Guest Post by Willis Eschenbach

Supporters of the British Columbia (Canada) carbon-based energy tax that I discussed in my last post have made claims that the data shows this tax was a success … so being a suspicious-type fellow, I thought I’d take a look at the data myself. I didn’t figure the tax was having much effect, but I was prepared to find anything. Reality’s funny that way, I like not knowing which bush hides the rabbit … anyhow, here’s a typical claim:

MOTOR GASOLINE (DRIVING)

The above figures show changes in overall use of all petroleum fuel products (subject to the carbon tax). To gain some insights specifically into how the carbon tax has affected the behaviour of drivers, one can examine just the changes in motor gasoline consumption (one component of the overall fuel use numbers). Since 2008, per capita gasoline use in BC has declined by 7.3% more than in the rest of Canada (Table 4) – a substantial difference. Gasoline use in BC was already declining faster than in the rest of Canada from 2000-2007 (see Figure 4).

The tax covers all carbon-based fuels, heating fuel, jet fuel, kerosene, natural gas, all of them. Data is unavailable for some of them, so I have looked at the consumption of the highway fuels, gasoline and diesel, to see if the tax has any effect on how people are driving up in the frozen North.

Statistics Canada has an excellent website, from which I got most of my data about the fuel use. First, here are the raw changes in per capita diesel and gasoline use (combined) by Province for the years 1993-2011. This analysis is only the gasoline and diesel used on the roads, not the use of those fuel for off-road vehicles and farm tractors and the like. (Note that off-road and farming fuel, and indeed fuels for all purposes and users, are all subject to the BC carbon-based energy tax.)

Figure 1. Per capita Canadian diesel plus gasoline use by Province. Only fuels used on the highway are counted. Thick red and black lines show British Columbia and Canadian average per capita fuel use. Nunavut and Northwest Territories are not included due to lack of data for the earlier years, before Nunavut was created. DATA SOURCE

Figure 1. Per capita Canadian diesel plus gasoline use by Province. Only fuels used on the highway are counted. Thick red and black lines show British Columbia and Canadian average per capita fuel use. Nunavut and Northwest Territories are not included due to lack of data for the earlier years, before Nunavut was created. DATA SOURCE

Now that’s interesting, but it doesn’t really allow us to look at the subtle year-to-year changes. For that we need to look at the percentage changes in emissions by province, to see who is going up and who is going down.

In looking at a percentage change in anything, the first question of interest is, percentage change from what starting point? Because the tax was instituted in 2008, I looked at the percentage change from that time. Figure 2 shows that result, and given the claims of the proponents of the tax, it’s quite funny … well, it’s funny except if you live in BC, I guess when the joke’s on you it kind of loses its humor. Anyhow, here’s the percentage change in per capita use of highway fuels by province:

Figure 2. Percentage change in fuel use, with the year 2008 used as the base from which the percentages are calculated. Blue line shows the corresponding percentage change in the real (inflation-adjusted) Canadian GDP. 2011 is the most recent year for which StatCan has data.

Figure 2. Percentage change in fuel use, with the year 2008 used as the base from which the percentages are calculated. Blue line shows the corresponding percentage change in the real (inflation-adjusted) Canadian GDP. 2011 is the most recent year for which StatCan has data.

The first thing that stands out is what I found in my analysis of the US driving habits—Americans drive more miles in good economic times, and cut back on the driving in tough economic times. Similarly, the highway fuel used in both British Columbia and also the rest of Canada has moved roughly in parallel with the national economic situation.

The next thing I noticed was that from 1993 to 2008, BC had the slowest growth in highway fuel use of all of the Provinces.

Next, the changes in highway fuel use after the imposition of the tax are interesting. Figure 3 shows a closeup of Figure 2, highlighting the recent period from 2004 to 2011.

Figure 3. Closeup of Figure 2, showing the post-tax changes in road-fuel use. The BC carbon-based energy tax was instituted in 2008.

Figure 3. Closeup of Figure 2, showing the post-tax changes in road-fuel use. The BC carbon-based energy tax was instituted in 2008.

So … just like the rest of Canada (thick black line), BC road fuel use dropped from 2004 to 2008, when the BC tax was instituted … except it was dropping faster than the national average.

Again just like the rest of Canada, the BC road fuel use bottomed out in 2009, the year following the imposition of the carbon based energy tax. I can only assume that this is related to the blue line, showing the real GDP for Canada.

And just like the rest of Canada, since then British Columbia road fuel use has risen to the end of the record … except it’s risen faster than the national average.

Now here’s the funny part. From 2004 to the tax year of 2008, BC road fuel use was showing nearly the fastest decrease in fuel use in the country. Fuel use dropped about three times as much as the rest of Canada during that period. That was before the tax.

After the tax, BC road fuel use dropped, but for only one year. So did the rest of Canada, and the US, showing that the drop was at least in part due to the global financial meltdown.

And since 2009, BC is tied with the Yukon territory and Newfoundland/Labrador for the fastest increase in fuel use in the country. Highway fuel use rose five times faster in BC than in the rest of Canada since 2009.

