the culture is main factors. All countries noted in the figure are affluent, I don’t think that there is any big difference because of it. Australia, USA, Canada and New Zealand are rather similar in this aspect.

Patrick, do You have any alternatives as effective as computer, phone, electricity, pharmaceuticals? I guess no, however commuting with car has alternatives.

It is impossible, that some can’t just accept that car riding is a cultural thing not economical.

One possibly significant variable that you could have included in your multi-linear regression is miles/gallon. It may be covarient with GDP. Both have gradually increased with time. It is certainly a more cost effective way of reducing CO2 emissions than increasing price.

John says:

July 10, 2013 at 2:12 am

“In short term the increase of price will hurt the poor, but in long run they would be forced to change their habits and they may even benefit from the increase.”

I hope you are a troll and not that…., well, let’s just say I hope you are a troll because really, “in long run they would be forced to change their habits and they may even benefit from the increase”?

Say I’m a part of a single wage family of eight. Money is very tight between food, medical, rent, utilities, and fuel, though no consumer debt. So, as a result of this tax my food, utility, and fuel costs go up, I cut out any remaining flexible variable costs and am still coming up short. Now I am, as you well note, “hurt”. Tell me, how exactly am I now going to change my habits to relive my situation so that may end up even better than when I started?

Two wages? The second will at best go to cover the increase in child care costs.

Public transportation? Costs more than driving. If costs go down, that primarily means that taxes have gone up to cover the losses. That doesn’t help me a bit.

Move closer to work? Cost of living within a three mile one way walking radius of work nearly doubles. That’s not going to help.

Or maybe you would be of the mind that we should die and decrease the surplus population.

I so hope you are a troll.

Watchman says:

July 10, 2013 at 5:13 am

You raise some good points, the more you think about such things, the more there are issues raised, I guess as an Australian visiting all the great things to see and do in New Zealand I have been responsible for seriously skewing their per head of population to miles travelled. Our Dollar was buying more and it was holidays (and work too at times) so cost of fuel never entered the equation, and all those Americans that were tossing prawns on a Barbie (who actually does that!!) all over Australia and boosting our mileage travelled and fuel used – sort of reminds me of all those climate models that miss vital factors like clouds and make assumptions, guesses, and someone pays out good money for speculation.

Thanks for making us think Willis – Politicians hate thinkers, thinkers question too many things!!

John says:

July 10, 2013 at 2:12 am

In short term the increase of price will hurt the poor, but in long run they would be forced to change their habits and they may even benefit from the increase.

And the use of the word “forced” is the difference between Europe and America. Freedom means not being force by a government to do something whether good for your or not. As long a socialists think force is a proper way to treat citizens then please stay on your side of the Atlantic.

John – I must apologize for saying this but Europeans smugly telling me that I should bicycle to work like they do because I like in a city like they do. I live in Dallas Texas a major city. However my workplace is 32km from my home. This in not unusual, nor is the fact that although Dallas has both a train and bus service there is no realistic way to make that commute. My wife might seem a more likely candidate as her office is only 10km from our home, and there IS bus service between our neighborhood and her workplace area.

I examined this idea as she doesn’t particularly like driving. It turned out that her 10km commute would take more than 1.5 hours and involve 2 transfers. More surprising was that it turned out to be as expensive or more so than driving, when comparing fuel and insurance cost (her car is paid for). Finally we must add in the weather factor – the temp today will be 38°C. This is not unusualc and will be the average for the next 45 days. My 45 kilo executive wife is not going to bicycle 10 km in her dress , nor is she going to walk 1/2 km to the bus station and then wait in the heat.

you will no dout say that these things are functions of our (relative) wealth and location, however I will give you one more ancedote: as manager of a major distribution center in Virginia where the climate is cooler, I bullied the local bus service for months to get them to provide bus service for our 1200 employees. I argued that -being in an industrial park among other companies-there would be plenty of passengers. They agreed to a one-month test. We did plenty of advertising for amonth in advance and made bus passes available in the center…at the end of the one month test, the ridership turned out to be exactly zero..