Finally, since 2008 when the carbon-based energy tax was imposed, energy use on the road has risen in BC, not fallen. And not only has it risen, since the tax took effect BC has risen faster than all but three of the other provinces.

Can we say that the carbon-based energy tax hasn’t changed fuel use in BC? Nope, all I’ve looked at is road fuel … but fuel use on the highways of BC sure hasn’t changed. Well, that’s not exactly true.

Before the tax, per capita road fuel use in BC was dropping faster than almost all the provinces.

…

After the tax, per capita road fuel use in BC is increasing faster than almost all the provinces.

…

So actually, yes, I’d say I was wrong, the tax has had an effect on BC road fuel use … but likely not the one expected by the promoters.

w.

PS—you may recall that up top, the promoters extolled the drop in gasoline used for road fuel in British Columbia … why didn’t I find that result? Why do I show an increase?

Well, it’s because I show all the highway fuel used, not just gasoline. And although there was a small decrease in gasoline use in BC, there was a larger increase in diesel use. And as a result, total BC road fuel use is not 7.3% less than the rest of Canada as they would lead you to believe by omitting the diesel figures—BC road fuel use has increased by 4.2% more than the rest of Canada. Like I say, it pays to be really suspicious with statements from folks like that, single issue fanatics.

PPS—In my previous post on the BC carbon-based energy tax, I said I wanted to discuss the (lack of) benefits, the costs, and the results of the tax. That post showed that the maximum possible benefit of the BC tax is a cooling of three thousandths of a degree (0.003°C) after fifty years. This post is about a curious result of the tax, the fact that BC highway fuel use (gas plus diesel) was dropping before the tax, and has increased since then by much more than the rest of Canada. The next post will discuss the costs of the tax, and why “revenue neutral” isn’t.

NOTE: This is one of a four-part series on the BC carbon-based energy tax. The parts are:

British Columbia, British Utopia

Fuel on the Highway in British Pre-Columbia

Why Revenue Neutral Isn’t, and Other Costs of the BC Tax

They have significant cojones to engage you in any such debate….but its always good to read your stuff. Its humbling…and entertaining.

Willis: BC is not the frozen north. We affectionately call it the “Left Coast” for its politics, the “wet coast” for its weather, and the “land of newly weds, nearly deads and pot heads”,for its mix of tourists, retirees and local agrarian activity.

Willis wrote, ” … I show all the highway fuel used, not just gasoline. And although there was a small decrease in gasoline use in BC, there was a larger increase in diesel use.”

<a href="http://en.wikipedia.org/wiki/Substitute_good"<Wikipedia …

In economics, one way two or more goods are classified is by examining the relationship of the demand schedules when the price of one good changes. This relationship between demand schedules leads to classification of goods as either substitutes or complements. Substitute goods are goods which, as a result of changed conditions, may replace each other in use (or consumption)

<a href="http://en.wikipedia.org/wiki/Lie#Lying_by_omission"<Wikipedia again …

Also known as a continuing misrepresentation, a lie by omission occurs when an important fact is left out in order to foster a misconception.

What Willis has done here reminds me of the work done by the authors of Freakonomics.

I realize that the book is not without its shortcomings but Freakonomics should be required reading for all high school students. The book clearly demonstrates that we should be skeptical about all claims based on statistics. It goes beyond basic cynicism by showing us the kind of questions we should be asking when faced with statistical evidence.

Many educators push media literacy programs which are intended to toughen students against the barrage of propaganda they face daily. As far as I can tell, none of those programs deal with the kind of analysis Willis has demonstrated here. They should. If more people could muster that kind of thinking, the AWG alarmists would have a much harder time pushing their crap.

Looks like the Yukon is the place to be!

How green is your electric car?

Here is something on renewable energy use failure over the years.

Willis: This writer in BC agress with you. He even goes a step further, and says that BC has reduced emissions LESS than the rest of Canada.

http://blogs.theprovince.com/2012/10/11/guest-column-northern-b-c-has-no-love-for-the-carbon-tax/

Total emissions, I should have stated, not just emissions from highway use.

Of course BC is the Frozen North, haven’t you ever see ice caps on mountains up here? Haven’t you ever been to the southern USA? So yes we in BC are in the frozen north Willis. Yes we live in Igloo’s too by the way. [;-)]

Excellent set of articles Willis, thanks. Hopefully your analysis can bring some logical and rationality and help revoke this blatant CO2 Tax Theft by the government cult members up here in the Left Coast of the Frozen North. I am skeptical however since it’s really a placate the anti-green-co2 eco-terrorists up here and the pro-business Liberal Party likely won’t take the chance of pissing off the Left Coastists by revoking this pernicious irrational tax grab. Also with gas prices reaching $1.49 per liter yesterday why would they remove such a lucrative and growing source of tax theft revenues?

pwl says:

July 12, 2013 at 5:19 am

“Also with gas prices reaching $1.49 per liter yesterday why would they remove such a lucrative and growing source of tax theft revenues?”

For gawd’s man. That’s almost $6.00/gal. Socialism ain’t cheap.

Here in Alberta gasoline is about $1.12 per litre [4litres ~ 1US gallon]

Thanks, Willis. An excellent reply, and an enjoyable read, as always.