The thing, I’m not a Troll. I’m just tired to see people making bad decisions and later to complain about it.

Oh, You could easily cycle to work. I cycle by average 25 km a day and I’m perfectly fine and actually I save time compared to car. If I would have a need I could cycle up to 20 km or about 12 miles each way. The time is not wasted compared to time driving.

You could also find a friend who goes the same direction and both of You would save half. Even if You did it once a week You would save more than increase of price. If there are 3 friends Yous ave even more. All You need is good communication with others.

Could You please ask to Yourself why nobody use public transport? Because it is expensive. Why it is expensive, because nobody use it. As well, You most likely consider only short term marginal costs to car and public transport. If so, of course car wins. However You need to buy a car, to maintain it, to place it somewhere. How much does it cost to ride to work if You include all these costs.

And if You really need a car for a day, You can hire one.

Finally, the author could be right, the demand of petrol wouldn’t change much in USA even the price would double. It is twice bigger in most of Europe, but there are freaks who drive a car to work, when there are convenient and cheap public transport. Socially bad activities should be punished and economical means are the most effective.

There are about 10 to 25% of people who will always need a car, while most of people need it because of habit, culture and lack of infrastructure, not because car is necessity.

Okay, it’s official. John is a troll. I particularly like the one about finding a friend and driving half way… it’s actually gotvme giggling.

John says…

Speaking from ignorance of geography, or population density, or any other kind of reality will leave you looking like an idiot. You’ve accomplished it in spades.

No doubt the Luddites (look it up) were fine folks. No doubt the Amish can make it work. But the current reality of the twenty first century cannot be solved by references back to a time when 38% of the workforce was farming. Why not refer back to 1800 when about 90% of the workforce was farming. Certainly they were making things work. Didn’t need mass transit or automobiles.

What does that have to do with 2013 when farm labor is approaching 2% of the total labor force in the United States? Whale oil lamps and horse drawn plows were very labor intensive ways of living, but they have no application in our time, especially in the west. Total miles of railroad track peaked in the early 1900’s at around 250,000 miles. Today it is less than 100,000. The very infrastructure for mass transit would have to magically restored for you scheme to have any hope of working. But it doesn’t. People cherish and defend the freedom to be able to travel when, where and how they would like. And they don’t need or want to have more of their hard earned dollars stolen from their pockets to fund stupid schemes at carbon reduction.

I write this as I sit on a commuter train. I like mass transit. But it is not a solution to higher taxes that hurt the poor. Come on down from the ivory tower. The view from behind the wheel of a car worn thin in the commute to work may just adjust your attitude…or not if you truly believe your utopia might be the answer in the here and now.

pbh

fhhaynie says:

July 10, 2013 at 5:45 am

“One possibly significant variable that you could have included in your multi-linear regression is miles/gallon. It may be covarient with GDP. Both have gradually increased with time. It is certainly a more cost effective way of reducing CO2 emissions than increasing price.”

There is no cost effective way to reduce CO2, because there is “no benefit” from reducing man made CO2. The payback on more fuel efficient cars is so bad(hybrids are the worst) that our big government nannies are compelled to force us to do the right thing. That’s socialism.

@John-

What is it with you Europeans; always ready to send someone around with guns to force me into a situation I did not choose for myself? Why do I say “With guns”? Because that’s ultimately what happens with government, when they “force” people into something, as if you hadn’t noticed…

It would be interesting to run a correlation test with gravity as a variable. I think you will find that the more your country sux the less likely you are to want to drive around in it.

Pertinax says: “Public transportation? Costs more than driving. ”

True and you got me going…!

Boston’s MBTA carries about 1.8 billion passenger miles per year at a cost of about $1.3 billion per year or 72 cents a passenger mile, (over 2/3 of which is taxpayer subsidized).

http://metrobostondatacommon.org/site_media/weave_thumbnails/852.png

http://www.mbta.com/uploadedfiles/About_the_T/Financials/Stats%20Presentation%209-7-11.pdf

According to AAA, cost per VEHICLE-mile is 61 cents, cost passenger mile is under 30 cents from another site I found but unable to confirm.

Now imagine if we car owners were SUBSIDIZED like the MBTA? Someone “ELSE” would pay for 2/3 of your gasoline, 2/3 of your car payments and 2/3 of your insurance and maintenance!

John says later…

I’ve been to the UK. I enjoyed riding the trains there. But even in the UK many of the small rail lines that made the use of mass transit for the common folks possible is long gone.

I love my bicycle. in some years my riding has gone over the 10,000 mile mark. But using a bike to ride 80 miles each way to work? Stupid thought, isn’t it.

Just because you have opportunities to live a life style that suits you and saves money doesn’t mean that it will fit for anyone else, much less for everyone else. Are you volunteering to pay for that lack of infrastructure you so glibly ramble on about? Standard rail track costs in excess of five million dollars per mile. Electrified rail track is nearly an order of magnitude higher. Who will pay for it…and how?

Crunch a few number and get back to us. Airy fairy hand waving will not produce the infrastructure. If the infrastructure was in place it would be under used. 40 million people in California is plenty for me. I don’t think the added population density to make your scheme possible would in any way add to my joy of living.

Go back to the troll cave. It is research time.

Dear RCM,

My intention was to show that arguments of some people were not valid, not that some people should do something else. It’s everybody’s’ own decision. I’m not a socialist for Europe’s standard, but I could be one for USA standard.

You gave valid examples, it is almost impossible to use any alternatives for both of You. The cycling is not possible two months a year. Regarding costs, of ridership You skip significant costs, Your family don’t have to pay for it, but somebody have to do that.

Regarding example You gave, it perfectly well characterize the culture. Americans ride a car and no cost savings would be an argument. If we can agree that it is bad to waste fuel or anything else, than we can argue that riding a car, when it is unnecessary, is socially unfavorable action. Thus those people who act wrongly for whole society should be somehow motivated, a tax could be rather good motivator.

dp says: ” I think you will find that the more your country sux the less likely you are to want to drive around in it.”

But a true pessimist could say that the worse it is wherever you live – the more you drive to be away from wherever that is.

On Update 2: if there are 8.9Kg CO2 in a gallon of gas, one percent of that is 0.089Kg not 0.89Kg as currently stated. Assuming the error carried in to the rest of the calculation, net benefit is only 10% of the original result. If 0.89Kg was a typo for 0.089Kg, then maybe that should be corrected.

[Thanks, fixed. It was just a typo. -w.]

I wanted to show other perspective, but it appears that nobody is interested. Very sad.

“John says:

July 10, 2013 at 5:43 am

Patrick, do You have any alternatives as effective as computer, phone, electricity, pharmaceuticals? I guess no, however commuting with car has alternatives.”

I guess you have not seen the alternatives available. WOW! a bicycle? Can I have food please, bicycles give me gas? John, you have no idea what you are talking about regarding poor, people in abject poverty. You want to deprive them the luxury you enjoyed getting to where you are now.

Lil Fella from OZ says:July 10, 2013 at 2:47 am “Australia is a big country with a relative low population which means auto travel is essential” and “You simply cannot get around auto use.”

That is right. There is practically no public transport except in the centre of large cities (state capitals). Anyone one in the country or even in the outer suburbs needs a car or families even two to go to work, go shopping, go see a medical doctor etc. Some say that Sydney (NSW) is the largest city in area in the world. It stretches about 60km north, south and west (east is the ocean) I lived in an outer suburb (no public transport within 15km, 40km to theCBD) I travelled about 35-40,000 km /yr just going to work, my wife in her car travelled about 20,000 km/yr part-time teaching. When the three daughters were going to University 30km away (40 minutes in peak hour traffic) they each had their own car (five car family then). They would have averaged 15,000km each. Around where we lived two incomes were necessary to support kids going to University.and pay the mortgage on the house.