To me a tax on an essential service or commodity is ineffective because we cannot do without it. Our inability to pay for the item is the greatest incentive to cut back. or seek alternate cheaper options .Public transportation in a huge country like Canada would be very expensive because of the distances. Carbon tax has become just another generator of revenue for the government that liberally minded public seems to support falsely.thinking that it will do some good for the environment.

The Canadian government would call this a success because they imposed a per unit tax on fossil fuel and the amount of fossil fuel sold went up. The government now as more revenue to redistribute. If Canadian politicians are like U.S. politicians then they only give lip service to CO2 reduction. They only want to generate funds they can use to reward their constituents and donors.

I don’t have any hard numbers, but I recently visited relatives in northwest Washington. They report that gas stations close to British Columbia do a brisk business selling gas to Canadians. The same goes for various other commodities that are taxed or subsidized differently on the two sides of the border. This is probably not a big enough effect to impact Willis’ analysis, but people do naturally try to get the best prices, even if it mean occasional trips to other cities/states/countries.

Raise the price of gasoline high enough and people will start to conserve. But the new price has to be high enough. If the price of gasoline is raised through taxes, but If the new price isn’t high enough to produce any kind of substantial reduction in consumption, then the true function of the tax is merely to raise revenue for the state, not to modify the public’s gasoline consumption choices.

Is there any country on this planet for sane people to live? Western civilization countries need not apply.

One must remember as well that, similar to per capita fuel usage comparison between countries, the vast majority of the population of BC lives in the Fraser Valley, a 25 by 50 km corner in the SW portion of BC. Of course BC will have one of the smallest per capita fuel usages in Canada.

As well, in the run up to the 2010 Winter Olympics, BC puts major money into public transit, getting more cars off the road supposedly.

Willis, taxes in Canada are only for one thing, and it has nothing to do with saving the planet. It always has to do with filling the coffers of governments who run continued deficits. You should include provincial deficit numbers in your graphs.

YFNWG says:

July 12, 2013 at 6:38 am

Of course BC will have one of the smallest per capita fuel usages in Canada.

============

Most of the people in BC spend their time idling in traffic jams, as part of the government’s plan to encourage people to take transit. Cars burn less fuel at idle than actually going from place to place.

If taxes increase, then presumably I would have to work more in order to keep my income reasonably the same. Thus, would it not be fair to expect an increase in taxes to cause an increase in emissions..? (whenever I am not relaxing on the couch, I am pretty much out there “emitting” — though my wife would probably like to point out that I emit gases when on the couch as well)

BC government must be overjoyed! Usually when a “sin” is taxed or the taxes are raised, the use of the “sin” drops so the total revenue that the government sees remains the same or maybe even drops. In this case they (the guberment) got their tax and usage went up meaning even more money for bloated government to waste….and that’s what this is really all about. More revenue for government! It’s a great scam. Who’s going to say no to a tax in the spirit to save the planet?

That post showed that the maximum possible benefit of the BC tax is a cooling of three thousandths of a degree (0.003°C) after fifty years.

Why do we continue to give credence to the IPCC and other warmists that CO2 warms globally?

That carbon tax in BC makes me laugh. BCers will do anything to keep up with California.

When that BC carbon tax started a couple of years ago, they said that the rest of Canada would follow suit. It didn’t. BC is the only province with the carbon tax. Suckers.

Just another in a long series of carbon related lies, and BCers fall for them every time. Another reason why I don’t live there anymore.

Figures don’t lie but liars figure! If people would only look at the real data, they would find out how much propaganda we are being fed each day. I for one are tired of the steady diet of BS! Carbon taxes don’t help reduce carbon use they simply are designed to redistribute wealth. Generally line the politicians pockets.

Liars plan and planners lie.

All for the sake of planning more plans so they have something to plan.

These politicians and bureaucrats just can’t help themselves.

And when they get occasionally confronted in their various committees by those who would dissent

the reaction is universal dismissal with the higher mission of contributing to the greater global good.

They need no demonstrations of local accomplishment. We know this to be the case.

They believe their efforts, when combined with the collective actions of others, will ultimately be shown to have been the appropriate thing to have done. What’s best.

However, they will never even approach any juncture when any measurement or assessment

will ever make that judgment.

Perpetual postponement is their friend.

Even these figures are understated quite substantially, because of the fact that many people fill up in the US once a week, with a Nexus pass there is no delay at the border, so I will fill up with 100 liters of high test saving $35 to $50 at least, combine this with a bottle of duty free wine and some groceries and you are saving serious money! Bellingham Washington residents are quite concerned at the number of Canadians who are doing this ( its Chamber of Commerce and Costco iaren’t!)

Good on ya Willis. I am a resident of the People’s Republic of British Columbia, and can certainly confirm that this carbon tax has been a complete and utter boondoggle. The most absurd bit about it is that schools and hospitals have to pay the government exorbitant $$ to offset their carbon consumption – basically, take away money from health care and education and toss it into the green trough. Brilliant!

I see no merit or benefit in either the carbon tax or the reduction in motor fuel use.