“John says:

July 10, 2013 at 6:28 am”

If you live in a world where you have the choice, private bicycle, private car or some form of public transport I guarantee you there are MILLIONS in Africa, even India and China, right now that would trade places with you in an instant. Talk about a different perspective, my guess is you have never experienced poverty let alone seen it in reality!

John’s critique (July 10, 2013 at 2:12 am ) of the article is misplaced. Even if most people live in densely populated states, those states are relatively larger than European countries. Moreover, a significant number of people live outside of the major cities. For example,New York State is not just New York City. In Upstate NY there are five relatively large metropolitan areas: Buffalo, Rochester, Syracuse, Utica, and Albany, Schnectady & Troy stretching about 300 miles west to east. Travel within each of those areas is primarily cars and, importantly, travel between them is also by car.

Another point to keep in mind is that these areas once (prior to 1930) had public transit that was comparable to European cities. Extensive trolley within the cities and interurban trains between the four western cities were available. Add in extensive train services and it was possible to live and work without having a car. That has all changed and now it is extremely inconvenient to not have a car. In theory I could use public transit to commute to work but I estimate it roughly doubles the time in transit and the sparse options available means that schedules have to be arranged around the time available to the point that public transit is not a practical option.

I agree with Willis that an energy tax is regressive and would practically achieve little or nothing.

Public transport (PT) works in large density populations. Take New York, London, Hong Kong, central Sydney, Melbourne, Perth etc. Once the population density starts to disperse, PT becomes expensive (Beyond taxpayer subsidies, and in Sydney, prices are subsidised to the tune of ~75% by he taxpayer).

Mikeyj says:

July 10, 2013 at 6:10 am

Don’t get so upset. I didn’t say trying to control anthropogenic emissions was economically benificial. It isn’t. Click on my name to discover one reason.

Thinking a bit more and shifting into Jonathan Swift mode… if a government wants less of something, tax it. If a government wants more of something, subsidize it. So of course it makes sense for a government to tax fuel for driving and then give the money to those who don’t drive. It reduces the number of people who drive and increases the number of people who don’t drive.

I’m all over that. Starting now, all of ya’ll who drove in to work today can each send me five bucks for each day you drive ’cause I just quit my job and quit driving.

I’ve got it all figured out. I’ll have everything delivered; food, clothing, pharmaceuticals. I’ll have my clubs delivered to the golf course down the road and they can keep them there for me so I’ll have them available whenever I bike down for 9 or 18 holes. I can hike the 1/2 mile to the reservoir for some fishing whenever the mood strikes. I can get all my reading material online and do a little online-gambling from time to time, depending on how big my non-driver subsidy checks are. I’ll upgrade my cable to get all the premium movie channels and put in a home theatre. I’ll have to give up downhill skiing and stick to cross-country in the winter, but I suppose it’s inevitable I’ll have to make a few sacrifices.

Yup. This will work out great! Let’s all do it. And think of how much better off the poor will be with a fuel tax after they quit driving altogether. We’ll ALL be rich.

Taxing fuel is the way to go if you want to eliminate poverty.

John says:

July 10, 2013 at 6:28 am

“I wanted to show other perspective, but it appears that nobody is interested. Very sad.”

Not true. Most were interested enough to read what you wrote. It appears most of the readers here disagree with you. Happy pedaling.

Of course they would like to change with me, because I’ve made decisions to give me a choice.

I just can’t see how it relates to those who drive a car, because they can’t be poor when they can afford to have a car even a 20 year’s old one.

John says: ” If we can agree that it is bad to waste fuel or anything else, than we can argue that riding a car, when it is unnecessary, is socially unfavorable action. Thus those people who act wrongly for whole society…”

‘bad to waste fuel’ – In free market capitalism, the ONLY person to make the FREE decision whether or not a particular use of the fuel is ‘bad’ is – the one who PAID for it.

‘people who act wrongly for whole society’ – WHO gets to make the determination whether or not a given act is wrong? You? Some dictator? In FREE countries we elect representatives to write laws that determine what acts are “wrong” and those representative are even further RESTRICTED by our Constitution as to what laws they can write. So in our FREE country, WE THE PEOPLE collectively have ultimate control of what laws we wish to have hanging over us.

Individual freedom is the main reason more people immigrate to the USA than the total of those to ALL other countries combined.

Wills Eschenbach: “[A]ny energy tax on gasoline will hit the hardest on the poorest.”

If a “carbon” tax really did accurately price a valid externality, and if the the tax’s proceeds were distributed in a neutral (I’m thinking per capita, but I’m open to being convinced otherwise) way, it would still be true that the tax would “hit the hardest on the poorest.” Yet I for one would be comfortable with such a tax, since it would contribute to the accuracy of the price signal, making resource allocation more efficient–and thereby raising some otherwise poor people out of poverty.

Of course, the preceding paragraph relates to a parallel universe that none of us inhabits; the externality such a tax addresses is illusory. But I raise the point to caution against arguments based on the proposition that a given price change “hits the poor the hardest.” All too often that’s not an argument so much as a tautology: suffering from price increases is almost the definition of being poor.

Now, you may argue–and I may agree with you–that some prices affect the poor more than others; it’s at least plausible that increasing the cost of, say, milk or sugar will have a greater impact on the poor than raising the Tesla’s cost. But basing choices among among goods and services to tax on how much we–or, more likely, those boys and girls in Washington–think the tax will affect the poor is almost certain to result in worsening our allocation of resources; the economy is too interconnected for any of us to know accurately who will ultimately be affected and how.

Yes, a “carbon” tax is a terrible idea. And the reason is that it will make us poorer as a group and thereby make more poor. But if such a tax really did remedy an externality as its proponents claim, the result would be a more-productive allocation of resources and a consequent reduction in poverty. It could therefore be desirable even if, for the reasons Mr. Eschenbach sets forth, it can be characterized as in some sense “hit[ting] the hardest on the poorest.”

So, although Mr. Eschenbach’s post is interesting as usual, I don’t find the quoted aspect particularly compelling.

“John says:

July 10, 2013 at 6:53 am

Of course they would like to change with me, because I’ve made decisions to give me a choice.”

And what does one do when one does not have that choice?

Willis, I disagree… but not with the analysis per se. It is true that higher energy costs reduces energy use very little. And when it does it is not always good – think of all houses with too much insulation and to little ventilation that is infested with mould and mildew. But anything you tax becomes dearer and on the margin less of it will be used. Raise income taxes on the poor and more people will be unemployed, raise an energy tax and less energy will be reduced. Even a minimal government will have to tax something and I prefer less environmental damage to more unemployment.

I also would add that preferably a tax is taken as late as possible in the economic cycle. Energy taxes are both a production tax (when it is used for e.g. production or commercial transport) and a consumption tax (when it is used for e.g. residential heating). In my eyes it makes it neutral and a good revenue source that internalizes environmental damage (i.e. makes it cost) and strikes at least some part in the later stages of the economic cycle.

(If you’re going to argue that governments can’t be trusted to lower income/payroll taxes if they are allowed to raise energy taxes, well, yeah, could be…)

“Joe Born says:

July 10, 2013 at 6:59 am

Now, you may argue–and I may agree with you–that some prices affect the poor more than others; it’s at least plausible that increasing the cost of, say, milk or sugar will have a greater impact on the poor than raising the Tesla’s cost.”

I do believe you have never had to chose, heat or eat (Or anything else actually)!

Willis: Of course, the real impetus is simply to generate more tax revenue, regardless of the excuse.

Mike M,

You may do whatever You want unless You affect others. It is not a freedom You talk about, it is anarchy. Your freedom end where starts my freedom and vice versa.

I intentionally stated “If we can agree”, those “we” in USA should be citizens of USA. You asked: “WHO gets to make the determination whether or not a given act is wrong?” Answer is simple, the society. And every member of society is rights to do the best to convince others.