The former rips off the taxpayer yet more (twice, first for the cost of the tax itself, and second, for the cost of administering it).

The latter would be indicative of a lower per capita and domestic product.

Both bad, not good; both failures, not successes

There is a big part of the picture missing. The BC population near the US crosses the boarder to purchase dairy products, booze, tobacco, and gasoline driven by high taxes in BC and low prices in US. In the early nineties, BC passes an ‘equalization” tax on goods returning to BC from the US which dampens boarder crossings and eases some laws such as not alcohol service on Sundays in anticipation of hosting the Worlds Fair. As BC continues it’s taxations on specific goods, this has had the effect of a continued market in the US for BC consumers. More so than other US Canada boarder crossing areas. Also, the 9-11-2001 tragedy had an effect on boarder crossings.

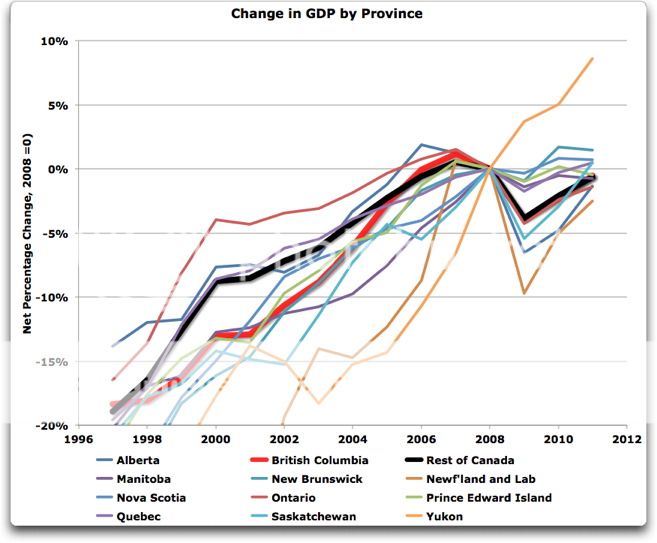

What we need and it is hard to get out of the data is the impact of the tax on the GDP for BC. As the recession impacted GDP at the same time as the tax, pulling apart the two events is not easy. What could be tracked is the change in BC GDP vs Canadian GDP. My guess is that increased fuel consumption in the Yukon is associated with increased economic activity. If the BC economy is recovering faster than provinces with less growth in fuel consumption, then this may explain the increased fuel use. Fuel cost is not a major part of the decision to drive. The need to get to work or deliver goods and services is important though. So you pay the price for fuel and move on. Your decision is simple. Only people with marginal income will drive less as fuel price increases. And then you have the choice of public transportation if it exists and if it goes where you need, or carpooling, or not going. If you job depends on it, you drive regardless of the cost.

Cute. I overuse the word. Perhaps “neat”, “tidy”, or “elegant”. Nicely focused on a well-formed proposition.

Thanks again.

Certain follow-up questions suggest themselves, such as, was the slight change in road fuel use caused by the down-turn in the economy? Did it occur in anticipation of the tax, then simply re-adjust as is common?

When attempting to correlate road use with economic times in Canada, you need to be careful. You also may need to look at immigration dynamics as well. Canada’s population tends to be more tightly clustered than in the US. There ‘s an interesting anecdotal observation I’ve noticed in the GTA (Toronto, C of U, MPBUI) and I’d expect this to be true in Vanc, not so much in Montreal: long time immigrants from South Asian and Caribbean cultures especially tend not to travel far in Canada outside of their home city. They will regularly head to the airport though. I started noticing this when talking to long time foreign origin colleagues; they didn’t know the common local geography, even though they’d lived here as much as a dozen years or more. Its not that they don’t travel, it’s that they don’t travel in-country. While there may be a correlation with the economy, the end figures may have other equally significant modifiers, Nonetheless, carbon tax on fuel still isn’t an answer other than for the elites who are in line to profit from it.

But then, BC isn’t called the Left Coast for nothing…

Willis, in addition, everyone living in BC near the border with Alberta will fill up his tank in Alberta. Also everybody from other provinces or countries, including tourists (last year my wife an I included) and especially truck drivers will do the same. You can see the long rows of cars and trucks just over the border in both directions. That also adds to the statistics…

Yet another perspicacious article, Willis.

@Mickeyj ~ “For gawd’s man. That’s almost $6.00/gal. Socialism ain’t cheap.”

Spare a thought for us poor blighters here in New Zealand, Mickey! We have an ETS in place – imposed by a supposedly conservative government – and and most of the people I speak to are unaware that they are paying 4 cents a litre (plus 5% of their power bill) in this government-run grand theft program.

Our petrol price has just gone up to a historic high for 91 octane to NZ$2.28 per litre. Therefore we are forking out US$6.81 per US gallon. Socialist Conservatism ain’t cheap, either!

$2.28 NZ$/litre

$1.80 US$/litre

3.79 litres/US gal.

$8.63 NZ$/US gal.

$6.81 US$/US gal.

I suspect if you looked at year to year sales results at US gas stations in relative proximity to the border you might also be able to find a measurable effect of tax.