Ptrick,

“And what does one do when one does not have that choice?”

There are always a choice. Just in many cases we don’t like the alternatives.

John says –

“I wanted to show other perspective, but it appears that nobody is interested. Very sad.”

Frankly John, it sounds like you live in a bubble, out of touch with reality. Some perspective eh?

John says:

July 10, 2013 at 6:53 am

So you think all the poor choose to be poor by making poor decisions. Try telling that to the millions who are living from paycheck to paycheck because the cost-of-living has been going up faster than their income,or those that have lost jobs, or have been foreclosed on their house.

another hit to the poor is that our food is transported by truck trains and boats so the added taxes for carbon are added to the “food chain” increasing food prices on everything.

I completely disagree with the premise, that the original graph doesn’t show what it claims to show, i.e., gas prices are inversely correlated with per capita fuel use, the implication being that gas pricing impacts the amount of fuel used per capita.

Of course it does. Try raising prices to $100 per gallon and see what happens to per capita fuel use, even in the larger countries.

But the relationship goes both ways, because you’re really looking at the result of a supply/demand situation in each country.

In the U.S., politician’s heads would be on the block if they tried to put taxes at EU levels. Why? Because the impact on their constituents’ lifestyles would be extremely oppressive due to the way that the transportation system has evolved here. In other words, low gas prices permit long driving distances, so people choose to live far from where they work, and will take their car for convenience even if a bus runs alongside them to work each day.

In other words, the U.S. has a gas pricing structure that more closely approximates a true “free-market” price, simply because the politicians don’t dare tax gas much more than they already do. Even the relatively low tax that is levied is primarily used to improve the road systems in most states. EU countries have perverted the free market by determining that their people need to change their behavior, so they’ve taxed gas (and cars) oppressively. They’ve done this for so long, and so consistently, that the people have adjusted without a revolution, but make no mistake, they have adjusted.

When politicians decide to tax something on the pretext of changing their constituents behavior for the better, you can bet on two things: 1) They don’t really give a rat’s butt about your behavior, and 2) They want more money to spend on stuff they really do care about. In the meantime, their tax increases pervert the free-market pricing structure, which usually leads to unintended consequences elsewhere in the economic system.

Public Transit is largely designed to take advantage of economies of scale. Whether Public Transit can work largely depends on how people and their destinations are organized. If people “live” in one small area and “work” in another small area, then transit is reasonably efficient. However, best case 50% of the vehicle miles are essentially “empty” as you must return the vehicles to pick up the next load of passengers.

If however passengers and their destinations are essentially random it is a nightmare to design an efficient transit system. You cannot achieve the economy of scale necessary to fill and route Transit vehicles such that you can pay the driver and vehicle costs. Your costs per passenger mile go through the roof, as do passenger wait times.

It is a nonsense to suggest that public transit can solve this problem, because it is hugely expensive to supply Transit in these circumstances. To solve the random problem you need many more smaller vehicles. However, the labor costs of having a paid driver for each of these vehicles quickly overwhelms the costs of the vehicles and fuel, making it much cheaper and more efficient overall if people drive themselves.

When cities are laid out such that passengers and their destinations are largely random, then private vehicles are significantly less expensive and more efficient, less time is wasted that could be used more productively, and overall CO2 will be reduced as compared to using Transit. Otherwise the transit system essentially becomes a very inefficient, expensive taxi service that provides poor service because it doesn’t drive you door to door.

This is what most people miss when they suggest Transit as the “universal” solution to private vehicles. The model only works when demand is concentrated. When demand is diffuse, private vehicles are much more efficient, because you don’t have empty vehicles driving around waiting to pick up passengers. With private vehicles the vehicles only move when they have passengers.

John,

True. I could.