The population of BC is 4.1 million. The population of the world is 7.1 trillion. Multiply that 0.001 or 0.003 by the appropriate ratio.

What the carbon tax in BC has shown is that a carbon tax is a workable way to reduce emissions

7.1 billion oops

“What the carbon tax in BC has shown is that

a carbon taxtheft is a workable way toreduce emissionsbloat government.”There. Fixed it for you.

The biggest emitter of CO2 in B.C. are the forests. It’s 600PPM under those canopies.

policycritic says:

July 12, 2013 at 10:37 am

The biggest emitter of CO2 in B.C. are the forests. It’s 600PPM under those canopies.

Finally, it is discovered that forestation begets forestation!

Steve Oregon says:

July 12, 2013 at 7:55 am

Cool, poetry I can read.

Vivian Krause ‘s broadcast on a local community TV in B.C. Uploaded last weekend. Broadcasts tonight, I think. She’s the one who uncovered via US tax returns that the Rockefellers bankrolled Bill McKibben from inception. She accuses large American charities of using environmental issues to save American oil for Americans and American investor profit. [Mod: you should homepage this over the weekend.]

eli rabbet: You miss the point entirely.

BC, with a carbon tax, has highway emissions growing faster than the rest of Canada without a tax.

BCs total emissions, even with a carbon tax, are being reduced less than the rest of Canada without a tax.

BCs carbon tax is doing nothing for emissions. Ergo, it is not affecting global temps, except possibly increasing them.

Dr. Bob says:

July 12, 2013 at 9:16 am

We’re nothing if not a full service website … Statcan has all the data.

w.

Willis, Because the tax was instituted in 2008, I looked at the percentage change from that time.

When in 2008 was the tax instituted? Unless the tax was instituted in December 2008, I’m not sure I would have normalized on the 2008 numbers. Using 2007 might have been a better base year. Particularly if the tax was instituted in the first quarter of 2008.

Another question, when was the tax passed? There might have been an anticipation effect going on.

Eye-balling Fig. 3, if you normalized on 2007, the visual impact of the change to BC looks quite substantial and longer lasting.

Also, I would like to see Alberta in a more distinctive color; it’s confused with Nova Scotia. The increase in oil use from shale-gas development ought to be seen in Alberta. Do we see a significant rise in Saskatchewan? Is that from energy development?

Eli Rabett says:

July 12, 2013 at 10:23 am

Seven point one trillion people on earth? Send the rabbit back to school, he’s embarrassing himself again …

w

Eli Rabett says:

July 12, 2013 at 10:23 an

Yeah, and “carbon tax oops” as well …

w.

Stephen Rasey says:

July 12, 2013 at 11:26 am

Since BC highway fuel use was dropping faster before the tax, if you normalize on 2004 or 2005 or 2006, you get a big drop before the tax. Same with 2007, just smaller.

But we’re not interested (or not as much) in the drop before the tax was implemented, we’re looking at the rise after it was implemented.

In any case, the tax was implemented in mid-year 2008, so centering anywhere but 2008 is special pleading. We want to compare the “before” and “after” snapshots …

w.

Supporters of the British Columbia (Canada) carbon-based energy tax that I discussed in my last post have made claims that the data shows this tax was a success….

The BC socialist supporters of carbon based energy taxes may not have achieved their stated goal of reducing road fuel use…. but they did achieve their unstated goal of increasing tax revenues!

Willis Eschenbach says:

July 12, 2013 at 11:24 am

Dr. Bob says:

July 12, 2013 at 9:16 am

What could be tracked is the change in BC GDP vs Canadian GDP.

W replied: We’re nothing if not a full service website … Statcan has all the data.

Dang! The Yukon Territories look even better!

@Willis 11:34 am

In any case, the tax was implemented in mid-year 2008, so centering anywhere but 2008 is special pleading. We want to compare the “before” and “after” snapshots …

2007 is ‘before’. 2008 is ‘during;’, 2009 is ‘after’.

Making the base year 2008 instead of 2007 raises questions and complications that need not be asked. It is not “special pleading”; just an honest and respectful disagreement about methodlogy.

Does it matter whether the base year is 2008 or 2007? If it does, why? And its it not worth investigation? If it doesn’t, it isn’t special pleading.

Eli Rabett says:

July 12, 2013 at 10:23 am

Well, it certainly hasn’t reduced highway emissions. Those have increased since the tax was passed.

And at present the tax has reached its full amount, about $0.25 per gallon. As a result, as a number of people have stated, they and lots of folks now buy their gas in either Alberta or the US. Not only that, but the people who visit BC are more likely to fill up before crossing the border …

And so the fall in highway gasoline use of 4% since the tax passed is guaranteed to be overstated by at least some amount, and may not be a reduction at all. And that in turn means that instead of highway emissions rising by 5% since the tax while the rest of Canada has seen little change, the rise in highway emissions is likely more like 7% or 8% more than the rest of Canada.

So no, Eli, here in the real world we expect that “workable” policies to reduce emissions actually reduce emissions more than their neighbors … crazy, I know, but that’s how we roll.