I live on what passes for a mountain around my neck of the woods, about a thousand feet above the floor of the Tennesee valley, but let’s ignore that. It does rain an average of one out of every three days where I live. It gets pretty darn hot in the summer, and pretty darn cold in the winter, but let’s agree that I ought to just ignore that too, that I ought to butch up and deal with that.

Of course, I have kids to get to school. Kids to pick up from school and transport to after-school care. I have Dr.’s appointments to get them to, dentist appointments, hockey games, karate classes, voice lessons. I have groceries and other goods to buy.

There is no public transportation within any reasonable distance of my work, my home, or most of these destinations where I live.

No thanks.

Watchman is right about the population density issue. If you have a big country but everyone lives in a few small spots the population density of the country will be low, but the average person will live in a high density area. Perhaps something like the median population density weighted by inhabitants averaged over a grid formed from 25sqmi blocks over the country. Thus Siberia would be weighed much lower than Moscow.

Miles per gallon has been increasing so that the use per capita does not quite match the same graph.

Additional note – countries with the low miles driven and high taxes are also all below replacement birth rates. We should never adopt policies that lead to not enough babies. Really, who is going to feed all the 70 year olds in Russia in 15 years?

“John says:

July 10, 2013 at 7:19 am

There are always a choice. Just in many cases we don’t like the alternatives.”

Well, in my experience, in Africa, people walk. They don’t even have the luxury of a bicycle, let alone rods to use it on! So, no roads, no bicycle, no car, no public transport, no beast and cart, what are the alternatives?

The UK tory party solved the problem way back, realising that a one off fuel price increase had only short term effect they introduced the “fuel price escalator”. Fuel tax increased each year by the rate of inflation plus four percent. This is why we now have the world’s highest fuel prices.

Wow, those people in the big cities don’t drive much do they?? Willis, I average much closer to 40,000 miles a year. Many you could expand your analysis a bit more, exclude those that live in the top twenty cities, and see what the average mileage is for the rest of us!

How can there be “8.9 kg (19.6 pounds) of CO2 in a gallon of gasoline” when, according to http://wiki.answers.com/Q/How_much_does_a_gallon_of_gasoline_weigh, gas weighs 6.073 pounds per US Gallon. Just askin’.

John is what I call a person of little thought. He sees the world from his own vantage point and believes that what is right for him applies to all. But I think it is worse than that. He believes that he knows what is best for all of humanity. Our greater prosperity and longevity is because we continue to master the use of energy and it has never been the case that energy use has been metered out by overlords of society for maximum benefit with the exception of wartime rationing. Energy is everything and more energy is better than less energy. If there are problems, there are solutions. I think that Elon Musk ( SpaceX, Tesla, PayPal, etc. ) would not claim to know what is best for all of us. What he says is that he thinks he knows a better way and puts his time, talents, and treasure behind proving that to be true. John is just a clanging gong with nothing to show for his life but words. ( I am striving to not have my words be my only legacy ). Actions speak louder than words John.

Perhaps Elon Musk can get behind clean and safe nuclear technology, safe pebble bed reactors, or thorium reactors to complete the revolution of energy abundance with maximum environmental benefit. More affordable clean energy would benefit all. Battery technology is getting better all of the time. But you can’t legislate innovation and prosperity. I have looked down on the valley in LA and seen the brown smog. It is much better than it use to be and it is getting better all of the time. But socialist forcing cannot compete with capitalism. Just look at what Kennedy did with the private sector. Get the EPA and other government organizations out of the standards business, set the long term goals, lower the cost of doing business, and get the government out of the way of the private sector. Get the Johns out of our lives.

“So you think all the poor choose to be poor by making poor decisions.”

No, they didn’t choose to be poor as companies don’t choose to bankrupt. But people may have made poor decisions.

However true reason why African are poor is their lack of capital (including human capital). However most poor people in Western World are poor because of bad decisions (for example, no attention to subjects in school, too much partying, using drugs, as well spending money where the money shouldn’t be spent.