In addition, yes, there are “workable” ways to reduce emissions. North Korea, for example, has a very “workable” method, they have little emissions from highway fuel use … so clearly, the fact that a plan is “workable” doesn’t mean that it is desirable.

w.

Stephen Rasey says:

July 12, 2013 at 12:17 pm

The tax was applied in mid-2008, starting at $10 per ton. It has now ratcheted up to $30 per tonne.

If “2007 is ‘before’. 2008 is ‘during;’, 2009 is ‘after’”, then if you wish to compare before with after, you have to base it in 2008. If you center it in 2007 you can’t compare “before” because according to you 2007 is “before”. Similarly, if you center it in 2009 you can’t compare “after”.

So yes, if you wish to compare Pre-Columbian North America with Post-Columbian North America, you have to use 1492 as the base date … and yes, for a comparison of pre-tax and post-tax emission, using anything but the date of the tax is indeed special pleading. That date is mid-2008.

But heck, you’re free to twist the data any way you want, all the rest of the supporters of the tax are doing it, so why not you? Let us know when your brilliant analysis is done, would you?

w.

From my perspective, as a BC resident, the carbon tax is a total sham. The tax is added to all hydrocarbon based fuels, i.e. gasoline, diesel, propane, natural gas etc. , currently it is frozen at 6.67 cents/liter. That tax is supposed to be revenue neutral with tax credits provided by the government but it is really difficult to see what happens on an individual basis.

The government has also required that publicly funded services such as hospitals, schools etc spend tax payer dollars to reduce their “carbon foot print”. They were required to determine what their impact was according to government guidelines and pay for carbon credits at a private carbon trust. They were not allowed to use the dollars paid to the carbon trust to upgrade facilities.

To reduce the taxpayer dollars spent their they were to upgrade buildings etc to reduce C02 emissions! In the small city I live in, the school board has spent some $800K of capital dollars to replace the heating/A/C system with ground source geothermal system and to reduce the carbon credit dollars paid to the carbon trust. This is insanity, tax payer dollars paid to a private carbon credit trust which grow trees that no one monitors to determine if they are even alive.

This is total insanity to appease the greenie agenda.

I invite you to read the following article from the IEEE Spectrum which further shows the ridiculous lengths that have been taken to reduce CO2 emissions with no consideration for total environmental impact.

http://spectrum.ieee.org/energy/renewables/unclean-at-any-speed/?utm_source=techalert&utm_medium=email&utm_campaign=062713

Willis, it makes little sense to make the “base” year the year of greatest rate of change. Better to make the “base” year the last full year before the decision was made and law passed.

You call that “twisting the data”?

The decline in BC fuel consumption was entirely recession related, and the province was making a strong post-2009 recovery largely as a result of a large rise in exports to Asia, particularly in BC forest products and metallurgical coal. Vancouver has been the site of large, sustained population growth, and sustained very high prices in housing, again largely because of affluent Asian immigration. To pretend that the carbon tax has had any restraining effect on fuel consumption as Rabett suggests is simply delusional given the much larger economic forces at play.

In the case of Saskatchewan, the province has been undergoing a huge economic revival for about the last eight years mostly as a result of the ejection of the NDP from government after about 15 years in power. This has been largely the result of a large surge in business investment across the board in Sask. In 10 years, it has gone from a have-not province to Canada’s second strongest provincial economy. Oil and gas are only a part of the story.

If it was a liberal and it was speaking, there was lying involved.

pwl says:

July 12, 2013 at 5:19 am

Also with gas prices reaching $1.49 per liter yesterday why would they remove such a lucrative and growing source of tax theft revenues?

Yes, you are right, unfortunately I have seldom seen politicians reducing taxation.

Why the tax was introduced is irrelevant. The money is spent on various “absolutely needed projects” – and the result is increasing bureaucracy. A reduction in taxation would only be possible through a reduction in costs, or else it is simply increasing the deficit which is also not the best option.

However reducing costs would mean reducing bureaucracy – which means taking unpopular decision (unpopular with the ones “reduced”), losing their votes.

Once the tax is installed it will stay, unless a very strong majority is against it and the strong message goes through to politics, and the elected ones form a majority and keep their word…

Green tax is just another way to tax the people with the advantage one gets the lunatics to support taxation and can be better “packaged”. What it does in reality is not relevant to politics, but hopefully to enough voters.

I live in a border city in BC, so I always skip across the line to fuel up and buy dairy. The carbon tax was the catalyst that made me a frequent cross-border shopper. The reason why fuel consumption lagged from ’93 to ’98 was political: the previous provincial government from ’91 – ’01 ransacked the economy. Our economic growth was tepid compared to the rest of North America during that time.

Stephen Rasey says:

July 12, 2013 at 11:26 am

When in 2008 was the tax instituted ?

– – –

The tax and subsequent annual increases took effect on Canada day, July 1st. (mid year as Willis has stated).

Just wait till these politicians get the idea for a “Oxygen Tax”

Richard Vada says:

Exactly.

If the tax took effect halfway through 2008, centering on 2008 is inappropriate.You can’t use a period that partially includes the tax to show the change since the tax was implemented.

2007 is your last clean datapoint without the tax, unless you can find seasonally-adjusted monthly data. Looks like centering on 2007 would still show BC doing worse than the rest of the country.

B.C. mulls extra charges for smart meter resisters

http://bc.ctvnews.ca/b-c-mulls-extra-charges-for-smart-meter-resisters-1.1363979

A contact on the inside tells me money is being firehosed at smart meter contractors.

Neo says:

July 12, 2013 at 2:40 pm

Just wait till these politicians get the idea for a “Oxygen Tax”

That’s one thing we are safe from as long as politicians talk.

BC exports twice as much natural gas as is used in the Province. All carbon tax free . The tax

has had no effect in reducing consumption.Natural gas was $10 GJ when the tax was introduced in 2008 .Its now about $4 GJ. so to claim it has had an effect is a lie and the promoters of it know the truth. All the tax does is give the Liberals some greenie wash they can play politics with. The carbon tax is a job killer and is self imposed trade treason by the government of BC.

Duncan MacKenzie says:

July 12, 2013 at 3:28 pm

Fine. When you and Stephen Rasey collaborate on your blog post, you can center it on 2007. Your desires are immaterial to me. I’ve made my decision. You don’t like it? Go do your own.

w.

Jean Parisot says:

July 12, 2013 at 10:21 am

I suspect if you looked at year to year sales results at US gas stations in relative proximity to the border you might also be able to find a measurable effect of tax.

This is exactly right – the city of Bellingham Washington would not survive without the massive number of Canadians who Regularly cross-border shop for gas, clothes, and groceries.

Gasbuddy has Regular Gas at around $1.00 a liter in Bellingham. I will be going down in the next few days for a tankful of gas that will cost just under $30 CDN LESS in Bellingham; I will also buy some books and groceries – these are also cheaper to massively cheaper in Bellingham, compared to Metro Vancouver.

The carbon tax has spawned a growth in fuel tanks for pick up trucks. It seems every second truck has a tank in the back. Fill it in Alberta or Washington and your good for a month or two. The tax has done nothing but raise the cost of food and transportation.

The following link is an RTF file containing 4 Excel Chart Pictures:

Gross Gasoline

Net Gasoline + Net Diesel

Gross Gasoline + Net Diesel

Net Diesel

All are from 2002 to 2011, with 2007 = 1.0

Series by Canadian Province

http://www.wikiupload.com/I88VAYSUWUIJ0NW

(You’ll have to trust me that it is a safe RTF).

Data source:

http://www5.statcan.gc.ca/access_acces/alternative_alternatif.action?l=eng&keng=7.5&kfra=7.5&teng=Download%20file%20from%20CANSIM&tfra=Fichier%20extrait%20de%20CANSIM&loc=http://www20.statcan.gc.ca/tables-tableaux/cansim/csv/04050002-eng.zip&dispext=CSV

Original data from 1992 to 2011, Edited down to 2002 to 2011.

BC, ALB, SAS Emphasized with square markers.

Maritime in dotted lines.

NW Territories and Nunawat series combined. There was some suspected data in these series, but clearly 2007 was a high point for some reason.

Not really. The liberals ( leftists, progressives, socialists, neocommunists … ) like cancer have metastasized to all parts of the planetary body now. Wherever these cells spread they drag along their dogma of worshiping a powerful central government that is empowered to regulate every facet of our lives. God is not dead, government is God.

We all have to face the fact that they are everywhere now and must be dealt with. They have always counted on our boundless good will and ability to stay quiet, ignore them or even vacate to escape their craziness. This was fine when it was just a few big cities but they have trickled down to all points, every state, local and rural government included.

The first step is recognizing and identifying the enemy. They don’t always have convenient (D) and (R) or other obvious nametags. But their common characteristic is that they are natural born slaves, and tireless evangelists for a kind of neo-feudalism. When you see those that fight to the death over concepts of freedom, private property, independence, decentralization and privacy then you have found the enemy within.

They are the ones that never met a tax they wouldn’t accept and never seen a government rule or regulation they wouldn’t bend over for. They are hiding in plain sight asking you to vote for them to save the children and even if you don’t, they will find a way to steal the votes on election day. Amazingly, their only real strategy is to demonize their opponents using strawman arguments like: “What’s the alternative to patronizing government, anarchy?” or in the case of the mad AGW cult: “Vote for us to fix the weather and stop hurricanes and sea level rise”. Simply put, all we really have to do is ridicule and shun them and most important of all, send them packing. We do have that power. No, there is nowhere left to run, we will have to get our hands dirty now.

Just another take from a yank in Bellingham.

I never buy gas in BC and make sure I have enough before I cross the line. Never realized they had the carbon tax but that certainly explains the large increase in gas sales to our Northern Brothers flooding the various gas stations like Costco & Fred Meyers from here to Burlington (25 miles South). These things go in waves and just as suddenly the Canadians stop coming down. Even though it seems like a lot of people coming down, there may not be much of an impact, but I think it would be worth looking at gas station data of towns within 50 miles of the border in Washington, Idaho and Montana.