Richard Howes says:

July 10, 2013 at 7:36 am

How can there be “8.9 kg (19.6 pounds) of CO2 in a gallon of gasoline” when, according to http://wiki.answers.com/Q/How_much_does_a_gallon_of_gasoline_weigh, gas weighs 6.073 pounds per US Gallon. Just askin’.

——————–

Cause the oxygen that the engine burns the fuel with doesn’t come with the fuel.

Molecular weight of CO2 / atomic weight of C = 44/12 = 3.66667

6 * 3.666667 = 22 pounds, ballpark of the CO2 in gasoline. Of course gasoline isn’t pure carbon that converts 100% to CO2.

Richard,

Let’s consider Methane CH4. When you burn it you make 1CO2 and 2H20. The CO2 weighs more than CH4 (almost three times as much). Same basic process, you grab oxygen out of the air and add it to the carbon. The inclusion of that oxygen raises the weight.

“John says:

July 10, 2013 at 7:39 am”

(for example, no attention to subjects in school, too much partying, using drugs, as well spending money where the money shouldn’t be spent.”

You are talking out of a hole in the back of your head! There are more degree holders in Addis Ababa, Ethiopia than in Sydney, Australia!

Yet another example of “John” opening mouth and changing foot!

A carbon tax on fuel will also impact commercial vehicles, like those involved in delivery of essential goods and services. Think food delivery, clothing, household goods and the like. A fuel price increase will naturally be passed on to the consumer in higher prices for those goods, thus increasing the attack on the poor.

In other words, the stated ends (cutting carbon) don’t justify the meanness.

John,

A lack of capital is not the reason Africa is poor. Their capital level a couple hundred years ago was not significantly different than that of the rest of the world. Additionally they do not have significantly fewer natural resources than other parts of the world. Something else is different between Africa and Europe.

Poverty may be largely caused by poor choices. However, taxpayers paying someone at the IRS $100,000 per year to work for a union that argues for IRS agents who then enforce a tax that raises the cost of gasoline disproportionately felt by the poor doesn’t help. If I have an extra $200 in my pocket at the end of the year I will either spend it or save it. If I spend it someone somewhere gets paid for contributing to the economy since I buy a good or service. If I save it someone somewhere gets hired as the bank lends the money to an employer. If it gets confiscated by the government to raise the price of gasoline, what contribution is made? What good or service has the IRS agent on “official time” provided? The single mother working at IHOP (my mom growing up) is better off if I have that extra money and use it to go out to eat than she is if that money goes to the IRS worker.

“Well, in my experience, in Africa, people walk. They don’t even have the luxury of a bicycle, let alone rods to use it on! So, no roads, no bicycle, no car, no public transport, no beast and cart, what are the alternatives?”

Of course they do, because of reasons I stated above. Africa is completely different story and doesn’t have anything common to people in USA or other countries where everybody have chance to get good education.

“John says:

July 10, 2013 at 5:43 am

…some can’t just accept that car riding is a cultural thing not economical.”

That’s where you go astray John. Car usage by the average person anywhere is based almost entirely upon economic decisions made by the individual. Sure, there are cultural elements involved in the decision as to which car to purchase, or whether to even own one, but most of the decision process is based solidly on economics. You just don’t understand economics, apparently.

I purchase used cars because they’re cheaper to operate overall for the time I own them. My wife drives an all-wheel drive because she has to do extensive traveling in our winter weather. I also own an older SUV for the occasional hauling I have to do. I don’t care about the gas mileage on it because I only drive it a couple thousand miles a year. Hers is a smaller SUV for better gas mileage, but an SUV because she has to haul a lot of stuff. My older car is always the more comfortable of the three vehicles we own because we use it for longer trips. Etc. All of those choices were based on economic decisions. I even buy mostly white or silver vehicles because they don’t show our typical salt-spray dried winter slush as much, so they look better in winter generally, so I don’t have to run them through the car wash every other day to keep them looking decent.

Sure, cultural decisions are involved as well (clean car–dirty car?), but you vastly underestimate the degree to which nearly all decision-making regarding personal transport is based on economics.