Funny thing, I was just up to Richmond for Dim Sum and Granville Island and the gas prices were all 145.1 no matter if it was Petro Canada, Esso, Shell, Chevron, Husky, etc. Is there some sort of price control there now?

Something got fouled up with the Vivian Krause link I left at July 12, 2013 at 10:47 am.

So go to the channel here

http://www.youtube.com/user/DavidBernerTV?feature=watch

and choose Episode 88: Vivian Krause

Anthony picked up her article here:

Rockefellers behind ‘scruffy little outfit’

Anti-Keystone protests get millions in funding

By Vivian Krause, Financial Post, Feb 14, 2013

http://opinion.financialpost.com/2013/02/14/rockefellers-behind-scruffy-little-outfit/

Add me to the list. I buy enough fuel at the Alberta border with BC to bet me to my BC destination. Then if I am near the US border like at Grand Forks, I slip across the border like everyone else and fill up for the return trip. The US Danville station there is just a few hundred metres across the border.

Hey Klem and others! Stop pushing the idea that BC is a lefty paradise! For all the hippies and Vancouver dope smokers etc. we elected the liberals because they were the pro business alternative to the socialist NDP. We did not vote for a carbon tax any more than we voted for harmonized sales tax. We were poorly served. Recently we re elected the bums, even though we wanted them out, because the alternative party was against the enbridge pipeline. Does that sound like California to you folks? At least our premier doesn’t travel to the states to slag our principal source of revenue…(ears burning, you Albertans out there?)

the Canadian north ..NWT and NON-of-THAT have few roads and is very resource driven. so their numbers are always difficult to understand.

Great writing Willis. carbon tax does nothing but wealth redistribution. the progressives actually don’t care even if global warming caused by man. they just use it as an excuse to exert control over the sheeple and other useful idiots. one day the educated people will stop talking to them and trying to explain their folly. trying to debate them is pointless as the comments from the trolls prove. I hope we stop these leaches sooner then later. they are nothing but a waste of bio-fuel themselves.

Eli Rabett on July 12, 2013 at 10:23 am

Ummmm, I suppose the emmissions tax scheme works if you dont use math correctly or you dont understand which metric to measure by.

Let us use your simpleton population stat–4.1 mill to 7.1 tril…err..billion…we get 0.000577…that is 1 whole order of magnitude off. WOW!!

Now let us do the more appropriate calculation of land mass….BC has 364,764 sq miles while the planet has 57, 500, 000 sq miles. That fraction equates to 0.00634!!!

WOW ELI WOW…YOU REALLY HIT THE NAIL ON THE HEAD!!!! BC’s gas tax has les than half of the expected value that it needs in order to keep GLOBAL WARMING in their neck of the woods at bay.

Now, how much tax is needed to get BC to the .00634?

And how much time do we need to get you to use the proper numbers AND THEN UNDERSTAND WHAT THEY MEAN?

Eli Rabbit….under your twisted math Australia–population 22.31 million amd land mass of 2.97 mm sq miles—-would be responsible for only 0.00314 of emissions reduction (population divided by population) WHERE WHEN IN A GLOBAL WORLD—NOT A FLAT EARTH ONE MIND YOU—AUSTRALIA IS RESPONSIBLE FOR THEIR LAND MASS OF THE WORLD….so that calculation takes us to 2.97 mm sq miles / 57.5 mm sq miles and POP BANG WOW WOW WOW the nymber turns out to be 0.0516—-

Come on Eli….

I affectionately call the Costco in Bellingham “Little BC”. Now, if we could get them to stop driving like Californians…

Eli Rabbet: What the carbon tax in BC has shown is that a carbon tax is a workable way to reduce emissions

Really? Where exactly was that “shown”?

great analysis Willis, thanks very much! I’m guessing that Shale Gas development in the Horn River Basin in the NE corner of BC is driving the increased consumption. Hard to control the statistics for increased commercial activity – but this work and approach is very important. Thanks again.

john s says:

July 12, 2013 at 8:49 pm

Don’t blame me, I voted Wildrose. Saw Redford coming from a mile away. She is killing Alberta.

Ferdinand Engelbeen says:

July 12, 2013 at 9:51 am

Where exactly are people from BC “filling up” in Alberta?

Willis- do you ever sleep? This last week I’ve been rehearsing “Damn Yankees” at local community theater. Playing shows for audiences Fri, Sat , and Sun .So I haven’t looked at your sreadsheet yet

David Ball: Crowsnest, mostly… when I go there, for example to see Frank Slide, I see more BC plates than Alberta.

NW Libertarian says:

July 12, 2013 at 6:31 pm

the gas prices were all 145.1 no matter if it was Petro Canada, Esso, Shell, Chevron, Husky, etc. Is there some sort of price control there now?

==================

collusion. also known as rip off at the pump. the prices of all gas stations go up and down in unison, regardless of brand. quite a bit of computer power is used to analyze buying patterns to maximize revenues. and the government does nothing to investigate.

CodeTech says:

July 14, 2013 at 1:58 am

What is that, maybe 10 or 20 cars per day. Wow!!

Sarc off/

On a busy day. It is also 1/2 a tank from any major centre. Really stretching there. I call bulls**t.